The Packaging Printing Market size was valued at USD 525.26 Bn. in 2024, and the total revenue is expected to grow at 4.5% through 2025 to 2032, reaching nearly USD 746.97 BnPackaging Printing Market Overview

The packaging printing includes the Technology of printing technology produces labels, cartons, flexible packaging, and other materials used for product branding, information display, and protection. This includes techniques such as flaxography, digital and offset printing, which are inspired by the demand for sustainable and customized packaging solutions in industries such as food, beverages, and healthcare. Development is fueled by e-commerce expansion, brand discrimination needs, and environmentally friendly innovations. The packaging printing market is driven by the increasing demand for branded, durable and customized packaging, especially in e-commerce, food and healthcare sectors. The supply is supported with progress in digital and flexographic printing technologies, along with increasing production capacity from major industries players and progress. The Asia-Pacific region dominated the packaging printing market in 2024, due to rapid industrialization, booming e-commerce, and growing consumer goods demand. Major key players include Amcor Ltd., Mondi Group, Sonoco Products Company, WestRock Company, and Sealed Air Corporation, who lead with innovations in sustainable and high-performance packaging solutions. The report covered all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants by Region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by Reion on the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.To know about the Research Methodology :- Request Free Sample Report

Packaging Printing Market Dynamics

Efficiency and Sustainability to Drive Packaging Printing Market Growth

Digital printing is frequently used for cost and time efficiency in manufacturing packaging. It saves a lot of time compared to conventional printing, as there is no need to continually change plates, considering the technology does not use any plates at all. Also, it is environmentally friendly. For example, Flatbed printing is also eco-friendlier than conventional printing as it produces a lower amount of waste cartridges and creates lesser air pollution. It leaves behind a smaller carbon footprint.Increasing workflow and productivity to restrain the Packaging Printing Market

Brand owners are expecting more dynamic packaging, but they also want it delivered more quickly than before. Naturally, the increased demand leads to a higher cost of fulfilment. However, it doesn’t appear that brands are raising their prices to reflect this. Printing companies and package designers are indirectly affected by this pressure. Brand owners are looking to printing companies to keep prices low so they don’t have to increase retail prices. Automated workflow systems can help by streamlining workflows and processes. As the cost of fulfilment decreases, prices can be reduced. Brand owners are actively seeking lower pricing.On-Demand & Customized Packaging to Create the Packaging Printing Market

Rapid adoption of digital printing techniques offers a major opportunity, which is inspired by the demand for short runs, personal packaging, and rapid turnaround. Brands in e-commerce, cosmetics, and FMCG are choosing faster for digital solutions to enhance the shelf appeal, reduce waste, and enable tight supply chains. Inkjet and toner-based systems improve advanced cost efficiency, enabling digital printing for SMEs. As the concern of stability increases, the minimum setup of digital printing waste and environmentally friendly ink options keeps it as a major development block in the packaging industry.Packaging Printing Market Segment Analysis

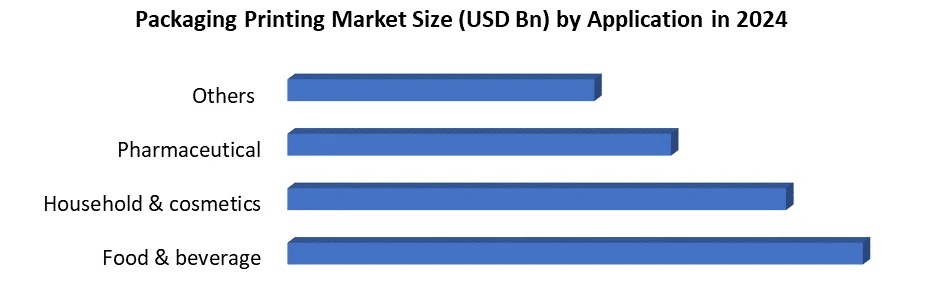

Based on Application, the Packaging Printing Market is segmented into Food & beverage, Household & cosmetics, Pharmaceutical, and Others. The food & beverage segment dominated the Packaging Printing Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to the lifeline of the food and beverage industry being used in various forms, including stand-up or lay-down pouches, sealable zip-lock pouches, and so on. Printed food packaging is used for the primary packs of foods and beverages that are supplied directly to consumers. Its benefits are not limited to the functional values but rather extend to adding an aesthetic appeal to the packed product. Competing in a customer-centric market, brands need to ensure that their design ticks multiple checkboxes, including factors like user-friendliness, brand identification, quality, and so on. This not only requires choosing the right packaging material but also the right printing process. Scroll down to know more about the printing processes for flexible packaging.

Packaging Printing Market Regional Analysis

The Asia-Pacific (APAC) dominated the global packaging printing market in 2024, which is inspired by rapid industrialization, booming e-commerce, and increasing demand for consumer goods in countries such as China, India, and Japan. The region benefits from government support for cost-effective production, expanding retail areas and permanent packaging. Follow North America and Europe, with tight eco-regulations, high adoption of digital printing and demand for premium packaging in food, healthcare and cosmetics, as well as development. Europe goes to permanent packaging innovations, while North America looks at increasing investment in smart packaging technologies. Latin America and the Middle East and Africa are emerging markets, with development associated with urbanization, an increase in disposable income and expanding FMCG areas. However, infrastructure challenges and slow technology continue to hinder adoption in these areas. Overall, APAC remains the fastest-growing market, while the mature areas focus on automation and environment-friendly solutions to meet the demands.Packaging Printing Market Competitive Landscape

Amcor plc is anticipated to report USD XX billion in revenue for 2024, building on its leadership in sustainable flexible and rigid packaging, especially in food, beverage, and healthcare. Its focus on recyclable materials and global expansion (notably in Asia-Pacific) continues to drive growth. Mondi Group, expected to surpass USD XX billion in 2024, benefits from soaring demand for fiber-based sustainable packaging, with innovations like lightweight barrier papers and e-commerce solutions. Both companies are investing heavily in digital printing and automation to meet demand for customization and efficiency.Packaging Printing Market Recent Trend

1. Sustainability Shift – Rising use of biodegradable inks, recyclable substrates, and compostable packaging. 2. Digital Printing Boom – High demand for cost-effective, short-run, and customized prints. 3. Smart Packaging – Integration of QR codes, NFC, and AR for engagement and traceability. 4. E-commerce Influence – Need for durable, lightweight, and visually appealing packaging for online retail.Packaging Printing Market Recent Development

1. Amcor plc February 6, 2024: Launched AmPrima PE Plus, a recyclable mono-material film for snack packaging. 2. Mondi Group November 15, 2023: Introduced Functional Barrier Paper, a plastic-free, recyclable packaging solution. 3. HP Inc. & Koehler Paper March 12, 2024: Announced collaboration for sustainable digital printing paper solutions. 4. WestRock Company January 9, 2024: Unveiled Connected Packaging with NFC technology at CES 2024. 5. Sealed Air Corporation December 1, 2023: Completed acquisition of AFP Advanced Food Products LLC.Packaging Printing Market Scope: Inquire before buying

Packaging Printing Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 525.26 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 746.97 Bn. Segments Covered: by Product type Corrugated Flexible Folding cartons Label & Tags Others by Technology Flexography Gravure Offset Screen Printing Digital by Application Food & beverage Household & cosmetics Pharmaceutical Others Packaging Printing Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Packaging Printing Market Key Players

North America 1. WestRock Company – USA 2. Sealed Air Corporation – USA 3. Sonoco Products Company – USA 4. Berry Global, Inc. – USA 5. Printpack Holdings, Inc. – USA Europe 1. DS Smith plc – UK 2. Tetra Pak – Switzerland 3. Stora Enso Oyj – Finland 4. Huhtamaki Oyj – Finland 5. Constantia Flexibles – Austria Asia Pacific 1. Amcor plc – Australia (global HQ, major APAC presence) 2. Toppan Printing Co., Ltd. – Japan 3. Dai Nippon Printing Co., Ltd. (DNP) – Japan 4. Oji Holdings Corporation – Japan 5. Nippon Paper Industries Co., Ltd. – Japan 6. UFlex Limited – India Middle East and Africa 1. Al Ghurair Group (AGP) – UAE 2. Nampak Ltd. – South Africa South America 1. Klabin S.A. – Brazil 2. Braskem S.A. – BrazilFrequently Asked Questions:

1. What is the forecast period considered for the Packaging Printing Market report? Ans. The forecast period for the Global Packaging Printing Market is 2025-2032. 2. Which key factors are hindering the growth of the Packaging Printing Market? Ans. Increasing workflow and productivity restrain the printing and packaging market. 3. What is the compound annual growth rate (CAGR) of the Global Packaging Printing Market for the forecast period? Ans. The annual growth rate of the global packaging printing market is 4.5% 4. Which are the worldwide major key players covered for the Packaging Printing Market report? Ans. Key market players in the Packaging Printing Market include Klabin S.A., Tetra Pak, Amcor plc, Braskem S.A., and Crown Holdings.

1. Packaging Printing Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Packaging Printing Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Business Segment 2.4.4. End-user Segment 2.4.5. Revenue (2024) 2.4.6. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Packaging Printing Market: Dynamics 3.1. Region-wise Trends of the Packaging Printing Market 3.1.1. North America Packaging Printing Market Trends 3.1.2. Europe Packaging Printing Market Trends 3.1.3. Asia Pacific Packaging Printing Market Trends 3.1.4. Middle East and Africa Packaging Printing Market Trends 3.1.5. South America Packaging Printing Market Trends 3.2. Packaging Printing Market Dynamics 3.2.1. Global Packaging Printing Market Drivers 3.2.1.1. Increasing Power Outages 3.2.1.2. Technological Advancements 3.2.2. Global Packaging Printing Market Restraints 3.2.3. Global Packaging Printing Market Opportunities 3.2.3.1. Expansion in Emerging Markets 3.2.4. Global Packaging Printing Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government regulations on data privacy 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Packaging Printing Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Corrugated 4.1.2. Flexible 4.1.3. Folding cartons 4.1.4. Label & Tags 4.1.5. Others 4.2. Packaging Printing Market Size and Forecast, By Technology (2024-2032) 4.2.1. Flexography 4.2.2. Gravure 4.2.3. Offset 4.2.4. Screen Printing 4.2.5. Digital 4.3. Packaging Printing Market Size and Forecast, By Application (2024-2032) 4.3.1. Food & beverage 4.3.2. Household & cosmetics 4.3.3. Pharmaceutical 4.3.4. Others 4.4. Packaging Printing Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Packaging Printing Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Corrugated 5.1.2. Flexible 5.1.3. Folding cartons 5.1.4. Label & Tags 5.1.5. Others 5.2. North America Packaging Printing Market Size and Forecast, By Technology (2024-2032) 5.2.1. Flexography 5.2.2. Gravure 5.2.3. Offset 5.2.4. Screen Printing 5.2.5. Digital 5.3. North America Packaging Printing Market Size and Forecast, By Application (2024-2032) 5.3.1. Food & beverage 5.3.2. Household & cosmetics 5.3.3. Pharmaceutical 5.3.4. Others 5.4. North America Packaging Printing Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 5.4.1.1.1. Corrugated 5.4.1.1.2. Flexible 5.4.1.1.3. Folding cartons 5.4.1.1.4. Label & Tags 5.4.1.1.5. Others 5.4.1.2. United States Packaging Printing Market Size and Forecast, By Technology (2024-2032) 5.4.1.2.1. Flexography 5.4.1.2.2. Gravure 5.4.1.2.3. Offset 5.4.1.2.4. Screen Printing 5.4.1.2.5. Digital 5.4.1.3. United States Packaging Printing Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Food & beverage 5.4.1.3.2. Household & cosmetics 5.4.1.3.3. Pharmaceutical 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 5.4.2.1.1. Corrugated 5.4.2.1.2. Flexible 5.4.2.1.3. Folding cartons 5.4.2.1.4. Label & Tags 5.4.2.1.5. Others 5.4.2.2. Canada Packaging Printing Market Size and Forecast, By Technology (2024-2032) 5.4.2.2.1. Flexography 5.4.2.2.2. Gravure 5.4.2.2.3. Offset 5.4.2.2.4. Screen Printing 5.4.2.2.5. Digital 5.4.2.3. Canada Packaging Printing Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Food & beverage 5.4.2.3.2. Household & cosmetics 5.4.2.3.3. Pharmaceutical 5.4.2.3.4. Others 5.4.2.4. Mexico Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 5.4.2.4.1. Corrugated 5.4.2.4.2. Flexible 5.4.2.4.3. Folding cartons 5.4.2.4.4. Label & Tags 5.4.2.4.5. Others 5.4.2.5. Mexico Packaging Printing Market Size and Forecast, By Technology (2024-2032) 5.4.2.5.1. Flexography 5.4.2.5.2. Gravure 5.4.2.5.3. Offset 5.4.2.5.4. Screen Printing 5.4.2.5.5. Digital 5.4.2.6. Mexico Packaging Printing Market Size and Forecast, By Application (2024-2032) 5.4.2.6.1. Food & beverage 5.4.2.6.2. Household & cosmetics 5.4.2.6.3. Pharmaceutical 5.4.2.6.4. Others 6. Europe Packaging Printing Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4. Europe Packaging Printing Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.1.2. United Kingdom Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.1.3. United Kingdom Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.2. France 6.4.2.1. France Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.2.2. France Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.2.3. France Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.3.2. Germany Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.3.3. Germany Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.4.2. Italy Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.4.3. Italy Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.5.2. Spain Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.5.3. Spain Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.6.2. Sweden Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.6.3. Sweden Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.7.2. Austria Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.7.3. Austria Packaging Printing Market Size and Forecast, Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 6.4.8.2. Rest of Europe Packaging Printing Market Size and Forecast, By Technology (2024-2032) 6.4.8.3. Rest of Europe Packaging Printing Market Size and Forecast, Application (2024-2032) 7. Asia Pacific Packaging Printing Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4. Asia Pacific Packaging Printing Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.1.2. China Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.1.3. China Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.2.2. S Korea Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.2.3. S Korea Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.3.2. Japan Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.3.3. Japan Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.4. India 7.4.4.1. India Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.4.2. India Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.4.3. India Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.5.2. Australia Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.5.3. Australia Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.6.2. Indonesia Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.6.3. Indonesia Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.7.2. Philippines Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.7.3. Philippines Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.8.2. Malaysia Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.8.3. Malaysia Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.9.2. Vietnam Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.9.3. Vietnam Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.10.2. Thailand Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.10.3. Thailand Packaging Printing Market Size and Forecast, Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Packaging Printing Market Size and Forecast, By Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific Packaging Printing Market Size and Forecast, Application (2024-2032) 8. Middle East and Africa Packaging Printing Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Packaging Printing Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Packaging Printing Market Size and Forecast, Application (2024-2032) 8.4. Middle East and Africa Packaging Printing Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 8.4.1.2. South Africa Packaging Printing Market Size and Forecast, By Technology (2024-2032) 8.4.1.3. South Africa Packaging Printing Market Size and Forecast, Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 8.4.2.2. GCC Packaging Printing Market Size and Forecast, By Technology (2024-2032) 8.4.2.3. GCC Packaging Printing Market Size and Forecast, Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 8.4.3.2. Nigeria Packaging Printing Market Size and Forecast, By Technology (2024-2032) 8.4.3.3. Nigeria Packaging Printing Market Size and Forecast, Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 8.4.4.2. Rest of ME&A Packaging Printing Market Size and Forecast, By Technology (2024-2032) 8.4.4.3. Rest of ME&A Packaging Printing Market Size and Forecast, Application (2024-2032) 9. South America Packaging Printing Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Packaging Printing Market Size and Forecast, By Technology (2024-2032) 9.3. South America Packaging Printing Market Size and Forecast, Application (2024-2032) 9.4. South America Packaging Printing Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 9.4.1.2. Brazil Packaging Printing Market Size and Forecast, By Technology (2024-2032) 9.4.1.3. Brazil Packaging Printing Market Size and Forecast, Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 9.4.2.2. Argentina Packaging Printing Market Size and Forecast, By Technology (2024-2032) 9.4.2.3. Argentina Packaging Printing Market Size and Forecast, Application (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Packaging Printing Market Size and Forecast, By Product Type (2024-2032) 9.4.3.2. Rest of South America Packaging Printing Market Size and Forecast, By Technology (2024-2032) 9.4.3.3. Rest of South America Packaging Printing Market Size and Forecast, Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Players) 10.1. WestRock Company 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Sealed Air Corporation 10.3. Sonoco Products Company 10.4. Berry Global, Inc. 10.5. Printpack Holdings, Inc. 10.6. DS Smith plc 10.7. Tetra Pak 10.8. Stora Enso Oyj 10.9. Huhtamaki Oyj 10.10. Constantia Flexibles 10.11. Amcor plc 10.12. Toppan Printing Co., Ltd. 10.13. Dai Nippon Printing Co., Ltd. (DNP) 10.14. Oji Holdings Corporation 10.15. Nippon Paper Industries Co., Ltd. 10.16. UFlex Limited 10.17. Al Ghurair Group (AGP) 10.18. Nampak Ltd. 10.19. Klabin 10.20. Braskem 11. Key Findings 12. Analyst Recommendations 13. Packaging Printing Market: Research Methodology