Organ Preservation Market size was valued at USD 328.61 Million in 2024, and the total Organ Preservation Market revenue is expected to grow by 6.41% from 2025 to 2032, reaching nearly USD 540.18 Million.Organ Preservation Market Overview

Organ preservation involves techniques used to maintain organs in a viable state outside the human body, mainly for transplantation purposes. It ensures the organ’s structural integrity and functional capacity from the moment it is removed from a donor until it is implanted into a recipient. This process is essential to prevent ischemic damage and other complications during storage and transportation. The global organ preservation market is growing rapidly due to increasing organ failure cases, a growing elderly population, and a rise in the number of transplantation procedures around the world. The market has relied on static cold storage for most of its history, but is now moving towards different methods of preservation. New technologies include hypothermic and normothermic machine perfusion systems, which allow for longer organ preservation and greater viability.To know about the Research Methodology:-Request Free Sample Report Many of these technologies include either artificial intelligence or real-time monitoring, and often also portable logistics capabilities. These improvements enable more organ transplants and better outcome. North America is expected to witness the fastest growth in the organ preservation market, owing to several factors including urbanization, increased healthcare investments, and supportive government policies for better transplant infrastructure, and less reliance on historical methods.

Organ Preservation Market Dynamics

The rising geriatric population and the increasing prevalence of multiple organ failures are expected to drive the growth of the Organ Preservation Market. One of the most frequent causes of death in ICUs is multiple organ failure, which is primarily brought on by sepsis. According to the MMR study, up to 20% of individuals with sepsis exhibit acute respiratory failure, and 26–50% develop acute renal failure. Acute renal failure is more common in the elderly due to age-related declines in renal plasma flow and glomerular filtration rate. Diabetes makes people more susceptible to both of these diseases and multiple organ failure. Geriatric patients are more likely to have illnesses, including TB and liver cirrhosis, which may necessitate organ transplantation. The Organ Procurement and Transplantation Network asserts that the increase in the number of elderly individuals undergoing organ transplants has a significant impact on the volume of organ transplantation procedures performed. For instance, the number of organ transplants in the over-65 age category increased in the US from 8,691 in 2019 to 8,895 in 2021. According to the UN World Population Ageing Report, there were 728 million individuals in the world who were 65 or older in 2020; this number is likely to reach 1.5 billion by 2050, indicating the possibility of rising demand. Given that this demographic is more susceptible to illnesses that cause organ failure, its rise is expected to be a major factor in the organ preservation market growth.The high cost of organ transplant procedures acts as a significant barrier, limiting the growth of the Organ Preservation Market Organ transplantation requires a lot of resources, including highly compensated doctors and surgeons, pricey transportation, and expensive medications. The whole cost is increased by the fees for inpatient treatment, organ procurement, preservation, post-operative recipient care, and anti-rejection drugs. These majorly restraints restrain the growth of the organ preservation market. For evaluation or follow-up appointments arranged at the transplant center for a recommended length of medical care, patients must incur additional expenses for travel, housing, meals, hospital visits, and other medical testing. For patients with little financial resources, these costs immediately compete with spending on needs like food, clothes, and housing, making organ transplant treatments frequently unattainable without outside assistance. Rising investments in the healthcare sector are expected to create lucrative growth opportunities for the Organ Preservation Market Rising investments in healthcare are creating significant growth opportunities for the organ preservation market by advancing preservation technologies and expanding transplant programs. Innovative methods such as normothermic machine perfusion, which maintains organs at body temperature with oxygen and nutrients, are increasingly being adopted to enhance transplant success rates, particularly for kidney and liver procedures. This shift is vital in addressing the growing burden of chronic diseases such as diabetes and heart failure, which drive demand for improved organ viability solutions. Also, governments and private healthcare providers are strengthening infrastructure, funding research, and launching awareness initiatives to promote organ donation and transplantation. For instance, expanded funding in countries such as the U.S. and South Korea has enabled wider adoption of advanced preservation techniques, reduced tissue damage and extending organ shelf life. Collectively, these efforts are overcoming donor shortages and improving patient survival, fostering lucrative opportunities in the global organ preservation market. The significant gap between the annual need for organs and the number of donated organs Currently, there is a substantial discrepancy between the number of donated organs and the quantity needed. Over 103,000 patients in the U.S. were on the national transplant waiting list, yet only 48,129 transplants were performed in 2023. This huge gap is a major challenge for the organ preservation market. The small number of organs donated each year is mostly the result of inadequate legislative policies, a lack of public knowledge regarding organ donation, and an increasing danger of organ trafficking. Various governments are also putting into practice updated legislation (such as opt-out laws that imply every citizen is an organ donor except under certain exempt circumstances) and campaigns to promote organ donation.

Organ Preservation Market Segmentation

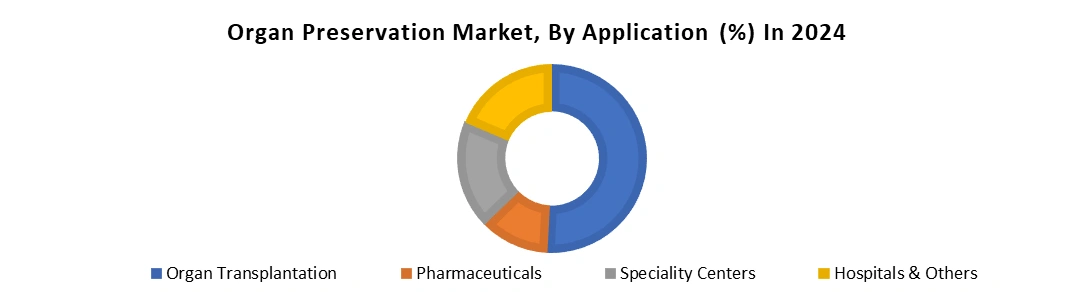

Based on Application: The market is segmented into Pharmaceuticals, Organ transplantation, Specialty Centers, and Others. The Organ transplantation segment dominated the application segment of Organ Preservation Market in 2024. the rising prevalence of chronic and lifestyle-related diseases leading to organ failure. Conditions such as diabetes, cardiovascular disorders, liver cirrhosis, and kidney failure have significantly increased the demand for organ transplants worldwide. As the global burden of end-stage organ diseases continues to rise, the need for advanced preservation methods has grown correspondingly to ensure the viability and success of donor organs. Technological advancements have also strengthened this segment’s dominance. The adoption of innovative preservation techniques such as hypothermic machine perfusion and normothermic machine perfusion has enhanced organ survival rates by minimizing ischemic damage and extending storage duration compared to conventional cold storage methods. These innovations have been widely adopted in kidney, liver, heart, and lung transplants, further boosting the segment’s growth.

Organ Preservation Market Regional Analysis

North America dominated the organ preservation market in 2024, accounting for nearly 45% of the global share. This leadership is attributed to advanced healthcare infrastructure, supportive government policies, and high organ transplant rates across the region. A growing burden of chronic conditions such as kidney disease, heart failure, and liver disorders has further driven the demand for transplants and preservation technologies. In the United States alone, approximately 46,632 organ transplants were performed in 2023, reflecting steady growth supported by cutting-edge methods like hypothermic and normothermic machine perfusion, which enhance organ viability and transplant outcomes. Government-backed initiatives, including reforms in the Organ Procurement and Transplantation Network (OPTN), have streamlined allocation processes and improved donor participation. The favorable reimbursement frameworks and rising investments in transplant facilities have strengthened market growth. Key players such as Paragonix Technologies and Xvivo Perfusion maintain a strong presence in the region, introducing innovative organ storage and transport solutions. North America’s dominance is boosted by technological innovation, growing transplant volumes, and proactive governmental and institutional support, positioning the region as a critical hub for organ preservation advancements. Organ Preservation Market Competitive Landscape The global organ preservation market is highly competitive, led by major players such as TransMedics and XVIVO Perfusion AB. TransMedics dominates the market with its breakthrough Organ Care System (OCS), which enables normothermic preservation maintaining donor organs at warm physiologic temperatures while functioning. This innovation has transformed transplant logistics by significantly extending transport times, expanding transplant windows, and allowing long-distance donor-recipient matches. With over 3,000 successful transplants performed worldwide, TransMedics has established strong partnerships through exclusive agreements with leading North American transplant centers. The company commands approximately 45% of the U.S. lung transplant market and continues to gain market share in Europe. Generating revenues exceeding $600 million, its FDA-approved OCS platforms for heart, lung, and liver systems reinforce its leadership. Meanwhile, XVIVO Perfusion holds a strong competitive position with expertise in hypothermic and ex vivo perfusion technologies. Its XPS and RAPID systems, supported by patented solutions such as Perfadex and Steen Solution, are widely trusted for kidney, lung, and liver transplantation. XVIVO is recognized as a clinically reliable and cost-effective option, particularly across Europe and Asia. With approvals in more than 40 countries, the company is rapidly expanding its footprint in the Asia-Pacific region, further intensifying competition. Organ Preservation Market Key Developments In October 2024, Bridge to Life entered a collaboration with ULS Coimbra to enhance liver preservation for transplantation. The initiative involves conducting case studies within Coimbra’s liver transplant program, showcasing novel procedures aimed at improving preservation outcomes. This partnership is expected to advance best practices in liver transplantation, strengthen clinical adoption, and position Bridge to Life as a key innovator in the sector. In August 2024, Getinge announced the acquisition of Paragonix Technologies for approximately USD 477 million. This strategic move expands Getinge’s footprint in the organ preservation and transportation market, adding advanced storage and transport solutions to its portfolio. The acquisition strengthens Getinge’s competitive positioning globally, enabling it to offer comprehensive solutions across the transplant ecosystem and address the growing demand for organ viability solutions. In March 2025, TransMedics launched its National OCS Program in more U.S. states to strengthen transplant logistics and coordination for heart, lung, and liver procedures. Using its normothermic technology platform, the company aims to expand access, improve organ utilization, and streamline nationwide transplant operations, marking a significant step in advancing organ preservation and transplantation infrastructure. January 2024, Shanghai Genext partnered with a leading Southeast Asian hospital to pilot its next-generation kidney perfusion machine. The initiative focuses on generating clinical evidence to validate advanced preservation technology. Successful results are expected to support broader regional rollout, positioning the company as a key contributor to innovation and accessibility in kidney preservation and transplantation practices. January 2024, X-Therma completed preclinical trials of its XT-ViVo organ preservation platform, showing extended organ viability under cold storage. The technology enhances preservation outcomes, helping address critical shortages in transplant-ready organs. The positive results pave the way for regulatory submissions and clinical trials, strengthening X-Therma’s position in advancing long-term organ storage and supporting global transplant systems. May 2024, BioLife Solutions introduced an enhanced version of HypoThermosol FRS preservation solution. Designed for greater stability and shelf life, it improves the preservation of cells, tissues, and organs during cold storage. This development supports higher success rates in transplantation by maintaining biological integrity, aligning with growing demand for advanced solutions in regenerative medicine and organ preservation. Organ Preservation Market Key Trends 1. Shift Toward Normothermic Machine Perfusion (NMP) A major trend in the organ preservation market is the growing adoption of normothermic machine perfusion. Unlike traditional cold storage, NMP maintains organs at body temperature with continuous oxygen and nutrient supply, keeping them functional outside the body. This approach improves organ viability, reduces ischemic damage, and extends preservation times, allowing longer-distance matches and higher transplant success rates, making it increasingly preferred by transplant centers globally. 2. Increasing Focus on Personalized and Targeted Preservation Solutions Healthcare providers are shifting toward personalized preservation methods tailored to specific organ types such as kidneys, liver, lungs, and hearts. Advanced solutions, including patented perfusion fluids and targeted preservation techniques, are being developed to improve outcomes for each organ. This trend ensures reduced complications, greater transplant efficiency, and better patient survival rates, thereby driving innovation and adoption of organ-specific preservation technologies worldwide. 3. Rising Strategic Collaborations and Investments The organ preservation market is witnessing increased collaborations between healthcare providers, research institutions, and medical technology companies. These partnerships focus on developing next-generation preservation systems and expanding access to innovative solutions. Significant investments, including acquisitions and clinical trial funding, are accelerating innovation and global expansion. Such collaborations enhance product portfolios, regulatory approvals, and clinical adoption, fueling competitive growth and shaping the future of the market.Organ preservation Market Scope: Inquire before buying

Global Organ preservation Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 328.61 Mn. Forecast Period 2025 to 2032 CAGR: 6.41% Market Size in 2032: USD 540.18 Mn. Segments Covered: by Organ Type Kidney Heart Lung Liver Pancreas Small Bowel by Solution University of Wisconsin (UW) Custodiol HTK Perfadex Others by Preservation Technique Static Cold Storage Hypothermic Machine Perfusion Normothermic Machine Perfusion Others by Application Pharmaceuticals Organ transplantation Specialty Centers Hospitals Others Organ Preservation Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Organ Preservation Market, Key Players

1. Paragonix Technologies (US) 2. XVIVO Perfusion AB (Sweden) 3. Dr. Franz Köhler Chemie GmbH (Germany) 4. Essential Pharmaceuticals, LLC (US) 5. TransMedics (US) 6. OrganOx Limited (UK) 7. 21st Century Medicine (US) 8. Shanghai Genext Medical Technology (China) 9. Bridge to Life Limited (US) 10. Waters Medical Systems (US) 11. Preservation Solutions (US) 12. Carnamedica (Poland) 13. Transplant Biomedicals (Spain) 14. Institut Georges Lopez (France) 15. Global Transplant Solutions (US) 16. Avionord (Italy) 17. Organ Preservation Solutions (England) 18. EBERS (Spain) 19. S.A.L.F. (Italy) 20. Biochefa (Poland) 21. Vascular Perfusion Solutions (US) 22. TX Innovations (Netherlands)Frequently Asked Questions:

1] What segments are covered in the Global Organ Preservation Market report? Ans. The segments covered in the Global Organ Preservation Market report are based on Organ Type, Solution, Preservation Technique, and Application. 2] Which region is expected to hold the largest Organ Preservation Market share during the forecast period? Ans. The North American region is expected to hold the largest Organ Preservation Market share in 2032. 3] What is the expected Global Organ Preservation Market size by 2032? Ans. The expected Global Organ Preservation Market size by 2032 is US$ 540.18 Mn. 4] What is the forecast period for the Global Organ Preservation Market research? Ans. The forecast period for the Global Organ Preservation Market research is 2025-2032. 5] What was the Global Organ Preservation Market size in 2024? Ans. The Global Organ Preservation Market size in 2024 was valued at US$328.61 Mn.

1. Organ Preservation Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Organ Preservation Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Organ Preservation Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Organ Preservation Market: Dynamics 3.1. Organ Preservation Market Trends by Region 3.1.1. North America Organ Preservation Market Trends 3.1.2. Europe Organ Preservation Market Trends 3.1.3. Asia Pacific Organ Preservation Market Trends 3.1.4. Middle East and Africa Organ Preservation Market Trends 3.1.5. South America Organ Preservation Market Trends 3.2. Organ Preservation Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Organ Preservation Market Drivers 3.2.1.2. North America Organ Preservation Market Restraints 3.2.1.3. North America Organ Preservation Market Opportunities 3.2.1.4. North America Organ Preservation Market Challenges 3.2.2. Europe 3.2.2.1. Europe Organ Preservation Market Drivers 3.2.2.2. Europe Organ Preservation Market Restraints 3.2.2.3. Europe Organ Preservation Market Opportunities 3.2.2.4. Europe Organ Preservation Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Organ Preservation Market Drivers 3.2.3.2. Asia Pacific Organ Preservation Market Restraints 3.2.3.3. Asia Pacific Organ Preservation Market Opportunities 3.2.3.4. Asia Pacific Organ Preservation Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Organ Preservation Market Drivers 3.2.4.2. Middle East and Africa Organ Preservation Market Restraints 3.2.4.3. Middle East and Africa Organ Preservation Market Opportunities 3.2.4.4. Middle East and Africa Organ Preservation Market Challenges 3.2.5. South America 3.2.5.1. South America Organ Preservation Market Drivers 3.2.5.2. South America Organ Preservation Market Restraints 3.2.5.3. South America Organ Preservation Market Opportunities 3.2.5.4. South America Organ Preservation Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Organ Preservation Industry 3.8. Analysis of Government Schemes and Initiatives For Organ Preservation Industry 3.9. Organ Preservation Market Trade Analysis 3.10. The Global Pandemic Impact on Organ Preservation Market 4. Organ Preservation Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Organ Preservation Market Size and Forecast, by Type (2024-2032) 4.1.1. Kidney 4.1.2. Heart 4.1.3. Lung 4.1.4. Liver 4.1.5. Pancreas 4.1.6. Small Bowel 4.2. Organ Preservation Market Size and Forecast, by Solution (2024-2032) 4.2.1. University of Wisconsin (UW) 4.2.2. Custodiol HTK 4.2.3. Perfadex 4.2.4. Others 4.3. Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 4.3.1. Static Cold Storage 4.3.2. Hypothermic Machine Perfusion 4.3.3. Normothermic Machine Perfusion 4.3.4. Others 4.4. Organ Preservation Market Size and Forecast, by Application (2024-2032) 4.4.1. Pharmaceuticals 4.4.2. Organ transplantation 4.4.3. Specialty Centers 4.4.4. Hospitals 4.4.5. Others 4.5. Organ Preservation Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Organ Preservation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Organ Preservation Market Size and Forecast, by Type (2024-2032) 5.1.1. Kidney 5.1.2. Heart 5.1.3. Lung 5.1.4. Liver 5.1.5. Pancreas 5.1.6. Small Bowel 5.2. North America Organ Preservation Market Size and Forecast, by Solution (2024-2032) 5.2.1. University of Wisconsin (UW) 5.2.2. Custodiol HTK 5.2.3. Perfadex 5.2.4. Others 5.3. North America Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 5.3.1. Static Cold Storage 5.3.2. Hypothermic Machine Perfusion 5.3.3. Normothermic Machine Perfusion 5.3.4. Others 5.4. North America Organ Preservation Market Size and Forecast, by Application (2024-2032) 5.4.1. Pharmaceuticals 5.4.2. Organ transplantation 5.4.3. Specialty Centers 5.4.4. Hospitals 5.4.5. Others 5.5. North America Organ Preservation Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Organ Preservation Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Kidney 5.5.1.1.2. Heart 5.5.1.1.3. Lung 5.5.1.1.4. Liver 5.5.1.1.5. Pancreas 5.5.1.1.6. Small Bowel 5.5.1.2. United States Organ Preservation Market Size and Forecast, by Solution (2024-2032) 5.5.1.2.1. University of Wisconsin (UW) 5.5.1.2.2. Custodiol HTK 5.5.1.2.3. Perfadex 5.5.1.2.4. Others 5.5.1.3. United States Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 5.5.1.3.1. Static Cold Storage 5.5.1.3.2. Hypothermic Machine Perfusion 5.5.1.3.3. Normothermic Machine Perfusion 5.5.1.3.4. Others 5.5.1.4. United States Organ Preservation Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Pharmaceuticals 5.5.1.4.2. Organ transplantation 5.5.1.4.3. Specialty Centers 5.5.1.4.4. Hospitals 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Organ Preservation Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Kidney 5.5.2.1.2. Heart 5.5.2.1.3. Lung 5.5.2.1.4. Liver 5.5.2.1.5. Pancreas 5.5.2.1.6. Small Bowel 5.5.2.2. Canada Organ Preservation Market Size and Forecast, by Solution (2024-2032) 5.5.2.2.1. University of Wisconsin (UW) 5.5.2.2.2. Custodiol HTK 5.5.2.2.3. Perfadex 5.5.2.2.4. Others 5.5.2.3. Canada Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 5.5.2.3.1. Static Cold Storage 5.5.2.3.2. Hypothermic Machine Perfusion 5.5.2.3.3. Normothermic Machine Perfusion 5.5.2.3.4. Others 5.5.2.4. Canada Organ Preservation Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Pharmaceuticals 5.5.2.4.2. Organ transplantation 5.5.2.4.3. Specialty Centers 5.5.2.4.4. Hospitals 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Organ Preservation Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Kidney 5.5.3.1.2. Heart 5.5.3.1.3. Lung 5.5.3.1.4. Liver 5.5.3.1.5. Pancreas 5.5.3.1.6. Small Bowel 5.5.3.2. Mexico Organ Preservation Market Size and Forecast, by Solution (2024-2032) 5.5.3.2.1. University of Wisconsin (UW) 5.5.3.2.2. Custodiol HTK 5.5.3.2.3. Perfadex 5.5.3.2.4. Others 5.5.3.3. Mexico Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 5.5.3.3.1. Static Cold Storage 5.5.3.3.2. Hypothermic Machine Perfusion 5.5.3.3.3. Normothermic Machine Perfusion 5.5.3.3.4. Others 5.5.3.4. Mexico Organ Preservation Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Pharmaceuticals 5.5.3.4.2. Organ transplantation 5.5.3.4.3. Specialty Centers 5.5.3.4.4. Hospitals 5.5.3.4.5. Others 6. Europe Organ Preservation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.2. Europe Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.3. Europe Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.4. Europe Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5. Europe Organ Preservation Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.1.3. United Kingdom Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.1.4. United Kingdom Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.2.3. France Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.2.4. France Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.3.3. Germany Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.3.4. Germany Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.4.3. Italy Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.4.4. Italy Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.5.3. Spain Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.5.4. Spain Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.6.3. Sweden Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.6.4. Sweden Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.7.3. Austria Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.7.4. Austria Organ Preservation Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Organ Preservation Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Organ Preservation Market Size and Forecast, by Solution (2024-2032) 6.5.8.3. Rest of Europe Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 6.5.8.4. Rest of Europe Organ Preservation Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Organ Preservation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.3. Asia Pacific Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.4. Asia Pacific Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Organ Preservation Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.1.3. China Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.1.4. China Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.2.3. S Korea Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.2.4. S Korea Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.3.3. Japan Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.3.4. Japan Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.4.3. India Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.4.4. India Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.5.3. Australia Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.5.4. Australia Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.6.3. Indonesia Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.6.4. Indonesia Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.7.3. Malaysia Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.7.4. Malaysia Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.8.3. Vietnam Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.8.4. Vietnam Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.9.3. Taiwan Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.9.4. Taiwan Organ Preservation Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Organ Preservation Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Organ Preservation Market Size and Forecast, by Solution (2024-2032) 7.5.10.3. Rest of Asia Pacific Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 7.5.10.4. Rest of Asia Pacific Organ Preservation Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Organ Preservation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Organ Preservation Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Organ Preservation Market Size and Forecast, by Solution (2024-2032) 8.3. Middle East and Africa Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 8.4. Middle East and Africa Organ Preservation Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Organ Preservation Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Organ Preservation Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Organ Preservation Market Size and Forecast, by Solution (2024-2032) 8.5.1.3. South Africa Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 8.5.1.4. South Africa Organ Preservation Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Organ Preservation Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Organ Preservation Market Size and Forecast, by Solution (2024-2032) 8.5.2.3. GCC Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 8.5.2.4. GCC Organ Preservation Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Organ Preservation Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Organ Preservation Market Size and Forecast, by Solution (2024-2032) 8.5.3.3. Nigeria Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 8.5.3.4. Nigeria Organ Preservation Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Organ Preservation Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Organ Preservation Market Size and Forecast, by Solution (2024-2032) 8.5.4.3. Rest of ME&A Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 8.5.4.4. Rest of ME&A Organ Preservation Market Size and Forecast, by Application (2024-2032) 9. South America Organ Preservation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Organ Preservation Market Size and Forecast, by Type (2024-2032) 9.2. South America Organ Preservation Market Size and Forecast, by Solution (2024-2032) 9.3. South America Organ Preservation Market Size and Forecast, by Preservation Technique(2024-2032) 9.4. South America Organ Preservation Market Size and Forecast, by Application (2024-2032) 9.5. South America Organ Preservation Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Organ Preservation Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Organ Preservation Market Size and Forecast, by Solution (2024-2032) 9.5.1.3. Brazil Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 9.5.1.4. Brazil Organ Preservation Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Organ Preservation Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Organ Preservation Market Size and Forecast, by Solution (2024-2032) 9.5.2.3. Argentina Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 9.5.2.4. Argentina Organ Preservation Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Organ Preservation Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Organ Preservation Market Size and Forecast, by Solution (2024-2032) 9.5.3.3. Rest Of South America Organ Preservation Market Size and Forecast, by Preservation Technique (2024-2032) 9.5.3.4. Rest Of South America Organ Preservation Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Paragonix Technologies (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. XVIVO Perfusion AB (Sweden) 10.3. Dr. Franz Köhler Chemie GmbH (Germany) 10.4. Essential Pharmaceuticals, LLC (US) 10.5. TransMedics (US) 10.6. OrganOx Limited (UK) 10.7. 21st Century Medicine (US) 10.8. Shanghai Genext Medical Technology (China) 10.9. Bridge to Life Limited (US) 10.10. Waters Medical Systems (US) 10.11. Preservation Solutions (US) 10.12. Carnamedica (Poland) 10.13. Transplant Biomedicals (Spain) 10.14. Institut Georges Lopez (France) 10.15. Global Transplant Solutions (US) 10.16. Avionord (Italy) 10.17. Organ Preservation Solutions (England) 10.18. EBERS (Spain) 10.19. S.A.L.F. (Italy) 10.20. Biochefa (Poland) 10.21. Vascular Perfusion Solutions (US) 10.22. TX Innovations (Netherlands) 11. Key Findings 12. Industry Recommendations 13. Organ Preservation Market: Research Methodology 14. Terms and Glossary