Global Off-Road Motorcycle Market size was valued at USD 13.97 Bn. in 2024, and the total Off-Road Motorcycle Market revenue is expected to grow by 5.15% from 2025 to 2032, reaching nearly USD 20.88 Bn.Off-Road Motorcycle Market Overview:

The off-road motorcycle markets include vehicles designed specifically for rugged areas, such as dirt bikes, dune buggies, snowmobiles, and dual-purpose (double-purpose) motorcycles that are street-legal that are still capable of riding off-road. Dual-game bikes, similar to motocross machines, provide flexibility to ride on both highways and unexpected the use of public land as a rapidly valuable feature is limited. The dirt manufactured for challenging conditions offers motorcycles, light frames, long-traction tires, knob tires, and high ground clearance, which makes them ideal for forests, deserts, mountains, and motocross tracks. The leading manufacturers in this market include Honda, Yamaha, KTM, Kawasaki, Suzuki, and Husqvarna, offering models favourable for various areas and rider levels. Reedelically, North America dominates due to its strong entertainment and motorcycle culture, followed by Europe, where brands like KTM and Husqvarna, and Asia-Pacific, where development is increasing due to increasing interest in adventure sports and increasing strength.To know about the Research Methodology:-Request Free Sample Report

Off-Road Motorcycle Market Dynamics

Rising Popularity of Recreational Activities and Motorsports to drive the Off-Road Motorcycle Market The rising popularity of motorsports and outdoor recreation significantly drive the Off-Road Motorcycle Market. Activities such as motocross, enduro races, and adventure riding are rapidly expanding worldwide, boosting the demand for motorcycles designed for rugged terrains and trail riding. According to the American Motorcycle Association, more than 400,000 off-road motorcycle units were sold globally in 2024, reflecting the growing consumer shift toward these activities. The Enduro segment, in particular, dominated the market in 2024, as endurance races across mountainous and forest landscapes gained traction. Leading brands such as KTM, Husqvarna, Honda, and Yamaha continue to introduce advanced models tailored to these needs, with Husqvarna’s 2025 Enduro series featuring optimized braking systems and enhanced engine performance to elevate both competition and recreational riding. Alongside motorsports, the rise of adventure tourism has further accelerated demand, as travelers increasingly seek motorcycles for exploring offbeat destinations and natural trails. This trend is supported by the expanding availability of off-road routes worldwide, making such motorcycles essential for adventure enthusiasts. The youth participation and lifestyle influence are significantly shaping the market. Younger generations are increasingly attracted to motorsports, driven by the thrill of racing events, strong social media presence, and lifestyle-oriented branding strategies by key manufacturers. This cultural shift toward outdoor recreational lifestyles continues to push the adoption of off-road motorcycles, positioning them not only as vehicles for sport and tourism but also as symbols of adventure and identity. Collectively, these factors ensure sustained momentum for the off-road motorcycle market.Honda is one of the world's top vehicle manufacturers. It produces high-quality, effective vehicles, including cars, motorbikes, and power tools. In terms of volume, it is also the biggest manufacturer of internal combustion engines globally. KTM- CROSS Industries and Bajaj Auto are the owners of the Austrian motorcycle manufacturer KTM. More than 260 world championship records and five manufacturers' titles have been won by KTM bikes. Off-road motorbike sales at the firm have grown over time. In 2015, the company sold 71,854 off-road motorbikes, with 22,674 of those being motocross bikes and 49,180 being enduro bikes. Key strategy and improvement capability drive market growth. The development of the off-road motorcycle market is expected to be significantly influenced by advancements in off-road motorcycle capabilities. The market's manufacturers are focusing more attention on the advancement of improved powertrain, brake, transmission, and combustion technologies, as well as the creation of better engine designs and suspension systems. They have high-speed and high-suspension systems with compression damping that are adjustable and self-adjust to the motorcycle's speed. Off-road bikes' high ground clearance and skid plates also contribute to their durability. Off-road motorbike tires also include broad grooves and reinforced carcasses that are designed for use on a variety of surfaces and circumstances. The Off-road motorcycle skills will be improved, stress on bikes and riders will be reduced, and they will be more fit for use on comfortable and developed roads. Automobile suspension systems are an essential component, especially in off-road vehicles that must navigate harsh terrain. To enhance the off-road capabilities of off-road bikes, a number of industry suppliers are concentrating on the development of reducing suspension technology. Off-road motorcycles may operate well under tremendous stress thanks to the innovative custom shock absorbers and springs offered by TFX Suspension Technology. Advanced fork springs, shock springs, and shock absorbers are available for off-road motorcycles from K-Tech Suspension Ltd. One of the most important off-road motorcycle market trends is the employment of such cutting-edge suspension technology, which will help market manufacturers in differentiating their products and, as a result, drive the market's growth over the forecast period. The rising material cost forces OMEs to increase their prices to Restrain the Off-Road Motorcycle Market. The volatility in raw material costs, which has become a critical concern for manufacturers. The production of motorcycles relies heavily on raw materials such as steel, aluminum, rubber, and plastics, all of which are subject to price fluctuations influenced by global supply chain disruptions, energy costs, and geopolitical tensions. When these input costs rise suddenly and sharply, manufacturers often struggle to adjust their pricing strategies accordingly. Unlike in some industries where costs can be directly passed on to consumers, the competitive nature of the off-road motorcycle market limits the ability of companies to raise retail prices without risking market share loss. This situation is particularly challenging when raw material costs rise while retail prices remain stagnant or even decline due to competitive pressures or weakened consumer demand. In such scenarios, profit margins are squeezed, and the ability to maintain a stable and sustainable market structure becomes increasingly difficult. Moreover, poor pricing strategies in response to cost volatility led to further financial instability, affecting profitability but also long-term growth prospects. The lack of flexibility in transferring costs to end-users forces manufacturers to absorb much of the financial burden, which can hinder investments in innovation, product development, and market expansion. For smaller players in the industry, this can even threaten business continuity. Raw material price fluctuations represent a significant restraint on the off-road motorcycle market, as they disrupt cost management, erode profitability, and heighten the risk of unsustainable market practices.

Off-Road Motorcycle Market Segment Analysis:

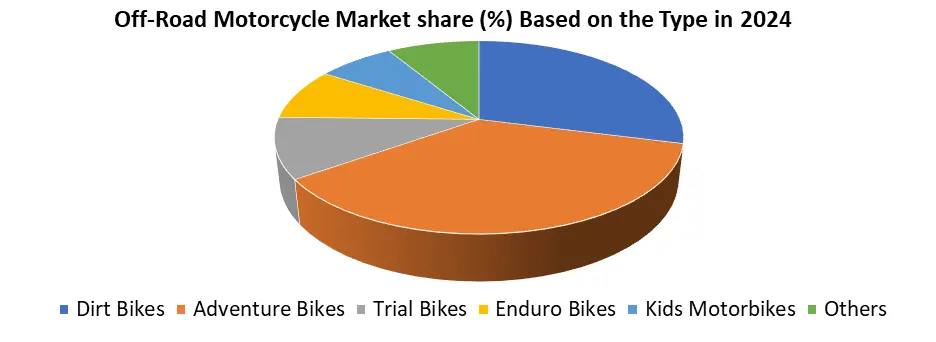

Based on the Type, Off-Road Motorcycle Market is segmented into Dirt Bikes, Adventure Bikes, Trial Bikes, Enduro Bikes, Kids Motorbikes and Others. The Adventure Bikes dominated the type segment in 2024. The Adventure Bikes segment dominated the Off-Road Motorcycle Market in 2024 due to their growing popularity among both enthusiasts and casual riders seeking versatility and comfort in off-road and on-road conditions. Unlike dirt or trial bikes, adventure motorcycles are designed to handle rugged terrains while offering longer travel ranges, advanced ergonomics, and superior safety features, making them a preferred choice for long-distance touring and outdoor exploration. Rising interest in adventure tourism and cross-country travel, especially in regions such as North America, Europe, and Asia-Pacific, has further propelled demand. Manufacturers are also introducing technologically advanced models with features like GPS integration, traction control, ABS, and lightweight durable frames, which appeal to modern riders seeking convenience and performance. The segment benefits from a wide consumer base, spanning professionals, adventure sports enthusiasts, and hobbyists. Additionally, the growing affordability of mid-range adventure bikes has expanded accessibility for younger riders. The increasing popularity of adventure biking events, rallies, and social media communities has further boosted market growth. Collectively, these factors established Adventure Bikes as the dominant type in the off-road motorcycle market in 2024.

Off-Road Motorcycle Market Regional Insights:

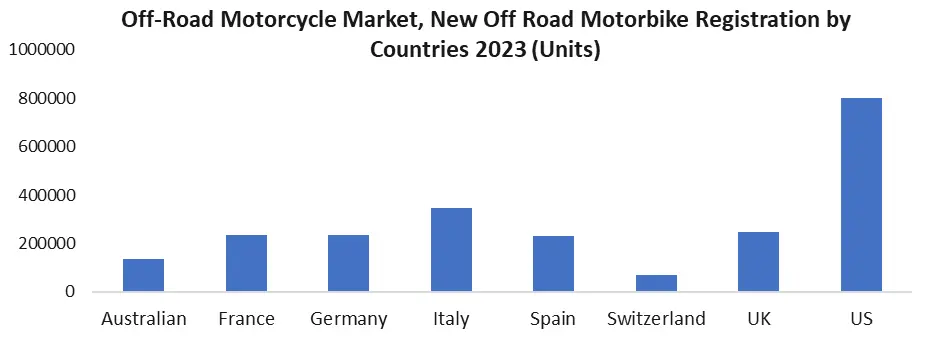

The Europe dominated Off-Road Motorcycle Market in 2024. Supported by its strong motorsports culture, high adoption rates, and presence of leading manufacturers. The region hosts globally renowned events such as the FIM Grand Prix Motocross World Championship, European Motocross Championship, and UCI E-MTB Cross-country World Cup, held across countries including Spain, Italy, France, Germany, Belgium, and Sweden. These events attract both professional riders and large audiences, reinforcing the popularity of off-road sports and boosting motorcycle sales. According to the European Association of Motorcycle Manufacturers (ACEM), registrations in Europe’s five largest markets France, Germany, Italy, Spain, and the UK in 2024, reaching nearly 1.1 million units, underlining the rising demand for motorcycles as both mobility and recreational solutions. Europe also benefits from being home to key brands like KTM, Husqvarna, BMW, and Ducati, which consistently innovate and introduce specialized off-road models. KTM’s development of the Dakar-inspired 690 Rally, tested extensively in Europe, demonstrates the region’s influence on high-performance motorcycle design. Furthermore, the advanced dealer and distribution networks across Europe provide strong aftersales support, ensuring consumer confidence in repairs, spare parts, and maintenance. Adventure tourism and outdoor recreation trends also play a pivotal role, as European riders place high importance on trail riding and exploration, supported by extensive trail infrastructure. With revenues estimated at several billion USD in 2024, Europe accounted for over 60% of global off-road motorcycle sales. This dominance reflects the region’s cultural affinity for motorsports, strong economic capacity, and leadership in motorcycle technology.

Off-Road Motorcycle Market Competitive Landscape

The Off-Road Motorcycle Market is a fast-moving, competitive scene, with major manufacturers across multiple competitive facets vying for attention through innovation, product mix and differentiation, geographic interests, and collaborative ventures. KTM AG (Austria) is at the forefront of the competitive position and highly popular, both in competition and recreational markets. KTM has been successful at developing its premium brand position within the Off-Road Motorcycle Market and is now also committing resources to its electric dirt bike products (i.e., E-Ride series). KTM is incredibly successful with its overwhelming share of both domestic and international racing events, such as the Dakar Rally. For 2024, it is estimated that KTM holds between 22 and 25% of all off-road global market share. Honda Motor Co., Ltd. (Japan) is and remains another significant competitor in the Off-Road Motorcycle Market with its CRF series of products, and with the intention of using universal export routes along with production volume to offer competitive pricing, coupled with brand loyalty. Yamaha Motor Co., Ltd. (Japan) shares a similar competitive strategy, listing a large quantity of performance Off-Road Motorcycles in its product lines while at the same time trying to offer leading-edge technologies within safety features to differentiate itself in the dual-sport and racing product lines. Since entering a partnership with KTM, Bajaj Auto Ltd. (India) is introducing significant increases to its Off-Road Motorcycle product offering due to their relationship with KTM and therefore the growing demand for off-road motorcycles within the domestic Indian motorcycle market.Off-Road Motorcycle Market Key Developments

In October 17,2024 KTM unveiled the refreshed 2025 FREERIDE E, marking a decade since its original electric concept. Endorsed by hard enduro star Manuel Lettenbichler, the model combines low emissions, near-silent performance, and minimal maintenance with trial-like capabilities. Offering instant torque, advanced braking, and rider-friendly design, it represents KTM’s next step in sustainable, high-performance off-road e-mobility. In 2025, Yamaha has unveiled the all-new 2025 YZ250FX, featuring major upgrades to enhance agility, handling, and rider comfort. The bike debuts a redesigned aluminium bilateral beam frame with lower centre of gravity, revised KYB suspension, and improved ergonomics for sharper performance in cross-country racing. Enhanced intake, optimised ECU, and updated Yamaha Power Tuner App with three-level traction control deliver refined power and tuning flexibility, making the YZ250FX lighter, faster, and more competitive. In September 2024, Husqvarna Mobility has introduced its 2025 Pro enduro models – the 2-stroke TE 300 Pro and 4-stroke FE 350 Pro – built with race-tested components for maximum performance. Featuring updated WP XACT suspension, advanced Engine Management System with selectable maps, Traction Control, and Quickshifter, both models offer customisable power delivery and superior handling. Equipped with premium Technical Accessories including EXCEL Takasago rims, Brembo systems, Pro Taper handlebars, and enhanced protection parts, the Pro series delivers durability, precision, and a true competitive edge.Off-Road Motorcycle Market Key Trends

1. Rising Adoption of Electric Off-Road Motorcycles The market is witnessing a strong push toward electrification, with leading brands like KTM, Husqvarna, and Yamaha introducing advanced electric off-road models. Features such as low emissions, near-silent operation, instant torque, and low maintenance appeal to both eco-conscious riders and new entrants. Growing environmental regulations and the demand for sustainable motorsports further accelerate this trend. 2. Integration of Advanced Technology and Connectivity Manufacturers are equipping off-road motorcycles with smart technologies, including smartphone-based tuning apps, traction control systems, and adjustable engine mapping. For example, Yamaha’s Power Tuner App and KTM’s advanced ECU systems allow riders to personalise performance based on terrain and riding style. These innovations enhance safety, control, and rider experience, setting new benchmarks in the off-road motorcycle segment.Off-road Motorcycles Market Scope: Inquire before buying

Off-road Motorcycles Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 13.97 Bn. Forecast Period 2025 to 2032 CAGR: 5.15% Market Size in 2032: USD 20.88 Bn. Segments Covered: by Type Dirt Bikes Adventure Bikes Trial Bikes Enduro Bikes Kids Motorbikes Others by Propulsion Internal Combustion Engine (ICE) Electric by Engine Capacity Less Than 500 cc 500 cc to 1000 cc More Than 1000 cc by Application Recreational Defence Kids Motorbikes Others Off-Road Motorcycle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Off-Road Motorcycle Market Key players:

1. Yamaha Motor Co., Ltd. (Japan) 2. Honda Motor Co., Ltd. (Japan) 3. KTM AG (Austria) 4. Husqvarna Motorcycles GmbH (Austria) 5. Kawasaki Heavy Industries, Ltd. (Japan) 6. Suzuki Motor Corporation (Japan) 7. BMW Motorrad (Germany) 8. Ducati Motor Holding S.p.A. (Italy) 9. Triumph Motorcycles Ltd. (United Kingdom) 10. Hero MotoCorp Ltd. (India) 11. Bajaj Auto Ltd. (India) 12. TVS Motor Company (India) 13. Royal Enfield (India) 14. GasGas Motorcycles GmbH (Austria) 15. Beta Motorcycles (Italy) 16. Sherco Motorcycles (France) 17. Rieju S.A. (Spain) 18. Alta Motors (United States) 19. Zero Motorcycles (United States) 20. Polaris Inc. (United States) 21. Harley-Davidson, Inc. (United States) 22. AJP Motos (Portugal) 23. Cleveland CycleWerks (United States) 24. Electric Motion (France) 25. Fantic Motor S.p.A. (Italy) 26. Zongshen Industrial Group (China) 27. Loncin Motor Co., Ltd. (China) 28. CFMOTO (China) 29. Kymco (Taiwan) 30. Segway Powersports (China)FAQs:

1] What segments are covered in the Global Off-Road Motorcycle Market report? Ans. The segments covered in the Off-Road Motorcycle Market report are based on Type, Propulsion, Engine Capacity, Application and Region. 2] Which region is expected to hold the highest share in the Global Off-Road Motorcycle Market? Ans. The North America region is expected to hold the highest share of the Off-Road Motorcycle Market. 3] What is the market size of the Global Off-Road Motorcycle Market by 2032? Ans. The market size of the Off-Road Motorcycle Market by 2032 is expected to reach US$ 20.88 Bn. 4] What is the forecast period for the Global Off-Road Motorcycle Market? Ans. The forecast period for the Off-Road Motorcycle Market is 2025-2032. 5] What was the market size of the Global Off-Road Motorcycle Market in 2023? Ans. The market size of the Off-Road Motorcycle Market in 2024 was valued at US$ 13.97 Bn.

1. Off-Road Motorcycle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Off-Road Motorcycle Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Off-Road Motorcycle Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Off-Road Motorcycle Market: Dynamics 3.1. Off-Road Motorcycle Market Trends by Region 3.1.1. North America Off-Road Motorcycle Market Trends 3.1.2. Europe Off-Road Motorcycle Market Trends 3.1.3. Asia Pacific Off-Road Motorcycle Market Trends 3.1.4. Middle East and Africa Off-Road Motorcycle Market Trends 3.1.5. South America Off-Road Motorcycle Market Trends 3.2. Off-Road Motorcycle Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Off-Road Motorcycle Market Drivers 3.2.1.2. North America Off-Road Motorcycle Market Restraints 3.2.1.3. North America Off-Road Motorcycle Market Opportunities 3.2.1.4. North America Off-Road Motorcycle Market Challenges 3.2.2. Europe 3.2.2.1. Europe Off-Road Motorcycle Market Drivers 3.2.2.2. Europe Off-Road Motorcycle Market Restraints 3.2.2.3. Europe Off-Road Motorcycle Market Opportunities 3.2.2.4. Europe Off-Road Motorcycle Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Off-Road Motorcycle Market Drivers 3.2.3.2. Asia Pacific Off-Road Motorcycle Market Restraints 3.2.3.3. Asia Pacific Off-Road Motorcycle Market Opportunities 3.2.3.4. Asia Pacific Off-Road Motorcycle Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Off-Road Motorcycle Market Drivers 3.2.4.2. Middle East and Africa Off-Road Motorcycle Market Restraints 3.2.4.3. Middle East and Africa Off-Road Motorcycle Market Opportunities 3.2.4.4. Middle East and Africa Off-Road Motorcycle Market Challenges 3.2.5. South America 3.2.5.1. South America Off-Road Motorcycle Market Drivers 3.2.5.2. South America Off-Road Motorcycle Market Restraints 3.2.5.3. South America Off-Road Motorcycle Market Opportunities 3.2.5.4. South America Off-Road Motorcycle Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Off-Road Motorcycle Industry 3.8. Analysis of Government Schemes and Initiatives For Off-Road Motorcycle Industry 3.9. Off-Road Motorcycle Market Trade Analysis 3.10. The Global Pandemic Impact on Off-Road Motorcycle Market 4. Off-Road Motorcycle Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 4.1.1. Dirt Bikes 4.1.2. Adventure Bikes 4.1.3. Trial Bikes 4.1.4. Enduro Bikes 4.1.5. Kids Motorbikes 4.1.6. Others 4.2. Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 4.2.1. Internal Combustion Engine (ICE) 4.2.2. Electric 4.3. Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 4.3.1. Less Than 500 cc 4.3.2. 500 cc to 1000 cc 4.3.3. More Than 1000 cc 4.4. Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 4.4.1. Recreational 4.4.2. Defence 4.4.3. Kids Motorbikes 4.4.4. Others 4.5. Off-Road Motorcycle Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Off-Road Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 5.1.1. Dirt Bikes 5.1.2. Adventure Bikes 5.1.3. Trial Bikes 5.1.4. Enduro Bikes 5.1.5. Kids Motorbikes 5.1.6. Others 5.2. North America Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 5.2.1. Internal Combustion Engine (ICE) 5.2.2. Electric 5.3. North America Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 5.3.1. Less Than 500 cc 5.3.2. 500 cc to 1000 cc 5.3.3. More Than 1000 cc 5.4. North America Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 5.4.1. Recreational 5.4.2. Defence 5.4.3. Kids Motorbikes 5.4.4. Others 5.5. North America Off-Road Motorcycle Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Dirt Bikes 5.5.1.1.2. Adventure Bikes 5.5.1.1.3. Trial Bikes 5.5.1.1.4. Enduro Bikes 5.5.1.1.5. Kids Motorbikes 5.5.1.1.6. Others 5.5.1.2. United States Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 5.5.1.2.1. Internal Combustion Engine (ICE) 5.5.1.2.2. Electric 5.5.1.3. United States Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 5.5.1.3.1. Less Than 500 cc 5.5.1.3.2. 500 cc to 1000 cc 5.5.1.3.3. More Than 1000 cc 5.5.1.4. United States Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Recreational 5.5.1.4.2. Defence 5.5.1.4.3. Kids Motorbikes 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Dirt Bikes 5.5.2.1.2. Adventure Bikes 5.5.2.1.3. Trial Bikes 5.5.2.1.4. Enduro Bikes 5.5.2.1.5. Kids Motorbikes 5.5.2.1.6. Others 5.5.2.2. Canada Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 5.5.2.2.1. Internal Combustion Engine (ICE) 5.5.2.2.2. Electric 5.5.2.3. Canada Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 5.5.2.3.1. Less Than 500 cc 5.5.2.3.2. 500 cc to 1000 cc 5.5.2.3.3. More Than 1000 cc 5.5.2.4. Canada Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Recreational 5.5.2.4.2. Defence 5.5.2.4.3. Kids Motorbikes 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Dirt Bikes 5.5.3.1.2. Adventure Bikes 5.5.3.1.3. Trial Bikes 5.5.3.1.4. Enduro Bikes 5.5.3.1.5. Kids Motorbikes 5.5.3.1.6. Others 5.5.3.2. Mexico Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 5.5.3.2.1. Internal Combustion Engine (ICE) 5.5.3.2.2. Electric 5.5.3.3. Mexico Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 5.5.3.3.1. Less Than 500 cc 5.5.3.3.2. 500 cc to 1000 cc 5.5.3.3.3. More Than 1000 cc 5.5.3.4. Mexico Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Recreational 5.5.3.4.2. Defence 5.5.3.4.3. Kids Motorbikes 5.5.3.4.4. Others 6. Europe Off-Road Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.2. Europe Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.3. Europe Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.4. Europe Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5. Europe Off-Road Motorcycle Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.1.3. United Kingdom Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.1.4. United Kingdom Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.2.3. France Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.2.4. France Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.3.3. Germany Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.3.4. Germany Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.4.3. Italy Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.4.4. Italy Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.5.3. Spain Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.5.4. Spain Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.6.3. Sweden Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.6.4. Sweden Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.7.3. Austria Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.7.4. Austria Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 6.5.8.3. Rest of Europe Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 6.5.8.4. Rest of Europe Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Off-Road Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.3. Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.4. Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.1.3. China Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.1.4. China Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.2.3. S Korea Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.2.4. S Korea Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.3.3. Japan Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.3.4. Japan Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.4.3. India Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.4.4. India Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.5.3. Australia Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.5.4. Australia Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.6.3. Indonesia Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.6.4. Indonesia Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.7.3. Malaysia Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.7.4. Malaysia Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.8.3. Vietnam Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.8.4. Vietnam Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.9.3. Taiwan Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.9.4. Taiwan Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 7.5.10.3. Rest of Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 7.5.10.4. Rest of Asia Pacific Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Off-Road Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 8.3. Middle East and Africa Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 8.4. Middle East and Africa Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Off-Road Motorcycle Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 8.5.1.3. South Africa Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.1.4. South Africa Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 8.5.2.3. GCC Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.2.4. GCC Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 8.5.3.3. Nigeria Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.3.4. Nigeria Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 8.5.4.3. Rest of ME&A Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 8.5.4.4. Rest of ME&A Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 9. South America Off-Road Motorcycle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 9.2. South America Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 9.3. South America Off-Road Motorcycle Market Size and Forecast, by Engine Capacity(2024-2032) 9.4. South America Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 9.5. South America Off-Road Motorcycle Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 9.5.1.3. Brazil Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 9.5.1.4. Brazil Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 9.5.2.3. Argentina Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 9.5.2.4. Argentina Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Off-Road Motorcycle Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Off-Road Motorcycle Market Size and Forecast, by Propulsion (2024-2032) 9.5.3.3. Rest Of South America Off-Road Motorcycle Market Size and Forecast, by Engine Capacity (2024-2032) 9.5.3.4. Rest Of South America Off-Road Motorcycle Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Yamaha Motor Co., Ltd. (Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Honda Motor Co., Ltd. (Japan) 10.3. KTM AG (Austria) 10.4. Husqvarna Motorcycles GmbH (Austria) 10.5. Kawasaki Heavy Industries, Ltd. (Japan) 10.6. Suzuki Motor Corporation (Japan) 10.7. BMW Motorrad (Germany) 10.8. Ducati Motor Holding S.p.A. (Italy) 10.9. Triumph Motorcycles Ltd. (United Kingdom) 10.10. Hero MotoCorp Ltd. (India) 10.11. Bajaj Auto Ltd. (India) 10.12. TVS Motor Company (India) 10.13. Royal Enfield (India) 10.14. GasGas Motorcycles GmbH (Austria) 10.15. Beta Motorcycles (Italy) 10.16. Sherco Motorcycles (France) 10.17. Rieju S.A. (Spain) 10.18. Alta Motors (United States) 10.19. Zero Motorcycles (United States) 10.20. Polaris Inc. (United States) 10.21. Harley-Davidson, Inc. (United States) 10.22. AJP Motos (Portugal) 10.23. Cleveland CycleWerks (United States) 10.24. Electric Motion (France) 10.25. Fantic Motor S.p.A. (Italy) 10.26. Zongshen Industrial Group (China) 10.27. Loncin Motor Co., Ltd. (China) 10.28. CFMOTO (China) 10.29. Kymco (Taiwan) 10.30. Segway Powersports (China) 11. Key Findings 12. Industry Recommendations 13. Off-Road Motorcycle Market: Research Methodology 14. Terms and Glossary