Global Nuclear Medicine/Radiopharmaceuticals Market size was valued at USD 7.43 Billion in 2024 and is expected to grow at a CAGR of 5.93% from 2025 to 2032, reaching nearly USD 11.78 Billion in 2032Global Nuclear Medicine/Radiopharmaceuticals Market Overview:

Nuclear Medicine Radiopharmaceuticals are radioactive compounds used for diagnostic imaging (PET, SPECT) and targeted therapy. They consist of a radioisotope (e.g., Tc-99m, F-18, Lu-177) bound to a biological molecule, enabling disease detection at molecular levels or precise radiation delivery to tumors. Key applications include oncology, cardiology, and neurology, driving advancements in personalized medicine. Demand for nuclear medicine radiopharmaceuticals is rising due to increasing cancer prevalence, aging populations, and adoption of theranostics. Supply faces challenges from short isotope half-lives, reactor dependency, and complex logistics. The cyclotron and generator-based production are expanding, demand growth outpaces supply, creating regional shortages—especially for Lu-177 and Ac-225 therapies.To know about the Research Methodology :- Request Free Sample Report North America leads the Nuclear Medicine/Radiopharmaceuticals market, driven by advanced healthcare infrastructure, widespread adoption of theranostics, and high investment in medical technology. The region benefits from a robust network of hospitals, diagnostic centers, and research institutes, which accelerates the integration of innovative radiopharmaceuticals and imaging technologies. Europe holds the second position, supported by strong research and development capabilities, well-established regulatory frameworks, and growing collaborations between academic institutions and industry players. This environment fosters the development of novel radiopharmaceuticals and advanced imaging solutions. Asia-Pacific is the fastest-growing region, fueled by rapid healthcare expansion, increasing awareness of nuclear medicine, rising prevalence of chronic diseases, and government initiatives promoting advanced diagnostics. Emerging markets in China, India, and Japan are witnessing substantial investments in nuclear imaging infrastructure.

Nuclear Medicine/Radiopharmaceuticals Market Recent Trend

1. Theranostics Boom • Combining diagnostics + therapy (e.g., Ga-68 for imaging + Lu-177 for treatment). • FDA approvals: Pluvicto (Lu-177 PSMA) for prostate cancer, Lutathera for neuroendocrine tumors. • New targets: FAP inhibitors for pan-cancer applications. 2. Shift to Alpha Emitters • Ac-225, Ra-223, Pb-212 gaining traction for precision therapy. • Higher efficacy but supply chain challenges (limited Ac-225 production).Nuclear Medicine/Radiopharmaceuticals Market Dynamics:

Rising Demand for Precision Cancer Theranostics to Drive the Nuclear Medicine/Radiopharmaceuticals Market The nuclear medicine/radiopharmaceuticals market is experiencing significant growth, driven by the rising demand for precision cancer theranostics. Theranostics, which combines therapy and diagnostics, is revolutionizing oncology by enabling targeted diagnosis and personalized treatment, improving patient outcomes while minimizing side effects. The increasing incidence of cancer globally, coupled with advancements in molecular imaging and targeted radiotherapy, is accelerating the adoption of radiopharmaceuticals in clinical settings. Precision cancer theranostics uses radioisotopes to detect and treat malignancies with high specificity. This approach facilitates early detection of tumors, accurate staging, and real-time monitoring of treatment efficacy. For example, the use of positron emission tomography (PET) tracers such as fluorodeoxyglucose (FDG) and novel theranostic agents like Lutetium-177 and Gallium-68 have gained widespread clinical acceptance. These agents are particularly effective in treating cancers like prostate, thyroid, and neuroendocrine tumors, where conventional therapies often show limited effectiveness. The growth of the Nuclear Medicine/Radiopharmaceuticals market is propelled by technological advancements in imaging modalities, expanding clinical research, and supportive government initiatives to enhance nuclear medicine infrastructure. Additionally, collaborations between pharmaceutical companies and research institutions are leading to the development of innovative radiopharmaceuticals with better safety and efficacy profiles. Short Half-Life & Supply Chain Challenges Hampered the Nuclear Medicine/Radiopharmaceuticals Market Growth The radiopharmaceutical market faces significant challenges due to the inherently short half-life of many key isotopes, which directly impacts production, logistics, and distribution. For instance, Fluorine-18 (F-18) has a half-life of only 110 minutes, while Gallium-68 (Ga-68) lasts just 68 minutes. Such brief stability periods necessitate rapid synthesis, quality control, and delivery to hospitals or imaging centers, often within a few hours. This tight window limits geographic reach and requires sophisticated cold-chain logistics, increasing operational complexity and costs. Many radiopharmaceuticals depend on specialized production facilities such as nuclear reactors or cyclotrons, which are expensive to build and maintain. Limited availability of these facilities contributes to frequent supply shortages, as observed with isotopes like Actinium-225 (Ac-225) used in targeted therapies. Any disruption due to maintenance, regulatory delays, or geopolitical issues can create bottlenecks, affecting patient access and treatment schedules. Regulatory compliance complicates the supply chain. Radiopharmaceuticals are subject to stringent rules from authorities such as the FDA, EMA, and local nuclear regulatory bodies, encompassing production, transportation, and administration. These regulations ensure safety but also lengthen approval processes and add administrative burdens. High production and distribution costs, coupled with the need for highly trained personnel, further constrain market expansion. Specialized handling, radiation safety measures, and waste management protocols add layers of complexity and expense. Smaller markets or remote regions often struggle to gain access, limiting the global reach of Nuclear Medicine/Radiopharmaceuticals Market. Rising Demand for Radiopharmaceuticals in Neurological and Cardiovascular Imaging in Nuclear Medicine/Radiopharmaceuticals Market Traditionally, radiopharmaceuticals have been utilized in oncology for diagnostic imaging and targeted therapies. However, the increasing prevalence of neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, and epilepsy, is driving demand for advanced imaging agents capable of early detection and monitoring of disease progression. Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT) tracers, such as Fluorine-18 (F-18) labeled compounds, are increasingly being employed to visualize amyloid plaques, tau proteins, and other biomarkers, enabling more accurate diagnosis and personalized treatment strategies. This trend is expected to fuel growth in Nuclear Medicine/Radiopharmaceuticals Market adoption within neurology. The cardiovascular diseases, which remain the leading cause of mortality globally, offer substantial market potential. Radiopharmaceuticals such as Technetium-99m (Tc-99m) agents are widely used in myocardial perfusion imaging to assess blood flow and detect ischemic regions of the heart. Innovations in targeted tracers for detecting vulnerable plaques, assessing cardiac metabolism, and monitoring post-intervention outcomes are expanding the utility of radiopharmaceuticals beyond conventional imaging. These developments not only improve patient outcomes but also increase the clinical adoption of radiopharmaceutical diagnostics in cardiology. Moreover, the convergence of molecular imaging with artificial intelligence and precision medicine is enhancing the ability to quantify disease states, predict therapeutic responses, and optimize individualized treatment plans. The growing aging population and rising incidence of chronic neurological and cardiovascular disorders support this Nuclear Medicine/Radiopharmaceuticals Market Growth.Nuclear Medicine/Radiopharmaceuticals Market Segment Analysis

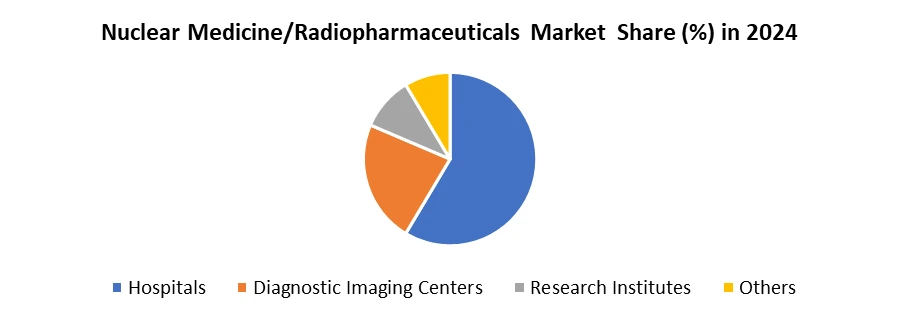

Based on End-User Nuclear Medicine/Radiopharmaceuticals Market is segmented into Hospitals, Diagnostic Imaging Centers, Research Institutes and Others. The hospitals segment dominated the Nuclear Medicine/Radiopharmaceuticals Market in 2024 and is expected to hold the largest market share over the forecast period. Their dominance stems from being primary care centers equipped with advanced imaging technologies (PET/CT, SPECT), in-house radiopharmacies, and the capability to administer both diagnostic and therapeutic radiopharmaceuticals. The rising prevalence of cancer and cardiovascular diseases drives hospital adoption, supported by established insurance coverage and government healthcare investments.

Nuclear Medicine/Radiopharmaceuticals Market Regional Insights

North America held the largest share of the global nuclear medicine/ radiopharmaceuticals market in 2024, driven by a combination of advanced healthcare infrastructure, technological adoption, and strong research and development capabilities. The region benefits from a well-established network of hospitals, diagnostic centers, and specialized laboratories, enabling rapid deployment and utilization of radiopharmaceuticals for both diagnostic and therapeutic purposes. The high prevalence of chronic diseases, particularly cancer, cardiovascular disorders, and neurological conditions, further fuels demand for advanced imaging agents and targeted therapies. Technetium-99m (Tc-99m) and Fluorine-18 (F-18) are widely used isotopes in the region, primarily for SPECT and PET imaging. Meanwhile, therapeutic isotopes like Lutetium-177 (Lu-177) and Yttrium-90 (Y-90) are gaining traction due to the rising adoption of targeted radionuclide therapies in oncology. The presence of leading pharmaceutical and biotechnology companies investing heavily in isotope production, innovative tracers, and personalized medicine strengthens North America’s market position. Moreover, supportive regulatory frameworks, reimbursement policies, and government initiatives for cancer treatment and advanced diagnostics facilitate Nuclear Medicine/Radiopharmaceuticals Market growth. Increasing collaborations between hospitals, research institutions, and radiopharmaceutical manufacturers further enhance access and innovation.Nuclear Medicine/Radiopharmaceuticals Market Competitive Landscape

The global Nuclear Medicine/Radiopharmaceuticals Market is led by five key players driving innovation and market expansion. Novartis AG dominates through its advanced theranostics portfolio, including FDA-approved therapies like Pluvicto (Lu-177 PSMA) and Lutathera (Lu-177 DOTATATE). Siemens Healthineers follows with cutting-edge PET/CT imaging systems and radiopharmaceutical production solutions. Cardinal Health secures a strong position as a leading supplier of diagnostic and therapeutic isotopes, including Tc-99m generators. Curium Pharma specializes in nuclear medicine diagnostics, offering widely used agents like FDG and Ga-68 DOTATOC. Rounding out the top five, Lantheus Holdings focuses on precision diagnostics with products such as Pylarify (PSMA-PET) and Definity (ultrasound contrast). These companies compete through strategic acquisitions (e.g., Novartis-Endocyte), AI-integrated imaging, and expanded radiopharmaceutical pipelines, collectively shaping the future of cancer theranostics and diagnostic advancements.Nuclear Medicine/Radiopharmaceuticals Market Recent Development

Date Company Name Headquarter Country Recent Development 15-Mar-2024 Novartis AG Switzerland FDA granted priority review for expanded use of Pluvicto (Lu-177 PSMA-I&T) in early-stage prostate cancer 28-Feb-2024 Lantheus Holdings USA Launched Pylarify AI analytics platform for automated PSMA-PET image interpretation 10-Jan-2024 Siemens Healthineers Germany Installed 50th PETtrace cyclotron system worldwide to boost radiopharmaceutical production 05-Dec-2023 Curium Pharma France Signed research collaboration with Mayo Clinic for novel Ga-68/Lu-177 theranostics 22-Nov-2023 Cardinal Health USA Opened new Tc-99m generator manufacturing facility in Missouri to address shortages Nuclear Medicine/Radiopharmaceuticals Market Scope: Inquire before buying

Global Nuclear Medicine/Radiopharmaceuticals Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 7.43 Bn. Forecast Period 2025 to 2032 CAGR: 5.93% Market Size in 2032: USD 11.78 Bn. Segments Covered: by Type Diagnostic Radiopharmaceuticals Therapeutic Radiopharmaceuticals by Isotope Technetium-99m (Tc-99m) Fluorine-18 (F-18) Iodine-131 (I-131) Lutetium-177 (Lu-177) Gallium-68 (Ga-68) Others (Copper-64, Yttrium-90, etc.) by Technology Single Photon Emission Computed Tomography (SPECT) Positron Emission Tomography (PET) Hybrid Imaging by Procedure Diagnostic Procedures PET Imaging SPECT Imaging Therapeutic Procedures Targeted Alpha Therapy (TAT) Peptide Receptor Radionuclide Therapy (PRRT) Radioimmunotherapy by Application Oncology Cardiology Neurology Orthopedics Others by End User Hospitals Diagnostic Imaging Centers Research Institutes Others Nuclear Medicine/Radiopharmaceuticals Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Nuclear Medicine/Radiopharmaceuticals Market Key Players

North America Nuclear Medicine/Radiopharmaceuticals Market Key Players 1. Lantheus Holdings, Inc. (USA) 2. Cardinal Health (USA) 3. GE HealthCare (USA) 4. Curium Pharma (USA/France – Major NA presence) 5. Jubilant Radiopharma (USA) 6. NorthStar Medical Radioisotopes (USA) Europe Nuclear Medicine/Radiopharmaceuticals Market Key Players 1. Novartis AG (Advanced Accelerator Applications - AAA) (Switzerland) 2. Siemens Healthineers (Germany) 3. Bayer AG (Germany) 4. Curium Pharma (France) 5. ITM Isotope Technologies Munich SE (Germany) 6. Eckert & Ziegler (Germany) Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Key Players 1. China Isotope & Radiation Corporation (CIRC) (China) 2. Jubilant Pharma Limited (India/Singapore) 3. Dongcheng Pharmaceutical Group (China) 4. Sinotau Pharmaceutical Group (China) Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Key Players 1. Neptunium (South Africa) 2. NTP Radioisotopes (South Africa) South America Nuclear Medicine/Radiopharmaceuticals Market Key Players 1. Instituto de Pesquisas Energéticas e Nucleares (IPEN) (Brazil) 2. Comisión Nacional de Energía Atómica (CNEA) (Argentina)Frequently Asked Questions:

1. What is the growth rate of Nuclear Medicine/Radiopharmaceuticals Market? Ans: The Global Nuclear Medicine/Radiopharmaceuticals Market is growing at a CAGR of 9 % during forecasting period 2025-2032. 2. What segments are covered in Nuclear Medicine/Radiopharmaceuticals market? Ans: Global Nuclear Medicine/Radiopharmaceuticals Market is segmented into by Type, Isotope, Technology, Procedure, Applications, End User, and Region. 3. Who are the key players in Nuclear Medicine/Radiopharmaceuticals market? Ans: Lantheus Holdings, Inc., Jubilant Radiopharma, Siemens Healthineers and China Isotope & Radiation Corporation are the top key players in the Nuclear Medicine/Radiopharmaceuticals market. 4. What is the study period of this market? Ans: The Global Market is studied from 2024 to 2032.

1. Nuclear Medicine/Radiopharmaceuticals Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Nuclear Medicine/Radiopharmaceuticals Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Nuclear Medicine/Radiopharmaceuticals Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Nuclear Medicine/Radiopharmaceuticals Market: Dynamics 3.1. Nuclear Medicine/Radiopharmaceuticals Market Trends by Region 3.1.1. North America Nuclear Medicine/Radiopharmaceuticals Market Trends 3.1.2. Europe Nuclear Medicine/Radiopharmaceuticals Market Trends 3.1.3. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Trends 3.1.4. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Trends 3.1.5. South America Nuclear Medicine/Radiopharmaceuticals Market Trends 3.2. Nuclear Medicine/Radiopharmaceuticals Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Nuclear Medicine/Radiopharmaceuticals Market Drivers 3.2.1.2. North America Nuclear Medicine/Radiopharmaceuticals Market Restraints 3.2.1.3. North America Nuclear Medicine/Radiopharmaceuticals Market Opportunities 3.2.1.4. North America Nuclear Medicine/Radiopharmaceuticals Market Challenges 3.2.2. Europe 3.2.2.1. Europe Nuclear Medicine/Radiopharmaceuticals Market Drivers 3.2.2.2. Europe Nuclear Medicine/Radiopharmaceuticals Market Restraints 3.2.2.3. Europe Nuclear Medicine/Radiopharmaceuticals Market Opportunities 3.2.2.4. Europe Nuclear Medicine/Radiopharmaceuticals Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Drivers 3.2.3.2. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Restraints 3.2.3.3. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Opportunities 3.2.3.4. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Drivers 3.2.4.2. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Restraints 3.2.4.3. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Opportunities 3.2.4.4. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Challenges 3.2.5. South America 3.2.5.1. South America Nuclear Medicine/Radiopharmaceuticals Market Drivers 3.2.5.2. South America Nuclear Medicine/Radiopharmaceuticals Market Restraints 3.2.5.3. South America Nuclear Medicine/Radiopharmaceuticals Market Opportunities 3.2.5.4. South America Nuclear Medicine/Radiopharmaceuticals Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Nuclear Medicine/Radiopharmaceuticals Industry 3.8. Analysis of Government Schemes and Initiatives For Nuclear Medicine/Radiopharmaceuticals Industry 3.9. Nuclear Medicine/Radiopharmaceuticals Market Trade Analysis 3.10. The Global Pandemic Impact on Nuclear Medicine/Radiopharmaceuticals Market 4. Nuclear Medicine/Radiopharmaceuticals Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 4.1.1. Diagnostic Radiopharmaceuticals 4.1.2. Therapeutic Radiopharmaceuticals 4.2. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 4.2.1. Technetium-99m (Tc-99m) 4.2.2. Fluorine-18 (F-18) 4.2.3. Iodine-131 (I-131) 4.2.4. Lutetium-177 (Lu-177) 4.2.5. Gallium-68 (Ga-68) 4.2.6. Others (Copper-64, Yttrium-90, etc.) 4.3. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 4.3.1. Single Photon Emission Computed Tomography (SPECT) 4.3.2. Positron Emission Tomography (PET) 4.3.3. Hybrid Imaging 4.4. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 4.4.1. Diagnostic Procedures 4.4.2. Therapeutic Procedures 4.5. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 4.5.1. Oncology 4.5.2. Cardiology 4.5.3. Neurology 4.5.4. Orthopedics 4.5.5. Others 4.6. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 4.6.1. Hospitals 4.6.2. Diagnostic Imaging Centers 4.6.3. Research Institutes 4.6.4. Others 4.7. Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 5.1.1. Diagnostic Radiopharmaceuticals 5.1.2. Therapeutic Radiopharmaceuticals 5.2. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 5.2.1. Technetium-99m (Tc-99m) 5.2.2. Fluorine-18 (F-18) 5.2.3. Iodine-131 (I-131) 5.2.4. Lutetium-177 (Lu-177) 5.2.5. Gallium-68 (Ga-68) 5.2.6. Others (Copper-64, Yttrium-90, etc.) 5.3. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 5.3.1. Single Photon Emission Computed Tomography (SPECT) 5.3.2. Positron Emission Tomography (PET) 5.3.3. Hybrid Imaging 5.4. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 5.4.1. Diagnostic Procedures 5.4.2. Therapeutic Procedures 5.5. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 5.5.1. Oncology 5.5.2. Cardiology 5.5.3. Neurology 5.5.4. Orthopedics 5.5.5. Others 5.6. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 5.6.1. Hospitals 5.6.2. Diagnostic Imaging Centers 5.6.3. Research Institutes 5.6.4. Others 5.7. North America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. United States Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 5.7.1.1.1. Diagnostic Radiopharmaceuticals 5.7.1.1.2. Therapeutic Radiopharmaceuticals 5.7.1.2. United States Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 5.7.1.2.1. Technetium-99m (Tc-99m) 5.7.1.2.2. Fluorine-18 (F-18) 5.7.1.2.3. Iodine-131 (I-131) 5.7.1.2.4. Lutetium-177 (Lu-177) 5.7.1.2.5. Gallium-68 (Ga-68) 5.7.1.2.6. Others (Copper-64, Yttrium-90, etc.) 5.7.1.3. United States Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 5.7.1.3.1. Single Photon Emission Computed Tomography (SPECT) 5.7.1.3.2. Positron Emission Tomography (PET) 5.7.1.3.3. Hybrid Imaging 5.7.1.4. United States Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 5.7.1.4.1. Diagnostic Procedures 5.7.1.4.2. Therapeutic Procedures 5.7.1.5. United States Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 5.7.1.5.1. Oncology 5.7.1.5.2. Cardiology 5.7.1.5.3. Neurology 5.7.1.5.4. Orthopedics 5.7.1.5.5. Others 5.7.1.6. United States Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 5.7.1.6.1. Hospitals 5.7.1.6.2. Diagnostic Imaging Centers 5.7.1.6.3. Research Institutes 5.7.1.6.4. Others 5.7.2. Canada 5.7.2.1. Canada Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 5.7.2.1.1. Diagnostic Radiopharmaceuticals 5.7.2.1.2. Therapeutic Radiopharmaceuticals 5.7.2.2. Canada Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 5.7.2.2.1. Technetium-99m (Tc-99m) 5.7.2.2.2. Fluorine-18 (F-18) 5.7.2.2.3. Iodine-131 (I-131) 5.7.2.2.4. Lutetium-177 (Lu-177) 5.7.2.2.5. Gallium-68 (Ga-68) 5.7.2.2.6. Others (Copper-64, Yttrium-90, etc.) 5.7.2.3. Canada Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 5.7.2.3.1. Single Photon Emission Computed Tomography (SPECT) 5.7.2.3.2. Positron Emission Tomography (PET) 5.7.2.3.3. Hybrid Imaging 5.7.2.4. Canada Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 5.7.2.4.1. Diagnostic Procedures 5.7.2.4.2. Therapeutic Procedures 5.7.2.5. Canada Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 5.7.2.5.1. Oncology 5.7.2.5.2. Cardiology 5.7.2.5.3. Neurology 5.7.2.5.4. Orthopedics 5.7.2.5.5. Others 5.7.2.6. Canada Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 5.7.2.6.1. Hospitals 5.7.2.6.2. Diagnostic Imaging Centers 5.7.2.6.3. Research Institutes 5.7.2.6.4. Others 5.7.3. Mexico 5.7.3.1. Mexico Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 5.7.3.1.1. Diagnostic Radiopharmaceuticals 5.7.3.1.2. Therapeutic Radiopharmaceuticals 5.7.3.2. Mexico Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 5.7.3.2.1. Technetium-99m (Tc-99m) 5.7.3.2.2. Fluorine-18 (F-18) 5.7.3.2.3. Iodine-131 (I-131) 5.7.3.2.4. Lutetium-177 (Lu-177) 5.7.3.2.5. Gallium-68 (Ga-68) 5.7.3.2.6. Others (Copper-64, Yttrium-90, etc.) 5.7.3.3. Mexico Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 5.7.3.3.1. Single Photon Emission Computed Tomography (SPECT) 5.7.3.3.2. Positron Emission Tomography (PET) 5.7.3.3.3. Hybrid Imaging 5.7.3.4. Mexico Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 5.7.3.4.1. Diagnostic Procedures 5.7.3.4.2. Therapeutic Procedures 5.7.3.5. Mexico Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 5.7.3.5.1. Oncology 5.7.3.5.2. Cardiology 5.7.3.5.3. Neurology 5.7.3.5.4. Orthopedics 5.7.3.5.5. Others 5.7.3.6. Mexico Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 5.7.3.6.1. Hospitals 5.7.3.6.2. Diagnostic Imaging Centers 5.7.3.6.3. Research Institutes 5.7.3.6.4. Others 6. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.2. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.3. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.4. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.5. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.6. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7. Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.1.2. United Kingdom Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.1.3. United Kingdom Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.1.4. United Kingdom Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.1.5. United Kingdom Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.1.6. United Kingdom Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.2. France 6.7.2.1. France Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.2.2. France Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.2.3. France Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.2.4. France Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.2.5. France Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.2.6. France Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.3.2. Germany Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.3.3. Germany Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.3.4. Germany Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.3.5. Germany Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.3.6. Germany Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.4.2. Italy Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.4.3. Italy Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.4.4. Italy Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.4.5. Italy Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.4.6. Italy Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.5.2. Spain Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.5.3. Spain Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.5.4. Spain Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.5.5. Spain Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.5.6. Spain Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.6.2. Sweden Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.6.3. Sweden Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.6.4. Sweden Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.6.5. Sweden Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.6.6. Sweden Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.7. Austria 6.7.7.1. Austria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.7.2. Austria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.7.3. Austria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.7.4. Austria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.7.5. Austria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.7.6. Austria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 6.7.8.2. Rest of Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 6.7.8.3. Rest of Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 6.7.8.4. Rest of Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 6.7.8.5. Rest of Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 6.7.8.6. Rest of Europe Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.3. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.4. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.5. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.6. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7. Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.1.2. China Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.1.3. China Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.1.4. China Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.1.5. China Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.1.6. China Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.2.2. S Korea Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.2.3. S Korea Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.2.4. S Korea Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.2.5. S Korea Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.2.6. S Korea Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.3.2. Japan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.3.3. Japan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.3.4. Japan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.3.5. Japan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.3.6. Japan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.4. India 7.7.4.1. India Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.4.2. India Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.4.3. India Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.4.4. India Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.4.5. India Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.4.6. India Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.5.2. Australia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.5.3. Australia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.5.4. Australia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.5.5. Australia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.5.6. Australia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.6.2. Indonesia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.6.3. Indonesia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.6.4. Indonesia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.6.5. Indonesia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.6.6. Indonesia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.7.2. Malaysia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.7.3. Malaysia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.7.4. Malaysia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.7.5. Malaysia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.7.6. Malaysia Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.8. Vietnam 7.7.8.1. Vietnam Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.8.2. Vietnam Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.8.3. Vietnam Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.8.4. Vietnam Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.8.5. Vietnam Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.8.6. Vietnam Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.9. Taiwan 7.7.9.1. Taiwan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.9.2. Taiwan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.9.3. Taiwan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.9.4. Taiwan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.9.5. Taiwan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.9.6. Taiwan Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 7.7.10. Rest of Asia Pacific 7.7.10.1. Rest of Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 7.7.10.2. Rest of Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 7.7.10.3. Rest of Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 7.7.10.4. Rest of Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 7.7.10.5. Rest of Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 7.7.10.6. Rest of Asia Pacific Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 8.3. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 8.4. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 8.5. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 8.6. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 8.7. Middle East and Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 8.7.1.2. South Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 8.7.1.3. South Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 8.7.1.4. South Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 8.7.1.5. South Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 8.7.1.6. South Africa Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 8.7.2.2. GCC Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 8.7.2.3. GCC Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 8.7.2.4. GCC Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 8.7.2.5. GCC Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 8.7.2.6. GCC Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 8.7.3. Nigeria 8.7.3.1. Nigeria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 8.7.3.2. Nigeria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 8.7.3.3. Nigeria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 8.7.3.4. Nigeria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 8.7.3.5. Nigeria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 8.7.3.6. Nigeria Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 8.7.4. Rest of ME&A 8.7.4.1. Rest of ME&A Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 8.7.4.2. Rest of ME&A Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 8.7.4.3. Rest of ME&A Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 8.7.4.4. Rest of ME&A Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 8.7.4.5. Rest of ME&A Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 8.7.4.6. Rest of ME&A Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 9. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 9.2. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 9.3. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology(2024-2032) 9.4. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 9.5. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 9.6. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 9.7. South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 9.7.1.2. Brazil Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 9.7.1.3. Brazil Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 9.7.1.4. Brazil Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 9.7.1.5. Brazil Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 9.7.1.6. Brazil Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 9.7.2.2. Argentina Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 9.7.2.3. Argentina Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 9.7.2.4. Argentina Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 9.7.2.5. Argentina Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 9.7.2.6. Argentina Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 9.7.3. Rest Of South America 9.7.3.1. Rest Of South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Type (2024-2032) 9.7.3.2. Rest Of South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Isotope (2024-2032) 9.7.3.3. Rest Of South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Technology (2024-2032) 9.7.3.4. Rest Of South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Procedure (2024-2032) 9.7.3.5. Rest Of South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by Applications (2024-2032) 9.7.3.6. Rest Of South America Nuclear Medicine/Radiopharmaceuticals Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Lantheus Holdings, Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cardinal Health (USA) 10.3. GE HealthCare (USA) 10.4. Curium Pharma (USA/France – Major NA presence) 10.5. Jubilant Radiopharma (USA) 10.6. NorthStar Medical Radioisotopes (USA) 10.7. Novartis AG (Advanced Accelerator Applications - AAA) (Switzerland) 10.8. Siemens Healthineers (Germany) 10.9. Bayer AG (Germany) 10.10. Curium Pharma (France) 10.11. ITM Isotope Technologies Munich SE (Germany) 10.12. Eckert & Ziegler (Germany) 10.13. China Isotope & Radiation Corporation (CIRC) (China) 10.14. Jubilant Pharma Limited (India/Singapore) 10.15. Dongcheng Pharmaceutical Group (China) 10.16. Sinotau Pharmaceutical Group (China) 10.17. Neptunium (South Africa) 10.18. NTP Radioisotopes (South Africa) 10.19. Instituto de Pesquisas Energéticas e Nucleares (IPEN) (Brazil) 10.20. Comisión Nacional de Energía Atómica (CNEA) (Argentina) 11. Key Findings 12. Industry Recommendations 13. Nuclear Medicine/Radiopharmaceuticals Market: Research Methodology 14. Terms and Glossary