Network Management System Market size was valued at US$ 9.20 Bn. in 2022 and the total revenue is expected to grow at 9.53 % through 2023 to 2029, reaching nearly US$ 17.39 Bn.Network Management System Market Overview:

A network management system (NMS) is a collection of software that enables network administrators to manage the various components of a network within the context of a wider network management framework. This tool can keep track of the hardware and software on a network. A network management system, or NMS, collects data from remote network nodes and sends it to a system administrator for analysis. APIs or a standard like Net Flow are used by network element vendors to give performance data to NMS software. This program's key benefit is that it allows users to manage and monitor all areas of their organization from a single spot.To know about the Research Methodology :- Request Free Sample Report

Network Management System Market Dynamics:

The government's digitization strategy in both developed and developing countries, as well as rising internet penetration, are important factors driving the global market growth. Other factors projected to boost market growth include increased government spending on IT infrastructure and an increase in the number of internet users. Other factors expected to support the global market's growth over the forecast period include an increase in the number of mobile phone users, as well as an increase in demand from the digital economy for network management systems to manage and control network functions in order to provide excellent services. Additionally, rising demand from different industry verticals such as BFSI, government, healthcare, and others is estimated to drive market growth to some extent. Other factors projected to drive market growth include rising data security approaches among service providers, which is resulting in increased need for improved network management systems that give transparency and allow greater optimization in corporate operations. During the forecast period, technological improvements and increased investment by major players are projected to open up new revenue potential for participants in the target market. Furthermore, increased merger and acquisition activity among regional and international competitors is likely to generate revenue opportunities, which will help the target market develop to some extent. On the other hand, the vast range of network management tools offered is a major problem that is expected to limit the global market growth.Network Management System Market Segment Analysis:

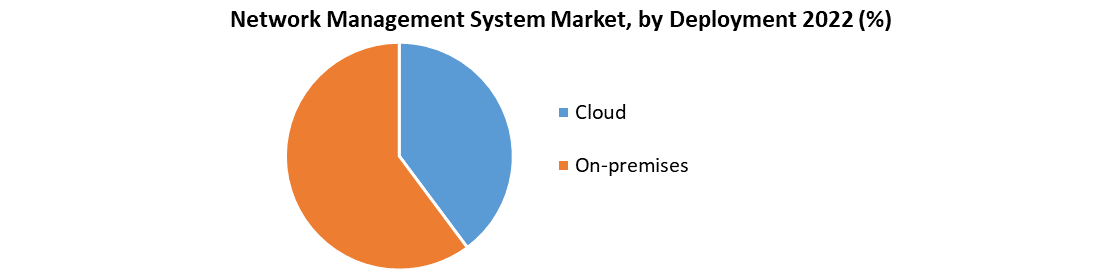

Based on the Component, the global market is sub-segmented into Solutions and Services. The Solutions segment held the largest market share of 73% in 2022 and it is expected to grow at the highest CAGR of 8.24% during the forecast period. Security Management, Trouble Shooting, Configuration Management, Performance Management, and Accounting Management are some of the solutions available through NMS. The Solution segment's market share is boosted by rising concerns about data security, as well as increased demand for the deployment of the system for maintaining and monitoring communication infrastructure. Integration and Deployment, training, support and maintenance, and consulting services are all available through NMS. While the Services segment is expected to increase at the fastest pace of 10.3% over the forecast period. The increased implementation of NMS solutions in cloud and telecom service providers to improve communications infrastructure is driving demand for NMS services such as Continuous integration. Based on the Deployment, the global market is sub-segmented into Cloud and On-premises. The On-premises segment held the largest market share of 72% in 2022. In comparison to third-party managed solutions, on-premise solutions may be able to minimize total turnaround time (TAT) while still providing support and maintenance services in the event of failure. However, during the last several years, the popularity of cloud-based solutions and the preference for the software as a service (SaaS) delivery model, particularly among small and medium businesses (SMEs), has risen dramatically. Cloud-based solutions have a number of advantages, including lower total infrastructure costs, faster solution implementation, and ease of use. Over the projected period, the CAGR for the cloud-based sector is expected to be higher.

Regional Insights:

North America held the largest market share of 35.3% in 2022. North America has seen a quick rollout of 5G infrastructure, large investments in new data centers, and rising internet penetration rates. Europe held the 2nd largest market share of 29% in 2022 and it is expected to grow at the highest CAGR of 8.92% in the global network management system during the forecast period. Because of the continuing growth of IoT devices and systems, the growth of the healthcare sector, and the drafting of data protection regulations such as the Data Protection Act of 2018, the area has one of the leading positions in the business (U.K.). Asia Pacific is expected to grow at the highest CAGR of 9.92% in the global market during the forecast period. The implementation of long-term evolution (LTE) equipment in the Asia Pacific has been growing at a rapid pace. In the meantime, in response to rising urbanization and the concomitant development of the internet, various governments in the region have launched projects to promote digitalization. In addition, some Asia Pacific countries, such as India, China, and Japan, are preparing to establish 5G networks. Such advancements are expected to pave the way for the widespread adoption of network management systems in the region, resulting in considerable possibilities for NMS suppliers throughout the projection period. The objective of the report is to present a comprehensive analysis of the global Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Network Management System Market dynamic, structure by analyzing the market segments and project the global Network Management System Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Network Management System Market make the report investor’s guide.Network Management System Market Scope:Inquire before buying

Network Management System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 9.20 Bn. Forecast Period 2023 to 2029 CAGR: 9.53 % Market Size in 2029: US $ 17.40 Bn. Segments Covered: by Component Solutions Services by Deployment Cloud On-premises by Enterprise Size Large Enterprises SMEs by End-User Vertical Service Provider Network Management System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Key Players

1. Avaya Inc. 2. Alcatel-Lucent S.A. 3. IBM Corporation 4. Juniper Networks Inc. 5. Cisco Systems Inc. 6. Aruba Network Inc. 7. CA Technologies Inc. 8. Netscout System, Inc. 9. Solarwinds Worldwide 10. LLC 11. BMC Software, Inc. 12. Compuware Corporation 13. Huawei 14. Nokia 15. Riverbed Technology 16. Micro Focus 17. Ipswitch 18. ExtraHop Networks 19. Colasoft 20. Flowmon Networks 21. ManageEngine 22. LiveAction 23. Paessler AG 24. SevOne 25. Cubro Network Visibility Frequently Asked Questions: 1] What segments are covered in Network Management System Market report? Ans. The segments covered in Network Management System Market report are based on Component, Deployment, Enterprise Size and End-User. 2] Which region is expected to hold the highest share in the global Network Management System Market? Ans. North America is expected to hold the highest share in the global Network Management System Market. 3] What is the market size of global Network Management System Market by 2029? Ans. The market size of global Network Management System Market by 2029 is US $ 17.39 Bn. 4] Who are the top key players in the global Network Management System Market? Ans. Avaya Inc., Alcatel-Lucent S.A., IBM Corporation, Juniper Networks Inc., Cisco Systems Inc. and Aruba Network Inc. are the top key players in the global Network Management System Market. 5] What was the market size of global Network Management System Market in 2022? Ans. The market size of global Network Management System Market in 2022 was US $ 9.20 Bn.

Global Network Management System Market

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 1.4. Key Questions Answered 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations Used 2.3. Research Methodology 3. Executive Summary 3.1. Global Network Management System Market Size, by Market Value (US$ Bn) and Market, by Region 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.3. Drivers and Restraints Snapshot Analysis 4.3.1. Drivers 4.3.2. Restraints 4.3.3. Opportunities 4.3.4. Porter’s Analysis 4.3.5. Value Chain Analysis 4.3.6. SWOT Analysis 5. Global Network Management System Market Analysis and Forecast 5.1. Global Network Management System Market Analysis and Forecast 5.2. Global Network Management System Market Size& Y-o-Y Growth Analysis 5.2.1. North America 5.2.2. Europe 5.2.3. Asia Pacific 5.2.4. Middle East & Africa 5.2.5. Latin America 6. Global Network Management System Market Analysis and Forecast, by Component 6.1. Introduction and Definition 6.2. Key Findings 6.3. Global Network Management System Market Value Share Analysis, by Component 6.4. Market Size (US$ Bn) Forecast, by Component 6.5. Network Management System Market Analysis, by Component 6.6. Global Network Management System Market Attractiveness Analysis, by Component 7. Global Network Management System Market Analysis and Forecast, by Development Type 7.1. Introduction and Definition 7.2. Global Network Management System Market Value Share Analysis, by Development Type 7.3. Market Size (US$ Bn) Forecast, by Development Type 7.4. Global Network Management System Market Analysis, by Development Type 7.5. Global Network Management System Market Attractiveness Analysis, by Development Type 8. Global Network Management System Market Analysis and Forecast, by End user 8.1. Introduction and Definition 8.2. Global Network Management System Market Value Share Analysis, by End user 8.3. Market Size (US$ Bn) Forecast, by End user 8.4. Global Network Management System Market Analysis, by End user 8.5. Global Network Management System Market Attractiveness Analysis, by End user 9. Global Network Management System Market Analysis, by Region 9.1. Global Network Management System Market Value Share Analysis, by Region 9.2. Market Size (US$ Bn) Forecast, by Region 9.3. Global Network Management System Market Attractiveness Analysis, by Region 10. North America Network Management System Market Analysis 10.1. Key Findings 10.2. North America Network Management System Market Overview 10.3. North America Network Management System Market Value Share Analysis, by Component 10.4. North America Network Management System Market Forecast, by Component 10.4.1. Service 10.4.2. Industrial 10.5. North America Network Management System Market Value Share Analysis, by Development Type 10.6. North America Network Management System Market Forecast, by Development Type 10.6.1. GPU 10.6.2. MPU 10.7. North America Network Management System Market Value Share Analysis, by End user 10.8. North America Network Management System Market Forecast, by End user 10.8.1. Machine Learning 10.8.2. Computer Vision 10.9. North America Network Management System Market Analysis, by Country 10.10. U.S. Network Management System Market Forecast, by Component 10.10.1. Solution 10.10.2. Service 10.11. U.S. Network Management System Market Forecast, by Development Type 10.11.1. GPU 10.11.2. MPU 10.12. U.S. Network Management System Market Forecast, by End user 10.12.1. Vertical 10.12.2. Service provider 10.13. Canada Network Management System Market Forecast, by Component 10.13.1. Solution 10.13.2. Service 10.14. Canada Network Management System Market Forecast, by Development Type 10.14.1. GPU 10.14.2. MPU 10.15. Canada Network Management System Market Forecast, by End user 10.15.1. Vertical 10.15.2. Service provider 10.16. North America Network Management System Market Attractiveness Analysis 10.16.1. By Component 10.16.2. By Development Type 10.16.3. By End user 10.16.4. By Application 10.17. PEST Analysis 11. Europe Network Management System Market Analysis 11.1. Key Findings 11.2. Europe Network Management System Market Overview 11.3. Europe Network Management System Market Value Share Analysis, by Component 11.4. Europe Network Management System Market Forecast, by Component 11.4.1. Solution 11.4.2. Service 11.5. Europe Network Management System Market Value Share Analysis, by Development Type 11.6. Europe Network Management System Market Forecast, by Development Type 11.6.1. GPU 11.6.2. MPU 11.7. Europe Network Management System Market Value Share Analysis, by End user 11.8. Europe Network Management System Market Forecast, by End user 11.8.1. Vertical 11.8.2. Service provider 11.9. Europe Network Management System Market Value Share Analysis, by Country 11.10. Europe Network Management System Market Forecast, by Country 11.10.1.1. Germany 11.10.1.2. U.K. 11.10.1.3. France 11.10.1.4. Italy 11.10.1.5. Spain 11.10.1.6. Rest of Europe 11.11. Europe Network Management System Market Analysis, by Country/ Sub-region 11.12. Germany Network Management System Market Forecast, by Component 11.12.1. Solution 11.12.2. Service 11.13. Germany Network Management System Market Forecast, by Development Type 11.13.1. Cloud 11.13.2. On-premises 11.14. Germany Network Management System Market Forecast, by End user 11.14.1. Vertical 11.14.2. Service provider 11.15. U.K. Network Management System Market Forecast, by Component 11.15.1. Solution 11.15.2. Service 11.15.3. Heavy Commercial Vehicle 11.16. U.K. Network Management System Market Forecast, by Development Type 11.16.1. Cloud 11.16.2. On-premises 11.17. U.K. Network Management System Market Forecast, by End user 11.17.1. Vertical 11.17.2. Service provider 11.18. France Network Management System Market Forecast, by Component 11.18.1. Solution 11.18.2. Service 11.19. France Network Management System Market Forecast, by Development Type 11.19.1. Cloud 11.19.2. On-premises 11.20. France Network Management System Market Forecast, by End user 11.20.1. Vertical 11.20.2. Service provider 11.21. Italy Network Management System Market Forecast, by Component 11.21.1. Solution 11.21.2. Service 11.22. Italy Network Management System Market Forecast, by Development Type 11.22.1. Cloud 11.22.2. On-premises 11.23. Italy Network Management System Market Forecast, by End user 11.23.1. vertical 11.23.2. service provider 11.24. Spain Network Management System Market Forecast, by Component 11.24.1. Solution 11.24.2. Service 11.25. Spain Network Management System Market Forecast, by Development Type 11.25.1. Cloud 11.25.2. On-premises 11.26. Spain Network Management System Market Forecast, by End user 11.26.1. Vertical 11.26.2. Service provider 11.27. Rest of Europe Network Management System Market Forecast, by Component 11.27.1. Solution 11.27.2. Service 11.28. Rest of Europe Network Management System Market Forecast, by Development Type 11.28.1. Cloud 11.28.2. On-premises 11.29. Rest of Europe Network Management System Market Forecast, by End user 11.29.1. Vertical 11.29.2. Service provider 11.30. Europe Network Management System Market Attractiveness Analysis 11.30.1. By Component 11.30.2. By Development Type 11.30.3. By End user 11.30.4. By Application 11.31. PEST Analysis 12. Asia Pacific Network Management System Market Analysis 12.1. Key Findings 12.2. Asia Pacific Network Management System Market Overview 12.3. Asia Pacific Network Management System Market Value Share Analysis, by Component 12.4. Asia Pacific Network Management System Market Forecast, by Component 12.4.1. Solution 12.4.2. Service 12.5. Asia Pacific Network Management System Market Value Share Analysis, by Development Type 12.6. Asia Pacific Network Management System Market Forecast, by Development Type 12.6.1. Solution 12.6.2. Service 12.7. Asia Pacific Network Management System Market Value Share Analysis, by End user 12.8. Asia Pacific Network Management System Market Forecast, by End user 12.8.1. Vertical 12.8.2. Service provider 12.9. Asia Pacific Network Management System Market Value Share Analysis, by Application 12.10. Asia Pacific Network Management System Market Value Share Analysis, by Country 12.11. Asia Pacific Network Management System Market Forecast, by Country 12.11.1. China, 2018–2026 12.11.2. India, 2018–2026 12.11.3. Japan, 2018–2026 12.11.4. ASEAN, 2018–2026 12.11.5. Rest of Asia Pacific, 2018–2026 12.12. Asia Pacific Network Management System Market Analysis, by Country/ Sub-region 12.13. China Network Management System Market Forecast, by Component 12.13.1. Solution 12.13.2. Service 12.14. China Network Management System Market Forecast, by Development Type 12.14.1. Cloud 12.14.2. On-premises 12.15. China Network Management System Market Forecast, by End user 12.15.1. Vertical 12.15.2. Service provider 12.16. India Network Management System Market Forecast, by Component 12.16.1. Solution 12.16.2. Service 12.17. India Network Management System Market Forecast, by Development Type 12.17.1. Cloud 12.17.2. On-premises 12.18. India Network Management System Market Forecast, by End user 12.18.1. Vertical 12.18.2. Service provider 12.19. Japan Network Management System Market Forecast, by Component 12.19.1. Solution 12.19.2. Service 12.20. Japan Network Management System Market Forecast, by Development Type 12.20.1. Cloud 12.20.2. On-premises 12.21. Japan Network Management System Market Forecast, by End user 12.21.1. Vertical 12.21.2. Service provider 12.22. ASEAN Network Management System Market Forecast, by Component 12.22.1. Solution 12.22.2. Service 12.23. ASEAN Network Management System Market Forecast, by Development Type 12.23.1. GPU 12.23.2. MPU 12.24. ASEAN Network Management System Market Forecast, by End user 12.24.1. Vertical 12.24.2. Service provider 12.25. Rest of Asia Pacific Network Management System Market Forecast, by Component 12.25.1. Solution 12.25.2. Service 12.26. Rest of Asia Pacific Network Management System Market Forecast, by Development Type 12.26.1. Cloud 12.26.2. On-premises 12.27. Rest of Asia Pacific Network Management System Market Forecast, by End user 12.27.1. Vertical 12.27.2. Service provider 12.28. Asia Pacific Network Management System Market Attractiveness Analysis 12.28.1. By Component 12.28.2. By Development Type 12.28.3. By End user 12.28.4. By Application 12.29. PEST Analysis 13. Middle East & Africa Network Management System Market Analysis 13.1. Key Findings 13.2. Middle East & Africa Network Management System Market Overview 13.3. Middle East & Africa Network Management System Market Value Share Analysis, by Component 13.4. Middle East & Africa Network Management System Market Forecast, by Component 13.4.1. Solution 13.4.2. Service 13.5. Middle East & Africa Network Management System Market Value Share Analysis, by Development Type 13.6. Middle East & Africa Network Management System Market Forecast, by Development Type 13.6.1. Cloud 13.6.2. On-premises 13.7. Middle East & Africa Network Management System Market Value Share Analysis, by End user 13.8. Middle East & Africa Network Management System Market Forecast, by End user 13.8.1. Vertical 13.8.2. Service provider 13.9. Middle East & Africa Network Management System Market Value Share Analysis, by Application 13.10. Middle East & Africa Network Management System Market Value Share Analysis, by Country 13.11. Middle East & Africa Network Management System Market Forecast, by Country 13.11.1. GCC, 2018–2026 13.11.2. South Africa, 2018–2026 13.11.3. Rest of Middle East & Africa, 2018–2026 13.12. Middle East & Africa Network Management System Market Analysis, by Country/ Sub-region 13.13. GCC Network Management System Market Forecast, by Component 13.13.1. Solution 13.13.2. Service 13.14. GCC Network Management System Market Forecast, by Development Type 13.14.1. Cloud 13.14.2. On-premises 13.15. GCC Network Management System Market Forecast, by End user 13.15.1. Vertical 13.15.2. Service provider 13.16. South Africa Network Management System Market Forecast, by Component 13.16.1. Solution 13.16.2. Service 13.17. South Africa Network Management System Market Forecast, by Development Type 13.17.1. Vertical 13.17.2. Service provider 13.18. South Africa Network Management System Market Forecast, by End user 13.18.1. Vertical 13.18.2. Service provider 13.19. Rest of Middle East & Africa Network Management System Market Forecast, by Component 13.19.1. Solution 13.19.2. Service 13.20. Rest of Middle East & Africa Network Management System Market Forecast, by Development Type 13.20.1. Cloud 13.20.2. On-premises 13.21. Rest of Middle East & Africa Network Management System Market Forecast, by End user 13.21.1. Vertical 13.21.2. Service provider 13.22. Rest of Middle East & Africa Network Management System Market Forecast, by Application 13.22.1. Public Relations 13.22.2. Stock Management 13.22.3. Others 13.23. Middle East & Africa Network Management System Market Attractiveness Analysis 13.23.1. By Component 13.23.2. By Development Type 13.23.3. By End user 13.23.4. By Application 13.24. PEST Analysis 14. Latin America Network Management System Market Analysis 14.1. Key Findings 14.2. Latin America Network Management System Market Overview 14.3. Latin America Network Management System Market Value Share Analysis, by Component 14.4. Latin America Network Management System Market Forecast, by Component 14.4.1. Solution 14.4.2. Service 14.5. Latin America Network Management System Market Value Share Analysis, by Development Type 14.6. Latin America Network Management System Market Forecast, by Development Type 14.6.1. Cloud 14.6.2. On-premises 14.7. Latin America Network Management System Market Value Share Analysis, by End user 14.8. Latin America Network Management System Market Forecast, by End user 14.8.1. Vertical 14.8.2. Service provider 14.9. Latin America Network Management System Market Value Share Analysis, by Application 14.10. Latin America Network Management System Market Value Share Analysis, by Country 14.11. Latin America Network Management System Market Forecast, by Country 14.11.1.1. Brazil, 2018–2026 14.11.1.2. Mexico, 2018–2026 14.11.1.3. Rest of Latin America, 2018–2026 14.12. Latin America Network Management System Market Analysis, by Country/ Sub-region 14.13. Brazil Network Management System Market Forecast, by Component 14.13.1. Solution 14.13.2. Service 14.14. Brazil Network Management System Market Forecast, by Development Type 14.14.1. Cloud 14.14.2. On-premises 14.15. Brazil Network Management System Market Forecast, by End user 14.15.1. Vertical 14.15.2. Service provider 14.16. Brazil Network Management System Market Forecast, by Application 14.16.1. Public Relations 14.16.2. Stock Management 14.16.3. Others 14.17. Mexico Network Management System Market Forecast, by Component 14.17.1. Solution 14.17.2. Service 14.18. Mexico Network Management System Market Forecast, by Development Type 14.18.1. Cloud 14.18.2. On-premises 14.19. Mexico Network Management System Market Forecast, by End user 14.19.1. Vertical 14.19.2. Service provider 14.20. Rest of Latin America Network Management System Market Forecast, by Component 14.20.1. Solution 14.20.2. Service 14.21. Rest of Latin America Network Management System Market Forecast, by Development Type 14.21.1. Cloud 14.21.2. On-premises 14.22. Rest of Latin America Network Management System Market Forecast, by End user 14.22.1. Vertical 14.22.2. Service provider 14.23. Latin America Network Management System Market Attractiveness Analysis 14.23.1. By Component 14.23.2. By Development Type 14.23.3. By End user 14.23.4. By Application 14.24. PEST Analysis 15. Company Profiles 15.1. Market Share Analysis, by Company 15.2. Competition Matrix 15.3. Company Profiles: Key Players 15.3.1. ABB 15.3.1.1. Company Overview 15.3.1.2. Financial Overview 15.3.1.3. Business Strategy 15.3.1.4. Recent Developments 15.3.1.5. Stock Management Footprint 15.3.2. Avaya Inc. 15.3.3. Alcatel-Lucent S.A. 15.3.4. IBM Corporation 15.3.5. Juniper Networks Inc. 15.3.6. Cisco Systems Inc. 15.3.7. Aruba Network Inc. 15.3.8. CA Technologies Inc. 15.3.9. Netscout System, Inc. 15.3.10. Solarwinds Worldwide 15.3.11. LLC 15.3.12. BMC Software, Inc. 15.3.13. Compuware Corporation 15.3.14. Huawei 15.3.15. Nokia 15.3.16. Riverbed Technology 15.3.17. Micro Focus 15.3.18. Ipswitch 15.3.19. ExtraHop Networks 15.3.20. Colasoft 15.3.21. Flowmon Networks 15.3.22. ManageEngine 15.3.23. LiveAction 15.3.24. Paessler AG 15.3.25. SevOne 15.3.26. Cubro Network Visibility 16. Primary Key Insights