Global Motorcycle Battery Market size was valued at USD 9.39 Bn. in 2024 and the total Motorcycle Battery Market revenue is expected to grow by 4.7% from 2025 to 2032, reaching nearly USD 13.56 Bn by 2032Motorcycle Battery Market Overview:

Motorcycle batteries are an essntial part of power ignition, lights, and electronics in traditional motorcycles, and newer electric two-wheelers. The Motorcycle Battery Market has transitioned from an earlier era of traditional flooded lead-acid batteries to various forms of maintenance-free AGM (Absorbent Glass Mat) and gel batteries, to newer offers of lithium-ion batteries that are lighter, charge faster, and have longer cycle life. The global demand for motorcycle batteries is increasing as urbanization takes place, motorcycle ownership rises in growing economies, and the shift to electric motorcycles and scooters accelerates. For example, lithium-ion batteries are being used in electric motorcycles in the Asia Pacific and Europe, while AGM and VRLA batteries are the Motorcycle Battery Market leader in many growing economies like India and South America where reliability, and low maintenance have made them a preferred choice for traditional motorcycles. In North America and Europe, the demand for advanced battery technology in premium motorcycles and e-motorcycles are aimed at improving performance and efficiency.To know about the Research Methodology :- Request Free Sample Report The trend towards electrification, increasing consumers' inclination for maintenance-free products, or localized investment into battery production. The Motorcycle Battery Industry is segmented by battery type, vehicle type, capacity, and sales channel. Players in the global motorcycle battery market include GS Yuasa International Ltd., Exide Technologies, Johnson Controls-Hitachi Battery Ltd., Leoch International, East Penn Manufacturing, EnerSys, and Panasonic Corporation, all of whom lead the market through tactical investments towards new generation battery technologies, ability to increase production capacity, and partnership development with motorcycle OEM.

Motorcycle Battery Market Dynamics

Government Regulations and Policies to Boost Motorcycle Battery Market Growth The Ministry of Environment, Forest and Climate Change (MoEFC) in India has delivered the Battery Waste Management Rules, 2022, in response to the increase in demand for electric vehicles (EVs) and the need for organized battery disposal and recycling channels. These rules apply to all stakeholders involved in the lifecycle of batteries, from production to recycling, and cover all battery types regardless of their chemistry or use and drive Motorcycle Battery Market growth. The rules include provisions for penal actions and environmental compensation for violations, along with setting determined recovery targets for battery materials: 70% by FY25, 80% by FY26, and 90% by FY27. This ensures that recovered materials are reused in new batteries, promoting a circular economy. The EU's Batteries Regulation, aligned with the European Green Deal, strengthens these efforts by imposing strict limits on harmful substances and setting high targets for recycling efficiency and material recovery from 2025 onwards. This regulation also introduces the need for battery carbon footprint declarations, performance standards, and consumer information through digital passports. In India, the government's sustained push for EV adoption, supported by policies such as the FAME-II scheme with a budget allocation of INR 10,000 crore, provides purchase incentives, tax exemptions, and subsidies to make EVs more reasonable. Such comprehensive regulatory frameworks and supportive policies are growth drivers for the motorcycle battery market, ensuring environmental sustainability, economic viability, and technological advancement in the transition to electric mobility. Insufficient Charging Infrastructure to Hamper Market Growth Insufficient charging infrastructure presents a significant restraint for the motorcycle battery market primarily due to its impact on consumer convenience and adoption. Electric motorcycles rely on available and reliable charging stations for practical daily use and longer journeys. Without an adequate network of charging points, potential buyers hesitate to switch from traditional gasoline-powered motorcycles, fearing range anxiety and the incapability to recharge when needed. This lack of infrastructure limits the appeal of electric motorcycles, particularly in regions with limited urban development or sparse population densities where establishing charging stations is economically unfeasible. The perception of long charging times compared to refueling gasoline bikes deters potential buyers.Global Motorcycle Battery Market Segment Analysis

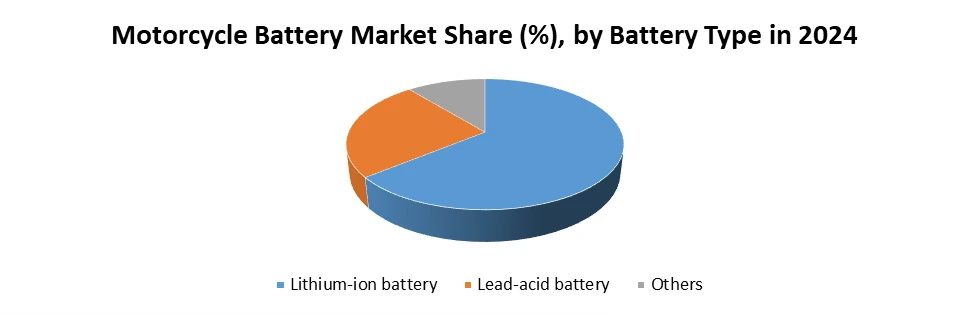

Based on Type, the market is segmented into and Dry cell battery, Gel motorcycle battery,and Wet cell battery. Dry cell battery held the Motorcycle Battery Market share in 2024 and is expected to continue their dominance over the forecast period. Dry cell batteries, particularly maintenance-free sealed lead-acid (AGM) types, are widely preferred for their low maintenance, spill-proof design, and superior vibration resistance, making them ideal for both commuter and high-performance motorcycles. Their longer lifespan, faster recharge capability, and consistent performance in varied climatic conditions enhance their appeal for OEMs and end-users alike. The growing adoption of premium motorcycles and the increasing focus on reliability and convenience in urban commuting are driving demand for dry cell solutions. In contrast, wet cell batteries require frequent maintenance, and gel batteries, though efficient, have higher costs limiting mass adoption. The well-established manufacturing ecosystem, cost efficiency, and compatibility with a wide range of motorcycle models ensure that dry cell batteries remain the Motorcycle Battery Market leader.Based on Battery Type, the Motorcycle Battery Market is segmented into Lithium-Ion Batteries, Lead-Acid Batteries and Others. Lead-acid batteries segment is dominated the matket in 2024 and is expected to hold largest market share over forecast period. Due to its cost-effectiveness, proven reliability, and widespread compatibility with existing motorcycle models. Lead-acid batteries, including conventional flooded, AGM, and gel types, remain the preferred choice for internal combustion engine (ICE) motorcycles, which account for the majority of global two-wheeler sales. Their robust performance in varying climatic conditions, ease of maintenance, and established supply chain networks further reinforce their market position. Additionally, the affordability of lead-acid batteries makes them highly attractive in price-sensitive markets such as India, Southeast Asia, and Africa, where commuter and low-cost motorcycles are in high demand. OEMs and aftermarket suppliers continue to prioritize lead-acid solutions for their predictable lifespan, quick availability, and ease of recycling. While lithium-ion adoption is growing, lead-acid batteries maintain dominance due to their extensive usage base, infrastructure readiness, and lower initial investment requirements for both manufacturers and consumers.

Motorcycle Battery Market Regional Insights

Asia Pacific dominated the Motorcycle Battery Market in 2024 and is expected to continue its dominance during the forecast period. The complete scale of motorcycle production and consumption in developing economies such as China and India, which are among the largest markets globally for two-wheelers helps to drive regional Motorcycle Battery industry growth. These countries have a huge population and strong cultural affinity towards motorcycles as a main mode of transportation. There has been a significant shift towards electric motorcycles in Asia-Pacific, boosted by increasing environmental concerns, government incentives, and technological advancements. Countries such as China, India, and several Southeast Asian nations are actively encouraging electric mobility as a portion of their efforts to minimize air pollution and greenhouse gas emissions. This transition towards electric motorcycles requires advanced battery technologies, especially lithium-ion batteries, which offer higher energy densities, longer lifespans and quicker charging abilities compared to traditional lead-acid batteries. And this boosts Motorcycle Battery Market growth. Many countries have implemented supportive policies including subsidies, tax incentives, and regulations to promote the adoption of electric vehicles (EVs) and the establishment of charging infrastructure. For instance, India's Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME) scheme provides financial incentives to manufacturers and consumers of electric vehicles, including motorcycles. This policy support encourages both domestic and international manufacturers to invest in the production of electric motorcycles and their associated batteries within the region. Countries such as Japan and South Korea are at the lead of battery technology innovation, constantly driving the boundaries of battery performance, safety and sustainability. This continuous innovation helps maintain the region's competitive edge in the global Motorcycle Battery Market and ensures that manufacturers in the region are well-positioned to meet evolving consumer demands for efficient and reliable battery solutions. Competitive Landscape Some of the Motorcycle Battery Key players are GS Yuasa Corporation (Kyoto, Japan), Exide Technologies (Milton, Georgia, USA), EnerSys (Reading, Pennsylvania, USA), East Penn Manufacturing (Lyon Station, Pennsylvania, USA), Leoch International Technology (Shenzhen, China) and other. These key players have adopted strategies including pricing, investments, product portfolio expansion, mergers and acquisitions, collaboration, agreements and geographical expansion to enhance the Motorcycle Battery Market. For instance, in a recent development, GS Yuasa Corporation announced that Tata AutoComp GY Batteries Private Ltd. (TGY), an equity-method affiliate of its subsidiary GS Yuasa International Ltd., plans to double its annual production capacity for motorcycle lead-acid batteries to 8.4 million units. Established in October 2005, TGY is growing its Motorcycle Battery market share in India, the largest motorcycle-producing country in Asia. In 2021, TGY launched production in a newly added wing at its plant and aims to begin mass production with a further new production line in 2022. This expansion enables the production system to handle 8.4 million lead-acid motorcycle batteries annually, doubling the previous capacity of 4.2 million units. The expansion also allows TGY to manufacture a wider range of battery models. TGY emphasizes producing high-performance automotive lead-acid batteries, particularly for environmentally friendly vehicles including start-stop vehicles. To meet the increasing demand, GS Yuasa enhanced its supply chain and its ability to cater to the diverse needs of the Indian market. Motorcycle Battery Market Competitive Landscape The global Motorcycle Battery Market benefits from the presence of established manufacturers with extensive product portfolios covering traditional and advanced technologies. Leading companies are actively innovating in lithium-ion solutions while maintaining strong offerings in lead-acid and AGM batteries. GS Yuasa International Ltd. (Japan) reported revenues of USD 3952.77 Million in FY2024, driven by rising demand for lightweight, maintenance-free batteries and advanced lithium-ion units approved for specialty applications, including space satellites. Exide Technologies (USA) generated an estimated nearly USD 900 million in FY2024, supported by a robust OEM and aftermarket distribution network. The company recently completed the first phase of its 6 GWh lithium-ion cell manufacturing plant in Bengaluru, India, as part of its strategy to supply EV batteries for electric mopeds, scooters, and motorcycles. Exide is expanding R&D and exploring differentiated lithium-ion pathways to strengthen its position in the rapidly electrifying Motorcycle Battery Market. Motorcycle Battery Market Recent TrendsMotorcycle Battery Market Recent Development • On July 1, 2025, GS Yuasa Corporation announced that lithium-ion batteries from its subsidiary GS Yuasa Technology Ltd. were installed in the H-IIA Launch Vehicle No. 50 and the GOSAT-GW satellite launched on June 29, 2025. GYT batteries have been used in all H-IIA and H-IIB rockets since 2002 and over 250 space vehicles globally. Renowned for durability in extreme environments, GYT continues advancing high-performance lithium-ion batteries for space and special applications. • On Nov 14, 2024 Exide Industries is nearing completion of its 6 GWh lithium-ion cell manufacturing plant in Bengaluru, set for commercialization by FY26 through subsidiary Exide Energy Solutions. The USD 570.58 Million first phase will produce NMC and LFP cells for mobility and stationary uses, leveraging SVOLT’s technology. Partnerships include Hyundai and Kia, supporting India’s push for localized EV battery production. • On February 20, 2025 EnerSys will showcase its new NexSys BESS energy storage system and Synova Sync charger at LogiMAT and ProMat 2025. Designed to optimize renewable and grid energy use, these solutions enable cost savings via peak shaving, two-way energy flow, and cloud-based management, supporting on-site microgrids and enhancing operational resilience amid the global energy transition. • In March 2025, East Penn Manufacturing Co. (USA) introduced their Deka Power Sports AGM battery line for motorcycles, ATVs, snowmobiles and watercraft, which included enhancements such as calcium/calcium grid construction, spill-proof factory sealing, and flexible threaded terminal design for improvement in power sports performance, durability, and ease of installation.

Category Key Trend Example Product Market Impact EV Battery Manufacturing Strategic capacity expansion in lithium-ion cell production Exide’s 6 GWh lithium-ion cell plant in Bengaluru, India; Panasonic’s USD 4 billion Kansas EV battery cell plant Boosts domestic EV battery supply, supports electrification of motorcycles and other vehicles, and reduces dependence on imports Product Innovation Launch of high-performance, maintenance-free AGM and multi-chemistry chargers East Penn’s Deka Power Sports AGM batteries; EnerSys Odyssey multi-chemistry chargers Enhances reliability, safety, and performance for motorcycle and powersports users, meeting demand for better aftermarket solutions Advanced Applications Diversification into space and specialized energy storage solutions GS Yuasa’s lithium-ion batteries for H IIA Launch Vehicle No. 50 & GOSAT GW satellite; EnerSys NexSys BESS and Synova Sync charger Demonstrates technical leadership, expands use cases beyond motorcycles to space and industrial applications, strengthening brand reputation Scope of Motorcycle Battery Market: Inquire before buying

Global Motorcycle Battery Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.39 Bn. Forecast Period 2025 to 2032 CAGR: 4.7% Market Size in 2032: USD 13.56 Bn. Segments Covered: by Type Dry cell battery Gel motorcycle battery Wet cell battery by Battery Type Lithium-ion battery Lead-acid battery Others by Motorcycle Type Standard Sports Cruiser Others by Propulsion Type Internal Combustion Engine (ICE) Electric by Battery Capacity Below 12V 12V-24V Above 24V by Sales Channel OEM Aftermarket Motorcycle Battery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Motorcycle Battery Key Players

1. Exide Technologies (USA) 2. EnerSys (USA) 3. East Penn Manufacturing (USA) 4. C&D Technologies (USA) 5. ACDelco (USA) 6. YUASA Battery, Inc. (USA) 7. Trojan Battery Company (USA) 8. Shorai Inc. (USA) 9. BikeMaster (USA) 10. Robert Bosch GmbH (Germany) 11. GS Yuasa International (Japan) 12. Panasonic Corporation (Japan) 13. Furukawa Battery Co., Ltd. (Japan) 14. Primearth EV Energy Co., Ltd. (Japan) 15. Johnson Controls-Hitachi Battery (Japan) 16. TATA AutoComp GY Batteries Pvt Ltd (India) 17. Leoch International Technology (China) 18. Camel Group Co., Ltd. (China) 19. Tianneng Battery Group Co., Ltd. (China) 20. Shenzhen Center Power Tech Co., Ltd. (China) 21. Zhejiang Haijiu Battery Co., Ltd. (China)Frequently Asked Questions:

1. Which region has the largest share in the Global Motorcycle Battery Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Motorcycle Battery Market? Ans: The Global Market is expected to grow at a CAGR of 4.7% during the forecast period 2025-2032. 3. What is the scope of the Global Motorcycle Battery Market report? Ans: The Global Motorcycle Battery Market report helps with the PESTEL, PORTER, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Motorcycle Battery Market? Ans: The key players in the Global Motorcycle Battery Market are – GS Yuasa International (Japan), Panasonic Corporation (Japan), Furukawa Battery Co., Ltd. (Japan), Primearth EV Energy Co., Ltd. (Japan), Johnson Controls-Hitachi Battery (Japan), TATA AutoComp GY Batteries Pvt Ltd (India), Leoch International Technology (China), etc. 5. What is the study period of this market? Ans: The Global Motorcycle Battery Market is studied from 2025 to 2032

1. Motorcycle Battery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Motorcycle Battery Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Motorcycle Battery Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Motorcycle Battery Market: Dynamics 3.1. Motorcycle Battery Market Trends by Region 3.1.1. North America Motorcycle Battery Market Trends 3.1.2. Europe Motorcycle Battery Market Trends 3.1.3. Asia Pacific Motorcycle Battery Market Trends 3.1.4. Middle East and Africa Motorcycle Battery Market Trends 3.1.5. South America Motorcycle Battery Market Trends 3.2. Motorcycle Battery Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Motorcycle Battery Market Drivers 3.2.1.2. North America Motorcycle Battery Market Restraints 3.2.1.3. North America Motorcycle Battery Market Opportunities 3.2.1.4. North America Motorcycle Battery Market Challenges 3.2.2. Europe 3.2.2.1. Europe Motorcycle Battery Market Drivers 3.2.2.2. Europe Motorcycle Battery Market Restraints 3.2.2.3. Europe Motorcycle Battery Market Opportunities 3.2.2.4. Europe Motorcycle Battery Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Motorcycle Battery Market Drivers 3.2.3.2. Asia Pacific Motorcycle Battery Market Restraints 3.2.3.3. Asia Pacific Motorcycle Battery Market Opportunities 3.2.3.4. Asia Pacific Motorcycle Battery Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Motorcycle Battery Market Drivers 3.2.4.2. Middle East and Africa Motorcycle Battery Market Restraints 3.2.4.3. Middle East and Africa Motorcycle Battery Market Opportunities 3.2.4.4. Middle East and Africa Motorcycle Battery Market Challenges 3.2.5. South America 3.2.5.1. South America Motorcycle Battery Market Drivers 3.2.5.2. South America Motorcycle Battery Market Restraints 3.2.5.3. South America Motorcycle Battery Market Opportunities 3.2.5.4. South America Motorcycle Battery Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Motorcycle Battery Industry 3.8. Analysis of Government Schemes and Initiatives For Motorcycle Battery Industry 3.9. Motorcycle Battery Market Trade Analysis 3.10. The Global Pandemic Impact on Motorcycle Battery Market 4. Motorcycle Battery Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 4.1.1. Dry cell battery 4.1.2. Gel motorcycle battery 4.1.3. Wet cell battery 4.2. Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 4.2.1. Lithium-ion battery 4.2.2. Lead-acid battery 4.2.3. Others 4.3. Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 4.3.1. Standard 4.3.2. Sports 4.3.3. Cruiser 4.3.4. Others 4.4. Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 4.4.1. Internal Combustion Engine (ICE) 4.4.2. Electric 4.5. Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 4.5.1. Below 12V 4.5.2. 12V-24V 4.5.3. Above 24V 4.6. Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 4.6.1. OEM 4.6.2. Aftermarket 4.7. Motorcycle Battery Market Size and Forecast, by Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Motorcycle Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 5.1.1. Dry cell battery 5.1.2. Gel motorcycle battery 5.1.3. Wet cell battery 5.2. North America Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 5.2.1. Lithium-ion battery 5.2.2. Lead-acid battery 5.2.3. Others 5.3. North America Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 5.3.1. Standard 5.3.2. Sports 5.3.3. Cruiser 5.3.4. Others 5.4. North America Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 5.4.1. Internal Combustion Engine (ICE) 5.4.2. Electric 5.5. North America Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 5.5.1. Below 12V 5.5.2. 12V-24V 5.5.3. Above 24V 5.6. North America Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 5.6.1. OEM 5.6.2. Aftermarket 5.7. North America Motorcycle Battery Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. United States Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 5.7.1.1.1. Dry cell battery 5.7.1.1.2. Gel motorcycle battery 5.7.1.1.3. Wet cell battery 5.7.1.2. United States Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 5.7.1.2.1. Lithium-ion battery 5.7.1.2.2. Lead-acid battery 5.7.1.2.3. Others 5.7.1.3. United States Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 5.7.1.3.1. Standard 5.7.1.3.2. Sports 5.7.1.3.3. Cruiser 5.7.1.3.4. Others 5.7.1.4. United States Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 5.7.1.4.1. Internal Combustion Engine (ICE) 5.7.1.4.2. Electric 5.7.1.5. United States Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 5.7.1.5.1. Below 12V 5.7.1.5.2. 12V-24V 5.7.1.5.3. Above 24V 5.7.1.6. United States Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 5.7.1.6.1. OEM 5.7.1.6.2. Aftermarket 5.7.2. Canada 5.7.2.1. Canada Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 5.7.2.1.1. Dry cell battery 5.7.2.1.2. Gel motorcycle battery 5.7.2.1.3. Wet cell battery 5.7.2.2. Canada Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 5.7.2.2.1. Lithium-ion battery 5.7.2.2.2. Lead-acid battery 5.7.2.2.3. Others 5.7.2.3. Canada Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 5.7.2.3.1. Standard 5.7.2.3.2. Sports 5.7.2.3.3. Cruiser 5.7.2.3.4. Others 5.7.2.4. Canada Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 5.7.2.4.1. Internal Combustion Engine (ICE) 5.7.2.4.2. Electric 5.7.2.5. Canada Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 5.7.2.5.1. Below 12V 5.7.2.5.2. 12V-24V 5.7.2.5.3. Above 24V 5.7.2.6. Canada Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 5.7.2.6.1. OEM 5.7.2.6.2. Aftermarket 5.7.3. Mexico 5.7.3.1. Mexico Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 5.7.3.1.1. Dry cell battery 5.7.3.1.2. Gel motorcycle battery 5.7.3.1.3. Wet cell battery 5.7.3.2. Mexico Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 5.7.3.2.1. Lithium-ion battery 5.7.3.2.2. Lead-acid battery 5.7.3.2.3. Others 5.7.3.3. Mexico Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 5.7.3.3.1. Standard 5.7.3.3.2. Sports 5.7.3.3.3. Cruiser 5.7.3.3.4. Others 5.7.3.4. Mexico Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 5.7.3.4.1. Internal Combustion Engine (ICE) 5.7.3.4.2. Electric 5.7.3.5. Mexico Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 5.7.3.5.1. Below 12V 5.7.3.5.2. 12V-24V 5.7.3.5.3. Above 24V 5.7.3.6. Mexico Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 5.7.3.6.1. OEM 5.7.3.6.2. Aftermarket 6. Europe Motorcycle Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.2. Europe Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.3. Europe Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.4. Europe Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.5. Europe Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.6. Europe Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7. Europe Motorcycle Battery Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.1.2. United Kingdom Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.1.3. United Kingdom Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.1.4. United Kingdom Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.1.5. United Kingdom Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.1.6. United Kingdom Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.2. France 6.7.2.1. France Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.2.2. France Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.2.3. France Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.2.4. France Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.2.5. France Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.2.6. France Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.3.2. Germany Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.3.3. Germany Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.3.4. Germany Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.3.5. Germany Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.3.6. Germany Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.4.2. Italy Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.4.3. Italy Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.4.4. Italy Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.4.5. Italy Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.4.6. Italy Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.5.2. Spain Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.5.3. Spain Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.5.4. Spain Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.5.5. Spain Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.5.6. Spain Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.6.2. Sweden Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.6.3. Sweden Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.6.4. Sweden Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.6.5. Sweden Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.6.6. Sweden Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.7. Austria 6.7.7.1. Austria Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.7.2. Austria Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.7.3. Austria Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.7.4. Austria Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.7.5. Austria Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.7.6. Austria Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 6.7.8.2. Rest of Europe Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 6.7.8.3. Rest of Europe Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 6.7.8.4. Rest of Europe Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 6.7.8.5. Rest of Europe Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 6.7.8.6. Rest of Europe Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7. Asia Pacific Motorcycle Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.3. Asia Pacific Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.4. Asia Pacific Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.5. Asia Pacific Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.6. Asia Pacific Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7. Asia Pacific Motorcycle Battery Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.1.2. China Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.1.3. China Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.1.4. China Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.1.5. China Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.1.6. China Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.2.2. S Korea Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.2.3. S Korea Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.2.4. S Korea Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.2.5. S Korea Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.2.6. S Korea Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.3.2. Japan Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.3.3. Japan Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.3.4. Japan Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.3.5. Japan Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.3.6. Japan Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.4. India 7.7.4.1. India Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.4.2. India Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.4.3. India Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.4.4. India Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.4.5. India Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.4.6. India Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.5.2. Australia Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.5.3. Australia Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.5.4. Australia Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.5.5. Australia Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.5.6. Australia Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.6.2. Indonesia Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.6.3. Indonesia Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.6.4. Indonesia Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.6.5. Indonesia Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.6.6. Indonesia Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.7.2. Malaysia Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.7.3. Malaysia Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.7.4. Malaysia Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.7.5. Malaysia Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.7.6. Malaysia Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.8. Vietnam 7.7.8.1. Vietnam Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.8.2. Vietnam Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.8.3. Vietnam Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.8.4. Vietnam Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.8.5. Vietnam Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.8.6. Vietnam Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.9. Taiwan 7.7.9.1. Taiwan Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.9.2. Taiwan Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.9.3. Taiwan Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.9.4. Taiwan Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.9.5. Taiwan Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.9.6. Taiwan Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 7.7.10. Rest of Asia Pacific 7.7.10.1. Rest of Asia Pacific Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 7.7.10.2. Rest of Asia Pacific Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 7.7.10.3. Rest of Asia Pacific Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 7.7.10.4. Rest of Asia Pacific Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 7.7.10.5. Rest of Asia Pacific Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 7.7.10.6. Rest of Asia Pacific Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 8. Middle East and Africa Motorcycle Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 8.3. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 8.4. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 8.5. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 8.6. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 8.7. Middle East and Africa Motorcycle Battery Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 8.7.1.2. South Africa Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 8.7.1.3. South Africa Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 8.7.1.4. South Africa Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 8.7.1.5. South Africa Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 8.7.1.6. South Africa Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 8.7.2.2. GCC Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 8.7.2.3. GCC Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 8.7.2.4. GCC Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 8.7.2.5. GCC Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 8.7.2.6. GCC Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 8.7.3. Nigeria 8.7.3.1. Nigeria Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 8.7.3.2. Nigeria Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 8.7.3.3. Nigeria Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 8.7.3.4. Nigeria Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 8.7.3.5. Nigeria Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 8.7.3.6. Nigeria Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 8.7.4. Rest of ME&A 8.7.4.1. Rest of ME&A Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 8.7.4.2. Rest of ME&A Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 8.7.4.3. Rest of ME&A Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 8.7.4.4. Rest of ME&A Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 8.7.4.5. Rest of ME&A Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 8.7.4.6. Rest of ME&A Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 9. South America Motorcycle Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 9.2. South America Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 9.3. South America Motorcycle Battery Market Size and Forecast, by Motorcycle Type(2024-2032) 9.4. South America Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 9.5. South America Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 9.6. South America Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 9.7. South America Motorcycle Battery Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 9.7.1.2. Brazil Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 9.7.1.3. Brazil Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 9.7.1.4. Brazil Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 9.7.1.5. Brazil Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 9.7.1.6. Brazil Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 9.7.2.2. Argentina Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 9.7.2.3. Argentina Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 9.7.2.4. Argentina Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 9.7.2.5. Argentina Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 9.7.2.6. Argentina Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 9.7.3. Rest Of South America 9.7.3.1. Rest Of South America Motorcycle Battery Market Size and Forecast, by Type (2024-2032) 9.7.3.2. Rest Of South America Motorcycle Battery Market Size and Forecast, by Battery Type (2024-2032) 9.7.3.3. Rest Of South America Motorcycle Battery Market Size and Forecast, by Motorcycle Type (2024-2032) 9.7.3.4. Rest Of South America Motorcycle Battery Market Size and Forecast, by Propulsion Type (2024-2032) 9.7.3.5. Rest Of South America Motorcycle Battery Market Size and Forecast, by Battery Capacity (2024-2032) 9.7.3.6. Rest Of South America Motorcycle Battery Market Size and Forecast, by Sales Channel (2024-2032) 10. Company Profile: Key Players 10.1. Exide Technologies (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. EnerSys (USA) 10.3. East Penn Manufacturing (USA) 10.4. C&D Technologies (USA) 10.5. ACDelco (USA) 10.6. YUASA Battery, Inc. (USA) 10.7. Trojan Battery Company (USA) 10.8. Shorai Inc. (USA) 10.9. BikeMaster (USA) 10.10. Robert Bosch GmbH (Germany) 10.11. GS Yuasa International (Japan) 10.12. Panasonic Corporation (Japan) 10.13. Furukawa Battery Co., Ltd. (Japan) 10.14. Primearth EV Energy Co., Ltd. (Japan) 10.15. Johnson Controls-Hitachi Battery (Japan) 10.16. TATA AutoComp GY Batteries Pvt Ltd (India) 10.17. Leoch International Technology (China) 10.18. Camel Group Co., Ltd. (China) 10.19. Tianneng Battery Group Co., Ltd. (China) 10.20. Shenzhen Center Power Tech Co., Ltd. (China) 10.21. Zhejiang Haijiu Battery Co., Ltd. (China) 11. Key Findings 12. Industry Recommendations 13. Motorcycle Battery Market: Research Methodology 14. Terms and Glossary