Motor Driver IC Market was valued at USD 3.64 Bn. in 2024 and the total revenue of Global Motor Driver IC Market is expected to grow at CAGR of 6.5% from 2025 to 2032 reaching nearly 6.02 Bn. by 2032Motor Driver IC Market Overview:

Motor Driver IC market comprises of integrated circuits used to control and drive electric motors in applications across automotive, industrial automation, consumer electronics, medical devices, and robotics sectors. Market growth has been largely driven by the rising adoption of electric vehicles, Industry 4.0 automation trends, and increasing demand for energy efficient motor control systems. Global EV market surpassed USD 1 trillion valuation in 2024, directly accelerating demand for compact, power efficient motor driver ICs. Growing use of motor driver ICs in smart appliances, autonomous robots and electric power tools is further fuelling market increases. Demand for precision motor control in surgical robotics and diagnostic equipment is strengthening the healthcare application segment. The Asia Pacific region held the largest market share in 2024, growth by strong semiconductor manufacturing capacity, rapid industrial automation in China and Japan, and growing electric mobility in India and South Korea. Motor Driver ICsTop companies like Texas Instruments, Infineon, STMicroelectronics, ROHM, and Allegro Micro Systems are spending in smart, energy-efficient, and fault-tolerant motor driver ICs to meet evolving application requirements. The end users of the Motor Driver IC market include OEMs in automotive, factory automation, consumer device manufacturers, and healthcare equipment providers who require reliable, compact, and performance-optimized motor control solutions. The report covers the Motor Driver IC Market dynamics, structure by analysing the market segments and projecting Motor Driver IC Market size. It includes a clear representation of competitive analysis of key players by type, technology, financial position, product portfolio, growth strategies, and regional presence.To Know About The Research Methodology :- Request Free Sample Report

Motor Driver IC Market Dynamics

Rising Industrial Automation and Robotics to drive Growth in Motor Driver IC Market Rising demand for the industrial automation industry along with the growth in the automation industry has led to increasing demand for the motor driver IC market. Mass production has put more pressure on the assembling line besides, to reduce the processing time of the assembly line and increasing production, manufactures are more focusing on the advanced devices this has made a positive impact on the motor driver ICs market. With the increasing adoption of Motor driver ICs in the automation industry for instance, such as in logistics systems, tool machines and robots, food, and packaging are fuelling the market growth. In addition, with the rising adoption of industrial robots as these robots consume less power, has high accuracy, the high speed which makes the operation more efficient are further driving the Motor Driver IC Market growth. These industrial robots are controlled and operated by using motor drivers also offers protection against faults in the power supply and thus, this has created many lucrative opportunities for the motor driver ICs market. Industrial automation industry manufactures are focusing on improving the motor's efficiency, accuracy, robustness, and reliability as these factors play a vital role to improve the productivity of the industry which in turn has created many opportunities for the key players operating in the Motor Driver IC Industry. Technological Advancements and Expanding Automotive Sector to Boost opportunity in Motor Driver IC Market Motor driver integrated circuits are used in many areas of technology, including the medical and automobile industries. During the period of assessment, continuous improvements happening in the semiconductor market and increasing desire for consumer electronics are supporting market possibilities. The automotive market is expanding due to the introduction of automated vehicles and connected cars. Continuous advancements in technology in defense, healthcare, and aerospace are also becoming part of the revenue stream for motor driver IC makers. Businesses all around the world are putting money into automation, seeking to increase their production abilities and lessen the costs of running. Motor driver ICs are very important for controlling electric motors in industrial automation uses. These components provide needed signals to drive and manage motor speed, direction as well as torque - factors that make sure machines and equipment run accurately and dependably. Thus, growth in the adoption of automation is fueling Motor Driver IC Market growth.Motor Driver IC Market Segment Analysis:

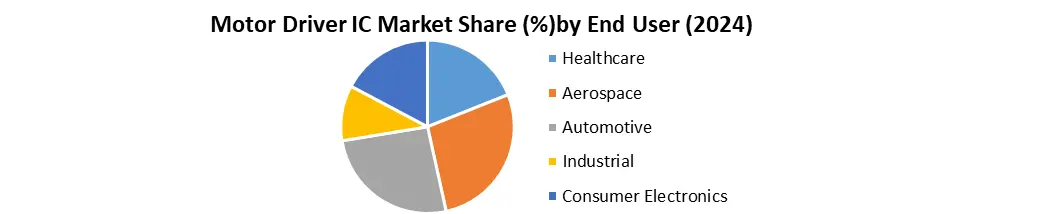

Based on End-User, the Automotive segment dominated the market in 2024 and is expected to hold largest share during thr forecast period. Big Use of Motor Driver ICs in Consumer Electronics, as per the most recent market analysis for motor driver ICs, the end-use industry part of consumer electronics had the second biggest Motor Driver IC Market share with in 2024. The growth of this segment is being driven by the increase in the consumer electronics sector. Consumer electronic devices are commonly seen in homes, and they rely on motor driver ICs to manage their electric motors. The term "consumer electronics" is used to describe a large variety of electronic items that people use for personal or household purposes. This can include everything from appliances such as washing machines and refrigerators to personal computers, smartphones, and gaming consoles. Based on Application the Motor Driver IC Market Segmented into industrial Automation, Automotive, Consumer electronics, Healthcare and Medical Devices and Aerospace and Defence. the Automotive segment dominated the Market in 2024 and is expected to hold largest share during the forecast period by its. The automotive segment dominated the motor driver IC market due to the rapid adoption of electric vehicles (EVs), increasing use of advanced driver assistance systems (ADAS), and growing demand for vehicle automation. Motor driver ICs are essential in managing electric motors used in powertrains, infotainment, and safety systems. Additionally, rising consumer demand for connected and autonomous vehicles, coupled with stringent emission norms and the shift toward vehicle electrification, continues to drive significant growth in this segment.

Motor Driver IC Market Regional Analysis:

The Motor Driver IC market in the Asia Pacific dominated and is expected to dominate at a rapid pace during the forecast period, led by the rising trends towards electric and hybrid vehicles. In countries like India, China, and Japan governments and automobile manufacturers are more focused on new-energy vehicles (NEVs) this has provided many lucrative opportunities for the auto brands which in turn has made a positive impact on the demand for motor drivers ICs industry. government initiatives promoting industrial automation, growing adoption of electric vehicles, and availability of low-cost manufacturing and skilled labour have further fuelled demand, making Asia-Pacific the largest and fastest-growing regional market. Motor Driver IC Market Competitive Landscape: Emerging Motor Driver IC Market key players like Texas Instruments Inc., Infineon Technologies AG, Toshiba Corporation, STMicroelectronics, and ROHM Semiconductor form the strength of the Motor Driver IC market growth increase by their technological expertise and strong R&D capabilities. Motor Driver IC Market players lead the global landscape by spending in energy efficient designs, miniaturization and integration of smart features. Texas Instruments, Infineon, STMicroelectronics, Toshiba and ROHM are at the forefront of innovation, supporting the shift towards industrial automation, electric vehicles and robotics. Texas Instruments reported revenue of approximately USD 18.5 Million in 2024, with a Research and Development investment of around USD 1.7 billion, showcasing its strong commitment to innovation. Infineon Technologies increasing its product line with high performance motor drivers for automotive and industrial applications, while STMicroelectronics has strengthened its position in robotics and automation by offering robust and power efficient solutions. Key trends in Motor Driver IC Market:Recent Development in Motor Driver IC Market • On 10 March 2025, Infineon Technologies AG (Germany) launched a new generation of energy-efficient BLDC motor driver ICs targeting industrial automation and HVAC applications, aiming to improve power efficiency and reduce system cost. • On 22 January 2025, STMicroelectronics (Switzerland) announced the opening of a new R&D center in Singapore focused on developing next-gen motor control solutions for robotics and electric mobility. • On 18 December 2024, Texas Instruments (USA) unveiled a compact, high-precision motor driver IC designed for use in surgical robotics and medical devices, expanding its healthcare product portfolio. • On 05 November 2024, ROHM Semiconductor (Japan) introduced an advanced smart motor driver IC with integrated fault detection and thermal management for automotive safety systems. • On 15 October 2024, Toshiba Corporation (Japan) expanded its motor driver IC production capacity at its Iwate facility to meet surging global demand from EV and industrial automation markets.

Sr No Trend Impact on Market 1 Electrification of Vehicles Rising demand for EVs is increasing the need for efficient and compact motor driver ICs. 2 Industrial Automation Growth Increased use of robotics, CNC machines, and automation tools fuels demand for motor drivers. 3 Miniaturization & Integration Development of compact, integrated ICs for space-constrained applications. 4 Energy Efficiency Focus Shift toward low-power, high-efficiency ICs to reduce energy consumption. Motor Driver ICs Market Scope: Inquire before buying

Motor Driver ICs Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.64 Bn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 6.02 Bn. Segments Covered: by Motor Type Brushed DC Motor Brushless DC Motor Stepper Motor by Semiconductor Materials SiC Si GAN by Mode of Attachment On-Chip Discrete by End-User Healthcare Aerospace Automotive Industrial Consumer Electronics Others Global Motor Deice ICs Market, by Region:

North America (United Packaging Types, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A)Key Players in Motor Driver IC Market:

North America 1. Allegro Micro Systems, LLC (United States) 2. Texas Instruments Incorporated (United States) 3. Microchip Technology Inc. (United States) 4. Diodes Incorporated (United States) 5. Analog Devices, Inc. (Maxim Integrated) (United States) 6. ON Semiconductor (United States) 7. Monolithic Power Systems, Inc. (United States) Europe 8. Infineon Technologies AG (Germany) 9. STMicroelectronics (Switzerland) 10. Melexis NV (Belgium) 11. Trinamic Motion Control GmbH (Germany) 12. Elmos Semiconductor SE (Germany) 13. ABB Ltd. (Switzerland) Asia-Pacific 14. TOSHIBA Electronic Devices & Storage Corporation (Japan) 15. ROHM Semiconductor (Japan) 16. Panasonic Corporation (Japan) 17. Hitachi Power Semiconductor Device, Ltd. (Japan) 18. Fuji Electric Co., Ltd. (Japan) 19. Sanken Electric Co., Ltd. (Japan) 20. Renesas Electronics Corporation (Japan) 21. Samsung Electronics Co., Ltd. (South Korea) 22. MediaTek Inc. (Taiwan) 23. NXP Semiconductors (Netherlands) Middle East & Africa 24. Tower Semiconductor Ltd. (Israel) 25. Fuji Electric Co., Ltd. (Japan) 26. Delta Electronics, Inc. (Taiwan) South America 27. WEG S.A. (Brazil)Frequently Asked Questions:

1. Which region has the largest share in the Global Motor Driver ICs Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Motor Driver ICs Market? Ans: The Global Motor Driver ICs Market is growing at a CAGR of 6.5% during the forecasting period. 3. What is the scope of the Global Motor Driver ICs Market report? Ans: Global Motor Driver ICs Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Motor Driver ICs Market? Ans: The important key players in the Global Motor Driver IC Market are Allegro MicroSystems, LLC, Infineon Technologies AG, Maxim Integrated, Microchip Technology Inc., are the major key players in Global Motor Driver ICs Market. 5. What is the study period of this Market? Ans: The Global Motor Driver ICs Market is studied from 2024 to 2032.

1. Motor Driver IC Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Motor Driver IC Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Motor Driver IC Market: Dynamics 3.1. Region-wise Trends of Motor Driver IC Market 3.1.1. North America Motor Driver IC Market Trends 3.1.2. Europe Motor Driver IC Market Trends 3.1.3. Asia Pacific Motor Driver IC Market Trends 3.1.4. Middle East and Africa Motor Driver IC Market Trends 3.1.5. South America Motor Driver IC Market Trends 3.2. Motor Driver IC Market Dynamics 3.2.1. Motor Driver IC Market Drivers 3.2.1.1. Growing Demand for Electric Vehicles (EVs) 3.2.1.2. Expansion of Industrial Automation and Robotics 3.2.2. Motor Driver IC Market Restraints 3.2.3. Motor Driver IC Market Opportunities 3.2.3.1. Growth in Industrial IoT and Smart Manufacturing 3.2.3.2. Expanding Healthcare and Medical Device Market 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Health Policy Influence on Edible Oils 3.4.2. Rise in E-commerce & Direct-to-Consumer Sales 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Motor Driver IC Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 4.1.1. Brushed DC Motor 4.1.2. Brushless DC Motor 4.1.3. Stepper Motor 4.2. Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 4.2.1. SiC 4.2.2. Si 4.2.3. GAN 4.3. Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 4.3.1. On-Chip 4.3.2. Discrete 4.4. Motor Driver IC Market Size and Forecast, By End User (2024-2032) 4.4.1. Healthcare 4.4.2. Aerospace 4.4.3. Automotive 4.4.4. Industrial 4.4.5. Consumer Electronics 4.4.6. Others 4.5. Motor Driver IC Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Motor Driver IC Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 5.1.1. Brushed DC Motor 5.1.2. Brushless DC Motor 5.1.3. Stepper Motor 5.2. North America Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 5.2.1. SiC 5.2.2. Si 5.2.3. GAN 5.3. North America Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 5.3.1. On-Chip 5.3.2. Discrete 5.4. North America Motor Driver IC Market Size and Forecast, By End User (2024-2032) 5.4.1. Healthcare 5.4.2. Aerospace 5.4.3. Automotive 5.4.4. Industrial 5.4.5. Consumer Electronics 5.4.6. Others 5.5. North America Motor Driver IC Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 5.5.1.1.1. Brushed DC Motor 5.5.1.1.2. Brushless DC Motor 5.5.1.1.3. Stepper Motor 5.5.1.2. United States Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 5.5.1.2.1. SiC 5.5.1.2.2. Si 5.5.1.2.3. GAN 5.5.1.3. United States Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 5.5.1.3.1. On-Chip 5.5.1.3.2. Discrete 5.5.1.4. United States Motor Driver IC Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. Healthcare 5.5.1.4.2. Aerospace 5.5.1.4.3. Automotive 5.5.1.4.4. Industrial 5.5.1.4.5. Consumer Electronics 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 5.5.2.1.1. Brushed DC Motor 5.5.2.1.2. Brushless DC Motor 5.5.2.1.3. Stepper Motor 5.5.2.2. Canada Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 5.5.2.2.1. SiC 5.5.2.2.2. Si 5.5.2.2.3. GAN 5.5.2.3. Canada Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 5.5.2.3.1. On-Chip 5.5.2.3.2. Discrete 5.5.2.4. Canada Motor Driver IC Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. Healthcare 5.5.2.4.2. Aerospace 5.5.2.4.3. Automotive 5.5.2.4.4. Industrial 5.5.2.4.5. Consumer Electronics 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 5.5.3.1.1. Brushed DC Motor 5.5.3.1.2. Brushless DC Motor 5.5.3.1.3. Stepper Motor 5.5.3.2. Mexico Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 5.5.3.2.1. SiC 5.5.3.2.2. Si 5.5.3.2.3. GAN 5.5.3.3. Mexico Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 5.5.3.3.1. On-Chip 5.5.3.3.2. Discrete 5.5.3.4. Mexico Motor Driver IC Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. Healthcare 5.5.3.4.2. Aerospace 5.5.3.4.3. Automotive 5.5.3.4.4. Industrial 5.5.3.4.5. Consumer Electronics 5.5.3.4.6. Others 6. Europe Motor Driver IC Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.2. Europe Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.3. Europe Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.4. Europe Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5. Europe Motor Driver IC Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.1.2. United Kingdom Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.1.3. United Kingdom Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.1.4. United Kingdom Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.2. France 6.5.2.1. France Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.2.2. France Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.2.3. France Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.2.4. France Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.3.2. Germany Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.3.3. Germany Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.3.4. Germany Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.4.2. Italy Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.4.3. Italy Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.4.4. Italy Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.5.2. Spain Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.5.3. Spain Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.5.4. Spain Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.6.2. Sweden Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.6.3. Sweden Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.6.4. Sweden Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.7.2. Russia Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.7.3. Russia Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.7.4. Russia Motor Driver IC Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 6.5.8.2. Rest of Europe Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 6.5.8.3. Rest of Europe Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 6.5.8.4. Rest of Europe Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Motor Driver IC Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.2. Asia Pacific Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.3. Asia Pacific Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.4. Asia Pacific Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific Motor Driver IC Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.1.2. China Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.1.3. China Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.1.4. China Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.2.2. S Korea Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.2.3. S Korea Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.2.4. S Korea Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.3.2. Japan Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.3.3. Japan Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.3.4. Japan Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.4.2. India Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.4.3. India Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.4.4. India Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.5.2. Australia Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.5.3. Australia Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.5.4. Australia Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.6.2. Indonesia Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.6.3. Indonesia Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.6.4. Indonesia Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.7.2. Malaysia Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.7.3. Malaysia Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.7.4. Malaysia Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.8.2. Philippines Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.8.3. Philippines Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.8.4. Philippines Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.9.2. Thailand Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.9.3. Thailand Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.9.4. Thailand Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.10.2. Vietnam Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.10.3. Vietnam Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.10.4. Vietnam Motor Driver IC Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 7.5.11.3. Rest of Asia Pacific Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 7.5.11.4. Rest of Asia Pacific Motor Driver IC Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Motor Driver IC Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 8.2. Middle East and Africa Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 8.3. Middle East and Africa Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 8.4. Middle East and Africa Motor Driver IC Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa Motor Driver IC Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 8.5.1.2. South Africa Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 8.5.1.3. South Africa Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 8.5.1.4. South Africa Motor Driver IC Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 8.5.2.2. GCC Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 8.5.2.3. GCC Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 8.5.2.4. GCC Motor Driver IC Market Size and Forecast, By End User (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 8.5.3.2. Egypt Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 8.5.3.3. Egypt Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 8.5.3.4. Egypt Motor Driver IC Market Size and Forecast, By End User (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 8.5.4.2. Nigeria Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 8.5.4.3. Nigeria Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 8.5.4.4. Nigeria Motor Driver IC Market Size and Forecast, By End User (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 8.5.5.2. Rest of ME&A Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 8.5.5.3. Rest of ME&A Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 8.5.5.4. Rest of ME&A Motor Driver IC Market Size and Forecast, By End User (2024-2032) 9. South America Motor Driver IC Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 9.2. South America Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 9.3. South America Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 9.4. South America Motor Driver IC Market Size and Forecast, By End User (2024-2032) 9.5. South America Motor Driver IC Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 9.5.1.2. Brazil Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 9.5.1.3. Brazil Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 9.5.1.4. Brazil Motor Driver IC Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 9.5.2.2. Argentina Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 9.5.2.3. Argentina Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 9.5.2.4. Argentina Motor Driver IC Market Size and Forecast, By End User (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 9.5.3.2. Colombia Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 9.5.3.3. Colombia Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 9.5.3.4. Colombia Motor Driver IC Market Size and Forecast, By End User (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 9.5.4.2. Chile Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 9.5.4.3. Chile Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 9.5.4.4. Chile Motor Driver IC Market Size and Forecast, By End User (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Motor Driver IC Market Size and Forecast, By Motor Type (2024-2032) 9.5.5.2. Rest Of South America Motor Driver IC Market Size and Forecast, By Semiconductor Materials (2024-2032) 9.5.5.3. Rest Of South America Motor Driver IC Market Size and Forecast, By Mode of Attachment (2024-2032) 9.5.5.4. Rest Of South America Motor Driver IC Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players 10.1. Allegro MicroSystems, LLC (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Texas Instruments Incorporated (United States) 10.3. Microchip Technology Inc. (United States) 10.4. Diodes Incorporated (United States) 10.5. Analog Devices, Inc. (Maxim Integrated) (United States) 10.6. ON Semiconductor (onsemi) (United States) 10.7. Monolithic Power Systems, Inc. (United States) 10.8. Infineon Technologies AG (Germany) 10.9. STMicroelectronics (Switzerland) 10.10. Melexis NV (Belgium) 10.11. Trinamic Motion Control GmbH (Germany) 10.12. Elmos Semiconductor SE (Germany) 10.13. ABB Ltd. (Switzerland) 10.14. TOSHIBA Electronic Devices & Storage Corporation (Japan) 10.15. ROHM Semiconductor (Japan) 10.16. Panasonic Corporation (Japan) 10.17. Hitachi Power Semiconductor Device, Ltd. (Japan) 10.18. Fuji Electric Co., Ltd. (Japan) 10.19. Sanken Electric Co., Ltd. (Japan) 10.20. Renesas Electronics Corporation (Japan) 10.21. Samsung Electronics Co., Ltd. (South Korea) 10.22. MediaTek Inc. (Taiwan) 10.23. NXP Semiconductors (Netherlands) 10.24. Tower Semiconductor Ltd. (Israel) 10.25. Fuji Electric Co., Ltd. (Japan) 10.26. Delta Electronics, Inc. (Taiwan) 10.27. WEG S.A. (Brazil) 11. Key Findings 12. Industry Recommendations 13. Motor Driver IC Market: Research Methodology