The Global Marble Market size was valued at USD 69.52 Billion in 2024 and is expected to reach USD 104.29 Billion by 2032, at a CAGR of 5.2%. Marble is a metamorphic rock primarily composed of recrystallized carbonate minerals such as dolomite and calcite. Its luxurious aesthetic appeal and availability in various colors such as white, yellow, red, and black make it a highly preferred material for both decorative and construction applications. Marble is widely used in sculptures, architecture, flooring, and interior design due to its beauty and durability. The Marble Market Growth is being boosted by the increasing use of marble in flooring, bathroom interiors, countertops, and modern construction projects.To know about the Research Methodology:-Request Free Sample Report The exceptional aesthetic qualities and color variety of marble make it one of the most desirable materials for interior design applications. Additionally, the abundance of marble quarries across the world contributes positively to the market supply. Countries such as China, India, and Italy are among the world’s largest producers and exporters of marble. Over the past few years, marble production statistics have shown tremendous growth, especially in Asia-Pacific, where the demand for natural stone market products such as marble has surged due to rapid urbanization and construction activity. Marble Market Key Trends

Marble Market Dynamics:

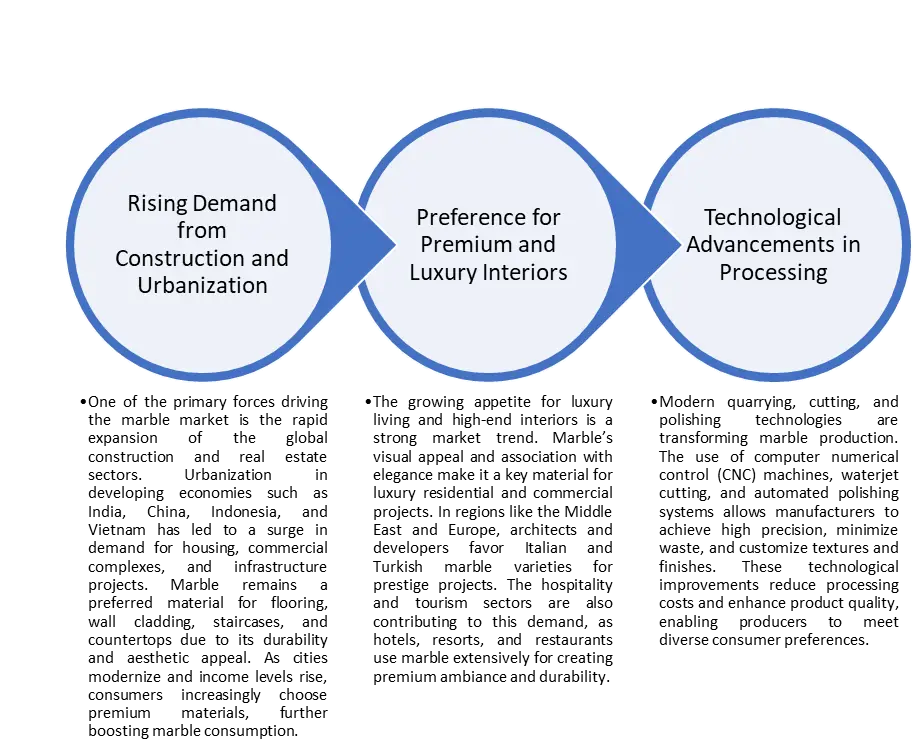

Rising Demand for Premium Aesthetic Surfaces and Innovation to drive the growth of Marble Market Growing market adoption of marble products across India and other emerging economies has become increasingly important. Manufacturers are improving the physical and visual properties of marble blocks by using marble powder and advanced finishing techniques, boosting demand in construction and design sectors. The trend of raw, polished, and tumbled stone finishes has become popular among architects and interior designers. However, marble is often mistaken for granite, but manufacturers are raising awareness that marble has veined patterns whereas granite has a granular texture. The ability of marble to absorb moisture, along with its timeless beauty, makes it a preferred choice for both commercial and residential interiors. Manufacturers are expanding their production capacity and investing in R&D to create innovative marble styles, patterns, and colors. This product diversification allows competitive pricing and brand differentiation. In India, where the Marble industry is fragmented, companies are focusing on streamlining supply chains and increasing efficiency. The demand for white marble slabs has significantly risen in residential and commercial projects, with architects preferring marbles with diverse hardness and durability levels.For Instance In 2024, India’s premium marble slab market recorded one of the fastest growth rates globally, supported by infrastructure and real estate growth . Availability of Substitutes and Environmental Issues as Key Restraining Factors for the Marble Market The Marble Market faces significant challenges due to the availability of low-cost substitutes such as granite, porcelain, and engineered stone. These alternatives are often more durable, scratch-resistant, and easier to maintain, making them highly preferred in cost-sensitive regions such as Asia and south America. As a result, the demand for marble in mid-range construction projects remains limited.Also, natural marble faces performance challenges such as surface peeling, discoloration, and vulnerability to acidic substances, which restrict its use in high-traffic or outdoor areas. Apart from these limitations, marble continues to hold strong appeal in luxury construction and premium interior design due to its natural veining, unique color variations, and aesthetic value. However, environmental issues related to quarrying, such as land degradation, dust emissions, and carbon-intensive processing, have led to stricter mining regulations in countries including Italy, India, and China. These sustainability challenges have increased production and compliance costs for manufacturers, prompting the industry to adopt eco-friendly quarrying methods and explore recycled marble-based composites to reduce its carbon footprint. Innovation and Sustainable Practices in the Marble cretes lucrative growth opportunities The marble market presents promising opportunities as industry fragmentation encourages new entrants and startups to explore niche segments. Investments in CNC (Computer Numerical Control) cutting machinery, digital templating, and eco-friendly processing technologies are transforming production efficiency and design capabilities. This shift allows manufacturers to deliver highly customized marble products with superior precision and reduced material wastage. For example, Marble Innovation, a Malta-based startup, has pioneered sustainable marble fabrication techniques that minimize environmental impact while maintaining aesthetic quality. Manufacturers are increasingly diversifying their portfolios by producing advanced facades, countertops, staircases, and shower trays to meet the growing demand in premium residential and commercial projects. In India, exporters are capitalizing on strong demand from the UAE and GCC markets, where luxury construction and interior renovation activities are accelerating. Companies such as Rollza Granito (Gujarat, India) are expanding their white marble collections to cater to this booming Middle Eastern market. Furthermore, sustainability-focused suppliers in Europe and Asia are introducing “green-certified” marble, aligning with the global shift toward eco-friendly and ethically sourced construction materials, thereby creating new growth opportunities in the premium architectural segment .Marble Market Segment Analysis

Based On Color , the Marble Market is segmented into White, Black,Yellow,Red, Others.The White Marble segment dominated the color segment in 2024. White marble symbolizes purity, sophistication, and luxury, making it a preferred choice in both residential and commercial construction. Its ability to brighten spaces enhances the aesthetic appeal of modern interiors, making it ideal for kitchen countertops, bathroom floors, shower walls, and entryways. Variants such as Carrara marble from Italy and Makrana white marble from India continue to lead the global white marble trade due to their fine grain quality, smooth texture, and timeless appeal. Also,the growing adoption of minimalistic and contemporary design styles has increased the demand for white marble in luxury hotels, villas, and corporate spaces. Its versatility and ability to blend seamlessly with diverse color palettes ensure its continued dominance and strong growth trajectory in the global marble market.Based On Product, the Marble Market is segmented into Tiles or Slabs,Blocks,Others.The Tiles or Slabs segment dominated the Product segment in 2024. The tiles or slabs segment dominated the product category of the Marble Market in 2024, driven by its extensive use in flooring, wall cladding, countertops, and decorative applications. Marble tiles and slabs offer versatility, easy installation, and superior finishing, making them the preferred choice for both residential and commercial construction projects. The growing trend of modern interiors and luxury architecture has further boosted demand for large-format slabs that enhance aesthetic appeal and create seamless surfaces. Technological advancements such as CNC cutting and resin reinforcement have improved the durability and precision of marble tiles, increasing their adoption in premium spaces like hotels, offices, and villas. Moreover, the availability of polished, honed, and tumbled finishes provides design flexibility, positioning marble tiles and slabs as the most popular and profitable product type in the global Marble Market.

Based On Application, the Marble Market is segmented into Building and Decoration,Statues and Monuments,Furniture,Others.The Building and Decoration segment dominated the Application segment in 2024.Marble’s high compressive strength and aesthetic versatility make it indispensable for construction and decorative applications, such as flooring, wall cladding, facades, stairways, sculptures, and monuments. With the surge in real estate investment and architectural renovation, demand for decorative stone market materials like marble has grown exponentially. The Rapid urban development in China, India, and the United States is expected to generate significant marble demand for both residential and commercial projects.

Marble Market Regional Analysis

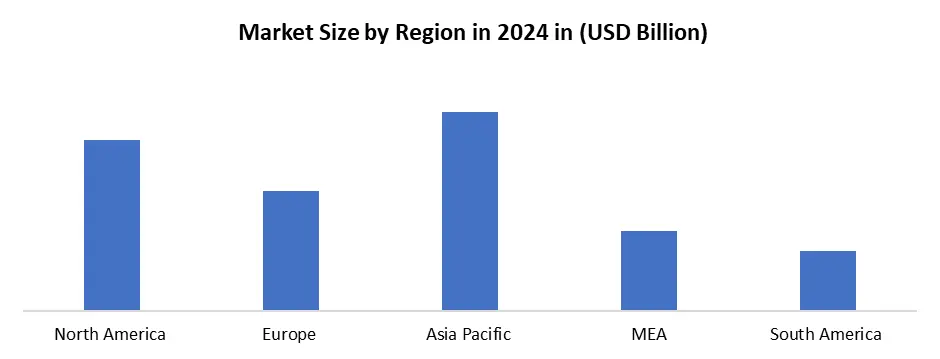

The Asia-Pacific region dominated the Marble market in 2024, driven by rapid urbanization, industrial expansion, and strong government investment in the building and construction sectors. China remains the world’s largest marble producer, adding nearly 2 billion square meters of new building space annually, which fuels continuous demand for decorative stone and marble materials. India is emerging as one of the fastest-growing marble markets, supported by large-scale infrastructure and housing projects such as the Palva Industrial Township and the Zaheerabad Integrated Industrial Township, representing cumulative investments of around USD 29.4 billion. Additionally, 100% FDI approval in township and housing development has boosted marble consumption in the country. Emerging markets like Vietnam and Indonesia are also becoming key low-cost marble exporters, strengthening Asia-Pacific’s leadership in the global marble trade network. Europe remains a key region for premium marble production and exports, led by Italy (Carrara), Spain, and Greece, which supply luxury marble for architectural landmarks and high-end interiors. The European Marble Market Forecast predicts steady growth supported by sustainable quarrying, green building standards, and rising demand for luxury marble in modern architecture. In North America, the U.S. Marble Market Size is expanding due to remodeling, luxury housing, and infrastructure projects, while Canada sees increasing imports from Italy and Turkey. The Middle East Marble Market is thriving in Turkey, Egypt, and GCC nations, driven by major projects like NEOM and Dubai’s Smart City. In Latin America, Brazil and Mexico are boosting marble exports through infrastructure investments and advanced quarrying technologies.

Marble Market Competative Landscape :

The marble market features strong competition among global and regional players such as Fox Marble, Kangli Stone Group, China Kingstone Mining Holdings Limited, and Daltile. Fox Marble, based in London, specializes in quarrying and processing premium marble and limestone from its quarries in Kosovo and North Macedonia, offering varieties like Alexandrian White for global construction and design projects. Kangli Stone Group, established in 1989, is a leading Chinese manufacturer with multiple production bases and a diverse portfolio of marble, granite, and quartz, serving markets across Europe, America, and Asia. China Kingstone Mining Holdings Limited, headquartered in Sichuan, operates the Zhangjiaba and Tujisi mines, producing beige marble and offering building decoration services. Daltile, a U.S.-based manufacturer, distributes a wide range of marble tiles and slabs, including Carrara White and Calacatta Gold, catering to both residential and commercial applications across North America and international markets.Marble Market Recent Development :

In June 2023, Fox Marble successfully completed a reverse takeover of Eco Buildings Group Ltd., marking its transition into a modular housing company listed on the AIM market in London. This strategic move is designed to enhance production capacity and support the execution of existing sales contracts, while continuing to leverage Fox Marble’s high-quality marble and limestone quarries in Kosovo.Marble Market Scope: Inquire before buying

Marble Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 69.52 Bn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 104.29 Bn. Segments Covered: by Color White Black Yellow Red Others by Product Tiles or Slabs Blocks Others by Application Building and Decoration Statues and Monuments Furniture Others Marble Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Marble Key Players

1. Levantina Asociados de Minerales, S.A. 2. Temmer Marble 3. Fox Marble 4. Kangli stone group 5. Best Cheer Stone 6. Tekma 7. Pakistan Onyx Marble 8. Dimpomar 9. Mumal Marbles 10. Can Simsekler Construction 11. Mármoles Marín S.A. 12. Aurangzeb Marble Industry 13. Etgran 14. Amso International 15. Universal Mrble & Granite 16. Best Cheer Stone Group 17. Fujian Fengshan Stone Group 18. Xiamen Wanlistone stock 19. Kangli Stone Group 20. Hongfa 21. Xishi Group 22. Jin Long Run Yu 23. Xinpengfei Industry Frequently Asked Questions: 1. Which region holds the most potential for the Marble Market? Answer: - The Asia-Pacific (APAC) region presents the highest growth potential for the Marble Market, driven by rapid urbanization, expanding construction activities, and rising demand from commercial and residential infrastructure projects. 2. What are the key opportunities for new entrants in the Marble Market? Answer: - Government initiatives promoting infrastructure development and the renovation of public buildings are creating lucrative opportunities for new market entrants. 3. What factors are driving the growth of the Marble Market during the forecast period? Answer: - The market growth is primarily driven by rising demand from the construction and interior design sectors, increasing adoption of premium natural stones for aesthetic appeal, and rapid industrialization in emerging economies. 4. What is the projected market size and growth rate of the Marble Market? Answer: - The global Marble Market was valued at USD 69.52 billion in 2024 and is projected to reach nearly USD 104.29 billion by 2032, growing at a CAGR of 5.2% during the forecast period (2025–2032). 5. What key segments are included in the Marble Market report? Answer: - The report covers comprehensive segmentation based on Color, Product, Application, and Region, providing detailed insights into each category’s growth trends and market dynamics.

1. Marble Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Marble Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Marble Market: Dynamics 3.1. Marble Market Trends 3.2. Marble Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Marble Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Marble Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Marble Market Size and Forecast, By Color (2024-2032) 4.1.1. White 4.1.2. Black 4.1.3. Yellow 4.1.4. Red 4.1.5. Others 4.2. Marble Market Size and Forecast, By Product (2024-2032) 4.2.1. Tiles or Slabs 4.2.2. Blocks 4.2.3. Others 4.3. Marble Market Size and Forecast, By End-User (2024-2032) 4.3.1. Building and Decoration 4.3.2. Statues and Monuments 4.3.3. Furniture 4.3.4. Others 4.4. Marble Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Marble Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Marble Market Size and Forecast, By Color (2024-2032) 5.1.1. White 5.1.2. Black 5.1.3. Yellow 5.1.4. Red 5.1.5. Others 5.2. North America Marble Market Size and Forecast, By Product (2024-2032) 5.2.1. Tiles or Slabs 5.2.2. Blocks 5.2.3. Others 5.3. North America Marble Market Size and Forecast, By End-User (2024-2032) 5.3.1. Building and Decoration 5.3.2. Statues and Monuments 5.3.3. Furniture 5.3.4. Others 5.4. North America Marble Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Marble Market Size and Forecast, By Color (2024-2032) 5.4.1.2. United States Marble Market Size and Forecast, By Product (2024-2032) 5.4.1.3. United States Marble Market Size and Forecast, By End-User (2024-2032) 5.4.2. Canada 5.4.2.1. Canada Marble Market Size and Forecast, By Color (2024-2032) 5.4.2.2. Canada Marble Market Size and Forecast, By Product (2024-2032) 5.4.2.3. Canada Marble Market Size and Forecast, By End-User (2024-2032) 5.4.3. Mexico 5.4.3.1. Mexico Marble Market Size and Forecast, By Color (2024-2032) 5.4.3.2. Mexico Marble Market Size and Forecast, By Product (2024-2032) 5.4.3.3. Mexico Marble Market Size and Forecast, By End-User (2024-2032) 6. Europe Marble Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Marble Market Size and Forecast, By Color (2024-2032) 6.2. Europe Marble Market Size and Forecast, By Product (2024-2032) 6.3. Europe Marble Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Marble Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Marble Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Marble Market Size and Forecast, By Color (2024-2032) 7.2. Asia Pacific Marble Market Size and Forecast, By Product (2024-2032) 7.3. Asia Pacific Marble Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Marble Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Marble Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Marble Market Size and Forecast, By Color (2024-2032) 8.2. Middle East and Africa Marble Market Size and Forecast, By Product (2024-2032) 8.3. Middle East and Africa Marble Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Marble Market Size and Forecast, By Country (2024-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America Marble Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Marble Market Size and Forecast, By Color (2024-2032) 9.2. South America Marble Market Size and Forecast, By Product (2024-2032) 9.3. South America Marble Market Size and Forecast, By End-User (2024-2032) 9.4. South America Marble Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. Levantina Asociados de Minerales, S.A. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Temmer Marble 10.3. Tekma 10.4. Fox Marble 10.5. Kangli stone group 10.6. Best Cheer Stone 10.7. Pakistan Onyx Marble 10.8. Dimpomar 10.9. Mumal Marbles 10.10. Can Simsekler Construction 10.11. Mármoles Marín S.A. 10.12. Aurangzeb Marble Industry 10.13. Etgran 10.14. Amso International 10.15. Universal Mrble & Granite 10.16. Best Cheer Stone Group 10.17. Fujian Fengshan Stone Group 10.18. Xiamen Wanlistone stock 10.19. Kangli Stone Group 10.20. Hongfa 10.21. Xishi Group 10.22. Jin Long Run Yu 10.23. Xinpengfei IndustryJuice Financial Inc. 10.24. PrimeTrust Federal Credit Union 10.25. The PNC Financial Services Group, Inc. 10.26. UnionPay International Co., Ltd. 10.27. Wells Fargo & Company 10.28. Paysafe Holdings UK Limited) 11. Key Findings 12. Analyst Recommendations 13. Marble Market – Research Methodology