Lubricant Market size was valued at USD 170.52 Billion in 2024 and the total Global Lubricant Market revenue is expected to grow at a CAGR of 3.5% from 2025 to 2032, reaching nearly USD 224.54 Billion. Rising automotive demand, industrial growth, and advancements in synthetic and bio-based lubricants for enhanced performance and efficiency.Lubricant Market Overview:

The global Lubricant market was valued at US $201.56 Bn. in 2023, and it is expected to reach US $253.85 Bn. by 2030 with a CAGR of 3.35% during the forecast period. A lubricant is a material which, lowers friction between two surfaces in contact, lowering the amount of heat generated while the surfaces operate. It may have the potential to transfer forces, move foreign particles, and cool or heat surfaces. Lubricity is a quality that helps to reduce friction. Lubricants are applied for a variety of purposes in addition to industrial applications. Cooking (baking to prevent food sticking, oils, and fats in frying pans), bio-applications on humans (e.g., lubricants for artificial joints), ultrasound examination, medical examination, and sexual relations are some of the other applications. It is primarily used to reduce friction and aid in the smooth and efficient operation of a device.To know about the Research Methodology :- Request Free Sample Report 2023 is considered a base year however 2023's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

Lubricant Market Dynamics:

The lubricant industry is evolving and growing as a result of increased demand for high-performance engines: Internal combustion engines have come a long way since Ford designed the first commercial car in the early twentieth century. Thanks to engine improvements, the internal components of the engine are exposed to much higher tension and heat. This has also resulted in engines with extremely high RPMs, necessitating the use of higher-quality engine oil. Aside from that, car transmission systems have improved, with vehicles achieving speeds of up to 150 miles per hour. The technology of the gear system and bearings has also advanced. All of these advancements and evolutions need the use of more effective lubricants. Thus, lubricants have evolved and expanded driving the market growth. Growing condom production, specifically in the Asia Pacific demands lubricants: The surge in contraceptive product adoption rates among consumers around the world is driving up condom demand, particularly during the COVID-19 pandemic which, drive the demand for condoms suddenly. Lubricants like water-based, oil-based, and silicone-based lubricants respectively are used in the production of condoms which, helps to reduce friction during sexual acts. Also, rising awareness as a result of government initiatives, as well as comprehensive sex education programs aimed at reducing the prevalence of sexually transmitted illnesses, is driving global market growth which, directly uplifts the lubricant demand. Hybrid vehicle demand is surging, as is battery price equivalence: Hybrid vehicles combine a tiny internal combustion engine (ICE) with an electric motor to maximize power efficiency while lowering pollution. Lubricants, primarily engine oil and transmission fluid, are required by ICE inside a car. According to industry experts, the increased number of hybrid vehicles may reduce lubricant use per vehicle by nearly half. This reason, together with rising battery parity, may diminish the global lubricant market's volume. Electric vehicle batteries are expensive; but, as technology improves, the cost is decreasing and the driving range per charge is growing. These factors have affected lubricant consumption. According to industry experts, engine oil accounts for more than 40% of the total lubricant market. Renewable energy demand may have a favorable impact on the lubricants market: Industrial lubricants, ranging from turbine oil to transformer oil, are used extensively in the power industry. Lubricants are consumed in a variety of processes. The renewable energy sector is a promising sub-segment of the power generation sector. Wind power generation represents a very small portion of the entire energy mix, but the industry is increasing at a 10% annual rate, with a capacity of 596,556 megawatts in 2022, according to the World Wind Energy Association. Lubricants are required for optimal operation of wind turbines providing growth opportunities for the market to developed advanced lubricants.Lubricant Market Trends:

• Bio-based and synthetic lubricants are seeing a comeback as a result of improved technologies and environmental concerns. To keep up with the oxygen-containing esters in the oils, the upgraded version of bio-based grease requires more suitable additives. Oils derived from algae or exotic plants that contain a blend of minerals, synthetic oils, or plant-based oils are growing demand for new lubricant feedstocks. • With a US $200 million investment, ExxonMobil launched the Port Allen lubricant factory. By 2040, demand for aviation fuels and lubricants is expected to climb by 55.24%. Advanced manufacturing processes are increasingly in demand, such as a high-speed quart line, in-line mixing, and flow-through racking. This technology aids in the improvement of electrical energy efficiency, resulting in increased demand in the lubricants industry. • Royal Dutch Shell is one of the world's leading lubricant manufacturers. In the lubricants market, the company's growth strategy has been expansion. For example, the business launched its first lubricant laboratory in India in May 2021. The laboratory will cater to the expanding demand for new lubricating products in both the automotive and industrial sectors.Lubricant Market Segment Analysis:

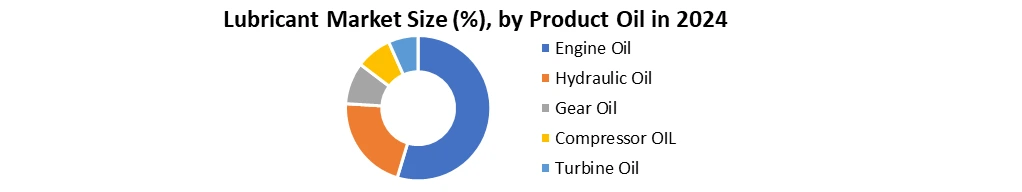

Based on Based Oil the market is segmented into Mineral Oil, Synthetic Oil, Semi-Synthetic Oil, Bio-Based Oil. Mineral Oil segment is dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Its low cost, widespread availability, and sufficient performance for standard automotive and industrial applications. Its strong presence in developing regions and established use in conventional engines further support its leading market position. Based on Product Type the market is segmented into Engine Oil, Hydraulic Oil, Gear Oil, Compressor Oil, Turbine Oil. Engine oil segment is dominated the market in 2024 & is expected to hold the largest market share during the forecast period. its critical role in automotive applications. It is widely used to reduce friction, prevent wear, and enhance the performance of internal combustion engines in passenger cars, commercial vehicles, and two-wheelers. Large global vehicle fleet and frequent oil change intervals, engine oil experiences consistent and high demand. Growth in vehicle ownership in emerging markets, along with a strong aftermarket service sector boosts consumption. Essential function and use make engine oil the leading lubricant product type in the market this year.

Regional Insights:

During the forecast period, the Asia Pacific is expected to hold a considerable share of xx% of the global lubricant market in terms of both volume and revenue. The region's growing population, together with expanding industrial investment and infrastructure advancements in China, India, and Indonesia's developing markets, is expected to make it an ideal destination for the lubricant market. Europe is expected to hold the second-highest share of xx% of the global lubricant market in terms of both volume and value during the forecast period. The rise of numerous industrial sectors, together with the increasing number of automobiles in the countries, is the main reason for this. However, thanks to policy differences, Russia is expected to have the greatest growth rate of xx% among European countries. Because Russia is not a member of the European Union, it is exempt from the EU's strict auto regulations and standards. The objective of the report is to present a comprehensive analysis of the global market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global market dynamics, structure by analyzing the market segments and project the global market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global market makes the report investor's guide.Lubricant Market Scope: Inquire before buying

Lubricant Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 170.52 Bn. Forecast Period 2025 to 2032 CAGR: 3.5% Market Size in 2032: USD 224.54 Bn. Segments Covered: by Base Oil Mineral Oil Synthetic Oil Semi-Synthetic Oil Bio-Based Oil by Product Type Engine Oil Hydraulic Oil Gear Oil Compressor Oil Turbine Oil by Application Automotive Industrial Marine Aerospace Construction by Distribution Channel OEM Aftermarket Online Direct Sales Lubricant Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players:

1. Royal Dutch Shell PLC 2. ExxonMobil Corporation 3. British Petroleum Plc 4. Chevron Corporation 5. Total SA 6. PetroChina Company Limited 7. Sinopec Limited 8. Lukoil 9. Fuchs Petrolub AG 10. Idemitsu Kosan Co. Ltd. 11. Pennzoil 12. Quaker Chemical Corp 13. JX Nippon Oil & Energy Corp 14. Philips 66 Company 15. Castrol 16. Valvoline LLC 17. Amalie Oil Co. 18. Others Frequently Asked Questions: 1. What is the forecast period considered for the Lubricant market report? Ans. The considered forecast period for the lubricant market is 2025-2032. 2. Which key factors are hindering the growth of the Lubricant market? Ans. The growing adoption of hybrid vehicles is the key factor expected to hinder the growth of the market during the forecast period. 3. What is the compound annual growth rate (CAGR) of the Lubricant market during forecast period? Ans. The global lubricant market is expected to grow at a CAGR of 3.5% during the forecast period (2025-2032). 4. What are the key factors driving the growth of the Lubricant market? Ans. The growing automotive industry and condom manufacturing across the globe are the key factors expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered in the Lubricant market report? Ans. Royal Dutch Shell PLC, ExxonMobil Corporation, British Petroleum Plc, Chevron Corporation, Total SA, PetroChina Company Limited, Sinopec Limited, Lukoil, Fuchs Petrolub AG, Idemitsu Kosan Co. Ltd., Pennzoil.

1. Lubricant Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Lubricant Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Lubricant Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Lubricant Market: Dynamics 3.1. Lubricant Market Trends by Region 3.1.1. North America Lubricant Market Trends 3.1.2. Europe Lubricant Market Trends 3.1.3. Asia Pacific Lubricant Market Trends 3.1.4. Middle East and Africa Lubricant Market Trends 3.1.5. South America Lubricant Market Trends 3.2. Lubricant Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Lubricant Market Drivers 3.2.1.2. North America Lubricant Market Restraints 3.2.1.3. North America Lubricant Market Opportunities 3.2.1.4. North America Lubricant Market Challenges 3.2.2. Europe 3.2.2.1. Europe Lubricant Market Drivers 3.2.2.2. Europe Lubricant Market Restraints 3.2.2.3. Europe Lubricant Market Opportunities 3.2.2.4. Europe Lubricant Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Lubricant Market Drivers 3.2.3.2. Asia Pacific Lubricant Market Restraints 3.2.3.3. Asia Pacific Lubricant Market Opportunities 3.2.3.4. Asia Pacific Lubricant Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Lubricant Market Drivers 3.2.4.2. Middle East and Africa Lubricant Market Restraints 3.2.4.3. Middle East and Africa Lubricant Market Opportunities 3.2.4.4. Middle East and Africa Lubricant Market Challenges 3.2.5. South America 3.2.5.1. South America Lubricant Market Drivers 3.2.5.2. South America Lubricant Market Restraints 3.2.5.3. South America Lubricant Market Opportunities 3.2.5.4. South America Lubricant Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Lubricant Industry 3.8. Analysis of Government Schemes and Initiatives For Lubricant Industry 3.9. Lubricant Market Trade Analysis 3.10. The Global Pandemic Impact on Lubricant Market 4. Lubricant Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Lubricant Market Size and Forecast, by Base Oil (2024-2032) 4.1.1. Mineral Oil 4.1.2. Synthetic Oil 4.1.3. Semi-Synthetic Oil 4.1.4. Bio-Based Oil 4.2. Lubricant Market Size and Forecast, by Product Type (2024-2032) 4.2.1. Engine Oil 4.2.2. Hydraulic Oil 4.2.3. Gear Oil 4.2.4. Compressor Oil 4.2.5. Turbine Oil 4.3. Lubricant Market Size and Forecast, by Application (2024-2032) 4.3.1. Automotive 4.3.2. Industrial 4.3.3. Marine 4.3.4. Aerospace 4.3.5. Construction 4.4. Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.1. OEM 4.4.2. Aftermarket 4.4.3. Online 4.4.4. Direct Sales 4.5. Lubricant Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Lubricant Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Lubricant Market Size and Forecast, by Base Oil (2024-2032) 5.1.1. Mineral Oil 5.1.2. Synthetic Oil 5.1.3. Semi-Synthetic Oil 5.1.4. Bio-Based Oil 5.2. North America Lubricant Market Size and Forecast, by Product Type (2024-2032) 5.2.1. Engine Oil 5.2.2. Hydraulic Oil 5.2.3. Gear Oil 5.2.4. Compressor Oil 5.2.5. Turbine Oil 5.3. North America Lubricant Market Size and Forecast, by Application (2024-2032) 5.3.1. Automotive 5.3.2. Industrial 5.3.3. Marine 5.3.4. Aerospace 5.3.5. Construction 5.4. North America Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1. OEM 5.4.2. Aftermarket 5.4.3. Online 5.4.4. Direct Sales 5.5. North America Lubricant Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Lubricant Market Size and Forecast, by Base Oil (2024-2032) 5.5.1.1.1. Mineral Oil 5.5.1.1.2. Synthetic Oil 5.5.1.1.3. Semi-Synthetic Oil 5.5.1.1.4. Bio-Based Oil 5.5.1.2. United States Lubricant Market Size and Forecast, by Product Type (2024-2032) 5.5.1.2.1. Engine Oil 5.5.1.2.2. Hydraulic Oil 5.5.1.2.3. Gear Oil 5.5.1.2.4. Compressor Oil 5.5.1.2.5. Turbine Oil 5.5.1.3. United States Lubricant Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Automotive 5.5.1.3.2. Industrial 5.5.1.3.3. Marine 5.5.1.3.4. Aerospace 5.5.1.3.5. Construction 5.5.1.4. United States Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.1.4.1. OEM 5.5.1.4.2. Aftermarket 5.5.1.4.3. Online 5.5.1.4.4. Direct Sales 5.5.2. Canada 5.5.2.1. Canada Lubricant Market Size and Forecast, by Base Oil (2024-2032) 5.5.2.1.1. Mineral Oil 5.5.2.1.2. Synthetic Oil 5.5.2.1.3. Semi-Synthetic Oil 5.5.2.1.4. Bio-Based Oil 5.5.2.2. Canada Lubricant Market Size and Forecast, by Product Type (2024-2032) 5.5.2.2.1. Engine Oil 5.5.2.2.2. Hydraulic Oil 5.5.2.2.3. Gear Oil 5.5.2.2.4. Compressor Oil 5.5.2.2.5. Turbine Oil 5.5.2.3. Canada Lubricant Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Automotive 5.5.2.3.2. Industrial 5.5.2.3.3. Marine 5.5.2.3.4. Aerospace 5.5.2.3.5. Construction 5.5.2.4. Canada Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.2.4.1. OEM 5.5.2.4.2. Aftermarket 5.5.2.4.3. Online 5.5.2.4.4. Direct Sales 5.5.3. Mexico 5.5.3.1. Mexico Lubricant Market Size and Forecast, by Base Oil (2024-2032) 5.5.3.1.1. Mineral Oil 5.5.3.1.2. Synthetic Oil 5.5.3.1.3. Semi-Synthetic Oil 5.5.3.1.4. Bio-Based Oil 5.5.3.2. Mexico Lubricant Market Size and Forecast, by Product Type (2024-2032) 5.5.3.2.1. Engine Oil 5.5.3.2.2. Hydraulic Oil 5.5.3.2.3. Gear Oil 5.5.3.2.4. Compressor Oil 5.5.3.2.5. Turbine Oil 5.5.3.3. Mexico Lubricant Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Automotive 5.5.3.3.2. Industrial 5.5.3.3.3. Marine 5.5.3.3.4. Aerospace 5.5.3.3.5. Construction 5.5.3.4. Mexico Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.3.4.1. OEM 5.5.3.4.2. Aftermarket 5.5.3.4.3. Online 5.5.3.4.4. Direct Sales 6. Europe Lubricant Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.2. Europe Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.3. Europe Lubricant Market Size and Forecast, by Application (2024-2032) 6.4. Europe Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5. Europe Lubricant Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.1.2. United Kingdom Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.1.3. United Kingdom Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.2. France 6.5.2.1. France Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.2.2. France Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.2.3. France Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.3.2. Germany Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.3.3. Germany Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.4.2. Italy Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.4.3. Italy Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.5.2. Spain Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.5.3. Spain Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.6.2. Sweden Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.6.3. Sweden Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.7.2. Austria Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.7.3. Austria Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Lubricant Market Size and Forecast, by Base Oil (2024-2032) 6.5.8.2. Rest of Europe Lubricant Market Size and Forecast, by Product Type (2024-2032) 6.5.8.3. Rest of Europe Lubricant Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Lubricant Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.2. Asia Pacific Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.3. Asia Pacific Lubricant Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5. Asia Pacific Lubricant Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.1.2. China Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.1.3. China Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.2.2. S Korea Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.2.3. S Korea Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.3.2. Japan Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.3.3. Japan Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.4. India 7.5.4.1. India Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.4.2. India Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.4.3. India Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.5.2. Australia Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.5.3. Australia Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.6.2. Indonesia Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.6.3. Indonesia Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.7.2. Malaysia Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.7.3. Malaysia Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.8.2. Vietnam Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.8.3. Vietnam Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.9.2. Taiwan Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.9.3. Taiwan Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Lubricant Market Size and Forecast, by Base Oil (2024-2032) 7.5.10.2. Rest of Asia Pacific Lubricant Market Size and Forecast, by Product Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Lubricant Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Lubricant Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Lubricant Market Size and Forecast, by Base Oil (2024-2032) 8.2. Middle East and Africa Lubricant Market Size and Forecast, by Product Type (2024-2032) 8.3. Middle East and Africa Lubricant Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 8.5. Middle East and Africa Lubricant Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Lubricant Market Size and Forecast, by Base Oil (2024-2032) 8.5.1.2. South Africa Lubricant Market Size and Forecast, by Product Type (2024-2032) 8.5.1.3. South Africa Lubricant Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Lubricant Market Size and Forecast, by Base Oil (2024-2032) 8.5.2.2. GCC Lubricant Market Size and Forecast, by Product Type (2024-2032) 8.5.2.3. GCC Lubricant Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Lubricant Market Size and Forecast, by Base Oil (2024-2032) 8.5.3.2. Nigeria Lubricant Market Size and Forecast, by Product Type (2024-2032) 8.5.3.3. Nigeria Lubricant Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Lubricant Market Size and Forecast, by Base Oil (2024-2032) 8.5.4.2. Rest of ME&A Lubricant Market Size and Forecast, by Product Type (2024-2032) 8.5.4.3. Rest of ME&A Lubricant Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Lubricant Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Lubricant Market Size and Forecast, by Base Oil (2024-2032) 9.2. South America Lubricant Market Size and Forecast, by Product Type (2024-2032) 9.3. South America Lubricant Market Size and Forecast, by Application(2024-2032) 9.4. South America Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 9.5. South America Lubricant Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Lubricant Market Size and Forecast, by Base Oil (2024-2032) 9.5.1.2. Brazil Lubricant Market Size and Forecast, by Product Type (2024-2032) 9.5.1.3. Brazil Lubricant Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Lubricant Market Size and Forecast, by Base Oil (2024-2032) 9.5.2.2. Argentina Lubricant Market Size and Forecast, by Product Type (2024-2032) 9.5.2.3. Argentina Lubricant Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Lubricant Market Size and Forecast, by Base Oil (2024-2032) 9.5.3.2. Rest Of South America Lubricant Market Size and Forecast, by Product Type (2024-2032) 9.5.3.3. Rest Of South America Lubricant Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Lubricant Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Royal Dutch Shell PLC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ExxonMobil Corporation 10.3. British Petroleum Plc 10.4. Chevron Corporation 10.5. Total SA 10.6. PetroChina Company Limited 10.7. Sinopec Limited 10.8. Lukoil 10.9. Fuchs Petrolub AG 10.10. Idemitsu Kosan Co. Ltd. 10.11. Pennzoil 10.12. Quaker Chemical Corp 10.13. JX Nippon Oil & Energy Corp 10.14. Philips 66 Company 10.15. Castrol 10.16. Valvoline LLC 10.17. Amalie Oil Co. 10.18. Others 11. Key Findings 12. Industry Recommendations 13. Lubricant Market: Research Methodology 14. Terms and Glossary