The Low Voltage Motors Market was valued at USD 44.57 Billion in 2024, and the total low voltage motors revenue is projected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 75.45 Billion. This growth is driven by increasing adoption of energy-efficient low voltage motors across industrial, automotive, and commercial sectors, alongside global mandates for sustainable and low-carbon operations. Low voltage motors are designed to operate at voltages below 1000V and can generate power up to 1000KW. These motors provide standard output with minimal power input, offering 2–8% higher efficiency than conventional motors. With capabilities such as precise speed control, stability, energy efficiency, and current measurement, low voltage AC motors and low voltage DC motors are integral to modern industrial automation and machinery. However, these motors require careful maintenance due to susceptibility to corrosion and overheating. The report delivers a comprehensive analysis of the Global Low Voltage Motors Market, segmented by type, end-user, and region. It examines past market dynamics from 2025 to 2032, enabling readers to benchmark trends and assess the contributions of key players. The study profiles 30 major manufacturers, including market leaders, followers, and emerging players, while also providing insights for investors. Regional manufacturing environments, cost of production, supply chain factors, availability of raw materials, labor costs, technological adoption, and trusted vendors are analyzed to identify future hot spots, particularly in North America. The impact of country-specific policies on low voltage motors demand is also included.To know about the Research Methodology :- Request Free Sample Report

Low Voltage Motors Market Dynamics

Stringent government regulations to reduce CO2 emissions have increased demand for low voltage electric motors. Manufacturers and end-users must adhere to Minimum Energy Performance Standards (MEPS) to enhance energy efficiency and reduce carbon footprints. Rapid technological advancements and growing industrial machinery demand are further driving market growth. The need for energy-efficient motors across industries, including HVAC, pumps, compressors, and automotive applications, is a major factor boosting adoption. Despite high efficiency, the maintenance and operational costs of low voltage motors can be higher than the initial purchase, acting as a potential restraint on market growth.Low Voltage Motors Market Segment Analysis:

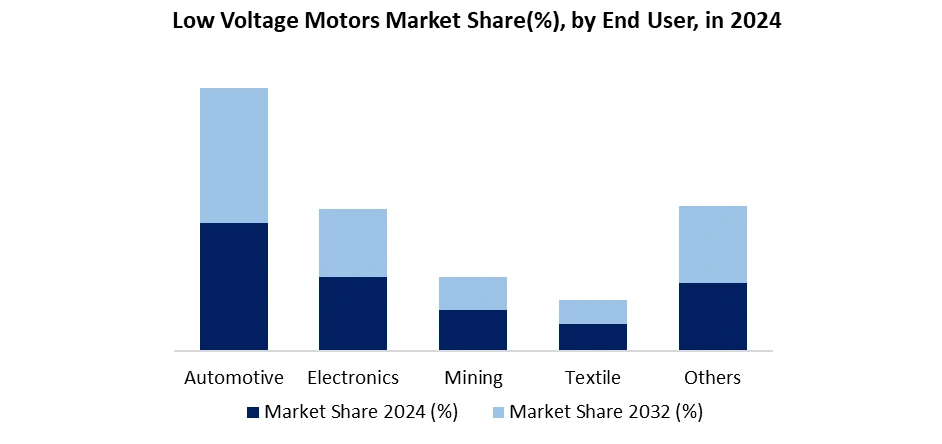

Based on the type, IE2 and IE3 motors dominated in 2024 and are projected to continue leading the market by 2032 due to their corrosion resistance, efficiency, and adaptability in inverters, air-handling units, refrigeration plants, hydraulic power packs, and pumps. IE3 motors, utilizing copper conductors instead of aluminum, minimize rotor losses and deliver superior efficiency. IE1 motors are lighter and widely used in fans, compressors, and pumps.Based on the end-user, the automotive sector led the market in 2024 and is expected to maintain dominance through 2032. Factors include increasing demand for clean power technologies, government regulations limiting greenhouse gas emissions, and growing environmental concerns. Other end-users, including electronics, mining, and other sectors are also adopting low voltage motors to reduce energy consumption and improve operational efficiency.

Regional Insights:

The demand for low voltage motors is growing across North America, Europe, and Asia Pacific due to expanding automotive, electronics, and industrial sectors. In North America, rising power generation capacity, government mandates for energy-efficient motors, and replacement of conventional high-energy-consuming motors have significantly boosted the adoption of low voltage electric motors. Similarly, Europe and Asia Pacific are witnessing increasing investments in high-performance low voltage motors to meet regulatory and industrial efficiency targets. This report also provides a detailed competitive analysis, including pricing, financial performance, material portfolios, growth strategies, and regional presence of key market players, making it a comprehensive investor guide for the global low voltage motors market.Low Voltage Motors Market Scope- Inquire before buying

Low Voltage Motors Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 44.57 Bn. Forecast Period 2025 to 2032 CAGR: 6.8 % Market Size in 2032: USD 75.45 Bn. Segments Covered: by Type IE1 IE2 IE3 IE4 by Motor Type Induction Motors Synchronous Motors DC Motors Others by End user Automotive Electronics Mining Textile Others Low Voltage Motors Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Low Voltage Motors Market, Key Players

1. ABB Ltd. 2. Siemens AG 3. Nidec Corporation 4. WEG S.A. 5. Schneider Electric SE 6. Rockwell Automation, Inc. 7. Mitsubishi Electric Corporation 8. Toshiba Corporation 9. Regal Rexnord Corporation (Regal Beloit) 10. TECO Electric & Machinery Co., Ltd. 11. Hyosung Heavy Industries 12. Baldor Electric Company 13. Brook Crompton 14. Franklin Electric Co., Inc. 15. Allied Motion Technologies, Inc. 16. ARC Systems, Inc. 17. Oriental Motor Co., Ltd. 18. Hoyer Motors 19. Lafert Group 20. SEW-Eurodrive GmbH & Co. KG 21. Emerson Electric Co. 22. CG Power & Industrial Solutions Ltd. 23. Havells India Ltd. 24. Fuji Electric Co., Ltd. 25. Hyundai Electric & Energy Systems 26. Maxon Group (Maxon Motor) 27. Wolong Electric Group Co., Ltd. 28. Hanzel Motor 29. VYBO Electric 30. ATB Austria Antriebstechnik AGFrequently Asked Questions:

1. Which region has the largest share in Global Low Voltage Motors Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global Low Voltage Motors Market? Ans: The Global Low Voltage Motors Market is growing at a CAGR of 6.8% during forecasting period 2025-2032. 3. What is scope of the Global Low Voltage Motors market report? Ans: Global Low Voltage Motors Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Low Voltage Motors market? Ans: The important key players in the Global Low Voltage Motors Market are – ABB, TECO-Westinghouse Motor Company, Siemens, Hyosung Power and Industrial Types Performance Group, Anhui Wannan Electric Machine, ATB Group, Leroy Somer, LEZ Ruselprom, Luan JiangHuai, NIDEC, Regal Beloit, Shandong Huali Electric Motor Group, GE Industrial, Toshiba International, WEG, and VEM Group. 5. What was the Global Low Voltage Motors Market size in 2024? Ans: The Global Low Voltage Motors Market size was USD 44.57 Billion in 2024.

1. Low Voltage Motors Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Low Voltage Motors Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. MMR Comptetive Positioning 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End-User Segment 2.3.5. Revenue Details in 2024 2.3.6. Market Share (%) 2.3.7. Profit Margin(%) 2.3.8. Growth Rate [Y-o-Y %)] 2.3.9. Certifications 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Low Voltage Motors Market: Dynamics 3.1. Low Voltage Motors Market Trends 3.2. Low Voltage Motors Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis For the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Low Voltage Motors Market Trends and Technological Advancements 4.1. Innovations in energy-efficient low voltage motors and intelligent controls 4.2. Development of IoT-enabled and connected motor solutions for industries 4.3. Advancements in materials improving corrosion resistance and heat management 4.4. Integration of low voltage motors in renewable energy and smart grids 4.5. Emerging technologies reducing power losses and increasing motor lifespan 5. Import-Export and Trade Analysis 5.1. Global low voltage motors import trends from 2019–2024 5.2. Export patterns and top exporting countries and regions 5.3. Trade barriers affecting low voltage motors market expansion globally 5.4. Tariff and non-tariff regulations influencing cost and supply chains 5.5. Opportunities for cross-border collaboration and international market penetration 6. Cost Structure and Pricing Analysis 6.1. Manufacturing cost breakdown by raw materials, labor, and overheads 6.2. Production cost comparison across regions and key suppliers 6.3. Impact of energy consumption and efficiency on operational expenses 6.4. Pricing trends for different types and efficiency classes of motors 6.5. Recommendations for cost optimization and profitability enhancement 7. Investment and ROI Analysis 7.1. Capital investment trends in low voltage motors production facilities 7.2. Forecasted ROI for different motor types and applications 7.3. Risk assessment for new entrants and expansion projects 7.4. Financial incentives and government support influencing investment decisions 7.5. Strategic recommendations for maximizing profitability in emerging markets 8. Customer and End-User Analysis 8.1. Automotive sector adoption trends and future market potential 8.2. Industrial end-users’ requirements for energy-efficient low voltage motors 8.3. Commercial applications driving demand for high-performance motors 8.4. Buyer behavior analysis: purchasing criteria and decision-making factors 8.5. Customer preferences for sustainable and technologically advanced motors 9. Regional Market Insights 9.1. North America low voltage motors market analysis and growth trends 9.2. Europe market trends, efficiency regulations, and industry adoption rates 9.3. Asia-Pacific industrial and automotive demand driving regional expansion 9.4. Middle East & Africa market opportunities and infrastructure development 9.5. South America market potential and import-export dynamics 10. Sustainability and Environmental Impact 10.1. Regulatory compliance for carbon footprint reduction and efficiency standards 10.2. Role of low voltage motors in reducing energy consumption globally 10.3. Opportunities for eco-friendly and recyclable materials in motor production 10.4. Adoption of renewable energy-driven low voltage motor applications 10.5. Assessment of environmental benefits for industrial and commercial use 11. Low Voltage Motors Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 11.1. Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 11.1.1. IE1 11.1.2. IE2 11.1.3. IE3 11.1.4. IE4 11.2. Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 11.2.1. Induction Motors 11.2.2. Synchronous Motors 11.2.3. DC Motors 11.2.4. Others 11.3. Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 11.3.1. Automotive 11.3.2. Electronics 11.3.3. Mining 11.3.4. Textile 11.3.5. Others 11.4. Low Voltage Motors Market Size and Forecast, By Region (2024-2032) 11.4.1. North America 11.4.2. Europe 11.4.3. Asia Pacific 11.4.4. Middle East and Africa 11.4.5. South America 12. North America Low Voltage Motors Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 12.1. North America Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 12.1.1. IE1 12.1.2. IE2 12.1.3. IE3 12.1.4. IE4 12.2. North America Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 12.2.1. Induction Motors 12.2.2. Synchronous Motors 12.2.3. DC Motors 12.2.4. Others 12.3. North America Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 12.3.1. Automotive 12.3.2. Electronics 12.3.3. Mining 12.3.4. Textile 12.3.5. Others 12.4. North America Low Voltage Motors Market Size and Forecast, By Country (2024-2032) 12.4.1. United States 12.4.1.1. United States Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 12.4.1.1.1. IE1 12.4.1.1.2. IE2 12.4.1.1.3. IE3 12.4.1.1.4. IE4 12.4.1.2. United States Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 12.4.1.2.1. Induction Motors 12.4.1.2.2. Synchronous Motors 12.4.1.2.3. DC Motors 12.4.1.2.4. Others 12.4.1.3. United States Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 12.4.1.3.1. Automotive 12.4.1.3.2. Electronics 12.4.1.3.3. Mining 12.4.1.3.4. Textile 12.4.1.3.5. Others 12.4.2. Canada 12.4.2.1. Canada Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 12.4.2.1.1. IE1 12.4.2.1.2. IE2 12.4.2.1.3. IE3 12.4.2.1.4. IE4 12.4.2.2. Canada Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 12.4.2.2.1. Induction Motors 12.4.2.2.2. Synchronous Motors 12.4.2.2.3. DC Motors 12.4.2.2.4. Others 12.4.2.3. Canada Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 12.4.2.3.1. Automotive 12.4.2.3.2. Electronics 12.4.2.3.3. Mining 12.4.2.3.4. Textile 12.4.2.3.5. Others 12.4.3. Mexico 12.4.3.1. Mexico Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 12.4.3.1.1. IE1 12.4.3.1.2. IE2 12.4.3.1.3. IE3 12.4.3.1.4. IE4 12.4.3.2. Mexico Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 12.4.3.2.1. Induction Motors 12.4.3.2.2. Synchronous Motors 12.4.3.2.3. DC Motors 12.4.3.2.4. Others 12.4.3.3. Mexico Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 12.4.3.3.1. Automotive 12.4.3.3.2. Electronics 12.4.3.3.3. Mining 12.4.3.3.4. Textile 12.4.3.3.5. Others 13. Europe Low Voltage Motors Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 13.1. Europe Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.2. Europe Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.3. Europe Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4. Europe Low Voltage Motors Market Size and Forecast, By Country (2024-2032) 13.4.1. United Kingdom 13.4.1.1. United Kingdom Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.1.2. United Kingdom Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.1.3. United Kingdom Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.2. France 13.4.2.1. France Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.2.2. France Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.2.3. France Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.3. Germany 13.4.3.1. Germany Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.3.2. Germany Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.3.3. Germany Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.4. Italy 13.4.4.1. Italy Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.4.2. Italy Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.4.3. Italy Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.5. Spain 13.4.5.1. Spain Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.5.2. Spain Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.5.3. Spain Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.6. Sweden 13.4.6.1. Sweden Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.6.2. Sweden Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.6.3. Sweden Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.7. Russia 13.4.7.1. Russia Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.7.2. Russia Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.7.3. Russia Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 13.4.8. Rest of Europe 13.4.8.1. Rest of Europe Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 13.4.8.2. Rest of Europe Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 13.4.8.3. Rest of Europe Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14. Asia Pacific Low Voltage Motors Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 14.1. Asia Pacific Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.2. Asia Pacific Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.3. Asia Pacific Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4. Asia Pacific Low Voltage Motors Market Size and Forecast, By Country (2024-2032) 14.4.1. China 14.4.1.1. China Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.1.2. China Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.1.3. China Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.2. S Korea 14.4.2.1. S Korea Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.2.2. S Korea Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.2.3. S Korea Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.3. Japan 14.4.3.1. Japan Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.3.2. Japan Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.3.3. Japan Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.4. India 14.4.4.1. India Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.4.2. India Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.4.3. India Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.5. Australia 14.4.5.1. Australia Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.5.2. Australia Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.5.3. Australia Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.6. Indonesia 14.4.6.1. Indonesia Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.6.2. Indonesia Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.6.3. Indonesia Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.7. Malaysia 14.4.7.1. Malaysia Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.7.2. Malaysia Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.7.3. Malaysia Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.8. Philippines 14.4.8.1. Philippines Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.8.2. Philippines Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.8.3. Philippines Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.9. Thailand 14.4.9.1. Thailand Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.9.2. Thailand Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.9.3. Thailand Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.10. Vietnam 14.4.10.1. Vietnam Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.10.2. Vietnam Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.10.3. Vietnam Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 14.4.11. Rest of Asia Pacific 14.4.11.1. Rest of Asia Pacific Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 14.4.11.2. Rest of Asia Pacific Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 14.4.11.3. Rest of Asia Pacific Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 15. Middle East and Africa Low Voltage Motors Market Size and Forecast (by Value in USD Million) (2024-2032 15.1. Middle East and Africa Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 15.2. Middle East and Africa Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 15.3. Middle East and Africa Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 15.4. Middle East and Africa Low Voltage Motors Market Size and Forecast, By Country (2024-2032) 15.4.1. South Africa 15.4.1.1. South Africa Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 15.4.1.2. South Africa Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 15.4.1.3. South Africa Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 15.4.2. GCC 15.4.2.1. GCC Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 15.4.2.2. GCC Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 15.4.2.3. GCC Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 15.4.3. Egypt 15.4.3.1. Egypt Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 15.4.3.2. Egypt Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 15.4.3.3. Egypt Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 15.4.4. Nigeria 15.4.4.1. Nigeria Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 15.4.4.2. Nigeria Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 15.4.4.3. Nigeria Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 15.4.5. Rest of ME&A 15.4.5.1. Rest of ME&A Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 15.4.5.2. Rest of ME&A Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 15.4.5.3. Rest of ME&A Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 16. South America Low Voltage Motors Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 16.1. South America Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 16.2. South America Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 16.3. South America Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 16.4. South America Low Voltage Motors Market Size and Forecast, By Country (2024-2032) 16.4.1. Brazil 16.4.1.1. Brazil Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 16.4.1.2. Brazil Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 16.4.1.3. Brazil Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 16.4.2. Argentina 16.4.2.1. Argentina Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 16.4.2.2. Argentina Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 16.4.2.3. Argentina Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 16.4.3. Colombia 16.4.3.1. Colombia Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 16.4.3.2. Colombia Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 16.4.3.3. Colombia Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 16.4.4. Chile 16.4.4.1. Chile Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 16.4.4.2. Chile Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 16.4.4.3. Chile Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 16.4.5. Rest Of South America 16.4.5.1. Rest Of South America Low Voltage Motors Market Size and Forecast, By Type (2024-2032) 16.4.5.2. Rest Of South America Low Voltage Motors Market Size and Forecast, By Motor Type (2024-2032) 16.4.5.3. Rest Of South America Low Voltage Motors Market Size and Forecast, By End User (2024-2032) 17. Company Profile: Key Players 17.1. ABB Ltd. 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview (2022-2024) 17.1.3.1. Total Company Revenue 17.1.3.2. Cost of Sales 17.1.3.3. Earnings 17.1.3.4. Business Segments Share (%) (2024) 17.1.3.5. Regional Share (%) (2024) 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. Siemens AG 17.3. Nidec Corporation 17.4. WEG S.A. 17.5. Schneider Electric SE 17.6. Rockwell Automation, Inc. 17.7. Mitsubishi Electric Corporation 17.8. Toshiba Corporation 17.9. Regal Rexnord Corporation (Regal Beloit) 17.10. TECO Electric & Machinery Co., Ltd. 17.11. Hyosung Heavy Industries 17.12. Baldor Electric Company 17.13. Brook Crompton 17.14. Franklin Electric Co., Inc. 17.15. Allied Motion Technologies, Inc. 17.16. ARC Systems, Inc. 17.17. Oriental Motor Co., Ltd. 17.18. Hoyer Motors 17.19. Lafert Group 17.20. SEW-Eurodrive GmbH & Co. KG 17.21. Emerson Electric Co. 17.22. CG Power & Industrial Solutions Ltd. 17.23. Havells India Ltd. 17.24. Fuji Electric Co., Ltd. 17.25. Hyundai Electric & Energy Systems 17.26. Maxon Group (Maxon Motor) 17.27. Wolong Electric Group Co., Ltd. 17.28. Hanzel Motor 17.29. VYBO Electric 17.30. ATB Austria Antriebstechnik AG 18. Key Findings 19. Industry Recommendations 20. Low Voltage Motors Market: Research Methodology