The Lingerie Market was valued at USD 50.52 billion in 2024, and the total market revenue is expected to grow at a CAGR of 7.8% from 2025 to 2032, reaching nearly USD 92.14 billion by 2032 The global lingerie industry is experiencing strong momentum as consumers shift toward comfort-fit, wire-free bras, seamless lingerie, and breathable innerwear. With rising fashion consciousness, higher female workforce participation, and rapid digital adoption, the industry continues to evolve in terms of product innovation, material quality, and retail. Growing demand for bras and panties, sports bras, nursing bras, and shapewear reflects a broader transition toward multifunctional and body-positive lingerie, trends in hybrid work lifestyles, fitness culture, and casual fashion. Regionally, the Asia Pacific lingerie market remains dominant due to its large female population, rising disposable incomes, and the rapid expansion of online lingerie stores across India and China. Countries such as the U.S., U.K., Germany, Brazil, and the UAE are witnessing strong uptake of premium lingerie, sustainable lingerie, and innovative products like period panties, recycled polyester bras, and organic cotton knickers. Retail innovation, particularly the growth of AI-powered virtual bra fitting tools, influencer-led product discovery, and omnichannel strategies, is driving the global lingerie market landscape. Across major demographics, consumers increasingly value fit, comfort, fabric quality, and inclusivity, driving higher adoption of plus-size lingerie, cotton underclothing, and material alternatives like silk and nylon. The speciality lingerie stores continue to hold the largest share due to personalised fittings and product variety. The online lingerie market is growing at the fastest pace, supported by home delivery convenience, promotional discounts, and broader product discovery. As brands emphasise sustainability, diverse sizing, innovative designs, and social media engagement, the global lingerie industry is expected to maintain strong growth and continue redefining intimate wear as a lifestyle and wellness-driven category.To know about the Research Methodology :- Request Free Sample Report

Lingerie Market Dynamics:

Global Lingerie Market Drivers: Fashion Trends, Workforce Growth & Digital Influence The global lingerie market is growing rapidly due to several lifestyle, demographic, and digital transformation factors. The increasing number of working women, with workforce participation rising to 47% globally, which boosts demand for women’s lingerie, bras and panties, and shapewear that support active professional lifestyles. Changing fashion preferences and exposure to global trends through social media have accelerated demand for premium lingerie, seamless lingerie, cotton lingerie, silk lingerie, and innerwear market innovations. Consumers increasingly prefer comfort-fit, wire-free bras, sports bras, nursing bras, and breathable stretch-fit lingerie, driven by hybrid work routines and fitness lifestyles.The rise of lingerie online, online lingerie shopping trends in Asia Pacific, and influencer-driven lingerie marketing has transformed consumer behavior. Social media platforms like Instagram, TikTok, and YouTube play a critical role in shaping demand for fashionable lingerie, period panties, sustainable lingerie, and innovative products like leak-proof underwear. The strong growth of specialty stores, the popularity of hypermarkets and supermarkets in lingerie retail, and the shift toward customized sizing also support market expansion. Regionally, strong demand is fueled by China lingerie market growth drivers, India’s urbanization, and United States demand for multipurpose lingerie contributing to robust global lingerie market growth. Challenges Impacting the Lingerie Industry: Unorganized Sector & Price Sensitivity Despite strong momentum, the global lingerie industry faces notable challenges. One of the largest restraints is the dominance of the unorganized lingerie sector, which accounts for 60–65% of sales in emerging markets such as India, Southeast Asia, and parts of South America. Local manufacturers offer lower-priced options, limiting uptake of premium lingerie, luxury lingerie, and branded lingerie stores. High cost of luxury lingerie market restrains adoption among price-sensitive consumers. Fluctuation in raw material prices especially cotton, nylon, and silk—creates cost pressure for manufacturers. Cotton prices have fluctuated 10–15% annually, impacting affordability in the underwear market. Additionally, supply chain disruptions, particularly during COVID-19, affected production and availability. The COVID-19 impact on lingerie production and retail led to temporary closures of physical stores, reducing demand for fashion-forward designs while boosting only basic essentials. Competition is intensifying as SMEs use cross-border e-commerce to sell at 30–50% lower prices, challenging established brands. Increasing competition from new entrants offering seamless underwear, budget bras, and fast-fashion lingerie also puts pressure on global brands to innovate quickly. Limited size inclusivity among older brands additionally constrains lingerie market penetration in categories like plus-size lingerie. Innovation & Technology-Driven Opportunities in the Lingerie Market The lingerie industry is changing consumer preferences, technology adoption, and innovation. Growing interest in sustainable lingerie, eco-friendly materials, and organic cotton innerwear opens new avenues for brands to differentiate themselves. In markets such as Germany, the U.K., and France, Europe's sustainable lingerie market trends are driving the adoption of biodegradable fabrics, recycled polyester, and responsible manufacturing. Technology is unlocking future growth. Tools such as AI-powered virtual bra fitting tools, 3D body scanning, and smart-sizing algorithms reduce return rates and boost customer confidence—especially in online lingerie stores. The rise of omnichannel retail and omnichannel strategies for lingerie brands enables seamless shopping experiences across digital and physical stores, improving convenience and loyalty. Post-pandemic, renewed consumer demand and recovery trends in lingerie industry after 2020 have accelerated the shift toward premium lingerie market in emerging region. Growing consumer focus on body positivity and diversity creates opportunities in plus-size lingerie, shapewear adoption, period panties, and comfort-led categories such as wire-free bras, seamless lingerie, and breathable cotton lingerie. Markets such as South America, driven by beach culture, and the UAE & MEA demand for premium lingerie brands, provide strong regional expansion potential. Meanwhile, rising brand investments, product innovation, and expansion in the global lingerie market size, ensuring ample opportunities for both established and emerging vendors.

Trend Description Comfort-First & Seamless Intimates Consumers increasingly preferred comfort, wire-free bras, seamless fits, and breathable fabrics over traditional designs. E-Commerce & Digital Transformation Online lingerie shopping accelerated, with consumers adopting digital channels, influencer marketing, and virtual fitting. Body Positivity & Inclusive Sizing Brands expanded size ranges to cater to diverse body types, driven by body-positivity movements and consumer demand. Sustainable & Eco-Friendly Materials Increasing use of organic cotton, recycled polyester, and biodegradable fabrics in lingerie manufacturing. Lingerie Market Segment Analysis:

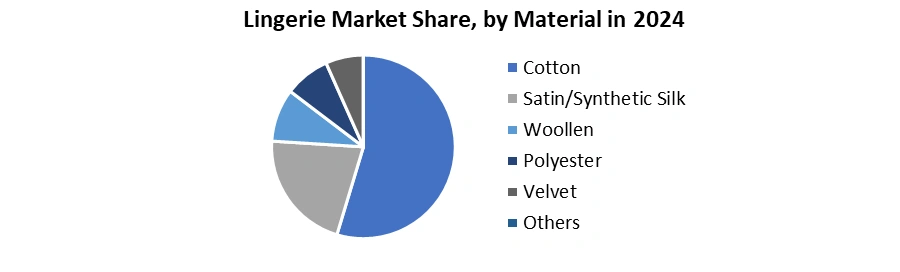

Based on Product, the lingerie market was divided into Bras, Knickers & Panties, Loungewear, Shapewear, and Others. The Bra segment accounted for the largest share in 2024 and continued to dominate due to its essential role in everyday wear. More than 40–45% of total women’s lingerie purchases globally consisted of bras, driven by rising demand for seamless bras, wire-free designs, T-shirt bras, and sports bras. Sports bras in particular, with 20–25% annual growth, supported by increasing fitness adoption among women worldwide. The Knickers & Panties segment followed, driven by high replacement rates averaging 10–15 pairs per woman annually. The Shapewear category emerged as the fastest-growing segment, expanding at 7–9% CAGR, fueled by growing body-positivity trends and social media influence. Loungewear also gained momentum as post-pandemic comfort trends encouraged the shift toward soft, breathable home-wear styles.Based on Material, the lingerie market was divided into Cotton, Satin/Synthetic Silk, Woollen, Polyester, Velvet, and Others. Cotton remained the dominant material segment in 2024, representing 35–40% of global lingerie production, owing to its softness, durability, and high breathability. In hot and humid regions such as Asia Pacific, over half of all bras and panties sold contained cotton due to comfort needs. Satin and synthetic silk were the fastest-growing materials, supported by rising interest in premium lingerie, bridal collections, and sensual nightwear. Demand for satin lingerie increased 8–10% annually, especially among younger consumers seeking affordable luxury. Velvet and microfiber blends expanded due to their smooth texture and suitability for seamless lingerie and shapewear. Polyester-based lingerie also grew steadily owing to its low cost, lightweight feel, and versatility. Meanwhile, sustainable materials such as recycled polyester and biodegradable silk gained traction, appealing to eco-conscious buyers.

Regional Analysis

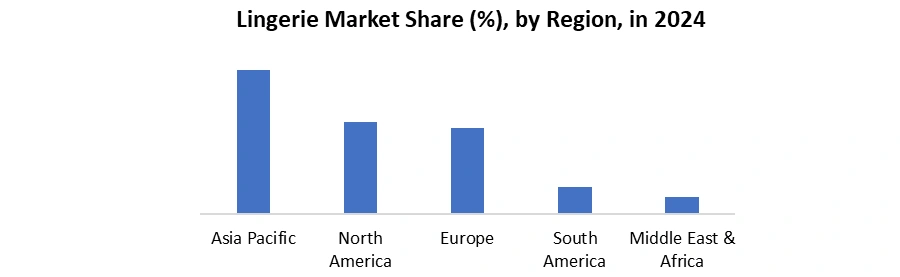

Based on Region, the lingerie market was segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific region accounted for the largest share in 2024, contributing over 32–35% of global revenue, supported by a large female population, rapid urbanization, and a surge in online lingerie shopping. Countries such as China and India recorded double-digit growth due to increasing disposable incomes and demand for fashionable yet affordable innerwear. Europe remained a strong premium market, with Germany, the U.K., and France driving trends in sustainable lingerie, organic cotton innerwear, and luxury lingerie brands. North America showed high adoption of multipurpose lingerie, plus-size lingerie, and tech-enabled virtual bra-fitting tools. South America’s growth was influenced by vibrant fashion culture and strong demand for bras, panties, and shapewear, particularly in Brazil. The Middle East & Africa region expanded steadily as premium brands entered markets such as the UAE, Saudi Arabia, and South Africa, supported by rising tourism and retail modernisation.

Competitive Landscape:

The global women’s lingerie market featured an intensely competitive landscape, led by mass brands such as HanesBrands Inc, Fruit of the Loom, Jockey, Gap, and Bare Necessities, alongside fashion and premium leaders Victoria’s Secret, Calvin Klein, Triumph, Hunkemöller, Wacoal, Uniqlo, MAS Holdings, and major Asian labels like Aimer, Embry Form, Cosmo-lady, and Hop Lun. HanesBrands continued to execute its transformation strategy, reporting stronger 2024 performance and margin improvements. Victoria’s Secret pushed an inclusivity-focused comeback with its revived #VSFS24 show and collaborations, driving record engagement and repositioning the brand. MAS Holdings accelerated its sustainability roadmap, with 40% of 2024 revenue from sustainable products and a target of 75% by 2030, reinforcing its role as a key innovation and manufacturing partner to global lingerie brands. Wacoal focused on improving profitability despite softer innerwear demand, reflecting the ongoing restructuring among legacy intimate players.Recent Development:

On July 23, 2025, Victoria’s Secret unveiled the Body by Victoria FlexFactor Lightly Lined Plunge Demi Bra, featuring a flexible titanium underwire and memory-foam support in bands 30-44 and cups A-G, marking a major technological step in its top-selling collection. On January 9, 2025, HanesBrands launched its campaign titled “If You Wouldn’t Flaunt It, Refresh It!”, promoting new trend-forward underwear and bra styles under its Hanes, Bali and Maidenform brands, designed with the latest comfort and style innovations.Lingerie Market Scope: Inquiry Before Buying

Lingerie Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 50.52 Bn. Forecast Period 2025 to 2032 CAGR: 7.8% Market Size in 2032: USD 92.14 Bn. Segments Covered: by Product Bra Knickers and Panties Loungewear Shapewear Other by Material Cotton Satin/Synthetic Silk Woollen Polyester Velvet Others by Price Low Medium High by Distribution Channel Offline Supermarket/Hypermarket Specialty Stores Multi Brands Stores Online E-commerce Company-owned Website Lingerie Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Lingerie Market, Key players

1. Hanes brands Inc (US) 2. Fruit of the Loom (US) 3. Jockey International (US) 4. Lise Charmel (US) 5. Venies (US) 6. Victoria’s Secret (US) 7. Gap, Inc. (US) 8. Bare Necessities (US) 9. Calvin Klein (US) 10. Triumph International (Germany) 11. Nubian Skin (UK) 12. Calida (Switzerland) 13. Hunkemoller (Netherlands) 14. Wacoal Holdings (Japan) 15. Uniqlo Co., Ltd. (Japan) 16. Aimer Group (China) 17. Mani Form (China) 18. Embry Form (China) 19. Ordifen (China) 20. Oleno International Company Ltd. (China) 21. Cosmo-lady (China) 22. Essentie (HongKong) 23. Hoplun Group (Hong Kong) 24. Hop Lun Limited (Hong Kong) 25. MAS Holdings (Sri Lanka)Frequently Asked Questions:

1] What is the growth rate of the Global Lingerie Market? Ans. The Global Lingerie Market is growing at a significant rate of 7.8 % during the forecast period. 2] Which region is expected to dominate the Global Lingerie Market? Ans. Asia Pacific is expected to dominate the Lingerie Market during the forecast period. 3] What was the Global Lingerie Market size in 2024? Ans: The Global Lingerie Market size was USD 50.52 Billion in 2024. 4] Which are the top players in the Global Lingerie Market? Ans. The major top players in the Global Lingerie Market are HanesBrands Inc(US), Fruit of the Loom (US), Jockey International (US), Lise Charmel (US), Venies (US), Victoria’s Secret (US), Gap, Inc. (US), Bare Necessities (US), Calvin Klein (US), Triumph International (Germany), Nubian Skin (UK) and others. 5] What are the factors driving the Global Lingerie Market growth? Ans. The increasing number of working women across the globe and rising consumer preferences for fashionable apparel products are expected to drive market growth during the forecast period.

1. Lingerie Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Lingerie Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Integration Capabilities 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Lingerie Market: Dynamics 3.1. Lingerie Market Trends 3.2. Lingerie Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Lingerie Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Lingerie Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Lingerie Market Size and Forecast, By Product (2024-2032) 4.1.1.1. Bra 4.1.1.2. Knickers and Panties 4.1.1.3. Loungewear 4.1.1.4. Shapewear 4.1.1.5. Other 4.2. Lingerie Market Size and Forecast, By Material (2024-2032) 4.2.1.1. Cotton 4.2.1.2. Satin/Synthetic Silk 4.2.1.3. Woollen 4.2.1.4. Polyester 4.2.1.5. Velvet 4.2.1.6. Others 4.3. Lingerie Market Size and Forecast, By Price (2024-2032) 4.3.1.1. Low 4.3.1.2. Medium 4.3.1.3. High 4.4. Lingerie Market Size and Forecast, By Distribution Channel (2024-2032) 4.4.1.1. Offline 4.4.1.1.1. Supermarket/Hypermarket 4.4.1.1.2. Specialty Stores 4.4.1.1.3. Multi Brands Stores 4.4.1.2. Online 4.4.1.2.1. E-commerce 4.4.1.2.2. Company-owned Website 4.5. Lingerie Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Lingerie Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Lingerie Market Size and Forecast, By Product (2024-2032) 5.1.1.1. Bra 5.1.1.2. Knickers and Panties 5.1.1.3. Loungewear 5.1.1.4. Shapewear 5.1.1.5. Other 5.2. North America Lingerie Market Size and Forecast, By Material (2024-2032) 5.2.1.1. Cotton 5.2.1.2. Satin/Synthetic Silk 5.2.1.3. Woollen 5.2.1.4. Polyester 5.2.1.5. Velvet 5.2.1.6. Others 5.3. North America Lingerie Market Size and Forecast, By Price (2024-2032) 5.3.1.1. Low 5.3.1.2. Medium 5.3.1.3. High 5.4. North America Lingerie Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.1.1. Offline 5.4.1.1.1. Supermarket/Hypermarket 5.4.1.1.2. Specialty Stores 5.4.1.1.3. Multi Brands Stores 5.4.1.2. Online 5.4.1.2.1. E-commerce 5.4.1.2.2. Company-owned Website 5.5. North America Lingerie Market Size and Forecast, by Country (2024-2032) 5.5.1.1. United States 5.5.1.2. Canada 5.5.1.3. Mexico 6. Europe Lingerie Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Lingerie Market Size and Forecast, By Product (2024-2032) 6.2. Europe Lingerie Market Size and Forecast, By Material (2024-2032) 6.3. Europe Lingerie Market Size and Forecast, By Price (2024-2032) 6.4. Europe Lingerie Market Size and Forecast, By Distribution Channel (2024-2032) 6.5. Europe Lingerie Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.2. France 6.5.3. Germany 6.5.4. Italy 6.5.5. Spain 6.5.6. Sweden 6.5.7. Russia 6.5.8. Rest of Europe 7. Asia Pacific Lingerie Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Lingerie Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Lingerie Market Size and Forecast, By Material (2024-2032) 7.3. Asia Pacific Lingerie Market Size and Forecast, By Price (2024-2032) 7.4. Asia Pacific Lingerie Market Size and Forecast, By Distribution Channel (2024-2032) 7.5. Asia Pacific Lingerie Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.2. S Korea 7.5.3. Japan 7.5.4. India 7.5.5. Australia 7.5.6. Indonesia 7.5.7. Malaysia 7.5.8. Philippines 7.5.9. Thailand 7.5.10. Vietnam 7.5.11. Rest of Asia Pacific 8. Middle East and Africa Lingerie Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Lingerie Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Lingerie Market Size and Forecast, By Material (2024-2032) 8.3. Middle East and Africa Lingerie Market Size and Forecast, By Price (2024-2032) 8.4. Middle East and Africa Lingerie Market Size and Forecast, By Distribution Channel (2024-2032) 8.5. Middle East and Africa Lingerie Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.2. GCC 8.5.3. Nigeria 8.5.4. Rest of ME&A 9. South America Lingerie Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Lingerie Market Size and Forecast, By Product (2024-2032) 9.2. South America Lingerie Market Size and Forecast, By Material (2024-2032) 9.3. South America Lingerie Market Size and Forecast, By Price (2024-2032) 9.4. South America Lingerie Market Size and Forecast, By Distribution Channel (2024-2032) 9.5. South America Lingerie Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.2. Argentina 9.5.3. Colombia 9.5.4. Chile 9.5.5. Rest of South America 10. Company Profile: Key Players 10.1. HanesBrands Inc(US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Fruit of the Loom (US) 10.3. Jockey International (US) 10.4. Lise Charmel (US) 10.5. Venies (US) 10.6. Victoria’s Secret (US) 10.7. Gap, Inc. (US) 10.8. Bare Necessities (US) 10.9. Calvin Klein (US) 10.10. Triumph International (Germany) 10.11. Nubian Skin (UK) 10.12. Calida (Switzerland) 10.13. Hunkemoller (Netherlands) 10.14. Wacoal Holdings (Japan) 10.15. Uniqlo Co., Ltd. (Japan) 10.16. Aimer Group (China) 10.17. Mani Form (China) 10.18. Embry Form (China) 10.19. Ordifen (China) 10.20. Oleno International Company Ltd. (China) 10.21. Cosmo-lady (China) 10.22. Essentie (HongKong) 10.23. Hoplun Group (Hong Kong) 10.24. Hop Lun Limited (Hong Kong) 10.25. MAS Holdings (Shri Lanka) 11. Key Findings 12. Analyst Recommendations 13. Lingerie Market – Research Methodology