The Large Power Transformers Market size was valued at USD 10.6 billion in 2024, and the Large Power Transformers market revenue is growing at a CAGR of 5.6% from 2025 to 2032, reaching USD 16.39 billion by 2032.Large Power Transformers Market Overview

Large Power Transformers are critical components in power transmission networks, enabling efficient long-distance electricity transfer and grid stability. The rising global electricity demand, grid modernization, and renewable energy integration drive the Large Power Transformers Market growth. High-capacity transformers are critical for stable, efficient power transmission over long distances, supporting smart grids and digital energy infrastructure. Rapid urbanization, industrialization, and the expansion of rural electrification programs are creating a pressing need for robust transmission and distribution infrastructure.To know about the Research Methodology:-Request Free Sample Report The integration of renewable energy sources such as solar, wind, and hydroelectric power into regional and national grids boosts the Large Power Transformers Market growth. Unlike conventional power plants, renewable sources are geographically dispersed and inherently variable, necessitating high-capacity transformers capable of managing fluctuations in supply while delivering consistent power to end-users. The transition toward smart grids is increasing demand for transformers with digital monitoring, automation, and real-time load management capabilities. These advanced transformers enable predictive maintenance, optimize energy efficiency, and enhance grid resilience, making them vital for modern energy infrastructure. Investments in smart grid modernization, energy-efficient transformer technologies, and intelligent LPT solutions.

Large Power Transformers Market Dynamics

Increasing Global Electricity Demand and Grid Modernization to Drive Large Power Transformers Market This surge in energy consumption is pushing utilities and governments to expand and reinforce their transmission and distribution networks, with large power transformers (LPTs) playing a central role in ensuring grid stability and efficiency. As societies become more reliant on electricity for residential, industrial, and commercial activities, the need for high-capacity transformers capable of transmitting bulk power across long distances has never been more critical. Solar and wind farms are located in remote areas, far from urban load centers, requiring advanced transformer infrastructure to step up voltage for long-distance transmission, driving the Large Power Transformers Market growth. LPTs ensure minimal transmission losses and maintain system reliability, even with the inherent intermittency of renewable sources. This makes them indispensable for enabling countries to meet their decarbonization targets and transition to cleaner energy systems. In developed economies, the focus has shifted to modernizing aging grid infrastructure. Many existing transmission systems, built decades ago, are no longer sufficient to handle the rising load or the complexities of renewable integration. Investments in smart grids and digitalized power systems are driving the replacement of outdated equipment with high-capacity, intelligent transformers that support automation, remote monitoring, and real-time load management. High Capital Investment and Long Lead Times to Hamper the Large Power Transformers Market LPTs are complex, heavy-duty equipment that demand substantial raw materials such as copper and steel, advanced engineering, and strict regulatory compliance. The manufacturing process is resource-intensive, requiring substantial quantities of raw materials such as copper, steel, and insulation materials, all of which are subject to volatile global pricing. This makes procurement costly and often unpredictable. LPTs demand advanced engineering, precision design, and adherence to stringent safety and regulatory standards, which hamper Large Power Transformers Market growth. Unlike smaller transformers, large units often exceed hundreds of tons in weight and require specialized manufacturing facilities, testing infrastructure, and skilled labor. These complexities extend delivery timelines, with production alone taking anywhere from 12 to 24 months, followed by additional time for transportation, installation, and commissioning. The logistical challenges of transporting such massive equipment requiring railcars, barges, or customized trailers add to both cost and lead time. Renewable Energy Integration and Smart Grid Expansion is a Lucrative Opportunity for the Large Power Transformers Market Solar farms, wind parks, and hydroelectric plants are expanding rapidly, yet these facilities are often situated in remote locations where the natural resource potential is highest. To transmit this electricity to urban centers and industrial hubs, high-capacity transformers are essential for stepping up voltage for long-distance transmission and stepping it down for distribution. Unlike conventional power sources, renewable energy comes with inherent variability; wind and solar output fluctuate with weather conditions, which places additional demands on transformers to maintain grid stability and reliability. This makes advanced LPTs indispensable for ensuring seamless integration of renewables into national and regional grids. The global push toward smart grid development represents a significant growth catalyst for the Large Power Transformers Market. Smart grids incorporate digital monitoring, automation, and real-time load balancing, requiring transformers equipped with intelligent sensors, communication systems, and energy-efficient designs. These next-generation LPTs help operators predict failures, optimize load distribution, and minimize transmission losses, thereby increasing overall grid efficiency. With governments and utilities worldwide prioritizing energy security, decarbonization, and digital transformation, the demand for smart, resilient transformers is increasing.Large Power Transformers Market Segment Analysis

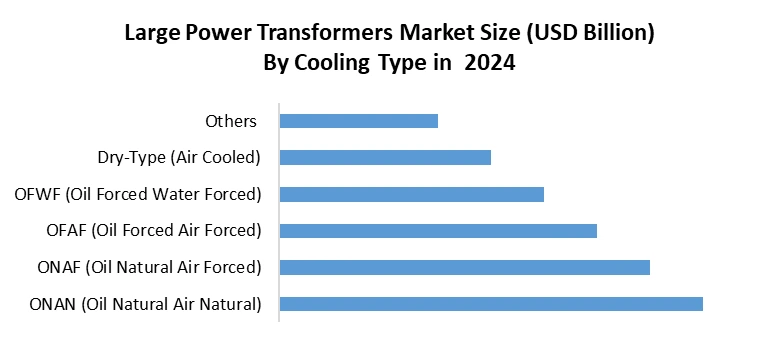

Based on Type, the market is segmented into the Single-phase Transformer, Three-phase Transformer and Auto Transformers. The three-phase transformer dominated the Large Power Transformers Market in 2024. Three-Phase Transformers provide superior efficiency, balanced power distribution, and compact design, making them the preferred choice for utility-scale power infrastructure. They are capable of handling massive power loads, which is essential in urban grids, industrial zones, and renewable energy integration projects. With the accelerating expansion of smart grids and the growing integration of renewable sources such as wind and solar, three-phase transformers ensure stable power flow by minimizing losses during transmission over long distances. Their cost-effectiveness compared to installing three individual single-phase transformers makes them attractive for utilities and heavy industries. Their adaptability to both step-up and step-down operations, particularly in high-voltage direct current (HVDC) and ultra-high-voltage alternating current (UHVAC) projects, enhances their demand globally.Based on Cooling Type, the market is categorized into the ONAN (Oil Natural Air Natural), ONAF (Oil Natural Air Forced), OFAF (Oil Forced Air Forced), OFWF (Oil Forced Water Forced), Dry-Type (Air Cooled) and Others. ONAN (Oil Natural Air Natural) is expected to dominate the Large Power Transformers Market over the forecast period. ONAN transformers utilize natural convection of oil for internal cooling and natural air circulation for external dissipation, eliminating the need for external fans or pumps. This passive cooling system reduces operational complexity, ensures low maintenance, and provides long service life, making ONAN transformers the preferred choice for utilities and industries where operational continuity is critical. Their robustness makes them particularly suitable for base-load operations in substations, rural electrification projects, and medium-to-large transmission systems. ONAN cooling is energy-efficient, as it avoids additional power consumption for cooling equipment, aligning with sustainability initiatives and lowering operating costs. The growing demand for reliable, low-maintenance transformers in developing regions, combined with the push for cost optimization in mature markets, supports the widespread adoption of ONAN-cooled transformers.

Large Power Transformers Market Regional Insights

Asia Pacific held the largest Large Power Transformers Market share in 2024. The rapid urbanization, strong industrial growth, and massive investments in energy infrastructure across countries such as China, India, Japan, and South Korea. The rising demand for reliable electricity to support expanding manufacturing sectors, data centers, transportation electrification, and renewable energy integration drives the Large Power Transformers Market growth. China leads the Large Power Transformers Market due to its aggressive grid expansion projects, state-owned utility investments, and ongoing upgrades to ultra-high-voltage transmission networks aimed at efficiently transmitting renewable energy from remote areas to urban centers. India is also witnessing significant growth, fueled by government initiatives such as “Power for All” and accelerated adoption of renewable energy projects under its ambitious target of 500 GW of non-fossil fuel capacity by 2030, which requires modern transformer infrastructure. Japan and South Korea contribute through their advanced smart grid projects, technological innovation, and focus on energy efficiency and sustainability, supporting market expansion. The shift toward electric vehicles, digital economies, and smart cities is boosting demand for reliable transmission and distribution infrastructure, creating opportunities for advanced large power transformers with higher efficiency, lower losses, and eco-friendly insulating materials. Large Power Transformers Market Competitive Landscape The global Large Power Transformer Market is competitive, dominated by key players such as Siemens Energy, Hitachi Energy, General Electric (GE), Mitsubishi Electric, and ABB, who are actively investing in R&D, capacity expansion, and technological innovation to meet rising electricity demand and grid modernization needs. Siemens Energy is expanding its Charlotte, North Carolina, facility to reduce import dependence and support renewable energy integration, while Hitachi Energy is investing $6 billion to scale production amid overwhelming global demand for power infrastructure. GE Vernova focuses on enhancing grid efficiency and reliability, and Mitsubishi Electric emphasizes sustainability and high-capacity solutions for utilities and industrial applications. ABB offers both oil-immersed and dry-type transformers with a focus on digitalization and performance optimization. The Large Power Transformer Market growth is driven by increasing electricity consumption, renewable energy expansion, and smart grid initiatives, but it faces challenges including supply chain constraints, rising material costs, and the need for skilled labor. Key Development Large Power Transformers Market • On 10 March 2025, Hitachi Energy announced an additional investment of over USD 250 million to expand global production of critical transformer components, building on its USD 6 billion 2024 investment. More than 40% of the new funds are allocated to the U.S., including hiring over 100 personnel and expanding domestic manufacturing of key components such as bushings and insulation to strengthen the local supply chain. This initiative targets the escalating global transformer shortage driven by surging electricity demand from electrification, data centers, AI, and renewable energy integration. The investment enhances manufacturing capacity in the U.S., Asia, Europe, and South America, while incorporating digitalization, automation, and supply chain improvements to accelerate production, ensure supply resilience, and support critical grid infrastructure projects worldwide. • On June 26, 2025, Siemens Energy confirmed that production at its new Charlotte, North Carolina, facility will begin in early 2027, aiming to reduce U.S. dependence on imports that currently meet over 80% of demand. Earlier, in March 2025, Hitachi Energy announced a $250 million investment, with over 40% allocated to the U.S., to expand transformer component production and strengthen domestic supply chains. Additionally, in April 2025, GE Vernova secured a large contract to deliver more than 70 ultra-high-voltage (765 kV) transformers and shunt reactors to India’s Power Grid Corporation, with deliveries starting in 2026. These moves highlight accelerating global efforts to overcome supply bottlenecks and ensure reliable power infrastructure for energy transition goals. Key Large Power Transformers Market Trends

Trend Description High Demand and Global Transformer Shortage Rising electricity demand, renewable energy integration, and modernization of grid infrastructure have created a surge in demand for large power transformers. Manufacturers face challenges such as raw material inflation, limited production capacity, and long lead times, causing delays in power transmission projects. Technological Innovation for Renewable Energy Support Transformer manufacturers are developing advanced solutions for renewable energy projects. Examples include lightweight, corrosion-resistant dry-type transformers for offshore wind farms and ultra-high-voltage (765 kV) transformers in India for renewable-heavy grids and EV infrastructure. Digitalization and Smart Grid Integration Growing adoption of IoT, sensors, and AI in transformers enables real-time monitoring, predictive maintenance, and enhanced grid reliability, supporting smart grid initiatives and reducing downtime. Scope of Global Large Power Transformers Market: Inquire before buying

Global Large Power Transformers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.6 Bn. Forecast Period 2025 to 2032 CAGR: 5.6% Market Size in 2032: USD 16.39 Bn. Segments Covered: by Type Single-phase Transformer Three-phase Transformer Auto Transformers by Cooling Type ONAN (Oil Natural Air Natural) ONAF (Oil Natural Air Forced) OFAF (Oil Forced Air Forced) OFWF (Oil Forced Water Forced) Dry-Type (Air Cooled) Others by Power Rating Up to 100 MVA 100–300 MVA 300–500 MVA 500–1000 MVA Above 1000 MVA by Application Power Generation Transmission & Distribution Renewable Energy Integration Others by End User Utilities Industrial Sector Commercial Sector Government / Public Infrastructure Others Large Power Transformers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Large Power Transformers Key Players are

1. ABB Ltd 2. Siemens Energy AG 3. General Electric Company (GE) 4. Hitachi Energy 5. Mitsubishi Electric Corporation 6. Schneider Electric 7. Eaton Corporation plc 8. Toshiba Corporation 9. Hyundai Electric & Energy Systems Co. 10. Crompton Greaves Ltd. (CG Power) 11. Wilson Power Solutions 12. TBEA Co., Ltd. 13. SPX Transformer Solutions, Inc. 14. Hyosung Heavy Industries Corporation 15. Daelim Industrial Co., Ltd. 16. Shandong Power Equipment Group Co., Ltd. 17. Jiangsu Huapeng Transformer Co., Ltd. 18. Zhejiang Chint Electrics Co., Ltd. 19. Efacec Engenharia e Sistemas S.A. 20. Wilson Transformer Company 21. Bharat Heavy Electricals Limited (BHEL) 22. ZTR Control Systems LLC 23. SGB-SMIT Group 24. Shaanxi Hanzhong Transformer Co., Ltd. 25. CG Power and Industrial Solutions Ltd. 26. Tianwei Baobian Electric Co., Ltd. 27. Nissin Electric Co., Ltd. 28. Shandong Taikai Power Engineering Co., Ltd. 29. Jiangsu Zhongtian Technology Co., Ltd. 30. Shandong Luneng Taishan Power Grid Co., LtdFAQ’S

1. Which region has the largest share in the Global Large Power Transformers Market? Ans: The Asia Pacific region held the largest share in the Global Large Power Transformers Market in 2024. 2. What is the growth rate of the Global Large Power Transformers Market? Ans: The Global Market is expected to grow at a CAGR of 5.6% during the forecast period 2024-2032. 3. What was the Global Large Power Transformers Market Size in 2024? Ans: The Global Large Power Transformers Market Size was USD 10.6 billion in 2024. 4. Who are the key players in the Global Large Power Transformers market? Ans: The key players in the Global Large Power Transformers Market are ABB Ltd., Siemens Energy AG, General Electric Company (GE), Hitachi Energy, Mitsubishi Electric Corporation, Schneider Electric, Eaton Corporation plc 5. What is the study period of this Large Power Transformers Market? Ans: The Global Large Power Transformers Market is studied from 2024 to 2032.

1. Large Power Transformers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Large Power Transformers Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Large Power Transformers Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Large Power Transformers Market: Dynamics 3.1. Large Power Transformers Market Trends by Region 3.1.1. North America Large Power Transformers Market Trends 3.1.2. Europe Large Power Transformers Market Trends 3.1.3. Asia Pacific Large Power Transformers Market Trends 3.1.4. Middle East and Africa Large Power Transformers Market Trends 3.1.5. South America Large Power Transformers Market Trends 3.2. Large Power Transformers Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Large Power Transformers Market Drivers 3.2.1.2. North America Large Power Transformers Market Restraints 3.2.1.3. North America Large Power Transformers Market Opportunities 3.2.1.4. North America Large Power Transformers Market Challenges 3.2.2. Europe 3.2.2.1. Europe Large Power Transformers Market Drivers 3.2.2.2. Europe Large Power Transformers Market Restraints 3.2.2.3. Europe Large Power Transformers Market Opportunities 3.2.2.4. Europe Large Power Transformers Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Large Power Transformers Market Drivers 3.2.3.2. Asia Pacific Large Power Transformers Market Restraints 3.2.3.3. Asia Pacific Large Power Transformers Market Opportunities 3.2.3.4. Asia Pacific Large Power Transformers Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Large Power Transformers Market Drivers 3.2.4.2. Middle East and Africa Large Power Transformers Market Restraints 3.2.4.3. Middle East and Africa Large Power Transformers Market Opportunities 3.2.4.4. Middle East and Africa Large Power Transformers Market Challenges 3.2.5. South America 3.2.5.1. South America Large Power Transformers Market Drivers 3.2.5.2. South America Large Power Transformers Market Restraints 3.2.5.3. South America Large Power Transformers Market Opportunities 3.2.5.4. South America Large Power Transformers Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Large Power Transformers Industry 3.8. Analysis of Government Schemes and Initiatives For Large Power Transformers Industry 3.9. Large Power Transformers Market Trade Analysis 3.10. The Global Pandemic Impact on Large Power Transformers Market 4. Large Power Transformers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Large Power Transformers Market Size and Forecast, by Type (2024-2032) 4.1.1. Single-phase Transformer 4.1.2. Three-phase Transformer 4.1.3. Auto Transformers 4.2. Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 4.2.1. ONAN (Oil Natural Air Natural) 4.2.2. ONAF (Oil Natural Air Forced) 4.2.3. OFAF (Oil Forced Air Forced) 4.2.4. OFWF (Oil Forced Water Forced) 4.2.5. Dry-Type (Air Cooled) 4.2.6. Others 4.3. Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 4.3.1. Up to 100 MVA 4.3.2. 100–300 MVA 4.3.3. 300–500 MVA 4.3.4. 500–1000 MVA 4.3.5. Above 1000 MVA 4.4. Large Power Transformers Market Size and Forecast, by Application (2024-2032) 4.4.1. Power Generation 4.4.2. Transmission & Distribution 4.4.3. Renewable Energy Integration 4.4.4. Others 4.5. Large Power Transformers Market Size and Forecast, by End User (2024-2032) 4.5.1. Utilities 4.5.2. Industrial Sector 4.5.3. Commercial Sector 4.5.4. Government / Public Infrastructure 4.5.5. Others 4.6. Large Power Transformers Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Large Power Transformers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Large Power Transformers Market Size and Forecast, by Type (2024-2032) 5.1.1. Single-phase Transformer 5.1.2. Three-phase Transformer 5.1.3. Auto Transformers 5.2. North America Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 5.2.1. ONAN (Oil Natural Air Natural) 5.2.2. ONAF (Oil Natural Air Forced) 5.2.3. OFAF (Oil Forced Air Forced) 5.2.4. OFWF (Oil Forced Water Forced) 5.2.5. Dry-Type (Air Cooled) 5.2.6. Others 5.3. North America Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 5.3.1. Up to 100 MVA 5.3.2. 100–300 MVA 5.3.3. 300–500 MVA 5.3.4. 500–1000 MVA 5.3.5. Above 1000 MVA 5.4. North America Large Power Transformers Market Size and Forecast, by Application (2024-2032) 5.4.1. Power Generation 5.4.2. Transmission & Distribution 5.4.3. Renewable Energy Integration 5.4.4. Others 5.5. North America Large Power Transformers Market Size and Forecast, by End User (2024-2032) 5.5.1. Utilities 5.5.2. Industrial Sector 5.5.3. Commercial Sector 5.5.4. Government / Public Infrastructure 5.5.5. Others 5.6. North America Large Power Transformers Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Large Power Transformers Market Size and Forecast, by Type (2024-2032) 5.6.1.1.1. Single-phase Transformer 5.6.1.1.2. Three-phase Transformer 5.6.1.1.3. Auto Transformers 5.6.1.2. United States Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 5.6.1.2.1. ONAN (Oil Natural Air Natural) 5.6.1.2.2. ONAF (Oil Natural Air Forced) 5.6.1.2.3. OFAF (Oil Forced Air Forced) 5.6.1.2.4. OFWF (Oil Forced Water Forced) 5.6.1.2.5. Dry-Type (Air Cooled) 5.6.1.2.6. Others 5.6.1.3. United States Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 5.6.1.3.1. Up to 100 MVA 5.6.1.3.2. 100–300 MVA 5.6.1.3.3. 300–500 MVA 5.6.1.3.4. 500–1000 MVA 5.6.1.3.5. Above 1000 MVA 5.6.1.4. United States Large Power Transformers Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Power Generation 5.6.1.4.2. Transmission & Distribution 5.6.1.4.3. Renewable Energy Integration 5.6.1.4.4. Others 5.6.1.5. United States Large Power Transformers Market Size and Forecast, by End User (2024-2032) 5.6.1.5.1. Utilities 5.6.1.5.2. Industrial Sector 5.6.1.5.3. Commercial Sector 5.6.1.5.4. Government / Public Infrastructure 5.6.1.5.5. Others 5.6.2. Canada 5.6.2.1. Canada Large Power Transformers Market Size and Forecast, by Type (2024-2032) 5.6.2.1.1. Single-phase Transformer 5.6.2.1.2. Three-phase Transformer 5.6.2.1.3. Auto Transformers 5.6.2.2. Canada Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 5.6.2.2.1. ONAN (Oil Natural Air Natural) 5.6.2.2.2. ONAF (Oil Natural Air Forced) 5.6.2.2.3. OFAF (Oil Forced Air Forced) 5.6.2.2.4. OFWF (Oil Forced Water Forced) 5.6.2.2.5. Dry-Type (Air Cooled) 5.6.2.2.6. Others 5.6.2.3. Canada Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 5.6.2.3.1. Up to 100 MVA 5.6.2.3.2. 100–300 MVA 5.6.2.3.3. 300–500 MVA 5.6.2.3.4. 500–1000 MVA 5.6.2.3.5. Above 1000 MVA 5.6.2.4. Canada Large Power Transformers Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Power Generation 5.6.2.4.2. Transmission & Distribution 5.6.2.4.3. Renewable Energy Integration 5.6.2.4.4. Others 5.6.2.5. Canada Large Power Transformers Market Size and Forecast, by End User (2024-2032) 5.6.2.5.1. Utilities 5.6.2.5.2. Industrial Sector 5.6.2.5.3. Commercial Sector 5.6.2.5.4. Government / Public Infrastructure 5.6.2.5.5. Others 5.6.3. Mexico 5.6.3.1. Mexico Large Power Transformers Market Size and Forecast, by Type (2024-2032) 5.6.3.1.1. Single-phase Transformer 5.6.3.1.2. Three-phase Transformer 5.6.3.1.3. Auto Transformers 5.6.3.2. Mexico Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 5.6.3.2.1. ONAN (Oil Natural Air Natural) 5.6.3.2.2. ONAF (Oil Natural Air Forced) 5.6.3.2.3. OFAF (Oil Forced Air Forced) 5.6.3.2.4. OFWF (Oil Forced Water Forced) 5.6.3.2.5. Dry-Type (Air Cooled) 5.6.3.2.6. Others 5.6.3.3. Mexico Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 5.6.3.3.1. Up to 100 MVA 5.6.3.3.2. 100–300 MVA 5.6.3.3.3. 300–500 MVA 5.6.3.3.4. 500–1000 MVA 5.6.3.3.5. Above 1000 MVA 5.6.3.4. Mexico Large Power Transformers Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Power Generation 5.6.3.4.2. Transmission & Distribution 5.6.3.4.3. Renewable Energy Integration 5.6.3.4.4. Others 5.6.3.5. Mexico Large Power Transformers Market Size and Forecast, by End User (2024-2032) 5.6.3.5.1. Utilities 5.6.3.5.2. Industrial Sector 5.6.3.5.3. Commercial Sector 5.6.3.5.4. Government / Public Infrastructure 5.6.3.5.5. Others 6. Europe Large Power Transformers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.2. Europe Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.3. Europe Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.4. Europe Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.5. Europe Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6. Europe Large Power Transformers Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.1.2. United Kingdom Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.1.3. United Kingdom Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.1.4. United Kingdom Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.2. France 6.6.2.1. France Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.2.2. France Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.2.3. France Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.2.4. France Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.3.2. Germany Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.3.3. Germany Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.3.4. Germany Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.4.2. Italy Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.4.3. Italy Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.4.4. Italy Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.5.2. Spain Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.5.3. Spain Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.5.4. Spain Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.6.2. Sweden Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.6.3. Sweden Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.6.4. Sweden Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.7.2. Austria Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.7.3. Austria Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.7.4. Austria Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Large Power Transformers Market Size and Forecast, by End User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Large Power Transformers Market Size and Forecast, by Type (2024-2032) 6.6.8.2. Rest of Europe Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 6.6.8.3. Rest of Europe Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 6.6.8.4. Rest of Europe Large Power Transformers Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Large Power Transformers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.3. Asia Pacific Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.4. Asia Pacific Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6. Asia Pacific Large Power Transformers Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.1.2. China Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.1.3. China Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.1.4. China Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.2.2. S Korea Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.2.3. S Korea Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.2.4. S Korea Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.3.2. Japan Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.3.3. Japan Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.3.4. Japan Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.4. India 7.6.4.1. India Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.4.2. India Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.4.3. India Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.4.4. India Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.5.2. Australia Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.5.3. Australia Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.5.4. Australia Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.6.2. Indonesia Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.6.3. Indonesia Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.6.4. Indonesia Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.7.2. Malaysia Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.7.3. Malaysia Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.7.4. Malaysia Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.8.2. Vietnam Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.8.3. Vietnam Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.8.4. Vietnam Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.9.2. Taiwan Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.9.3. Taiwan Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.9.4. Taiwan Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Large Power Transformers Market Size and Forecast, by End User (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Large Power Transformers Market Size and Forecast, by Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 7.6.10.4. Rest of Asia Pacific Large Power Transformers Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Large Power Transformers Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Large Power Transformers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Large Power Transformers Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 8.3. Middle East and Africa Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 8.4. Middle East and Africa Large Power Transformers Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Large Power Transformers Market Size and Forecast, by End User (2024-2032) 8.6. Middle East and Africa Large Power Transformers Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Large Power Transformers Market Size and Forecast, by Type (2024-2032) 8.6.1.2. South Africa Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 8.6.1.3. South Africa Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 8.6.1.4. South Africa Large Power Transformers Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Large Power Transformers Market Size and Forecast, by End User (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Large Power Transformers Market Size and Forecast, by Type (2024-2032) 8.6.2.2. GCC Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 8.6.2.3. GCC Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 8.6.2.4. GCC Large Power Transformers Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Large Power Transformers Market Size and Forecast, by End User (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Large Power Transformers Market Size and Forecast, by Type (2024-2032) 8.6.3.2. Nigeria Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 8.6.3.3. Nigeria Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 8.6.3.4. Nigeria Large Power Transformers Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Large Power Transformers Market Size and Forecast, by End User (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Large Power Transformers Market Size and Forecast, by Type (2024-2032) 8.6.4.2. Rest of ME&A Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 8.6.4.3. Rest of ME&A Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 8.6.4.4. Rest of ME&A Large Power Transformers Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Large Power Transformers Market Size and Forecast, by End User (2024-2032) 9. South America Large Power Transformers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Large Power Transformers Market Size and Forecast, by Type (2024-2032) 9.2. South America Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 9.3. South America Large Power Transformers Market Size and Forecast, by Power Rating(2024-2032) 9.4. South America Large Power Transformers Market Size and Forecast, by Application (2024-2032) 9.5. South America Large Power Transformers Market Size and Forecast, by End User (2024-2032) 9.6. South America Large Power Transformers Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Large Power Transformers Market Size and Forecast, by Type (2024-2032) 9.6.1.2. Brazil Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 9.6.1.3. Brazil Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 9.6.1.4. Brazil Large Power Transformers Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Large Power Transformers Market Size and Forecast, by End User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Large Power Transformers Market Size and Forecast, by Type (2024-2032) 9.6.2.2. Argentina Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 9.6.2.3. Argentina Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 9.6.2.4. Argentina Large Power Transformers Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Large Power Transformers Market Size and Forecast, by End User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Large Power Transformers Market Size and Forecast, by Type (2024-2032) 9.6.3.2. Rest Of South America Large Power Transformers Market Size and Forecast, by Cooling Type (2024-2032) 9.6.3.3. Rest Of South America Large Power Transformers Market Size and Forecast, by Power Rating (2024-2032) 9.6.3.4. Rest Of South America Large Power Transformers Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Large Power Transformers Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. ABB Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Siemens Energy AG 10.3. General Electric Company (GE) 10.4. Hitachi Energy 10.5. Mitsubishi Electric Corporation 10.6. Schneider Electric 10.7. Eaton Corporation plc 10.8. Toshiba Corporation 10.9. Hyundai Electric & Energy Systems Co. 10.10. Crompton Greaves Ltd. (CG Power) 10.11. Wilson Power Solutions 10.12. TBEA Co., Ltd. 10.13. SPX Transformer Solutions, Inc. 10.14. Hyosung Heavy Industries Corporation 10.15. Daelim Industrial Co., Ltd. 10.16. Shandong Power Equipment Group Co., Ltd. 10.17. Jiangsu Huapeng Transformer Co., Ltd. 10.18. Zhejiang Chint Electrics Co., Ltd. 10.19. Efacec Engenharia e Sistemas S.A. 10.20. Wilson Transformer Company 10.21. Bharat Heavy Electricals Limited (BHEL) 10.22. ZTR Control Systems LLC 10.23. SGB-SMIT Group 10.24. Shaanxi Hanzhong Transformer Co., Ltd. 10.25. CG Power and Industrial Solutions Ltd. 10.26. Tianwei Baobian Electric Co., Ltd. 10.27. Nissin Electric Co., Ltd. 10.28. Shandong Taikai Power Engineering Co., Ltd. 10.29. Jiangsu Zhongtian Technology Co., Ltd. 10.30. Shandong Luneng Taishan Power Grid Co., Ltd 11. Key Findings 12. Industry Recommendations 13. Large Power Transformers Market: Research Methodology 14. Terms and Glossary