The global Kraft Paper market is expected to reach USD 19.52 billion in 2024 and USD 25.50 billion by 2032, growing at a CAGR of 3.4%. The increasing demand for eco-friendly packaging, sustainability initiatives, and growth in e-commerce drive the Kraft paper Market growth.Kraft Paper Market Overview

Kraft paper is a strong, durable paper made from wood pulp using the kraft process. It is known for its natural brown color, high tear resistance, and recyclability, commonly used in packaging, shipping, and eco-friendly applications. The global Kraft paper market has seen significant growth in recent years, driven by the increasing demand for eco-friendly packaging solutions and sustainable packaging materials. As industries continue to shift towards more environmentally conscious practices, Kraft paper has emerged as a preferred material due to its recyclability, strength, and minimal environmental impact. The innovative Kraft paper packaging solutions meet the growing demand in sectors such as e-commerce, food and beverage, and industrial packaging. Unbleached Kraft paper and Recycled Kraft paper are gaining traction for their eco-friendly attributes, with e-commerce packaging seeing a surge in demand for durable and sustainable packaging materials.To know about the Research Methodology :- Request Free Sample Report Kraft Paper Market Trend: Increasing Use of Kraft Paper in E-commerce Packaging As online shopping continues to boom globally, there is an increasing need for Kraft paper packaging solutions that are not only durable but also eco-friendly. The rise in online shopping has led to a higher volume of shipments, with consumers increasingly preferring sustainable packaging materials for their orders. Kraft paper, known for its strength and recyclability, is ideal for e-commerce packaging, ensuring that products are securely shipped while minimizing environmental impact. Moreover, brands are increasingly using Kraft paper for their packaging to meet consumer demand for eco-friendly packaging solutions, as part of their sustainability commitments. Key factors influencing the Kraft Paper Market trend include consumer awareness about Kraft paper as an eco-friendly alternative to plastic packaging, advancements in Kraft paper production, and the rise of environmentally conscious brands that are shifting away from plastic. Unbleached Kraft paper is particularly popular for e-commerce packaging due to its natural appearance and lower environmental footprint. Increasing Demand for Sustainable Packaging to Drive Kraft Paper Market Growth As environmental concerns and the need for eco-friendly packaging solutions continue to rise, Kraft paper is increasingly being adopted across various industries due to its recyclability and biodegradability. Governments and regulatory bodies are also contributing to this shift by implementing stringent regulations on plastic use, particularly single-use plastics, which drives the Kraft paper Market growth. The ban on plastic packaging in several regions has created an opportunity for Kraft paper packaging solutions to thrive as a viable alternative. Companies are looking for sustainable paper solutions, and Kraft paper, especially Unbleached Kraft paper, is seen as a cost-effective and eco-friendly material. The increasing demand for sustainable packaging is driving the adoption of Kraft paper. African countries like South Africa, Kenya, Nigeria, Egypt, and Rwanda are at the forefront, implementing eco-friendly policies and expanding Kraft paper production for various industries. African countries leading the Kraft paper revolution:

Kraft paper production has become more sustainable with advancements in manufacturing processes, which help reduce environmental impact. With increasing consumer awareness of environmental issues, brands are focusing on adopting Kraft paper packaging to appeal to eco-conscious consumers. This shift is most noticeable in the food and beverage industry, e-commerce packaging, and cosmetics packaging, where Kraft paper applications are rapidly expanding. The growing preference for Kraft paper as part of sustainability initiatives is driving its widespread adoption globally. Investment and Business Opportunities in Kraft Paper

Country Key Developments South Africa Major producers like Sappi and Mondi are exporting Kraft paper globally. Kenya One of the first to ban plastic bags, boosting the production of paper bags and eco-friendly packaging solutions. Nigeria The rapidly growing Kraft paper market is driven by increasing demand in the retail and industrial sectors. Egypt High demand for Kraft paper packaging in the food and FMCG industries. Rwanda & Tanzania Green policies have fostered small-scale startups in the paper packaging sector, promoting sustainable growth. High Production Costs to Restraint Kraft Paper Market Growth The process of producing Kraft paper requires the use of high-quality raw materials, including wood pulp, which contributes to higher costs. In 2023, it was estimated that Kraft paper production costs were around 20-25% higher than other paper products due to the complex and energy-intensive production process. The fluctuations in raw material costs, such as the price of wood pulp and chemicals used in the kraft pulping process, can further strain the profitability of manufacturers. For instance, increases in timber prices or supply chain disruptions can significantly impact production costs. This makes it challenging for manufacturers to offer competitive pricing while maintaining profitability in the Kraft Paper Market. The adoption of eco-friendly paper materials often requires investments in advanced technology and infrastructure, which can lead to high initial capital expenditures for companies. While there is increasing demand for sustainable packaging materials, the higher production costs of Kraft paper may limit its adoption among small and medium-sized enterprises (SMEs) that are unable to afford the higher costs compared to plastic or other packaging alternatives.

Kraft Paper Market Segment Analysis

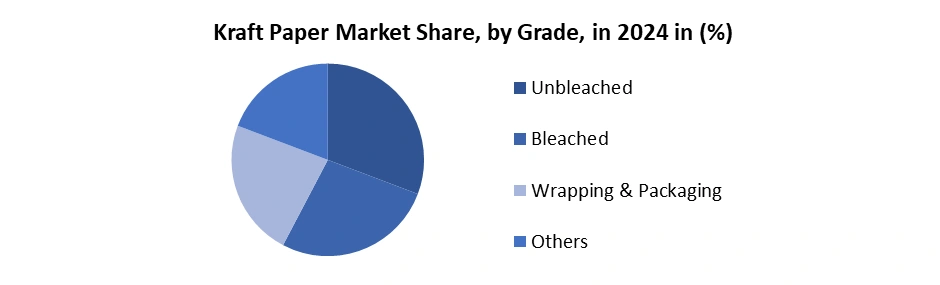

By Product, the market is segmented into Virgin Natural Kraft Paper, Recycled Kraft Paper, Bleached (White) Kraft Paper and Others. Virgin is expected to dominate the Kraft Paper Market over the forecast period. This is driven by its superior strength, durability, and versatility, which make it the preferred choice for high-end packaging applications, particularly in industries like e-commerce packaging, food and beverage, and retail packaging. Virgin Kraft paper, made from fresh wood pulp, is highly valued for its high tensile strength and resilience, making it ideal for demanding packaging needs. With the growing shift towards eco-friendly packaging and sustainable materials, Virgin Kraft Paper continues to benefit from increasing demand, as it aligns with sustainability goals while offering the necessary performance attributes for packaging solutions. The segment's dominance is supported by its widespread adoption across both developed and emerging markets.By grade, the market is categorized into the Unbleached, Bleached, Wrapping & Packaging and Others. Unbleached held the largest Kraft paper Market share in 2024. Unbleached kraft paper is highly valued for its natural brown color, strength, and minimal processing, making it ideal for a wide range of applications, including industrial packaging, e-commerce packaging, and shipping materials. Its popularity is driven by the increasing demand for eco-friendly packaging solutions, as it is made with minimal chemical processing and is fully recyclable. The demand for unbleached kraft paper is particularly strong in sectors where durability and cost-effectiveness are key considerations, such as the food and beverage industry and industrial sectors. As sustainability continues to be a major driver in the packaging industry, unbleached kraft paper’s alignment with sustainable packaging materials further solidifies its dominance. The segment is expected to maintain its leadership position over the forecast period due to the growing global preference for sustainable alternatives to plastic, as well as ongoing innovations that improve its performance in various packaging applications.

Kraft Paper Market Regional Insights

Asia Pacific held the largest Kraft Paper Market share in 2024 and is expected to continue its dominance over the forecast period. The rapid industrialization, expanding e-commerce sectors, and increasing environmental awareness drive the Kraft Paper Industry. In countries like China and India, the demand for eco-friendly and sustainable packaging materials is surging, as companies in these regions transition from plastic to more environmentally conscious alternatives. Kraft paper demand is particularly strong in e-commerce packaging, where Kraft’s durability and recyclability make it a preferred choice for packaging materials. The significant growth in Kraft paper production within Asia-Pacific, alongside a robust supply chain of Kraft paper suppliers, supports the region's leading position. Unbleached Kraft paper, in particular, is seeing strong Kraft Paper Market growth due to its cost-effectiveness and minimal processing, aligning well with the increasing focus on sustainable paper solutions. Countries in this region are not only major producers of Kraft paper but also account for a large portion of global consumption, driven by applications in industries such as food and beverage, industrial packaging, and retail packaging. The growing shift towards sustainable packaging is set to boost demand for Kraft paper, cementing Asia-Pacific’s dominance in the global market.Kraft Paper Market Competitive Landscape

The competitive landscape of the global Kraft paper market is characterized by intense rivalry among both global and regional players seeking to capitalize on the growing demand for sustainable packaging solutions. Major companies like International Paper, Mondi Group, and Smurfit Kappa Group have solidified their positions through economies of scale, extensive global distribution networks, and a strong focus on sustainability initiatives. Innovation plays a key role, with product differentiation based on grade (unbleached vs. bleached), packaging formats (corrugated, grocery, and industrial bags), and enhanced supply chain efficiencies. However, fragmentation in the market remains significant, with smaller regional manufacturers competing on cost, customization, and localized services, which increases pricing pressure. This dynamic has led larger companies to pursue strategic acquisitions or invest in product innovation to maintain a competitive edge and meet diverse customer demands. • December 19, 2023: Mondi Group expanded its range of saturating kraft paper, increasing capacity across its mills in Austria and Sweden. The investment in a new paper machine at its Štĕtí plant (Czech Republic) boosts production of Advantage MF Boost, a high-quality paper used for laminates. This expansion improves efficiency and enhances product offerings, including a broader grammage range. Mondi’s commitment to boosting supply strengthens its position in the laminated applications market for building panels, worktops, and technical films. • July 9, 2024: The merger between Smurfit Kappa and WestRock officially created the largest containerboard and boxmaking company globally, named Smurfit Westrock. The combined company now operates 63 paper mills and 500 converting facilities across 40 countries, with an annual consumption of 15 million tons of recycled fiber. The deal, first announced in 2023, positions Smurfit Westrock as a major player in the global fiber and packaging market, with a strong presence in both recycling and fiber collection operations.Kraft Paper Market Scope: Inquiry Before Buying

Global Kraft Paper Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 19.52 Bn. Forecast Period 2025 to 2032 CAGR: 3.4% Market Size in 2032: USD 25.50 Bn. Segments Covered: by Product Virgin Natural Kraft Paper Recycled Kraft Paper Bleached (White) Kraft Paper Others by Grade Unbleached Bleached Wrapping & Packaging Others by Packaging Form Corrugated Boxes Grocery Bags Industrial Bags Others by Application Foods & Beverage Pharmaceuticals Building and Construction Cosmetics & Personal Care Others by Distribution Channel Distributors/Wholesalers Retail Online/E-commerce Others Kraft Paper Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Kraft Paper Key Players

1. Mondi Group Plc 2. International Paper Company 3. WestRock Company 4. Smurfit Kappa Group PLC 5. Stora Enso Oyj 6. Billerud AB 7. Oji Holdings Corporation 8. Sappi Limited 9. Canfor Corporation 10. Georgia Pacific LLC 11. Natron Hayat d.o.o. 12. Tokushu Tokai Paper Co., Ltd. 13. Nordic Paper Oyj 14. Gascogne Papier 15. SCG Packaging Public Company Limited 16. Canadian Kraft Paper Industries Ltd 17. ND Paper (Nine Dragons Paper) 18. Segezha Group 19. Daio Paper Corporation 20. ITC Limited 21. Glatfelter Corporation 22. Shree Gajanan Paper & Boards Pvt Ltd 23. Laxmi Board & Paper Mills Pvt Ltd 24. PT Suparma Tbk 25. Golden Paper Co., Ltd. 26. Taiko Paper Mfg. Ltd. 27. Shouguang Sunrise Industry Co., Ltd. 28. Port Townsend Paper Corporation 29. Ballavpur Paper Mfg. Ltd. 30. The Navigator Company, S.A.Frequently Asked Questions:

1] What is the growth rate of the Global Kraft Paper Market? Ans. The Global Kraft Paper Market is growing at a significant rate of 3.4 % during the forecast period. 2] Which region is expected to dominate the Global Kraft Paper Market? Ans. Asia Pacific is expected to dominate the Kraft Paper Market during the forecast period. 3] What was the Global Kraft Paper Market size in 2024? Ans. The Kraft Paper Market size is expected to reach USD 19.50 billion in 2024. 4] What is the expected Global Kraft Paper Market size by 2032? Ans. The Kraft Paper Market size is expected to reach USD 25.52 billion by 2032. 5] Which are the top players in the Global Kraft Paper Market? Ans. The major players in the Global Kraft Paper Market are Mondi Group Plc, International Paper Company, WestRock Company, Smurfit Kappa Group PLC, Stora Enso Oyj and Others. 6] What are the factors driving the Global Kraft Paper Market growth? Ans. The increasing demand for eco-friendly packaging, sustainability initiatives, increasing e-commerce, regulatory bans on plastic, and Kraft paper's strength, recyclability, and cost-effectiveness.

1. Kraft Paper Market: Research Methodology 2. Kraft Paper Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Kraft Paper Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Kraft Paper Market: Dynamics 4.1. Kraft Paper Market Trends 4.2. Kraft Paper Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Kraft Paper Market 5. Kraft Paper Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 5.1. Kraft Paper Market Size and Forecast, by Product (2024-2032) 5.1.1. Virgin Natural Kraft Paper 5.1.2. Recycled Kraft Paper 5.1.3. Bleached (White) Kraft Paper 5.1.4. Others 5.2. Kraft Paper Market Size and Forecast, by Grade (2024-2032) 5.2.1. Unbleached 5.2.2. Bleached 5.2.3. Wrapping & Packaging 5.2.4. Others 5.3. Kraft Paper Market Size and Forecast, by Packaging Form (2024-2032) 5.3.1. Corrugated Boxes 5.3.2. Grocery Bags 5.3.3. Industrial Bags 5.3.4. Others 5.4. Kraft Paper Market Size and Forecast, by Application (2024-2032) 5.4.1. Foods & Beverage 5.4.2. Pharmaceuticals 5.4.3. Building and Construction 5.4.4. Cosmetics & Personal Care 5.4.5. Others 5.5. Kraft Paper Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.1. Distributors/Wholesalers 5.5.2. Retail 5.5.3. Online/E-commerce 5.5.4. Others 5.6. Kraft Paper Market Size and Forecast, by Region (2024-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Kraft Paper Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 6.1. North America Kraft Paper Market Size and Forecast, by Product (2024-2032) 6.1.1. Virgin Natural Kraft Paper 6.1.2. Recycled Kraft Paper 6.1.3. Bleached (White) Kraft Paper 6.1.4. Others 6.2. North America Kraft Paper Market Size and Forecast, by Grade (2024-2032) 6.2.1. Unbleached 6.2.2. Bleached 6.2.3. Wrapping & Packaging 6.2.4. Others 6.3. North America Kraft Paper Market Size and Forecast, by Packaging Form (2024-2032) 6.3.1. Corrugated Boxes 6.3.2. Grocery Bags 6.3.3. Industrial Bags 6.3.4. Others 6.4. North America Kraft Paper Market Size and Forecast, by Application (2024-2032) 6.4.1. Foods & Beverage 6.4.2. Pharmaceuticals 6.4.3. Building and Construction 6.4.4. Cosmetics & Personal Care 6.4.5. Others 6.5. North America Kraft Paper Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.1. Distributors/Wholesalers 6.5.2. Retail 6.5.3. Online/E-commerce 6.5.4. Others 6.6. North America Kraft Paper Market Size and Forecast, by Country (2024-2032) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Kraft Paper Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 7.1. Europe Kraft Paper Market Size and Forecast, by Product (2024-2032) 7.2. Europe Kraft Paper Market Size and Forecast, by Grade (2024-2032) 7.3. Europe Kraft Paper Market Size and Forecast, by Packaging Form (2024-2032) 7.4. Europe Kraft Paper Market Size and Forecast, by Application (2024-2032) 7.5. Europe Kraft Paper Market Size and Forecast, by Distribution Channel (2024-2032) 7.6. Europe Kraft Paper Market Size and Forecast, by Country (2024-2032) 7.6.1. United Kingdom 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Russia 7.6.7. Rest of Europe 8. Asia Pacific Kraft Paper Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 8.1. Asia Pacific Kraft Paper Market Size and Forecast, by Product (2024-2032) 8.2. Asia Pacific Kraft Paper Market Size and Forecast, by Grade (2024-2032) 8.3. Asia Pacific Kraft Paper Market Size and Forecast, by Packaging Form (2024-2032) 8.4. Asia Pacific Kraft Paper Market Size and Forecast, by Application (2024-2032) 8.5. Asia Pacific Kraft Paper Market Size and Forecast, by Distribution Channel (2024-2032) 8.6. Asia Pacific Kraft Paper Market Size and Forecast, by Country (2024-2032) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Rest of Asia Pacific 9. Middle East and Africa Kraft Paper Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 9.1. Middle East and Africa Kraft Paper Market Size and Forecast, by Product (2024-2032) 9.2. Middle East and Africa Kraft Paper Market Size and Forecast, by Grade (2024-2032) 9.3. Middle East and Africa Kraft Paper Market Size and Forecast, by Packaging Form (2024-2032) 9.4. Middle East and Africa Kraft Paper Market Size and Forecast, by Application (2024-2032) 9.5. Middle East and Africa Kraft Paper Market Size and Forecast, by Distribution Channel (2024-2032) 9.6. Middle East and Africa Kraft Paper Market Size and Forecast, by Country (2024-2032) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Nigeria 9.6.4. Rest of ME&A 10. South America Kraft Paper Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 10.1. South America Kraft Paper Market Size and Forecast, by Product (2024-2032) 10.2. South America Kraft Paper Market Size and Forecast, by Grade (2024-2032) 10.3. South America Kraft Paper Market Size and Forecast, by Packaging Form (2024-2032) 10.4. South America Kraft Paper Market Size and Forecast, by Application (2024-2032) 10.5. South America Kraft Paper Market Size and Forecast, by Distribution Channel (2024-2032) 10.6. South America Kraft Paper Market Size and Forecast, by Country (2024-2032) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Colombia 10.6.4. Chile 10.6.5. Rest Of South America 11. Company Profile: Key Players 11.1. Mondi Group Plc 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. International Paper Company 11.3. WestRock Company 11.4. Smurfit Kappa Group PLC 11.5. Stora Enso Oyj 11.6. Billerud AB 11.7. Oji Holdings Corporation 11.8. Sappi Limited 11.9. Canfor Corporation 11.10. Georgia Pacific LLC 11.11. Natron Hayat d.o.o. 11.12. Tokushu Tokai Paper Co., Ltd. 11.13. Nordic Paper Oyj 11.14. Gascogne Papier 11.15. SCG Packaging Public Company Limited 11.16. Canadian Kraft Paper Industries Ltd 11.17. ND Paper (Nine Dragons Paper) 11.18. Segezha Group 11.19. Daio Paper Corporation 11.20. ITC Limited 11.21. Glatfelter Corporation 11.22. Shree Gajanan Paper & Boards Pvt Ltd 11.23. Laxmi Board & Paper Mills Pvt Ltd 11.24. PT Suparma Tbk 11.25. Golden Paper Co., Ltd. 11.26. Taiko Paper Mfg. Ltd. 11.27. Shouguang Sunrise Industry Co., Ltd. 11.28. Port Townsend Paper Corporation 11.29. Ballavpur Paper Mfg. Ltd. 11.30. The Navigator Company, S.A. 12. Key Findings 13. Analyst Recommendations