The Kids Wear Market size was valued at USD 324.32 Billion in 2024 and the total Kids Wear revenue is expected to grow at a CAGR of 5.3% from 2025 to 2032, reaching nearly USD 490.23 Billion in 2032. The Kids Wear Market is undergoing a significant transformation as parents increasingly prioritise comfort, safety, and fashion-forward designs for children across all age groups. Modern consumers are shifting toward skin-friendly, breathable, and ethically sourced fabrics, which has led to a measurable rise in product innovation. In 2024, global fashion trackers reported over 18,000 new kids wear launches, with approximately 5,000 of these belonging to organic, non-toxic, and eco-friendly categories clear indicator of growing awareness around children’s skin sensitivity and environmental impact. Sustainability is becoming a mainstream trend, with around 35% of premium kids wear collections now displaying certifications such as GOTS, OEKO-TEX, or BCI Cotton. Digital behavior is also reshaping the market: e-commerce contributed nearly 35% of global kids apparel sales, and online-driven inspiration especially through influencers, social media, and brand-driven plays a crucial role in purchasing decisions. Subscription-based kids fashion boxes grew rapidly, delivering over 9 million curated packages globally, reflecting strong adoption among urban families. Character-based and licensed apparel continues to dominate fashion preferences, with more than 12,000 SKUs launched from franchises such as Disney, Marvel, Anime, and gaming properties, accounting for 20–25% of branded kids wear revenue. Meanwhile, core product development is shifting toward comfort-first fashion, half of the newly introduced SKUs fall under casualwear or athleisure. Gender-neutral lines represent 12–15% of new collections, reinforcing the industry’s movement toward inclusivity and functional design. This combination of sustainability, digital retail, premiumization, and shifting lifestyle choices continues to define the evolving global Kids Wear Market.To know about the Research Methodology :- Request Free Sample Report

Kids Wear Market Dynamics:

The Kids Wear Market continues to evolve as global spending on children’s apparel increases steadily across both developed and emerging economies. The families worldwide spend an average of USD 380–420 per child annually on clothing and footwear, with the highest spending observed in North America, where average annual expenditure exceeds USD 520 per child. In Western Europe, annual children’s apparel spending typically ranges from USD 450 to USD 480, while emerging Asian markets such as India and Indonesia show rising averages between USD 160 and USD 220. Globally, parents purchase USD 45–60 worth of new clothing per child each month, influenced by rapid size changes, fashion cycles, and seasonal requirements. Regulatory tightening around dyes, flame retardants, formaldehyde, and PFAS has pushed brands to shift toward safer materials, leading to a fast-growing segment of USD 12–15 billion in certified organic and toxin-free kids clothing. Tax structures in the United States influence purchasing behavior. States such as New York and Massachusetts allow tax exemptions on children’s apparel up to USD 110 per item, while “tax holiday” states drive seasonal surges in sales, often adding USD 1–1.5 billion in extra revenue during back-to-school months. Per-capita global consumption varies widely: the average child in the U.S. receives clothing worth USD 600–650 annually, while children in Japan average USD 500, and those in Brazil average USD 240–260. In Africa, per-child clothing expenditure is lower but rising, currently estimated at USD 80–120 per year, which drives Kids Wear Market. Leading brands have set financial and sustainability targets. H&M Kids, Zara Kids, and Nike Kids collectively invest more than USD 2.5 billion annually in R&D, supply-chain improvements, and recycled materials. Major companies aim to source USD 100% equivalent of their cotton from sustainable origins by 2030, alongside large-scale commitments to reduce production waste valued at USD 500–700 million per year.Rising Demand for Premium and Fashion-Forward Kids’ Apparel Boosts Kids Wear Market Demand The Kids Wear Market significant opportunities driven by shifting consumer behavior, rising disposable incomes, and rapid expansion of organized retail. One of the strongest opportunities lies in the growing demand for premium, stylish, and comfortable kids’ apparel, influenced by social media, celebrity collaborations, and the growing trend of “mini-me” fashion where children’s styles mirror adult fashion. Brands offering trendy, functional designs stand to benefit from this rising fashion consciousness among parents. Another major opportunity is the expansion of e-commerce and omnichannel retail. Parents increasingly prefer online shopping for convenience, wider choices, and better pricing. Companies investing in AI-driven personalization, virtual fitting tools, and subscription-based clothing boxes can capture strong recurring demand. There is also high potential in sustainable and organic kids’ clothing, as parents prioritize skin-friendly, chemical-free, and eco-conscious materials. Brands adopting organic cotton, recycled fibers, and ethical production processes can differentiate themselves in a growing niche. The sportswear and athleisure category offers strong growth prospects with increasing outdoor activities and sports participation among children. Furthermore, emerging markets such as Asia-Pacific, Latin America, and the Middle East present opportunities through rising urbanization, growing middle-class populations, and increasing brand awareness, creating long-term expansion potential for global and regional players. Table: Tech Marvels Revolutionizing Sports Apparel: A Glimpse into the Future of Athletic Fashion in India

Technology Impact on Sports Apparel in India Artificial Intelligence Accelerates design, forecasts trends, and enhances inventory management. Gen AI speeds up creative processes and aids in real-time inventory tracking for efficient supply chain management. Novel Fabrics Sustainable options like lab-grown leather and innovative materials with features like temperature control and moisture-wicking gain popularity. 3D-printed fabrics revolutionize design possibilities and aesthetics. Internet of Things (IoT) Smart clothing, wearable spaces, and responsive sportswear flourish. IoT facilitates data sharing, inventory management, and personalized experiences. Expansion of 5G networks enhances real-time data transfer for IoT applications. Rapid Data Analysis Real-time feedback and alerts improve supply chain efficiency. AI-driven tools like Techpacker streamline communication, making tech pack creation faster. Rapid data analysis ensures quick adaptation to market needs. Mobile Commerce Growing sector in eCommerce; smartphones enable easy online shopping. Digital wallet options and social media integrations enhance customer experience. Sustainable fashion apps gain popularity, transforming online sales. Kids Wear Market Segment Analysis:

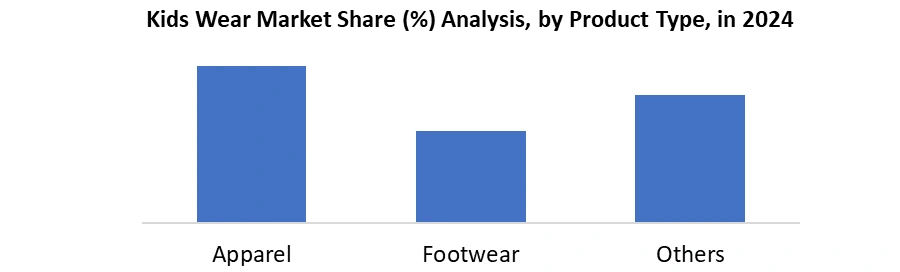

Based on Product Type, the market is segmented into Apparel, Footwear, and Others, with Apparel dominating the market in 2024. Apparel accounted for the highest share due to continuous purchasing needs stemming from rapid child growth, high replacement frequency, and the expanding range of fashion trends across casual, ethnic, seasonal, and character-themed clothing. Categories such as T-shirts, dresses, tops, shorts, and winterwear drive substantial revenue, supported by the growing influence of e-commerce, social media–driven styling trends, and increased preference for branded, comfortable, and skin-friendly fabrics. The Footwear segment represents the second-largest share, growing steadily as parents increasingly prioritize support, comfort, and durability. Demand for school shoes, sports footwear, sandals, and casual shoes remains strong, especially in urban regions. The rise of athleisure culture among kids, along with a growing focus on outdoor and sports activities, is pushing premium and performance-oriented footwear adoption.

Kids Wear Market Regional Analysis

The Asia-Pacific (APAC) region accounted the global Kids Wear Market and continued to hold the largest share in 2024. This leadership is driven by its massive child population, rapid urbanization, and rising disposable incomes across countries such as China, India, Indonesia, and Vietnam. With a growing middle-class and increasing preference for branded, fashionable, and comfortable children’s clothing, APAC has become the largest consumer base for both mass and premium kids wear. E-commerce growth is another major catalyst, with platforms like Myntra, Taobao, Shopee, and Zalora accelerating online purchases through discounts, fast delivery, and wide product availability. China remains the strongest market due to high spending on premium clothing and the strong presence of domestic brands such as Anta Kids, Balabala, and Semir. India, on the other hand, is witnessing double-digit growth driven by rising nuclear families, increasing participation of mothers in the workforce, and expansion of children-specific fashion stores. North America follows as the second-largest market, supported by high purchasing power and demand for premium, sustainable, and athleisure kids wear. Europe also shows steady demand driven by fashion-conscious consumers and strong sustainability trends.Competitive Landscape:

The kids wear market is highly fragmented and competitive, led by global sportswear and casualwear giants Nike, Adidas, Under Armour, and V.F. Corporation (Vans, The North Face), which focus on performance, lifestyle, and branded kids’ collections. Carter’s, GAP, H&M, Inditex (Zara), NEXT, BESTSELLER, Mothercare, Orchestra, C&A, Gymboree, and Fast Retailing (UNIQLO) compete strongly in affordable fashion and basics. Character and licensing powerhouses Disney and Sanrio strengthen co-brand kids’ lines. In China, players such as Semir, Annil, PEPCO, Honghuanglan, Liying, and MIKI HOUSE (strong in Asia) drive regional growth with localized designs and aggressive retail expansion.Recent Development

May 29, 2025 – Nike & LEGO declared Global Multi-Year Kids Play Partnership Nike and LEGO launched a global multi-year partnership starting summer 2025, featuring co-brand footwear, apparel, accessories, immersive experiences, and a focus on creative active play for children. April 29, 2025 – Gap × DÔEN Launches Second Capsule Collaboration Gap and DÔEN launched their second capsule collection 38 pieces for spring/summer 2025, including women’s, men’s and kids’ apparel. The collection brings vintage-inspired prints, matching sets, and expanded sizing options.Kids Wear Market Scope: Inquire before buying

Kids Wear Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 324.32 Bn. Forecast Period 2025 to 2032 CAGR: 5.3% Market Size in 2032: USD 490.23 Bn. Segments Covered: by Product Type Apparel Footwear Others by Age Group Below 5 Years 5-10 Years Above 10 Years by Distribution Channel Offline Online Kids Wear Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Kids Wear Market, Key players

1. Nike 2. Carter's 3. GAP 4. Inditex 5. Adidas 6. HandM 7. Gymboree 8. V.F. Corporation 9. Fast Retailing 10. CandA 11. NEXT 12. ID Group 13. Mothercare 14. Orchestra 15. BESTSELLER 16. Under Armour 17. Benetton 18. Sanrio 19. MIKI HOUSE 20. Disney 21. Semir 22. Liying 23. Honghuanglan 24. Annil 25. PEPCOFAQs

1] What segments are covered in Kids Wear Market report? Ans. The segments covered in the Kids Wear Market report are based on Product, End User and Distribution Channel. 2] Which region is expected to hold the highest share in the Kids Wear Market? Ans. Asia Pacific Region is expected to hold the highest share in the Kids Wear Market. 3] What is the market size of Kids Wear Market by 2032? Ans. The market size of Kids Wear Market by 2032 is USD 490.23 Bn. 4] Who are the top key players in the Kids Wear Market? Ans. Nike, Carter's, GAP, Inditex, Adidas, HandM, Gymboree, V.F. Corporation, Fast Retailing, CandA, NEXT, ID Group, Mothercare, Orchestra, BESTSELLER, Under Armour, Benetton, Sanrio, MIKI HOUSE, Disney, Semir, Liying, Honghuanglan, Annil, PEPCO. 5] What was the market size of Kids Wear Market in 2024? Ans. The market size of Kids Wear Market in 2024 was USD 324.32 Bn.

1. Kids Wear Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion)-By Segments, Regions, and Country 2. Kids Wear Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Kids Wear Market : Dynamics 3.1. Kids Wear Market Trends 3.2. Kids Wear Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Biscuits Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Statistical & Market Insights on the Global Kids Wear Market 4.1. Global kids wear consumption trends (by value & volume, 2019–2032) 4.2. Market split by product: clothing, footwear, accessories 4.3. Per-capita spending on kids wear by region (Asia Pacific, Europe, North America, Latin America, MEA) 4.4. Channel mix evolution: specialty stores, supermarkets, department stores, e-commerce, D2C brands 4.5. Penetration of premium, branded, and licensed character-based kids wear 4.6. Share of sustainable / organic / eco-friendly kids wear in total launches and sales 5. Product, Material & Design Dynamics in Kids Wear 5.1. Fabric landscape: cotton, organic cotton, synthetic blends, performance fabrics 5.2. Shift from conventional materials to certified sustainable and skin-friendly textiles (GOTS, OEKO-TEX, etc.) 5.3. Role of comfort, safety, hypoallergenic and breathable properties in product differentiation 5.4. Design trends: casualwear, athleisure, mini-me fashion, gender-neutral and adaptive clothing 5.5. Innovation in sizing, fit and functionality: stretch fabrics, adjustable waistbands, season-specific layering concepts 5.6. Branding, packaging and positioning: gift packs, subscription boxes, eco-packaging and storytelling for parents and kids 6. Kids Wear Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Kids Wear Market Size and Forecast, By Product Type (2024-2032) 6.1.1.1. Apparel 6.1.1.2. Footwear 6.1.1.3. Others 6.2. Kids Wear Market Size and Forecast, By Age Group (2024-2032) 6.2.1.1. Below 5 Years 6.2.1.2. 5-10 Years 6.2.1.3. Above 10 Years 6.3. Kids Wear Market Size and Forecast, By Distribution Channel 2024-2032) 6.3.1.1. Online 6.3.1.2. Offline 6.4. Kids Wear Market Size and Forecast, By Region (2024-2032) 6.4.1.1. North America 6.4.1.2. Europe 6.4.1.3. Asia Pacific 6.4.1.4. Middle East and Africa 6.4.1.5. South America 7. North America Kids Wear Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. North America Kids Wear Market Size and Forecast, By Product Type (2024-2032) 7.1.1.1. Apparel 7.1.1.2. Footwear 7.1.1.3. Others 7.2. North America Kids Wear Market Size and Forecast, By Age Group (2024-2032) 7.2.1.1. Below 5 Years 7.2.1.2. 5-10 Years 7.2.1.3. Above 10 Years 7.3. North America Kids Wear Market Size and Forecast, By Distribution Channel 2024-2032) 7.3.1.1. Online 7.3.1.2. Offline 7.4. North America Kids Wear Market Size and Forecast, by Country (2024-2032) 7.4.1.1. United States 7.4.1.2. Canada 7.4.1.3. Mexico 8. Europe Kids Wear Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Europe Kids Wear Market Size and Forecast, By Product Type (2024-2032) 8.2. Europe Kids Wear Market Size and Forecast, By Age Group (2024-2032) 8.3. Europe Kids Wear Market Size and Forecast, By Distribution Channel (2024-2032) 8.4. Europe Kids Wear Market Size and Forecast, By Country (2024-2032) 8.4.1. United Kingdom 8.4.2. France 8.4.3. Germany 8.4.4. Italy 8.4.5. Spain 8.4.6. Sweden 8.4.7. Russia 8.4.8. Rest of Europe 9. Asia Pacific Kids Wear Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. Asia Pacific Kids Wear Market Size and Forecast, By Product Type (2024-2032) 9.2. Asia Pacific Kids Wear Market Size and Forecast, By Age Group (2024-2032) 9.3. Asia Pacific Kids Wear Market Size and Forecast, By Distribution Channel (2024-2032) 9.4. Asia Pacific Kids Wear Market Size and Forecast, by Country (2024-2032) 9.4.1. China 9.4.2. S Korea 9.4.3. Japan 9.4.4. India 9.4.5. Australia 9.4.6. Indonesia 9.4.7. Malaysia 9.4.8. Philippines 9.4.9. Thailand 9.4.10. Vietnam 9.4.11. Rest of Asia Pacific 10. Middle East and Africa Kids Wear Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1. Middle East and Africa Kids Wear Market Size and Forecast, By Product Type (2024-2032) 10.2. Middle East and Africa Kids Wear Market Size and Forecast, By Age Group (2024-2032) 10.3. Middle East and Africa Kids Wear Market Size and Forecast, By Distribution Channel (2024-2032) 10.4. Middle East and Africa Kids Wear Market Size and Forecast, By Country (2024-2032) 10.4.1. South Africa 10.4.2. GCC 10.4.3. Nigeria 10.4.4. Rest of ME&A 11. South America Kids Wear Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 11.1. South America Kids Wear Market Size and Forecast, By Product Type (2024-2032) 11.2. South America Kids Wear Market Size and Forecast, By Age Group (2024-2032) 11.3. South America Kids Wear Market Size and Forecast, By Distribution Channel (2024-2032) 11.4. South America Kids Wear Market Size and Forecast, By Country (2024-2032) 11.4.1. Brazil 11.4.2. Argentina 11.4.3. Colombia 11.4.4. Chile 11.4.5. Rest of South America 12. Company Profile: Key Players 12.1. Nike 12.1.1. Company Overview 12.1.2. Business Portfolio 12.1.3. Financial Overview 12.1.4. SWOT Analysis 12.1.5. Strategic Analysis 12.2. Carter's 12.3. GAP 12.4. Inditex 12.5. Adidas 12.6. HandM 12.7. Gymboree 12.8. V.F. Corporation 12.9. Fast Retailing 12.10. CandA 12.11. NEXT 12.12. ID Group 12.13. Mothercare 12.14. Orchestra 12.15. BESTSELLER 12.16. Under Armour 12.17. Benetton 12.18. Sanrio 12.19. MIKI HOUSE 12.20. Disney 12.21. Semir 12.22. Liying 12.23. Honghuanglan 12.24. Annil 12.25. PEPCO 13. Key Findings 14. Analyst Recommendations 15. Kids Wear Market – Research Methodology