IoT Professional Services Market was valued at US$ 114.30 Bn. in 2022. Global IoT Professional Services Market size is expected to grow at a CAGR of 8.22 % through the forecast period.IoT Professional Services Market Overview:

IoT Professional Services is a package that allows enterprises to bootstrap commercial IoT products. IoT professional services can be arranged into innovation counseling services, business counseling services, and operational counseling services. In this developing IoT marketplace, the services identified with those associated things help procure more an incentive for organizations. IoT professional services guarantee improvement and usage of the suitable IoT applications and design in companies. They manage organization to make new IoT frameworks to upgrade their current frameworks. The suppliers of IoT professional services additionally help non-IT organizations with negligible aptitude to comprehend IoT innovation.IoT Professional Services Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Being associated with a large number of gadgets to the internet, IoT enable organizations to be more brilliant with constant operational bits of knowledge while decreasing working expenses. IoT will improve tracking assets (tools, machinery, equipment’s, and so on) utilizing sensors and network, which enables firms to profit by real-time experiences. IoT opens the way for new business openings and enables organizations to profit by new income streams created by cutting edge plans of action and services. IoT-driven advancements fabricate solid business cases, lessens time to market and build return on investments. The report explores the Global IoT Professional Services Market segments (Type, Deployment, Organization Site, Application, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2017 to 2020. The report investigates the Global IoT Professional Services Market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Global IoT Professional Services Market contemporary competitive scenario. 2022 is considered as a base year to forecast the market from 2022 to 2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2029. 2020 is a year of exception and analysis especially with the impact of lockdown by region.

Global IoT Professional Services Market Dynamics:

The demand for minimizing operational and capital expenditures: Due to the increase in demand for minimizing operational and capital expenditures, the market is rising. The growing demand for highly tailored IoT professional services in the transportation and industrial sectors, as well as the increasing use of digital transformation services in organizations, presents a lucrative potential for the IoT professional service market resulted into the growth of the Global IoT Professional Services Market. The adoption of the IoT professional service market from existing IT infrastructure to new infrastructure and less skilled experts are hampering the market's growth. IoT devices are also providing to perform various functions in real-time. As a result of the increased usage of IoT devices around the world, data analysis insights enable meaningful activities to improve the organization. Mobile phones, desktop computers, tablets, and wearables can all be used to access and control connected devices. The rising demand for connected devices around the world to ensure that connected devices perform properly has resulted in a surge in the demand for IoT professional services. Professional IoT services aid in the management of device vulnerability, assuring continuous communication, controlling the internet, and addressing data security issues linked with the usage of connected devices. These all factors lead to the rising in the demand for the Global IoT Professional Services Market. The growing popularity of advanced technologies: The Internet of Things (IoT) which is a crucial digital transformation technology allows companies to improve their operational efficiency. Big data analytics, cloud computing, and edge computing are just some of the technologies are the driving factors which hampers the market growth. IoT professional service providers have been forced to retool their current IoT professional service offerings in response to the increased need for the digital transformation of businesses. The custom Application Programming Interface (API) and solutions is used by the companies for every IoT project. A common protocol and communication standard is required for communicating among IoT-enabled devices so that it can share data or form an intelligent network. This, in turn, will facilitate standardization in IoT technology and make it easier for every service provider to offer most solutions in one package. Interoperability and easy exchange of information among connected devices are the important devices which are used mostly. However, the current technical and market scenarios pertaining to IoT professional services lack in terms of providing a promising architectural service or a universal standard to solve the interoperability issues among different connected devices. These leads to restrain the growth of the market. The increasing demand for IoT-enabled digital transformation of businesses is the best opportunity for the growth of the market during the forecast period. IoT is a key digital transformation technology which provides businesses for increasing their operational efficiency. Big data analytics, cloud, and edge computing are few technologies which is boosting the demand for the digital transformation of businesses. The growing demand for digital transformation of companies has compelled IoT professional service providers to retool their current IoT professional services offerings. The rising popularity of advanced technologies helps organizations which opt for IoT-based digital transformation of their businesses. Retail, agriculture, manufacturing, transportation, and healthcare are verticals undergoing digital transformation. Smart retail, smart manufacturing, and connected health are the applications which resulted in to the growth of IoT-based digital transformation for opt of businesses. Concerns which are associated with data security and privacy are the biggest challenge for the Global IoT Professional Services Market. IoT is vulnerable to threats that could result in substantial financial and data losses. More than 70% of devices which are used in IoT contains critical security vulnerabilities which is a common threat. The IoT professional services market has significant growth potential for enterprises across all verticals; however, maintaining data security and privacy is a key challenge faced by players operating in this market. The installed smart devices and sensors continuously generate a huge amount of data. This is used to help organizations which are handling data gain insights and this is related to the market position for their competitors. The enterprises demand for better security and privacy protections due to the popularity of IoT professional services which is spreading across the world. With the increase in the number of IoT devices, a number of security and privacy issues will arise, and every endpoint, gateway, sensor, and smartphone will become a potential target for hackers. Hence, there is a dire need for IoT security and privacy protection among enterprises. These are the major challenges which are faced during the growth of the Global IoT Professional Services Market.Key Trends:

In October 2022 - Tata Consultancy Services announced a partnership with AIS, Thailand’s largest telecom operator, to enable manufacturers to adopt IoT solutions based on 5G smart network technology. The collaboration integrates AIS’ leadership in telecommunications services in Thailand and TCS’ extensive portfolio of intellectual property and expertise in IT consulting to help Thai enterprises accelerate their growth and transformation using TCS’ 5G-enabled IoT offerings. In September 2022 - Telstra and Cisco announced a new five-year partnership to improve connectivity management for IoT services through the Telstra Control Center powered by Cisco. Telstra has been using Cisco's IoT Control Center SaaS solution for more than 10 years, and it has helped the company achieve its business objectives and generate new revenue streams. Thousands of customers, including Australia's leading financial institutions, retailers, and government, benefit from the company's increased visibility and flexibility in managing their companies and turning IoT data into choices. In February 2022 - Boingo Wireless, a total connectivity provider of distributed antenna systems (DAS), Wi-Fi, and private network, announced its partnership with Qualcomm Technologies Inc. and the Qualcomm Smart Cities Accelerator Program ecosystem to streamline the deployment of IoT devices for venue and enterprise customers leveraging the Qualcomm IoT Services Suite. In February 2022 - Astrocast, a global nanosatellite IoT network, announced a partnership agreement with IoT service provider, UnaBiz, to develop an end-to-end IoT solution for asset tracking and monitoring. Through the partnership, Astrocast will provide its direct-to-satellite data service offering and consulting services to UnaBiz. Furthermore, UnaBiz is expected to facilitate the onboarding of Astrocast-enabled devices on UnaConnect, an ISO27001 certified IoT device management data platform that manages close to a million IoT devices.Global IoT Professional Services Market Segment Analysis:

Based on Type, The segment IoT consulting services is expected to grow with the highest market share because it helps in refining business processes of organizations and are used for formulating different strategies, developing use cases, planning roadmaps, assessing technologies, and framing IoT architectures. The development and implementation of the appropriate IoT applications and architecture in organizations is ensured by providers of IoT consulting services. They guide companies to create new IoT infrastructures and to enhance their existing systems. Providers of IoT consulting services also help non-IT companies with minimal expertise to understand IoT technology. These all factors lead to the grow of the Global IoT Professional Services Market in IoT consulting services segment during the forecast period.IoT Professional Services Market, by Type in 2022

Based on deployment, The segment cloud is growing with the highest CAGR of XX% during the forecast period as it offers scalability and agility in organizations. It provides more functions than on-premises IoT professional services at an affordable cost. With rapid advancements in cloud technology, organizations are inclined toward implementing cost-effective cloud-based solutions. About half of the industry employs, adapts these technologies to execute IoT data analysis, aggregation, and filtering functions closer to the source of the data. Because of the rapid improvements in cloud technology, businesses are increasingly opting for cost-effective cloud-based solutions. The use of cloud-based IoT professional services allows SMEs and large corporations to concentrate on their core capabilities rather than IT operations. Organizations can save money on software, storage, and technical employees by using cloud-based IoT professional services.

IoT Professional Services Market, by Deployment Mode in 2022 (%)

Based on Organization Site, The large enterprises hold the largest market share in the year 2022. To enable efficient deployment, integration, and maintenance of IoT devices for business processes, the large enterprises use IoT professional services platform. Large businesses are among the first to use IoT professional services. Large organizations are said to be more likely than SMEs to utilize IoT professional services. Large organizations have the necessary resources, but the availability of a wide range of solutions and apps creates challenges when it comes to deployment types. This complexity and sophistication of the IT infrastructure may lead to the requirement of a dedicated department for IT infrastructure management. Due to the number of users and the importance of data these organizations have large budgets which may leads to the growth of the Global IoT Professional Services Market.

IoT Professional Services Market, by Organization Size in 2022 (%)

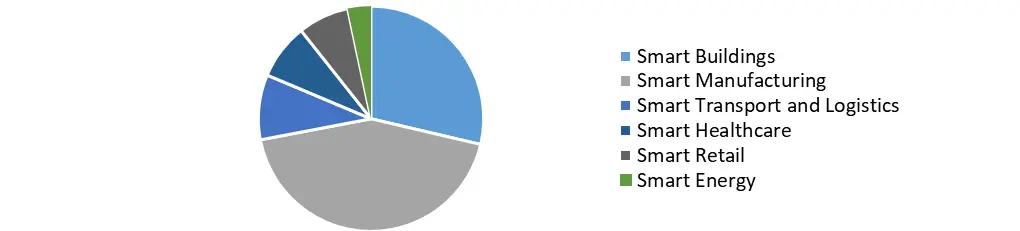

Based on application, the smart transport and logistics are expected to grow with the highest market share in the year 2022. The integration of advanced technologies with the existing transportation and logistics infrastructure to deliver real-time online information related to traffic flow, asset tracking, and passengers/commuters leads to the growth of the Global IoT Professional Services Market. It is also used for traffic management, supply chain and logistics management, inventory management, passenger information system management, fleet management, freight management, cargo and container tracking, ticketing management, and parking management. By deploying IoT technological solutions, IoT professional services help companies operating in the transportation and logistics sectors to achieve automation.

IoT Professional Services Market, by Application in 2022 (%)

IoT Professional Services Market Regional Insights:

North America region is expected to witness significant growth at a CAGR of xx% through the forecast period. This country has sustainable and well-established economies, which empower them to strongly invest in R&D activities and thereby contributing to the development of new technologies. The region is technologically advanced, and several government programs, such as smart cities and industrial IoT, have been implemented (IoT). North American businesses are eager to incorporate IoT technology into their processes due to the early adoption of trending technologies such as IoT, cloud, AI, big data, and mobility. The growth of the market in North America is likely to be fuelled by the emergence of SMEs and the adoption of digitalization in manufacturing sectors by major corporations. Some of the main providers of IoT professional services in North America include DXC Technology, AT&T, IBM, and Cognizant. AT&T linked over 4 million IoT devices in the fourth quarter of 2020. The objective of the report is to present a comprehensive analysis of the Global IoT Professional Services Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global IoT Professional Services Market dynamic, structure by analyzing the market segments and projecting the Global IoT Professional Services Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Global IoT Professional Services Market make the report investor’s guide.IoT Professional Services Market Scope: Inquire before buying

Global IoT Professional Services Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 114.30 Bn. Forecast Period 2023 to 2029 CAGR: 8.22% Market Size in 2029: US $ 198.7 Bn. Segments Covered: by Service Type IoT Consulting Service Technology Consulting Service Business Consulting Service Operational Consulting Service

IoT Infrastructure ServiceNetwork Service Deployment Services Cloud Service

System Designing and Integration ServicePlatform Development and Integration Mobile and Web Application Development

Support and Maintenance Service Education and Training Serviceby Organization Size SMEs Large Enterprises by Deployment Type Cloud On-premises by Application Smart Buildings Smart Manufacturing Smart Transport and Logistics Smart Healthcare Smart Retail Smart Energy IoT Professional Services Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)IoT Professional Services Market, Key Players are

1. Accenture 2. Atos 3. IBM Corporation 4. Cognizant 5. DXC Technology 6. Deloitte 7. Capgemini 8. Tata Consultancy Services 9. NTT DATA Corporation 10. Infosys 11. AT&T Inc. 12. Wipro Limited 13. Happiest Minds 14. Mindtree 15. General Electric 16. Honeywell International Inc. 17. Oracle 18. HCL 19. Virtusa 20. Vodafone 21. Tech Mahindra 22. EY Global 23. Prodapt Solutions 24. Unisys 25. Siemens Advanta Consulting 26. ORBCOMM Frequently Asked Questions: 1] What segments are covered in the Global IoT Professional Services Market report? Ans. The segments covered in the Global IoT Professional Services Market report are based on Type, Deployment, Organization Size and Application. 2] Which region is expected to hold the highest share in the Global IoT Professional Services Market? Ans. North America region is expected to hold the highest share in the Global IoT Professional Services Market. 3] What is the market size of the Global IoT Professional Services Market by 2029? Ans. The market size of the Global IoT Professional Services Market by 2029 is expected to reach US$ 198.7 Bn. 4] What is the forecast period for the Global IoT Professional Services Market? Ans. The forecast period for the Global IoT Professional Services Market is 2023-2029. 5] What was the market size of the Global IoT Professional Services Market in 2022? Ans. The market size of the Global IoT Professional Services Market in 2022 was valued at US$ 114.3 Bn.

1. Global IoT Professional Services Market: Research Methodology 2. Global IoT Professional Services Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global IoT Professional Services Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global IoT Professional Services Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global IoT Professional Services Market Segmentation 4.1. Global IoT Professional Services Market, By Type (2022-2029) • IoT Consulting Service o Technology Consulting Service o Business Consulting Service o Operational Consulting Service • IoT Infrastructure Service o Network Service o Deployment Services o Cloud Service • System Designing and Integration Service o Platform Development and Integration o Mobile and Web Application Development • Support and Maintenance Service • Education and Training Service 4.2. Global IoT Professional Services Market, By Organization Size (2022-2029) • SMEs • Large Enterprises 4.3. Global IoT Professional Services Market, By Deployment (2022-2029) • Cloud • On-premises 4.4. Global IoT Professional Services Market, By Application (2022-2029) • Smart Buildings • Smart Manufacturing • Smart Transport and Logistics • Smart Healthcare • Smart Retail • Smart Energy 5. North America IoT Professional Services Market (2022-2029) 5.1. North America IoT Professional Services Market, By Type (2022-2029) • IoT Consulting Service o Technology Consulting Service o Business Consulting Service o Operational Consulting Service • IoT Infrastructure Service o Network Service o Deployment Services o Cloud Service • System Designing and Integration Service o Platform Development and Integration o Mobile and Web Application Development • Support and Maintenance Service • Education and Training Service 5.2. North America IoT Professional Services Market, By Organization Size (2022-2029) • SMEs • Large Enterprises 5.3. North America IoT Professional Services Market, By Deployment (2022-2029) • Cloud • On-premises 5.4. North America IoT Professional Services Market, By Application (2022-2029) • Smart Buildings • Smart Manufacturing • Smart Transport and Logistics • Smart Healthcare • Smart Retail • Smart Energy 5.5. North America IoT Professional Services Market, by Country (2022-2029) • United States • Canada • Mexico 6. European IoT Professional Services Market (2022-2029) 6.1. European IoT Professional Services Market, By Type (2022-2029) 6.2. European IoT Professional Services Market, By Organization Size (2022-2029) 6.3. European IoT Professional Services Market, By Deployment (2022-2029) 6.4. European IoT Professional Services Market, By Application (2022-2029) 6.5. European IoT Professional Services Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific IoT Professional Services Market (2022-2029) 7.1. Asia Pacific IoT Professional Services Market, By Type (2022-2029) 7.2. Asia Pacific IoT Professional Services Market, By Organization Size (2022-2029) 7.3. Asia Pacific IoT Professional Services Market, By Deployment (2022-2029) 7.4. Asia Pacific IoT Professional Services Market, By Application (2022-2029) 7.5. Asia Pacific IoT Professional Services Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa IoT Professional Services Market (2022-2029) 8.1. Middle East and Africa IoT Professional Services Market, By Type (2022-2029) 8.2. Middle East and Africa IoT Professional Services Market, By Organization Size (2022-2029) 8.3. Middle East and Africa IoT Professional Services Market, By Deployment (2022-2029) 8.4. Middle East and Africa IoT Professional Services Market, By Application (2022-2029) 8.5. Middle East and Africa IoT Professional Services Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America IoT Professional Services Market (2022-2029) 9.1. South America IoT Professional Services Market, By Type (2022-2029) 9.2. South America IoT Professional Services Market, By Organization Size (2022-2029) 9.3. South America IoT Professional Services Market, By Deployment (2022-2029) 9.4. South America IoT Professional Services Market, By Application (2022-2029) 9.5. South America IoT Professional Services Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Accenture 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Atos 10.3. IBM Corporation 10.4. Cognizant 10.5. DXC Technology 10.6. Deloitte 10.7. Capgemini 10.8. Tata Consultancy Services 10.9. NTT DATA Corporation 10.10. Infosys 10.11. AT&T Inc. 10.12. Wipro Limited 10.13. Happiest Minds 10.14. Mindtree 10.15. General Electric 10.16. Honeywell International Inc. 10.17. Oracle 10.18. HCL 10.19. Virtusa 10.20. Vodafone 10.21. Tech Mahindra 10.22. EY Global 10.23. Prodapt Solutions 10.24. Unisys 10.25. Siemens Advanta Consulting 10.26. ORBCOMM