Hydroxyproline Market size was valued at USD 84.53 Million in 2024. The total Hydroxyproline Industry is expected to grow by 5.8 % from 2024 to 2032, reaching nearly USD 132.71 Million in 2032.Global Hydroxyproline Market Overview:

Hydroxyproline is a non-essential amino acid, meaning the body can produce it, and it's primarily found in collagen. Hydroxyproline is formed when proline, another amino acid, undergoes a modification called hydroxylation after a protein is synthesized. Hydroxyproline plays a vital role in maintaining the structure and stability of collagen, which is crucial for the strength and elasticity of various tissues like skin, bones, tendons, and ligaments. The growing emphasis on health, wellness, and anti-aging solutions has been a key factor driving demand for hydroxyproline across global markets. Hydroxyproline, known for its essential role in collagen synthesis, has found increasing application in pharmaceuticals, nutraceuticals, and cosmetics. Countries such as the United States, Germany, France, the United Kingdom, Italy, Japan, China, South Korea, and India have emerged as major contributors to this demand surge in the Hydroxyproline Market.The rise in osteoarthritis and chronic wound cases has created strong demand for collagen-based therapies.

For example, the U.S. has reported over 32.5 million osteoarthritis cases, while Germany, the U.K., and Italy have each recorded millions of affected individuals. This trend has been fueling the adoption of hydroxyproline in joint care and wound healing formulations. Meanwhile, Japan and South Korea have been leveraging hydroxyproline in skincare products, and China and India have become manufacturing hubs for cost-effective, large-scale production. Several companies have responded to this growing need with strategic product launches and acquisitions. BrainMD has introduced Smart Collagen in the U.S. market, Adroit Biomed has launched Fortisil C in India, and Darling Ingredients has acquired Gelnex in Brazil to expand its collagen capabilities. These moves have been reshaping the competitive landscape and have positioned hydroxyproline as a vital ingredient for future health-focused innovation.To know about the Research Methodology :- Request Free Sample Report

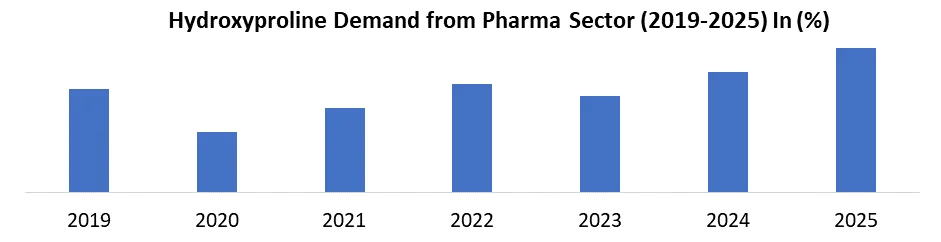

Rising demand in pharmaceuticals to drive the Hydroxyproline Market Growth

The pharmaceutical sector is emerging as a strong growth engine for the Hydroxyproline Market. Hydroxyproline’s vital role in collagen formation makes it indispensable for wound healing, tissue repair, and skin regeneration. With increasing aging populations and non-communicable diseases such as diabetes, there's more demand for quick, efficient recovery options. This is where hydroxyproline comes in, with drug makers more and more using it in collagen-containing creams, injectables, and wound dressings aimed at accelerating healing. Another promising development is its application as a clinical biomarker. Physicians are now using hydroxyproline levels to monitor collagen turnover in postoperative patients or those with connective tissue diseases, providing more effective, more tailored treatment options. And besides, with regenerative medicine increasing in traction, hydroxyproline is being incorporated into tissue-engineered scaffolds, further increasing its applications. the pharmaceutical-grade segment will register a CAGR of XX% between 2025 and 2032, ahead of others, owing to more stringent quality standards and proliferating R&D. Key players such as Kyowa Hakko and Jinyang Pharmaceutical are increasing production levels of high-purity hydroxyproline, indicating a strong, future-oriented demand trajectory.

Limited Raw Material Supply Limits the Hydroxyproline Market Growth

The global hydroxyproline market faces significant restraints due to limited and volatile raw material availability. Disruptions and shipping delays severely impacted the supply of pharmaceutical-grade animal collagen, particularly from New Zealand and Australia, which together account for 38% of the global supply. These delays led to a 22% surge in L-hydroxyproline prices within six months, forcing manufacturers in major production hubs such as India and China to ration supplies and prioritize critical pharmaceutical output. Geopolitical tensions also contribute to supply issues. The 2022 Russia-Ukraine conflict disrupted ammonia supplies, a key fermentation component, resulting in a 15% drop in hydroxyproline yields across European facilities, notably in Germany and France. This extended delivery timeline for collagen-based drugs by up to 60 days and raised operational costs. Regulatory hurdles compound these challenges. In 2023, new FDA guidelines mandating BSE-free certification led 40% of Chinese hydroxyproline exporters to temporarily suspend shipments, creating a shortage equivalent to 850,000 doses of collagenase-based medications monthly. Simultaneously, Brazil’s 2022 drought reduced sugarcane harvests by 12%, affecting glucose availability for fermentation processes. Together, these geopolitical, environmental, and regulatory pressures continue to constrain hydroxyproline production and global supply stability.Growth in nutraceuticals and dietary supplements to creates lucrative growth opportunities for the Hydroxyproline Market

The growing demand for nutraceuticals and dietary supplements is unlocking major opportunities for the hydroxyproline market. As a key amino acid in collagen synthesis, hydroxyproline plays a vital role in promoting joint flexibility, bone strength, and skin elasticity, health benefits highly sought after by aging populations and wellness-driven consumers. This has led to its increasing inclusion in collagen supplements, functional foods, and anti-aging formulations across global markets. In the United States, companies such as Vital Proteins and NeoCell are incorporating hydroxyproline into powders and capsules targeted at joint and skin health. Japan’s Kyowa Hakko has scaled up production using fermentation-based methods to deliver high-purity hydroxyproline to global nutraceutical brands. In India and China, rising health awareness and robust e-commerce networks are driving consumer interest in collagen-based beverages and supplements tailored to both the youth and elderly demographics. Key factors boosting this trend include an aging population across Europe, North America, and East Asia, alongside the popularity of clean-label products and preventive healthcare. Innovations in extraction and biosynthesis techniques are reducing production costs and increasing accessibility. Also, global regulatory support and quality certifications are opening up new pharmaceutical and supplement markets, making this segment a strong engine of hydroxyproline market growth.Regulatory Landscape

Country-Wise Regulatory Overview and Description for the Hydroxyproline Market

Country/Region Regulatory Authority/Framework Description & Key Regulatory Points United States FDA Hydroxyproline used in food, dietary supplements, and pharmaceuticals must comply with FDA regulations. Cosmetic and supplement products require labeling and safety data. High demand due to aging population and beauty industry growth. European Union EFSA, EMA, Regulation (EU) No 1169/2011 Strict requirements for food labeling, safety, and traceability. Hydroxyproline in supplements/foods must comply with Novel Food regulations and ingredient safety standards. Pharmaceutical use follows EMA guidelines. High-purity, traceable sources required. Japan MHLW, PMDA Rigorous approval for food, cosmetic, and pharmaceutical applications. Focus on anti-aging, beauty, and functional foods. High demand due to longevity trends and active lifestyle focus. France ANSM, ANSES Hydroxyproline approved in certain topical pharmaceutical products (e.g., Cicactive gel). Must comply with EU and French pharma regulations. Germany, Italy, UK National Health Authorities, EFSA High standards for ingredient purity and safety in food, pharma, and cosmetics. Market growth is supported by aging populations and demand for nutraceuticals. Hydroxyproline Market Segment Analysis:

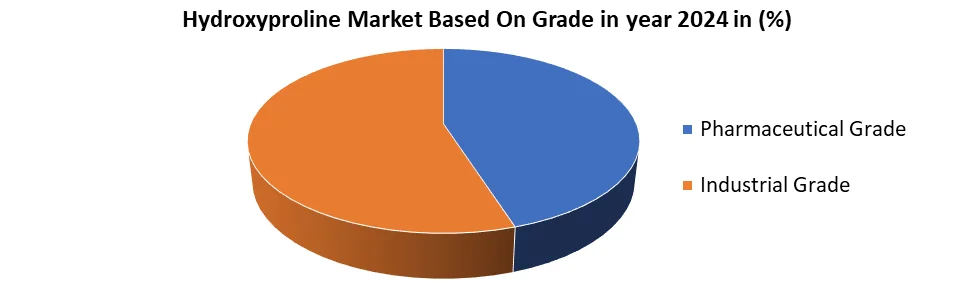

Based on Grade, The Market is segmented into Pharmaceutical Grade and Industrial Grade. The Industrial Grade segment held the largest market share in 2024. The industrial grade segment emerged as the dominant force in the hydroxyproline market, driven by its extensive application across diverse sectors such as cosmetics, food processing, animal nutrition, and biochemical industries. Unlike pharmaceutical grade, industrial grade does not require ultra-high purity, making it a cost-effective option for mass-market products. In countries such as China and India, it is widely utilized as a protein fortifier in functional foods and beverages, as well as a feed additive to enhance the nutritional profile of animal diets. Its affordability and versatility make it highly suitable for large-scale, price-sensitive applications. Also, its usage in less-regulated industries ensures consistent demand, further reinforcing its Market dominance. Although pharmaceutical-grade hydroxyproline is experiencing faster growth due to increasing use in wound healing and regenerative medicine, the industrial grade continues to lead in terms of volume. Its broader application base, lower production cost, and stable consumption across various non-therapeutic sectors have enabled it to maintain the largest market share, underscoring its critical role in sustaining the global hydroxyproline supply chain.

Hydroxyproline Market Regional Analysis:

North America accounted for the largest share of the global Hydroxyproline Market in 2024.The Region’s advanced pharmaceutical, nutraceutical, and personal care sectors. High consumer awareness regarding health, aging, and wellness has significantly boosted the demand for collagen-based products. The growing elderly population and rising cases of joint and skin-related conditions have boosted the uptake of hydroxyproline enriched supplements. Prominent U.S. brands such as Vital Proteins and NeoCell continue to expand their collagen supplement portfolios to meet this demand. Supportive regulatory frameworks, such as the U.S. FDA’s simplified approval process for dietary supplements and NIH-backed research funding, accelerates market growth. Strategic collaborations between supplement companies and biotech firms are driving innovations, including the use of fermentation-based hydroxyproline production, which improves sustainability and purity. Moreover, North America's robust distribution networks and favorable regulatory environment have accelerated product launches and market penetration. These factors collectively reinforce the region’s dominant position in the global hydroxyproline market.Hydroxyproline Market Recent Developments:

1. In August 2024, Kenvue launched Neutrogena Collagen Bank, featuring Kenvue’s patented micro-peptide technology. This launch enabled the company to move into the pre-aging category to meet the demand for skin aging among the population. 2. In June 2023, Revive Collagen launched its collagen supplement brand Revive Collagen with an aim to strengthen its presence in Europe. Thus, a growing number of product launches for dietary supplements, among others, is likely to augment the demand for hydroxyproline. 3. According to 2023 statistics published by the Yale School of Medicine, it was reported that about one in four people are affected by skin health in the U.S. Thus, the growing prevalence of skin disorders is supporting the rising demand for collagen-based products, driving the regional market growth. 4. For instance, according to a 2023 study published by the Japan Society for the Promotion of Science, hydroxyproline is an effective therapeutic agent for muscular atrophy among the patient population. Thus, the growing number of clinical studies, among other factors, is likely to support the regional market growth.Hydroxyproline Market Scope: Inquiry Before Buying

Global Hydroxyproline Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 84.53 Million Forecast Period 2025 to 2032 CAGR: 5.8% Market Size in 2032: USD 132.71 Million Segments Covered: by Grade Pharmaceutical Grade Industrial Grade by End User Pharmaceutical & Biotechnological Companies Cosmeceutical Companies Nutraceutical Companies Others Hydroxyproline Market by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Hydroxyproline Market Top Key players are:

1. Kyowa Hakko Bio 2. Evonik Industries 3. Jinyang Pharmaceutical 4. Beile Group 5. Puyer Biopharma 6. Fengchen Group 7. Merck KGaA 8. Baokang Biological 9. Wuxi Jinghai Amino Acid 10. Jiangxi Hengtian 11. Dongchen Biology 12. Hebei Fangrui 13. ACERBLEND Ingredients 14. Haitian Amino Acid 15. Hebei Dahe 16. Hebei Bolunte 17. HY Group 18. Thermo Fisher Scientific 19. Sigma-Aldrich 20. Tokyo Chemical Industry 21. Quickzyme Biosciences 22. HQ Biosciences 23. Human Biosciences 24. AECOCHEM 25. Ningbo Create-Bio 26. LGC Limited 27. MP Biomedicals 28. Spectrum Chemical 29. Acros Organics 30. BioibericaFrequently Asked Questions:

1) What are the key applications of hydroxyproline? Answer: Hydroxyproline is used in pharmaceuticals, nutraceuticals, cosmetics, food & beverages, and animal feed. 2).What is driving the growth of the hydroxyproline market? Answer: Rising demand for collagen-based products, increasing health awareness, expanding pharmaceutical applications, and aging populations are major growth drivers. 3).Which region dominates the hydroxyproline market? Answer: North America holds the largest market share due to high consumer awareness and a strong nutraceutical/pharmaceutical industry, followed by Asia-Pacific due to rising manufacturing and consumption. 4).Who are the major players in the hydroxyproline market? Answer: Key players include Kyowa Hakko Bio, Evonik Industries, Merck KGaA, Fengchen Group, Quickzyme Biosciences, and Thermo Fisher Scientific, among others. 5).What are the challenges in this market? Answer: Key challenges include limited raw material availability, high production costs for pharmaceutical-grade hydroxyproline, and regulatory constraints.

1. Hydroxyproline Market: Research Methodology 2. Hydroxyproline Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Hydroxyproline Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Service Segment 3.3.3. End-user Segment 3.3.4. Revenue (2024) 3.3.5. Company Locations 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Mergers and Acquisitions Details 4. Hydroxyproline Market: Dynamics 4.1. Hydroxyproline Market Trends 4.2. Hydroxyproline Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technology Roadmap 4.6. Regulatory Landscape 4.7. Key Opinion Leader Analysis for Hydroxyproline Market 4.8. Analysis of Government Schemes and Initiatives for the Hydroxyproline Market 5. Hydroxyproline Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 5.1.1. Pharmaceutical Grade 5.1.2. Industrial Grade 5.2. Hydroxyproline Market Size and Forecast, By End User (2024-2032) 5.2.1. Pharmaceutical & Biotechnological Companies 5.2.2. Cosmeceutical Companies 5.2.3. Nutraceutical Companies 5.2.4. Others 5.3. Hydroxyproline Market Size and Forecast, by region (2024-2032) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Hydroxyproline Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. North America Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 6.1.1. Pharmaceutical Grade 6.1.2. Industrial Grade 6.2. North America Hydroxyproline Market Size and Forecast, By End User (2024-2032) 6.2.1. Pharmaceutical & Biotechnological Companies 6.2.2. Cosmeceutical Companies 6.2.3. Nutraceutical Companies 6.2.4. Others 6.3. North America Hydroxyproline Market Size and Forecast, by Country (2024-2032) 6.3.1. United States 6.3.1.1. United States Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 6.3.1.1.1. Pharmaceutical Grade 6.3.1.1.2. Industrial Grade 6.3.1.2. United States Hydroxyproline Market Size and Forecast, By End User (2024-2032) 6.3.1.2.1. Pharmaceutical & Biotechnological Companies 6.3.1.2.2. Cosmeceutical Companies 6.3.1.2.3. Nutraceutical Companies 6.3.1.2.4. Others 6.3.2. Canada 6.3.2.1. Canada Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 6.3.2.1.1. Pharmaceutical Grade 6.3.2.1.2. Industrial Grade 6.3.2.2. Canada Hydroxyproline Market Size and Forecast, By End User (2024-2032) 6.3.2.2.1. Pharmaceutical & Biotechnological Companies 6.3.2.2.2. Cosmeceutical Companies 6.3.2.2.3. Nutraceutical Companies 6.3.2.2.4. Others 6.3.3. Mexico 6.3.3.1. Mexico Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 6.3.3.1.1. Pharmaceutical Grade 6.3.3.1.2. Industrial Grade 6.3.3.2. Mexico Hydroxyproline Market Size and Forecast, By End User (2024-2032) 6.3.3.2.1. Pharmaceutical & Biotechnological Companies 6.3.3.2.2. Cosmeceutical Companies 6.3.3.2.3. Nutraceutical Companies 6.3.3.2.4. Others 7. Europe Hydroxyproline Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Europe Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.2. Europe Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3. Europe Hydroxyproline Market Size and Forecast, by Country (2024-2032) 7.3.1. United Kingdom 7.3.1.1. United Kingdom Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.1.2. United Kingdom Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.2. France 7.3.2.1. France Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.2.2. France Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.3. Germany 7.3.3.1. Germany Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.3.2. Germany Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.4. Italy 7.3.4.1. Italy Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.4.2. Italy Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.5. Spain 7.3.5.1. Spain Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.5.2. Spain Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.6. Sweden 7.3.6.1. Sweden Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.6.2. Sweden Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.7. Austria 7.3.7.1. Austria Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.7.2. Austria Hydroxyproline Market Size and Forecast, By End User (2024-2032) 7.3.8. Rest of Europe 7.3.8.1. Rest of Europe Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 7.3.8.2. Rest of Europe Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8. Asia Pacific Hydroxyproline Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Asia Pacific Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.2. Asia Pacific Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3. Asia Pacific Hydroxyproline Market Size and Forecast, by Country (2024-2032) 8.3.1. China 8.3.1.1. China Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.1.2. China Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.2. S Korea 8.3.2.1. S Korea Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.2.2. S Korea Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.3. Japan 8.3.3.1. Japan Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.3.2. Japan Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.4. India 8.3.4.1. India Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.4.2. India Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.5. Australia 8.3.5.1. Australia Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.5.2. Australia Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.6. Indonesia 8.3.6.1. Indonesia Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.6.2. Indonesia Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.7. Malaysia 8.3.7.1. Malaysia Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.7.2. Malaysia Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.8. Vietnam 8.3.8.1. Vietnam Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.8.2. Vietnam Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.9. Taiwan 8.3.9.1. Taiwan Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.9.2. Taiwan Hydroxyproline Market Size and Forecast, By End User (2024-2032) 8.3.10. Rest of Asia Pacific 8.3.10.1. Rest of Asia Pacific Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 8.3.10.2. Rest of Asia Pacific Hydroxyproline Market Size and Forecast, By End User (2024-2032) 9. Middle East and Africa Hydroxyproline Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Middle East and Africa Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 9.2. Middle East and Africa Hydroxyproline Market Size and Forecast, By End User (2024-2032) 9.3. Middle East and Africa Hydroxyproline Market Size and Forecast, by Country (2024-2032) 9.3.1. South Africa 9.3.1.1. South Africa Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 9.3.1.2. South Africa Hydroxyproline Market Size and Forecast, By End User (2024-2032) 9.3.2. GCC 9.3.2.1. GCC Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 9.3.2.2. GCC Hydroxyproline Market Size and Forecast, By End User (2024-2032) 9.3.3. Nigeria 9.3.3.1. Nigeria Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 9.3.3.2. Nigeria Hydroxyproline Market Size and Forecast, By End User (2024-2032) 9.3.4. Rest of ME&A 9.3.4.1. Rest of ME&A Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 9.3.4.2. Rest of ME&A Hydroxyproline Market Size and Forecast, By End User (2024-2032) 10. South America Hydroxyproline Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. South America Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 10.2. South America Hydroxyproline Market Size and Forecast, By End User (2024-2032) 10.3. South America Hydroxyproline Market Size and Forecast, by Country (2024-2032) 10.3.1. Brazil 10.3.1.1. Brazil Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 10.3.1.2. Brazil Hydroxyproline Market Size and Forecast, By End User (2024-2032) 10.3.2. Argentina 10.3.2.1. Argentina Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 10.3.2.2. Argentina Hydroxyproline Market Size and Forecast, By End User (2024-2032) 10.3.3. Chile 10.3.3.1. Chile Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 10.3.3.2. Chile Hydroxyproline Market Size and Forecast, By End User (2024-2032) 10.3.4. Rest Of South America 10.3.4.1. Rest Of South America Hydroxyproline Market Size and Forecast, By Grade (2024-2032) 10.3.4.2. Rest Of South America Hydroxyproline Market Size and Forecast, By End User (2024-2032) 11. Company Profile: Key Players 11.1. Kyowa Hakko Bio 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Evonik Industries 11.3. Jinyang Pharmaceutical 11.4. Beile Group 11.5. Puyer Biopharma 11.6. Fengchen Group 11.7. Merck KGaA 11.8. Baokang Biological 11.9. Wuxi Jinghai Amino Acid 11.10. Jiangxi Hengtian 11.11. Dongchen Biology 11.12. Hebei Fangrui 11.13. ACERBLEND Ingredients 11.14. Haitian Amino Acid 11.15. Hebei Dahe 11.16. Hebei Bolunte 11.17. HY Group 11.18. Thermo Fisher Scientific 11.19. Sigma-Aldrich 11.20. Tokyo Chemical Industry 11.21. Quickzyme Biosciences 11.22. HQ Biosciences 11.23. Human Biosciences 11.24. AECOCHEM 11.25. Ningbo Create-Bio 11.26. LGC Limited 11.27. MP Biomedicals 11.28. Spectrum Chemical 11.29. Acros Organics 11.30. Bioiberica 12. Key Findings 13. Industry Recommendations