Hybrid Truck Market was valued at USD 26.10 Bn in 2024, and total global Hybrid Truck Market revenue is expected to grow at a CAGR of 7.8% from 2025 to 2032, reaching nearly USD 47.60 Bn.Hybrid Truck Market Overview

Hybrid truck is a commercial vehicle that uses combination of internal combustion and electric powertrains to optimize fuel efficiency and reduce emissions. The hybrid truck market encompasses vehicles across light, medium and heavy-duty segments, integrating parallel, series and plug-in hybrid technologies. Major growth driver has been tightening of global emission norms, pushing OEMs toward sustainable transport solution. Rising urban logistics and electrification of fleets have bolstered demand, while component cost and hybrid system complexity moderately constrain supply. North America led hybrid truck market in 2024 due to stringent emission regulation and infrastructure support, while Asia Pacific follows with rapid production scale up, particularly in China and India. Key players like Volvo Group, BYD Auto and Ford are shaping innovation through integrated powertrains and scalable hybrid platforms. Notably, end users in public transit and urban delivery are accelerating hybrid adoption. Recent trade policies and regional subsidies have further stimulated hybrid truck production and cross border component sourcing. Report covers the Hybrid Truck Market dynamic, structure by analysing the market segments and projecting Hybrid Truck Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies and regional presence in Hybrid Truck Market.To know about the Research Methodology :- Request Free Sample Report

Hybrid Truck Market Dynamics

Rising Emission Norms to Drive the Hybrid Truck Market Growth in Electric Buses and Trucks Regulatory agencies are enacting more stringent emission limits as public awareness of pollution develops. As pollution restrictions become more stringent, automakers are being driven to build hybrid and electric vehicles. Automobiles that run on gasoline or diesel emit more greenhouse gases than hybrid ones. Governments in the United States and Europe are working on lowering pollution regulations and boosting automotive fuel economy in order to minimize greenhouse gas emissions. The US Department of Transportation, for example, created the Corporate Average Fuel Economy (CAFE) requirements for automobiles. Electrification of MHDV powertrains has long been recognized as a way to reduce fuel costs and emissions for the nation's freight movement, the development of a competitive market for electrified commercial vehicles has lagged well behind that of light trucks. In the 1930s, the United Parcel Service used electric delivery vans. In the last ten years, battery performance has improved and battery costs have reduced, making MHDV electrification more appealing. According to industry sources, these low pricing have yet to be realized in the MHDV sector due to low volume purchases and unique pack needs. Electric commercial vehicles are being reevaluated, and they are now being used in freight, package delivery, and buses on the road. Buses are the most popular electric commercial vehicle in the world, with large numbers in China and Europe. According to the American Public Transit Association, US transit agencies had 9,821 electrified buses in 2022, with 538 of these being battery electric vehicles (BEVs). A range of incentives and laws have aided this business. The National Academies of Sciences, Engineering, and Medicine released a report in 2021 on the state of battery-electric buses in the United States, which included a survey of 21 transportation organizations that have previously deployed electric buses. By 2030, approximately 160,000 battery-electric trucks will be delivered annually. China accounted for 79% of global battery-electric truck deliveries in 2023, but that figure is expected to drop to 80 percent by 2030. The global battery-electric bus market will be dominated by intercity buses, which will account for 31% of the market. This is owing to China's heavy subsidies on hybrid and electric intercity buses, which will account for the great bulk of worldwide demand over the predicted period. Yutong and BYD are the market leaders in both China and the rest of the world. EVs Pose a Challenge to the Expansion of Fuel Cell and Hybrid Vehicles The rising demand for battery electric cars (BEVs) and fuel cell electric vehicles will be one of the major obstacles to the expansion of hybrid vehicles (FCEVs). There is a range of models and types of BEVs in the passenger car category, including hatchbacks, sedans, and SUVs. BYD (China), Tesla (USA), and Volkswagen (Germany) are just a few of the automakers putting more attention on BEV research. FCEVs features a long-range, fast recharging, silent operating, and no greenhouse gas or air pollution emissions. As a result of these benefits, demand for FCEVs is increasing. Governments are also taking initiatives to promote and support the use of fuel cells in transportation, which might boost demand for fuel cells in the automotive and transportation industries.Hybrid Truck Market Segmentation

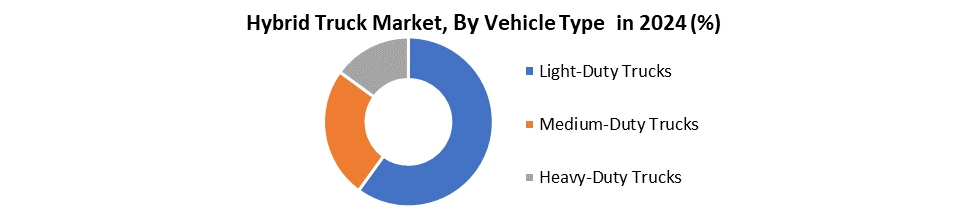

Based on Power Train, the hybrid truck market is segmented into parallel and series hybrids. The parallel hybrid segment is estimated to hold the largest market share by volume throughout the forecast period. This market is likely to grow as the adoption of regenerative braking technology increases. A regenerative braking system returns energy to the battery when the brakes are used. As a result, there is less of a requirement for external electric infrastructure. The regenerative braking system is the most common technology in hybrid vehicles. The use of regenerative braking and the reduced cost of micro and mild hybrids compared to PHEVs will improve parallel hybrid demand. Based on Vehicle Type, the hybrid truck market is segmented by vehicle type into Light-Duty Trucks (LDT), Medium-Duty Trucks (MDT), and Heavy-Duty Trucks (HDT). Light-duty trucks, such as hybrid pickups and delivery vans, are widely used in urban logistics due to their fuel efficiency and ease of electrification. Medium-duty trucks serve applications like municipal services and short-range distribution, offering a balance of payload and range. Heavy-duty trucks, used for long-haul and industrial transport, are slower to adopt hybrid tech due to high power demands. Currently, light and medium-duty trucks dominate the hybrid market, driven by stricter emission norms and growing demand for sustainable fleet operations.

Hybrid Truck Market Regional Analysis

North America led the global hybrid truck market in 2024, this dominance is driven by stringent emission regulations in the U.S. and Canada, which compel fleet operators and manufacturers to adopt cleaner technologies. High profile incentives and robust infrastructure like charging stations suitable for plug-in hybrids further bolster adoption rates. Asia Pacific is growing faster with countries like Japan, China and India ramping up hybrid and electric truck production, North America remains the substantial market segment. The presence of major OEMs (e.g., Ford, GM) and a strong commercial trucking industry reinforce this regional leadership. In contrast, Europe is also a significant player, spurred by tight climate targets, but lags behind North America and APAC in scale. Hybrid Truck Market Competitive Landscape Hybrid truck market is increasingly shaped by three dominant players: Volvo Group (Sweden), BYD Auto (China) and Ford Motor Company (U.S.). Volvo Group leads in medium and heavy duty hybrid solution, leveraging its advanced powertrain technology, strong European base, and growing global reach. Focus on integrated fleet services and carbon neutrality positions it as a long term leader. BYD Auto, backed by China supportive EV policies and in house battery production, is rapidly expanding its hybrid commercial vehicle footprint across Asia, Latin America and Africa. Its vertically integrated model allows for cost efficiency and product agility. Ford, traditional powerhouse in North America, excels in light duty hybrid segment with models like the F-150 Power Boost. While innovation in vehicle connectivity is commendable, scaling in heavier segments remain a challenge. As the industry evolves, leadership will depend on control over battery ecosystem, regulatory alignment, and regional adaptability across logistics and fleet application. Hybrid Truck Market TrendsHybrid Truck Market Key Developments • 28th May 2025, Shanghai Auto (China), Geely launched the Radar Horizon EM P a plug-in hybrid pickup featuring a 1.5 L turbo and 3-speed hybrid transmission initiating production in China. • 10th January 2025, Toyota’s (Japan) Hino Motors and Daimler’s Mitsubishi Fuso Truck & Bus finalized a merger to form a new listed holding company in Tokyo, each owning 25%. The integrated entity will combine R&D, production, and procurement efforts accelerating clean-energy technologies, including hydrogen trucks targeted to launch by April 2026 • 18th December 2024, Stellantis (U.S.) announced on this date it is advancing the release of the Ram 1500 Ramcharger hybrid pickup, reacting to weaker EV uptake. Consumer orders will open in the first half of 2025, representing a strategic shift back toward hybrids over fully electric models • 17th October 2024, Bharat Forge (India) acquired U.S.-based American Axle & Manufacturing for USD 64.8 million. This move strengthens Bharat Forge’s drive train and hybrid component manufacturing capabilities impacting hybrid truck production globally. • 4th May 2024, BYD (China) unveiled its Shark plug-in hybrid mid-size pickup in Mexico marking BYD’s first global debut outside China. Subsequent launches occurred in Australia (Oct 2024) and Brazil (Oct 2024). It features BYD’s innovative longitudinal range extender hybrid layout.

Trends Details Advanced hybrid powertrains & differentiated architectures Manufacturers are developing new hybrid layouts from mild/full hybrids to plug-in and range extender systems often integrating innovative battery types (e.g., gas-powered series hybrids, LFP blade batteries) to boost efficiency, range, and towing. Tech integration: regenerative braking, connectivity & vehicle-as-power-source Hybrid trucks now come equipped with regenerative braking, telematics/AI-based energy management, advanced driver-assist features, and onboard power (e.g., Pro Power Onboard), enhancing efficiency and utility Regulatory & fleet-driven adoption fueling plug-in and heavy-duty hybrids Stricter emissions policies and incentives are driving OEMs to roll out hybrid versions including PHEVs and heavy-duty variants as a transitional solution ahead of full EVs. Fleet demands for sustainable, lower-cost trucks support growth. Hybrid Truck Market Scope: Inquiry Before Buying

Hybrid Truck Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 26.10 Bn. Forecast Period 2025 to 2032 CAGR: 7.8% Market Size in 2032: USD 47.60 Bn. Segments Covered: by Technology Parallel Hybrid Series Hybrid Series-parallel Hybrid Plug-in Hybrid by Hybrid Type Full Hybrid Micro Hybrid Mild Hybrid by Vehicle Type Light-Duty Trucks Medium-Duty Trucks Heavy-Duty Trucks by Power Train Type Series Parallel Hybrid Truck Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hybrid Truck Market Key Players

North America 1. Ford Motor Company (U.S.) 2. General Motors (GM) (U.S.) 3. PACCAR Inc. (U.S.) 4. Workhorse Group Inc. (U.S.) 5. XL Fleet Corp. (U.S.) 6. Nikola Corporation (U.S.) Europe 7. Volvo Group (Sweden) 8. Daimler Truck AG (Germany) 9. Iveco Group (Italy) 10. MAN Truck & Bus SE (Germany) 11. Renault Trucks (France) 12. Scania AB (Sweden) 13. DAF Trucks (Netherlands) Asia Pacific 14. BYD Auto Co., Ltd. (China) 15. Tata Motors (India) 16. Ashok Leyland (India) 17. Hino Motors, Ltd. (Japan) 18. Isuzu Motors Ltd. (Japan) 19. Toyota Motor Corporation (Japan) 20. Mitsubishi Fuso Truck and Bus Corporation (Japan) 21. Dongfeng Motor Corporation (China) 22. FAW Group Corporation (China) 23. Hyundai Motor Company (South Korea) Middle East & Africa 24. Ashok Leyland UAE LLC (UAE) 25. Shacman Trucks Middle East (UAE) 26. Laraki Automotive (Morocco) South America 27. Volkswagen (Brazil) 28. Agrale S.A. (Brazil) 29. Mercedes-Benz do (Brazil) 30. Volvo do Brasil (Brazil)Hybrid Truck Market FAQs

1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Vehicle Type, Manufacturing Method, and Material Type 2] Which region is expected to hold the highest share in the Global Market? Ans. The North America region is expected to hold the highest share in the Market. 3] What is the market size of the Global Market by 2032? Ans. The market size of the Market by 2032 is expected to reach USD 47.60 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2025-2032. 5] What was the market size of the Global Market in 2024? Ans. The market size of the Hybrid Truck Market in 2024 was valued at USD 26.10 Bn.

1. Hybrid Truck Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Hybrid Truck Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Hybrid Truck Market: Dynamics 3.1. Region wise Trends of Hybrid Truck Market 3.1.1. North America Hybrid Truck Market Trends 3.1.2. Europe Hybrid Truck Market Trends 3.1.3. Asia Pacific Hybrid Truck Market Trends 3.1.4. Middle East and Africa Hybrid Truck Market Trends 3.1.5. South America Hybrid Truck Market 3.2. Hybrid Truck Market Dynamics 3.2.1. Global Hybrid Truck Market Drivers 3.2.1.1. Tightening Emission Norms 3.2.1.2. Urban Freight Demand 3.2.1.3. Fuel Efficiency Goals 3.2.2. Global Hybrid Truck Market Restraints 3.2.3. Global Hybrid Truck Market Opportunities 3.2.3.1. Fleet Electrification Push 3.2.3.2. Government Incentive Schemes 3.2.3.3. Emerging Market Penetration 3.2.4. Global Hybrid Truck Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Government Subsidies 3.4.2. Fuel Cost Savings 3.4.3. Emission Norms Enforcement 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Analysis of Government Schemes and Initiatives for Hybrid Truck Industry 3.7. Key Opinion Leader Analysis 4. Hybrid Truck Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 4.1.1. Parallel Hybrid 4.1.2. Series Hybrid 4.1.3. Series-parallel Hybrid 4.1.4. Plug-in Hybrid 4.2. Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 4.2.1. Full Hybrid 4.2.2. Micro Hybrid 4.2.3. Mild Hybrid 4.3. Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 4.3.1. Light-Duty Trucks 4.3.2. Medium-Duty Trucks 4.3.3. Heavy-Duty Trucks 4.4. Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 4.4.1. Series 4.4.2. Parallel 4.5. Hybrid Truck Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Hybrid Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 5.1.1. Parallel Hybrid 5.1.2. Series Hybrid 5.1.3. Series-parallel Hybrid 5.1.4. Plug-in Hybrid 5.2. North America Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 5.2.1. Full Hybrid 5.2.2. Micro Hybrid 5.2.3. Mild Hybrid 5.3. North America Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 5.3.1. Light-Duty Trucks 5.3.2. Medium-Duty Trucks 5.3.3. Heavy-Duty Trucks 5.4. North America Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 5.4.1. Series 5.4.2. Parallel 5.5. North America Hybrid Truck Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 5.5.1.1.1. Parallel Hybrid 5.5.1.1.2. Series Hybrid 5.5.1.1.3. Series-parallel Hybrid 5.5.1.1.4. Plug-in Hybrid 5.5.1.2. United States Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 5.5.1.2.1. Full Hybrid 5.5.1.2.2. Micro Hybrid 5.5.1.2.3. Mild Hybrid 5.5.1.3. United States Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.1.3.1. Light-Duty Trucks 5.5.1.3.2. Medium-Duty Trucks 5.5.1.3.3. Heavy-Duty Trucks 5.5.1.4. United States Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 5.5.1.4.1. Series 5.5.1.4.2. Parallel 5.5.2. Canada 5.5.2.1. Canada Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 5.5.2.1.1. Parallel Hybrid 5.5.2.1.2. Series Hybrid 5.5.2.1.3. Series-parallel Hybrid 5.5.2.1.4. Plug-in Hybrid 5.5.2.2. Canada Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 5.5.2.2.1. Full Hybrid 5.5.2.2.2. Micro Hybrid 5.5.2.2.3. Mild Hybrid 5.5.2.3. Canada Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.2.3.1. Light-Duty Trucks 5.5.2.3.2. Medium-Duty Trucks 5.5.2.3.3. Heavy-Duty Trucks 5.5.2.4. Canada Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 5.5.2.4.1. Series 5.5.2.4.2. Parallel 5.5.3. Mexico 5.5.3.1. Mexico Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 5.5.3.1.1. Parallel Hybrid 5.5.3.1.2. Series Hybrid 5.5.3.1.3. Series-parallel Hybrid 5.5.3.1.4. Plug-in Hybrid 5.5.3.2. Mexico Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 5.5.3.2.1. Full Hybrid 5.5.3.2.2. Micro Hybrid 5.5.3.2.3. Mild Hybrid 5.5.3.3. Mexico Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 5.5.3.3.1. Light-Duty Trucks 5.5.3.3.2. Medium-Duty Trucks 5.5.3.3.3. Heavy-Duty Trucks 5.5.3.4. Mexico Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 5.5.3.4.1. Series 5.5.3.4.2. Parallel 6. Europe Hybrid Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.2. Europe Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.3. Europe Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.4. Europe Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5. Europe Hybrid Truck Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.1.2. United Kingdom Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.1.3. United Kingdom Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.1.4. United Kingdom Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.2. France 6.5.2.1. France Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.2.2. France Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.2.3. France Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.2.4. France Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.3.2. Germany Hybrid Truck Market Size and Forecast, By Hybrid Type 2025-2032) 6.5.3.3. Germany Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.3.4. Germany Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.4.2. Italy Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.4.3. Italy Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.4.4. Italy Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.5.2. Spain Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.5.3. Spain Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.5.4. Spain Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.6.2. Sweden Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.6.3. Sweden Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.6.4. Sweden Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.7.2. Russia Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.7.3. Russia Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.7.4. Russia Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 6.5.8.2. Rest of Europe Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 6.5.8.3. Rest of Europe Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 6.5.8.4. Rest of Europe Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7. Asia Pacific Hybrid Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.2. Asia Pacific Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.3. Asia Pacific Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.4. Asia Pacific Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5. Asia Pacific Hybrid Truck Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.1.2. China Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.1.3. China Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.1.4. China Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.2.2. S Korea Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.2.3. S Korea Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.2.4. S Korea Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.3.2. Japan Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.3.3. Japan Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.3.4. Japan Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.4. India 7.5.4.1. India Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.4.2. India Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.4.3. India Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.4.4. India Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.5.2. Australia Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.5.3. Australia Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.5.4. Australia Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.6.2. Indonesia Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.6.3. Indonesia Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.6.4. Indonesia Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.7.2. Malaysia Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.7.3. Malaysia Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.7.4. Malaysia Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.8.2. Philippines Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.8.3. Philippines Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.8.4. Philippines Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.9.2. Thailand Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.9.3. Thailand Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.9.4. Thailand Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.10.2. Vietnam Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.10.3. Vietnam Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.10.4. Vietnam Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 7.5.11.2. Rest of Asia Pacific Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 7.5.11.4. Rest of Asia Pacific Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 8. Middle East and Africa Hybrid Truck Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 8.2. Middle East and Africa Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 8.3. Middle East and Africa Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 8.4. Middle East and Africa Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 8.5. Middle East and Africa Hybrid Truck Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 8.5.1.2. South Africa Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 8.5.1.3. South Africa Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.1.4. South Africa Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 8.5.2.2. GCC Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 8.5.2.3. GCC Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.2.4. GCC Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 8.5.3.2. Egypt Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 8.5.3.3. Egypt Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.3.4. Egypt Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 8.5.4.2. Nigeria Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 8.5.4.3. Nigeria Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.4.4. Nigeria Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 8.5.5.2. Rest of ME&A Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 8.5.5.3. Rest of ME&A Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 8.5.5.4. Rest of ME&A Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 9. South America Hybrid Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 9.2. South America Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 9.3. South America Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 9.4. South America Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 9.5. South America Hybrid Truck Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 9.5.1.2. Brazil Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 9.5.1.3. Brazil Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.1.4. Brazil Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 9.5.2.2. Argentina Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 9.5.2.3. Argentina Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.2.4. Argentina Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 9.5.3.2. Colombia Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 9.5.3.3. Colombia Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.3.4. Colombia Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 9.5.4.2. Chile Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 9.5.4.3. Chile Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.4.4. Chile Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Hybrid Truck Market Size and Forecast, By Technology (2024-2032) 9.5.5.2. Rest of South America Hybrid Truck Market Size and Forecast, By Hybrid Type (2024-2032) 9.5.5.3. Rest of South America Hybrid Truck Market Size and Forecast, By Vehicle Type (2024-2032) 9.5.5.4. Rest of South America Hybrid Truck Market Size and Forecast, By Power Train Type (2024-2032) 10. Company Profile: Key Players 10.1. Volvo Group (Sweden) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Ford Motor Company (U.S.) 10.3. General Motors (GM) (U.S.) 10.4. PACCAR Inc. (U.S.) 10.5. Workhorse Group Inc. (U.S.) 10.6. XL Fleet Corp. (U.S.) 10.7. Nikola Corporation (U.S.) 10.8. Daimler Truck AG (Germany) 10.9. Iveco Group (Italy) 10.10. MAN Truck & Bus SE (Germany) 10.11. Renault Trucks (France) 10.12. Scania AB (Sweden) 10.13. DAF Trucks (Netherlands) 10.14. BYD Auto Co., Ltd. (China) 10.15. Tata Motors (India) 10.16. Ashok Leyland (India) 10.17. Hino Motors, Ltd. (Japan) 10.18. Isuzu Motors Ltd. (Japan) 10.19. Toyota Motor Corporation (Japan) 10.20. Mitsubishi Fuso Truck and Bus Corporation (Japan) 10.21. Dongfeng Motor Corporation (China) 10.22. FAW Group Corporation (China) 10.23. Hyundai Motor Company (South Korea) 10.24. Ashok Leyland UAE LLC (UAE) 10.25. Shacman Trucks Middle East (UAE) 10.26. Laraki Automotive (Morocco) 10.27. Volkswagen (Brazil) 10.28. Agrale S.A. (Brazil) 10.29. Mercedes-Benz do (Brazil) 10.30. Volvo do Brasil (Brazil) 11. Key Findings 12. Industry Recommendations 13. Hybrid Truck Market: Research Methodology