Global Household Vacuum Cleaners Market size was valued at USD 17.90 Bn. in 2024, and the total Household Vacuum Cleaners Market revenue is expected to grow by 5.2% from 2025 to 2032, reaching nearly USD 26.85 Bn.Household Vacuum Cleaners Market Overview:

Household vacuum cleaners are a necessary type of home appliance that is used for cleaning carpet, floors, upholstery, and other surfaces of dust, dirt, and allergens. Over the years, household vacuum cleaners have transformed from simple corded canister vacuum cleaners to unparalleled robotic and smart vacuums with the capabilities of artificial intelligence (AI), cordless, with HEPA filtration, edge detection, and app controls. Global sales of household vacuum cleaners are expected to expand with urbanization, pet ownership, dual-income households, and increased demand for hygiene (due to COVID-19). For instance, robotic and stick vacuums are important cleaning devices for the small spaces in densely populated urban homes across Japan and South Korea. In North America and Europe, hybrid wet-dry vacuum cleaners and pet vacuum cleaners are gaining traction as multi-purpose tools and cleaning devices for deep cleaning. The Household vacuum report covered a detailed examination of the major driving forces behind the market: expansions in technology-driven integrators and end users, key segments (product type, pricing, distribution channel, capacity). Companies operating in the global vacuum cleaner market include Dyson, Bissell, iRobot, LG, Samsung, Panasonic, and Xiaomi, all leading the charge and strategically unveiling energy-efficient, smart technology-integrated, and eco-friendly vacuum cleaners that meet different consumer needs. The report illustrates how technological developments integrating smart homes, e-commerce advancement, and other driving forces are reshaping the household vacuum cleaner market. The recent trends within the market include the growth of robotic vacuum cleaners, cordless vacuum cleaners, and crossovers to commercial segments (offices, schools, retail).To know about the Research Methodology:-Request Free Sample Report

Global Household Vacuum Cleaners Market Dynamics:

Technological Innovation to Drive the Household Vacuum Cleaners Market Growth Continuous technological advancements drive market growth by offering innovative features and improved cleaning performance. For instance, Dyson's laser technology in the Dyson V12 Detect Slim enhances dirt detection, providing users with more efficient cleaning. Similarly, Miele's home vision HD robot in the Scout RX3 offers better cleaning results, showcasing the importance of technological innovation in driving market demand. Companies investing in research and development (R&D) to develop advanced products stimulate market growth. Dyson's plan to invest US$ 1.1 Bn in Singapore to expand its manufacturing facility and develop advanced robotic machines demonstrates a commitment to innovation and product development, which is likely to positively impact market growth in the region. Continuous product innovation drives market growth by offering consumers more choices and improved cleaning experiences. For example, Electrolux's groundbreaking cordless vacuum cleaner, the Pure F9, reinvents traditional vacuuming methods, combining the performance of a traditional vacuum cleaner with the freedom of a stick vacuum. This innovation addresses consumer needs for versatile and efficient cleaning solutions, contributing to market growth. Smart Cleaning Solutions to Create Household Vacuum Cleaners Market Opportunity Manufacturers focusing on improving the efficiency of vacuum cleaners contribute to market growth by meeting consumer demand for more effective cleaning solutions. Miele's development of the Triflex HX2, which has 60% more power than previous models, illustrates efforts to enhance cleaning efficiency, driving demand for advanced vacuum cleaners in the market. Growing awareness of health and hygiene drives market growth as consumers seek products that offer cleaner living environments. Dyson's introduction of the Dyson Purifier Big+Quiet Formaldehyde addresses these concerns by delivering upgraded filtration and ultra-low noise, appealing to consumers looking for effective air purification solutions. Vacuum cleaners offering convenience and ease of use attract consumers and drive market growth. Tineco's Pure One Station, with features like automatic debris detection and hands-free emptying for up to 60 days, exemplifies efforts to enhance user experience and convenience, contributing to market demand. Sustainability, Affordability, and Global Reach to Drive Household Vacuum Cleaners Market Growth Increasing consumer consciousness towards environmental sustainability fuels market growth for eco-friendly vacuum cleaners. Blueland, for instance, offers everyday eco-friendly cleaning products, aligning with consumer preferences for environmentally responsible cleaning solutions and driving market demand. Growth into new markets and regions stimulates market growth by tapping into new consumer demographics. Samsung's global launch of the Bespoke Jet AI cordless stick vacuum demonstrates efforts to expand market reach and cater to diverse consumer needs worldwide, driving market growth through increased sales and market penetration. Competitive pricing strategies stimulate market growth by making vacuum cleaners more accessible to a wider range of consumers. BISSELL's introduction of the Revolution HydroSteam Pet, which integrates advanced cleaning technology at a competitive price point, demonstrates efforts to attract price-conscious consumers and drive market demand.Rise of Smart Cleaning Appliances to Create Opportunity for Household Vacuum Cleaners Market A Lucrative Opportunity The introduction of products like Roborock's Dyad Air, offering simultaneous wet and dry cleaning capabilities, presents a significant growth opportunity in the household vacuum cleaners market. This innovative solution addresses consumers' need for efficient and versatile cleaning tools, especially in homes with varied floor surfaces and spill-prone areas. The emergence of smart cleaning appliances, exemplified by Tineco's Pure One Station, presents a lucrative growth opportunity. These intelligent devices offer features such as automatic debris detection, self-cleaning stations, and app connectivity, enhancing convenience and efficiency for users. As consumers increasingly prioritize smart home technologies, the demand for advanced, automated cleaning solutions is expected to drive market growth. The development of high-powered cordless stick vacuums, like Samsung's Bespoke Jet AI, represents a significant growth opportunity. These devices offer powerful suction, self-emptying capabilities, and AI-based cleaning services, catering to consumers seeking premium cleaning experiences with the convenience of cordless operation. As cordless vacuums continue to evolve with advanced features, they are likely to gain traction in the market, driving growth. Urban Living, Sustainability, and Customization to Create Household Vacuum Cleaners Market Opportunity The growing consumer demand for eco-friendly cleaning products presents an opportunity for manufacturers to innovate sustainable vacuum cleaner solutions. Companies investing in environmentally conscious technologies, such as recyclable materials and energy-efficient designs, can capitalize on this trend. For example, introducing vacuum cleaners with reusable dustbins and minimal environmental impact aligns with consumer preferences for sustainable household appliances, driving market growth. Offering customizable and personalized cleaning experiences can differentiate brands and drive market growth. Manufacturers can explore options like interchangeable accessories, adjustable suction power settings, and customizable cleaning modes to cater to diverse consumer needs and preferences. By providing tailored solutions, such as specialized attachments for pet owners or allergy sufferers, companies can attract a broader customer base and foster brand loyalty. Urbanization and evolving lifestyles drive market growth as consumers seek efficient cleaning solutions to accommodate busy schedules and smaller living spaces. Cordless vacuum cleaners, such as those offered by Dyson and Electrolux, cater to the needs of urban consumers by providing flexibility and ease of use, driving market demand. Limited Battery Life in Cordless Vacuums to Restrain Household Vacuum Cleaners Market The household vacuum cleaners market faces a restraint due to the high initial investment required for purchasing advanced models with cutting-edge features. For example, Dyson's premium models, such as the Dyson V12 Detect Slim, come with innovative technologies like laser dirt detection, making them costly upfront investments that may deter budget-conscious consumers from purchasing. Many cordless vacuum cleaners suffer from limited battery life, restricting the duration of cleaning sessions. For instance, while Tineco's Pure One Station offers advanced features like automatic debris detection and self-cleaning, its battery life may limit prolonged use, inconveniencing users and potentially impacting market adoption. Some vacuum cleaner models may lack durability, leading to frequent breakdowns and the need for repairs or replacements. For instance, lower-priced vacuum cleaners may use inferior materials that compromise longevity, resulting in a shorter product lifespan and dissatisfaction among consumers. Weak Suction and Waste Concerns Create Household Vacuum Cleaners Market Challenge Certain vacuum cleaner models may suffer from inadequate suction power, impacting their cleaning effectiveness, especially on carpets and rugs. For example, budget-friendly vacuum cleaners may sacrifice suction power to reduce costs, resulting in subpar cleaning performance and limiting their appeal to consumers seeking thorough cleaning solutions. The use of disposable components and non-recyclable materials in some vacuum cleaner models contributes to environmental concerns, leading to sustainability issues. For instance, vacuum cleaners that rely on single-use disposable bags generate plastic waste, raising environmental awareness among consumers and potentially influencing purchasing decisions toward eco-friendly alternatives.

Global Household Vacuum Cleaners Market Segment Analysis

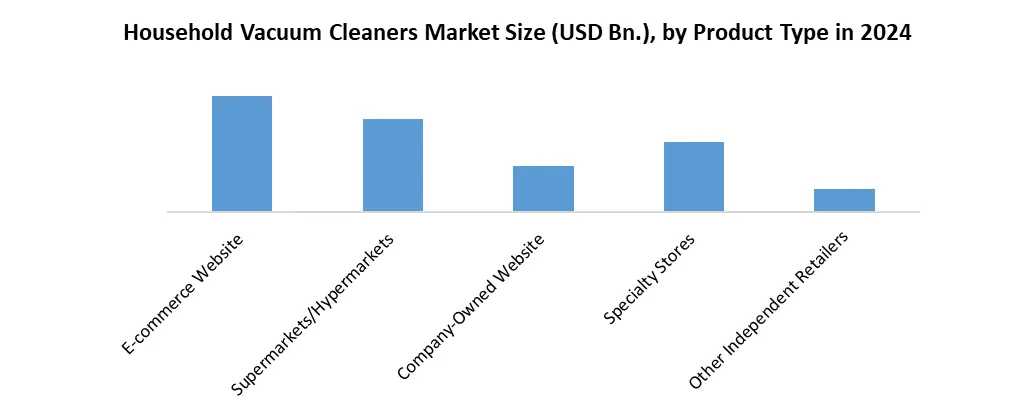

Based on Product Type, the robotic vacuum cleaners Segment held a dominant position in 2024 and is expected to dominate in the forecast period, due to their convenience and automation, particularly in households with busy lifestyles. Their ability to operate autonomously and navigate through spaces without human intervention appeals to consumers seeking hands-free cleaning solutions. However, handheld vacuum cleaners are also popular for their portability and versatility in reaching tight spaces and spot cleaning. While robotic vacuum cleaners are expected to maintain their dominance, handheld vacuum cleaners are projected to see increased adoption, especially in applications requiring targeted cleaning or supplementary cleaning alongside robotic counterparts. As technology advances, both segments are likely to evolve to meet consumer demands for more efficient and effective cleaning solutions across various applications.Based on Distribution Channel, the Household Vacuum Cleaners Market is segmented into E-commerce websites, Company-Owned websites, Supermarkets/Hypermarkets, Specialty Stores, and Other Independent Retailers. The e-commerce Website segment has dominated the Household Vacuum Cleaners Market in 2024 and is expected to hold the largest market share over the forecast period. Consumer preference for digital convenience, product breadth, the ability to instantly compare prices and specifications, and rapid fulfillment from platforms such as Amazon, Flipkart, JD.com, and Walmart.com have all contributed to its growth by enabling these platforms to offer exclusive deals, fast shipping, bundled accessories, etc. Overall, e-commerce has established itself as the top channel within the vacuum cleaner market as consumers continue to shift away from brick-and-mortar stores after the pandemic.

Household Vacuum Cleaners Market Regional Insights

North America dominated the Household Vacuum Cleaners market in 2024, and is expected to grow during the forecast period, due to high consumer awareness of cleanliness and hygiene. This region benefits from a mature market and robust consumer spending on home appliances, driving significant demand for vacuum cleaners. Moreover, technological advancements and the introduction of innovative cleaning solutions further propel market growth in North America. Meanwhile, the Asia Pacific region, particularly countries like China and India, is expected to witness substantial growth in the household vacuum cleaner market. This growth is attributed to increasing urbanization, rising disposable income levels, and evolving consumer lifestyles, leading to higher adoption of home cleaning appliances. For instance, in China, rapid urbanization and the growing middle-class population are driving demand for household vacuum cleaners. Additionally, the emergence of online retail channels and aggressive marketing strategies by key market players further contribute to the growth of the household vacuum cleaners market in the Asia Pacific region.Household Vacuum Cleaners Market Competitive Landscape Key Players in the Household Vacuum Market, and Dyson Ltd and iRobot Corporation, are at the leading edge of that competition through different applications of innovation, financial capacity, and market agility. Dyson Ltd (UK) has revenue of USD XX billion in 2024, primarily through their staples of high-end cordless and robotic vacuums, and the company's 15 – 20% return on investment of R&D (robotics, AI, batteries, motors, etc). Bissell Inc. (USA) is a clean appliances brand originally based in the U.S. that has a long history in the market, especially with mass-market North America. They have emphasized traditional pet-focused, wet-dry, and multi-use vacuum cleaners. It is estimated that by 2024 that Bissell's revenue is estimated to have surpassed one billion USD, with contributions from the outlet sales of products like the CrossWave Edge and PowerClean FurFinder, specifically for pet owners and beyond, as multi-use. Bissell and Dyson Ltd are developing product innovation, pet-specific tech solutions, and sustainable products, as they both expect to build brand loyalty in core products and remain competitive in a changing, technology-driven home cleaning marketplace. Household Vacuum Cleaners Market Recent Development • Dyson Ltd (UK/Global) revealed in May 2025 that it is taking its PencilVac to market, an ultra-slim cordless vacuum at only 38 mm wide, equipped with its high-speed 140,000 RPM Hyperdymium motor, laser-guided dust detection, compressed dust bin storage, MyDyson app connectivity, and magnetic dock. Dyson aims the PencilVac at the ultra-compact market and is releasing it first in Japan; it expects the U.S. to have it by 2026. • iRobot Corporation (USA) launched its biggest ever Roomba product line in March 2025, which includes new models with improved Lidar-based navigation, a 70× increase in suction power, debris-compacting technology, and dual spinning mop pads. The company announced the Roomba Max 705 Vac Robot with an auto-empty dock that can hold 75 days' worth of debris in April 2025. • LG Electronics Inc. (South Korea) announced in April 2025 that it has a commercial robotic vacuum co-developed with Marriott Design Lab, with LiDAR navigation and a 3-litre dust bin targeted at hospitality use in hotels and public venues. The vacuum is now being rolled out across all Marriott locations in the U.S. • Japanese-based Panasonic Corporation launched a slim, all-in-one cordless stick vacuum (MC KC1) in 2024, which has nearly 99.5% efficiency at capturing dust (0.3–10 μm particles), is fast charging, and is designed for multi-use in the home. This product launch expanded the company's portfolio in a rapidly growing, competitive market. • Bissell Inc. (USA) launched for home use the upgraded wet-dry vac, CrossWave Edge, in April 2025, featuring "ZeroGap™" technology that is engineered to assist in cleaning from edge to edge along walls and baseboards. Bissell Inc. also launched the PowerClean FurFinder, a stick vacuum with illuminated pet-hair detection and tangle-free brushes. This product was designed for pet owners and incorporates multi-use options. Household Vacuum Cleaners Market Recent Trends

Category Key Trend Example Product Market Impact Cordless Technology Shift toward ultra-lightweight and high-suction cordless vacuums Dyson PencilVac Increased adoption among urban users due to space efficiency and powerful, compact cleaning design Robotic Automation Integration of AI-powered navigation and self-emptying bins iRobot Roomba Max 705 Vac Robot 30–40% growth in robotic segment; enhanced convenience and rise in smart home compatibility Pet-Focused Solutions Rise in vacuums tailored for pet owners with anti-tangle brushes and UV tech. BISSELL PowerClean FurFinder Expanded market share in pet households, especially in North America and Europe Household Vacuum Cleaners Market Scope: Inquire before buying

Household Vacuum Cleaners Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 17.90 Bn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 26.85 Bn. Segments Covered: by Product Type Handheld Vacuum Cleaners Canister Vacuum Cleaners Upright Vacuum Cleaners Stick Vacuum Cleaners Robotic Vacuum Cleaners by Distribution Channel E-commerce Website Company-Owned Website Supermarkets/Hypermarkets Specialty Stores Other Independent Retailers by Capacity Up to 0.9 L 1 to 1.4 L 1.5 to 1.9 L 2 L & Above by Category Corded Cordless Household Vacuum Cleaners Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Household Vacuum Cleaners Market Key Players

North America 1. Bissell Inc (USA) 2. iRobot Corporation (USA) 3. SharkNinja Operating LLC (USA) Europe 1. Dyson Ltd. (UK) 2. Electrolux AB (Sweden) 3. Koninklijke Philips N.V. (Netherlands) Asia Pacific 1. Haier Group (China) 2. Panasonic Corporation (Japan) 3. Samsung Electronics Co. Ltd. (South Korea) 4. LG Electronics, Inc. (South Korea) 5. Techtronic Industries (Hong Kong) 6. Ecovacs Robotics Inc. (China) 7. Xiaomi Corporation (China)Frequently Asked Questions:

1. Which region has the largest share in the Global Household Vacuum Cleaners Market? Ans: The North America region held the highest share in 2024. 2. What is the growth rate of the Global Household Vacuum Cleaners Market? Ans: The Global Market is expected to grow at a CAGR of 5.2% during the forecast period 2025-2032. 3. What is the scope of the Global Household Vacuum Cleaners Market report? Ans: The Global Household Vacuum Cleaners Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Household Vacuum Cleaners Market? Ans: The important key players in the Global Household Vacuum Cleaners Market are – Bissell Inc (USA), iRobot Corporation (USA), SharkNinja Operating LLC (USA), etc. 5. What is the study period of the Household Vacuum Cleaners market? Ans: The Global Household Vacuum Cleaners Market is studied from 2024 to 2032.

1. Household Vacuum Cleaners Market: Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Household Vacuum Cleaners Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Household Vacuum Cleaners Market: Dynamics 3.1. Region wise Trends of Household Vacuum Cleaners Market 3.1.1. North America Household Vacuum Cleaners Market Trends 3.1.2. Europe Household Vacuum Cleaners Market Trends 3.1.3. Asia Pacific Household Vacuum Cleaners Market Trends 3.1.4. Middle East and Africa Household Vacuum Cleaners Market Trends 3.1.5. South America Household Vacuum Cleaners Market Trends 3.2. Household Vacuum Cleaners Market Dynamics 3.2.1. Global Household Vacuum Cleaners Market Drivers 3.2.1.1. Technological Innovation 3.2.2. Global Household Vacuum Cleaners Market Restraints 3.2.3. Global Household Vacuum Cleaners Market Opportunities 3.2.3.1. Rise of Smart Cleaning Appliances 3.2.4. Global Household Vacuum Cleaners Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Import/export regulations and trade tariffs on electronic goods 3.4.2. Rising disposable incomes and urbanization in emerging economies 3.4.3. Increase in pet ownership and dual-income households 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Household Vacuum Cleaners Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Handheld Vacuum Cleaners 4.1.2. Canister Vacuum Cleaners 4.1.3. Upright Vacuum Cleaners 4.1.4. Stick Vacuum Cleaners 4.1.5. Robotic Vacuum Cleaners 4.2. Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 4.2.1. E-commerce Website 4.2.2. Company-Owned Website Supermarkets/Hypermarkets 4.2.3. Specialty Stores 4.2.4. Other Independent Retailers 4.3. Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 4.3.1. Up to 0.9 L 4.3.2. 1 to 1.4 L 4.3.3. 1.5 to 1.9 L 4.3.4. 2 L & Above 4.4. Household Vacuum Cleaners Market Size and Forecast, by Category (2024-2032) 4.4.1 Corded 4.4.2 Cordless 4.5. Household Vacuum Cleaners Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Household Vacuum Cleaners Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Handheld Vacuum Cleaners 5.1.2. Canister Vacuum Cleaners 5.1.3. Upright Vacuum Cleaners 5.1.4. Stick Vacuum Cleaners 5.1.5. Robotic Vacuum Cleaners 5.2. North America Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 5.2.1. E-commerce Website 5.2.2. Company-Owned Website Supermarkets/Hypermarkets 5.2.3. Specialty Stores 5.2.4. Other Independent Retailers 5.3. North America Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 5.3.1. Up to 0.9 L 5.3.2. 1 to 1.4 L 5.3.3. 1.5 to 1.9 L 5.3.4. 2 L & Above 5.4. North America Household Vacuum Cleaners Market Size and Forecast, by Category (2024-2032) 5.4.1 Corded 5.4.2 Cordless 5.5. North America Household Vacuum Cleaners Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 5.5.1.1.1. Handheld Vacuum Cleaners 5.5.1.1.2. Canister Vacuum Cleaners 5.5.1.1.3. Upright Vacuum Cleaners 5.5.1.1.4. Stick Vacuum Cleaners 5.5.1.1.5. Robotic Vacuum Cleaners 5.5.1.2. United States Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.1.2.1. E-commerce Website 5.5.1.2.2. Company-Owned Website Supermarkets/Hypermarkets 5.5.1.2.3. Specialty Stores 5.5.1.2.4. Other Independent Retailers 5.5.1.3. United States Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 5.5.1.3.1. Up to 0.9 L 5.5.1.3.2. 1 to 1.4 L 5.5.1.3.3. 1.5 to 1.9 L 5.5.1.3.4. 2 L & Above 5.5.1.4. United States Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 5.5.1.4.1. Corded 5.5.1.4.2. Cordless 5.5.2. Canada 5.5.2.1. Canada Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 5.5.2.1.1. Handheld Vacuum Cleaners 5.5.2.1.2. Canister Vacuum Cleaners 5.5.2.1.3. Upright Vacuum Cleaners 5.5.2.1.4. Stick Vacuum Cleaners 5.5.2.1.5. Robotic Vacuum Cleaners 5.5.2.2. Canada Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.2.2.1. E-commerce Website 5.5.2.2.2. Company-Owned Website Supermarkets/Hypermarkets 5.5.2.2.3. Specialty Stores 5.5.2.2.4. Other Independent Retailers 5.5.2.3. Canada Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 5.5.2.3.1. Up to 0.9 L 5.5.2.3.2. 1 to 1.4 L 5.5.2.3.3. 1.5 to 1.9 L 5.5.2.3.4. 2 L & Above 5.5.2.4. Canada Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 5.5.2.4.1. Corded 5.5.2.4.2. Cordless 5.5.3. Maxico 5.5.3.1. Mexico Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 5.5.3.1.1. Handheld Vacuum Cleaners 5.5.3.1.2. Canister Vacuum Cleaners 5.5.3.1.3. Upright Vacuum Cleaners 5.5.3.1.4. Stick Vacuum Cleaners 5.5.3.1.5. Robotic Vacuum Cleaners 5.5.3.2. Mexico Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.3.2.1. E-commerce Website 5.5.3.2.2. Company-Owned Website Supermarkets/Hypermarkets 5.5.3.2.3. Specialty Stores 5.5.3.2.4. Other Independent Retailers 5.5.3.3. Mexico Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 5.5.3.3.1. Up to 0.9 L 5.5.3.3.2. 1 to 1.4 L 5.5.3.3.3. 1.5 to 1.9 L 5.5.3.3.4. 2 L & Above 5.5.3.4. Mexico Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 5.5.3.4.1. Corded 5.5.3.4.2. Cordless 6. Europe Household Vacuum Cleaners Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.3. Europe Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.4. Europe Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5. Europe Household Vacuum Cleaners Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.1.2. United Kingdom Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.1.3. United Kingdom Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.1.4. United Kingdom Household Vacuum Cleaners Market Size and Forecast, By Category(2024-2032) 6.5.2. France 6.5.2.1. France Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.2.2. France Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.2.3. France Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.2.4. France Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.3.2. Germany Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.3.3. Germany Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.3.4. Germany Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.4.2. Italy Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.4.3. Italy Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.4.4. Italy Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.5.2. Spain Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.5.3. Spain Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.5.4. Spain Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.6.2. Sweden Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.6.3. Sweden Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.6.4. Sweden Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.7.2. Austria Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.7.3. Austria Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.7.4. Austria Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 6.5.8.2. Rest of Europe Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.8.3. Rest of Europe Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 6.5.8.4. Rest of Europe Household Vacuum Cleaners Market Size and Forecast, By Category(2024-2032) 7. Asia Pacific Household Vacuum Cleaners Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.3. Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.4. Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5. Asia Pacific Household Vacuum Cleaners Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.1.2. China Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.1.3. China Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.1.4. China Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.2.2. S Korea Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.2.3. S Korea Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.2.4. S Korea Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.3.2. Japan Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.3.3. Japan Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.3.4. Japan Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.4. India 7.5.4.1. India Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.4.2. India Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.4.3. India Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.4.4. India Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.5.2. Australia Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.5.3. Australia Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.5.4. Australia Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.6.2. Indonesia Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.6.3. Indonesia Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.6.4. Indonesia Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.7.2. Philippines Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.7.3. Philippines Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.7.4. Philippines Household Vacuum Cleaners Market Size and Forecast, By Category(2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.8.2. Malaysia Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.8.3. Malaysia Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.8.4. Malaysia Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.9.2. Vietnam Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.9.3. Vietnam Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.9.4. Vietnam Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.10.2. Thailand Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.10.3. Thailand Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.10.4. Thailand Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.11.3. Rest of Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 7.5.11.4. Rest of Asia Pacific Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 8. Middle East and Africa Household Vacuum Cleaners Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 8.3. Middle East and Africa Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 8.4. Middle East and Africa Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 8.5. Middle East and Africa Household Vacuum Cleaners Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 8.5.1.2. South Africa Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.1.3. South Africa Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 8.5.1.4. South Africa Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 8.5.2.2. GCC Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.2.3. GCC Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 8.5.2.4. GCC Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 8.5.3.2. Nigeria Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.3.3. Nigeria Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 8.5.3.4. Nigeria Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 8.5.4.2. Rest of ME&A Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.4.3. Rest of ME&A Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 8.5.4.4. Rest of ME&A Household Vacuum Cleaners Market Size and Forecast, By Category(2024-2032) 9. South America Household Vacuum Cleaners Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 9.3. South America Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 9.4. South America Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 9.5. South America Household Vacuum Cleaners Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 9.5.1.2. Brazil Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.1.3. Brazil Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 9.5.1.4. Brazil Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 9.5.2.2. Argentina Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.2.3. Argentina Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 9.5.2.4. Argentina Household Vacuum Cleaners Market Size and Forecast, By Category (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Household Vacuum Cleaners Market Size and Forecast, By Product Type (2024-2032) 9.5.3.2. Rest of South America Household Vacuum Cleaners Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.3.3. Rest of South America Household Vacuum Cleaners Market Size and Forecast, By Capacity (2024-2032) 9.5.3.4. Rest of South America Household Vacuum Cleaners Market Size and Forecast, By Category(2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Bissell Inc (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. iRobot Corporation (USA) 10.3. SharkNinja Operating LLC (USA) 10.4. Dyson Ltd. (UK) 10.5. Electrolux AB (Sweden) 10.6. Koninklijke Philips N.V. (Netherlands) 10.7. Haier Group (China) 10.8. Panasonic Corporation (Japan) 10.9. Samsung Electronics Co. Ltd. (South Korea) 10.10. LG Electronics, Inc. (South Korea) 10.11. Techtronic Industries (Hong Kong) 10.12. Ecovacs Robotics Inc. (China) 10.13. Xiaomi Corporation (China) 11. Key Findings 12. Analyst Recommendations 13. Household Vacuum Cleaners Market: Research Methodology