The Hafnium Market was valued at 127.75 Metric Tons in 2024, and total Global Hafnium Market revenue is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 221.14 Metric Tons.Hafnium Market Overview

Hafnium is a high-performance, silvery-grey transition metal valued for its exceptional heat resistance, corrosion stability and neutron absorption making it indispensable in advanced aerospace, defence and nuclear technologies. It is emerging as strategic material within the broader landscape of high temperature superalloys, nuclear grade components and next generation semiconductors. As OEMs and defence contractors pivot toward enhanced engine efficiency, space grade propulsion, and compact nuclear power solutions, hafnium and its derivatives like hafnium oxide and hafnium carbide are witnessing increased adoption. Our analysis indicates strong regional force in North America, driven by aerospace manufacturing and military modernization and Asia Pacific, where China and Japan are scaling nuclear reactor construction and semiconductor capacity. Meanwhile, global supply remains tight by hafnium’s by-product nature in zirconium refining, reinforcing its status as a high value, low volume material. The competitive landscape includes vertically integrated alloy manufacturers such as ATI Inc. and Plansee, specialized processors in Asia, leveraging R&D, OEM contracts and supply chain control to gain market share. By end user perspective, aerospace and nuclear sectors dominate demand, medical imaging and electronics applications are emerging as high growth niches. Export regulations and trade tensions, mainly in U.S. and China corridor, continue to shape supply strategies and pricing dynamics. As strategic industries accelerate, hafnium's role in enabling performance, safety and innovation is set to grow sharply in the coming decade.To know about the Research Methodology :- Request Free Sample Report

Hafnium Market Dynamics

Rising Aerospace Industry to Drive the Hafnium Market Growth Hafnium metal is a critical component in super alloys used for manufacturing jet engine components, such as turbine blades and nozzles. Its ability to maintain structural integrity at high temperatures contributes to increased engine efficiency and performance, making it a critical material in the modern aerospace industry. As global travel and defence capabilities continue to expand, the aerospace industry is likely to witness significant expansion. This expansion translates into an increased demand for Hafnium metal-based alloys, particularly in the production of advanced jet engines and spacecraft components. The growth in the aerospace industry is set to follow an upward trajectory, driven by factors, such as the rise in commercial space exploration, supersonic travel, and military aircraft development. Thus, the growth in the aerospace industry is anticipated to be a key driver for hafnium market growth. In addition, the entry of private players, such as SpaceX, Virgin Galactic, and Blue Origin, into the aerospace sector, with their significant investments in the development of next-generation aircraft and spacecraft, is likely to fuel the demand in the aerospace sector further. Ongoing Research and Development Activities in the Medical Industry to Boost Market Growth The market is expected to experience significant growth in the coming years, driven by ongoing research and development activities in the medical industry. The product adoption is expected to rise as the demand for medical imaging equipment continues to surge. Hafnium is a critical component of X-ray tubes, which are used to produce high-quality medical images for diagnosis and treatment planning. The use of X-ray technology in medical imaging has been growing steadily in recent years, and this trend is expected to continue in the coming years. As research and development activities continue to drive innovation in these industries, the demand for Hafnium is expected to grow, creating new opportunities for manufacturers and suppliers in the market. Fluctuating Prices of the Metal to Hamper Market Growth Hafnium metal is a by-product of zirconium production, and its supply is inherently linked to the trends in zirconium mining. Situations when zirconium demand surges, driven by the nuclear industry, can lead to higher Hafnium metal production, causing oversupply and subsequent price drops. In contrast, during periods of reduced zirconium demand, hafnium output may decrease, causing supply shortages and price spikes. Over the past few years, the market has been facing the challenge of volatile and unpredictable Hafnium prices. These fluctuations are influenced by various factors, such as the pandemic, geopolitical tensions, and the trade war, leading to supply-demand imbalances. The fluctuating prices of this metal can create uncertainty and risks for both producers and consumers. This, in turn, is likely to impact market growth negatively.Hafnium Market Segmentation

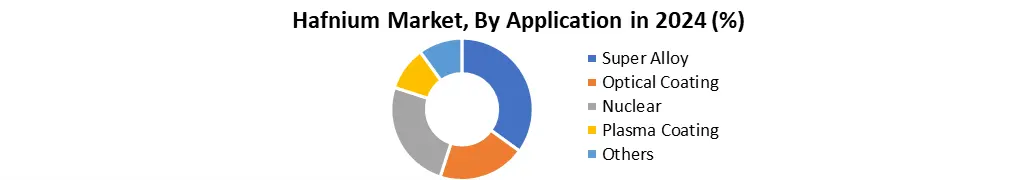

Based on type, the market is segmented into hafnium metal, hafnium oxide, hafnium carbide, and others. The hafnium metal segment accounted for the largest market share in 2024. Hafnium metal has a high melting point, making it ideal for use in high-temperature applications, such as plasma torches. Its high corrosion resistance allows it to withstand harsh environmental conditions encountered in the aerospace and nuclear power industries. On the other hand, hafnium oxide is a versatile material with a wide range of applications in semiconductors, optical coatings, ceramics, and medical devices. This product type is used as a dielectric in transistors, enabling the miniaturization of transistors and allowing for more efficient and powerful electronic devices. The rising demand for small and efficient electronic devices is expected to drive segment growth during the forecast period. Based on application, the market is segmented into super alloy, optical coating, nuclear, plasma cutting, and others. The super alloy segment held a dominant hafnium market share in 2024. Super alloys are critical materials with a wide range of applications that typically include both aerospace and non-aerospace. These include industries, such as aerospace, nuclear energy, gas turbines, biomedical, and others. Hafnium-based alloys are utilized in aircraft components, such as engine parts and armour materials. Advanced military aircraft rely on hafnium’s heat-resistant properties to withstand the intense heat generated during combustion. These alloys contribute to the performance, efficiency, and safety of aircraft engines encountered in flight or space travel. This capability enables sustained operation at high speeds and altitudes. The rising use of these super alloys owing to their superior properties is likely to drive market growth. Hafnium is used in plasma cutting due to its good heat conductivity, inert nature, and high melting point. It is inserted into the plasma torch and heated to a high temperature, which ionizes the surrounding gas, creating a plasma. This metal is often used to cut steel, stainless steel, and aluminium in plasma-cutting applications.

Hafnium Market Regional Insights

The North America region dominated the hafnium market in 2024, driven by a robust aerospace industry and significant investments in defence and nuclear energy. The rising demand for air travel, both domestically and internationally, is propelling the need for new aircraft. Airlines across the globe are upgrading their aircraft to meet passenger demand and comply with environmental regulations. The U.S. based manufacturers, such as Boeing, Lockheed Martin, and Cessna, offer a wide range of aircraft, from commercial airliners to business jets. With the rising demand for aircraft, these manufacturers are likely to position themselves to supply modern, efficient, and safe aircraft. Also, according to the Aerospace Industries Association (AIA), the aerospace and defence industry in the U.S. generated a sale of USD 959 billion in 2024, from the previous year. Hence, the growing aerospace industry will influence product demand in the upcoming years.Hafnium Market Competitive Landscape Global hafnium market features a moderately consolidated competitive landscape with key players concentrated in North America, Europe and Asia Pacific. In North America, companies like ATI Inc., Precision Castparts Corp. and Materion Corporation lead with integrated operations serving aerospace and nuclear sectors through OEM contracts, R&D innovation and advanced alloy development. Europe's precision metallurgy specialists like PLANSEE SE, Treibacher AG and CERATIZIT S.A., focusing on high purity products and customized solutions for electronics and coating applications. In Asia Pacific, China and Japan dominate with companies like CNNC Beijing Institute, Toho Titanium and TANAKA Kikinzoku, with cost efficient production, vertical integration and expansion in nuclear and semiconductor sectors. Middle East & Africa, represented by South African Rare Earths and EMRA, is emerging in resource exploration, while South America’s CBMM and Votorantim Metais focus on rare earth extraction and raw material exports. Competitive strategies range from OEM focused R&D and pricing optimization to government backed nuclear grade material supply. As demand rises in aerospace, electronics and clean energy, market leadership will depend on vertical integration, purity standards and regulatory compliance. Companies investing in innovation, recycling and geopolitical supply security are best positioned for long term growth in Hafnium market. Hafnium Market Trends

Hafnium Market Key Developments • 10th April 2025, at the MMTA conference in Lisbon, industry experts highlighted that global hafnium demand could grow nearly 40% by 2030, with supply needing to ramp from 70 t/yr to meet projected demand of 180 t/yr. • 10th April 2025, it was reported that China has increased hafnium output for its nuclear program, and one major processor is targeting 140 t/yr capacity enough to meet all current global demand. • 5th March 2025, The Metalnomist published that nuclear reactor construction is fueling a 4% annual demand increase for hafnium, driven by its use in control rods for an expanding global reactor fleet • 5th March 2024, Rolls Royce announced the integration of hafnium based superalloys into its next generation aircraft engines to enhance fuel efficiency and extend service life, signaling a significant uptick in aerospace demand for hafnium. • 30th November 2023, France's Framatome announced plans to ramp up production at its Jarrie facility from 30 t/yr to 45 t/yr of high-quality hafnium and zirconium alloys by the following year.

Trends Description Impact on Market Rising Demand in Nuclear Energy Sector Hafnium's neutron absorption capability boosts its use in nuclear reactors and control rods. Drives demand for high-purity hafnium, especially in China, U.S., and France. Growth in Aerospace & Superalloy Usage Increasing use of hafnium-based superalloys in jet engines and turbines for thermal resistance. Enhances OEM collaborations and R&D in high-performance alloy manufacturing. Limited Global Supply and Export Controls Hafnium is often a by-product of zirconium refining, with supply concentrated in few countries. Promotes investment in recycling, domestic production, and strategic stockpiling. Hafnium Market Scope: Inquire before buying

Hafnium Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 127.75 Metric Tons Forecast Period 2025 to 2032 CAGR: 7.1% Market Size in 2032: USD 221.14 Metric Tons Segments Covered: by Type Hafnium Metal Hafnium Oxide Hafnium Carbide Others by Application Super Alloy Optical Coating Nuclear Plasma Cutting Others by End-user Aerospace & Defence Nuclear Energy Electronics and Semiconductors Others Hafnium Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Thailand, Bangladesh, Philippines and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hafnium Market Key Players

North America 1. ATI Inc. (U.S.) 2. Precision Castparts Corp. (U.S.) 3. Trex Enterprises Corp. (U.S.) 4. Materion Corporation (U.S.) 5. H.C. Starck Solutions (U.S.) 6. Western Zirconium (U.S.) 7. Texas Rare Earth Resources Corp. (U.S.) 8. Ed Fagan Inc. (U.S.) 9. Climax Molybdenum Company (U.S.) Europe 10. Alfa Aesar (Germany) 11. Goodfellow Group (U.K.) 12. PLANSEE SE (Austria) 13. Treibacher Industry AG (Austria) 14. Eckart GmbH (Germany) 15. Metal Powder Company Ltd. (U.K.) 16. CERATIZIT S.A. (Luxembourg) 17. Molymet Belgium N.V. (Belgium) Asia Pacific 18. Nuclear JingHuan Zirconium Industry Co., Ltd. (China) 19. Baoji ChuangXin Metal Materials Co., Ltd. (China) 20. CNNC Beijing Research Institute (China) 21. Advanced Refractory Technologies, Inc. (Japan) 22. TANAKA Kikinzoku Kogyo K.K. (Japan) 23. Toho Titanium Co., Ltd. (Japan) 24. Nanjing Youtian Metal Technology Co., Ltd. (China) 25. Ningxia Orient Tantalum Industry Co., Ltd. (China) Middle East and Africa 26. South African Rare Earths (South Africa) 27. Egyptian Mineral Resources Authority (Egypt) South America 28. CBMM (Brazil) 29. Votorantim Metais (Brazil)Hafnium Market FAQs

1] What segments are covered in the Hafnium Market report? Ans. The segments covered in the Hafnium Market report By Type, By Application and By End-user. 2] Which region is expected to hold the highest share in the Hafnium Market? Ans. The North America region is expected to hold the highest share in the Hafnium Market. 3] What is the market size of the Hafnium Market by 2032? Ans. The Hafnium market size is expected to reach USD 221.14 Metric Tons by 2032. 4] What is the forecast period for the Hafnium Market? Ans. The forecast period for the Hafnium Market is 2025-2032. 5] What was the market size of the Hafnium Market in 2024? Ans. The market size of the Hafnium Market in 2024 was valued at USD 127.75 Metric Tons.

1. Hafnium Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hafnium Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Hafnium Market: Dynamics 3.1. Region-wise Trends of Hafnium Market 3.1.1. North America Hafnium Market Trends 3.1.2. Europe Hafnium Market Trends 3.1.3. Asia Pacific Hafnium Market Trends 3.1.4. Middle East and Africa Hafnium Market Trends 3.1.5. South America Hafnium Market 3.2. Hafnium Market Dynamics 3.2.1. Hafnium Market Drivers 3.2.1.1. Aerospace Industry Expansion 3.2.1.2. Nuclear Energy Growth 3.2.1.3. Medical Imaging Demand 3.2.2. Hafnium Market Restraints 3.2.3. Hafnium Market Opportunities 3.2.3.1. Semiconductor Miniaturization 3.2.3.2. Space Sector Investment 3.2.3.3. Advanced Alloy Development 3.2.4. Hafnium Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Export control regulations 3.4.2. Zirconium-linked supply 3.4.3. Green energy policies 3.5. Hafnium Rate (%), by region 3.6. Technological Advancements in Hafnium 3.7. Price Trend Analysis by Region 3.8. Technological Roadmap 3.9. Regulatory Landscape by Region 3.9.1. North America 3.9.2. Europe 3.9.3. Asia Pacific 3.9.4. Middle East and Africa 3.9.5. South America 3.10. Analysis of Government Schemes and Initiatives for Hafnium Industry 3.11. Key Opinion Leader Analysis 4. Hafnium Market: Global Market Size and Forecast by Segmentation (by Value in USD Metric Tons) (2024-2032) 4.1. Hafnium Market Size and Forecast, By Type (2024-2032) 4.1.1. Hafnium Metal 4.1.2. Hafnium Oxide 4.1.3. Hafnium Carbide 4.1.4. Others 4.2. Hafnium Market Size and Forecast, By Application (2024-2032) 4.2.1. Super Alloy 4.2.2. Optical Coating 4.2.3. Nuclear 4.2.4. Plasma Cutting 4.2.5. Others 4.3. Hafnium Market Size and Forecast, By End-user (2024-2032) 4.3.1. Aerospace & Defence 4.3.2. Nuclear Energy 4.3.3. Electronics and Semiconductors 4.3.4. Others 4.4. Hafnium Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Hafnium Market Size and Forecast by Segmentation (by Value in USD Metric Tons) (2024-2032) 5.1. North America Hafnium Market Size and Forecast, By Type (2024-2032) 5.1.1. Hafnium Metal 5.1.2. Hafnium Oxide 5.1.3. Hafnium Carbide 5.1.4. Others 5.2. North America Hafnium Market Size and Forecast, By Application (2024-2032) 5.2.1. Super Alloy 5.2.2. Optical Coating 5.2.3. Nuclear 5.2.4. Plasma Cutting 5.2.5. Others 5.3. Hafnium Market Size and Forecast, By End-user (2024-2032) 5.3.1. Aerospace & Defence 5.3.2. Nuclear Energy 5.3.3. Electronics and Semiconductors 5.3.4. Others 5.4. North America Hafnium Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Hafnium Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Hafnium Metal 5.4.1.1.2. Hafnium Oxide 5.4.1.1.3. Hafnium Carbide 5.4.1.1.4. Others 5.4.1.2. United States Hafnium Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Super Alloy 5.4.1.2.2. Optical Coating 5.4.1.2.3. Nuclear 5.4.1.2.4. Plasma Cutting 5.4.1.2.5. Others 5.4.1.3. United States Hafnium Market Size and Forecast, By End-user (2024-2032) 5.4.1.3.1. Aerospace & Defence 5.4.1.3.2. Nuclear Energy 5.4.1.3.3. Electronics and Semiconductors 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Hafnium Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Hafnium Metal 5.4.2.1.2. Hafnium Oxide 5.4.2.1.3. Hafnium Carbide 5.4.2.1.4. Others 5.4.2.2. Canada Hafnium Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Super Alloy 5.4.2.2.2. Optical Coating 5.4.2.2.3. Nuclear 5.4.2.2.4. Plasma Cutting 5.4.2.2.5. Others 5.4.2.3. Canada Hafnium Market Size and Forecast, By End-user (2024-2032) 5.4.2.3.1. Aerospace & Defence 5.4.2.3.2. Nuclear Energy 5.4.2.3.3. Electronics and Semiconductors 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Hafnium Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1. Hafnium Metal 5.4.3.1.2. Hafnium Oxide 5.4.3.1.3. Hafnium Carbide 5.4.3.1.4. Others 5.4.3.2. Mexico Hafnium Market Size and Forecast, By Application (2024-2032) 5.4.3.2.1. Super Alloy 5.4.3.2.2. Optical Coating 5.4.3.2.3. Nuclear 5.4.3.2.4. Plasma Cutting 5.4.3.2.5. Others 5.4.3.3. Mexico Hafnium Market Size and Forecast, By End-user (2024-2032) 5.4.3.3.1. Aerospace & Defence 5.4.3.3.2. Nuclear Energy 5.4.3.3.3. Electronics and Semiconductors 5.4.3.3.4. Others 6. Europe Hafnium Market Size and Forecast by Segmentation (by Value in USD Metric Tons) (2024-2032) 6.1. Europe Hafnium Market Size and Forecast, By Type (2024-2032) 6.2. Europe Hafnium Market Size and Forecast, By Application (2024-2032) 6.3. Europe Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4. Europe Hafnium Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.3.4. Germany Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Russia Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Russia Hafnium Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Hafnium Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Hafnium Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Hafnium Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Hafnium Market Size and Forecast by Segmentation (by Value in USD Metric Tons) (2024-2032) 7.1. Asia Pacific Hafnium Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Hafnium Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4. Asia Pacific Hafnium Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.4. India 7.4.4.1. India Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Malaysia Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Malaysia Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Philippines Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Philippines Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Thailand Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Thailand Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Vietnam Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Vietnam Hafnium Market Size and Forecast, By End-user (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Hafnium Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Hafnium Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Hafnium Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Hafnium Market Size and Forecast (by Value in USD Metric Tons) (2024-2032) 8.1. Middle East and Africa Hafnium Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Hafnium Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Hafnium Market Size and Forecast, By End-user (2024-2032) 8.4. Middle East and Africa Hafnium Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Hafnium Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Hafnium Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Hafnium Market Size and Forecast, By End-user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Hafnium Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Hafnium Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Hafnium Market Size and Forecast, By End-user (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Hafnium Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Egypt Hafnium Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Egypt Hafnium Market Size and Forecast, By End-user (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Hafnium Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Nigeria Hafnium Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Nigeria Hafnium Market Size and Forecast, By End-user (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Hafnium Market Size and Forecast, By Type (2024-2032) 8.4.5.2. Rest of ME&A Hafnium Market Size and Forecast, By Application (2024-2032) 9. South America Hafnium Market Size and Forecast by Segmentation (by Value in USD Metric Tons) (2024-2032) 9.1. South America Hafnium Market Size and Forecast, By Type (2024-2032) 9.2. South America Hafnium Market Size and Forecast, By Application (2024-2032) 9.3. South America Hafnium Market Size and Forecast, By End-User (2024-2032) 9.4. South America Hafnium Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Hafnium Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Hafnium Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Hafnium Market Size and Forecast, By End-user (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Hafnium Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Hafnium Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Hafnium Market Size and Forecast, By End-user (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Hafnium Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Colombia Hafnium Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Colombia Hafnium Market Size and Forecast, By End-user (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Hafnium Market Size and Forecast, By Type (2024-2032) 9.4.4.2. Chile Hafnium Market Size and Forecast, By Application (2024-2032) 9.4.4.3. Chile Hafnium Market Size and Forecast, By End-user (2024-2032) 9.4.5. Rest of South America 9.4.5.1. Rest of South America Hafnium Market Size and Forecast, By Type (2024-2032) 9.4.5.2. Rest of South America Hafnium Market Size and Forecast, By Application (2024-2032) 9.4.5.3. Rest of South America Hafnium Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. ATI Inc. (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. Precision Castparts Corp. (U.S.) 10.3. Trex Enterprises Corp. (U.S.) 10.4. Materion Corporation (U.S.) 10.5. H.C. Starck Solutions (U.S.) 10.6. Western Zirconium (U.S.) 10.7. Texas Rare Earth Resources Corp. (U.S.) 10.8. Ed Fagan Inc. (U.S.) 10.9. Climax Molybdenum Company (U.S.) 10.10. Alfa Aesar (Germany) 10.11. Goodfellow Group (U.K.) 10.12. PLANSEE SE (Austria) 10.13. Treibacher Industry AG (Austria) 10.14. Eckart GmbH (Germany) 10.15. Metal Powder Company Ltd. (U.K.) 10.16. CERATIZIT S.A. (Luxembourg) 10.17. Molymet Belgium N.V. (Belgium) 10.18. Nuclear JingHuan Zirconium Industry Co., Ltd. (China) 10.19. Baoji ChuangXin Metal Materials Co., Ltd. (China) 10.20. CNNC Beijing Research Institute (China) 10.21. Advanced Refractory Technologies, Inc. (Japan) 10.22. TANAKA Kikinzoku Kogyo K.K. (Japan) 10.23. Toho Titanium Co., Ltd. (Japan) 10.24. Nanjing Youtian Metal Technology Co., Ltd. (China) 10.25. Ningxia Orient Tantalum Industry Co., Ltd. (China) 10.26. South African Rare Earths (South Africa) 10.27. Egyptian Mineral Resources Authority (Egypt) 10.28. CBMM (Brazil) 10.29. Votorantim Metais (Brazil) 11. Key Findings 12. Analyst Recommendations 13. Hafnium Market: Research Methodology