Gunshot Detection System Market size was valued at USD 1.3 Billion in 2024 and the total Global Gunshot Detection System Market revenue is expected to grow at a CAGR of 11.5% from 2025 to 2032, reaching nearly USD 3.11 Billion.Gunshot Detection System Market Overview

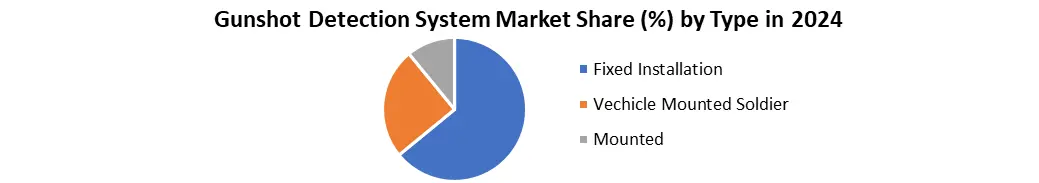

Gunshot detection system is a technique that uses acoustic, optical, other sensors to detect, detect and alert officers about tablets in real time. This increases public safety by enabling rapid alternative response and situational awareness. Global Gunshot Detection System market has been increasing concerns all public safety rising gun violence and the necessity for rapid law implementation response. These systems use acoustic devices, infrared as well as GPS technology to notice, locate gunfire incidents in real time allowing nearer emergency responses. Rising urban violence, growing adoption of smart-metro city initiatives and growing defence innovation programs. The demand for better situational awareness and real-time intelligence in high-risk environments presents strong market opportunities, particularly in schools, commercial areas and military zones. By type, the Fixed Installation segment dominated the market in 2024, driven by its wide use in urban infrastructure and nonstop surveillance capabilities. Regionally, North America led the market fuelled by high defence spending, supportive administration rules and general deployment in cities such as Chicago, New York, and Los Angeles. Major key players in the market include ShotSpotter Inc., Raytheon Technologies Corporation, Thales Group, Rheinmetall AG, and QinetiQ. Increasing investments in advanced security infrastructure and AI-integrated detection technologies, the global demand for gunshot finding systems is probable to surge significantly in the coming years.To know about the Research Methodology:- Request Free Sample Report

Gunshot Detection System Market Dynamics

Rising Gun Violence in Educational Institutions to Drive the Gunshot Detection System Market In the United States, major cities have started keeping track of gunfire or gunshots near schools, colleges & universities due to the rising number of shooting attacks that put students & staff at risk. In an examination of 200 active shooting incidents that occurred between 2001 and 2017, the Federal Bureau of Investigation (FBI) identified probable bullet targets. According to the research, shootings at educational institutions made up 22.50 percent of all shooting incidents while shootings in commercial locations accounted for 44 percent of all shooting incidents. Indoors & outdoor gunshot detection system can be installed to provide coverage in the event of an active shooting attack. When a gun is shot, the loud explosion triggers a network of sensors, cameras, or both. This network then sends summary information about the acoustic event to a review centre, where acoustics experts listen to & categorise the sound. The method for locating gunshots can be used in any sized structure with any number of levels. The event detection area is the coverage region where gunshots will be detected by the system & cause an alarm. The prevalence of gunshots and shooting in public places like schools, colleges, and institutions is increasing the need for gunshot detection systems. High Installation and Maintenance Costs to Impact of the Gunshot Detection System Market Growth Gunshot detection systems are frequently used in applications related to homeland security. These systems are expensive because they need the installation of several sensors that are spatially dispersed over a big area. A further expense is the cost of maintaining these systems. Advancements in IoT, AI, and Cloud Technologies Revolutionize Indoor to Boost Gunshot Detection Systems Market Growth New generation of indoor gunshot detection is being made possible by the growth of IoT and Cloud platforms, along with smarter, quicker, and cheaper AI engines. The cost of system hardware, sensors, software, installation fees, and monitoring services are all being redefined by the next generation of gunshot detection technologies. Strong mobile & web-based management software and installation tools are made possible by the Cloud, which provides all the benefits of a software-as-a-service (SaaS) model with low initial outlays and affordable yearly service fees. As a result, installation costs can be reduced, network needs can be streamlined, and IoT sensor devices can connect "plug & play" and be programmed and mapped from a phone or web browser. The accuracy of gunfire analysis is continuously improved by self-learning artificial intelligence (AI), driven by cloud servers, which minimises or completely replaces the requirement for human intervention during alert notification and monitoring. Campuses can now purchase gunfire detection systems with the same simplicity as adding smoke detectors thanks to the development of market technology. Gunfire detectors will soon be a necessary component of every active shooter technology plan due to their potential to save lives with only a minor incremental increase in security budgeting. The coverage area will be the main distinction for communities interested in gunshot detection. Currently, the majority of ShotSpotter deployments only cover a small area of land, usually a few square miles in a few neighbourhoods where the local police are particularly concerned about gun crime. However, if a community uses GE's automated streetlights, it will be quite inexpensive to install detectors throughout the entire city. COVID-19 Pandemic Severely to Impact on Commercial Gunshot Detection System Installations The COVID-19 outbreak has posed major financial hurdles for the threat detection sector in both commercial & military applications. Government investment in military equipment has reduced, while commercial gunfire detection system installation in new plans & the addition of new miles in plans has decreased dramatically. In comparison to military usages, commercial GDS installations are the most affected. There have been widespread travel prohibitions, which have caused in the suspension of all project management and GDS system installations. New GDS system installations are really hindered & are experiencing a significant lag. The number of new areas added, like new miles under existing contracts and new contracts for GDS installations, has drastically decreased. COVID19, as well as the limits imposed by regional authorities of many towns & the government as a result of it, like lockdowns and travel bans, has substantially reduced consumer interactions, affecting the Q2 revenue profits of the majority of commercial GDS suppliers. Commercial GDS installations are likely to fall slightly, & these conditions are expected to last until the end of 2023 and further. For example, because of regional government offices' lockdown and travel prohibition actions, one of the main participants in commercial GDS installations, ShotSpotter Inc (US), has cut its revenue expectations from USD 48 Mn to USD 46 Mn.Gunshot Detection System Market Segment Analysis

Based on Product the gunshot detection system market is segmented as, commercial, and defense. The gunshot detection system market's commercial segment is expected to grow at the fastest rate, or xx%, during the forecast period. The demand for increased security in future smart cities is driving the market for gunshot detection systems. In the past three to five years, numerous cities in North America and parts of Europe have built extensive gunshot detection systems. The military use gunshot detection systems, among other things, to safeguard military installations at bases and structures, troop wearables, border crossings, and armored vehicles. Defense systems are designed to identify the origin of gunshots and supply information for counteroffensive operations. Based on the installation, the gunshot detection system market is segmented as, fixed installations, vehicle-mounted, soldier mounted. The stationary category is expected to experience the fastest CAGR of xx% during the forecast period. The vehicle installation industry dominates the global market for GDS systems on vehicle installations, and as more armoured vehicles are needed by national forces, this market's size may increase. Based on Type the market is segmented into the Fixed Installation, Vehicle Mounted Soldier and Mounted. The fixed installation segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Fixed installation systems are widely adopted due to urban areas, significant infrastructure, their high accuracy in airports and public places, 24/7 monitoring capabilities and integration with city monitoring systems. These systems offer real -time alerts to law enforcement and emergency respondents, leading to quick response to shooting events and public safety. Governments of North America and Europe have rapidly deployed fixed systems as part of the Smart City and Homeland Security initiative, leading to their market share. Additionally, their ability to cover large geographical areas with centralized monitoring makes them more cost effective for the implementation of the city than vehicle-mounted or military-mounted options.

Gunshot Detection System Market Regional Insights:

North America dominated the market in 2024 & is expected to hold largest share during the forecast period. The gunshot detection system market in the United States is expected to grow at the fastest rate of xx% during the forecast period. In the United States, the threat of shooting-related occurrences has escalated as gun ownership and illegal arms transactions have both risen. A significant source of worry is an increase in homicides or deaths caused by firearms. The market for gunshot detection systems in North America is expected to grow as a result of the high number of firearm-related fatalities in the region, particularly in the United States, where the rate of firearm-related mortality is 25 times greater than in other countries. Major US cities plan to implement indoor gunshot detection systems at universities, corporate offices, and financial facilities, among other areas, over the projection period. For the purpose of enhancing their surveillance capabilities and alerting the department in the event of gunshots in the city, the Detroit Police Department received approval from ShotSpotter in November 2022 to install an acoustic gunshot detection system. Under a four-year, US $1.5 million deal, and the sensors are expected to be installed in two neighborhoods of the city that total six and a half square miles. The US military is putting up gunshot detection devices at its borders and facilities in the Middle East and Central Asia. In this regard, Raytheon stated that the Boomerang Warrior-X Dismounted Soldier Gunshot Detection System has been fully integrated with the Android Team Awareness Kit (ATAK) in its tactical operations centers (TOCs), allowing them to track and pinpoint incoming small weapons enemy fire in real-time. The market is expected to develop as a result of these installations. Gunshot Detection System Market Competitive Landscape Major Key players like ShotSpotter Inc. (SoundThinking Inc.), Raytheon Technologies Corporation, and Safran Electronics & Defense form backbone of the gunshot detection system market. ShotSpotter with a market share of nearly 18–20%, dominated the urban civilian segment offering cloud-based acoustic gunshot detection used by over 120 cities globally. It is real-time alerting technology enhances police response times and public safety, generating estimated revenues of USD 95–110 million in 2024. Raytheon Technologies, holding around 12–15% market share, focuses on military-grade detection systems integrated into combat vehicles and wearable solutions for soldiers. Backed by extensive R&D and U.S. Department of Defense contracts, Raytheon provides advanced AI-enabled gunfire localization across NATO and allied forces. Safran Electronics & Defense, with a 10–12% market share, caters to the military and border security sectors, offering acoustic vector sensors with high directional accuracy. The company is known for collaborating with European defense organizations and deploying solutions in UN peacekeeping missions. Urban crime rates and global defense threats rise, these key players leverage strategic partnerships, smart city integrations as well as AI-powered innovations to gain a competitive edge in both civilian and military applications of gunshot detection systems. Gunshot Detection System Market TrendsGunshot Detection System Market Key Development • On 15 March 2024, Emerson Electric Co. (North America) launched an upgraded DeltaV™ SIS with CHARMs, enhancing cybersecurity, modular scalability, and compliance with IEC 61511 standards. • On 21 January 2025, AmberBox Gunshot Detection (North America) introduced smart indoor integration technology, combining gunshot detection with fire, smoke, and security alarm systems. • On 3 March 2025, Rheinmetall AG (Europe) secured a military supply contract in Eastern Europe for its vehicle-mounted gunshot detection systems. • On 12 August 2024, Safran Electronics & Defense (Europe) partnered with EU defense agencies to integrate advanced acoustic sensors into unmanned aerial systems (UAS) for battlefield surveillance. • On 10 May 2024, ShotSpotter Inc. (SoundThinking Inc.) (North America) expanded its acoustic gunshot detection network to 10 additional U.S. cities, boosting its presence in the urban safety sector.

Trends Description Technological Advancements Integration of AI and machine learning for faster, more accurate gunshot detection. Smart City Adoption Increasing deployment of gunshot detection systems in smart city surveillance grids. Real-Time Alerting Shift towards real-time alert systems for quicker law enforcement response. Gunshot Detection System Market Scope: Inquire before buying

Gunshot Detection System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.3 Bn. Forecast Period 2025 to 2032 CAGR: 11.5% Market Size in 2032: USD 3.11 Bn. Segments Covered: by Product Commercial Defence by Type Fixed Installation Vehicle Mounted Soldier Mounted by Application System SaaS by End-Users Outdoor Indoor Gunshot Detection System Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Gunshot Detection System Market Key Players

North America 1. ShotSpotter Inc. (SoundThinking Inc.) – USA 2. Raytheon Technologies Corporation – USA 3. Safran Electronics & Defense – USA/France (North American operations) 4. Louroe Electronics – USA 5. ASELSAN Inc. – Turkey/USA 6. Acoem Group – USA 7. Thales Group – USA/France 8. AmberBox Gunshot Detection – USA 9. Databuoy Corporation – USA 10. QinetiQ North America – US Europe 11. Rheinmetall AG – Germany 12. Thales Group – France 13. Trigaten Ltd. – UK 14. Elsitel S.r.l. – Italy 15. Safety Dynamics Inc. (European Contracts) – Europe 16. Microflown AVISA – Netherlands 17. Acoem Group – France Asia-Pacific 18. Rolta India Limited – India 19. Hensoldt Sensors GmbH – Germany (with Asia-Pac presence) 20. Hanwha Systems – South Korea 21. China North Industries Group Corporation (NORINCO) – China 22. Aselsan A.S. – Turkey (Asia regional presence) Middle East & Africa 23. EDGE Group (formerly Emirates Advanced Research & Technology Holding) – UAE 24. Rheinmetall Denel Munition (Pty) Ltd. – South Africa 25. Aselsan Middle East PSC Ltd. – Jordan South America 26. Condor Non-Lethal Technologies – Brazil 27. Imbel (Indústria de Material Bélico do Brasil) – Brazil 28. VMI Sistemas de Segurança – BrazilFrequently Asked Question

1: What was the value of the Gunshot Detection System Market in 2024? Ans: The market was valued at USD 1.3 Billion in 2024. 2: Which segment dominated the market by type in 2024? Ans: The Fixed Installation segment dominated due to wide urban deployment and 24/7 monitoring. 3: Which region led the Gunshot Detection System Market in 2024? Ans: North America led the market, driven by high gun violence rates and smart city initiatives. 4: Name two major players in the Gunshot Detection System Market. Ans: ShotSpotter Inc. and Raytheon Technologies Corporation are key market players. 5: What is a key opportunity driving future market growth? Ans: Integration with smart cities and AI-based surveillance systems offers major growth opportunities.

1. Gunshot Detection System Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Gunshot Detection System Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Gunshot Detection System Market: Dynamics 3.1. Region-wise Trends of Gunshot Detection System Market 3.1.1. North America Gunshot Detection System Market Trends 3.1.2. Europe Gunshot Detection System Market Trends 3.1.3. Asia Pacific Gunshot Detection System Market Trends 3.1.4. Middle East and Africa Gunshot Detection System Market Trends 3.1.5. South America Gunshot Detection System Market Trends 3.2. Gunshot Detection System Market Dynamics 3.2.1. Gunshot Detection System Market Drivers 3.2.1.1. Rising urban gun violence 3.2.1.2. Increasing mass shooting incidents 3.2.2. Gunshot Detection System Market Restraints 3.2.3. Gunshot Detection System Market Opportunities 3.2.3.1. Integration with surveillance systems 3.2.3.2. Expansion in smart cities 3.2.4. Gunshot Detection System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Gunshot Detection System Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 4.1.1. Commercial 4.1.2. Defense 4.2. Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 4.2.1. Fixed Installation 4.2.2. Vehicle Mounted 4.2.3. Soldier Mounted 4.3. Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 4.3.1. System 4.3.2. SaaS 4.4. Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 4.4.1. Outdoor 4.4.2. Indoor 4.5. Gunshot Detection System Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Gunshot Detection System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 5.1.1. Commercial 5.1.2. Defense 5.2. North America Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 5.2.1. Fixed Installation 5.2.2. Vehicle Mounted 5.2.3. Soldier Mounted 5.3. North America Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 5.3.1. System 5.3.2. SaaS 5.4. North America Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 5.4.1. Outdoor 5.4.2. Indoor 5.5. North America Gunshot Detection System Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 5.5.1.1.1. Commercial 5.5.1.1.2. Defense 5.5.1.2. United States Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 5.5.1.2.1. Fixed Installation 5.5.1.2.2. Vehicle Mounted 5.5.1.2.3. Soldier Mounted 5.5.1.3. United States Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. System 5.5.1.3.2. SaaS 5.5.1.4. United States Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 5.5.1.4.1. Outdoor 5.5.1.4.2. Indoor 5.5.2. Canada 5.5.2.1. Canada Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 5.5.2.1.1. Commercial 5.5.2.1.2. Defense 5.5.2.2. Canada Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 5.5.2.2.1. Fixed Installation 5.5.2.2.2. Vehicle Mounted 5.5.2.2.3. Soldier Mounted 5.5.2.3. Canada Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. System 5.5.2.3.2. SaaS 5.5.2.4. Canada Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 5.5.2.4.1. Outdoor 5.5.2.4.2. Indoor 5.5.3. Mexico 5.5.3.1. Mexico Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 5.5.3.1.1. Commercial 5.5.3.1.2. Defense 5.5.3.2. Mexico Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 5.5.3.2.1. Fixed Installation 5.5.3.2.2. Vehicle Mounted 5.5.3.2.3. Soldier Mounted 5.5.3.3. Mexico Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. System 5.5.3.3.2. SaaS 5.5.3.4. Mexico Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 5.5.3.4.1. Outdoor 5.5.3.4.2. Indoor 6. Europe Gunshot Detection System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.2. Europe Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.3. Europe Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.4. Europe Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5. Europe Gunshot Detection System Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.1.2. United Kingdom Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.1.3. United Kingdom Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.2. France 6.5.2.1. France Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.2.2. France Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.2.3. France Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.3.2. Germany Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.3.3. Germany Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.4.2. Italy Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.4.3. Italy Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.5.2. Spain Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.5.3. Spain Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.6.2. Sweden Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.6.3. Sweden Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.7.2. Russia Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.7.3. Russia Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Russia Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 6.5.8.2. Rest of Europe Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 6.5.8.3. Rest of Europe Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Gunshot Detection System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.3. Asia Pacific Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5. Asia Pacific Gunshot Detection System Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.1.2. China Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.1.3. China Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.2.2. S Korea Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.2.3. S Korea Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.3.2. Japan Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.3.3. Japan Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.4. India 7.5.4.1. India Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.4.2. India Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.4.3. India Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.5.2. Australia Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.5.3. Australia Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.6.2. Indonesia Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.6.3. Indonesia Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.7.2. Malaysia Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.7.3. Malaysia Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Malaysia Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.8.2. Philippines Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.8.3. Philippines Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Philippines Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.9.2. Thailand Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.9.3. Thailand Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Thailand Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.10.2. Vietnam Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.10.3. Vietnam Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Vietnam Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 7.5.11.2. Rest of Asia Pacific Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Gunshot Detection System Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 8.3. Middle East and Africa Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 8.5. Middle East and Africa Gunshot Detection System Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 8.5.1.2. South Africa Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 8.5.1.3. South Africa Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 8.5.2.2. GCC Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 8.5.2.3. GCC Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 8.5.3.2. Egypt Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 8.5.3.3. Egypt Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Egypt Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 8.5.4.2. Nigeria Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 8.5.4.3. Nigeria Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Nigeria Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 8.5.5.2. Rest of ME&A Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 8.5.5.3. Rest of ME&A Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 8.5.5.4. Rest of ME&A Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 9. South America Gunshot Detection System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 9.2. South America Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 9.3. South America Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 9.4. South America Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 9.5. South America Gunshot Detection System Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 9.5.1.2. Brazil Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 9.5.1.3. Brazil Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 9.5.2.2. Argentina Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 9.5.2.3. Argentina Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 9.5.3.2. Colombia Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 9.5.3.3. Colombia Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Colombia Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 9.5.4.2. Chile Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 9.5.4.3. Chile Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 9.5.4.4. Chile Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Gunshot Detection System Market Size and Forecast, By Product (2024-2032) 9.5.5.2. Rest Of South America Gunshot Detection System Market Size and Forecast, By Type (2024-2032) 9.5.5.3. Rest Of South America Gunshot Detection System Market Size and Forecast, By Application (2024-2032) 9.5.5.4. Rest Of South America Gunshot Detection System Market Size and Forecast, By End-User (2024-2032) 10. Company Profile: Key Players 10.1. ShotSpotter Inc. (SoundThinking Inc.) – (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Raytheon Technologies Corporation – (USA) 10.3. Safran Electronics & Defense – (USA/France) 10.4. Louroe Electronics – (USA) 10.5. ASELSAN Inc. – (Turkey/USA) 10.6. Acoem Group – (USA) 10.7. Thales Group – (USA/France) 10.8. AmberBox Gunshot Detection – (USA) 10.9. Databuoy Corporation – (USA) 10.10. QinetiQ North America – (USA) 10.11. Rheinmetall AG – (Germany) 10.12. Thales Group – (France) 10.13. Trigaten Ltd. – (UK) 10.14. Elsitel S.r.l. – (Italy) 10.15. Safety Dynamics Inc. (European Contracts) – (Europe) 10.16. Microflown AVISA – (Netherlands) 10.17. Acoem Group – (France) 10.18. Rolta India Limited – (India) 10.19. Hensoldt Sensors GmbH – (Germany) 10.20. Hanwha Systems – (South Korea) 10.21. China North Industries Group Corporation (NORINCO) – (China) 10.22. Aselsan A.S. – (Turkey) 10.23. EDGE Group (formerly Emirates Advanced Research & Technology Holding) – (UAE) 10.24. Rheinmetall Denel Munition (Pty) Ltd. – (South Africa) 10.25. Aselsan Middle East PSC Ltd. – (Jordan) 10.26. Condor Non-Lethal Technologies – (Brazil) 10.27. Imbel (Indústria de Material Bélico do Brasil) – (Brazil) 10.28. VMI Sistemas de Segurança – (Brazil) 11. Key Findings 12. Industry Recommendations 13. Gunshot Detection System Market: Research Methodology