The Gasoline Fuel Injector Market size was valued at USD 9.08 Billion in 2025 and the total Gasoline Fuel Injector revenue is expected to grow at a CAGR of 3.8% from 2025 to 2032, reaching nearly USD 11.79 Billion by 2032.Gasoline Fuel Injector Market Overview:

Gasoline Fuel Injector is the small nozzle device used to supply fuel under high pressure into an engine combustion chamber. The main functions of the Gasoline Fuel Injector are to enhance engines in terms of performance and noise characteristics, increase working efficiency, and avoid leakages. Different types of gasoline fuel injectors available in the market are single-point or throttle body injection, port or multiport fuel injection, sequential fuel injection, and direct injection. Due to the presence of its advantages such as maximum fuel efficiency & power production and helps in minimizing the emission level etc. are increasingly used in modern vehicles. As a result, the global gasoline fuel injector market is expected to reach USD 11.79 Bn. by 2032.To know about the Research Methodology :- Request Free Sample Report

Gasoline Fuel Injector Market Dynamics:

The growing demand for gasoline vehicles due to their low maintenance and reduced emission level and increasing racing activities across the globe are creating demand for the gasoline fuel injector market. In 2022, the number of gasoline vehicles produced across the globe is 78 Mn and this number is expected to reach 126 Mn by 2032. Furthermore, increasing crude oil prices and growing consumer preference toward energy-efficient vehicles are boosting the growth of the market. The strict government rules for minimizing the vehicle emission to conserve the environment are anticipating the growth of the market. Recently measure taken at EU levels helps in the reduction of Co2 emission by cars for their 27 member countries and In 2015 PARIS AGREEMENT stated certain regulations to limit the global average temperature to 1.5 degrees Celsius. This regulation forced the fuel injector manufacturer to improve the efficiency of the injector to meet global standards. Increasing demand for the IC engine vehicles and growing technological advancement are fuelling the market growth. Recently “DENSO Technologies” developed a diesel engine fuel injector with a pressure sensor named i-ART. This innovation helps in measuring the fuel pressure and temperature to optimize the time and quantity of fuel injected. Results maximize the performance and reduce energy consumption. In April 2022, Argonne researcher, CUMMINS an engine design and manufacturing company, and Convergent Science, Inc a software developer announced that they are expanding partnership for further 3 years to develop accurate fuel spray models and integrate them into full engine simulations. Some of the factors slowing the growth of the gasoline fuel injector market are increasing global attraction towards electric vehicles and continuous fluctuation in the cost of raw materials. Furthermore, the huge requirement for maintenance, high rate of noise production, and series of government regulations to promote electric vehicles are becoming a roadblock to the market growth.Gasoline Fuel Injector Market Segmentation:

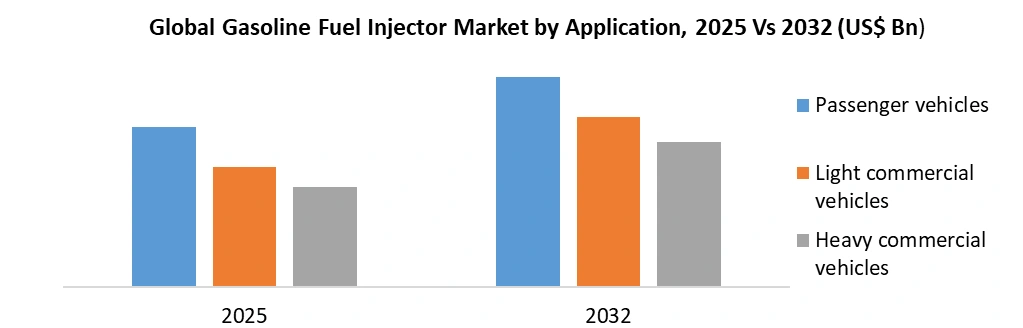

Based on Type, the Gasoline Fuel Injector Market is sub-segmented into gasoline port injection, gasoline direct injection, and diesel direct injection. The gasoline port injection segment dominates the global market and it held a share of 51 % in 2025. It is the most popular drive system for gasoline engines on the globe. Due to its low-pressure systems, this segment operates with a simple strategy and reduces the cost. The gasoline port injection is capable of providing engine power of 60 kW/liter and downsizing concepts with turbocharging of up to 25% and comfortable acceleration also at a low rotational speed. As a result, the gasoline port injection is expected to grow at a CAGR of 2.4% by 2032. The gasoline direct injection segment stood at second place and its slowing growth in the market is due to loss of engine efficiency due to deposits on the piston surface and low mileage misfire codes. Based on Application, the Gasoline Fuel Injector Market is sub-segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The passenger vehicles segment dominates the global market and was valued at US$ 2.1 Bn. in 2025. Growing demand for passenger vehicles in developed countries due to their low cost and the high-performance rate is driving the gasoline fuel injector market. More youths are attracted to gasoline vehicles is due to their quick start capacity than other vehicles, quiet combustion & operation, and powerful energy source because gasoline-powered passenger vehicles can run 24/7. Light commercial vehicles come in second place because of their high cost and low speed.

Gasoline Fuel Injector Market regional insights:

In 2025, Asia-Pacific held the largest share in the Gasoline Fuel Injector market. Rising purchasing power, increased demand for fuel-efficient vehicles, and stricter emission standards in emerging economies such as China and India have all resulted in increased demand for fuel injection systems in this region. Furthermore, factors such as rising global vehicle production and increasing research and growth in the automotive fuel injection systems are adding an advantage to the market growth. However, constantly fluctuating raw material prices can have an impact on the profitability of suppliers. The growing demand for two-wheelers in countries such as China, India, Japan, and South Korea is opening up new opportunities for fuel injection systems. The objective of the report is to present a comprehensive analysis of the global Fuel Injector market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Gasoline Fuel Injector Market dynamics, structure by analyzing the market segments and projecting the Gasoline Fuel Injector Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Gasoline Fuel Injector Market make the report investor’s guide.Gasoline Fuel Injector Market Scope: Inquiry Before Buying

Gasoline Fuel Injector Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 9.08 Bn. Forecast Period 2026 to 2032 CAGR: 3.8% Market Size in 2032: USD 11.79 Bn. Segments Covered: by Type Gasoline port injection Gasoline direct injection Diesel direct injection by Application Passenger vehicles Light commercial vehicles Heavy commercial vehicles Gasoline Fuel Injector Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gasoline Fuel Injector Market, Key Players are:

1.Delphi 2. Park-ohio 3. Bosch 4. Stanadyne 5. Hitachi 6. Schaeffler 7. Infineon 8. Denso 9. Valeo 10. Keihin 11. Continental 12. Renesas 13. Magneti marelli 14. Msr-jebsen technologies 15. Eaton Corporation 16. Mitsubishi electric corp. 17. Bajaj auto ltd 18. Westport innovations inc. 19. Woodward inc. 20. Uci international inc. (uci fram group) 21. Ti automotive inc. 22. Ngk spark plug co., ltd. 23. Edelbrock llc Frequently Asked Questions: 1. Which region has the largest share in Gasoline Fuel Injector Market? Ans: Asia-Pacific held the largest share in 2025. 2. What is the growth rate of the Market? Ans: The Gasoline Fuel Injector Market is growing at a CAGR of 3.8% during the forecasting period 2026-2032. 3. What segments are covered in Market? Ans: Gasoline Fuel Injector Market is segmented into type and application. 4. What is the study period of this market? Ans: The Gasoline Fuel Injector Market is studied from 2025 to 2032. 5. Who are the key players in Market? Ans: Delphi, Park-ohio, Bosch, Stanadyne, Hitachi, Schaeffler, Infineon, Denso, Valeo, Keihin, Continental, Renesas, Magneti marelli, Msr-jebsen technologies, Eaton Corporation, Mitsubishi electric corp., Bajaj auto ltd, Westport innovations inc., Woodward inc., Uci international inc. (uci fram group), Ti automotive inc., Ngk spark plug co., ltd, Edelbrock llc.

1. Gasoline Fuel Injector Market: Research Methodology 2. Gasoline Fuel Injector Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Gasoline Fuel Injector Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Gasoline Fuel Injector Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Gasoline Fuel Injector Market Segmentation 4.1 Gasoline Fuel Injector Market, by type (2025-2032) • Gasoline port injection • Gasoline direct injection • Diesel direct injection 4.2 Gasoline Fuel Injector Market, by Application (2025-2032) • Passenger vehicles • Light commercial vehicles • Heavy commercial vehicles 5. North America Gasoline Fuel Injector Market (2025-2032) 5.1 Gasoline Fuel Injector Market, by type (2025-2032) • Gasoline port injection • Gasoline direct injection • Diesel direct injection 5.2 Gasoline Fuel Injector Market, by Application (2025-2032) • Passenger vehicles • Light commercial vehicles • Heavy commercial vehicles 5.3 North America Gasoline Fuel Injector Market, by Country (2025-2032) • United States • Canada • Mexico 6. Asia Pacific Gasoline Fuel Injector Market (2025-2032) 6.1. Asia Pacific Gasoline Fuel Injector Market, by type (2025-2032) 6.2. Asia Pacific Gasoline Fuel Injector Market, by Application (2025-2032) 6.3. Asia Pacific Gasoline Fuel Injector Market, by Country (2025-2032) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Gasoline Fuel Injector Market (2025-2032) 7.1 Middle East and Africa Gasoline Fuel Injector Market, by type (2025-2032) 7.2. Middle East and Africa Gasoline Fuel Injector Market, by Application (2025-2032) 7.3. Middle East and Africa Gasoline Fuel Injector Market, by Country (2025-2032) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Gasoline Fuel Injector Market (2025-2032) 8.1. Latin America Gasoline Fuel Injector Market, by type (2025-2032) 8.2. Latin America Gasoline Fuel Injector Market, by Application (2025-2032) 8.3. Latin America Gasoline Fuel Injector Market, by Country (2025-2032) • Brazil • Argentina • Rest Of Latin America 9. European Gasoline Fuel Injector Market (2025-2032) 9.1. European Gasoline Fuel Injector Market, by type (2025-2032) 9.2. European Gasoline Fuel Injector Market, by Application (2025-2032) 9.3. European Gasoline Fuel Injector Market, by Country (2025-2032) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Delphi 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Park-ohio 10.3 Bosch 10.4 Stanadyne 10.5 Hitachi 10.6 Schaeffler 10.7 Infineon 10.8 Denso 10.9 Valeo 10.10 Keihin 10.11 Continental 10.12 Renesas 10.13 Magneti marelli 10.14 Msr-jebsen technologies 10.15 Eaton Corporation 10.16 Mitsubishi electric corp. 10.17 Bajaj auto ltd 10.18 Westport innovations inc. 10.19 Woodward inc. 10.20 Uci international inc. (uci fram group) 10.21 Ti automotive inc. 10.22 Ngk spark plug co., ltd. 10.23 Edelbrock llc