Global Flavor Enhancer Market size was valued at USD 9.68 Bn. in 2024 and the total Flavor Enhancer Market revenue is expected to grow by 6.5% from 2025 to 2032, reaching nearly USD 16.02 Bn.Flavor Enhancer Market Overview:

Flavor enhancers are key ingredients in any food product, addressing the need to enhance and build flavor profiles for food and beverage products while minimally changing their nutritional status. These compounds, which include monosodium glutamate (MSG) and nucleotides, as well as yeast extracts, hydrolyzed vegetable proteins (HVPs), and acidulants, are utilized to build umami flavor, mask off-notes, or find ways to limit salt/sugar addition without limiting flavor. Furthermore, evolved from synthetic, cost-efficient enhancements like MSG to society embracing natural, clean-label, and fermentation-derived enhancers, keeping up with continually shifting consumer preferences towards health & transparency, as well as sustainability. Flavor Enhancers Market demand continues to accelerate as people consume higher amounts of processed foods, ready-to-eat meals, plant-based alternatives, and the evolution of low-sodium products, especially in urban areas, Yeast extracts and HVPs, are widely used within the Asia-Pacific and North American markets to help boost savory flavor notes in beverage products, snack products, and instant meals, while Europe continue to experience a significant rise in interest surrounding natural and organic flavor systems due to regulatory pressures as well as the trend toward clean label products.To know about the Research Methodology :- Request Free Sample Report The Flavor Enhancer Market Report Covered in-depth analysis of the key growth drivers of urbanization, food development, eating habits, and reformulation for health-conscious consumers. The main segments discussed are product type, application, and end user groups. Overall, Ajinomoto, Givaudan, International Flavors & Fragrances (IFF), Kerry Group, ADM and Tate & Lyle are the main players within the global flavour enhancer market, with many investing in research and development for the creation of flavour enhancers that are more sustainable, cost-effective, and label-friendly. At the same time, there are growing trends in new products like fermented umami bases, salt-reduction enhancers, and multi-functional flavour modulators, alongside wider application of flavour enhancers across plant-based, vegan and low-fat food items, changing the competitive landscape of modern food formulation.

Flavor Enhancer Market Dynamics

Demand for Convenience, Health, and Exotic Tastes to Drive Flavor Enhancer Market Growth According to research conducted by MMR, the Flavor Enhancer Market is experiencing robust growth driven by various factors, including a surge in the demand for convenience foods and natural flavor enhancers, technological advancements, and the expanding use of flavor enhancers in the pharmaceutical industry. The global Flavor Enhancer Market is witnessing rapid expansion propelled by an increasing preference for premium-quality products and a growing inclination towards novel and exotic flavors. Despite the significant impact of the COVID-19 pandemic on the availability and prices of natural food flavors, the research indicates a substantial interest in foreign cuisines among a considerable number of people in South America, contributing to the overall growth of the food flavor and enhancer market. The report underscores the significant growth potential of the Flavor Enhancer Market, primarily fueled by the rising demand for healthy food products and convenient meals, coupled with the expanding utilization of natural flavors in the food and beverage industry. Rising Demand for Natural and Ethnic Flavors to Create Flavor Enhancer Market Opportunities The Flavor Enhancer Market has undergone substantial growth, driven by the increasing demand for food products with enhanced taste and flavor, reflecting consumers' preferences for more delightful culinary experiences. A prominent trend shaping this industry is the growing interest in natural and organic flavor enhancers, creating avenues for companies to introduce innovative products to the market. This trend is particularly noticeable in emerging markets like China, India, Brazil, and Southeast Asia, where the demand for packaged and convenience foods is surging, providing abundant opportunities for Flavor Enhancer Market Penetration. With consumers adopting busy lifestyles, the demand for convenience foods is on the rise, presenting collaboration opportunities for flavor enhancer companies with food manufacturers. Additionally, companies can capitalize on advancements in product development and leverage innovations in food technology to create cutting-edge products that enhance the taste and texture of food items. The report emphasizes the potential for flavor enhancer companies to explore the growing market for functional foods and personalized food products. The increasing popularity of ethnic cuisines also offers a strategic avenue for companies to tailor products that resonate with the distinctive taste profiles of diverse culinary traditions, contributing to their Flavor Enhancer Market Share. Cost, Regulation, and Perception in the Flavor Enhancer Industry to Create Flavor Enhancer Market Challenges The report delves into various restraints and challenges confronting the Flavor Enhancer Market. A primary concern among consumers is the usage of artificial flavor enhancers, which are perceived as unhealthy and potentially causing adverse long-term health effects. Consequently, there is a growing demand for natural and organic flavor enhancers, albeit these are expensive to produce and have limited availability. Stringent regulations governing the use of flavor enhancers can further curtail their availability and elevate production costs. Additionally, increasing awareness of food allergies and intolerance, coupled with the trend toward clean labels and minimally processed foods, may limit the application of certain flavor enhancers. Intense competition among companies, coupled with economic uncertainties and disruptions in the supply chain, poses constraints on the growth potential of individual firms in the Flavor Enhancer Market. Challenges include negative consumer perceptions of artificial flavor enhancers, regulatory restrictions on specific ingredients, the high costs associated with raw materials and manufacturing processes, limited availability and awareness of certain products in specific markets, and the broader trend toward healthier and natural food options. Furthermore, environmental concerns linked to the production and disposal of flavor enhancers may trigger heightened regulations and increased scrutiny.Global Flavor Enhancer Market Segment Analysis

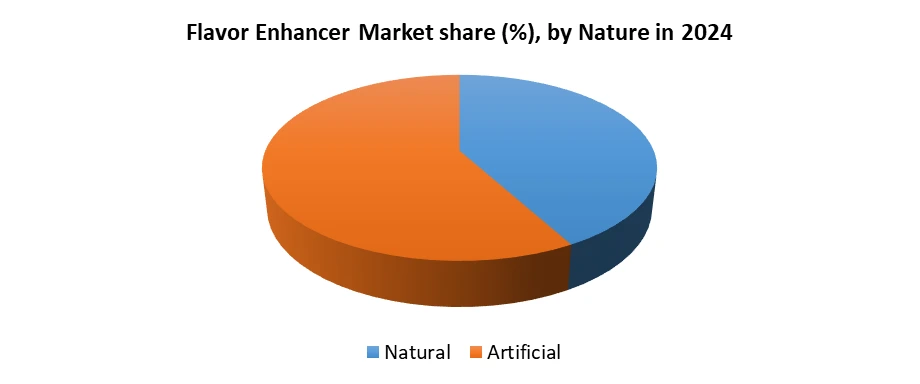

Based on Type, flavor enhancer market is segmented into Acidulants, Glutamates, Hydrolyzed Vegetable Protein, Yeast extract and Others. Among these Glutamates segment has dominated the market in 2024 and is expected to hold the largest market share over the forecast period. This dominance can be attributed to the widespread consumption of monosodium glutamate (MSG) and related compounds that induce umami, and are non-existent in household products that include instant noodles, soups, processed meats, and snacks. Glutamates are increasing in the Asia-Pacific region where umami flavors are heavily favored and MSG remains widely accepted in both traditional and modern food practices. In addition, glutamates offer a low-cost option to enhance flavor without increasing salt or fat content and can appeal to food manufacturers who can emphasize both low cost and flavor enhancement.Based on Nature, the flavor enhancer market is segmented into Natural and Artificial. Artificial segment has dominated the market in 2024 and is expected to hold the largest market share over the forecast period, owing largely to the global consumption of synthetic compounds including monosodium glutamate (MSG) or synthetic nucleotides in processed or packaged foods. There are a large number of artificial enhancers available that substantially lower the level of umami intensity at a relatively low cost, with virtually no restrictions in functionality and few restrictions regionally, particularly in Asia Pacific, where instant noodles, snacks and soups comprise primary food categories. Artificial flavor enhancers are in continuous competition with clean-label and natural products, reflecting a growing consumer preference in Western Markets. Artificial flavor enhancers retain their advantage primarily due to a long-established supply chain, consistent use over formulatory alternatives and regulatory acceptance in many high-volume food-processing sectors.

Flavor Enhancer Market Regional Insights

In 2024, the Asia-Pacific dominated Flavor Enhancer Market globally at around 35–38% market share. Countries like China, Japan, South Korea, India and Indonesia all have a long-standing and widespread culture and daily cooking practice of using umami flavor enhancers like monosodium glutamate (MSG). They also have the highest rates of consumption of instant noodles, snacks, sauces, soups, processed foods, etc. All these are potential sources of flavor enhancers to enhance flavor. The deeper story is that, in addition to the large manufacturing bases, increasing populations, increased urbanization, and changes to the diet in the Asia-Pacific region have led to a growing demand for artificial and natural flavor enhancement choices.Flavor Enhancer Market Competitive Landscape

The Flavor Enhancer Market is very competitive. The landscape is affected by many global players in food ingredients and flavor technology. There are several key competitors in this industry, including Ajinomoto Co., Inc. (Japan) and Givaudan SA (Switzerland), which both have large developed and supply a variety of flavor enhancement solutions. They supply flavor enhancement solutions across food and beverage, snacks, sauces, and ready meals with an increasing focus on umami and clean-label applications. Ajinomoto Co., Inc. has revenue of USD XX billion in 2024 as they benefited from strong global demand for monosodium glutamate (MSG), nucleotides (IMP, GMP), and amino acid-based enhancers in 2024, especially in Asia-Pacific and Latin America. Givaudan SA has revenues of USD XX billion in its Taste & Wellbeing segment from its savory and flavor enhancer offerings in 2024 as it benefited from strength in its fermented natural enhancers, yeast extracts, and sodium reduction platforms, particularly in Europe and North America. Both companies continue to invest in and explore natural flavor innovations, digital and robotics R&D tools, and sustainable production technologies in order to satisfy growing global demand for flavor enhancement, consumer clean-label transparency, and compliance with regulatory oversight. Flavor Enhancer Market Recent Development • Ajinomoto Co., Inc. (Japan) announced in January 2025 to introduce Deliciousness Technology, a collection of four core technologies: evaluation, analysis formulation, and production engineering, that aim to replicate and elevate the complex sensation of "deliciousness" in food applications. • International Flavors & Fragrances Inc. (IFF) (US) announced the introduction of a new line of IFF NEO™ natural flavors, 100% free of citrus-derived ingredients, in addition to restructuring its internal system to enhance its Taste and Food Ingredients segments effective 1 January 2025. • Givaudan SA (Switzerland) presented at VivaTech 2025 (May 2025) its digital-first approach to flavor enhancement featuring immersive, AI-enabled consumer engagement tools like a scent-based "mini piano" to shape next-generation flavor and fragrance experiences. • BASF SE (Germany) launched two new biotech (fermentation-based) flavor ingredients, Isobionics® Natural beta Sinensal 20 and Natural alpha Humulene 90, at FlavourTalk 2025 (March 2025) and announced the addition of a reduced product carbon footprint (rPCF) portfolio (e.g. Menthol, Citronellol, Geraniol) in early 2025 to promote sustainability throughout aroma ingredients. • Tate & Lyle PLC (UK) appointed a new CEO in June 2024 announced it had completed its strategic transformation, powered by its CP Kelco merger (November 2024), Primient divestiture (June 2024), and noted its enhanced capabilities across sweetening, mouthfeel and fortification solutions in food and beverage applications.Flavor Enhancer Market Recent Trends

Category Key Trend Example Product Market Impact Monosodium Glutamate Continued dominance in savory flavoring despite health debates Ajinomoto Aji-no-moto MSG Maintains strong usage in Asia-Pacific and Middle East; drives cost-effective flavor enhancement Yeast Extracts Surge in demand for clean-label, vegan-friendly umami enhancers Kerry Savr-Taste Clean Yeast Extracts Fuels growth in plant-based and natural food segments, especially in North America and Europe Hydrolyzed Vegetable Protein (HVP) Preference for non-GMO and allergen-free variants Tate & Lyle Non-GMO Soy HVP Drives adoption in EU and U.S. clean-label snack and instant meal categories Flavor Enhancer Industry Ecosystem

Flavor Enhancer Market Scope: Inquire before buying

Global Flavor Enhancer Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.68 Bn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 16.02 Bn. Segments Covered: by Type Acidulants Glutamates Hydrolyzed Vegetable Protein Yeast extract Others by Nature Natural Artificial by Application Dairy Bakery Confectionery Beverage Others by End-User Food and Beverage Bakery Confectionaries Soups and Salads Others Flavor Enhancer Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Flavor Enhancer Market, Key Players:

The competitive landscape of the Flavor Enhancer Industry is shaped by a diverse mix of industry leaders, followers, and new entrants, all of whom significantly influence industry dynamics. The leading companies in the Flavor Enhancer industry, including International Flavours & Fragrances Inc., and Givaudan are strategically expanding their product portfolios and forging partnerships to strengthen their presence in specific regional industry. These firms leverage their established brands and distribution networks to maintain a competitive edge. Simultaneously, new entrants are making their mark by capitalizing on the growing consumer demand for natural and organic products. These companies are successfully carving out niches in the industry by offering clean-label and plant-based solutions that cater to health-conscious consumers. Their commitment to sustainability and innovation allows them to differentiate themselves from established players, even amid intense competition. North America 1. Archer Daniels Midland Company (ADM) (US) 2. Cargill, Inc. (US) 3. FMC Corporation (US) 4. International Flavors & Fragrances Inc. (IFF) (US) 5. McCormick & Company, Inc. (US) 6. Sensient Technologies Corporation (US) 7. The Edlong Corporation (US) 8. The Flavor Factory, LLC (US) 9. The Flavor Apprentice (US) 10. The International Dehydrated Foods, Inc. (US) Europe 1. BASF SE (Germany) 2. Symrise AG (Germany) 3. Corbion NV (Netherlands) 4. Koninklijke DSM N.V. (Netherlands) 5. Royal DSM N.V. (Netherlands) 6. DSM Nutritional Products AG (Switzerland) 7. Givaudan SA (Switzerland) 8. Kerry Group plc (Ireland) 9. Mane SA (France) 10. Naturex SA (France) 11. Roquette Frères (France) 12. Novozymes A/S (Denmark) 13. Tate & Lyle PLC (UK) Asia Pacific 1. Ajinomoto Co., Inc. (Japan) 2. Takasago International Corporation (Japan) Frequently Asked Questions: 1. Which region has the largest share in the Global Flavor Enhancer Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Flavor Enhancer Market? Ans: The Global Flavor Enhancer Market is expected to grow at a CAGR of 6.5% during the forecast period 2025-2032. 3. What is the scope of the Global Flavor Enhancer Market report? Ans: The Global Flavor Enhancer Market report helps with the PESTEL, PORTER, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Flavor Enhancer Market? Ans: The important key players in the Global Flavor Enhancer Market are –Ajinomoto Co., Inc. (Japan), Takasago International Corporation (Japan), International Flavors & Fragrances Inc. (IFF) (US), McCormick & Company, Inc. (US), Sensient Technologies Corporation (US), etc. 5. What is the study period of Flavor Enhancer Market? Ans: The Global Flavor Enhancer Market is studied from 2024 to 2032.

1. Flavor Enhancer Market: Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Flavor Enhancer Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Flavor Enhancer Market: Dynamics 3.1. Region-wise Trends of Flavor Enhancer Market 3.1.1. North America Flavor Enhancer Market Trends 3.1.2. Europe Flavor Enhancer Market Trends 3.1.3. Asia Pacific Flavor Enhancer Market Trends 3.1.4. Middle East and Africa Flavor Enhancer Market Trends 3.1.5. South America Flavor Enhancer Market Trends 3.2. Flavor Enhancer Market Dynamics 3.2.1. Global Flavor Enhancer Market Drivers 3.2.1.1. Rising Demand for Processed and Convenience Foods 3.2.1.2. Growing Popularity of Umami and Savory Flavors 3.2.1.3. Increased Demand for Low-Sodium and Health-Conscious Products 3.2.2. Global Flavor Enhancer Market Restraints 3.2.3. Global Flavor Enhancer Market Opportunities 3.2.3.1. Growth of Plant-Based and Vegan Foods 3.2.3.2. Innovation in Salt and Sugar Reduction Solutions 3.2.3.3. Expansion in Functional and Fortified Foods 3.2.4. Global Flavor Enhancer Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Regulatory scrutiny on food additives 3.4.2. Growth of middle-class population and disposable incomes in Asia & Africa 3.4.3. Rising health awareness and demand for low-sodium, low-fat food 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Flavor Enhancer Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 4.1.1. Acidulants 4.1.2. Glutamates 4.1.3. Hydrolyzed Vegetable Protein 4.1.4. Yeast extract 4.1.5. Others 4.2. Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 4.2.1. Natural 4.2.2. Artificial 4.3. Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 4.3.1. Dairy 4.3.2. Bakery 4.3.3. Confectionery 4.3.4. Beverage 4.3.5. Others 4.4. Flavor Enhancer Market Size and Forecast, by End User (2024-2032) 4.4.1 Food and Beverage 4.4.2 Bakery 4.4.3 Confectionaries 4.4.4 Soups and Salads 4.4.5 Others 4.5. Flavor Enhancer Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Flavor Enhancer Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 5.1.1. Acidulants 5.1.2. Glutamates 5.1.3. Hydrolyzed Vegetable Protein 5.1.4. Yeast extract 5.1.5. Others 5.2. North America Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 5.2.1. Natural 5.2.2. Artificial 5.3. North America Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 5.3.1. Dairy 5.3.2. Bakery 5.3.3. Confectionery 5.3.4. Beverage 5.3.5. Others 5.4. North America Flavor Enhancer Market Size and Forecast, by End User (2024-2032) 5.4.1 Food and Beverage 5.4.2 Bakery 5.4.3 Confectionaries 5.4.4 Soups and Salads 5.4.5 Others 5.5. North America Flavor Enhancer Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. Acidulants 5.5.1.1.2. Glutamates 5.5.1.1.3. Hydrolyzed Vegetable Protein 5.5.1.1.4. Yeast extract 5.5.1.1.5. Others 5.5.1.2. United States Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 5.5.1.2.1. Natural 5.5.1.2.2. Artificial 5.5.1.3. United States Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Dairy 5.5.1.3.2. Bakery 5.5.1.3.3. Confectionery 5.5.1.3.4. Beverage 5.5.1.3.5. Others 5.5.1.4. United States Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. Food and Beverage 5.5.1.4.2. Bakery 5.5.1.4.3. Confectionaries 5.5.1.4.4. Soups and Salads 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. Acidulants 5.5.2.1.2. Glutamates 5.5.2.1.3. Hydrolyzed Vegetable Protein 5.5.2.1.4. Yeast extract 5.5.2.1.5. Others 5.5.2.2. Canada Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 5.5.2.2.1. Natural 5.5.2.2.2. Artificial 5.5.2.3. Canada Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Dairy 5.5.2.3.2. Bakery 5.5.2.3.3. Confectionery 5.5.2.3.4. Beverage 5.5.2.3.5. Others 5.5.2.4. Canada Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. Food and Beverage 5.5.2.4.2. Bakery 5.5.2.4.3. Confectionaries 5.5.2.4.4. Soups and Salads 5.5.2.4.5. Others 5.5.3. Maxico 5.5.3.1. Mexico Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. Acidulants 5.5.3.1.2. Glutamates 5.5.3.1.3. Hydrolyzed Vegetable Protein 5.5.3.1.4. Yeast extract 5.5.3.1.5. Others 5.5.3.2. Mexico Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 5.5.3.2.1. Natural 5.5.3.2.2. Artificial 5.5.3.3. Mexico Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Dairy 5.5.3.3.2. Bakery 5.5.3.3.3. Confectionery 5.5.3.3.4. Beverage 5.5.3.3.5. Others 5.5.3.4. Mexico Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. Food and Beverage 5.5.3.4.2. Bakery 5.5.3.4.3. Confectionaries 5.5.3.4.4. Soups and Salads 5.5.3.4.5. Others 6. Europe Flavor Enhancer Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.2. Europe Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.3. Europe Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.4. Europe Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5. Europe Flavor Enhancer Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.1.3. United Kingdom Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Flavor Enhancer Market Size and Forecast, By End User(2024-2032) 6.5.2. France 6.5.2.1. France Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.2.3. France Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.3.3. Germany Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.4.3. Italy Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.5.3. Spain Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.6.3. Sweden Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Austria Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.7.3. Austria Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Austria Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 6.5.8.3. Rest of Europe Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Flavor Enhancer Market Size and Forecast, By End User(2024-2032) 7. Asia Pacific Flavor Enhancer Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.3. Asia Pacific Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific Flavor Enhancer Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.1.3. China Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.2.3. S Korea Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.3.3. Japan Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.4.3. India Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.5.3. Australia Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.6.3. Indonesia Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Philippines Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.7.3. Philippines Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Philippines Flavor Enhancer Market Size and Forecast, By End User(2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Malaysia Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.8.3. Malaysia Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Malaysia Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Vietnam Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.9.3. Vietnam Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Vietnam Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Thailand Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.10.3. Thailand Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Thailand Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 7.5.11.3. Rest of Asia Pacific Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Flavor Enhancer Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 8.3. Middle East and Africa Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa Flavor Enhancer Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 8.5.1.3. South Africa Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 8.5.2.3. GCC Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Nigeria Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 8.5.3.3. Nigeria Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Nigeria Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Rest of ME&A Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 8.5.4.3. Rest of ME&A Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Rest of ME&A Flavor Enhancer Market Size and Forecast, By End User(2024-2032) 9. South America Flavor Enhancer Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 9.2. South America Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 9.3. South America Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 9.4. South America Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 9.5. South America Flavor Enhancer Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 9.5.1.3. Brazil Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 9.5.2.3. Argentina Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Flavor Enhancer Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Rest of South America Flavor Enhancer Market Size and Forecast, By Nature (2024-2032) 9.5.3.3. Rest of South America Flavor Enhancer Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Rest of South America Flavor Enhancer Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major End User Players) 10.1. Ajinomoto Co., Inc. (Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Takasago International Corporation (Japan) 10.3. BASF SE (Germany) 10.4. Symrise AG (Germany) 10.5. Corbion NV (Netherlands) 10.6. Koninklijke DSM N.V. (Netherlands) 10.7. Royal DSM N.V. (Netherlands) 10.8. DSM Nutritional Products AG (Switzerland) 10.9. Givaudan SA (Switzerland) 10.10. Kerry Group plc (Ireland) 10.11. Mane SA (France) 10.12. Naturex SA (France) 10.13. Roquette Frères (France) 10.14. Novozymes A/S (Denmark) 10.15. Tate & Lyle PLC (UK) 10.16. Archer Daniels Midland Company (ADM) (US) 10.17. Cargill, Inc. (US) 10.18. FMC Corporation (US) 10.19. International Flavors & Fragrances Inc. (IFF) (US) 10.20. McCormick & Company, Inc. (US) 10.21. Sensient Technologies Corporation (US) 10.22. The Edlong Corporation (US) 10.23. The Flavor Factory, LLC (US) 10.24. The Flavor Apprentice (US) 10.25. The International Dehydrated Foods, Inc. (US) 11. Key Findings 12. Analyst Recommendations 13. Flavor Enhancer Market: Research Methodology