The Environmental Monitoring Market was valued at USD 21.28 Bn in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2032, reaching nearly USD 33.16 Bn by 2032Environmental Monitoring Market Overview

Environmental monitoring involves the systematic collection of data to observe, measure and analyze environmental parameters such as air quality, water purity, soil composition, and noise levels using sensors, IoT devices, and analytical software. The environmental monitoring market is experiencing robust growth, with rising industrialization, increasing environmental regulations, and public health concerns. Availability of real-time monitoring technologies has improved, with demand surging from both public institutions and private sectors, particularly in urban and industrial regions. According to the U.S. Environmental Protection Agency (EPA), over 120 million Americans, more than one-third of the population, lived in areas with unhealthy air quality in 2023, which has compelled federal and state bodies to intensify environmental surveillance infrastructure. North America emerged as the leading regional market in 2024, driven by stringent regulatory enforcement, widespread adoption of AI-enabled environmental sensors and large-scale government investments. Government segment contributed the highest market share, as public bodies continue to fund air and water quality monitoring networks and smart city initiatives. The report covered Environmental Monitoring Market dynamics, porter, pestle analysis by analyzing the market segments and projecting the Environmental Monitoring Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies and regional presence in the Market.To know about the Research Methodology :- Request Free Sample Report

Environmental Monitoring Market Dynamics

The Power of IoT and Advanced Technologies to Boost the Environmental Monitoring Market Growth The implementation of global environmental regulations, including emission standards and pollution control measures, acts as a significant catalyst for the expansion of advanced monitoring solutions, propelling the growth of the Environmental Monitoring Market. For instance, in the United States, the enforcement of stringent regulations, like the Clean Air Act by the Environmental Protection Agency (EPA), is compelling industries to adopt innovative monitoring technologies. Companies such as Aclima are at the forefront, providing environmental sensor networks to aid industries in monitoring air quality, ensuring compliance, and mitigating harmful emissions. The growing global awareness of climate change and environmental degradation propels governments and organizations to invest in cutting-edge monitoring technologies. The Paris Agreement's commitment to combating climate change acts as a driver, motivating countries such as Germany to implement robust environmental monitoring systems. These systems, which track greenhouse gas emissions and assess the efficacy of renewable energy initiatives, contribute significantly to achieving climate goals. Technological advancements further boost the Environmental Monitoring Market growth, with continuous progress in sensor technologies and data analytics. The integration of artificial intelligence (AI) and machine learning (ML) algorithms, exemplified by IBM's Environmental Intelligence Suite, enhances the precision and efficiency of environmental data analysis. This empowers organizations to make informed, data-driven decisions, particularly in areas such as air quality, water usage, and energy consumption, ultimately supporting sustainability initiatives.Integration Issues and Infrastructure Gaps Hamper Environmental Monitoring Market Growth The high costs associated with implementing advanced monitoring systems are hindering the growth of the Environmental Monitoring Market. For instance, the deployment of comprehensive air quality monitoring networks proves financially burdensome for certain regions, impeding widespread adoption and hindering immediate advancements in environmental data collection and analysis. The financial constraints limit the accessibility of cutting-edge monitoring technologies, slowing down progress in addressing critical environmental issues. Absence of standardised protocols for environmental monitoring, such as a lack of uniform standards across regions, impedes interoperability and data consistency, presenting a substantial barrier to the market's growth. The varying standards for air or water quality monitoring make it difficult to compare and analyse data uniformly, obstructing the development of comprehensive global environmental insights. This lack of standardisation hampers the market's ability to provide cohesive solutions for effective environmental management. The increasing reliance on digital technologies introduces security challenges for the Environmental Monitoring Market. Instances of data breaches, such as unauthorised access to air quality data in smart cities, raise concerns about the protection of sensitive environmental information. This poses a risk to public trust in monitoring systems, hindering the market's potential growth. The need for robust data security measures becomes paramount to mitigate risks and foster confidence in the utilisation of digital technologies for environmental monitoring. The limited accessibility of monitoring infrastructure in remote or underdeveloped areas presents a formidable challenge. In such regions, the lack of necessary infrastructure impedes the collection of comprehensive environmental data, hindering efforts to address environmental challenges effectively. For example, certain rural areas may struggle to access real-time air quality monitoring due to infrastructure constraints, exacerbating disparities in environmental monitoring capabilities.

Environmental Monitoring Market Segment Analysis:

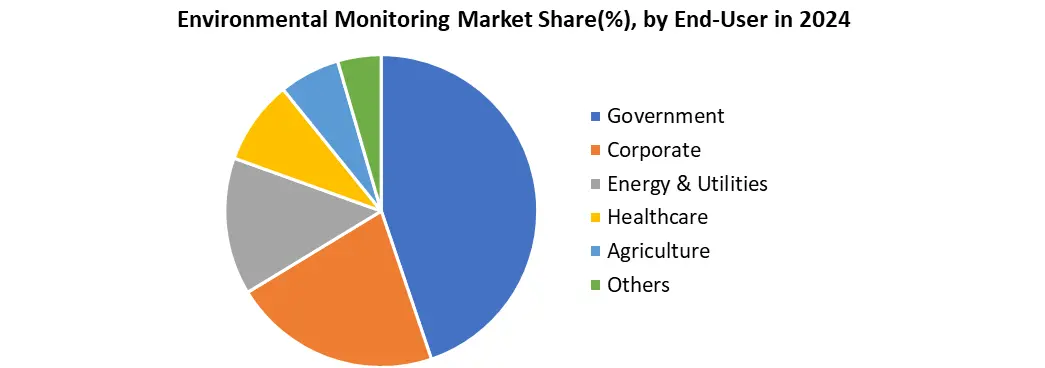

Based on Product Type, the product type is segmented into monitors, software, and services. among these, Environmental Monitoring Sensors dominated the Environmental Monitoring Market in 2024 and are expected to maintain their dominance over the forecast period. Sensors act as the frontline components that directly measure environmental parameters such as air pollutants, water contaminants, soil nutrients, temperature, and humidity in real time. Their ability to provide accurate, continuous, and location-specific data makes them indispensable across applications in industrial, commercial, and governmental sectors. The sensors are driven due to technological advancements such as miniaturization, wireless connectivity, IoT integration, and improved sensitivity, which have enhanced their performance and expanded their usability in diverse environments. Increasing demand for portable, low-cost, and energy-efficient sensors further supports widespread adoption, in smart city projects, healthcare, and environmental sustainability initiatives. Moreover, industries are under growing regulatory pressure to monitor emissions and waste output, making the deployment of reliable sensors essential for compliance and reporting.Based on End-Use, the government end-user segment dominated the Environmental Monitoring market, accounting for the largest revenue share in 2024. This dominance is attributed to the increasing number of public initiatives aimed at combating pollution, climate change, and biodiversity loss. Government agencies across countries like the U.S., Germany, China, and India have invested in national air quality networks, continuous emission monitoring systems (CEMS), and smart environmental infrastructure. Rising incidences of environmental hazards, coupled with the need to comply with international agreements such as the Paris Climate Accord, have compelled governments to adopt large-scale monitoring programs. Public sector agencies deploy comprehensive environmental monitoring networks to track pollutants, ensure regulatory compliance, and safeguard public health. These initiatives are typically supported by substantial government funding, which boosts the demand for sensors, software, and monitoring services. For instance, continuous air quality monitoring stations, nationwide water safety programs, and climate data collection projects are primarily managed by government entities. Additionally, governments play a vital role in establishing strict environmental regulations and mandating regular reporting, which further drives demand for monitoring solutions. By acting as both regulators and major users, the government sector holds a dual influence in the market. Its large-scale investments, coupled with its responsibility for environmental protection and sustainable development.

Environmental Monitoring Market Regional Insights

North America Dominated the Environmental Monitoring Market Demand North America dominated the Environmental Monitoring Market in 2024, particularly in the United States and Canada. The market thrives on stringent environmental regulations, boosting the demand for cutting-edge monitoring solutions. Environmental Monitoring Sensors and Software are adopted, especially in urban areas, addressing air and water quality issues. Europe, emphasizing sustainability, witnesses for Environmental Monitors market in industries striving to comply with stringent emissions standards. In the Asia-Pacific region, characterized by rapid industrialization and urbanization, there is a growing need for comprehensive environmental monitoring. Governments in countries like China and India invest significantly in air and water quality monitoring systems to combat pollution challenges. The adoption of wearable environmental monitors is also on the rise, driven by an increasing awareness of personal health and environmental impact. Meanwhile, in South America, the Middle East, and Africa, the market dynamics are influenced by factors such as industrial activities, resource management, and climate change, leading to a rising demand for monitoring solutions tailored to address these unique challenges. The global environmental monitoring market, with its diverse regional landscape, is poised for sustained growth as stakeholders collaborate to address the ecological complexities specific to each region.Environmental Monitoring Market Competitive Landscape

The environmental monitoring industry is growing due to a fusion of innovation, regulatory enforcement, and cross-sector collaboration. As global climate accountability intensifies, government bodies are accelerating monitoring mandates, boosting corporate response. For instance, the U.S. Environmental Protection Agency (EPA) reported a 17% increase in funding allocations for state and local air monitoring networks in 2024, while India’s Central Pollution Control Board (CPCB) expanded its national air quality index (NAQI) coverage to 410 cities, up from 286 in 2022. Thermo Fisher Scientific (United States) has maintained its leadership through aggressive expansion in air and water quality monitoring solutions. The company has invested heavily in smart monitoring platforms with data analytics capabilities, especially in industrial and life sciences applications. In 2023, it acquired Binding Site Group, enhancing its environmental diagnostics division and scaling up its real time emission tracking systems for public and private sector compliance projects globally. Siemens AG (Germany) has leveraged its strong industrial automation expertise to integrate environmental monitoring with energy and infrastructure management systems. By its Xcelerator portfolio, Siemens provides end-to-end digital environmental solutions, enabling predictive maintenance and environmental compliance for industrial plants.Environmental Monitoring Market Key Trends

Trends Descriptions Embedded Monitoring Systems Are Merging with Smart Logistics Platforms Environmental data is now being natively embedded into logistics control towers and transport optimisers, indicating a cross-industry convergence between ESG and SCM tech. Shift from Device Sales to Data-Driven Service Models in Monitoring Market leaders are pivoting from selling devices (sensors/monitors) to offering analytics-led platforms, monetising insights via subscriptions and predictive decision tools. Government-Led Monitoring is Outpacing Private Adoption in Emerging Markets In India and parts of Asia-Pacific, public initiatives dominate deployment (e.g., CPCB expanding to 410 cities), indicating the government as the primary market creator, not industry. Environmental Monitoring Market Recent Development

• In July 2024, Dickson (France) introduced the Cordless Smart Sensor, an advanced wireless solution tailored for cleanrooms and industrial environments. With its compact design, seamless temperature and humidity tracking, and easy installation, the sensor ensures improved data accuracy and repositioning flexibility. As a result, it significantly enhances environmental control and monitoring efficiency across critical sectors. • In May 2024, Thermo Fisher Scientific (India) took a strategic step by commencing local production of Air Quality Monitoring System (AQMS) analyzers at its Nasik plant, which were earlier manufactured in the USA and China. This initiative not only supports India’s clean air policies but also reinforces Thermo Fisher’s commitment to environmental stewardship, while improving real-time monitoring of air quality in major industries. • In March 2024, Pharmagraph unveiled the iVAS Roam, a handheld microbial air sampler offering EN 17141:2020 compliance. Equipped with enhanced data integrity features, ergonomic design, and RFID tracking, it seamlessly integrates with enVigil FMS software. Consequently, it improves sampling efficiency and strengthens compliance in critical cleanroom environments. • In March 2024, IIT Ropar’s AWaDH launched a BLE Gateway for IoT applications, designed to enable real-time environmental monitoring in agriculture, logistics, and smart cities. The system combines low cost, weather resistance, and scalability with long-range connectivity, energy efficiency, and cloud integration. This innovation underscores AWaDH’s focus on sustainable IoT deployment and technological advancement.Environmental Monitoring Market Scope: Inquire before buying

Environmental Monitoring Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 21.28 Bn. Forecast Period 2025 to 2032 CAGR: 5.7% Market Size in 2032: USD 33.16 Bn. Segments Covered: by Product Monitors Indoor Monitors Outdoor Monitors Portable Monitors Software Services by Component Temperature Moisture Biological Chemical Particulate Matter Noise by Sampling Method Continuous Monitoring Active Monitoring Passive Monitoring Intermittent Monitoring by Application Air Pollution Monitoring Water Pollution Monitoring Soil Pollution Monitoring Noise Pollution Monitoring by End-User Government Corporate Energy & Utilities Healthcare Agriculture Others Environmental Monitoring Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Environmental Monitoring Market Key Players

North America 1. Thermo Fisher Scientific (United States) 2. Agilent Technologies (United States) 3. Honeywell International Inc. (United States) 4. Danaher Corporation (United States) 5. 3M Company (United States) 6. General Electric (United States) 7. Teledyne Technologies (United States) 8. Emerson Electric Co. (United States) 9. Aeroqual (United States) 10. Xylem Inc. (United States) Europe 11. Siemens AG (Germany) 12. Vaisala Oyj (Finland) 13. Merck KGaA (Germany) 14. Horiba Ltd. (France) 15. ABB Ltd. (Switzerland) 16. Environnement S.A (France) 17. SKF Group (Sweden) 18. Opsis AB (Sweden) 19. OTT HydroMet (Germany) 20. Acoem Group (France) Asia Pacific 21. Shimadzu Corporation (Japan) 22. TSI Incorporated (Japan) 23. Yokogawa Electric Corporation (Japan) 24. Hitachi High-Tech Corporation (Japan) 25. Huawei Technologies Co., Ltd. (China) 26. PCE Instruments (China) 27. Skyray Instruments (China) Middle East & Africa 28. Gasmet Technologies (UAE) 29. Envirotech Instruments Pvt. Ltd. (India) South America 30. Ambiens S.A. (Argentina)FAQ:

1] What are the major Key players in the Environmental Monitoring Market? Ans. The top companies in the Environmental Monitoring Market are Thermo Fisher Scientific, Agilent Technologies, Honeywell International Inc., Danaher Corporation, Siemens AG, Merck KGaA, Horiba Ltd., and ABB Ltd. 2] Which region is expected to hold the highest share in the Global Environmental Monitoring Market? Ans. The North America region is expected to hold the largest share of the Environmental Monitoring Market. 3] What was the market size of the Environmental Monitoring Market in 2024? Ans. The market size of the Environmental Monitoring Market in 2024 was valued at USD 21.28 billion. 4] What is the market size of the Environmental Monitoring Market by 2032? Ans. The Environmental Monitoring Market size in 2032 is expected to reach USD 33.16 billion. 5] What segments are covered in the Global Environmental Monitoring Market report? Ans. The segments covered in the Environmental Monitoring Market report are based on Product, Component, sampling method, Application, End-User, and Region.

1. Environmental Monitoring Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Environmental Monitoring Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Environmental Monitoring Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Environmental Monitoring Market: Dynamics 3.1. Environmental Monitoring Market Trends by Region 3.1.1. North America Environmental Monitoring Market Trends 3.1.2. Europe Environmental Monitoring Market Trends 3.1.3. Asia Pacific Environmental Monitoring Market Trends 3.1.4. Middle East and Africa Environmental Monitoring Market Trends 3.1.5. South America Environmental Monitoring Market Trends 3.2. Environmental Monitoring Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Environmental Monitoring Market Drivers 3.2.1.2. North America Environmental Monitoring Market Restraints 3.2.1.3. North America Environmental Monitoring Market Opportunities 3.2.1.4. North America Environmental Monitoring Market Challenges 3.2.2. Europe 3.2.2.1. Europe Environmental Monitoring Market Drivers 3.2.2.2. Europe Environmental Monitoring Market Restraints 3.2.2.3. Europe Environmental Monitoring Market Opportunities 3.2.2.4. Europe Environmental Monitoring Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Environmental Monitoring Market Drivers 3.2.3.2. Asia Pacific Environmental Monitoring Market Restraints 3.2.3.3. Asia Pacific Environmental Monitoring Market Opportunities 3.2.3.4. Asia Pacific Environmental Monitoring Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Environmental Monitoring Market Drivers 3.2.4.2. Middle East and Africa Environmental Monitoring Market Restraints 3.2.4.3. Middle East and Africa Environmental Monitoring Market Opportunities 3.2.4.4. Middle East and Africa Environmental Monitoring Market Challenges 3.2.5. South America 3.2.5.1. South America Environmental Monitoring Market Drivers 3.2.5.2. South America Environmental Monitoring Market Restraints 3.2.5.3. South America Environmental Monitoring Market Opportunities 3.2.5.4. South America Environmental Monitoring Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Environmental Monitoring Industry 3.8. Analysis of Government Schemes and Initiatives For Environmental Monitoring Industry 3.9. Environmental Monitoring Market Trade Analysis 3.10. The Global Pandemic Impact on Environmental Monitoring Market 4. Environmental Monitoring Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 4.1.1. Monitors 4.1.2. Software 4.1.3. Services 4.2. Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 4.2.1. Temperature 4.2.2. Moisture 4.2.3. Biological 4.2.4. Chemical 4.2.5. Particulate Matter 4.2.6. Noise 4.3. Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 4.3.1. Continuous Monitoring 4.3.2. Active Monitoring 4.3.3. Passive Monitoring 4.3.4. Intermittent Monitoring 4.4. Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 4.4.1. Air Pollution Monitoring 4.4.2. Water Pollution Monitoring 4.4.3. Soil Pollution Monitoring 4.4.4. Noise Pollution Monitoring 4.5. Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 4.5.1. Government 4.5.2. Corporate 4.5.3. Energy & Utilities 4.5.4. Healthcare 4.5.5. Agriculture 4.5.6. Others 4.6. Environmental Monitoring Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Environmental Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 5.1.1. Monitors 5.1.2. Software 5.1.3. Services 5.2. North America Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 5.2.1. Temperature 5.2.2. Moisture 5.2.3. Biological 5.2.4. Chemical 5.2.5. Particulate Matter 5.2.6. Noise 5.3. North America Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 5.3.1. Continuous Monitoring 5.3.2. Active Monitoring 5.3.3. Passive Monitoring 5.3.4. Intermittent Monitoring 5.4. North America Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 5.4.1. Air Pollution Monitoring 5.4.2. Water Pollution Monitoring 5.4.3. Soil Pollution Monitoring 5.4.4. Noise Pollution Monitoring 5.5. North America Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 5.5.1. Government 5.5.2. Corporate 5.5.3. Energy & Utilities 5.5.4. Healthcare 5.5.5. Agriculture 5.5.6. Others 5.6. North America Environmental Monitoring Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 5.6.1.1.1. Monitors 5.6.1.1.2. Software 5.6.1.1.3. Services 5.6.1.2. United States Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 5.6.1.2.1. Temperature 5.6.1.2.2. Moisture 5.6.1.2.3. Biological 5.6.1.2.4. Chemical 5.6.1.2.5. Particulate Matter 5.6.1.2.6. Noise 5.6.1.3. United States Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 5.6.1.3.1. Continuous Monitoring 5.6.1.3.2. Active Monitoring 5.6.1.3.3. Passive Monitoring 5.6.1.3.4. Intermittent Monitoring 5.6.1.4. United States Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Air Pollution Monitoring 5.6.1.4.2. Water Pollution Monitoring 5.6.1.4.3. Soil Pollution Monitoring 5.6.1.4.4. Noise Pollution Monitoring 5.6.1.5. United States Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 5.6.1.5.1. Government 5.6.1.5.2. Corporate 5.6.1.5.3. Energy & Utilities 5.6.1.5.4. Healthcare 5.6.1.5.5. Agriculture 5.6.1.5.6. Others 5.6.2. Canada 5.6.2.1. Canada Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 5.6.2.1.1. Monitors 5.6.2.1.2. Software 5.6.2.1.3. Services 5.6.2.2. Canada Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 5.6.2.2.1. Temperature 5.6.2.2.2. Moisture 5.6.2.2.3. Biological 5.6.2.2.4. Chemical 5.6.2.2.5. Particulate Matter 5.6.2.2.6. Noise 5.6.2.3. Canada Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 5.6.2.3.1. Continuous Monitoring 5.6.2.3.2. Active Monitoring 5.6.2.3.3. Passive Monitoring 5.6.2.3.4. Intermittent Monitoring 5.6.2.4. Canada Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Air Pollution Monitoring 5.6.2.4.2. Water Pollution Monitoring 5.6.2.4.3. Soil Pollution Monitoring 5.6.2.4.4. Noise Pollution Monitoring 5.6.2.5. Canada Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 5.6.2.5.1. Government 5.6.2.5.2. Corporate 5.6.2.5.3. Energy & Utilities 5.6.2.5.4. Healthcare 5.6.2.5.5. Agriculture 5.6.2.5.6. Others 5.6.3. Mexico 5.6.3.1. Mexico Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 5.6.3.1.1. Monitors 5.6.3.1.2. Software 5.6.3.1.3. Services 5.6.3.2. Mexico Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 5.6.3.2.1. Temperature 5.6.3.2.2. Moisture 5.6.3.2.3. Biological 5.6.3.2.4. Chemical 5.6.3.2.5. Particulate Matter 5.6.3.2.6. Noise 5.6.3.3. Mexico Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 5.6.3.3.1. Continuous Monitoring 5.6.3.3.2. Active Monitoring 5.6.3.3.3. Passive Monitoring 5.6.3.3.4. Intermittent Monitoring 5.6.3.4. Mexico Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Air Pollution Monitoring 5.6.3.4.2. Water Pollution Monitoring 5.6.3.4.3. Soil Pollution Monitoring 5.6.3.4.4. Noise Pollution Monitoring 5.6.3.5. Mexico Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 5.6.3.5.1. Government 5.6.3.5.2. Corporate 5.6.3.5.3. Energy & Utilities 5.6.3.5.4. Healthcare 5.6.3.5.5. Agriculture 5.6.3.5.6. Others 6. Europe Environmental Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.2. Europe Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.3. Europe Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.4. Europe Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.5. Europe Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6. Europe Environmental Monitoring Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.1.2. United Kingdom Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.1.3. United Kingdom Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.1.4. United Kingdom Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.2. France 6.6.2.1. France Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.2.2. France Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.2.3. France Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.2.4. France Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.3.2. Germany Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.3.3. Germany Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.3.4. Germany Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.4.2. Italy Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.4.3. Italy Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.4.4. Italy Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.5.2. Spain Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.5.3. Spain Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.5.4. Spain Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.6.2. Sweden Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.6.3. Sweden Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.6.4. Sweden Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.7.2. Austria Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.7.3. Austria Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.7.4. Austria Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 6.6.8.2. Rest of Europe Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.8.3. Rest of Europe Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 6.6.8.4. Rest of Europe Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7. Asia Pacific Environmental Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.3. Asia Pacific Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.4. Asia Pacific Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6. Asia Pacific Environmental Monitoring Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.1.2. China Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.1.3. China Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.1.4. China Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.2.2. S Korea Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.2.3. S Korea Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.2.4. S Korea Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.3.2. Japan Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.3.3. Japan Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.3.4. Japan Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.4. India 7.6.4.1. India Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.4.2. India Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.4.3. India Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.4.4. India Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.5.2. Australia Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.5.3. Australia Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.5.4. Australia Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.6.2. Indonesia Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.6.3. Indonesia Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.6.4. Indonesia Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.7.2. Malaysia Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.7.3. Malaysia Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.7.4. Malaysia Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.8.2. Vietnam Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.8.3. Vietnam Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.8.4. Vietnam Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.9.2. Taiwan Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.9.3. Taiwan Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.9.4. Taiwan Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 7.6.10.2. Rest of Asia Pacific Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.10.3. Rest of Asia Pacific Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 7.6.10.4. Rest of Asia Pacific Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 8. Middle East and Africa Environmental Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 8.3. Middle East and Africa Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 8.4. Middle East and Africa Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 8.6. Middle East and Africa Environmental Monitoring Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 8.6.1.2. South Africa Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.1.3. South Africa Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 8.6.1.4. South Africa Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 8.6.2.2. GCC Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.2.3. GCC Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 8.6.2.4. GCC Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 8.6.3.2. Nigeria Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.3.3. Nigeria Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 8.6.3.4. Nigeria Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 8.6.4.2. Rest of ME&A Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.4.3. Rest of ME&A Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 8.6.4.4. Rest of ME&A Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 9. South America Environmental Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 9.2. South America Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 9.3. South America Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 9.4. South America Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 9.5. South America Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 9.6. South America Environmental Monitoring Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 9.6.1.2. Brazil Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 9.6.1.3. Brazil Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 9.6.1.4. Brazil Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 9.6.2.2. Argentina Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 9.6.2.3. Argentina Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 9.6.2.4. Argentina Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Environmental Monitoring Market Size and Forecast, by Product (2024-2032) 9.6.3.2. Rest Of South America Environmental Monitoring Market Size and Forecast, by Component (2024-2032) 9.6.3.3. Rest Of South America Environmental Monitoring Market Size and Forecast, by Sampling Method (2024-2032) 9.6.3.4. Rest Of South America Environmental Monitoring Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Environmental Monitoring Market Size and Forecast, by End-User (2024-2032) 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Agilent Technologies (United States) 10.3. Honeywell International Inc. (United States) 10.4. Danaher Corporation (United States) 10.5. 3M Company (United States) 10.6. General Electric (United States) 10.7. Teledyne Technologies (United States) 10.8. Emerson Electric Co. (United States) 10.9. Aeroqual (United States) 10.10. Xylem Inc. (United States) 10.11. Siemens AG (Germany) 10.12. Vaisala Oyj (Finland) 10.13. Merck KGaA (Germany) 10.14. Horiba Ltd. (France) 10.15. ABB Ltd. (Switzerland) 10.16. Environnement S.A (France) 10.17. SKF Group (Sweden) 10.18. Opsis AB (Sweden) 10.19. OTT HydroMet (Germany) 10.20. Acoem Group (France) 10.21. Shimadzu Corporation (Japan) 10.22. TSI Incorporated (Japan) 10.23. Yokogawa Electric Corporation (Japan) 10.24. Hitachi High-Tech Corporation (Japan) 10.25. Huawei Technologies Co., Ltd. (China) 10.26. PCE Instruments (China) 10.27. Skyray Instruments (China) 10.28. Gasmet Technologies (UAE) 10.29. Envirotech Instruments Pvt. Ltd. (India) 10.30. Ambiens S.A. (Argentina) 11. Key Findings 12. Industry Recommendations 13. Environmental Monitoring Market: Research Methodology 14. Terms and Glossary