The Electric Vehicle (EV) Charging Service Market size was valued at USD 17.87 billion in 2024, and the total Revenue is expected to grow at a CAGR of 20.14 % from 2025 to 2032, reaching nearly USD 77.56 billion. Electric Vehicle (EV) Charging Service Market Overview: The MMR report provides an in-depth and structured analysis of the Electric Vehicle (EV) Charging Service Market, covering all critical dimensions influencing market growth and long-term sustainability. It evaluates EV consumption patterns and infrastructure demand by analyzing leading EV-adopting countries, regional EV stock growth, vehicle-type adoption, and the charging behavior of top EV brands. The report further examines charging infrastructure penetration, including public charger density, network saturation levels, and urban–highway infrastructure gaps. Detailed insights into grid integration address load profiles, peak demand impacts, utility coordination, V2G readiness, and renewable energy integration. In addition, the report assesses emerging technologies such as ultra-fast and wireless charging, smart charging platforms, AI-driven planning tools, and digital ecosystems. It also analyzes evolving business models, pricing mechanisms, public–private investment structures, and monetization opportunities. Finally, the report highlights environmental and sustainability considerations, including grid emission impacts, circular economy models, second-life battery reuse, and the role of EV charging infrastructure in transport sector decarbonization. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region. As the number of electric vehicle consumers keeps increasing, companies will have the opportunity to lift their sales and revenue not only by selling electric vehicles but also by providing Electric vehicle charging services to the users. Electric vehicles require recharging in-between for long-distance routes due to their low-energy density batteries, hence a strong network of EV charging service providers is necessary for the growth of the industry. Although this market is less developed in emerging countries, it is a promising market with future prospects. The report has covered, demand drivers by region, pricing by region, and profit margins of key players operating in this industry. A brief analysis of restraints and challenges in the market is also covered with examples by region. It also has covered the analysis of key player’s growth strategies, micro and macro analysis of markets, key developments, and key trends in the market.To know about the Research Methodology :- Request Free Sample Report

Electric Vehicle (EV) Charging Service Market Dynamics

The increasing adoption of electric vehicles is driving the EV charging service market The fast increase in electric vehicle users is the main driver of the EV charging service market. In the year 2021, sales of electric vehicles grew more than two million units globally. Developments in lithium-ion batteries have improved the performance of electric vehicles and their applicability in the commercial sector. This improved applicability is further expected to accelerate the market growth. Stringent norms and regulations enforced by governments across the world regarding emission control from the automotive are expected to drive the market during the forecast period. For an instance, Euro VI norm implemented by the European Commission to reduce the carbon emission from the heavy-duty vehicle have left a positive influence on the electric vehicle industry in Europe. The growing population and fast depletion of natural reservoirs are expected to drive the demand of the EV charging service market during the forecast period. Fall in cost per kWh battery capacity of an electric vehicle is also expected to propel the growth of the market during the forecast period. As per the United States Department of Energy, the rate per kWh battery capacity of the electric trucks fell from USD 500 in 2013 to USD 200 in 2021 and with increasing technological advancements, it is expected to decrease further during the forecast period. Generous government funding and subsidies are anticipated to propel the market during the forecast period. The high Installation cost of the EV charging stations is the main restraining factor for the market Electric vehicles are costly as compared to traditional vehicles due to the lack of mass production and the high cost of a battery. In addition to this, EV charging stations require unique infrastructure hence installation cost of EV charging service is high. The availability of household chargers is also expected to hinder the demand of the EV charging service market. Mass deployment of EV charging infrastructure will bring new opportunities for the market Mass deployment of EV charging stations will bring new opportunities to run the equipment cost-effectively and efficiently. Technological advancement in the electric automotive industry is anticipated to create new opportunities for the market during the forecast period. Growing electric vehicle manufacturers across the globe is expected to create lucrative opportunities for the EV charging service market. DC Charger segment is expected to command the largest market share of 20.14% by 2029 DC's chargers are faster as compared to AC chargers; hence they are highly preferred charging stations by the users. The DC charging station is more than 50 times faster than the normal domestic socket. Almost all-electric vehicles including E-Buses and E-Trucks can be charged with the DC charging station. AC charging stations are 7 to 10 times more affordable as compared to DC charging stations. DC charging stations converts AC power supply from the grid into DC power supply and further charges the electric vehicle. The AC charger segment is further subdivided into Level-1 and Level-2 chargers. The DC charger segment is further subdivided into Level-3 and Level-4 chargers. 11 kW to 50 kW segment is expected to command the largest market share of 20.14% by 2029 Several electric vehicles are capable of charging in this range; hence it is the highly preferred segment for the EV charging service market. The 11kW-50kW segment is expected to experience growth of 20.14% CAGR during the forecast period, thanks to the high demand of the segment. There are few EVs that are capable of 50kW-100kW charging, hence this segment is also expected to experience significant growth during the forecast period. Very few vehicles are capable of more than 100kW charging range, only a few Tesla models are capable of this segment. APAC is expected to command the largest market share of 20.14% by 2029 Asia Pacific is leading the EV charging service market and is expected to continue its dominance during the forecast period with a growth of 20.14% CAGR. Countries like China, Japan, and South Korea are the hub for the EV charging service market. Asia pacific commanded more than 58% of the revenue of the EV market in 2021. The government of China has announced to invest in the deployment of EV charging service infrastructure to meet future targets. In addition to this, China announced a New Energy Vehicle mandate to ban vehicles with internal combustion engines. Government regulations in emerging countries regarding emission control from automotive are also expected to drive the market in the region during the forecast period. Government support and subsidies will further accelerate the market growth in the region. North America and Europe are also anticipated to experience significant growth during the forecast period, thanks to the availability of a large EV charging station network across the region. The growing adoption of electric vehicles is expected to boost the demand of the market during the forecast period. Countries like Norway, Germany, Luxembourg, and the UK have a large number of EVs hence these countries will fuel the growth of the market in the region. Governments of certain countries in APAC and Europe have announced the use of 40% EVs in the government sector. The growing popularity of fully automated electric vehicles is also expected to drive the demand of the market during the forecast period.Electric Vehicle (EV) Charging Service Market Segment Analysis

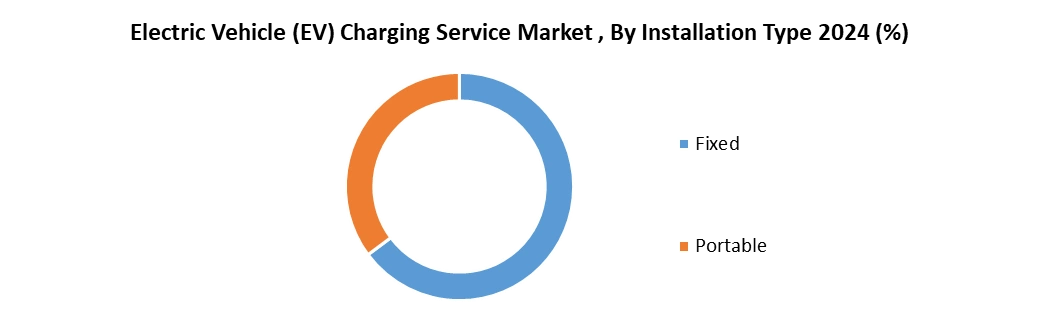

Based on the Charging Station Type, the Electric Vehicle Charging Service Market is dominated by AC charging stations, which hold the largest share due to widespread residential and workplace installations, lower costs, and suitability for overnight charging. DC fast charging stations represent the fastest-growing segment, driven by highway corridors, commercial hubs, fleet operations, and the need for reduced charging time to support long-distance and high-utilization EV use. Inductive (wireless) charging stations remain a niche but emerging segment, gaining traction in premium vehicles, urban pilots, and autonomous mobility applications due to convenience benefits, despite high infrastructure costs and limited standardization. Based on the Installation Type, the Electric Vehicle (EV) Charging Service Market is led by fixed charging stations, which account for the dominant share due to permanent installations across residential, commercial, highway, and fleet locations, offering higher power capacity, reliability, and integration with smart charging networks. Portable charging solutions represent a smaller but growing segment, driven by demand for emergency charging, fleet flexibility, roadside assistance, and temporary or remote-use scenarios, although limited power output and lower utilization restrict large-scale adoption.

Covid-19 Impact on the Global Electric Vehicle (EV) Charging Service Market:

• The coronavirus pandemic has placed tremendous pressure on businesses and sectors across the globe. Governments from all countries have introduced a lock-up to detect the transmission of infectious diseases. The contribution of these regulations has created a negative impact on the Electric Vehicle industry. • The coronavirus adversely impacted the EV charging installation and service sector. The interruption of export and import operations due to limitations on foreign flights would further restrict the market's development. The disruption caused by the lockdown would harm the market. Most of the industries are not functioning properly due to the influence of Covid-19 which has caused an adverse impact on the Global Electric Vehicle (EV) Charging Service Market. The objective of the report is to present a comprehensive analysis of the Global Electric Vehicle (EV) Charging Service Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Electric Vehicle (EV) Charging Service Market dynamics, structure by analyzing the market segments and projects the Global Electric Vehicle (EV) Charging Service Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Electric Vehicle (EV) Charging Service Market make the report investor’s guide.Electric Vehicle (EV) Charging Service Market Key Players

Enel X deployed the first EV charging station on the Italian motorway network in 2021. In the same year, Arther Energy launched a charging infrastructure service in India. Traditional automotive companies are now shifting to electric vehicle technology and, they are also planning to invest in EV charging service infrastructure. EV companies like Tesla are increasing their global presence by deploying EV manufacturing and charging service infrastructures in emerging countries. The report covers details of key players, their investment, and business strategies.Electric Vehicle (EV) Charging Service Market Scope: Inquire before buying

Global Electric Vehicle (EV) Charging Service Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 17.87 Bn. Forecast Period 2025 to 2032 CAGR: 20.14% Market Size in 2032: USD 77.56 Bn. Segments Covered: by Charging Station Type AC Charging Station DC Fast Charging Station Inductive Charging Station by Connector Type CHAdeMO CCD Others by Level of Charging Level 1 Level 2 Level 3 by Installation Type Fixed Portable by Application Residential Commercial Industrial Electric Vehicle (EV) Charging Service Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electric Vehicle (EV) Charging Service Market, Key Players are:

1. Tesla Superchargers 2. ChargePoint, Inc. 3. Electrify America 4. EVgo Services LLC 5. Shell Recharge 6. BP Pulse 7. ABB 8. Blink Charging 9. Ionity 10. EVBox 11. TotalEnergies 12. Allego B.V. 13. EDF Group 14. Fastned 15. E.ON Drive 16. Vattenfall InCharge 17. Pod Point 18. ubitricity 19. Mer 20. EV Connect 21. AmpUp 22. Revel 23. Volta EV Charging Network 24. Tata Power EZ Charge 25. Energy Efficiency Services Ltd 26. Ather Grid 27. ENEOS 28. HopCharge 29. SparkCharge 30. Volttic EV Charging 31. Others Frequently Asked Questions: 1] What segments are covered in the Electric Vehicle (EV) Charging Service Market report? Ans. The segments covered in the Electric Vehicle (EV) Charging Service Market report are based on Charging Station Type, Connector Type, Level of Charging, Installation Type, Application, and region 2] Which region is expected to hold the highest share of the Electric Vehicle (EV) Charging Service Market? Ans. The Asia Pacific region is expected to hold the highest share of the Electric Vehicle (EV) Charging Service Market. 3] What is the market size of the Electric Vehicle (EV) Charging Service Market by 2032? Ans. The market size of the Electric Vehicle (EV) Charging Service Market by 2032 is USD 77.56 Bn. 4] What is the growth rate of the Electric Vehicle (EV) Charging Service Market? Ans. The Global Electric Vehicle (EV) Charging Service Market is growing at a CAGR of 20.14 % during the forecasting period 2025-2032. 5] What was the market size of the Electric Vehicle (EV) Charging Service Market in 2024? Ans. The market size of the Electric Vehicle (EV) Charging Service Market in 2024 was USD 17.87 Bn.

1. Electric Vehicle (EV) Charging Service Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Electric Vehicle (EV) Charging Service Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. End User 2.3.5. Revenue (2024) 2.3.6. Market Share (%)2024 2.3.7. Growth Rate (%) 2.3.8. Profit Margin (%) 2.3.9. Installed Power Capacity 2.3.10. Certifications 2.3.11. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Electric Vehicle (EV) Charging Service Market: Dynamics 3.1. Electric Vehicle (EV) Charging Service Market Trends 3.2. Electric Vehicle (EV) Charging Service Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Electric Vehicle (EV) Charging Service Market 3.6. Analysis of Government Schemes and Support for the Industry 4. EV Consumption And Infrastructure Demand (2024) 4.1. Leading EV-Adopting Countries 4.2. EV Stock Growth Trends By Region 4.3. EV Adoption By Vehicle Type 4.4. Top EV-Selling Brands And Their Dependence On Public Vs. Private/Home Charging 5. EV Charging Infrastructure Penetration 5.1. Countries With The Most Public Charging Stations 5.2. Evs Per Public Charger – Network Saturation Index 5.3. Regional Benchmarking Of Charger Density 5.4. Urban Vs. Highway Charging Infrastructure Gaps 6. Grid Integration And Utility Coordination 6.1. Load Curves And Peak Demand Profiles By Charger Type 6.2. Impact On Distribution Transformers And Substations 6.3. V2G Integration And Demand Response Programs 6.4. Role Of Discoms & Dsos – Case Study Adaptation From RMI Haryana 6.5. Grid-Tied Vs. Battery-Backed Charging Systems 6.6. Renewable Energy Integration In Charging Infrastructure 7. Technology, Innovation & Emerging Trends 7.1. Ultra-Fast Charging And Liquid Cooling 7.2. Wireless / Inductive Charging (Pilot Projects & Grid Implications) 7.3. Smart Charging, V2G, And Grid-Responsive Systems 7.4. Cloud, Iot, App Ecosystems & Charging Platforms 7.5. Digital Twins, AI, And Geospatial Planning (E.G., KELVIN, GIS Tools) 8. Business Models, Pricing & Monetization 8.1. Revenue Models: Pay-Per-Use, Subscription, Free-To-User 8.2. Retail Revenue Augmentation Via Charger Hosting 8.3. Carbon Credits & Green Certification For Operators 8.4. Multi-Tenant And Shared Charging Revenue Models 8.5. Public-Private Investment Structures (PPP, VGF, Etc.) 9. Environmental Impact And Sustainability Analysis 9.1. EV Charging And Grid Emission Factors 9.2. End-Of-Life Disposal Of Charging Equipment 9.3. Circular Business Models – Second-Life Battery Reuse 9.4. EVSE’s Role In Decarbonization Of The Transport Sector 10. Electric Vehicle (EV) Charging Service Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1. Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 10.1.1. AC charging station 10.1.2. DC Fast Charging Station 10.1.3. Inductive charging station 10.2. Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 10.2.1. CHAdeMO 10.2.2. CCD 10.2.3. Others 10.3. Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 10.3.1. Level 1 10.3.2. Level 2 10.3.3. Level 3 10.4. Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 10.4.1. Fixed 10.4.2. Portable 10.5. Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 10.5.1. Residential 10.5.2. Commercial 10.5.3. Industrial 10.6. Electric Vehicle (EV) Charging Service Market Size and Forecast, By Region (2024-2032) 10.6.1. North America 10.6.2. Europe 10.6.3. Asia Pacific 10.6.4. Middle East and Africa 10.6.5. South America 11. North America Electric Vehicle (EV) Charging Service Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 11.1. North America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 11.1.1. AC charging station 11.1.2. DC Fast Charging Station 11.1.3. Inductive charging station 11.2. North America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 11.2.1. CHAdeMO 11.2.2. CCD 11.2.3. Others 11.3. North America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 11.3.1. Level 1 11.3.2. Level 2 11.3.3. Level 3 11.4. North America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 11.4.1. Fixed 11.4.2. Portable 11.5. North America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 11.5.1. Residential 11.5.2. Commercial 11.5.3. Industrial 11.6. North America Electric Vehicle (EV) Charging Service Market Size and Forecast, by Country (2024-2032) 11.6.1. United States 11.6.1.1. United States Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 11.6.1.2. United States Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 11.6.1.3. United States Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 11.6.1.4. United States Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 11.6.1.5. United States Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 11.6.2. Canada 11.6.2.1. Canada Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 11.6.2.2. Canada Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 11.6.2.3. Canada Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 11.6.2.4. Canada Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 11.6.2.5. Canada Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 11.6.3. Mexico 11.6.3.1. Mexico Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 11.6.3.2. Mexico Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 11.6.3.3. Mexico Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 11.6.3.4. Mexico Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 11.6.3.5. Mexico Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 12. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 12.1. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 12.2. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 12.3. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 12.4. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 12.5. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 12.6. Europe Electric Vehicle (EV) Charging Service Market Size and Forecast, By Country (2024-2032) 12.6.1. United Kingdom 12.6.2. France 12.6.3. Germany 12.6.4. Italy 12.6.5. Spain 12.6.6. Sweden 12.6.7. Russia 12.6.8. Rest of Europe 13. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 13.1. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 13.2. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 13.3. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 13.4. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 13.5. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 13.6. Asia Pacific Electric Vehicle (EV) Charging Service Market Size and Forecast, by Country (2024-2032) 13.6.1. China 13.6.2. S Korea 13.6.3. Japan 13.6.4. India 13.6.5. Australia 13.6.6. Indonesia 13.6.7. Malaysia 13.6.8. Philippines 13.6.9. Thailand 13.6.10. Vietnam 13.6.11. Rest of Asia Pacific 14. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 14.1. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 14.2. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 14.3. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 14.4. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 14.5. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 14.6. Middle East and Africa Electric Vehicle (EV) Charging Service Market Size and Forecast, By Country (2024-2032) 14.6.1. South Africa 14.6.2. GCC 14.6.3. Nigeria 14.6.4. Rest of ME&A 15. South America Electric Vehicle (EV) Charging Service Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 15.1. South America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Charging Station Type (2024-2032) 15.2. South America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Connector Type (2024-2032) 15.3. South America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Level of Charging (2024-2032) 15.4. 15.5. South America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Installation Type (2024-2032) 15.6. South America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Application (2024-2032) 15.7. South America Electric Vehicle (EV) Charging Service Market Size and Forecast, By Country (2024-2032) 15.7.1. Brazil 15.7.2. Argentina 15.7.3. Colombia 15.7.4. Chile 15.7.5. Rest of South America 16. Company Profile: Key Players 16.1. Tesla Superchargers 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.2. ChargePoint, Inc. 16.3. Electrify America 16.4. EVgo Services LLC 16.5. Shell Recharge 16.6. BP Pulse 16.7. ABB 16.8. Blink Charging 16.9. Ionity 16.10. EVBox 16.11. TotalEnergies 16.12. Allego B.V. 16.13. EDF Group 16.14. Fastned 16.15. E.ON Drive 16.16. Vattenfall InCharge 16.17. Pod Point 16.18. ubitricity 16.19. Mer 16.20. EV Connect 16.21. AmpUp 16.22. Revel 16.23. Volta EV Charging Network 16.24. Tata Power EZ Charge 16.25. Energy Efficiency Services Ltd 16.26. Ather Grid 16.27. ENEOS 16.28. HopCharge 16.29. SparkCharge 16.30. Volttic EV Charging 16.31. Others 17. Key Findings 18. Analyst Recommendations 19. Electric Vehicle (EV) Charging Service Market – Research Methodology