E-Drive for Automotive Market was valued at US$ 10.65 Bn. in 2022 and the total revenue is expected to grow at 8.7 % of CAGR through 2023 to 2029, reaching nearly US$ 19.10 Bn.Market Overview:

E-drive is the component and system, which convert electrical energy into power in the driving system of an electric vehicle, where the vehicles may be powered by fuel cell, batteries, or, other power sources. E-Drive is a user-friendly analytical tool to facilitate the development of electric car fast charging infrastructure across the region is the Evaluation & Development of Regional Infrastructure for Vehicle Electrification (E-DRIVE) in automation.It is a data-driven tool that takes into account a number of important parts related to the infrastructure for fast charging, such as the distance to already-existing fast charging stations, traffic volume, surrounding commercial activity, and availability of home charging. Based on regional, state, or regional goals, the highly adaptable dashboard interface serves a wide range of users and generates results that represent the relative suitability of locations for infrastructure development, which drives the e-drive for the automation market.The report covered the detailed analysis of local as well as key market players and their Tire 1 and tire2 suppliers with total revenue by region.To know about the Research Methodology :- Request Free Sample Report

E-Drive for Automotive Market Dynamics:

Stringent government rules and regulations towards vehicle emissions to drive the market Strict norms and regulations by governments across the world are driving the demand for electric vehicles during the forecast period. The policies, supporting to EVs have been immplemted by the governments acorss the world and same is driving the E-Drive market. Impact of regulation and government policies on the growth of the market by countries is analysed in the report.The role of EVs has increased as a result of the gradually stricter fuel efficiency and exhaust CO2 standards. Today, these criteria apply to roughly 85% of all automobile sales globally. The development of electric vehicle sales in the European Union, which had the greatest yearly increase in 2020 to reach 2.1 million units, was greatly helped by CO2 emissions rules. Some countries have required EV sales targets, such as California for decades and China since 2017. As the use of EVs grows, having convenient and economical public charging stations will become more important. Governments have taken steps to assist EV charging infrastructure to help combat this, including direct investments in the construction of publicly accessible chargers and financial incentives for EV owners to install charging stations in their homes. Sales of EVs outside of urban countries have increased as a result of efforts by cities to provide better value for consumers. These actions include the tactical deployment of charging infrastructure as well as the implementation of favored circulation or access policies like low- and zero-emission zones or varied circulation levies. Such actions have significantly impacted EV sales in Oslo and a number of cities in China. Furthermore, continuous battery cost decreases, increased availability of electric vehicle models, EV adoption by fleet operators, and demand for the electric car by consumers created an opportunity for the EV industry in 2020. Changing infrastructure and increasing prices hamper the market growth Purchasing an electric vehicle is expensive. The higher expense of buying an electric automobile instead of a conventional one mostly comes from the battery. It alone can make a difference of several thousand euros, which hamper the e-drive for the automotive market. The raw materials utilized in the battery as well as the costly process involved in battery manufacture are significant causes of this. With a price tag of roughly 500 euros per kWh for a mid-size car with a battery capacity of 20kW, the cost of the battery system adds up to 10,000 euros. Innovative battery materials with a better energy density as well as improved production techniques should mean that these costs could be significantly lower by 2020. The estimated cost per kWh ranges from 100 to 250 euros.Also, lack of charging points, From component shortages to a lack of experienced employees, expected lithium-ion scarcity, the absence of worldwide standards, and on-street charging. There are serious flaws that will affect the powering up of EVs, which hampers the e-drive for the automotive market during the forecast period. Growing advantages of e-drive create an opportunity for new market players Smart e-Drive may satisfy the need for weight reduction and space for many applications. The E-Drive for Automotive Industry is expected to derive from a number of advantages including high dependability, decreased size, higher force age, and more underlying functionality within the expected forecast period, which create an opportunity for new market players in e-drive for the automotive market.

E-Drive for Automotive Market Segment Analysis:

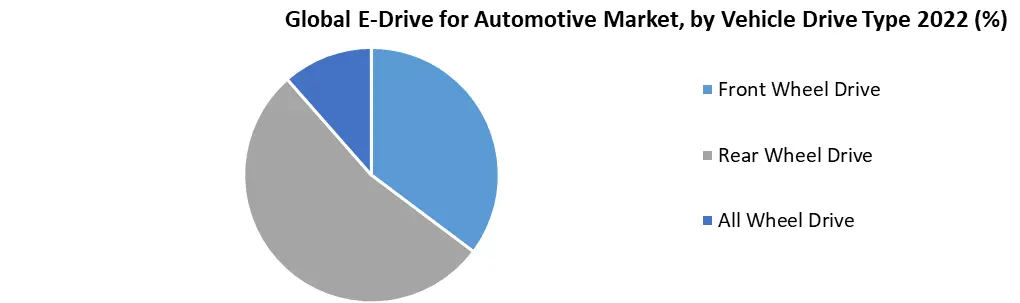

Based on Electric Vehicle Type, the E-Drive for Automotive Market is segmented into Battery Electric Vehicle, Plugin Hybrid Vehicles, and Hybrid Vehicle. Hybrid Vehicle is expected to grow faster during the forecast period. HEVs are driven by an internal combustion engine (ICE) and an electric motor that collects electricity from a battery. The additional power provided by the electric motor allows a smaller engine to be used without compromising performance; the battery may also power auxiliary loads such as music systems and illumination, as well as minimize engine running when the vehicle is stopped, this is expected to drive the E-Drive for the Automation market. Some HEVs can travel short distances at moderate speeds only on electricity. All of these abilities result in improved fuel efficiency. as well as fewer emissions than the equivalent automobiles that are standard. HEVs are not permitted. Electric cars are often more costly than conventional automobiles. However, because of cheaper fuel and maintenance costs, they may be a viable choice. The cost of electric driving in HEV cars is expected to drop more as battery technology improves. There are also federal and state tax incentives and rebates available to assist cover the cost of these automobiles. See the AFDC Laws, which hamper the market in hybrid electric vehicles Benefits of Electric-Drive Vehicles Based on the Vehicle Drive Type the E-Drive for Automotive Market is segmented into front-wheel drive, rear-wheel drive, and all-wheel drive. All-wheel drive is expected to dominate the e-drive for automation market during the forecast period. The important variables that are expected to fuel the growth of the market during the forecast period are the advancements and improvements made to the all-wheel-drive (AWD) system and its penetration into the increasing industry for electric cars. For example, in August 2022, Hyundai India plans to launch its brand-new AWD electric car, the Hyundai Ioniq 5 with e-drive features. Improved driving control, stability, and safety are a few of the variables that drive the demand for e-drive for the automation market globally. To further improve the AWD system's performance and fuel efficiency, emerging companies in the automobile industry continually research and improve each component in e-drive in all-wheel drive.The electric AWD is expected to high thanks to batter traction control and ride handling is high. AWD systems use less energy while operating under low load. Using two or more AWD motors to distribute power to the wheels increases efficiency and lowers power loss. The need for electric AWD systems is expected to be driven by consumer demand for an improved electric car economy. Two motors are used in the Tesla Model S to offer AWD. While the front motor is used for cruising, the rear motor is utilized for acceleration. As a result, it provides a better driving experience and rides, which drive the e-drive for automation market during the forecast period.

E-Drive for Automotive Market Regional Insights:

The Asia Pacific dominated the market with a 49 % share in 2022. The Asia Pacific is expected to witness significant growth during the forecast period. Thanks to rising demand for cars equipped with innovative components and technology, e-drive for the automotive sector has acquired enormous traction across Asia-Pacific. Furthermore, the Asia-Pacific e-drive for the automobile industry is controlled by government regulations that promote long-term manufacture and investment in the sector. Additionally, growing passenger car and vehicle registration in Asia-Pacific presents the profitable potential for market advancement. Furthermore, different technical developments linked to electric cars are occurring as a result of government efforts, driving the e-drive for automotive market growth. the growth is highly dependent on electric car adoption in china. According to data released by the Environmental and Energy Study Institute (EESI), the sale of electric vehicles in China has increased dramatically since The China Passenger Car Association modified its earlier forecast of 5.5 million EV sales this year to forecast that 6 million new EVs will be registered in the country in 2022. According to Tesla's most current sales data, September was its best-ever month in China, with 83,135 vehicles sold. China is currently well ahead of Europe and the United States in terms of the number of newly registered electric or plug-in hybrid vehicles, accounting for about a quarter of all new automobile registrations, due to this, the demand for e-drive in automation is penetrated during the forecast period.Competitive Landscape

The automotive all-wheel-drive market is dominated by several market players. ZF Friedrichshafen AG (Germany), GKN PLC (U.K.), and Continental AG (Germany)are some of the major key players in the e-drive for the automation market. The growth of global e-drive for the automotive market is driving, thanks to technological developments in the automotive industry that will create a positive impact on e-drive for the automotive market. Also, various stringent government rules and regulations towards vehicle emissions increase the sales of battery and hybrid electric vehicles are expected to create an opportunity for OMEs. The key market players are more focused on electric vehicles and started offering electric vehicle ranges for models including vans, large family cars, superminis, and sedans. Increased grid system deployment will improve the charging of electric vehicles and enhance demand for electric drive systems. The rise in electric vehicle sales in emerging markets represents a significant growth opportunity for e-drives. Rising demand for electric cars has allowed GKN Automotive to increase the range and volume of its products to its existing customers, who account for 90% of OEMs globally, as well as target newer players in the market. The e-powertrain branch of GKN Automotive provides solutions for all-electric cars and is the only company that provides torque vectoring, hybrid gearboxes, and modular e-drive systems. To remain competitive, ZF has introduced a new generation of electric drives built on a modular overall architecture that includes an electric motor, inverter, gearbox, and software. The report covered a detailed analysis of local as well as key market players’ investments in companies Tire1 and Tire2 suppliers, M&A, new product launching, and other stakeholders with in-depth information that will allow them to make well-informed strategic decisions about changes in the e-drive for automotive market around the world.E-Drive for Automotive Market Scope: Inquiry Before Buying

E-Drive for Automotive Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US$ 10.65 Bn. Forecast Period 2023 to 2029 CAGR: 8.7% Market Size in 2029: US$ 19.10 Bn. Segments Covered: by Electric Vehicle Type 1. Battery Electric Vehicle 2. Plugin Hybrid Vehicle 3. Hybrid Vehicle by Vehicle Drive Type 1. Front Wheel Drive 2. Rear Wheel Drive 3. All Wheel Drive by Application 1. Passenger cars 2. Commercial Vehicle E-Drive for Automotive Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)E-Drive for Automotive Market, Key Players are:

1. Robert Bosch AG 2. BorgWarner 3. ZF Friedrichshafen 4. Magnetic Systems Technology(Magtec) 5. ABM Greiffenberger 6. SMR , 7. GKN PLC 8. AVL List Gmbh 9. ACTIA Group 10. SIEMENS AG 11. Toyota Motor Corporation 12. Continental AG 13. Robert Bosch GmbH 14. Magna International Inc. 15. AISIN SEIKI Co. Ltd 16. Schaeffler AG 17. Hitachi, Ltd, 18. E-TRACTION B.V 19. NISSAN MOTOR CO., LTD. Frequently Asked Questions: 1] What segments are covered in the Global E-Drive for Automotive Market report? Ans. The segments covered in the E-Drive for Automotive Market report are based on Electric Vehicle Type, Vehicle Drive Type, Application and region 2] Which region is expected to hold the highest share in the Global E-Drive for Automotive Market? Ans. The Asia PAsific region is expected to hold the highest share in the E-Drive for Automotive Market. 3] What is the market size of the Global E-Drive for Automotive Market by 2029? Ans. The market size of the E-Drive for Automotive Market by 2029 is expected to reach US$ 19.10 Bn. 4] What is the forecast period for the Global E-Drive for Automotive Market? Ans. The forecast period for the E-Drive for Automotive Market is 2023-2029. 5] What was the market size of the Global E-Drive for Automotive Market in 2022? Ans. The market size of the E-Drive for Automotive Market in 2022 was valued at US$ 10.65 Bn.

1. Global E-Drive for Automotive Market Size: Research Methodology 2. Global E-Drive for Automotive Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global E-Drive for Automotive Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global E-Drive for Automotive Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global E-Drive for Automotive Market Size Segmentation 4.1. Global E-Drive for Automotive Market Size, by Electric Vehicle Drive Type (2022-2029) • Battery Electric Vehicle • Plugin Hybrid Vehicle • Hybrid Vehicle 4.2. Global E-Drive for Automotive Market Size, by Vehicle Drive Type (2022-2029) • Front Wheel Drive • Rear Wheel Drive • All Wheel Drive 4.3. Global E-Drive for Automotive Market Size, by Application (2022-2029) • Passenger cars • Commercial Vehicle 5. North America E-Drive for Automotive Market (2022-2029) 5.1. North America E-Drive for Automotive Market Size, by Electric Vehicle Drive Type (2022-2029) • Battery Electric Vehicle • Plugin Hybrid Vehicle • Hybrid Vehicle 5.2. North America E-Drive for Automotive Market Size, by Vehicle Drive Type (2022-2029) • Front Wheel Drive • Rear Wheel Drive • All Wheel Drive 5.3. Buses North America E-Drive for Automotive Market Size, by Application (2022-2029) • Passenger cars • Commercial Vehicle North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European E-Drive for Automotive Market (2022-2029) 6.1. European E-Drive for Automotive Market, by Electric Vehicle Drive Type (2022-2029) 6.2. European E-Drive for Automotive Market, by Vehicle Drive Type (2022-2029) 6.3. European E-Drive for Automotive Market, by Application (2022-2029) 6.4. European E-Drive for Automotive Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific E-Drive for Automotive Market (2022-2029) 7.1. Asia Pacific E-Drive for Automotive Market, by Electric Vehicle Drive Type (2022-2029) 7.2. Asia Pacific E-Drive for Automotive Market, by Vehicle Drive Type (2022-2029) 7.3. Asia Pacific E-Drive for Automotive Market, by Application (2022-2029) 7.4. Asia Pacific E-Drive for Automotive Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa E-Drive for Automotive Market (2022-2029) 8.1. Middle East and Africa E-Drive for Automotive Market, by Electric Vehicle Drive Type (2022-2029) 8.2. Middle East and Africa E-Drive for Automotive Market, by Vehicle Drive Type (2022-2029) 8.3. Middle East and Africa E-Drive for Automotive Market, by Application (2022-2029) 8.4. Middle East and Africa E-Drive for Automotive Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America E-Drive for Automotive Market (2022-2029) 9.1. South America E-Drive for Automotive Market, by Electric Vehicle Drive Type (2022-2029) 9.2. South America E-Drive for Automotive Market, by Vehicle Drive Type (2022-2029) 9.3. South America E-Drive for Automotive Market, by Application (2022-2029) 9.4. South America E-Drive for Automotive Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Robert Bosch AG 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. BorgWarner 10.3. ZF Friedrichshafen 10.4. Magnetic Systems Technology(Magtec) 10.5. ABM Greiffenberger 10.6. SMR , 10.7. GKN PLC 10.8. AVL List Gmbh 10.9. ACTIA Group 10.10. SIEMENS AG 10.11. Toyota Motor Corporation 10.12. Continental AG 10.13. Robert Bosch GmbH 10.14. Magna International Inc. 10.15. AISIN SEIKI Co. Ltd 10.16. Schaeffler AG 10.17. Hitachi, Ltd, 10.18. E-TRACTION B.V 10.19. NISSAN MOTOR CO., LTD.