The E-cigarette and Vaping Market was valued at USD 28.17 Billion in 2024 and is projected to reach USD 193.06 Billion by 2032, growing at a CAGR of 27.2 % during the forecast period.E cigarette and Vaping Market: Overview

The adult consumers shift toward smoke-free alternatives driven by rising health awareness, technological innovation, and evolving regulatory frameworks which creates strong opportunities to the E-cigarette and Vaping Market. Governments across the U.S., U.K., Europe, and Asia are implementing structured regulations that support safer product standards while encouraging innovation. For instance, the U.S. FDA’s PMTA pathway is pushing companies to launch scientifically tested, compliant e-vapor products, creating room for premium and regulated brands such as NJOY, Vuse, and Juul to strengthen market presence. Technological advancements such as smart vaping devices, ceramic coil technology, pod-mod systems, and rechargeable e-vapor devicesare reshaping product performance, battery life, and nicotine delivery efficiency. Companies such as British American Tobacco recently introduced devices such as Glo Hyper X2, showcasing the shift toward controlled heating systems and user-friendly designs. Governments are also promoting harm-reduction strategies; the U.K. “Swap to Stop” scheme encourages smokers to switch to vaping products by offering free devices. Meanwhile, new product launches such as nicotine pouches, heated tobacco systems, and disposable flavored vapes continue to expand consumer choices. With rising youth restrictions, expanding adult adoption, and continuous R&D investment, the market remains highly dynamic and innovation-driven.To know about the Research Methodology :- Request Free Sample Report

E-Cigarette and Vaping Market Key Trends

Technological Advancements in Vape Devices to drive the E cigarette and Vaping Market Rapid technological advancements are significantly accelerating the global e-cigarette and vaping market, transforming basic vape pens into advanced nicotine delivery systems. Modern vape technology focuses on enhanced performance, safety, and convenience, which is boosting demand for pod systems, mod systems, AIO devices, disposable vapes, and smart vape devices. Compact pod vapes offer user-friendly designs and smooth nicotine delivery using nicotine salt e-liquids, while mod systems provide adjustable wattage, strong vapor output, and customisation for experienced users. The rise of the disposable vape market is supported by improvements in battery life, leak-proof designs, and diverse vape flavours such as fruit, menthol, dessert, and tobacco. Innovations such as mesh coils and ceramic coils, along with precision temperature control, deliver richer flavour, consistent vapour production, and safer usage by preventing overheating and dry hits. Smart vaping represents the next growth wave, with Bluetooth-enabled vapes, app integration, and AI-powered personalisation offering real-time tracking and customised vaping settings. Additionally, eco-friendly materials, recyclable components, and growing demand for CBD and THC e-liquids are expanding market opportunities. Generations of E-Cigarettes and Vaping Devices

E cigarette and Vaping Market: Dynamics

Patent Analysis and Technological Evolution

Generation Description Key Features First Generation Designed to look like traditional cigarettes; mostly disposable with automatic batteries and low vapor output. Disposable, Non-rechargeable, Simple use, Minimal customization Second Generation Introduced vape pens with manual buttons, stronger batteries, and refillable tanks for better control and customization. Rechargeable, Refillable cartridges, Vape pen design, better battery life Third Generation Advanced vaporizers (mods) offering variable wattage/voltage, temperature control, and interchangeable parts for high performance. Highly modifiable, Customizable liquids, Interchangeable components, Enhanced performance Fourth Generation Pod systems with pre-filled or refillable pods; compact, portable, and beginner-friendly with draw-activated features. Refillable pods, High battery efficiency, Portable design, Easy customization Stringent Government Regulations & Compliance Costs limits the growth of E cigarette and Vaping Market Stringent government regulations and rising compliance costs are major restraints in the global e-cigarette and vaping market, limiting product availability and increasing operational challenges for manufacturers. Regulatory bodies worldwide have tightened rules through age restrictions, sales bans, advertising limits, and complex product approval requirements. In the U.S., the FDA’s PMTA (Premarket Tobacco Product Application) process demands extensive scientific evidence, and more than 99% of flavored e-cigarette submissions have been rejected—shrinking product diversity and reducing retail penetration. Countries such as India and Singapore have imposed complete bans on e-cigarette imports and sales, eliminating market growth opportunities and pushing consumers back to traditional cigarettes. Several Asian and South American regions have also enforced full restrictions, leaving no legal pathway for the vaping industry to expand. High compliance costsincluding scientific studies, safety certifications, packaging rules, and higher taxationfurther burden manufacturers. The PMTA process alone costs millions, preventing small businesses from competing. With flavored vape bans in multiple U.S. states and strict enforcement actions, many firms face product seizures, reformulation costs, or market exit, collectively restricting the overall growth of the e-cigarette and vaping market. Rapid Growth of Nicotine-Free & Herbal Vaping Products creates lucrative growth opportunities to the Market The rapid rise of nicotine-free vaping and herbal vape products is creating a high-growth opportunity in the E-Cigarette and Vaping Market, driven by health-focused consumers and tightening global nicotine regulations. Demand for nicotine-free e-liquids, herbal vaporizers, and wellness-based vape devices is increasing sharply as users shift toward non-addictive, cleaner, and regulation-friendly alternatives. Sales insights from leading online platforms show nicotine-free vape products growing by nearly 25% annually, with spikes of 40%–46% in 10ml zero-nicotine e-liquids. Herbal vape products such as green tea, eucalyptus, basil, and aromatherapy blends are gaining traction due to their perceived safety and lighter regulatory treatment. This trend opens strong market opportunities because brands expand without facing heavy compliance costs, flavor bans, or nicotine-related restrictions. Companies are launching herbal vapes, zero-nicotine disposable vapes, and plant-based vape pens to target wellness users, former smokers, and consumers seeking natural alternatives. E-commerce platforms amplify this growth, enabling global distribution and rapid scaling of nicotine-free and herbal vaping innovations.

E cigarette and Vaping Market: Segment Analysis

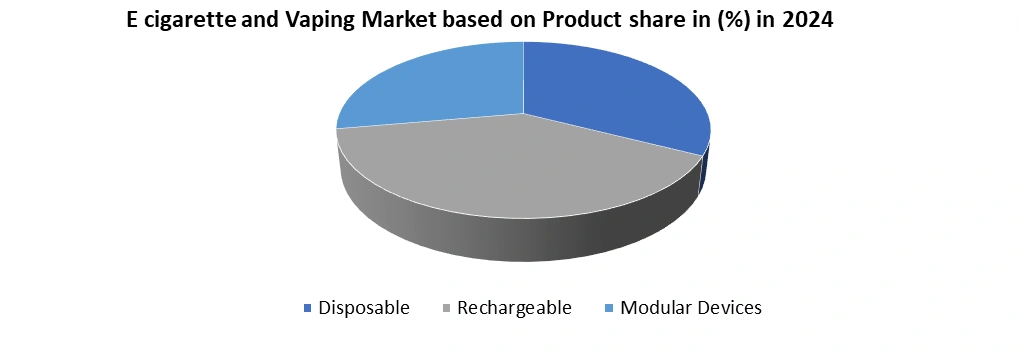

Based on Product, the E cigarette and Vaping Market is divided into Rechargeable, Modular, Disposable. The Rechargeable E cigarette products dominated the E cigarette and Vaping Market in year 2024. due to strong consumer demand for cost-effective and long-lasting vape devices. These products offer lower long-term costs than disposable vapes, making them attractive for regular users seeking affordable and flexible vaping solutions. Growing awareness around waste reduction and the demand for sustainable vaping solutions further accelerated the shift toward rechargeable devices, as they significantly reduce plastic waste and battery disposal issues. Advancements in vape technology, including longer battery life, customizable airflow, improved nicotine delivery, and compatibility with multiple e-liquid flavors, strengthened their market leadership. Retailers also promoted rechargeable systems due to higher repeat purchases of e-liquids and accessories, boosting overall vaping market growth. Moreover, many countries introduced stricter regulations and taxes on disposables, pushing consumers toward regulated and refillable formats. As a result, rechargeable e-cigarettes became the most preferred product segment, shaping key market trends across the global E-cigarette market.

E-cigarette and Vaping Market: Regional Analysis

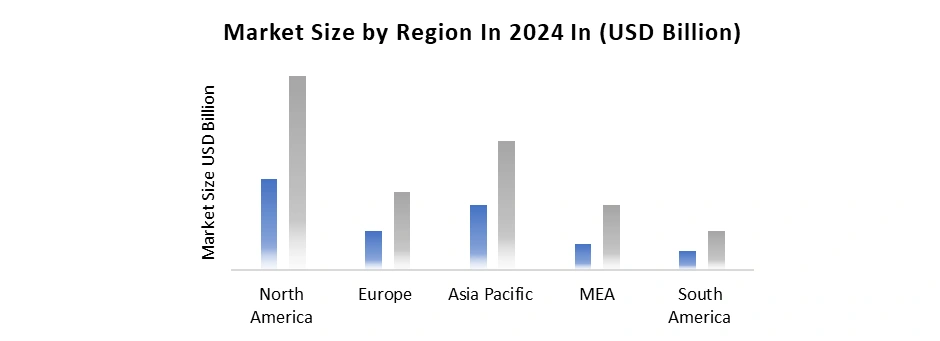

North America dominated the cigarette and Vaping Market In 2024. Due to its large consumer base, strong innovation ecosystem, and proactive harm-reduction policies. The U.S. leads regional growth, supported by high adoption of vape devices, disposable e-cigarettes, and flavored vaping products among adults seeking alternatives to traditional tobacco. Between February 2020 and June 2024, U.S. e-cigarette unit sales rose from 15.7 million to 21.1 million, marking a 34.7% increase in brick-and-mortar retail sales. As of June 2024, the U.S. market offered nearly 6,300 e-cigarette products, with disposable vapes dominating accounting for 58.1% (12.3 million units) of total sales, more than doubling from 26% in 2020. During the same period, prefilled cartridge sales declined from 73.9% to 41.8%. Flavored vapes remain highly popular, representing 80.6% (17 million units) of sales in June 2024. U.S. e-cigarette dollar sales reached $488.9 million. Top-selling brands from April–June 2024 included Vuse, JUUL, Geek Bar Pulse, Breeze Smoke, NJOY, RAZ, HQD, Loon Maxx, Breeze Prime, and Juicy Bar, strengthening North America’s leadership in the global vaping industry.

E cigarette and Vaping Market: Competitive Landscape

The E-cigarette and vaping market in 2024 is highly competitive, driven by rapid innovation, shifting regulations, aggressive brand strategies, and an expanding global consumer base. The ENDS market is dominated by a mix of established tobacco-backed brands and fast-growing disposable vape companies, creating intense pressure across product pricing, technology, distribution, and regulatory compliance. Vuse (BAT) remains the market leader. In late 2024, it held the highest U.S. dollar share, with BAT reporting 50.2% value share for its closed-system consumables in tracked channels. Vuse continues to expand globally, supported by strong retail networks and product diversification. JUUL maintains a significant presence despite regulatory challenges. It ranked among the top five best-selling U.S. vape brands in mid-2024, alongside Vuse, Geek Bar Pulse, Breeze Smoke, and RAZ. Ongoing FDA reviews of JUUL’s PMTA have increased industry attention and influenced competitive dynamics. RELX, dominant in China and parts of Asia, remains a strong international competitor, especially in closed-system pod devices, though its U.S. footprint is limited. New-age brands such as Geek Bar Pulse, Breeze Smoke, RAZ, HQD, NJOY, Loon Maxx, and Breeze Prime are capturing substantial market share, particularly in the disposable e-cigarette segment, which continues to grow rapidly.E cigarette and Vaping Market: Recent Development

1. Altria Group Acquires NJOY Holdings (June 2023) In June 2023, Altria Group, Inc. announced the acquisition of NJOY Holdings, Inc., one of the few e-vapor companies with U.S. FDA-authorized products. Following the deal, Altria began marketing NJOY’s e-vapor devices and pods through its subsidiary NJOY, LLC, while distribution is handled by Altria Group Distribution Company. This acquisition strengthens Altria’s presence in the regulated U.S. vaping market and expands its smoke-free product portfolio. 2. Imperial Brands Acquires Nicotine Pouch Portfolio from TJP Labs (June 2023) In June 2023, Imperial Brands plc entered the U.S. oral nicotine market by acquiring nicotine pouch brands and technologies from TJP Labs. The acquisition allows Imperial’s U.S. business, ITG Brands, to offer 14 innovative pouch varieties that performed strongly in consumer testing. This move aligns with Imperial’s strategy to accelerate harm-reduction product development and expand its nicotine alternatives portfolio. 3. Altria Group Partners with JT Group on Heated Tobacco (October 2022) In October 2022, Altria Group, Inc. formed a strategic partnership with JT Group to jointly develop, market, and commercialize heated tobacco stick products in the U.S. The collaboration aims to combine JT’s product expertise with Altria’s commercialization capabilities, accelerating the rollout of smoke-free solutions and strengthening both companies’ positions in the reduced-risk tobacco category. 4. British American Tobacco Launches Glo Hyper X2 (July 2022) In July 2022, British American Tobacco p.l.c. (BAT) introduced Glo Hyper X2 in Tokyo, Japan. The device features a redesigned barrel-style structure informed by consumer insights, delivering enhanced usability, improved design, and advanced heating performance. The launch reflects BAT’s growing investment in innovative heated tobacco technologies and its strategy to expand its global “New Category” product portfolio.E-Cigarette Market Scope: Inquire before buying

Global E-Cigarette Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 28.17 Bn. Forecast Period 2025 to 2032 CAGR: 27.2% Market Size in 2032: USD 193.06 Bn. Segments Covered: by Product Disposable Rechargeable Modular Devices by Category Open Closed by Component Atomizer Cartomizer E-liquid Others by Distribution Channel Online Retail Convenience Store Drug Store Newsstand Tobacconist Store Specialty E-cigarette Store E-Cigarette Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)E cigarette and Vaping Key Players

1. Altria Group, Inc. 2. British American Tobacco 3. Imperial Brands 4. International Vapor Group 5. Japan Tobacco 6. NicQuid 7. Philip Morris International Inc. 8. R.J. Reynolds Vapor Company 9. Shenzhen IVPS Technology Co., Ltd. 10. Shenzhen KangerTech Technology Co., Ltd. 11. VMR Products LLC 12. NJOY Inc. 13. International Vapor Group 14. Vapor Hub International Inc. 15. FIN Branding Group LLC 16. Fine Electronic Cigarettes 17. Innokin 18. KangerTech 19. Shoreditch 20. Ritchy 21. Vapouriz 22. Apollo Electronic Cigarettes 23. Eco-Cigs 24. Vape EmporiumFrequently Asked Questions:

1. Which region has the largest share in Global E cigarette and Vaping Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global E cigarette and Vaping Market? Ans: The Global E cigarette and Vaping Market is growing at a CAGR of 27.2 % during forecasting period 2025-2032. 3. What is scope of the Global market report? Ans: Global market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global E cigarette and Vaping Market are – Altria Group, Inc., British American Tobacco, Imperial Brands, International Vapor Group, Japan Tobacco, International, NicQuid, Philip Morris International Inc., and Others 5. What was the Global E cigarette and Vaping Market size in 2024? Ans: The Global E cigarette and Vaping Market size was USD 28.17 Billion in 2024

1. E-Cigarette Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. E-Cigarette Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global E-Cigarette Market: Dynamics 3.1. Region-wise Trends of E-Cigarette Market 3.1.1. North America E-Cigarette Market Trends 3.1.2. Europe E-Cigarette Market Trends 3.1.3. Asia Pacific E-Cigarette Market Trends 3.1.4. Middle East and Africa E-Cigarette Market Trends 3.1.5. South America E-Cigarette Market Trends 3.2. E-Cigarette Market Dynamics 3.2.1. Global E-Cigarette Market Drivers 3.2.2. Rising E-Cigarette Popularity 3.3. Global E-Cigarette Market Restraint 3.4. PORTER’s Five Forces Analysis 3.5. PESTLE Using Tree-Map Analysis 3.5.1. Taxation policies 3.5.2. Price sensitivity among consumers. 3.5.3. Continuous product innovation 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. E-Cigarette Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. E-Cigarette Market Size and Forecast, By Product (2024-2032) 4.1.1. Rechargeable 4.1.2. Modular 4.2. E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 4.2.1. Online 4.2.2. Offline 4.3. E-Cigarette Market Size and Forecast, by region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America E-Cigarette Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America E-Cigarette Market Size and Forecast, By Product (2024-2032) 5.1.1. Rechargeable 5.1.2. Modular 5.2. North America E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 5.2.1. Online 5.2.2. Offline 5.3. North America E-Cigarette Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States E-Cigarette Market Size and Forecast, By Product (2024-2032) 5.3.1.1.1. Rechargeable 5.3.1.1.2. Modular 5.3.1.2. United States E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 5.3.1.2.1. Online 5.3.1.2.2. Offline 5.3.2. Canada 5.3.2.1. Canada E-Cigarette Market Size and Forecast, By Product (2024-2032) 5.3.2.1.1. Rechargeable 5.3.2.1.2. Modular 5.3.2.2. Canada E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 5.3.2.2.1. Online 5.3.2.2.2. Offline 5.3.3. Mexico 5.3.3.1. Mexico E-Cigarette Market Size and Forecast, By Product (2024-2032) 5.3.3.1.1. Rechargeable 5.3.3.1.2. Modular 5.3.3.2. Mexico E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 5.3.3.2.1. Online 5.3.3.2.2. Offline 6. Europe E-Cigarette Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.2. Europe E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3. Europe E-Cigarette Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.1.2. United Kingdom E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.2. France 6.3.2.1. France E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.2.2. France E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.3. Germany 6.3.3.1. Germany E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.3.2. Germany E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.4. Italy 6.3.4.1. Italy E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.4.2. Italy E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.5. Spain 6.3.5.1. Spain E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.5.2. Spain E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.6.2. Sweden E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.7. Austria 6.3.7.1. Austria E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.7.2. Austria E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe E-Cigarette Market Size and Forecast, By Product (2024-2032) 6.3.8.2. Rest of Europe E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7. Asia Pacific E-Cigarette Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3. Asia Pacific E-Cigarette Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.1.2. China E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.2.2. S Korea E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.3. Japan 7.3.3.1. Japan E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.3.2. Japan E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.4. India 7.3.4.1. India E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.4.2. India E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.5. Australia 7.3.5.1. Australia E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.5.2. Australia E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.6.2. Indonesia E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.7. Philippines 7.3.7.1. Philippines E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.7.2. Philippines E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.8. Malaysia 7.3.8.1. Malaysia E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.8.2. Malaysia E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.9. Vietnam 7.3.9.1. Vietnam E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.9.2. Vietnam E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.10. Thailand 7.3.10.1. Thailand E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.10.2. Thailand E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific E-Cigarette Market Size and Forecast, By Product (2024-2032) 7.3.11.2. Rest of Asia Pacific E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 8. Middle East and Africa E-Cigarette Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa E-Cigarette Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 8.3. Middle East and Africa E-Cigarette Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa E-Cigarette Market Size and Forecast, By Product (2024-2032) 8.3.1.2. South Africa E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 8.3.2. GCC 8.3.2.1. GCC E-Cigarette Market Size and Forecast, By Product (2024-2032) 8.3.2.2. GCC E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria E-Cigarette Market Size and Forecast, By Product (2024-2032) 8.3.3.2. Nigeria E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A E-Cigarette Market Size and Forecast, By Product (2024-2032) 8.3.4.2. Rest of ME&A E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 9. South America E-Cigarette Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America E-Cigarette Market Size and Forecast, By Product (2024-2032) 9.2. South America E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 9.3. South America E-Cigarette Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil E-Cigarette Market Size and Forecast, By Product (2024-2032) 9.3.1.2. Brazil E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina E-Cigarette Market Size and Forecast, By Product (2024-2032) 9.3.2.2. Argentina E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 9.3.3. Rest of South America 9.3.3.1. Rest of South America E-Cigarette Market Size and Forecast, By Product (2024-2032) 9.3.3.2. Rest of South America E-Cigarette Market Size and Forecast, By Distribution (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Philip Morris International (PMI) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. British American Tobacco (BAT) 10.3. Altria Group Inc. 10.4. Japan Tobacco Inc. (JTI) 10.5. Imperial Brands PLC 10.6. Moore International Holdings Ltd. 10.7. JUUL Labs Inc. 10.8. RELX Technology 10.9. Softech (Smock) 10.10. Inno kin Technology Co. Ltd. 10.11. Geek Vape 10.12. Joye tech 10.13. Vaporise 10.14. Lost Mary / Elf Bar (IVPS Technology Co., Ltd. brands) 10.15. NJOY Holdings Inc. 10.16. Aspire 10.17. Voodoo 10.18. Elea 10.19. Kanger Tech 10.20. International Vapor Group Inc. 10.21. Microtek LLC 10.22. J WELL France 10.23. Pax Labs 10.24. Hansen 10.25. Sorin 10.26. Breeze Smoke LLC 10.27. SKE Crystal Bar 10.28. Dinner Lady 11. Analyst Recommendations 12. E-Cigarette Market: Research Methodology