The Drug Delivery Devices Market size was valued at US$ 242.67 Bn. in 2022 and the total Drug Delivery Devices revenue is expected to grow at 7.4 % through 2023 to 2029, reaching nearly US$ 400 Bn.Drug Delivery Devices Market Overview:

Global Drug delivery devices are specialised instruments designed to administer a drug or therapeutic material through a particular route. The medical treatments involve using the gadgets once or more than once. In many facets of product development, from regulatory strategy to design and material concerns to developing and using testing procedures, drug delivery devices pose special obstacles. Drug delivery is a vital component in administering pharmacological substances that provide therapeutic effects in people or animals. The usage of drug delivery systems among patients and clinicians is being driven by an increase in the number of diabetic patients as well as an increase in the incidence of cancer and respiratory disorders.To Know About The Research Methodology :- Request Free Sample Report In this report, the Drug Delivery Devices market's growth reasons, as well as the market's many segments (Route of Administration, Application, End-User, and Region.), are discussed. Data has been given by market players, regions, and specific requirements. This market report includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the Drug Delivery Devices market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the Global Drug Delivery Devices market situation. Drug Delivery Devices Market COVID Insights: The impact of COVID-19 had considerable growth of the market. This is attributed to the significant acceleration in the production of injectable drug delivery systems by manufacturers coupled with the increase in COVID-19 vaccination across the world. The market witnessed an increase of 26.2% in 2022 as compared to 2020. However, the market witnessed a slow growth in 2020 as compared to 2019. The slow growth in 2020 was due to the factors such as reduced hospital admissions due to COVID-19 and supply chain disruptions across the world. According to the World Health Organization (WHO), more than 10 billion doses of COVID-19 were given to worldwide population as of 7 February 2022, resulting in the growing production capacity of the systems. For instance, most of the companies focused especially on injectable manufacturing to smoothly drive the COVID-19 vaccinations. The rising incidence of respiratory disorders during COVID-19 and increase in the demand for syringes resulted in the high revenue of manufacturers as compared to the historical years. The demand for secure and user-friendly homecare solutions, which can be accomplished via self-injection devices, rises as a result of the decline in patient visits to hospitals and clinics during COVID-19. The major market participants have also created sophisticated medicine delivery systems that are simple to use at home. For patients who could not access healthcare facilities due to the pandemic, for example, E3D Elcam Medication Delivery Devices and Mount Sinai Hospital intended to develop a package in August 2022 that contains a ready-to-use Vial drug and Flexi-Q DV auto-injector device.

Drug Delivery Devices Market Dynamics:

In response to the rising demand, numerous businesses are creating patient-friendly drug delivery systems, and other market participants are acquiring these businesses to diversify their holdings. Prefilled syringes and auto-injectors are two examples of the patient-centric enhanced medication delivery training devices Noble International created. Through the use of sophisticated drug delivery systems, this acquisition will assist patients in appropriately administering prescriptions. Companies in the industry are always concentrating on methods like teamwork and the creation and introduction of new items. These tactics aid the businesses in generating more money, which fuels the growth of the market as a whole. New product introductions with improved safety and user-friendly features are anticipated to draw attention from the main pharmaceutical business. Additionally, improved dosage characteristics support the results of drug therapy and raise the possibility of illness management in homecare settings. For instance, Ypsomed introduced Ypso Mate in November 2022, claiming it to be the first auto-injector for prefilled syringes with integrated connectivity in the globe. It is available for self-administration. Additionally, there has been an increase in market participants working with pharmaceutical corporations to create and promote products. For instance, in April 2022, KINDEVA DRUG DELIVERY collaborated with Cambridge Healthcare Innovations Limited (CHI) to develop and commercialize CHI's aeolus dry-powder inhaler (DPI) platform technology. The top causes of death worldwide in recent years have been chronic illnesses like diabetes, cancer, asthma, and Chronic Obstructive Pulmonary Disease (COPD), among others. During the projected period, the market is expected to be driven by factors including the rising prevalence of chronic diseases like diabetes, COPD, and asthma as well as new technologies for treating these conditions. The prevalence of chronic diseases among such a sizable segment of the older population is expected to promote the uptake of such systems.Moreover, the increase in the launch of new products and digitalization in the healthcare sector has generated growth opportunities for the companies. The U.S. FDA's tight restrictions and criteria for approving medicine delivery devices as well as product recalls are the main reasons limiting the market. A Drugwatch report from 2022 states that approximately 4,500 medications and equipment are typically recalled from U.S. shelves each year. The market growth is being constrained by frequent product recalls due to negative side effects, non-compliance, and data security issues. For example, in 2019 Smiths Medical ASD, Inc. was forced to start a Class I regulatory recall of its ASD Medfusion 4000 Syringe Pump due to a software functionality issue that results in the device's low battery concerns. Products using cutting-edge technology must pass several governmental approval procedures. During the forecast period, the launch of technologically advanced and novel items is anticipated to be constrained by the regulatory authorities' strict rules for evaluating the performance and safety of the products. Customers' faith in the gadget may be impacted by the devices' intrusive character, and the market's growth is being constrained by tight rules for product approval.Drug Delivery Devices Market Segment Analysis:

By Route of Administration, During the forecast period, 2023-2029, the inhalation is expected to grow at a significant CAGR. The increasing use of inhalers and the prevalence of respiratory diseases like asthma and other bronchial problems are both factors in the growth of the inhalation market. In addition, the market growth is anticipated to be fueled by the leading players' increased product launches of inhalation systems through the forecast period. Injectables held the largest market share in 2022 and are expected to increase at the fastest rate over the forecast period. It is anticipated that there will be more product introductions as a result of the growing demand for wearable injectable medication delivery systems, which will promote segmental growth. In addition, it is anticipated that in the near future the global vaccination campaign, which is driving up syringe demand, would help to segment growth. For instance, Becton, Dickinson, and Company (BD) said in 2022 that it had received 2 billion injection devices altogether in pandemic orders for needles and syringes to support global COVID-19 immunisation efforts. The segmental growth is anticipated to increase due to the increased demand for syringes and needles till the vaccines are finished.

Market Regional Insights:

With a 34 % market share in 2022, North America region is expected to maintain its dominance through the forecast period. One of the contributing factors is the U.S. government's COVID19 immunisation drive's rapid expansion, which raised demand for syringes. In addition, a significant increase in the region's hospital admissions is anticipated to fuel the market growth for drug delivery devices in North America. The need for medicine delivery devices in the area is anticipated to rise as a result of these hospitalizations. Increased demand for advanced drug delivery delivers such as metered-dose inhalers and sensor-embedded devices and the growing incidence of chronic diseases are the other factors likely to drive the market growth in the region. Europe is expected to have the second-largest market share in 2022 and to experience rapid growth over the course of the forecast period. The expansion is brought on by the region's increasing use of innovative products and increased knowledge of modern drug delivery methods. Additionally, it is anticipated that the introduction of new products by the major players and clinical studies for important regulatory approvals of new products will fuel market growth in the area. For instance, in April 2022, Medtronic unveiled their prolonged infusion set, an insulin administration system that may be worn for up to seven days in a few European nations. The objective of the report is to present a comprehensive analysis of the Drug Delivery Devices market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Drug Delivery Devices market dynamics, and structure by analyzing the market segments and projecting the Drug Delivery Devices market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Drug Delivery Devices market make the report investor’s guide.Drug Delivery Devices Market Scope: Inquire before buying

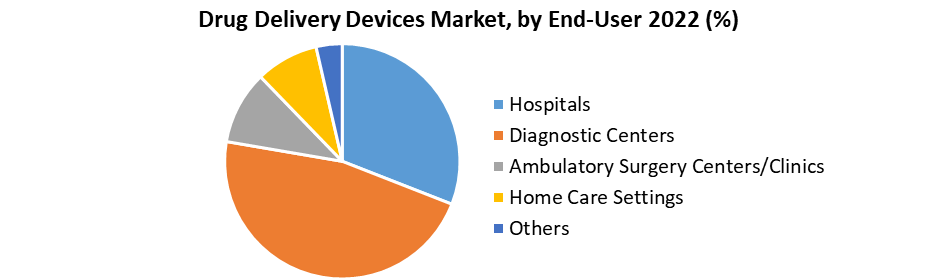

Drug Delivery Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 242.67 Bn. Forecast Period 2023 to 2029 CAGR: 7.4 % Market Size in 2029: US $ 400 Bn. Segments Covered: by Route of Administration Oral Inhalation Transdermal Injectable Others by Application Oncology Infectious Diseases Respiratory Diseases Diabetes Cardiovascular Diseases Autoimmune Diseases Central Nervous System Disorders Others by End-User Hospitals Diagnostic Centers Ambulatory Surgery Centers/Clinics Home Care Settings Others Drug Delivery Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Players are:

1.BD 2.F. Hoffmann-La Roche Ltd 3.Antares Pharma 4.Novartis AG 5.3M 6.Sulzer Ltd 7.Gerresheimer AG 8.Sanofi 9.Johnson & Johnson Services, Inc. 10.Bayer AG 11.GlaxoSmithKline plc 12.Novosanis 13.MEDMIX SYSTEMS AG 14.Merck & Co., Inc. 15.Pfizer Inc. 16.Insulet Corporation 17.OraSure Technologies, Inc. 18.Enable Injections 19.West Pharmaceutical Services, Inc. 20.SMC Ltd. 21.ViVO Smart Medical Devices Ltd. 22.Cipla Inc. FAQs: 1. What is the market size of the Drug Delivery Devices Market in 2022? Ans. Drug Delivery Devices Market size was valued at US$ 242.67 Bn. in 2022. 2. What is the Forecast Period of the Drug Delivery Devices Market? Ans. Forecast Period for Drug Delivery Devices Market in 2023-2029. 3. What is the projected market size & growth rate of the Drug Delivery Devices Market? Ans. Drug Delivery Devices Market is expected to grow at 7.4 % through 2023 to 2029, reaching nearly US$ 400 Bn. 4. What segments are covered in the Drug Delivery Devices Market report? Ans. The segments covered are Route of Administration, Application, End-User, and Region.

1. Global Drug Delivery Devices Market: Research Methodology 2. Global Drug Delivery Devices Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Drug Delivery Devices Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Drug Delivery Devices Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Drug Delivery Devices Market Segmentation 4.1 Global Drug Delivery Devices Market, by Route of Administration (2022-2029) • Oral • Inhalation • Transdermal • Injectable • Others 4.2 Global Drug Delivery Devices Market, by Application (2022-2029) • Oncology • Infectious Diseases • Respiratory Diseases • Diabetes • Cardiovascular Diseases • Autoimmune Diseases • Central Nervous System Disorders • Others 4.3 Global Drug Delivery Devices Market, by End-User (2022-2029) • Hospitals • Diagnostic Centers • Ambulatory Surgery Centers/Clinics • Home Care Settings • Others 5. North America Drug Delivery Devices Market 5.1 North America Drug Delivery Devices Market, by Route of Administration (2022-2029) • Oral • Inhalation • Transdermal • Injectable • Others 5.2 North America Drug Delivery Devices Market, by Application (2022-2029) • Oncology • Infectious Diseases • Respiratory Diseases • Diabetes • Cardiovascular Diseases • Autoimmune Diseases • Central Nervous System Disorders • Others 5.3 North America Drug Delivery Devices Market, by End-User (2022-2029) • Hospitals • Diagnostic Centers • Ambulatory Surgery Centers/Clinics • Home Care Settings • Others 5.4 North America Drug Delivery Devices Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Drug Delivery Devices Market 6.1. European Drug Delivery Devices Market, by Route of Administration (2022-2029) 6.2. European Drug Delivery Devices Market, by Application (2022-2029) 6.3. European Drug Delivery Devices Market, by End-User (2022-2029) 6.4. European Drug Delivery Devices Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Drug Delivery Devices Market (2022-2029) 7.1. Asia Pacific Drug Delivery Devices Market, by Route of Administration (2022-2029) 7.2. Asia Pacific Drug Delivery Devices Market, by Application (2022-2029) 7.3. Asia Pacific Drug Delivery Devices Market, by End-User (2022-2029) 7.4. Asia Pacific Drug Delivery Devices Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Drug Delivery Devices Market 8.1 Middle East and Africa Drug Delivery Devices Market, by Route of Administration (2022-2029) 8.2. Middle East and Africa Drug Delivery Devices Market, by Application (2022-2029) 8.3. Middle East and Africa Drug Delivery Devices Market, by End-User (2022-2029) 8.4. Middle East and Africa Drug Delivery Devices Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Drug Delivery Devices Market (2022-2029) 9.1. South America Drug Delivery Devices Market, by Route of Administration (2022-2029) 9.2. South America Drug Delivery Devices Market, by Application (2022-2029) 9.3. South America Drug Delivery Devices Market, by End-User (2022-2029) 9.6. South America Drug Delivery Devices Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 BD 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 F. Hoffmann-La Roche Ltd 10.3 Antares Pharma 10.4 Novartis AG 10.5 3M 10.6 Sulzer Ltd 10.7 Gerresheimer AG 10.8 Sanofi 10.9 Johnson & Johnson Services, Inc. 10.10 Bayer AG 10.11 GlaxoSmithKline plc 10.12 Novosanis 10.13 MEDMIX SYSTEMS AG 10.14 Merck & Co., Inc. 10.15 Pfizer Inc. 10.16 Insulet Corporation 10.17 OraSure Technologies, Inc. 10.18 Enable Injections 10.19 West Pharmaceutical Services, Inc. 10.20 SMC Ltd. 10.21 ViVO Smart Medical Devices Ltd. 10.22 Cipla Inc.