Direct Attach Cable Market size was valued at USD 5.62 Bn. in 2024 and is expected to reach US$ 68.63 Bn by 2032 to exhibit a CAGR of 36.71% during the forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.To know about the Research Methodology:-Request Free Sample Report

The demand for the direct attaches cable market is increasing due to rising investments by manufacturers in the global direct attach cable market. The manufacturers that invest in this market to achieve advancing requirements of high bandwidth applications, high-density applications, and lower power consumption are expected to manage demand for active optical cables (AOCs) and direct attach copper (DAC) cables. The adoption of direct attach cable markets are increasing for data storage is probably to improve the market growth. Data center operators utilize direct attach cable market assemblies for data storage on account of the cost-saving and energy-saving benefits they offer. Further, AOCs act as the main transmission medium in data centers and high-performance computing (HPC) centers to ensure the flexibility and stability of data transmission. DAC cables can be used to connect switches to routers and/or servers. They are becoming growingly popular in the network industry because the price difference is so large compared with regular optics and RJ-45 10G is not widely acquired. The rising demand for next-generation high-speed pluggable-products is raising the growth of the market over the forecast period. The pluggable products can perform in utmost conditions such as high-temperature data centers. These next-generation cables are used to support the ultra-fast speed required by the hyper-scale industry. The growing use of active optical cables in consumer electronics such as 4K televisions and digital signage is expected to prompt market growth over the forecast period. However, the high costs related to the set-up of optical cable networks, as well as the costly raw materials used in the manufacture of optical cables and the high cost of optical fiber hamper the growth of the market. Also, the continuous R&D activities managed by the manufacturers in order to assemble next-generation AOCs and transceivers to meet the developing requirements of data centers is an expensive process, which delays the market growth over the forecast period.Direct Attach Cable Market Dynamics:

Direct Attach Cable Market Segment Analysis:

Based on Type, Direct Attach Copper Cable, Passive Direct Attach Copper Cable, Active Direct Attach Copper Cable, and Active Optical Cable (AOC). In 2024, copper-based DACs dominated the global market, contributing to nearly 60% of total revenue, primarily due to their low cost per connection, energy efficiency, and ease of deployment in short-range data center networks. Passive DACs held the major share, accounting for about 35% of the market, and are widely used for top-of-rack (ToR) and server-to-switch connections up to 5 meters. Their plug-and-play nature, minimal power consumption, and high reliability make them the preferred choice for high-density environments.Active DACs, comprising approximately 25% of total demand, are increasingly adopted for medium-distance connections (up to 15 meters) within large data center facilities and hyperscale campuses, as they offer improved signal integrity through embedded electronics. On the other hand, the Active Optical Cable (AOC) segment is witnessing robust growth, driven by the transition toward high-speed 400G and 800G Ethernet interconnects, the expansion of AI/ML data processing clusters, and the need for low-latency, long-distance data transmission. AOCs are projected to reach around USD xx billion by 2032, supported by their lightweight design, superior flexibility, and immunity to electromagnetic interference (EMI), making them essential in high-performance and AI-optimized data center networks.

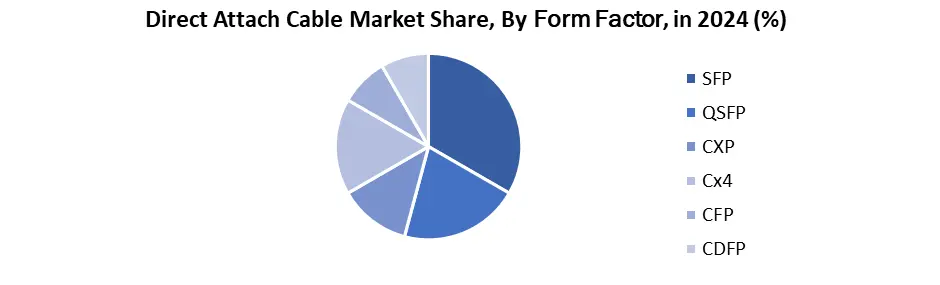

Based on Form Factor, the market is categorized into SFP, QSFP, CXP, CX4, CFP, and CDFP form factors, with significant differences in adoption across data rates and applications. The QSFP (Quad Small Form-Factor Pluggable) category dominated in 2024, capturing more than 40% of the market share, as it supports 40G, 100G, 200G, and 400G Ethernet connectivity, making it the backbone of cloud and hyperscale data centers. QSFP cables provide high port density, scalability, and lower power consumption, aligning with the shift toward AI-ready and GPU-based computing infrastructure. The SFP (Small Form-Factor Pluggable) segment accounted for around 20% share, primarily used in enterprise networks, telecom base stations, and short-range data center links that rely on 10G–25G connections. Meanwhile, CXP and CFP form factors collectively contributed around 18–20%, mainly used in high-performance computing (HPC) clusters, supercomputing networks, and 100G+ optical transport applications requiring maximum bandwidth. The CX4 category, representing legacy 10G Ethernet systems, retained less than 5% market share, as most organizations continue to migrate to higher-speed interconnects. Emerging CDFP (400G and above) solutions currently hold around 3–4%, but are expected to accelerate sharply as 800G and 1.6T Ethernet deployments become mainstream in AI hyperscale and quantum computing environments.

Direct Attach Cable Market Regional Analysis:

North America is expected to dominate the global market over the forecast period, mainly due to soaring demand for higher bandwidth speeds in high-performance computing centers as well as a consistent increase in data centers. Various manufacturers are launching AOCs and DAC cables for data centers. For example, in January 2018, Nexans introduced the addition of these cables to its data center solutions product portfolio. The products were announced to expand the offerings of the data center segment and were designed to offer cost-effective, high-performance, and reliable solutions.Direct Attach Cable Market, Key Highlights:

• Global Direct Attach Cable Market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Global Direct Attach Cable Market • Global Direct Attach Cable Market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Global Direct Attach Cable Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Global Direct Attach Cable Market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Global Direct Attach Cable Market are also profiled.Direct Attach Cable Market Scope: Inquire before buying

Direct Attach Cable Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.62 Bn. Forecast Period 2025 to 2032 CAGR: 36.71% Market Size in 2032: USD 68.63Bn. Segments Covered: by Type Direct Attach Copper Cable Passive Direct Attach Copper Cable Active Direct Attach Copper Cable Active Optical Cable by Form Factor SFP QSFP CXP Cx4 CFP CDFP by End-Users Networking Telecommunications Data Storage High Performance Computing Centers (HPCs) Others (Consumer Electronics) Direct Attach Cable Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Direct Attach Cable Market, Key Players

1. Arista Networks, Inc 2. Cisco Systems, Inc. 3. Broadcom (Avago Technologies Ltd) 4. TE Connectivity Ltd 5. Molex, LLC 6. Nexans 7. Panduit Corp. 8. ProLabs Ltd 9. Solid Optics 10. The Siemon Company 11. 3M 12. Cleveland Cable Compan 13. Hitachi, Ltd. 14. Juniper Networks, Inc. 15. Methode Electronics 16. Finisar Corporation (Coherent Corp.) 17. Shenzhen Gigalight Technology Co., Ltd. 18. Sumitomo Electric Industries, Ltd. 19. Emcore Corporation 20. FCI Electronics 21. Liverage Technology Inc. 22. Shenzhen Sopto Technology Co., Ltd. 23. American Cable Assemblies, Inc 24. Direct Wire 25. Methode Electronics 26. Juniper Networks, Inc. 27. Shenzhen HiLink Technology Co., Ltd. 28. JHA Tech 29. Hangzhou DAYTAI Network Tech 30. Dawnray Tech 31.Others Frequently Asked Questions: 1. Which region has the largest share in Global market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global market? Ans: The Global Direct Attach Cable Market is growing at a CAGR of 36.71% during forecasting period 2025-2032. 3. What is scope of the Global market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global market are – Arista Networks, Inc., Cisco Systems, Inc., Cleveland Cable Company, Hitachi, Ltd., Juniper Networks, Methode Electronics, Molex, LLC, Nexans, Panduit, ProLabs Ltd, Solid Optics, The Siemon Company, 3M, Avago Technologies Ltd, Emcore Corporation, FCI Electronics, Finisar Corporation, TE Connectivity Ltd. 5. What is the study period of this Market? Ans: The Global market is studied from 2024 to 2032.

1. Direct Attach Cable Market: Executive Summary 1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (Value in USD Billion) and Market Share (%) - By Segments, Regions and Country 2. Global Direct Attach Cable Market: Competitive Landscape 1. Industry Ecosystem 2. Competitive Positioning of key Players 3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. ASP 2.3.5. Technological Innovation 2.3.6. Revenue 2024 2.3.7. Market Share (%) 2.3.8. Geographical presence 4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 5. Mergers and Acquisitions Details 3. Market Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.4 PESTLE Analysis 3.5 Key Opinion Leader Analysis for the Direct Attach Cable Industry 3.6 Regulatory Landscape 4. Pricing Analysis 4.1 DAC Price Trend Analysis (2019-2024) 4.2 DAC Forecast Price Trend Analysis (2025-2032) 4.3 Price Influencing Factors 4.3.1 Cable Length 4.3.2 Connector Type 4.3.3 Miniaturization & Flexibility 4.3.4 Raw Material Prices 4.3.5 Warranty & Support 4.4 Comparative Pricing Analysis by Type of DAC (2019-2024) 4.4.1 Direct Attach Copper Cable 4.4.1.1 Passive Direct Attach Copper Cable 4.4.1.2 Active Direct Attach Copper Cable 4.4.2 Active Optical Cable 4.5 Price variation by Country (2024) 4.6 Price Variation by Distribution Channel (2024) 4.6.1 Online 4.6.2 Offline 5 Value Chain and Profitability Analysis 5.1 DAC Value Chain Mapping 5.2 Profit Margins by Stakeholder Tier 5.3 OEM vs Aftermarket Price Behavior 5.4 Pricing Impact of Vertical Integration 6 Direct Attach Cable Market: Global Market Size and Forecast by Segmentation (By Value in USD Billion) (2024-2032) 6.1 Global Direct Attach Cable Market Size and Forecast, By Type 6.1.1 Direct Attach Copper Cable 6.1.1.1 Passive Direct Attach Copper Cable 6.1.1.2 Active Direct Attach Copper Cable 6.1.2 Active Optical Cable 6.2 Global Direct Attach Cable Market Size and Forecast, By Form Factor 6.2.1 SFP 6.2.2 QSFP 6.2.3 CXP 6.2.4 Cx4 6.2.5 CFP 6.2.6 CDFP 6.3 Global Direct Attach Cable Market Size and Forecast, By End-users 6.3.1 Networking 6.3.2 Telecommunications 6.3.3 Data Storage 6.3.4 High Performance Computing Centers (HPCs) 6.3.5 Others (Consumer Electronics) 6.4 Direct Attach Cable Market Size and Forecast, By Region (2024-2032) 6.4.1 North America 6.4.2 Europe 6.4.3 Asia Pacific 6.4.4 South America 6.4.5 MEA 7 North America Direct Attach Cable Market Size and Forecast by Segmentation (By Value in USD Billion) (2024-2032) 7.1 North America Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 7.1.1 Direct Attach Copper Cable 7.1.1.1 Passive Direct Attach Copper Cable 7.1.1.2 Active Direct Attach Copper Cable 7.1.2 Active Optical Cable 7.2 North America Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 7.2.1 SFP 7.2.2 QSFP 7.2.3 CXP 7.2.4 Cx4 7.2.5 CFP 7.2.6 CDFP 7.3 North America Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 7.3.1 Networking 7.3.2 Telecommunications 7.3.3 Data Storage 7.3.4 High Performance Computing Centers (HPCs) 7.3.5 Others (Consumer Electronics) 7.4 North America Direct Attach Cable Market Size and Forecast, By Country (2024-2032) 7.4.1 United States 7.4.1.1 United States Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 7.4.1.1.1 Direct Attach Copper Cable 7.4.1.1.1.1 Passive Direct Attach Copper Cable 7.4.1.1.1.2 Active Direct Attach Copper Cable 7.4.1.1.2 Active Optical Cable 7.4.1.2 United States Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 7.4.1.2.1 SFP 7.4.1.2.2 QSFP 7.4.1.2.3 CXP 7.4.1.2.4 Cx4 7.4.1.2.5 CFP 7.4.1.2.6 CDFP 7.4.1.3 United States Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 7.4.1.3.1 Networking 7.4.1.3.2 Telecommunications 7.4.1.3.3 Data Storage 7.4.1.3.4 High Performance Computing Centers (HPCs) 7.4.1.3.5 Others (Consumer Electronics) 7.4.2 Canada 7.4.2.1 Canada Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 7.4.2.1.1 Direct Attach Copper Cable 7.4.2.1.1.1 Passive Direct Attach Copper Cable 7.4.2.1.1.2 Active Direct Attach Copper Cable 7.4.2.1.2 Active Optical Cable 7.4.2.2 Canada Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 7.4.2.2.1 SFP 7.4.2.2.2 QSFP 7.4.2.2.3 CXP 7.4.2.2.4 Cx4 7.4.2.2.5 CFP 7.4.2.2.6 CDFP 7.4.2.3 Canada Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 7.4.2.3.1 Networking 7.4.2.3.2 Telecommunications 7.4.2.3.3 Data Storage 7.4.2.3.4 High Performance Computing Centers (HPCs) 7.4.2.3.5 Others (Consumer Electronics) 7.4.3 Mexico 7.4.3.1 Mexico Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 7.4.3.1.1 Direct Attach Copper Cable 7.4.3.1.1.1 Passive Direct Attach Copper Cable 7.4.3.1.1.2 Active Direct Attach Copper Cable 7.4.3.1.2 Active Optical Cable 7.4.3.2 Mexico Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 7.4.3.2.1 SFP 7.4.3.2.2 QSFP 7.4.3.2.3 CXP 7.4.3.2.4 Cx4 7.4.3.2.5 CFP 7.4.3.2.6 CDFP 7.4.3.3 Mexico Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 7.4.3.3.1 Networking 7.4.3.3.2 Telecommunications 7.4.3.3.3 Data Storage 7.4.3.3.4 High Performance Computing Centers (HPCs) 7.4.3.3.5 Others (Consumer Electronics) 8 Europe Direct Attach Cable Market Size and Forecast By Segmentation (By Value in USD Billion) (2024-2032) 8.1 Europe Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.2 Europe Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.3 Europe Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4 Europe Direct Attach Cable Market Size and Forecast, By Country (2024-2032) 8.4.1 United Kingdom 8.4.1.1 United Kingdom Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.1.2 United Kingdom Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.1.3 United Kingdom Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.2 France 8.4.2.1 France Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.2.2 France Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.2.3 France Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.3 Germany 8.4.3.1 Germany Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.3.2 Germany Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.3.3 Germany Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.4 Italy 8.4.4.1 Italy Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.4.2 Italy Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.4.3 Italy Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.5 Spain 8.4.5.1 Spain Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.5.2 Spain Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.5.3 Spain Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.6 Sweden 8.4.6.1 Sweden Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.6.2 Sweden Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.6.3 Sweden Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.7 Austria 8.4.7.1 Austria Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.7.2 Austria Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.7.3 Austria Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 8.4.8 Rest of Europe 8.4.8.1 Rest of Europe Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 8.4.8.2 Rest of Europe Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 8.4.8.3 Rest of Europe Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9 Asia Pacific Direct Attach Cable Market Size and Forecast By Segmentation (By Value in USD Billion) (2024-2032) 9.1 Asia Pacific Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.2 Asia Pacific Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.3 Asia Pacific Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4 Asia Pacific Direct Attach Cable Market Size and Forecast, By Country (2024-2032) 9.4.1 China 9.4.1.1 China Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.1.2 China Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.1.3 China Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.2 S Korea 9.4.2.1 S Korea Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.2.2 S Korea Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.2.3 S Korea Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.3 Japan 9.4.3.1 Japan Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.3.2 Japan Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.3.3 Japan Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.4 India 9.4.4.1 India Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.4.2 India Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.4.3 India Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.5 Australia 9.4.5.1 Australia Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.5.2 Australia Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.5.3 Australia Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.6 Malaysia 9.4.6.1 Malaysia Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.6.2 Malaysia Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.6.3 Malaysia Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.7 Vietnam 9.4.7.1 Vietnam Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.7.2 Vietnam Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.7.3 Vietnam Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.8 Thailand 9.4.8.1 Thailand Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.8.2 Thailand Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.8.3 Thailand Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.9 Indonesia 9.4.9.1 Indonesia Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.9.2 Indonesia Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.9.3 Indonesia Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.10 Philippines 9.4.10.1 Philippines Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.10.2 Philippines Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.10.3 Philippines Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 9.4.11 Rest of Asia Pacific 9.4.11.1 Rest of Asia Pacific Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 9.4.11.2 Rest of Asia Pacific Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 9.4.11.3 Rest of Asia Pacific Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10 South America Direct Attach Cable Market Size and Forecast By Segmentation (By Value in USD Billion) (2024-2032) 10.1 South America Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.2 South America Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.3 South America Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10.4 South America Direct Attach Cable Market Size and Forecast, By Country (2024-2032) 10.4.1 Brazil 10.4.1.1 Brazil Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.4.1.2 Brazil Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.4.1.3 Brazil Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10.4.2 Argentina 10.4.2.1 Argentina Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.4.2.2 Argentina Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.4.2.3 Argentina Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10.4.3 Colombia 10.4.3.1 Colombia Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.4.3.2 Colombia Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.4.3.3 Colombia Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10.4.4 Chile 10.4.4.1 Chile Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.4.4.2 Chile Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.4.4.3 Chile Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10.4.5 Peru 10.4.5.1 Peru Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.4.5.2 Peru Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.4.5.3 Peru Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 10.4.6 Rest Of South America 10.4.6.1 Rest Of South America Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 10.4.6.2 Rest Of South America Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 10.4.6.3 Rest Of South America Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11 Middle East and Africa Direct Attach Cable Market Size and Forecast By Segmentation (By Value in USD Billion) (2024-2032) 11.1 Middle East and Africa Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.2 Middle East and Africa Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.3 Middle East and Africa Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11.4 Middle East and Africa Direct Attach Cable Market Size and Forecast, By Country (2024-2032) 11.4.1 South Africa 11.4.1.1 South Africa Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.4.1.2 South Africa Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.4.1.3 South Africa Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11.4.2 GCC 11.4.2.1 GCC Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.4.2.2 GCC Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.4.2.3 GCC Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11.4.3 Nigeria 11.4.3.1 Nigeria Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.4.3.2 Nigeria Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.4.3.3 Nigeria Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11.4.4 Egypt 11.4.4.1 Egypt Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.4.4.2 Egypt Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.4.4.3 Egypt Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11.4.5 Turkey 11.4.5.1 Turkey Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.4.5.2 Turkey Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.4.5.3 Turkey Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 11.4.6 Rest Of MEA 11.4.6.1 Rest Of MEA Direct Attach Cable Market Size and Forecast, By Type (2024-2032) 11.4.6.2 Rest Of MEA Direct Attach Cable Market Size and Forecast, By Form Factor (2024-2032) 11.4.6.3 Rest Of MEA Direct Attach Cable Market Size and Forecast, By End-users (2024-2032) 12 Company Profile: Key Players 12.1 Arista Networks, Inc. 12.1.1 Company Overview 12.1.2 Direct Attach Cable Portfolio 12.1.3 Financial Overview 12.1.4 SWOT Analysis 12.1.5 Strategic Analysis 12.1.6 Recent Developments 12.2 Cisco Systems, Inc 12.3 Broadcom (Avago Technologies Ltd) 12.4 TE Connectivity Ltd 12.5 Molex, LLC 12.6 Nexans 12.7 Panduit Corp. 12.8 ProLabs Ltd 12.9 Solid Optics 12.10 The Siemon Company 12.11 3M 12.12 Cleveland Cable Compan 12.13 Hitachi, Ltd. 12.14 Juniper Networks, Inc. 12.15 Methode Electronics 12.16 Finisar Corporation (Coherent Corp.) 12.17 Shenzhen Gigalight Technology Co., Ltd. 12.18 Sumitomo Electric Industries, Ltd. 12.19 Emcore Corporation 12.20 FCI Electronics 12.21 Liverage Technology Inc. 12.22 Shenzhen Sopto Technology Co., Ltd. 12.23 American Cable Assemblies, Inc 12.24 Direct Wire 12.25 Methode Electronics 12.26 Juniper Networks, Inc. 12.27 Shenzhen HiLink Technology Co., Ltd. 12.28 JHA Tech 12.29 Hangzhou DAYTAI Network Tech 12.30 Dawnray Tech 13 Key Findings 14 Analyst Recommendations 15 Direct Attach Cable Market – Research Methodology