The Global Dietary Supplements Market was valued at USD 175.2 Billion in 2024 and is projected to reach USD 287.14 Billion by 2032, growing at a CAGR of 6.37 % during the forecast period.Global Dietary Supplements Market

The Global Dietary Supplements Market is witnessing robust growth, fueled by increasing health awareness, preventive healthcare trends, and the rising demand for personalized nutrition. Key markets include the United States, China, India, Japan, Germany, and the United Kingdom, where consumers are adopting vitamins, minerals, probiotics, immunity boosters, and herbal supplements. A shift toward plant-based, vegan, organic, and clean-label dietary supplements is shaping product development globally. Technological advancements are transforming the industry, with innovations such as AI-driven personalized nutrition platforms, DNA-based supplement recommendations, microbiome testing, smart wearables, liposomal formulations, transparent liquid capsules, and sustained-release tablets enhancing bioavailability and consumer experience. Companies are leveraging these technologies to deliver tailored health solutions and improve overall wellness outcomes. Government initiatives are further driving market expansion. The U.S. FDA ensures quality and safety standards, India’s FSSAI promotes standardization and clean-label compliance, while China’s Healthy China 2030 plan encourages traditional nutraceutical development. European regulations strengthen safety and consumer confidence. With technological innovations, supportive regulations, and rising consumer focus on preventive wellness, the global dietary supplements market is set for sustained, long-term growth.To know about the Research Methodology :- Request Free Sample Report

Dietary Supplements Market: Dynamics

Increasing Health Consciousness to drive the growth of Dietary Supplements Market The Dietary Supplements Market is growing rapidly as consumers worldwide shift from curative treatments to preventive healthcare, driven by rising awareness of immunity, fitness, and overall wellness. Health-conscious users are increasingly integrating nutritional supplements, vitamin supplements, and herbal supplements into daily routines to manage lifestyle diseases, mental well-being, and healthy ageing. According to MMR Report, nearly three-quarters of U.S. adults consume dietary supplements, with strong growth seen in specialty products for stress relief, sleep improvement, and gut health key segments within the global dietary supplements market. In India, a 2024 Local Circles survey reports that seven in ten households regularly use nutraceuticals, reflecting increasing demand for functional supplements and clean-label formulations. European consumers are also adopting immunity-boosting supplements, vegan blends, and personalized nutrition products. Globally, multifunctional dietary supplements now outpace traditional single-ingredient vitamins, supported by rising interest in weight management, energy enhancement, and stress reduction. As consumers proactively manage ageing and chronic disease risks, the adoption of vitamins, minerals, sports nutrition, probiotics, and botanical extracts continues to accelerate, reinforcing long-term demand in the global nutritional supplements industry and boosting overall dietary supplements market growth.Regulatory Challenges limits the Dietary Supplements Market Growth Regulatory challenges significantly restrain the Dietary Supplements Market growth, as global authorities continue to tighten compliance rules to ensure product safety and quality. The absence of uniform international standards creates complexity for manufacturers, who must navigate different frameworks such as the U.S. FDA’s DSHEA regulations, Europe’s EFSA guidelines, and India’s FSSAI norms. These variations slow market entry, increase approval timelines, and raise the cost of developing nutritional supplements, herbal supplements, and vitamin supplements. Strict documentation, safety testing, ingredient verification, and labeling requirements further limit innovation, especially for emerging categories like plant-based supplements, probiotics, and sports nutrition products. Many small and mid-sized companies struggle with the high cost of regulatory compliance, leading to reduced product launches and restricted availability across markets. Additionally, frequent product recalls, claims restrictions, and warnings on misleading marketing practices undermine consumer trust and impact the dietary supplements market demand. The increasing scrutiny on health claims, contamination risks, and adulterated products also forces brands to invest heavily in quality control and third-party certifications. As a result, regulatory uncertainty remains one of the most critical restraints hindering global dietary supplements market growth. Regulatory Framework Dietary Supplements

Rising Demand for Plant-Based & Natural Ingredients creates lucrative growth opportunities to the market The rising demand for plant-based and natural ingredients is creating significant opportunities in the dietary supplements market as consumers worldwide shift away from synthetic formulations toward cleaner, nature-derived products. In the United States, sales of herbal dietary supplements increased by nearly 4–5% in 2023, driven by strong interest in botanical solutions for immunity, stress relief, and digestive wellness. Europe, which leads in new nutritional supplement launches, is witnessing rapid growth in vegan supplements and vegetarian formulations, supported by a consumer base of over 8 million vegans and millions of flexitarians seeking plant-based nutrition. In India, the nutraceutical sector continues to surge as demand rises for Ayurvedic supplements, clean-label herbal blends, and plant-based dietary supplements for preventive health. Ayurvedic manufacturers are expanding production to meet domestic and export requirements. Similarly, China and Japan are experiencing strong uptake of botanical and traditional medicine-based supplements as consumers prioritize natural, safe, and culturally rooted wellness solutions. This global shift toward natural ingredients, vegan supplements, and herbal nutraceuticals allows brands to differentiate on purity, sustainability, and tradition, command premium pricing, and capture growth in high-potential segments such as clean-label, botanical, and plant-based supplements.

Country / Region Primary Regulatory Authority Key Regulations Food and Drug Administration (USA) Food and Drug Administration (FDA) 1. Dietary Supplement Health and Education Act (DSHEA) 1994 2. Current Good Manufacturing Practices (cGMP – 21 CFR Part 111) 3. New Dietary Ingredient (NDI) Notification European Food Safety Authority / EU (European Union) European Food Safety Authority (EFSA) 1. EU Food Supplements Directive 2002/46/EC 2. General Food Law Regulation India Food Safety and Standards Authority of India (FSSAI) 1. Health Supplements & Nutraceuticals Regulations (2016, updated) 2. Food Safety & Standards Act Dietary Supplements Market: Segment Analysis

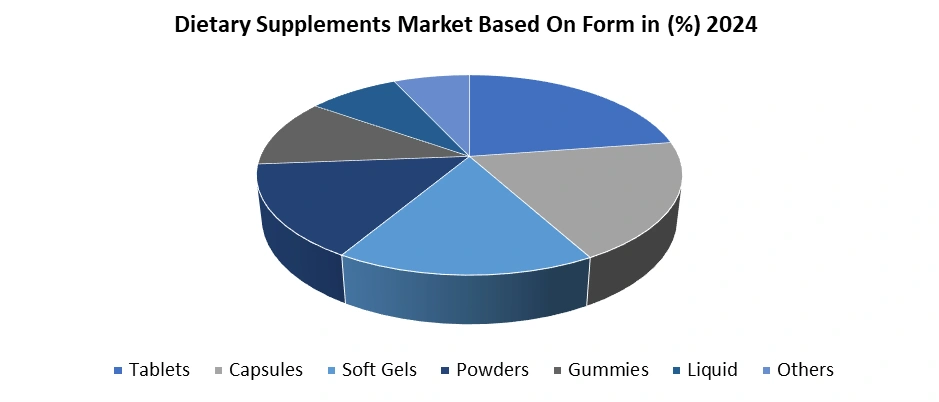

Based On Form, the Dietary Supplements Market segmented into Tablets, Capsules, Soft Gels, Powders, Gummies, Liquid, Others. The tablet segment dominated the Form segment in year 2024. Due to its strong consumer acceptance, cost efficiency, and longer shelf life. Tablets remain the most preferred format for vitamin supplements, mineral supplements, and herbal supplements, as they offer accurate dosing, easy storage, and mass-production benefits for manufacturers. Leading brands shows that over 50–60% of global multivitamins and immunity-boosting products are sold in tablet form because they are affordable and widely available across pharmacies, supermarkets, and online platforms. In countries such as the United States, tablets account for the highest share in multivitamin sales, supported by brands such as Nature Made and Centrum. In India, tablet-based nutraceuticals dominate due to price-sensitive consumers and strong demand for Ayurvedic herbal tablets such as ashwagandha and Giloy. Europe also shows high adoption of tablets for immunity, bone health, and energy supplements. The format’s stability, extended shelf life, and suitability for high-volume production continue to strengthen the dietary supplements market growth in this segment.

Dietary Supplements Market: Regional Analysis

North America dominated the Dietary Supplements Market in 2024. Due to high consumer spending on health, strong awareness of preventive wellness, and the presence of major global supplement manufacturers. The region has one of the world’s highest adoption rates of nutritional supplements, with in 2024 nearly 75% of U.S. adults regularly use vitamins, minerals, herbal supplements, probiotics, and sports nutrition products. This strong consumption base boosts demand across segments such as vitamin supplements, plant-based supplements, and immunity-boosting supplements. Real-time examples highlight this dominance. In the U.S., leading brands such as GNC, Nature Made, Garden of Life, and Optimum Nutrition expanded their product portfolios in 2024 to include clean-label, vegan, and personalized nutrition solutions. The rise of digital health platforms and online supplement sales led by Amazon, Walmart, and iHerb—further accelerated market penetration. Canada also reported high uptake of herbal supplements and omega-3 products due to ageing populations and rising preventive healthcare spending. Strong regulatory clarity under FDA’s DSHEA, high purchasing power, widespread fitness culture, and rapid adoption of sports nutrition products enabled North America to remain the largest contributor to global dietary supplements market growth in 2024.Dietary Supplements Market: Competitive Landscape

The Dietary Supplements Market is highly competitive, shaped by global brands, regional manufacturers, and emerging clean-label innovators. Leading companies such as Abbott, Amway, Bayer, Nestlé Health Science, GNC, Herbalife Nutrition, Nature Made (Pharmavite), Garden of Life, and NOW Foods dominate the market through strong product portfolios in vitamin supplements, herbal supplements, sports nutrition, and probiotics. These players leverage advanced R&D, strategic acquisitions, and broad distribution across retail, e-commerce, and direct selling channels. In 2024, the competitive landscape shifted toward plant-based supplements, vegan formulations, and clean-label nutraceuticals, driven by rising health awareness and demand for natural ingredients. Companies are increasingly launching botanical blends, immunity-boosting products, and personalized nutrition solutions. For example, Nestlé Health Science expanded its plant-based offerings, while GNC and Herbalife strengthened their sports nutrition and protein supplement lines. Regional players in India, China, and Southeast Asia are scaling quickly by focusing on Ayurvedic, herbal, and traditional medicine-based supplements. Meanwhile, digital-first brands are gaining traction through subscription models, influencer marketing, and AI-enabled personalized nutrition. Overall, innovation, transparency, and sustainability remain key differentiators in the evolving global dietary supplements competitive landscape.Dietary Supplements Market: Recent Development

1. In February 2025, Vitaboom and GetHealthy entered a strategic partnership aimed at reshaping the personalized nutrition landscape. The collaboration combines Vitaboom’s strong nutraceutical expertise with GetHealthy’s advanced digital health ecosystem to deliver AI-powered supplement recommendations and wellness plans. By using real-time user data and predictive insights, the partnership seeks to provide highly tailored nutrition solutions that help individuals meet their health goals more effectively. This initiative is expected to redefine personalized wellness standards and support better long-term health outcomes. 2. In October 2024, Vantage Nutrition introduced high-concentration VitaCholine in transparent liquid capsules, delivering 275–550 mg of free choline per dose. The visually appealing format highlights the company’s focus on quality, innovation, and accelerated product development. These capsules will be showcased at Supply Side West in Las Vegas, reinforcing Vantage Nutrition’s leadership in next-generation supplement formulations. 3. In April 2024, Naturacare expanded its global portfolio with four new nutraceutical products. The lineup includes Vital Extend, a bilayer energy-boosting tablet; Bacti Serenity, formulated for stress and gut-brain balance; Electrolytes, an effervescent recovery solution; and Ovo Immune, an immune-support formula with a pipette delivery. These launches emphasize Naturacare’s commitment to innovation, sustainability, and international market growth. 4. In September 2023, Kyowa Hakko, in partnership with pharmaceutical firm Quifaest, launched its postbiotic ingredient IMMUSE in Mexico for the first time. This milestone marks a key step in the global expansion of IMMUSE and strengthens its presence in emerging international markets.Dietary Supplements Market Scope: Inquire before buying

Global Dietary Supplements Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 175.2 Bn. Forecast Period 2025 to 2032 CAGR: 6.37% Market Size in 2032: USD 287.14 Bn. Segments Covered: by Product Vitamin Multivitamin Vitamin A Vitamin B Vitamin C Vitamin D Vitamin K Vitamin E Botanicals Minerals Calcium Potassium Magnesium Iron Zinc Others (Selenium, Chromium, Copper) Proteins & Amino Acids Collagen Others Fibers & Specialty Carbohydrates Omega Fatty Acids Probiotics Prebiotics & Postbiotics Others by Form Tablets Capsules Soft Gels Powders Gummies Liquid Others by Type OTC Prescribed by Application Energy & Weight Management General Health Bone & Joint Health Gastrointestinal Health Immunity Cardiac Health Diabetes Anti-cancer Lungs Detox/Cleanse Others by End User Male Female by Distribution Channel Offline Hypermarkets/Supermarkets Pharmacies Specialty Stores Practitioner Others (Direct to Consumer, MLM) Online Global Dietary Supplements Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Dietary Supplements Key Players

1. Abbott Laboratories - (USA) 2. Amway Corp. - (USA) 3. Archer Daniels Midland Co. - (USA) 4. Carlyle Nutritionals LLC - (USA) 5. Herbalife International of America Inc. - (USA) 6. Natures Sunshine Products Inc. - (USA) 7. Natures Way Products LLC - (USA) 8. NOW Health Group Inc. - (USA) 9. Nu Skin Enterprises Inc. - (USA) 10. NutriGold Inc. - (USA) 11. Orgenetics Inc. - (USA) 12. Pfizer Inc. - (USA) 13. Church & Dwight Co. Inc. - (USA) 14. The Clorox Company - (USA) 15. Arkopharma Laboratories - (France) 16. Bayer AG - (Germany) 17. Glanbia plc - (Ireland) 18. Haleon Plc - (United Kingdom) 19. Reckitt Benckiser Group PLC - (United Kingdom) 20. Sanofi SA - (France) 21. GlaxoSmithKline plc - (United Kingdom) 22. Danisco A/S (DuPont) - (Denmark) 23. Suntory Holdings Ltd. - (Japan) 24. Otsuka Holdings Co. Ltd. - (Japan) 25. Himalaya Global Holdings Ltd. - (India)Frequently Asked Questions:

1. What are the growth drivers for the Dietary Supplements Market? Ans. Increasing awareness and consciousness about health and wellness is expected to the major driver for the market. 2. What is the major restraint for the Dietary Supplements Market growth? Ans. Some dietary supplements lack robust scientific evidence to support their claimed health benefits is expected to be the major restraining factor for the Dietary Supplements Market growth. 3. Which region is expected to lead the global Dietary Supplements Market during the forecast period? Ans. North America is expected to lead the global market during the forecast period. 4. What was the Global Dietary Supplements Market size in 2024? Ans: The Global Dietary Supplements Market size was USD 175.2 Billion in 2024.

1. Dietary Supplements Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Dietary Supplements Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2024 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Dietary Supplements Market: Dynamics 3.1. Dietary Supplements Market Trends 3.2. Dietary Supplements Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Dietary Supplements Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 4.1. Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 4.1.1. Vitamin 4.1.1.1. Multivitamin 4.1.1.2. Vitamin A 4.1.1.3. Vitamin B 4.1.1.4. Vitamin C 4.1.1.5. Vitamin D 4.1.1.6. Vitamin K 4.1.1.7. Vitamin E 4.1.2. Botanicals 4.1.2.1. Minerals 4.1.2.2. Calcium 4.1.2.3. Potassium 4.1.2.4. Magnesium 4.1.2.5. Iron 4.1.2.6. Zinc 4.1.2.7. Others (Selenium, Chromium, Copper) 4.1.3. Proteins & Amino Acids 4.1.3.1. Collagen 4.1.3.2. Others 4.1.4. Fibers & Specialty Carbohydrates 4.1.5. Omega Fatty Acids 4.1.6. Probiotics 4.1.7. Prebiotics & Postbiotics 4.1.8. Others 4.2. Dietary Supplements Market Size and Forecast, By Form (2024-2032) 4.2.1. Tablets 4.2.2. Capsules 4.2.3. Soft Gels 4.2.4. Powders 4.2.5. Gummies 4.2.6. Liquid 4.2.7. Others 4.3. Dietary Supplements Market Size and Forecast, By Type (2024-2032) 4.3.1. OTC 4.3.2. Prescribed 4.4. Dietary Supplements Market Size and Forecast, By Application (2024-2032) 4.4.1.1. Energy & Weight Management 4.4.1.2. General Health 4.4.1.3. Bone & Joint Health 4.4.1.4. Gastrointestinal Health 4.4.1.5. Immunity 4.4.1.6. Cardiac Health 4.4.1.7. Diabetes 4.4.1.8. Anti-cancer 4.4.1.9. Lungs Detox/Cleanse 4.4.1.10. Others 4.5. Dietary Supplements Market Size and Forecast, By End User (2024-2032) 4.5.1. Male 4.5.2. Female 4.6. Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 4.6.1. Offline 4.6.1.1. Hypermarkets/Supermarkets 4.6.1.2. Pharmacies 4.6.1.3. Specialty Stores 4.6.1.4. Practitioner 4.6.1.5. Others (Direct to Consumer, MLM) 4.6.2. Online 4.7. Dietary Supplements Market Size and Forecast, By Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Dietary Supplements Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 5.1. Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 5.2. Dietary Supplements Market Size and Forecast, By Form (2024-2032) 5.3. Dietary Supplements Market Size and Forecast, By Type (2024-2032) 5.4. Dietary Supplements Market Size and Forecast, By Application (2024-2032) 5.5. Dietary Supplements Market Size and Forecast, By End User (2024-2032) 5.6. Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.7. North America Dietary Supplements Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 5.7.1.2. Dietary Supplements Market Size and Forecast, By Form (2024-2032) 5.7.1.3. Dietary Supplements Market Size and Forecast, By Type (2024-2032) 5.7.1.4. Dietary Supplements Market Size and Forecast, By Application (2024- 5.7.1.5. Dietary Supplements Market Size and Forecast, By End User (2024-2032) 5.7.1.6. Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.7.2. Canada 5.7.2.1. Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 5.7.2.2. Dietary Supplements Market Size and Forecast, By Form (2024-2032) 5.7.2.2.1. 5.7.2.3. Dietary Supplements Market Size and Forecast, By Type (2024-2032) 5.7.2.4. Dietary Supplements Market Size and Forecast, By Application (2024-2032) 5.7.2.5. Dietary Supplements Market Size and Forecast, By End User (2024-2032) 5.7.2.6. Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.7.3. Mexico 5.7.3.1. Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 5.7.3.2. Dietary Supplements Market Size and Forecast, By Form (2024-2032) 5.7.3.2.1. 5.7.3.3. Dietary Supplements Market Size and Forecast, By Type (2024-2032) 5.7.3.4. Dietary Supplements Market Size and Forecast, By Application (2024-2032) 5.7.3.5. Dietary Supplements Market Size and Forecast, By End User (2024-2032) 5.7.3.6. Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6. Europe Dietary Supplements Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 6.1. Europe Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.2. Europe Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.3. Europe Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.4. Europe Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.5. Europe Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.6. Europe Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7. Europe Dietary Supplements Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.1.2. United Kingdom Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.1.3. United Kingdom Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.1.4. United Kingdom Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.1.5. United Kingdom Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.1.6. United Kingdom Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.2. France 6.7.2.1. France Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.2.2. France Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.2.3. France Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.2.4. France Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.2.5. France Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.2.6. France Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.3.2. Germany Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.3.3. Germany Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.3.4. Germany Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.3.5. Germany Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.3.6. Germany Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.4.2. Italy Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.4.3. Italy Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.4.4. Italy Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.4.5. Italy Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.4.6. Italy Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.5.2. Spain Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.5.3. Spain Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.5.4. Spain Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.5.5. Spain Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.5.6. Spain Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.6.2. Sweden Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.6.3. Sweden Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.6.4. Sweden Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.6.5. Sweden Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.6.6. Sweden Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.7. Russia 6.7.7.1. Russia Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.7.2. Russia Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.7.3. Russia Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.7.4. Russia Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.7.5. Russia Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.7.6. Russia Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 6.7.8.2. Rest of Europe Dietary Supplements Market Size and Forecast, By Form (2024-2032) 6.7.8.3. Rest of Europe Dietary Supplements Market Size and Forecast, By Type (2024-2032) 6.7.8.4. Rest of Europe Dietary Supplements Market Size and Forecast, By Application (2024-2032) 6.7.8.5. Rest of Europe Dietary Supplements Market Size and Forecast, By End User (2024-2032) 6.7.8.6. Rest of Europe Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7. Asia Pacific Dietary Supplements Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 7.1. Asia Pacific Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.2. Asia Pacific Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.3. Asia Pacific Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.4. Asia Pacific Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.6. Asia Pacific Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7. Asia Pacific Dietary Supplements Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.1.2. China Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.1.3. China Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.1.4. China Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.1.5. China Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.1.6. China Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.2.2. S Korea Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.2.3. S Korea Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.2.4. S Korea Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.2.5. S Korea Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.2.6. S Korea Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.3.2. Japan Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.3.3. Japan Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.3.4. Japan Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.3.5. Japan Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.3.6. Japan Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.4. India 7.7.4.1. India Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.4.2. India Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.4.3. India Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.4.4. India Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.4.5. India Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.4.6. India Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.5.2. Australia Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.5.3. Australia Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.5.4. Australia Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.5.5. Australia Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.5.6. Australia Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.6.2. Indonesia Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.6.3. Indonesia Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.6.4. Indonesia Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.6.5. Indonesia Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.6.6. Indonesia Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.7.2. Malaysia Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.7.3. Malaysia Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.7.4. Malaysia Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.7.5. Malaysia Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.7.6. Malaysia Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.8. Philippines 7.7.8.1. Philippines Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.8.2. Philippines Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.8.3. Philippines Dietary Supplements Market Size and Forecast, By Type Philippines Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.8.4. Philippines Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.8.5. Philippines Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.9. Thailand 7.7.9.1. Thailand Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.9.2. Thailand Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.9.3. Thailand Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.9.4. Thailand Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.9.5. Thailand Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.9.6. Thailand Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.10. Vietnam 7.7.10.1. Vietnam Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.10.2. Vietnam Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.10.3. Vietnam Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.10.4. Vietnam Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.10.5. Vietnam Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.10.6. Vietnam Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.11. Rest of Asia Pacific 7.7.11.1. Rest of Asia Pacific Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 7.7.11.2. Rest of Asia Pacific Dietary Supplements Market Size and Forecast, By Form (2024-2032) 7.7.11.3. Rest of Asia Pacific Dietary Supplements Market Size and Forecast, By Type (2024-2032) 7.7.11.4. Rest of Asia Pacific Dietary Supplements Market Size and Forecast, By Application (2024-2032) 7.7.11.5. Rest of Asia Pacific Dietary Supplements Market Size and Forecast, By End User (2024-2032) 7.7.11.6. Rest of Asia Pacific Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8. Middle East and Africa Dietary Supplements Market Size and Forecast (by Value in USD Billion and Volume in Metric Tons) (2024-2032 8.1. Middle East and Africa Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 8.2. Middle East and Africa Dietary Supplements Market Size and Forecast, By Form (2024-2032) 8.3. Middle East and Africa Dietary Supplements Market Size and Forecast, By Type (2024-2032) 8.4. Middle East and Africa Dietary Supplements Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Dietary Supplements Market Size and Forecast, By End User (2024-2032) 8.6. Middle East and Africa Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.7. Middle East and Africa Dietary Supplements Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 8.7.1.2. South Africa Dietary Supplements Market Size and Forecast, By Form (2024-2032) 8.7.1.3. South Africa Dietary Supplements Market Size and Forecast, By Type (2024-2032) 8.7.1.4. South Africa Dietary Supplements Market Size and Forecast, By Application (2024-2032) 8.7.1.5. South Africa Dietary Supplements Market Size and Forecast, By End User (2024-2032) 8.7.1.6. South Africa Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 8.7.2.2. GCC Dietary Supplements Market Size and Forecast, By Form (2024-2032) 8.7.2.3. GCC Dietary Supplements Market Size and Forecast, By Type (2024-2032) 8.7.2.4. GCC Dietary Supplements Market Size and Forecast, By Application (2024-2032) 8.7.2.5. GCC Dietary Supplements Market Size and Forecast, By End User (2024-2032) 8.7.2.6. GCC Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.3. Egypt 8.7.3.1. Egypt Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 8.7.3.2. Egypt Dietary Supplements Market Size and Forecast, By Form (2024-2032) 8.7.3.3. Egypt Dietary Supplements Market Size and Forecast, By Type (2024-2032) 8.7.3.4. Egypt Dietary Supplements Market Size and Forecast, By Application (2024-2032) 8.7.3.5. Egypt Dietary Supplements Market Size and Forecast, By End User (2024-2032) 8.7.3.6. Egypt Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.4. Nigeria 8.7.4.1. Nigeria Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 8.7.4.2. Nigeria Dietary Supplements Market Size and Forecast, By Form (2024-2032) 8.7.4.3. Nigeria Dietary Supplements Market Size and Forecast, By Type (2024-2032) 8.7.4.4. Nigeria Dietary Supplements Market Size and Forecast, By Application (2024-2032) 8.7.4.5. Nigeria Dietary Supplements Market Size and Forecast, By End User (2024-2032) 8.7.4.6. Nigeria Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.5. Rest of ME&A 8.7.5.1. Rest of ME&A Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 8.7.5.2. Rest of ME&A Dietary Supplements Market Size and Forecast, By Form (2024-2032) 8.7.5.3. Rest of ME&A Dietary Supplements Market Size and Forecast, By Type (2024-2032) 8.7.5.4. Rest of ME&A Dietary Supplements Market Size and Forecast, By Application (2024-2032) 8.7.5.5. Rest of ME&A Dietary Supplements Market Size and Forecast, By End User (2024-2032) 8.7.5.6. Rest of ME&A Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9. South America Dietary Supplements Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 9.1. South America Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 9.2. South America Dietary Supplements Market Size and Forecast, By Form (2024-2032) 9.3. South America Dietary Supplements Market Size and Forecast, By Type (2024-2032) 9.4. South America Dietary Supplements Market Size and Forecast, By Application (2024-2032) 9.5. South America Dietary Supplements Market Size and Forecast, By End User (2024-2032) 9.6. South America Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.7. South America Dietary Supplements Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 9.7.1.2. Brazil Dietary Supplements Market Size and Forecast, By Form (2024-2032) 9.7.1.3. Brazil Dietary Supplements Market Size and Forecast, By Type (2024-2032) 9.7.1.4. Brazil Dietary Supplements Market Size and Forecast, By Application (2024-2032) 9.7.1.5. Brazil Dietary Supplements Market Size and Forecast, By End User (2024-2032) 9.7.1.6. Brazil Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 9.7.2.2. Argentina Dietary Supplements Market Size and Forecast, By Form (2024-2032) 9.7.2.3. Argentina Dietary Supplements Market Size and Forecast, By Type (2024-2032) 9.7.2.4. Argentina Dietary Supplements Market Size and Forecast, By Application (2024-2032) 9.7.2.5. Argentina Dietary Supplements Market Size and Forecast, By End User (2024-2032) 9.7.2.6. Argentina Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.3. Colombia 9.7.3.1. Colombia Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 9.7.3.2. Colombia Dietary Supplements Market Size and Forecast, By Form (2024-2032) 9.7.3.3. Colombia Dietary Supplements Market Size and Forecast, By Type (2024-2032) 9.7.3.4. Colombia Dietary Supplements Market Size and Forecast, By Application (2024-2032) 9.7.3.5. Colombia Dietary Supplements Market Size and Forecast, By End User (2024-2032) 9.7.3.6. Colombia Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.4. Chile 9.7.4.1. Chile Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 9.7.4.2. Chile Dietary Supplements Market Size and Forecast, By Form (2024-2032) 9.7.4.3. Chile Dietary Supplements Market Size and Forecast, By Type (2024-2032) 9.7.4.4. Chile Dietary Supplements Market Size and Forecast, By Application (2024-2032) 9.7.4.5. Chile Dietary Supplements Market Size and Forecast, By End User (2024-2032) 9.7.4.6. Chile Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.5. Rest Of South America 9.7.5.1. Rest Of South America Dietary Supplements Market Size and Forecast, By Ingredients (2024-2032) 9.7.5.2. Rest Of South America Dietary Supplements Market Size and Forecast, By Form (2024-2032) 9.7.5.3. Rest Of South America Dietary Supplements Market Size and Forecast, By Type (2024-2032) 9.7.5.4. Rest Of South America Dietary Supplements Market Size and Forecast, By Application (2024-2032) 9.7.5.5. Rest Of South America Dietary Supplements Market Size and Forecast, By End User (2024-2032) 9.7.5.6. Rest Of South America Dietary Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Abbott Laboratories - (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. Amway Corp. - (USA) 10.3. Archer Daniels Midland Co. - (USA) 10.4. Carlyle Nutritionals LLC - (USA) 10.5. Herbalife International of America Inc. - (USA) 10.6. Natures Sunshine Products Inc. - (USA) 10.7. Natures Way Products LLC - (USA) 10.8. NOW Health Group Inc. - (USA) 10.9. Nu Skin Enterprises Inc. - (USA) 10.10. NutriGold Inc. - (USA) 10.11. Orgenetics Inc. - (USA) 10.12. Pfizer Inc. - (USA) 10.13. Church & Dwight Co. Inc. - (USA) 10.14. The Clorox Company - (USA) 10.15. Arkopharma Laboratories - (France) 10.16. Bayer AG - (Germany) 10.17. Glanbia plc - (Ireland) 10.18. Haleon Plc - (United Kingdom) 10.19. Reckitt Benckiser Group PLC - (United Kingdom) 10.20. Sanofi SA - (France) 10.21. GlaxoSmithKline plc - (United Kingdom) 10.22. Danisco A/S (DuPont) - (Denmark) 10.23. Suntory Holdings Ltd. - (Japan) 10.24. Otsuka Holdings Co. Ltd. - (Japan) 10.25. Himalaya Global Holdings Ltd. - (India) 11. Key Findings 12. Analyst Recommendations 13. Dietary Supplements Market: Research Methodology