The Depth Filters Market is expected to grow from USD 3.61 Billion in 2025 to USD 6.71 Billion by 2032, reflecting a CAGR of 9.22%. This growth is fueled by the rising adoption of depth filtration in biopharmaceutical manufacturing and clarification processes within food & beverage production.Depth Filters Market Overview

Depth filters are made from materials such as cellulose, diatomaceous earth, or polypropylene, featuring a complex pore structure that captures particles throughout the entire filter matrix, providing efficient filtration. The increasing demand for efficient filtration in industries such as biopharmaceuticals, food processing, water treatment, and biotechnology boosts the Depth Filters Market.Key Highlights

• Leading Region: North America holds the largest market share at 36.16%, followed by Europe (31.54%) and Asia Pacific (24.15%), with Asia being the fastest-growing region. • Fastest Growing Region: The Asia Pacific region is growing rapidly, driven by pharmaceutical capacity expansion, increasing biologics production, and rising investments in healthcare manufacturing. • Top Product: Cartridge filters dominate the market due to their versatility and use in high-performance, regulated environments, with an Average Selling Price (ASP) of USD 365. • Key Application: Cell clarification leads the market, reflecting the growing importance of biologics, vaccines, and high-purity manufacturing processes, particularly in the pharmaceutical and biotechnology sectors. • Product Pricing: Filter modules command the highest ASP of USD 625 in 2025, driven by their large filtration area and suitability for commercial-scale pharmaceutical and biotechnology manufacturing.

To Know About The Research Methodology:- Request Free Sample Report

Depth Filters Market Trends

Structural Shift Toward Single-Use & Disposable Depth Filtration Systems Multi-product, flexible manufacturing: Biopharmaceutical manufacturers are increasingly adopting multi-product, flexible manufacturing facilities. This shift enables manufacturers to adjust more easily to changes in demand and production requirements. Cost reduction: The elimination of CIP/SIP (Cleaning in Place/Steam in Place) processes helps reduce validation costs, water consumption, downtime, and contamination risk, all of which are critical in biologics manufacturing. Rapid scale-up and tech transfer: Disposable depth filters enable faster scale-up, technology transfer, and batch changeover, significantly enhancing production flexibility.Biopharmaceutical & Biotechnology Applications boost the Demand Engine Demand Shift: Increasing focus on cell clarification, blood separation, and biologics processing, moving away from traditional industrial filtration. Strategic Importance: Depth filters are yield-critical in biologics workflows; failures lead to batch rejection, yield loss, and regulatory non-compliance.

Depth Filters Market Dynamics

Increasing Filtration Efficiency Requirements Rising demand for high-efficiency filters: Industries are increasingly adopting high-efficiency filters with 2× higher dirt-holding capacity compared to conventional filters. This improvement ensures better removal of contaminants, boosting production efficiency and reducing operational costs across various sectors. Increasing focus on reducing pressure drops: There is a growing emphasis on developing filters that achieve 50% lower pressure drops. This minimizes energy consumption, improves flow rates, and ensures enhanced system efficiency without compromising filtration performance, contributing to cost-effective operations. Operational Efficiency Comparison of Depth Filters Product Types

Metric Cartridge Filters Capsule Filters Filter Modules Throughput Moderate High Very High Yield Stability Medium High Very High Downtime High Low Very Low Depth Filter Market Restraints

Restraints Factors limit growth Impact on the market Insight High-Cost Sensitivity in Food & Beverage and Industrial Applications Food & beverage and industrial users operate under tight margin structures and remain price-driven in procurement decisions Preference for traditional filter sheets and low-cost media While F&B contributes significant volumes, its pricing sensitivity restricts value expansion and delays technology upgrades. Application-Specific Qualification Requirements & Limited Standardization Depth filter performance is highly process-specific, influenced by fluid chemistry, particulate load, and process conditions Longer sales and conversion cyclesHigher pre-sales technical effort and customer onboarding costs The absence of universal filtration standards increases switching barriers but slows new customer acquisition and rapid scaling. Depth Filters Market Segmentation Analysis

Based on Product type, the market is segmented into Cartridge Filters, Capsule Filters, Filter Modules, and Filter Sheets. Cartridge Filters dominated the Depth Filter Market with 34.70% share in 2025, driven by their efficiency and versatility in industrial applications.By Material, the market is categorized into Diatomaceous Earth, Activated Carbon, Cellulose and Perlite. Cellulose held the Depth Filters Market share 41.70% in 2025 due to its cost-effectiveness, high dirt-holding capacity, and suitability for various filtration applications.

Depth Filters Market Regional Analysis

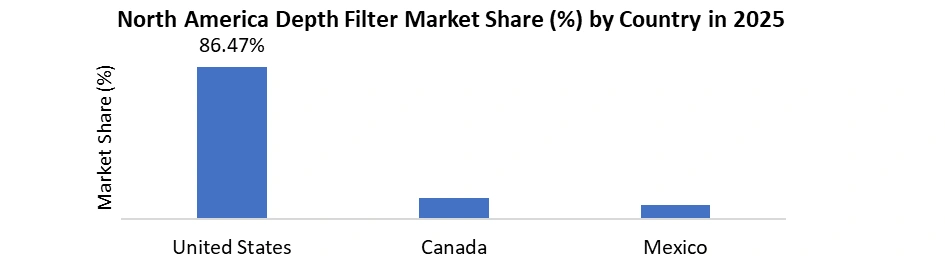

North America dominates the Depth Filters Market in 2024, with a 34.33% share, driven by advanced filtration technologies, economic growth, and regulatory support. Europe follows closely, benefiting from a strong pharmaceutical base and well-established beverage industries. Asia Pacific is the fastest-growing region, driven by rapid industrialization, increasing biologics production, and rising investments in healthcare manufacturing.

Depth Filters Market Competitive Landscape

Parker Hannifin Corporation agreed to acquire Filtration Group Corporation for USD 9.25 billion, enhancing its global filtration portfolio. Donaldson Company, Inc. acquired Isolere Bio in 2023 to expand its Life Sciences segment with advanced biopharmaceutical purification technologies. Ahlstrom acquired ErtelAlsop in 2024, entering the depth filtration segment and strengthening its position in life sciences filtration. Pentair’s 2025 acquisition of Hydra-Stop for USD 290 million bolsters its Commercial & Infrastructure Water portfolio, while its 2024 purchase of G&F Manufacturing for USD 108 million strengthens its Pool segment and expands its presence in the southeastern U.S. market. Recent Developments for Depth Filter Manufacturers

Date Company Recent Development March 24, 2025 Merck KGaA Introduced a new line of virus-retentive depth filters for sterile bioprocessing and high-integrity clarification applications. March, 2025 Sartorius AG Announced a collaboration with Pall Corporation to co-develop next-generation depth filtration media for biologics manufacturing workflows. December, 2024 Amazon Filters Ltd. Launched the SupaPore TMB high-temperature vent filter for pharmaceutical and biotechnology applications requiring robust thermal performance. 2024 Pall Corporation Launched the “Kleenpak Presto” series of high-efficiency depth filters for biologics and vaccine production with enhanced single-use technology. December 11, 2024 FILTROX Conducted a field test with a QSR operator to evaluate frying oil filtration, introducing SuperSorb CarbonPad for enhanced oil life and reduced downtime. September 4, 2024 Eaton Launched advanced filtration solutions at ACHEMA 2024, including SENTINEL MAXPO and BECO CARBON ACF03 activated carbon depth filter sheets. Depth Filters Market Scope: Inquire before buying

Global Depth Filters Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 3.61 Bn. Forecast Period 2026 to 2032 CAGR: 9.22% Market Size in 2032: USD 6.71 Bn. Segments Covered: by Product Type Cartridge Filters Capsule Filters Filter Modules Filter Sheets by Material Diatomaceous Earth Activated Carbon Cellulose Perlite by Application Final Product Processing Cell Clarification Blood Separations Others by End-User Food and Beverage Industry Pharmaceuticals Biotechnology Others Depth Filters Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Depth Filters Key Players

1. Merck KGaA 2. Sartorius AG 3. Pall Corporation. (Danaher) 4. Parker Hannifin Corp 5. 3M 6. Donaldson Company, Inc. 7. MANN HUMMEL 8. Ahlstrom 9. Eaton 10. Saint-Gobain 11. Pentair 12. Filtrox AG 13. Meissner Filtration 14. Porvair Filtration Group 15. Trinity Filtration 16. Filtteck Co., Ltd. 17. Allied Filter Systems Ltd 18. Fileder Filter Systems Ltd. 19. Cobetter 20. Membrane Solutions 21. Amazon Filters Ltd. 22. Graver Technologies 23. Clariance Technique 24. Lenntech 25. Hydac International 26. Microglass, Inc. 27. GE Water & Process Technologies 28. Filtration Group CorporationFrequently Asked Questions:

1. Which region has the largest share in the Global Depth Filters Market? Ans: North America region held the largest Depth Filters Market share in 2025. 2. What is the growth rate of the Global Depth Filters Market? Ans: The Global Market is expected to grow at a CAGR of 8.78 % during the forecast period 2026-2032. 3. What is the scope of the Global Depth Filters Market report? Ans: The Global Depth Filters Market report helps with the PESTEL, Porter's Five Forces, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Depth Filters Market? Ans: The important key players in the Global Depth Filters Market are Merck KGaA, Sartorius AG, Pall Corporation (Danaher), Parker Hannifin Corp,3M, Donaldson Company, Inc. and others. 5. What is the study period of this Depth Filters market? Ans: The Global Depth Filters Market is studied from 2025 to 2032. 6. What are the growth drivers for the Depth Filters Market? Ans: Growth drivers for the Depth Filters market include increasing demand for efficient filtration in industries like pharmaceuticals, food processing, water treatment, and biotechnology, along with advancements in filtration materials and technologies.

1. Depth Filters Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Depth Filters Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. End-User 2.3.5. Total Company Revenue (2025) 2.3.6. Certifications 2.3.7. Global Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Recent Developments 2.7. Market Positioning & Share Analysis 2.7.1. Company Revenue, Depth Filters Revenue, and Market Share (%) 2.7.2. MMR Competitive Positioning 2.8. Strategic Developments & Partnerships 2.8.1. Mergers, acquisitions, and joint ventures 2.8.2. Expansion into emerging markets 2.8.3. Strategic alliances with OEMs or system integrators 2.8.4. Investments in new production facilities 2.8.5. Sustainability initiatives and green product launches 3. Depth Filters Market: Dynamics 3.1. Depth Filters Market Trends 3.2. Depth Filters Market Dynamics 3.2.1. North America 3.2.2. Europe 3.2.3. Asia Pacific 3.2.4. Middle East and Africa 3.2.5. South America 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 4. Technology & Material Insights 4.1. Comparison of media types: diatomaceous earth, activated carbon, cellulose, perlite 4.2. Performance differentiation: flow rate, particle retention, and filtration efficiency 4.3. Material innovations for high-viscosity and high-purity applications 4.4. Longevity, maintenance, and cleaning efficiency of different filter types 4.5. Compatibility with liquid and gas filtration processes 4.6. Emerging technologies: hybrid and multi-layer filter systems 4.7. Thermal, chemical, and mechanical resistance benchmarking 5. Application Analysis 5.1. Depth filters in final product processing: efficiency, yield, and throughput 5.2. Role in cell clarification: adoption in pharma and biotech 5.3. Blood separation applications: operational requirements and trends 5.4. Process optimization: reducing downtime and contamination risk 5.5. Impact on product quality and regulatory compliance 5.6. Integration with upstream and downstream processing systems 6. Regional Market Insights 6.1. Adoption trends by region: North America, Europe, Asia-Pacific, RoW 6.2. Regional supply chain dynamics and key suppliers 6.3. Raw material availability and pricing trends 6.4. Regional regulatory influence on filter adoption 6.5. Growth opportunities in emerging economies 6.6. Infrastructure investments driving regional demand 6.7. Export-import dynamics and logistics challenges 7. Cost, ROI & Operational Efficiency 7.1. Total cost of ownership: initial cost, maintenance, and replacement frequency 7.2. ROI comparison for different filter types and media 7.3. Operational efficiency metrics: throughput, yield, and downtime reduction 7.4. Cost impact of filter lifespan and performance degradation 7.5. Payback period analysis by application and end-user 7.6. Cost-benefit analysis of advanced vs conventional media 7.7. Energy and resource consumption during operation 8. Sustainability & Environmental Impact 8.1. Environmental footprint of different filter media 8.2. Waste generation, disposal, and recycling potential 8.3. Energy efficiency of filtration systems 8.4. Compliance with green manufacturing standards 8.5. Role of single-use vs reusable filters in sustainability 8.6. Circular economy initiatives in the filtration industry 8.7. Impact on water, air, and product contamination control 9. Supply Chain & Procurement Analysis 9.1. Supplier concentration and global sourcing patterns 9.2. Lead time and inventory management benchmarking 9.3. Raw material dependency and risk assessment 9.4. Strategic sourcing of high-purity media (e.g., cellulose, DE) 9.5. Vendor evaluation criteria for quality, reliability, and cost 9.6. Impact of logistics disruptions on production timelines 9.7. Best practices in procurement for pharmaceuticals and F&B 10. Operational Performance & Reliability 10.1. Filter lifecycle performance metrics: MTBF/MTTR 10.2. Consistency in filtration efficiency across batches 10.3. Pressure drop and flow rate maintenance during operations 10.4. Downtime analysis due to filter clogging or replacement 10.5. Reliability under high-viscosity and high-purity processing 10.6. Benchmarking of preventive maintenance schedules 10.7. Correlation of filter type with operational uptime in pharma/F&B 11. Regulatory Compliance & Quality Standards 11.1. Industry standards for F&B (FDA, ISO, HACCP) 11.2. Compliance in pharmaceutical and biopharma sectors (cGMP, USP) 11.3. Filtration validation protocols and documentation requirements 11.4. Impact of regional regulations on material selection 11.5. Quality assurance metrics for incoming filter media 11.6. Audit readiness and inspection preparedness 11.7. Certification trends for advanced filter products 12. End-User Adoption & Behavior Analysis 12.1. Depth filter adoption patterns in pharma, biotech, and F&B 12.2. Factors influencing selection: media type, cost, and performance 12.3. Purchase decision drivers: supplier reputation, technical support 12.4. Shift from traditional to advanced or single-use filters 12.5. Influence of production scale on filter choice 12.6. Technology adoption rates by facility size and geography 12.7. Feedback-driven product innovation trends 13. Aftermarket & Services Analysis 13.1. Revenue contribution from replacement components (cartridges, modules, sheets) 13.2. Preventive maintenance and thermal/flow monitoring services 13.3. Predictive maintenance adoption using sensors and IoT 13.4. Service contract penetration in pharmaceuticals, biotech, and F&B 13.5. Spare part availability and delivery performance 13.6. Training and technical support offerings by manufacturers 13.7. Comparative benchmarking of service quality and reliability 14. Pricing & Market Economics 14.1. Average market prices by filter type 14.2. Regional Price Differentiation and Market Growth 14.3. Material Cost Contribution to Price Formation 14.4. Installation and operational cost benchmarking 14.5. Price Sensitivity Across End-User Industries 14.6. Competitive Pricing and Market Positioning 14.7. Economic Rationale for Transitioning to Advanced Filtration Systems 15. Depth Filters Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 15.1. Depth Filters Market Size and Forecast, by Product Type (2025-2032) 15.1.1. Cartridge Filters 15.1.2. Capsule Filters 15.1.3. Filter Modules 15.1.4. Filter Sheets 15.2. Depth Filters Market Size and Forecast, by Material (2025-2032) 15.2.1. Diatomaceous Earth 15.2.2. Activated Carbon 15.2.3. Cellulose 15.2.4. Perlite 15.3. Depth Filters Market Size and Forecast, by Application (2025-2032) 15.3.1. Final Product Processing 15.3.2. Cell Clarification 15.3.3. Blood Separations 15.3.4. Others 15.4. Depth Filters Market Size and Forecast, by End-Use (2025-2032) 15.4.1. Food and Beverage Industry 15.4.2. Pharmaceuticals 15.4.3. Biotechnology 15.4.4. Others 15.5. Depth Filters Market Size and Forecast, by Region (2025-2032) 15.5.1. North America 15.5.2. Europe 15.5.3. Asia Pacific 15.5.4. Middle East and Africa 15.5.5. South America 16. North America Depth Filters Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 16.1. North America Depth Filters Market Size and Forecast, by Product Type (2025-2032) 16.1.1. Cartridge Filters 16.1.2. Capsule Filters 16.1.3. Filter Modules 16.1.4. Filter Sheets 16.2. North America Depth Filters Market Size and Forecast, by Material (2025-2032) 16.2.1. Diatomaceous Earth 16.2.2. Activated Carbon 16.2.3. Cellulose 16.2.4. Perlite 16.3. North America Depth Filters Market Size and Forecast, by Application (2025-2032) 16.3.1. Final Product Processing 16.3.2. Cell Clarification 16.3.3. Blood Separations 16.3.4. Others 16.4. North America Depth Filters Market Size and Forecast, by End-Use (2025-2032) 16.4.1. Food and Beverage Industry 16.4.2. Pharmaceuticals 16.4.3. Biotechnology 16.4.4. Others 16.5. North America Depth Filters Market Size and Forecast, by Country (2025-2032) 16.5.1. United States 16.5.2. Canada 16.5.3. Mexico 17. Europe Depth Filters Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 17.1. Europe Depth Filters Market Size and Forecast, by Product Type (2025-2032) 17.2. Europe Depth Filters Market Size and Forecast, by Material (2025-2032) 17.3. Europe Depth Filters Market Size and Forecast, by Application (2025-2032) 17.4. Europe Depth Filters Market Size and Forecast, by End-Use (2025-2032) 17.5. Europe Depth Filters Market Size and Forecast, by Country (2025-2032) 17.5.1. United Kingdom 17.5.2. France 17.5.3. Germany 17.5.4. Italy 17.5.5. Spain 17.5.6. Sweden 17.5.7. Austria 17.5.8. Rest of Europe 18. Asia Pacific Depth Filters Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 18.1. Asia Pacific Depth Filters Market Size and Forecast, by Product Type (2025-2032) 18.2. Asia Pacific Depth Filters Market Size and Forecast, by Material (2025-2032) 18.3. Asia Pacific Depth Filters Market Size and Forecast, by Application (2025-2032) 18.4. Asia Pacific Depth Filters Market Size and Forecast, by End-Use (2025-2032) 18.5. Asia Pacific Depth Filters Market Size and Forecast, by Country (2025-2032) 18.5.1. China 18.5.2. S Korea 18.5.3. Japan 18.5.4. India 18.5.5. Australia 18.5.6. Indonesia 18.5.7. Malaysia 18.5.8. Vietnam 18.5.9. Taiwan 18.5.10. Rest of Asia Pacific 19. Middle East and Africa Depth Filters Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 19.1. Middle East and Africa Depth Filters Market Size and Forecast, by Product Type (2025-2032) 19.2. Middle East and Africa Depth Filters Market Size and Forecast, by Material (2025-2032) 19.3. Middle East and Africa Depth Filters Market Size and Forecast, by Application (2025-2032) 19.4. Middle East and Africa Depth Filters Market Size and Forecast, by End-Use (2025-2032) 19.5. Middle East and Africa Depth Filters Market Size and Forecast, by Country (2025-2032) 19.5.1. South Africa 19.5.2. GCC 19.5.3. Egypt 19.5.4. Nigeria 19.5.5. Rest of ME&A 20. South America Depth Filters Market Size and Forecast by Segmentation (by Value USD Mn) (2025-2032) 20.1. South America Depth Filters Market Size and Forecast, by Product Type (2025-2032) 20.2. South America Depth Filters Market Size and Forecast, by Material (2025-2032) 20.3. South America Depth Filters Market Size and Forecast, by Application (2025-2032) 20.4. South America Depth Filters Market Size and Forecast, by End-Use (2025-2032) 20.5. South America Depth Filters Market Size and Forecast, by Country (2025-2032) 20.5.1. Brazil 20.5.2. Argentina 20.5.3. Chile 20.5.4. Colombia 20.5.5. Rest Of South America 21. Company Profile: Key Players 21.1. Merck KGaA 21.1.1. Company Overview 21.1.2. Business Portfolio 21.1.3. Financial Overview 21.1.4. SWOT Analysis 21.1.5. Strategic Analysis 21.1.6. Recent Developments 21.2. Sartorius AG 21.3. Pall Corporation (Danaher) 21.4. Parker Hannifin Corp 21.5. 3M 21.6. Donaldson Company, Inc. 21.7. MANN+HUMMEL 21.8. Ahlstrom 21.9. Eaton 21.10. Saint-Gobain 21.11. Pentair 21.12. Filtrox AG 21.13. Meissner Filtration 21.14. Porvair Filtration Group 21.15. Trinity Filtration 21.16. Filtteck Co., Ltd. 21.17. Allied Filter Systems Ltd 21.18. Fileder Filter Systems Ltd. 21.19. Cobetter 21.20. Membrane Solutions 21.21. Amazon Filters Ltd. 21.22. Graver Technologies 21.23. Clariance Technique 21.24. Lenntech 21.25. Hydac International 21.26. Microglass, Inc. 21.27. GE Water & Process Technologies 21.28. Filtration Group Corporation 22. Key Findings 23. Industry Recommendations 24. Depth Filters Market: Research Methodology