The Cosmetics Market size was valued at USD 492.18 Billion in 2025 and the total Cosmetics revenue is expected to grow at a CAGR of 5.25% from 2025 to 2032, reaching nearly USD 704.17 Billion by 2032. The global Cosmetics Market continues to evolve rapidly in 2025, driven by rising beauty consciousness, expanding premium skincare demand, clean beauty movements, and digital transformation across the beauty and personal care industry. Several countries remain at the forefront of global innovation. The United States leads with advanced beauty tech, AI-powered personalization, and strong consumer adoption of skincare and dermatology-backed products. France, home to many of the world’s top luxury beauty houses, remains a leader in fragrance innovation and premium formulations. South Korea continues to shape global trends through K-beauty, delivering cutting-edge skincare, biotech ingredients, and tech-enabled beauty devices. Japan is a pioneer in high-efficacy, science-driven skincare, while China drives massive eCommerce-led beauty consumption and influencer-based product trends. In Germany and the U.K., strong cosmetic regulations, innovation hubs, and clean beauty brands support growing demand for sustainable and vegan cosmetics. Emerging markets like India and Brazil are expanding rapidly with herbal beauty products, inclusive cosmetics, and men’s grooming innovations. Ongoing advances in AI beauty tech, virtual try-ons, sustainable packaging, dermo cosmetics, and biotechnology continue to strengthen the global Cosmetics Market, shaping long-term industry growth.To know about the Research Methodology :- Request Free Sample Report

Cosmetics Market Dynamics:

Increasing Consumer Awareness & Demand to drive the Cosmetics Market growth The global cosmetics market is expanding rapidly due to rising consumer focus on wellness, appearance, and high-performance beauty solutions. Growing demand for clean beauty products, natural cosmetics, organic skincare, vegan beauty brands, and dermo cosmetic products is reshaping global beauty consumption. Increasing interest in chemical-free cosmetics, plant-based beauty ingredients, and cruelty-free beauty products continues to strengthen consumer trust. Biotech-driven advancements, including microbiome-friendly skincare, peptide-based cosmetics, stem-cell beauty actives, and AI-powered personalized skincare, are accelerating innovation and product differentiation. Digital expansion through beauty e-commerce, social commerce, and influencer-driven marketing is boosting visibility and accessibility across markets. Sustainability trends such as eco-friendly packaging, green beauty, transparent formulations, and ethical cosmetics are pushing brands toward cleaner and safer product development. Rising disposable incomes, premium skincare adoption, and the fast-growing men’s grooming market further accelerate overall industry growth, supported by the fusion of beauty, wellness, and longevity science. Major countries driving cosmetics revenue in 2024 include the United States, China, Japan, Brazil, India, South Korea, Germany, the United Kingdom, France, and Indonesia.Raw Material & Regulatory Challenges to limits the Cosmetics Market growth Strict regulatory requirements and growing raw-material limitations hamper the Cosmetics Market growth. In the United States, compliance with FDA cosmetic regulations, the FD&C Act, and Fair Packaging and Labeling Act increases cost and complexity, as brands must avoid adulteration, misbranding, and banned ingredients such as mercury compounds, methylene chloride, and CFC propellants. Mandatory safety testing, correct labeling, and adherence to Good Manufacturing Practices (GMP) further slow product launches. In Europe, the stringent EU Cosmetic Regulation, restrictions on CMR substances, mandatory safety assessments, Product Information Files, and ISO-based GMP requirements create significant documentation and compliance burdens, especially for brands using advanced actives, preservatives, colorants, and nanomaterials. Raw-material challenges are becoming a major restraint globally. Prices of natural ingredients, botanical extracts, essential oils, and organic compounds are rising due to climate pressures, crop fluctuations, and supply-chain disruptions. Limited availability of vegan, clean beauty, and cruelty-free ingredients increases production costs and affects product consistency. These shortages, along with sustainability demands, make sourcing high-quality raw materials difficult and hinder market growth. Cosmetics Market – Key Regulatory Requirements

Personalization & AI-driven Solutions to create lucrative growth opportunities to the Cosmetics Market AI-driven personalization is emerging as one of the most transformative opportunities in the global cosmetics market. The rising demand for personalized skincare, AI beauty solutions, virtual try-ons, and smart dermatology tools is reshaping consumer expectations and accelerating product adoption worldwide. Innovation hubs such as Australia, the UK, Estonia, Israel, and South Korea are demonstrating the strong commercial potential of AI in beauty. In Australia, Helfie uses advanced AI skin analysis through phone-camera scans, achieving up to 91% accuracy in detecting skin issues. In the UK, Skin Analytics’ CE-marked AI dermatology platform supports clinically validated remote skin assessments. Estonia’s Haut.AI showcases real-time diagnostics with “SkinGPT”-style models that read skin conditions instantly. South Korea’s AmorePacific operates an AI beauty lab that analyzes skin tone and creates custom foundation and lipstick shades from over 200 color combinations. Global beauty leaders such as L’Oréal are expanding this trend through AI + AR virtual try-on technology, personalized product recommendations, and customized skincare routines via its “Beauty Genius” platform. These advancements are driving a new era of precision beauty, increasing consumer engagement, boosting conversion rates, and opening lucrative long-term opportunities for the cosmetics market. Advanced Cosmetics Market Composition

Region / Authority Key Regulations Main Requirements United States (FDA) FD&C Act, FPLA, MoCRA Product safety, correct labeling, banned ingredient compliance, no adulteration/misbranding, voluntary registration (VCRP replaced by MoCRA reporting). European Union (EC 1223/2009) EU Cosmetic Regulation Product Information File (PIF), safety assessment, GMP (ISO 22716), CMR restrictions, nanomaterial disclosure, responsible person requirement. ASEAN / Singapore (HSA) ASEAN Cosmetic Directive (ACD) Cosmetic product notification, banned/restricted ingredient list, safety claims verification, heavy penalties for non-compliance. Japan (MHLW) Pharmaceutical and Medical Device Act Ingredient approval, quasi-drug classification, strict safety testing and labeling rules. China (NMPA) Cosmetic Supervision & Administration Regulation (CSAR) Mandatory pre-market registration for special cosmetics, ingredient safety data, animal testing exemptions for compliant imports. Cosmeceuticals, a blend of cosmetics and pharmaceuticals, are designed to improve skin health and enhance physical appearance. These products contain powerful antioxidants and active ingredients that deliver targeted skincare benefits. Natural cosmetics, an important segment of the global cosmetics market, use minimally processed plant-based and mineral-based raw materials sourced from renewable origins, ensuring low environmental impact. Advanced cosmetics focus on skin science, using bioengineered and innovative ingredients to create fast-acting beauty solutions, including beauty supplements and natural formulations. Beauty devices are also gaining traction, offering at-home aesthetic treatments for skin and hair, with hair-removal devices holding the largest share globally. Anti-ageing cosmetics remain a key growth area, featuring vitamin-rich, antioxidant-packed formulations that boost hydration, radiance, and slow skin degeneration.

Cosmetics Market: Segment Analysis

Based On Product, Cosmetics Market is segmented into Skincare, Color Cosmetics, and Perfumes/Deodorants/Body Mists. The Skin care product dominated the product segment of the Cosmetics Market in year 2025. Due to the rising global demand for advanced skincare products, clean beauty, and dermatologist-recommended formulations. Consumers increasingly prioritized skin health, driving strong adoption of moisturizers, serums, sunscreens, cleansers, anti-aging creams, and acne-care solutions. Growing concerns about pollution damage, premature aging, hyperpigmentation, and sensitive skin further pushed the popularity of scientifically backed skincare solutions. The rise of AI-powered skincare, personalized beauty, biotech ingredients, and microbiome-friendly formulations strengthened consumer confidence and spending. E-commerce, beauty influencers, and male grooming trends also expanded the demand for premium and daily-use skincare. With the global shift toward natural skincare, organic cosmetic products, and sustainable beauty brands, the skincare category maintained its dominant share, making it the fastest-growing and most influential segment of the global cosmetics market in 2025.

Cosmetics Market: Regional Analysis

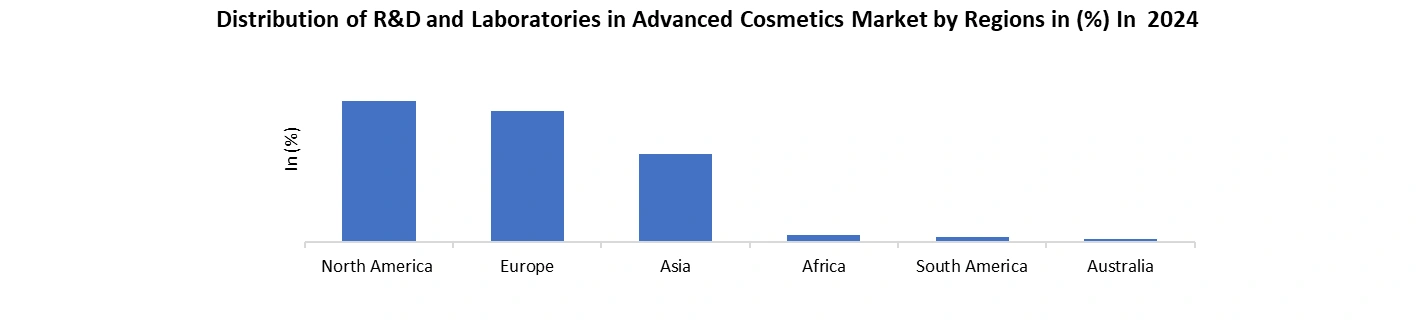

North America Dominated the Cosmetics Market in year 2025. Due to strong consumer spending, rapid beauty-tech adoption, and continuous product innovation across the beauty and personal care market. The United States, the region’s largest market, saw high demand for premium skincare, clean beauty, and dermatology-backed cosmetics, driven by younger consumers and a surge in social media–influenced purchasing. Brands like L’Oréal, Estée Lauder, and Fenty Beauty launched AI-powered shade-matching tools, personalized skincare analysers, and sustainable packaging to attract tech-savvy buyers. Government support for safe cosmetics, including the Modernization of Cosmetics Regulation Act (MoCRA) in the U.S., strengthened product safety standards and encouraged innovation in non-toxic and cruelty-free cosmetics, boosting consumer confidence. In Canada, rapid growth of natural and vegan beauty brands, supported by Health Canada’s strict regulatory framework, accelerated the adoption of clean-label cosmetics. Rising investments in biotech ingredients, personalization apps, and inclusive beauty lines further enhanced regional leadership. New launches such as AI-driven skin diagnostic devices, microbiome-friendly skincare, and refillable makeup systems positioned North America as the innovation hub of the global Cosmetics Market. Distribution of R&D and Laboratories in Advanced Cosmetics Market by Regions

Cosmetics Market: Competitive Analysis

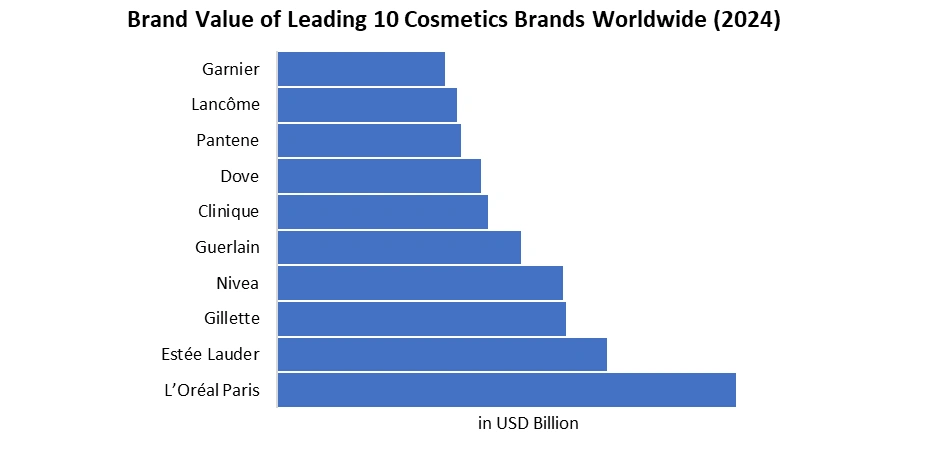

Global beauty leaders are rapidly intensifying competition in the cosmetics market by investing in beauty tech innovation, AI-powered personalization, and sustainable cosmetic technologies. L’Oréal is at the forefront with its advanced Longevity AI Cloud and “Wheel of Longevity,” tools designed to decode aging markers and create personalized skincare solutions. The company’s new Cell BioPrint device measures biological-age biomarkers, supporting ultra-precise anti-aging treatments. Its partnership with a leading AI chipmaker is accelerating generative AI, 3D product rendering, and scalable digital beauty content. L’Oréal also unveiled HAPTA, an AI-driven motion-stabilizing makeup applicator, and showcased vertical-farming biotechnology for clean, sustainable ingredients. AmorePacific strengthened the global beauty market with an award-winning generative AI beauty assistant that analyzes user images and voices to recommend customized makeup. Similarly, Shiseido introduced a cutting-edge “Skin Visualizer,” a non-invasive AI tool that evaluates real-time skin health and radiance. Perfect Corp continues to elevate the beauty and personal care industry with advanced AR try-ons, high-definition skin mapping, and intelligent interfaces for deeper beauty personalization. Together, these AI advancements, virtual try-on technologies, and sustainable biotech ingredients are reshaping the cosmetics industry and driving innovation-led market growth.

Cosmetics Market: Recent Development

In January 2024, the L'Oréal Group, through its venture capital arm BOLD (Business Opportunities for L'Oréal Development), announced a strategic investment in Timeline, a leading consumer health company focused on longevity, anti-aging solutions, and advanced skincare technologies. Timeline’s innovative platform uses Mitopure, a proprietary longevity ingredient, across premium topical skincare products and nutritional supplements. This investment aims to accelerate Timeline’s global expansion in the beauty, wellness, and health-tech markets, reinforcing L’Oréal’s commitment to science-driven skincare, skin longevity, and next-generation beauty innovations. In December 2023, Estée Lauder strengthened its presence in the premium cosmetics market by forming a collaboration with the Stanford Center. The company committed to a three-year funding partnership to support the Center’s newly launched Program on Aesthetics & Culture, focusing on pioneering research in longevity, vitality, consumer behavior, and beauty perception. The initiative includes funding for ‘New Map of Life’ post-doctoral fellowships, supporting global research on healthy aging, skincare science, and cultural shifts in beauty standards. This move enhances Estée Lauder’s leadership in innovation-driven beauty research, anti-aging skincare, and consumer-focused beauty trends.Global Cosmetics Market Scope: Inquire before buying

Global Cosmetics Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 492.18 Bn. Forecast Period 2026 to 2032 CAGR: 5.25% Market Size in 2032: USD 704.17 Bn. Segments Covered: by Product Skincare Face Care Moisturizers & Creams Serums & Essence Face Wash & Cleansers Face Mask Face Oil Under-eye Creams Others Body Care Lotions & Creams Body Oil Hand Creams Foot Creams Others Bath Products Shower Gel Bath Soap Others Intimate Care Intimate Washes Wipes Whitening Products Others Others Color Cosmetics Eye Products Eye Shadow Eye Liner Kohl Pencil Others Facial Products Primer Foundation Concealer Face Powder Others Lip Products Lipstick Lip Glosses Lip Liners Lip Mask Others Others Perfumes/Deodorants/Body Mists by End User Men Women by Distribution Channel Business-to-Business (B2B) Business-to-Consumer (B2C) Online Retail Stores Hypermarket/Supermarket Brand Stores Multi-brand Stores Departmental Stores Other Retail Stores Global Cosmetics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cosmetics Key Players

1. Proctor and Gamble Company 2. Revlon, Inc 3. The Estee Lauder Company Inc 4. Amway Corp 5. L’Oréal International 6. Proctor and Gamble Company 7. Bayer AG 8. Henkel AG 9. Clarins 10. Beiersdorf AG 11. Kiko Milano 12. kao corporation 13. Shiseido Company Limited 14. Nykaa E-Offline Pvt. Ltd 15. Sugar Cosmetics 16. Chicmax 17. Proya Cosmetics 18. Shenzhen Beauty Star Company 19. C'Bon Cosmetics 20. Paramount Cosmetics 21. Huda Beauty 22. The Foschini Group 23. Gulf Pharmaceutical Industries 24. Givaudan 25. Galderma Group 26. ULTA Beauty 27. Puig BrfandsFrequently Asked Questions:

1. Which region has the largest share in Global Cosmetics Market? Ans: North America region holds the highest share in 2025. 2. What is the growth rate of Global Cosmetics Market? Ans: The Global market is growing at a CAGR of 5.25% during forecasting period 2026-2032. 3. What segments are covered in Global Cosmetics market? Ans: Cosmetics Market is segmented into Product, End User, Distribution channel and region. 4. What was the Global Cosmetics Market size in 2025? Ans: The Global Cosmetics Market size was USD 492.18 Billion in 2025.

1. Cosmetics Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Cosmetics Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2025) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Cosmetics Market: Dynamics 3.1. Cosmetics Market Trends 3.2. Cosmetics Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Cosmetics Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Cosmetics Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 4.1. Cosmetics Market Size and Forecast, By Product (2025-2032) 4.1.1. Skincare 4.1.1.1. Face Care 4.1.1.2. Moisturizers & Creams 4.1.1.3. Serums & Essence 4.1.1.4. Face Wash & Cleansers 4.1.1.5. Face Mask 4.1.1.6. Face Oil 4.1.1.7. Under-eye Creams 4.1.1.8. Others 4.1.2. Body Care 4.1.2.1. Lotions & Creams 4.1.2.2. Body Oil 4.1.2.3. Hand Creams 4.1.2.4. Foot Creams 4.1.2.5. Others 4.1.3. Bath Products 4.1.3.1. Shower Gel 4.1.3.2. Bath Soap 4.1.3.3. Others 4.1.4. Intimate Care 4.1.4.1. Intimate Washes 4.1.4.2. Wipes 4.1.4.3. Whitening Products 4.1.4.4. Others 4.1.5. Others 4.1.6. Color Cosmetics 4.1.6.1. Eye Products 4.1.6.2. Eye Shadow 4.1.6.3. Eye Liner 4.1.6.4. Kohl Pencil 4.1.6.5. Others 4.1.7. Facial Products 4.1.7.1. Primer 4.1.7.2. Foundation 4.1.7.3. Concealer 4.1.7.4. Face Powder 4.1.7.5. Others 4.1.8. Lip Products 4.1.8.1. Lipstick 4.1.8.2. Lip Glosses 4.1.8.3. Lip Liners 4.1.8.4. Lip Mask 4.1.8.5. Others 4.1.9. Others 4.1.10. Perfumes/Deodorants/Body Mists 4.2. Cosmetics Market Size and Forecast, By End-user (2025-2032) 4.2.1. Men 4.2.2. Women 4.3. Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 4.3.1. Business-to-Business (B2B) 4.3.2. Business-to-Consumer (B2C) 4.3.2.1. Online Retail Stores 4.3.2.2. Hypermarket/Supermarket 4.3.2.3. Brand Stores 4.3.2.4. Multi-brand Stores 4.3.2.5. Departmental Stores 4.3.2.6. Other Retail Stores 4.4. Cosmetics Market Size and Forecast, By Region (2025-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Cosmetics Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 5.1. North America Cosmetics Market Size and Forecast, By Product (2025-2032) 5.2. North America Cosmetics Market Size and Forecast, By End-user (2025-2032) 5.3. North America Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 5.4. North America Cosmetics Market Size and Forecast, by Country (2025-2032) 5.4.1. United States 5.4.1.1. United States Cosmetics Market Size and Forecast, By Product (2025-2032) 5.4.1.2. United States Cosmetics Market Size and Forecast, By End-user (2025-2032) 5.4.1.3. United States Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 5.4.2. Canada 5.4.2.1. Canada Cosmetics Market Size and Forecast, By Product (2025-2032) 5.4.2.2. Canada Cosmetics Market Size and Forecast, By End-user (2025-2032) 5.4.2.3. Canada Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 5.4.3. Mexico 5.4.3.1. Mexico Cosmetics Market Size and Forecast, By Product (2025-2032) 5.4.3.2. Mexico Cosmetics Market Size and Forecast, By End-user (2025-2032) 5.4.3.3. Mexico Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 6. Europe Cosmetics Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 6.1. Europe Cosmetics Market Size and Forecast, By Product (2025-2032) 6.2. Europe Cosmetics Market Size and Forecast, By End-user (2025-2032) 6.3. Europe Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 6.4. Europe Cosmetics Market Size and Forecast, By Country (2025-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Cosmetics Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 7.1. Asia Pacific Cosmetics Market Size and Forecast, By Product (2025-2032) 7.2. Asia Pacific Cosmetics Market Size and Forecast, By End-user (2025-2032) 7.3. Asia Pacific Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 7.4. Asia Pacific Cosmetics Market Size and Forecast, by Country (2025-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Cosmetics Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 8.1. Middle East and Africa Cosmetics Market Size and Forecast, By Product (2025-2032) 8.2. Middle East and Africa Cosmetics Market Size and Forecast, By End-user (2025-2032) 8.3. Middle East and Africa Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 8.4. Middle East and Africa Cosmetics Market Size and Forecast, By Country (2025-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America Cosmetics Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2025-2032) 9.1. South America Cosmetics Market Size and Forecast, By Product (2025-2032) 9.2. South America Cosmetics Market Size and Forecast, By End-user (2025-2032) 9.3. South America Cosmetics Market Size and Forecast, By Distribution Channel (2025-2032) 9.4. South America Cosmetics Market Size and Forecast, By Country (2025-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. Proctor and Gamble Company 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Revlon, Inc 10.3. The Estee Lauder Company Inc 10.4. Amway Corp 10.5. L’Oréal International 10.6. Proctor and Gamble Company 10.7. Bayer AG 10.8. Henkel AG 10.9. Clarins 10.10. Beiersdorf AG 10.11. Kiko Milano 10.12. kao corporation 10.13. Shiseido Company Limited 10.14. Nykaa E-Offline Pvt. Ltd 10.15. Sugar Cosmetics 10.16. Chicmax 10.17. Proya Cosmetics 10.18. Shenzhen Beauty Star Company 10.19. C'Bon Cosmetics 10.20. Paramount Cosmetics 10.21. Huda Beauty 10.22. The Foschini Group 10.23. Gulf Pharmaceutical Industries 10.24. Givaudan 10.25. Galderma Group 10.26. ULTA Beauty 10.27. Puig Brfands 11. Key Findings 12. Analyst Recommendations 13. Cosmetics Market – Research Methodology