Global Copaiba Essential Oil Market size was valued at USD 2.56 Bn. in 2024, and the total Copaiba Essential Oil Market revenue is expected to grow by 5.4 % from 2025 to 2032, reaching nearly USD 3.9 Bn by 2032.Copaiba Essential Oil Market Overview:

Copaiba oil is derived from the copaiba tree, of which more than 70 species have been identified, primarily in South and Central America. These trees naturally produce an oil-resin, which is obtained by drilling a small hole into the trunk. The rising global demand for natural, plant-based wellness and personal care solutions, drives Copaiba Essential Oil Market growth. Extracted from the resin of Copaifera trees native to South America especially Brazil, Colombia, and Peru copaiba oil is obtained through steam distillation or direct tapping. Rich in bioactive compounds such as β-caryophyllene, it is renowned for its anti-inflammatory, antimicrobial, and analgesic properties, making it a versatile ingredient across industries.To know about the Research Methodology :- Request Free Sample Report The growing consumer shift toward herbal and organic alternatives over synthetic chemicals, particularly in skincare, cosmetics, and holistic healthcare drives the Copaiba Essential Oil Market. The oil’s popularity in aromatherapy, where it is valued for its calming and stress-relieving effects, continues to rise. In the cosmetics sector, copaiba oil is incorporated into moisturizers, anti-acne creams, serums, and hair care products for its soothing, moisturizing, and skin-repairing benefits. The pharmaceutical sector leverages its properties for topical pain relief, inflammation reduction, and wound healing. Beyond mainstream uses, copaiba oil finds applications in niche products such as natural dental care (mouthwashes and toothpastes) and herbal ointments. The growing health and wellness movement, coupled with the increasing focus on sustainable sourcing, is creating new opportunities for producers and brands.

Copaiba Essential Oil Market Dynamics:

Health Benefits Awareness to drive the Copaiba Essential Oil Market The increasing awareness of natural remedies and their scientifically backed health benefits is a strong driver for the Copaiba Essential Oil Market. Copaiba oil, extracted from the resin of Copaifera trees native to South America, is valued for its potent anti-inflammatory, antimicrobial, analgesic, and antioxidant properties. These benefits make it a popular choice in aromatherapy, alternative medicine, and natural skincare. Major wellness brands such as doTERRA and Young Living actively market Copaiba essential oil as a natural remedy for anxiety, muscle pain, skin irritation, and overall immune support. Over 60% of essential oil buyers first learn about new products through social media wellness influencers, indicating the critical role of digital platforms in driving awareness. Consumers prefer products with clean-label claims those free from synthetic chemicals and with transparent sourcing which directly supports Copaiba oil’s appeal. The increasing prevalence of lifestyle-related stress and skin sensitivity issues has led health-conscious individuals to seek plant-based alternatives over synthetic drugs. The rise of online wellness education and growing trust in traditional herbal remedies are expected to sustain long-term demand for Copaiba essential oil across global wellness and personal care sectors. Price Fluctuations limits the Copaiba Essential Oil Market The production of Copaiba oil is heavily dependent on Copaifera trees found mainly in the Amazon rainforest, making its supply vulnerable to environmental, seasonal, and regulatory factors. Unpredictable weather events such as prolonged droughts or flooding significantly reduce resin yields, while stricter deforestation control measures increase operational costs for suppliers. The export volumes to major markets such as North America have dropped by over 10%, highlighting the supply chain’s fragility. Ethical sourcing certifications, while essential for sustainability, add compliance costs, which can further push prices upward. For small and mid-sized brands in skincare, wellness, and aromatherapy, even a 15–20% increase in raw material costs can erode profit margins, forcing retail price hikes or reformulation. These fluctuations create a challenge for maintaining steady consumer demand, particularly in price-sensitive markets, and may discourage new entrants from investing in Copaiba-based product lines. Expansion in Organic Skincare and Cosmetics creates a growth opportunity to the Copaiba Essential Oil Market Increasing consumer demand for natural, chemical-free, and sustainably sourced beauty products has pushed cosmetic manufacturers to integrate botanical extracts with proven skin benefits, boosts Copaiba Essential Oil Market growth. Copaiba oil, known for its anti-inflammatory, antimicrobial, and skin-repairing properties, is increasingly used in facial serums, acne treatments, and anti-aging creams targeting sensitive and problem-prone skin. According to beauty industry trends, 45% of skincare consumers globally now prefer natural or organic formulations, with this preference particularly strong among millennials and Gen Z. In Europe, sales of organic beauty products have grown by around 12% annually in recent years, driven by stricter regulations and higher consumer trust in certified products. Leading clean beauty brands are incorporating Copaiba oil as a hero ingredient, often emphasizing its Amazonian origin and sustainable sourcing from Brazilian cooperatives. This not only supports biodiversity but also enhances brand image among eco-conscious buyers. With e-commerce accelerating access to niche beauty products worldwide, Copaiba oil producers and skincare formulators have a clear path to target premium, health-focused consumer segments while commanding higher profit margins.Copaiba Essential Oil Market Segment Analysis:

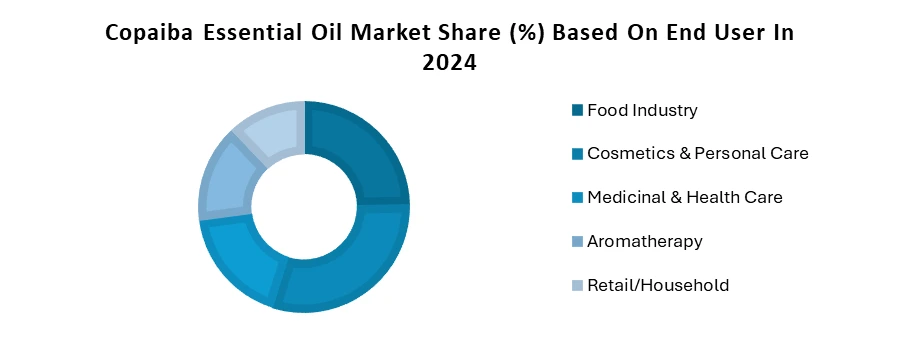

Based Product Type, Copaiba Essential Oil Market is segmented into Pure Copaiba Oil, Copaiba Blends and Other. The Pure Copaiba Oil segment dominated the Product Type, segment in 2024. Rising consumer preference for natural, unadulterated products with proven therapeutic benefits. Pure copaiba oil, extracted directly from Copaifera trees, is rich in beta-caryophyllene, offering strong anti-inflammatory, analgesic, and antimicrobial properties. This makes it highly valued in aromatherapy, skincare, and pharmaceutical formulations. The growing trend toward organic and clean-label products has boosted its adoption in premium cosmetics and personal care lines. Additionally, the wellness industry increasingly promotes pure copaiba oil for stress relief, joint health, and holistic healing, enhancing its market penetration. Compared to blends, pure copaiba commands higher trust among health-conscious consumers due to its potency and authenticity. Limited global supply, primarily sourced from the Amazon, also elevates its exclusivity, enabling higher pricing and market share dominance over blended and other derivative forms.Based End Users, the Copaiba Essential Oil Market is segmented into Food Industry, Cosmetics & Personal Care, Medicinal & Health Care, Aromatherapy, and Retail/Household. The Cosmetics & Personal Care segment dominated the End user segment in 2024. The leadership is attributed to the oil’s exceptional anti-inflammatory, antibacterial, and skin-regenerative properties, which make it a preferred ingredient in premium skincare, anti-aging creams, serums, and hair care products. The global shift toward natural and plant-based formulations has accelerated its adoption among cosmetic manufacturers aiming to meet clean beauty standards. Pure copaiba oil’s rich beta-caryophyllene content helps reduce redness, soothe irritation, and promote skin healing, driving its demand in facial care and therapeutic products. Rising consumer spending on personal grooming and wellness, particularly in markets such as North America, Europe, and Asia-Pacific, has strengthened this segment’s dominance.

Copaiba Essential Oil Market: Regional Analysis

South America held the largest Copaiba Essential Oil Market share in 2024. The presence of both natural abundance and industrial capacity. The Copaiba tree is native to the Amazon region, making South America the prime source of raw material. Extensive harvesting, combined with a well-established processing industry, enables the region to produce over 75% of the global supply. This large-scale production ensures lower costs, consistent quality, and the ability to meet both domestic and international demand, securing its leading Copaiba Essential Oil Market share. In North America, demand growth of 7% is driven by shifting consumer preferences toward plant-based alternatives in medicine, cosmetics, and food products. Heightened awareness of natural remedies, coupled with the clean-label trend, is encouraging consumers to replace synthetic ingredients with botanical options like Copaiba Essential Oil. Its anti-inflammatory, antimicrobial, and antioxidant properties make it popular in skincare, oral care, and wellness formulations. Targeted medical applications for kidney and immunity-related conditions have contributed to a 4% rise in sales. Growing research support, consumer trust in herbal therapies, and integration into complementary medicine have made Copaiba Essential Oil a favored ingredient, accelerating market penetration across healthcare and personal care sectors. Competitive environment of Copaiba Essential Oil Market Competitive environment for Copaiba Essential Oil is fragmented, dynamic and incentivized into are large multinational companies and small regional companies. These companies include doTERRA International, Young Living Essential Oils, Berje, Elixens America, and Bontoux that dominate the sector with brand recognition, many product lines and distribution networks. Aromatics International and Barefut sell to niche consumer bases, the latter specializing in supporting consumers with a focus on purity and therapeutic uses. The Copaiba Essential Oil market is defined by intense product differentiation, and firms are competing on extraction technology, transparency of sourcing, and organic certifications. Traditional consumption of Copaiba Essential Oil occurs in North America and Europe safety natives of copaiba resin who are based in Latin America hold strategic position in the supply chain. Asia-Pacific appears to be developing a strong consumption market as there is demand for natural ingredients in beauty and wellness. The report verified that major players in the Copaiba Essential Oil market are investing in sustainability through supply chain, pharmaceutical grade R&D and e-commerce channels as roadmap to improve their competitiveness. Though, price sensitivity, raw-material volatility, and regulatory scrutiny are important factors that form the competitive landscape. Recent Key developments in the Copaiba Essential Oil market • In Jul 7, 2022. doTERRA, a global leader in essential oils, has expanded into India to strengthen its presence in South Asia. With many oils sourced from India, Asia, and beyond, the new operations align with its global growth strategy. It highlighted improved regional access to products, supporting doTERRA’s mission to share wellness benefits worldwide. Led by industry veteran Manoj Shirodkar, the India team will serve customers and Wellness Advocates, introducing premium-quality essential oils to a market of 1.4 billion people. Key trends in the Copaiba Essential Oil market • Increasing Demand for Natural Wellness Solutions Consumers increasingly prefer natural remedies over synthetic alternatives, driving Copaiba essential oil demand. Its anti-inflammatory, analgesic, and skin-healing properties boost adoption in aromatherapy, cosmetics, and personal care. The trend aligns with growing awareness of holistic health and sustainable self-care products in developed and emerging markets alike. • Expanding Applications Beyond Personal Care While traditionally used in skincare and aromatherapy, Copaiba essential oil is gaining traction in food, beverage, and pharmaceutical industries. Its natural flavor-enhancing, antimicrobial, and preservative qualities open new market avenues. This diversification reduces reliance on cosmetic demand and supports steady Copaiba Essential Oil Market growth through innovation and R&D investment.Copaiba Essential Oil Market Scope: Inquire before buying

Global Copaiba Essential Oil Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.56 Bn. Forecast Period 2025 to 2032 CAGR: 5.4% Market Size in 2032: USD 3.9 Bn. Segments Covered: by Product Type Pure Copaiba Oil Copaiba Blends Other by Nature Organic Conventional by Formulation Type Essential Oils, Diffusers and Oils by End-Use Food Industry Cosmetics & Personal Care Medicinal & Health Care Aromatherapy Retail/Household by Distribution Channel Direct Sales Convenience Store Specialty Store Pharmacies E-Commerce Others Copaiba Essential Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Copaiba Essential Oil Market, Key Players are:

1. doTERRA International LLC (USA) 2. Young Living Essential Oils (USA) 3. Berje Inc. (USA) 4. Plant Therapy Essential Oils (USA) 5. Aura Cacia – Frontier Co-op (USA) 6. Beraca Ingredientes Naturais S.A. (Brazil) 7. Prakruti Products Pvt. Ltd. (India) 8. Brazilian Nature (Brazil) 9. Destilaria Bauru Ltda. (Brazil) 10. Flora Brasil (Brazil) 11. Elixens France (France) 12. Bontoux S.A. (France) 13. Indukern S.A. (Spain) 14. Hermitage Oils (UK) 15. Aldivia (France) 16. Synthite Industries Ltd. (India) 17. Camlin Fine Sciences Ltd. (India) 18. Anthea Aromatics Pvt. Ltd. (India) 19. Aromaaz International (India) 20. Katyani Exports (India) 21. Scatters Oils (South Africa) 22. Essential Oils of Africa (South Africa) 23. Escentia Products (South Africa) 24. Nambiti Essential Oils (South Africa) 25. Botanichem (South Africa)Frequently Asked Questions:

1. Which region has the largest share in Global Copaiba Essential Oil Market? Ans: South America region held the highest share in 2024. 2. What is the growth rate of Global Copaiba Essential Oil Market? Ans: The Global Copaiba Essential Oil Market is growing at a CAGR of 5.4% during forecasting period 2025-2032. 3. What is scope of the Global Copaiba Essential Oil Market report? Ans: Global Copaiba Essential Oil Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Copaiba Essential Oil Market? Ans: The important key players in the Global Copaiba Essential Oil Market are – Berje, Elixens America, Hermitage Oils, Young Living Essential Oils, Aromatics International, Bontoux, RTG Quimica, Schreiber Essenzen GmbH & Co. KG, and Others 5. What is the study period of this Market? Ans: The Global Copaiba Essential Oil Market is studied from 2024 to 2032.

1. Copaiba Essential Oil Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Copaiba Essential Oil Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Copaiba Essential Oil Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Copaiba Essential Oil Market: Dynamics 3.1. Copaiba Essential Oil Market Trends by Region 3.1.1. North America Copaiba Essential Oil Market Trends 3.1.2. Europe Copaiba Essential Oil Market Trends 3.1.3. Asia Pacific Copaiba Essential Oil Market Trends 3.1.4. Middle East and Africa Copaiba Essential Oil Market Trends 3.1.5. South America Copaiba Essential Oil Market Trends 3.2. Copaiba Essential Oil Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Copaiba Essential Oil Market Drivers 3.2.1.2. North America Copaiba Essential Oil Market Restraints 3.2.1.3. North America Copaiba Essential Oil Market Opportunities 3.2.1.4. North America Copaiba Essential Oil Market Challenges 3.2.2. Europe 3.2.2.1. Europe Copaiba Essential Oil Market Drivers 3.2.2.2. Europe Copaiba Essential Oil Market Restraints 3.2.2.3. Europe Copaiba Essential Oil Market Opportunities 3.2.2.4. Europe Copaiba Essential Oil Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Copaiba Essential Oil Market Drivers 3.2.3.2. Asia Pacific Copaiba Essential Oil Market Restraints 3.2.3.3. Asia Pacific Copaiba Essential Oil Market Opportunities 3.2.3.4. Asia Pacific Copaiba Essential Oil Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Copaiba Essential Oil Market Drivers 3.2.4.2. Middle East and Africa Copaiba Essential Oil Market Restraints 3.2.4.3. Middle East and Africa Copaiba Essential Oil Market Opportunities 3.2.4.4. Middle East and Africa Copaiba Essential Oil Market Challenges 3.2.5. South America 3.2.5.1. South America Copaiba Essential Oil Market Drivers 3.2.5.2. South America Copaiba Essential Oil Market Restraints 3.2.5.3. South America Copaiba Essential Oil Market Opportunities 3.2.5.4. South America Copaiba Essential Oil Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Copaiba Essential Oil Industry 3.8. Analysis of Government Schemes and Initiatives For Copaiba Essential Oil Industry 3.9. Copaiba Essential Oil Market Trade Analysis 3.10. The Global Pandemic Impact on Copaiba Essential Oil Market 4. Copaiba Essential Oil Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Electronic Medical Records (EMR) 4.1.2. Electronic Health Records (EHR) 4.2. Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 4.2.1. Organic 4.2.2. Conventional 4.3. Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 4.3.1. Essential Oils, 4.3.2. Diffusers and Oils 4.4. Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 4.4.1. Food Industry 4.4.2. Cosmetics & Personal Care 4.4.3. Medicinal & Health Care 4.4.4. Aromatherapy 4.4.5. Retail/Household 4.5. Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.1. Direct Sales 4.5.2. Convenience Store 4.5.3. Specialty Store 4.5.4. Pharmacies 4.5.5. E-Commerce 4.5.6. Others 4.6. Copaiba Essential Oil Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Copaiba Essential Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Electronic Medical Records (EMR) 5.1.2. Electronic Health Records (EHR) 5.2. North America Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 5.2.1. Organic 5.2.2. Conventional 5.3. North America Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 5.3.1. Essential Oils, 5.3.2. Diffusers and Oils 5.4. North America Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 5.4.1. Food Industry 5.4.2. Cosmetics & Personal Care 5.4.3. Medicinal & Health Care 5.4.4. Aromatherapy 5.4.5. Retail/Household 5.5. North America Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.1. Direct Sales 5.5.2. Convenience Store 5.5.3. Specialty Store 5.5.4. Pharmacies 5.5.5. E-Commerce 5.5.6. Others 5.6. North America Copaiba Essential Oil Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 5.6.1.1.1. Electronic Medical Records (EMR) 5.6.1.1.2. Electronic Health Records (EHR) 5.6.1.2. United States Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 5.6.1.2.1. Organic 5.6.1.2.2. Conventional 5.6.1.3. United States Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 5.6.1.3.1. Essential Oils, 5.6.1.3.2. Diffusers and Oils 5.6.1.4. United States Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 5.6.1.4.1. Food Industry 5.6.1.4.2. Cosmetics & Personal Care 5.6.1.4.3. Medicinal & Health Care 5.6.1.4.4. Aromatherapy 5.6.1.4.5. Retail/Household 5.6.1.5. United States Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 5.6.1.5.1. Direct Sales 5.6.1.5.2. Convenience Store 5.6.1.5.3. Specialty Store 5.6.1.5.4. Pharmacies 5.6.1.5.5. E-Commerce 5.6.1.5.6. Others 5.6.2. Canada 5.6.2.1. Canada Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 5.6.2.1.1. Electronic Medical Records (EMR) 5.6.2.1.2. Electronic Health Records (EHR) 5.6.2.2. Canada Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 5.6.2.2.1. Organic 5.6.2.2.2. Conventional 5.6.2.3. Canada Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 5.6.2.3.1. Essential Oils, 5.6.2.3.2. Diffusers and Oils 5.6.2.4. Canada Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 5.6.2.4.1. Food Industry 5.6.2.4.2. Cosmetics & Personal Care 5.6.2.4.3. Medicinal & Health Care 5.6.2.4.4. Aromatherapy 5.6.2.4.5. Retail/Household 5.6.2.5. Canada Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 5.6.2.5.1. Direct Sales 5.6.2.5.2. Convenience Store 5.6.2.5.3. Specialty Store 5.6.2.5.4. Pharmacies 5.6.2.5.5. E-Commerce 5.6.2.5.6. Others 5.6.3. Mexico 5.6.3.1. Mexico Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 5.6.3.1.1. Electronic Medical Records (EMR) 5.6.3.1.2. Electronic Health Records (EHR) 5.6.3.2. Mexico Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 5.6.3.2.1. Organic 5.6.3.2.2. Conventional 5.6.3.3. Mexico Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 5.6.3.3.1. Essential Oils, 5.6.3.3.2. Diffusers and Oils 5.6.3.4. Mexico Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 5.6.3.4.1. Food Industry 5.6.3.4.2. Cosmetics & Personal Care 5.6.3.4.3. Medicinal & Health Care 5.6.3.4.4. Aromatherapy 5.6.3.4.5. Retail/Household 5.6.3.5. Mexico Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 5.6.3.5.1. Direct Sales 5.6.3.5.2. Convenience Store 5.6.3.5.3. Specialty Store 5.6.3.5.4. Pharmacies 5.6.3.5.5. E-Commerce 5.6.3.5.6. Others 6. Europe Copaiba Essential Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.2. Europe Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.3. Europe Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.4. Europe Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.5. Europe Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6. Europe Copaiba Essential Oil Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.1.2. United Kingdom Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.1.3. United Kingdom Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.1.4. United Kingdom Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.1.5. United Kingdom Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.2. France 6.6.2.1. France Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.2.2. France Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.2.3. France Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.2.4. France Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.2.5. France Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.3.2. Germany Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.3.3. Germany Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.3.4. Germany Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.3.5. Germany Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.4.2. Italy Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.4.3. Italy Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.4.4. Italy Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.4.5. Italy Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.5.2. Spain Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.5.3. Spain Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.5.4. Spain Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.5.5. Spain Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.6.2. Sweden Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.6.3. Sweden Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.6.4. Sweden Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.6.5. Sweden Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.7.2. Austria Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.7.3. Austria Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.7.4. Austria Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.7.5. Austria Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 6.6.8.2. Rest of Europe Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 6.6.8.3. Rest of Europe Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 6.6.8.4. Rest of Europe Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 6.6.8.5. Rest of Europe Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Copaiba Essential Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.2. Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.3. Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.4. Asia Pacific Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.5. Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6. Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.1.2. China Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.1.3. China Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.1.4. China Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.1.5. China Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.2.2. S Korea Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.2.3. S Korea Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.2.4. S Korea Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.2.5. S Korea Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.3.2. Japan Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.3.3. Japan Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.3.4. Japan Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.3.5. Japan Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.4. India 7.6.4.1. India Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.4.2. India Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.4.3. India Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.4.4. India Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.4.5. India Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.5.2. Australia Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.5.3. Australia Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.5.4. Australia Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.5.5. Australia Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.6.2. Indonesia Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.6.3. Indonesia Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.6.4. Indonesia Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.6.5. Indonesia Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.7.2. Malaysia Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.7.3. Malaysia Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.7.4. Malaysia Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.7.5. Malaysia Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.8.2. Vietnam Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.8.3. Vietnam Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.8.4. Vietnam Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.8.5. Vietnam Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.9.2. Taiwan Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.9.3. Taiwan Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.9.4. Taiwan Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.9.5. Taiwan Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 7.6.10.3. Rest of Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 7.6.10.5. Rest of Asia Pacific Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Copaiba Essential Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 8.2. Middle East and Africa Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 8.3. Middle East and Africa Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 8.4. Middle East and Africa Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 8.5. Middle East and Africa Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 8.6. Middle East and Africa Copaiba Essential Oil Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 8.6.1.2. South Africa Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 8.6.1.3. South Africa Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 8.6.1.4. South Africa Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 8.6.1.5. South Africa Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 8.6.2.2. GCC Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 8.6.2.3. GCC Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 8.6.2.4. GCC Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 8.6.2.5. GCC Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 8.6.3.2. Nigeria Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 8.6.3.3. Nigeria Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 8.6.3.4. Nigeria Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 8.6.3.5. Nigeria Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 8.6.4.2. Rest of ME&A Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 8.6.4.3. Rest of ME&A Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 8.6.4.4. Rest of ME&A Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 8.6.4.5. Rest of ME&A Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Copaiba Essential Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 9.2. South America Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 9.3. South America Copaiba Essential Oil Market Size and Forecast, by Formulation Type(2024-2032) 9.4. South America Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 9.5. South America Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 9.6. South America Copaiba Essential Oil Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 9.6.1.2. Brazil Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 9.6.1.3. Brazil Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 9.6.1.4. Brazil Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 9.6.1.5. Brazil Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 9.6.2.2. Argentina Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 9.6.2.3. Argentina Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 9.6.2.4. Argentina Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 9.6.2.5. Argentina Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Copaiba Essential Oil Market Size and Forecast, by Product Type (2024-2032) 9.6.3.2. Rest Of South America Copaiba Essential Oil Market Size and Forecast, by Nature (2024-2032) 9.6.3.3. Rest Of South America Copaiba Essential Oil Market Size and Forecast, by Formulation Type (2024-2032) 9.6.3.4. Rest Of South America Copaiba Essential Oil Market Size and Forecast, by End Use (2024-2032) 9.6.3.5. Rest Of South America Copaiba Essential Oil Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. doTERRA International LLC (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Young Living Essential Oils (USA) 10.3. Berje Inc. (USA) 10.4. Plant Therapy Essential Oils (USA) 10.5. Aura Cacia – Frontier Co-op (USA) 10.6. Beraca Ingredientes Naturais S.A. (Brazil) 10.7. Prakruti Products Pvt. Ltd. (India) 10.8. Brazilian Nature (Brazil) 10.9. Destilaria Bauru Ltda. (Brazil) 10.10. Flora Brasil (Brazil) 10.11. Elixens France (France) 10.12. Bontoux S.A. (France) 10.13. Indukern S.A. (Spain) 10.14. Hermitage Oils (UK) 10.15. Aldivia (France) 10.16. Synthite Industries Ltd. (India) 10.17. Camlin Fine Sciences Ltd. (India) 10.18. Anthea Aromatics Pvt. Ltd. (India) 10.19. Aromaaz International (India) 10.20. Katyani Exports (India) 10.21. Scatters Oils (South Africa) 10.22. Essential Oils of Africa (South Africa) 10.23. Escentia Products (South Africa) 10.24. Nambiti Essential Oils (South Africa) 10.25. Botanichem (South Africa) 11. Key Findings 12. Industry Recommendations 13. Copaiba Essential Oil Market: Research Methodology 14. Terms and Glossary