The Global Control Valves Market was of USD 11.77 billion in 2025, and is expected to grow at a CAGR of 5.6%, reaching USD 17.24 billion by 2032. The accelerating industrial automation, burgeoning energy infrastructure projects, and evolving regulatory frameworks worldwide, which boosts Control Valves Market growth.Control Valves Market Overview

The Control Valves Market growth is driven by industrial automation, smart valve adoption, expanding pipeline construction, energy infrastructure upgrades, and regulatory mandates globally. Penetration is highest in oil & gas and power generation, with emerging opportunities in water treatment and pharmaceuticals.To know about the Research Methodology :- Request Free Sample Report

Key Markey Highlights:

Annually, global shipments exceed 10 million valve units, reflecting escalating demand across key sectors. The Control Valves Market geographic distribution underscores the pivotal roles of: • China, dominated with 30% of the Asia-Pacific regional Control Valves Market share in 2025, with annual consumption surpassing 4 million units, • In 2025, the United States, representing around 25% of the North American Control Valves Market share, and witnessing roughly 1 million valve replacements annually, is driven by ageing infrastructure. • India, registering one of the fastest growth trajectories globally, with a robust 12% year-on-year increase in valve demand. • Other strategic Control Valves Market includes Japan, Germany, Saudi Arabia, and Brazil, each catalyzing regional growth through industrial growth and infrastructure upgrades.

Control Valves Market Dynamics

Powering Industrial Automation: Surge in Smart Valve Adoption The control valves market is riding the wave of accelerated industrial automation, with global penetration increasing from 37% in 2020 to an expected 58% by 2025. Smart control valves equipped with cutting-edge digital capabilities represent nearly 45% of new valve installations worldwide, a testament to the industry's pivot toward intelligent, data-driven flow management solutions. The increase in demand is underscored by annual valve shipments of 11.5 million units in 2025, of which the oil & gas sector commands a substantial share with nearly 4.2 million valves deployed. This sector’s resilience is bolstered by a rigorous replacement cycle of 10 to 12% annually, translating into over 400,000 valves replaced each year to meet evolving safety and environmental mandates.Infrastructure Investments to Drive Valve Demand Growth The capital investments in energy infrastructure, particularly in developed economies, are directly boosting valve demand and boosting the Control Valves Market growth. The United States, for instance, increased spending on transmission and distribution infrastructure from USD 23.9 billion in 2020 to USD 28 billion by 2025. This expansion aligns with the rising deployment of advanced control valves in power generation, especially in combined cycle gas turbine (CCGT) plants and renewable energy projects, underscoring the critical role of valves in ensuring operational efficiency and regulatory compliance. Control Valves Market Opportunity: The water and wastewater treatment sector represents a compelling growth avenue, with a USD 1.5 billion annual market opportunity, driven by over 95,000 municipal treatment facilities globally. Ageing infrastructure necessitates urgent valve upgrades, creating a fertile market for innovative, durable control valve solutions. Pharmaceutical manufacturing is rapidly emerging as a pivotal growth vertical, exhibiting a value demand growth rate exceeding 8.5% annually through 2032. Technological advances, such as rotatable actuator heads reducing installation costs by up to 15% and aseptic valve designs, are propelling this trend, enabling pharmaceutical companies to meet stringent production and hygiene standards efficiently. The capital intensity associated with smart valve technologies remains a notable barrier; in 2025, over 35% of mid-sized enterprises in emerging markets cite upfront costs as a key constraint. Additionally, the absence of standardised communication protocols encompassing Ethernet, Profibus, and Zigbee presents integration challenges, impacting 42% of actuator installations. These technical barriers slow the pace of full-scale automation, presenting opportunities for industry-wide standardisation efforts.

Control Valves Market Segment Analysis

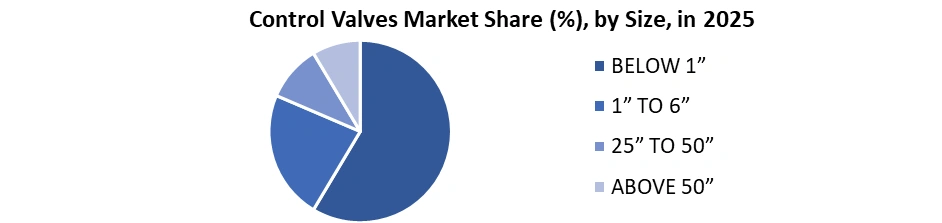

Based on Size, the 1” to 6” valve segment dominated the largest Control Valves Market share in 2025, attributed to its broad application within the chemical processing, pharmaceutical manufacturing, and food & beverage sectors. The valves under 1” diameter represent the fastest-growing category, driven by advancements in miniaturisation and smart valve technologies.

Control Valves Market Regional Analysis

Asia-Pacific dominated the largest Control Valves Market share in 2025. The market growth is driven by Emerson Electric’s 25% regional expansion and Flowserve’s entry into the water/wastewater sectors. Emerson’s digital valve controllers and Flowserve’s energy-efficient valves support a regional growth forecast of over 9% CAGR through 2025. IMI plc’s USD 38 million manufacturing facility in California also serves growing North American demand for sustainable and nuclear-grade valves. North America and the Middle East are witnessing steady growth, with Honeywell expanding valve repair services by 15% in North America, leveraging precision actuation tech. Alfa Laval boosted Middle East market share by 20%, fueled by smart valve upgrades for pharma and water infrastructure projects, supporting regional growth of 6-7% CAGR in 2025-2032. Competitive Landscape: Top Five Players’ Growth & Strategic Initiatives (2020-2025)The global control valves market is highly competitive, led by Emerson Electric, Flowserve, IMI plc, Honeywell, and Alfa Laval, who drive innovation through smart valve technologies, strategic expansions, and robust R&D, securing significant market share in industrial automation and energy sectors.

Company Revenue CAGR (2020-2024) Market Share (%), 2025 Key Strategic Moves R&D & Innovation Focus Emerson Electric Co. 7.8% 18.5% Launched digital valve controllers integrated with IIoT; Expanded Asia-Pacific presence by 25% Cloud-based predictive maintenance and AI diagnostics Flowserve Corporation 6.5% xx.xx% Acquisition of valve actuator startups; Entered water/wastewater sector with low-emission valves Development of energy-efficient valve designs IMI plc 8.2% xx.2% Announced USD 38 million manufacturing facility in California; Increased sustainable manufacturing Nuclear-grade valve solutions and solar power integration Honeywell Inc. 7.0% 9.7% Strategic partnership with Archer Aviation for actuator tech; Expanded valve repair services Precision actuation technology and repair network growth Alfa Laval AB 6.7% 8.5% Focused on Middle East water infrastructure projects; Rolled out smart valve upgrades in the pharma sector Sustainable fluid handling and aseptic valves Recent Development

• Aquana’s June 2023 launch of the IP68-rated remote cutoff valve integrated with Water IoT platforms underscores smart valve advancements. • Honeywell and Fokker Services (2023) expanded valve repair and maintenance services, enhancing aftermarket capabilities.Control Valves Market Scope: Inquire before buying

Global Control Valves Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 11.77 Bn. Forecast Period 2026 to 2032 CAGR: 5.6% Market Size in 2032: USD 17.24 Bn. Segments Covered: by Product Linear Gate Diaphragm Others Rotary Ball Butterfly Plug Others Others by Component Valve Body Actuators Others by Size Below 1” 1” TO 6” 25” TO 50” Above 50” by Material Type Stainless Steel Cast Iron Alloy-Based Cryogenic Others by Distribution Channel Direct Sales Distributors / Dealerships Online by Application Flow Control Pressure Control Others by End User Oil & Gas Chemicals Energy & Power Water & Wastewater Treatment Food & Beverages Pharmaceuticals Others Control Valve Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Control Valves Market, Key Players

1. Emerson Electric Co. 2. Flowserve Corporation 3. Honeywell International Inc. 4. Schneider Electric SE 5. General Electric Company 6. IMI plc 7. Metso Corporation 8. Curtiss‑Wright Corporation 9. Samson AG 10. Alfa Laval AB 11. Velan Inc. 12. Crane Co. 13. Rotork plc 14. KSB SE & Co. KGaA 15. Spirax‑Sarco Engineering plc 16. AVK Holding A/S 17. Cameron International Corporation (Baker Hughes) 18. Parker Hannifin Corporation 19. Belimo Aircontrols (USA), Inc. 20. ARCA Regler GmbH 21. Watts 22. Christian Bürkert GmbH & Co. KG 23. KITZ Corporation 24. Eaton Corporation plc 25. Lapar Control Valve 26. Athena Engineering S.R.L 27. Pentair plc 28. Others FAQ 1. What is the size of the Control Valves Market in 2025? Ans: The Control Valves Market was valued at USD 11.77 billion in 2025. 2. What is the expected CAGR of the Control Valves Market? Ans: The Control Valves Market is expected to grow at a CAGR of 5.6% from 2026 to 2032. 3. Which industries use control valves the most? Ans: Oil & gas, power generation, water treatment, pharmaceuticals, and chemicals are the top industries. 4. Which regions lead the Control Valves Market? Ans: Asia-Pacific leads with 30% market share in 2025, followed by North America and Europe. 5. Who are the top players in the Control Valves Market? Ans: Emerson Electric, Flowserve, Honeywell, IMI plc, and Alfa Laval are the key market leaders.

1. Control Valves Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Control Valves Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Control Valves Market: Dynamics 3.1. Control Valves Market Trends 3.2. Control Valves Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Production & Consumption Analysis 4.1. Global Control Valve Production by Region and Country 4.2. Consumption Patterns by Industry and Geography 4.3. Production Capacity vs Utilization Rates 4.4. Import Dependence vs Domestic Manufacturing Trends 4.5. Seasonal and Cyclical Demand Impacts on Production 4.6. Raw Material Availability and Supply Chain Constraints 5. Demand Analysis 5.1. Demand Trends by Valve Type (Ball, Butterfly, Globe, Gate, Others) 5.2. End-User Industry Demand (Oil & Gas, Water Treatment, Power Generation, Chemicals, HVAC) 5.3. Impact of Industrial Automation and Digitalization on Demand 5.4. Regional Demand Outlook and Growth Hotspots 5.5. Emerging Applications and Consumer Segments 5.6. Substitution and Alternative Technology Threats 6. Trade Analysis (2026) 6.1. Import and Export Volumes by Key Regions 6.2. Leading Exporting and Importing Countries for Control Valves 6.3. Trade Regulations, Certifications, and Compliance Standards 6.4. Global Trade Flow Patterns and Value Chain Dynamics 6.5. Impact of Geopolitical and Supply Chain Disruptions on Trade 6.6. Role of Regional Trade Agreements and Market Access Barriers 7. Pricing Analysis (2026) 7.1. Pricing Benchmarks by Valve Type and Material 7.2. Regional Pricing Differences and Affordability Trends 7.3. Impact of Raw Material Prices (Stainless Steel, Alloys) on Valve Pricing 7.4. Price Sensitivity Across End-User Industries 7.5. Premium vs Standard Valve Pricing Dynamics 7.6. Effects of Logistics and Tariffs on Final Pricing 8. Supply Chain & Manufacturing Insights 8.1. Key Raw Materials and Supplier Landscape 8.2. Manufacturing Technologies and Automation Trends 8.3. Quality Standards and Certification Requirements (API, ISO, ANSI) 8.4. Regional Sourcing and Localization Strategies 8.5. Challenges: Supply Security, Lead Times, and Cost Volatility 8.6. Sustainability Initiatives and Eco-friendly Manufacturing 9. Consumer & End-User Insights 9.1. Industrial Buyer Profiles and Procurement Behavior 9.2. Industry-specific Preferences and Requirements 9.3. Maintenance and Lifecycle Considerations Influencing Purchases 9.4. Role of OEMs and Aftermarket Services 9.5. Digital Platforms and E-commerce Adoption in Procurement 9.6. Brand Loyalty and Repeat Purchase Trends 10. Technology & Innovation Trends 10.1. Smart and IoT-Enabled Control Valves 10.2. Advances in Materials (Corrosion-Resistant, Lightweight Alloys) 10.3. Automation and AI Integration for Valve Diagnostics 10.4. Innovations in Valve Design for Energy Efficiency 10.5. Additive Manufacturing (3D Printing) Applications 10.6. Emerging Technologies: Predictive Maintenance and Remote Monitoring 11. Control Valves Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032) 11.1. Control Valves Market Size and Forecast, By Product (2025-2032) 11.1.1. Linear 11.1.1.1. Gate 11.1.1.2. Diaphragm 11.1.1.3. Others 11.1.2. Rotary 11.1.2.1. Ball 11.1.2.2. Butterfly 11.1.2.3. Plug 11.1.2.4. Others 11.1.3. Others 11.2. Control Valves Market Size and Forecast, By Component (2025-2032) 11.2.1. Valve Body 11.2.2. Actuators 11.2.3. Others 11.3. Control Valves Market Size and Forecast, By Size (2025-2032) 11.3.1. BELOW 1” 11.3.2. 1” TO 6” 11.3.3. 25” TO 50” 11.3.4. ABOVE 50” 11.4. Control Valves Market Size and Forecast, By Material (2025-2032) 11.4.1. Stainless Steel 11.4.2. Cast Iron 11.4.3. Alloy-Based 11.4.4. Cryogenic 11.4.5. Others 11.5. Control Valves Market Size and Forecast, By Distribution Channel (2025-2032) 11.5.1. Flow Control 11.5.2. Pressure Control 11.5.3. Others 11.6. Control Valves Market Size and Forecast, By Application (2025-2032) 11.6.1. Oil & Gas 11.6.2. Chemicals 11.6.3. Energy & Power 11.6.4. Water & Wastewater Treatment 11.6.5. Food & Beverages 11.6.6. Pharmaceuticals 11.6.7. Others 11.7. Control Valves Market Size and Forecast, By End User (2025-2032) 11.7.1. Direct Sales 11.7.2. Distributors / Dealerships 11.7.3. Online 11.8. Control Valves Market Size and Forecast, By Region (2025-2032) 11.8.1. North America 11.8.2. Europe 11.8.3. Asia Pacific 11.8.4. Middle East and Africa 11.8.5. South America 12. North America Control Valves Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032) 12.1. North America Control Valves Market Size and Forecast, By Product (2025-2032) 12.2. North America Control Valves Market Size and Forecast, By Component (2025-2032) 12.3. North America Control Valves Market Size and Forecast, By Size (2025-2032) 12.4. North America Control Valves Market Size and Forecast, By Material (2025-2032) 12.5. North America Control Valves Market Size and Forecast, By Distribution Channel (2025-2032) 12.6. North America Control Valves Market Size and Forecast, By Application (2025-2032) 12.7. North America Control Valves Market Size and Forecast, By End-User (2025-2032) 12.8. North America Control Valves Market Size and Forecast, by Country (2025-2032) 12.8.1. United States 12.8.2. Canada 12.8.3. Mexico 13. Europe Control Valves Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032) 13.1. Europe Control Valves Market Size and Forecast, By Product (2025-2032) 13.2. Europe Control Valves Market Size and Forecast, By Component (2025-2032) 13.3. Europe Control Valves Market Size and Forecast, By Size (2025-2032) 13.4. Europe Control Valves Market Size and Forecast, By Material (2025-2032) 13.5. Europe Control Valves Market Size and Forecast, By Distribution Channel (2025-2032) 13.6. Europe Control Valves Market Size and Forecast, By Application (2025-2032) 13.7. Europe Control Valves Market Size and Forecast, By End-User (2025-2032) 13.8. Europe Control Valves Market Size and Forecast, by Country (2025-2032) 13.8.1. United Kingdom 13.8.2. France 13.8.3. Germany 13.8.4. Italy 13.8.5. Spain 13.8.6. Sweden 13.8.7. Russia 13.8.8. Rest of Europe 14. Asia Pacific Control Valves Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032) 14.1. Asia Pacific Control Valves Market Size and Forecast, By Product (2025-2032) 14.2. Asia Pacific Control Valves Market Size and Forecast, By Component (2025-2032) 14.3. Asia Pacific Control Valves Market Size and Forecast, By Size (2025-2032) 14.4. Asia Pacific Control Valves Market Size and Forecast, By Material (2025-2032) 14.5. Asia Pacific Control Valves Market Size and Forecast, By Distribution Channel (2025-2032) 14.6. Asia Pacific Control Valves Market Size and Forecast, By Application (2025-2032) 14.7. Asia Pacific Control Valves Market Size and Forecast, By End-User (2025-2032) 14.8. Asia Pacific Control Valves Market Size and Forecast, by Country (2025-2032) 14.8.1. China 14.8.2. S Korea 14.8.3. Japan 14.8.4. India 14.8.5. Australia 14.8.6. Indonesia 14.8.7. Malaysia 14.8.8. Philippines 14.8.9. Thailand 14.8.10. Vietnam 14.8.11. Rest of Asia Pacific 15. Middle East and Africa Control Valves Market Size and Forecast (by Value in USD Billion and Volume in 000’Units) (2025-2032) 15.1. Middle East and Africa Control Valves Market Size and Forecast, By Product (2025-2032) 15.2. Middle East and Africa Control Valves Market Size and Forecast, By Component (2025-2032) 15.3. Middle East and Africa Control Valves Market Size and Forecast, By Size (2025-2032) 15.4. Middle East and Africa Control Valves Market Size and Forecast, By Material (2025-2032) 15.5. Middle East and Africa Control Valves Market Size and Forecast, By Distribution Channel (2025-2032) 15.6. Middle East and Africa Control Valves Market Size and Forecast, By Application (2025-2032) 15.7. Middle East and Africa Control Valves Market Size and Forecast, By End-User (2025-2032) 15.8. Middle East and Africa Control Valves Market Size and Forecast, by Country (2025-2032) 15.8.1. South Africa 15.8.2. GCC 15.8.3. Egypt 15.8.4. Nigeria 15.8.5. Rest of ME&A 16. South America Control Valves Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032) 16.1. South America Control Valves Market Size and Forecast, By Product (2025-2032) 16.2. South America Control Valves Market Size and Forecast, By Component (2025-2032) 16.3. South America Control Valves Market Size and Forecast, By Size (2025-2032) 16.4. South America Control Valves Market Size and Forecast, By Material (2025-2032) 16.5. South America Control Valves Market Size and Forecast, By Distribution Channel (2025-2032) 16.6. South America Control Valves Market Size and Forecast, By Application (2025-2032) 16.7. South America Control Valves Market Size and Forecast, By End-User (2025-2032) 16.8. South America Control Valves Market Size and Forecast, by Country (2025-2032) 16.8.1. Brazil 16.8.2. Argentina 16.8.3. Colombia 16.8.4. Chile 16.8.5. Rest Of South America 17. Company Profile: Key Players 17.1. Emerson Electric Co. 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. Flowserve Corporation 17.3. Honeywell International Inc. 17.4. Schneider Electric SE 17.5. General Electric Company 17.6. IMI plc 17.7. Metso Corporation 17.8. Curtiss‑Wright Corporation 17.9. Samson AG 17.10. Alfa Laval AB 17.11. Velan Inc. 17.12. Crane Co. 17.13. Rotork plc 17.14. KSB SE & Co. KGaA 17.15. Spirax‑Sarco Engineering plc 17.16. AVK Holding A/S 17.17. Cameron International Corporation (Baker Hughes) 17.18. Parker Hannifin Corporation 17.19. Belimo Aircontrols (USA), Inc. 17.20. ARCA Regler GmbH 17.21. Watts 17.22. Christian Bürkert GmbH & Co. KG 17.23. KITZ Corporation 17.24. Eaton Corporation plc 17.25. Lapar Control Valve 17.26. Athena Engineering S.R.L 17.27. Pentair plc 17.28. Others 18. Key Findings 19. Analyst Recommendations 20. Control Valves Market: Research Methodology