Construction Lasers Market size was valued at USD 3.30 Billion in 2024, and the total Construction Lasers revenue is expected to grow at a CAGR of 4.58% from 2025 to 2032, reaching nearly USD 4.72 billion by 2032.Construction Lasers Market Overview

Construction lasers are precision optical instruments that project visible beams (red/green) or laser planes for accurate alignment, levelling, and measurement in building projects. These tools include laser levels (rotary, line, dot), distance measurers, plumb bobs, and 3D scanners, serving applications from foundation layout to finish work. They enhance efficiency by replacing manual methods like chalk lines and spirit levels. The construction lasers market witnessed strong demand driven by global infrastructure development, urbanization, and precision requirements in green building projects. Supply is dominated by specialized manufacturers (Trimble, Bosch, Topcon) and Chinese budget brands, with production concentrated in Asia. The market faces occasional semiconductor shortages affecting laser diode availability. The Asia-Pacific (APAC) dominated the global construction lasers market in 2024, fuelled by massive infrastructure projects in China, India, and Southeast Asia, with North America and Europe following as key high-tech markets. Top players include Trimble (USA) for machine control systems, Topcon (Japan) for precision positioning, Leica Geosystems (Switzerland) for 3D scanning, and Bosch (Germany) and Hilti (Liechtenstein) for rugged jobsite lasers, while Chinese brands like Huepar gain share in budget segments. The report covered the analysis of the impact of the COVID-19 lockdown on the revenue of market leaders, followers, and disrupters. Since lockdown was implemented differently in different regions and countries, the impact of the same is also different by regions and segments. The report has covered the current short-term and long-term impact on the market.To know about the Research Methodology:-Request Free Sample Report

Construction Lasers Market Dynamics

Rising Infrastructure Development Projects to Drive the Construction Lasers Market

Governments globally are increasing investments in large-scale infrastructure, including roads, bridges, and smart cities, fuelling demand for precision laser tools. The U.S. Infrastructure Bill (USD 1.2 trillion) and India’s National Infrastructure Pipeline (USD 1.4 trillion) mandate high-accuracy alignment, boosting the adoption of rotary lasers and 3D scanners. Contractors rely on laser-guided equipment to meet strict regulatory standards and reduce rework, driving market growth.High Cost of Advanced Laser Systems to Restrain the Construction Lasers Market

Premium laser scanners and automated machine control systems require significant upfront investment, limiting adoption among small contractors. For example, a 3D laser scanner like the Leica RTC360 costs over $50,000, while traditional surveying tools remain cheaper. Budget constraints in developing nations further slow market penetration.Expansion of Rental and Subscription Models to Create Construction Lasers Market Opportunity

To address cost barriers, companies like United Rentals and Hilti now offer laser equipment rentals. Pay-per-use models for high-end scanners (e.g., Trimble X7) enable smaller firms to access advanced tech without heavy capital expenditure, unlocking growth in emerging markets.Construction Lasers Market Segment Analysis

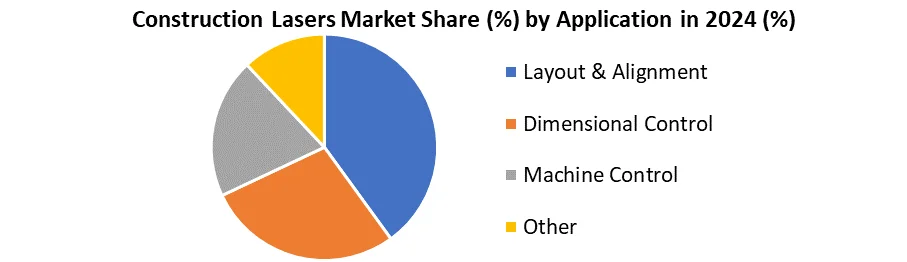

Based on Technology, the Construction Lasers Market is segmented into Manual Lasers, Automatic/Self-Leveling Lasers, Green Beam Lasers, Red Beam Lasers, and Others. Automatic/Self-Leveling Lasers) Segment dominated the Construction Lasers Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to their efficiency and error-reducing capabilities. Unlike the manual lasers requiring tedious calibration, these devices automatically are at a level within a specified range (usually ± 4 ° to ° 6 °), faster the layout function when, improving accuracy. Their popularity spans residential, commercial, and civil projects—from aligning drywall in homes to grading roads. Major brands like Bosch GLL3-330CG (self-leveling cross-line) and Spectra Precision LL300N (dual-slope rotary) are industry standards. The growth of the segment is carried forward by integration with machine control systems in heavy devices. Emerging technologies such as servo-assisted self-leveling and Bluetooth-competent adjustment are re-shaping the location, strengthening their market leadership through continuous innovation.Based on Application, the Construction Lasers Market is segmented into Layout & Alignment, Dimensional Control, Machine Control, and Other. The Layout & Alignment segment dominated the Construction Lasers Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance is due to their ability to ensure the precise positioning of structural elements. The segment's dominance stems from universal demand – electricians use line lasers for conduit runs, masons rely on plumb lasers for block walls, and carpenters depend on cross-line lasers for framing. Rotary lasers like the Topcon RL-H5A dominate exterior grade work, while indoor projects favor multi-line lasers such as the Huepar 603CG. This segment's growth is further accelerated by the transition from manual chalk lines to laser-guided layout, particularly in commercial construction, where BIM coordination requires millimeter-level accuracy. While machine control applications are growing rapidly in heavy civil work, the fundamental need for accurate layout across all trades solidifies this segment's market leadership.

Construction Lasers Market Regional Analysis

The Asia-Pacific dominated the global construction laser market in 2024, which is accounting for more than 40% revenue, driven by the development of large-scale infrastructure in China, India, and Southeast Asia. North America follows as the second-largest market, inspired by the adoption of technology in commercial construction and infrastructure renewal projects under the US infrastructure bill. Europe maintains a stable demand, especially for accurate lasers in renewal and green building projects, especially with the major adoption of Germany and the UK. The Middle East NEOM and Dubai Expo show a special increase in high-value projects, such as development, requiring advanced laser scanning technology. Latin America and Africa represent emerging markets where increasing construction activity is gradually running to adopt laser tools, although cost sensitivity remains a barrier. Regional development mirrors construction investment patterns, rapid urbanization of APAC, and market dynamics with technology-powered projects of North America.Construction Lasers Market Competitive Landscape

The Construction Leasers Market is led by Trimble Inc. and Topcon Corporation, collectively more than 35% of the global market share. Trimble reported about USD XX billion in 2024 Revenue (Construction Technologies segment), which is inspired by scanning solutions such as its advanced machine control lasers and Trimble X7 3D scanners, and the Earthworks Grade Control System. Topcon, with USD XX billion in revenue in 2024, dominates the exact position, especially for automated construction with its Magnet Field Software-Employed Ledger and Hipper VR GNSS system. Both companies are investing heavily in AI-powered layout robotics and cloud-based laser data management, reinforcing their leadership. Emerging competitors like Hilti and Bosch are gaining traction in handheld lasers, but Trimble and Topcon remain unmatched in high-end civil infrastructure applications.Construction Lasers Market Recent Trend

1. Transition to High-Visibility Green Laser Technology Construction sites are rapidly adopting green laser beams due to superior visibility. These lasers perform better in bright sunlight and over longer distances compared to traditional red lasers. • Examples: DeWalt DW089LG: A self-leveling green cross-line laser with 360° visibility 2. Integration of Smart Features and IoT Connectivity Modern construction lasers now incorporate wireless technology and app integration, enabling real-time data sharing and remote operation. • Examples: Hilti PLT 300: Connected laser tracker that pairs with smartphones for measurement documentation 3. Advanced 3D Scanning for Digital Construction High-precision 3D laser scanning has become essential for creating accurate as-built models and digital twins of construction projects. • Examples: Faro Focus Premium: Portable LiDAR scanner capturing 2 million points per second 4. Laser-Assisted Automated Machine Control Heavy construction equipment now incorporates laser guidance systems for precise grading and excavation without manual intervention. • Examples: Trimble Earthworks: Grade control platform for excavators with laser reference capabilityConstruction Lasers Market Recent Development

Date Company Name Headquarters Recent Development May 15, 2024 Trimble Inc. USA Launched the Trimble X12 3D scanner with AI-powered object recognition for automated construction layout. March 7, 2024 Topcon Corporation Japan Released GPT-6 Machine Control System, combining millimeter-wave radar with laser-guided grading July 22, 2024 Hilti Liechtenstein Unveiled PLT 500 Smart Laser Tracker, featuring NFC-based BIM sync for real-time updates. January 30, 2024 Bosch Germany Introduced VisiMax Laser Level with dual red/green beams for extreme outdoor visibility (600m range). April 10, 2024 Leica Geosystems Switzerland Announced partnership with Caterpillar for autonomous laser scanning in mining and heavy civil projects. Construction Lasers Market Scope: Inquire before buying

Construction Lasers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.30 Bn. Forecast Period 2025 to 2032 CAGR: 4.58% Market Size in 2032: USD 4.72 Bn. Segments Covered: by Product Type Laser Levels Laser Distance Measurers Laser Scanners Laser Plumb Bobs Others by Technology Automatic/Self-Leveling Lasers Manual Lasers Green Beam Lasers Red Beam Lasers Others by Application Layout & Alignment Dimensional Control Machine Control Other by End-User Civil & Infrastructure Residential Construction Commercial Construction Industrial Construction Others Construction Lasers Market by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Construction Lasers Market Key Players are:

North America 1. Trimble Inc. (USA) 2. Stanley Black & Decker (DeWalt) (USA) 3. Bosch Tools (USA) 4. Hilti North America (Liechtenstein/USA HQ) 5. Spectra Precision (Trimble Subsidiary) (USA) 6. Johnson Level & Tool (USA) Europe 1. Leica Geosystems (Hexagon) (Switzerland) 2. Bosch Power Tools (Germany) 3. Hilti Group (Liechtenstein) 4. Stabila (Germany) 5. Topcon Europe (Netherlands) 6. FARO Technologies (Germany) Asia Pacific 1. Topcon Corporation (Japan) 2. Hi-Target (China) 3. South Surveying & Mapping Instrument (China) 4. Huepar (China) 5. Bosch Power Tools Asia (Singapore) Middle East and Africa 1. Leica Geosystems Middle East (UAE/Switzerland) 2. Hilti Middle East (UAE/Liechtenstein) South America 1. Trimble South America (Brazil/USA) 2. Leica Geosystems South America (Colombia/Switzerland)Frequently Asked Questions:

1. Which region has the largest share of the Global Construction Lasers Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Construction Lasers Market? Ans: The Global Construction Lasers Market is growing at a CAGR of 4.58% during the forecasting period 2025-2032. 3. What is the scope of the Global Construction Lasers Market report? Ans: The Global Construction Lasers Market report helps with the PESTEL, Porter's, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Construction Lasers Market? Ans: The important key players in the Global market are – Trimble Inc., Stanley Black & Decker, Topcon Corporation, Hilti Group, and Johnson Level & Tool 5. What is the study period of Construction Lasers Market? Ans: The Global market is studied from 2024 to 2032.

1. Construction Lasers Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Construction Lasers Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Service Segment 2.2.4. End-User Segment 2.2.5. Revenue (2024) 2.2.6. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Construction Lasers Market: Dynamics 3.1. Construction Lasers Market Trends 3.2. Construction Lasers Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Construction Lasers Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Laser Levels 4.1.2. Laser Distance Measurers 4.1.3. Laser Scanners 4.1.4. Laser Plumb Bobs 4.1.5. Others 4.2. Construction Lasers Market Size and Forecast, By Technology (2024-2032) 4.2.1. Automatic/Self-Leveling Lasers 4.2.2. Manual Lasers 4.2.3. Green Beam Lasers 4.2.4. Red Beam Lasers 4.2.5. Others 4.3. Construction Lasers Market Size and Forecast, By Application (2024-2032) 4.3.1. Layout & Alignment 4.3.2. Dimensional Control 4.3.3. Machine Control 4.3.4. Other 4.4. Construction Lasers Market Size and Forecast, By End-User (2024-2032) 4.4.1. Civil & Infrastructure 4.4.2. Residential Construction 4.4.3. Commercial Construction 4.4.4. Industrial Construction 4.4.5. Others 4.5. Construction Lasers Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Construction Lasers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Laser Levels 5.1.2. Laser Distance Measurers 5.1.3. Laser Scanners 5.1.4. Laser Plumb Bobs 5.1.5. Others 5.2. North America Construction Lasers Market Size and Forecast, By Technology (2024-2032) 5.2.1. Automatic/Self-Leveling Lasers 5.2.2. Manual Lasers 5.2.3. Green Beam Lasers 5.2.4. Red Beam Lasers 5.2.5. Others 5.3. North America Construction Lasers Market Size and Forecast, By Application (2024-2032) 5.3.1. Layout & Alignment 5.3.2. Dimensional Control 5.3.3. Machine Control 5.3.4. Other 5.4. North America Construction Lasers Market Size and Forecast, By End User (2024-2032) 5.4.1. Civil & Infrastructure 5.4.2. Residential Construction 5.4.3. Commercial Construction 5.4.4. Industrial Construction 5.4.5. Others 5.5. North America Construction Lasers Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 5.5.1.1.1. Laser Levels 5.5.1.1.2. Laser Distance Measurers 5.5.1.1.3. Laser Scanners 5.5.1.1.4. Laser Plumb Bobs 5.5.1.1.5. Others 5.5.1.2. United States Construction Lasers Market Size and Forecast, By Technology (2024-2032) 5.5.1.2.1. Automatic/Self-Leveling Lasers 5.5.1.2.2. Manual Lasers 5.5.1.2.3. Green Beam Lasers 5.5.1.2.4. Red Beam Lasers 5.5.1.2.5. Others 5.5.1.3. United States Construction Lasers Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Layout & Alignment 5.5.1.3.2. Dimensional Control 5.5.1.3.3. Machine Control 5.5.1.3.4. Other 5.5.1.4. United States Construction Lasers Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. Civil & Infrastructure 5.5.1.4.2. Residential Construction 5.5.1.4.3. Commercial Construction 5.5.1.4.4. Industrial Construction 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 5.5.2.1.1. Laser Levels 5.5.2.1.2. Laser Distance Measurers 5.5.2.1.3. Laser Scanners 5.5.2.1.4. Laser Plumb Bobs 5.5.2.1.5. Others 5.5.2.2. Canada Construction Lasers Market Size and Forecast, By Technology (2024-2032) 5.5.2.2.1. Automatic/Self-Leveling Lasers 5.5.2.2.2. Manual Lasers 5.5.2.2.3. Green Beam Lasers 5.5.2.2.4. Red Beam Lasers 5.5.2.2.5. Others 5.5.2.3. Canada Construction Lasers Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Layout & Alignment 5.5.2.3.2. Dimensional Control 5.5.2.3.3. Machine Control 5.5.2.3.4. Other 5.5.2.4. Canada Construction Lasers Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. Civil & Infrastructure 5.5.2.4.2. Residential Construction 5.5.2.4.3. Commercial Construction 5.5.2.4.4. Industrial Construction 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 5.5.3.1.1. Laser Levels 5.5.3.1.2. Laser Distance Measurers 5.5.3.1.3. Laser Scanners 5.5.3.1.4. Laser Plumb Bobs 5.5.3.1.5. Others 5.5.3.2. Mexico Construction Lasers Market Size and Forecast, By Technology (2024-2032) 5.5.3.2.1. Automatic/Self-Leveling Lasers 5.5.3.2.2. Manual Lasers 5.5.3.2.3. Green Beam Lasers 5.5.3.2.4. Red Beam Lasers 5.5.3.2.5. Others 5.5.3.3. Mexico Construction Lasers Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Layout & Alignment 5.5.3.3.2. Dimensional Control 5.5.3.3.3. Machine Control 5.5.3.3.4. Other 5.5.3.4. Mexico Construction Lasers Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. Civil & Infrastructure 5.5.3.4.2. Residential Construction 5.5.3.4.3. Commercial Construction 5.5.3.4.4. Industrial Construction 5.5.3.4.5. Others 6. Europe Construction Lasers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.4. Europe Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5. Europe Construction Lasers Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.1.2. United Kingdom Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.1.3. United Kingdom Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.2. France 6.5.2.1. France Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.2.2. France Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.2.3. France Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.3.2. Germany Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.3.3. Germany Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.4.2. Italy Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.4.3. Italy Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.5.2. Spain Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.5.3. Spain Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.6.2. Sweden Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.6.3. Sweden Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.7.2. Russia Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.7.3. Russia Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Russia Construction Lasers Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 6.5.8.2. Rest of Europe Construction Lasers Market Size and Forecast, By Technology (2024-2032) 6.5.8.3. Rest of Europe Construction Lasers Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Construction Lasers Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Construction Lasers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific Construction Lasers Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.1.2. China Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.1.3. China Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. South Korea Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.2.2. S Korea Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.2.3. S Korea Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.3.2. Japan Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.3.3. Japan Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.4.2. India Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.4.3. India Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.5.2. Australia Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.5.3. Australia Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.6.2. Indonesia Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.6.3. Indonesia Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.7.2. Malaysia Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.7.3. Malaysia Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Malaysia Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.8.2. Philippines Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.8.3. Philippines Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Philippines Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.9.2. Thailand Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.9.3. Thailand Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Thailand Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.10.2. Vietnam Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.10.3. Vietnam Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Vietnam Construction Lasers Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Construction Lasers Market Size and Forecast, By Technology (2024-2032) 7.5.11.3. Rest of Asia Pacific Construction Lasers Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Construction Lasers Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Construction Lasers Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Construction Lasers Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Construction Lasers Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Construction Lasers Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa Construction Lasers Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 8.5.1.2. South Africa Construction Lasers Market Size and Forecast, By Technology (2024-2032) 8.5.1.3. South Africa Construction Lasers Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Construction Lasers Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 8.5.2.2. GCC Construction Lasers Market Size and Forecast, By Technology (2024-2032) 8.5.2.3. GCC Construction Lasers Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Construction Lasers Market Size and Forecast, By End User (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 8.5.3.2. Egypt Construction Lasers Market Size and Forecast, By Technology (2024-2032) 8.5.3.3. Egypt Construction Lasers Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Egypt Construction Lasers Market Size and Forecast, By End User (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 8.5.4.2. Nigeria Construction Lasers Market Size and Forecast, By Technology (2024-2032) 8.5.4.3. Nigeria Construction Lasers Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Nigeria Construction Lasers Market Size and Forecast, By End User (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 8.5.5.2. Rest of ME&A Construction Lasers Market Size and Forecast, By Technology (2024-2032) 8.5.5.3. Rest of ME&A Construction Lasers Market Size and Forecast, By Application (2024-2032) 8.5.5.4. Rest of ME&A Construction Lasers Market Size and Forecast, By End User (2024-2032) 9. South America Construction Lasers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Construction Lasers Market Size and Forecast, By Technology (2024-2032) 9.3. South America Construction Lasers Market Size and Forecast, By Application (2024-2032) 9.4. South America Construction Lasers Market Size and Forecast, By End User (2024-2032) 9.5. South America Construction Lasers Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 9.5.1.2. Brazil Construction Lasers Market Size and Forecast, By Technology (2024-2032) 9.5.1.3. Brazil Construction Lasers Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Construction Lasers Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 9.5.2.2. Argentina Construction Lasers Market Size and Forecast, By Technology (2024-2032) 9.5.2.3. Argentina Construction Lasers Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Construction Lasers Market Size and Forecast, By End User (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 9.5.3.2. Colombia Construction Lasers Market Size and Forecast, By Technology (2024-2032) 9.5.3.3. Colombia Construction Lasers Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Colombia Construction Lasers Market Size and Forecast, By End User (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 9.5.4.2. Chile Construction Lasers Market Size and Forecast, By Technology (2024-2032) 9.5.4.3. Chile Construction Lasers Market Size and Forecast, By Application (2024-2032) 9.5.4.4. Chile Construction Lasers Market Size and Forecast, By End User (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Construction Lasers Market Size and Forecast, By Product Type (2024-2032) 9.5.5.2. Rest Of South America Construction Lasers Market Size and Forecast, By Technology (2024-2032) 9.5.5.3. Rest Of South America Construction Lasers Market Size and Forecast, By Application (2024-2032) 9.5.5.4. Rest Of South America Construction Lasers Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players 10.1. Trimble Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Stanley Black & Decker (DeWalt) 10.3. Bosch Tools 10.4. Hilti Group 10.5. Spectra Precision (Trimble Subsidiary) 10.6. Johnson Level & Tool 10.7. Leica Geosystems (Hexagon) 10.8. Stabila 10.9. Topcon Europe 10.10. FARO Technologies 10.11. Topcon Corporation 10.12. Hi-Target 10.13. South Surveying & Mapping Instrument 10.14. Huepar 10.15. Leica Geosystems 11. Key Findings 12. Industry Recommendations 13. Construction Lasers Market: Research Methodology