The Global Connected Logistics Market size was valued at USD 32.41 Billion in 2023 and the total Connected Logistics Market revenue is expected to grow at a CAGR of 15.2 % from 2024 to 2030, reaching nearly USD 87.27 Billion. Connected logistics is an interdependent set of technologies working together to streamline the flow of goods from the production line to the consumer. It uses cutting-edge technology such as the Internet of Things (IoT), big data, and analytics to connect all stakeholders involved in the supply chain. This includes manufacturers, suppliers, logistics providers, and end consumers. The primary goal of connected logistics is to create an efficient, transparent, and responsive supply chain. By leveraging real-time data, it enhances visibility, optimizes routes, reduces costs, and minimizes risks, ensuring goods reach their destination in a timely and efficient manner. The growing adoption of IoT solutions in the transportation and logistics industry is one of the primary factors driving the connected logistics market forward. These solutions provide real-time tracking and monitoring capabilities, enhancing supply chain visibility and efficiency. There is an increasing demand for end-to-end visibility and predictive analytics in logistics. Connected logistics provides a comprehensive view of the supply chain, enabling better decision-making and proactive problem-solving, which is driving the Connected Logistics Market growth. Technological advancements such as blockchain, artificial intelligence, and machine learning are propelling the connected logistics market. These technologies improve efficiency, reduce costs, and enhance overall supply chain management. Blockchain technology is gaining traction in connected logistics due to its ability to enhance security, transparency, and traceability in the supply chain. It ensures the integrity of data and transactions, which is crucial for the logistics industry. The integration of artificial intelligence (AI) and machine learning (ML) in connected logistics is a significant trend. AI and ML algorithms analyze data to optimize routes, predict maintenance needs, and improve overall supply chain efficiency. With the rise in e-commerce activities, there is an increasing focus on last-mile delivery optimization. Connected logistics market plays a crucial role in achieving this optimization, leading to improved customer satisfaction and reduced delivery costs.To know about the Research Methodology :- Request Free Sample Report

Connected logistics Market Dynamics:

Technological Advancements in Supply Chain Management: The increasing integration of advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and Blockchain in supply chain management systems is driving the growth of the connected logistics market. For example, the adoption of IoT-enabled sensors allows logistics companies to monitor the condition and location of goods in real time, ensuring better efficiency and security in transportation and warehousing. The demand for real-time visibility and transparency in supply chain operations is a significant driver. Technologies like GPS tracking, RFID, and cloud-based software provide real-time updates on the status and location of shipments. For instance, solutions like Blue Yonder’s Yard Management system enhance yard visibility using camera technology and machine learning, as implemented by Penske Logistics. The rapid growth of e-commerce and omnichannel retailing is fueling the demand for connected logistics solutions. Companies are increasingly adopting innovative supply chain solutions to optimize shipments, reduce transportation costs, and improve service. FedEx's fdx platform, offering end-to-end e-commerce solutions, is an excellent example of catering to the growing e-commerce market. The rising focus on sustainability and environmental concerns is driving the adoption of connected logistics solutions. For example, the acquisition of the Reverse Logistics Association (RLA) by the National Retail Federation (NRF) underscores the commitment to sustainable practices throughout the retail industry, promoting the circular economy. There is a growing demand for predictive analytics in logistics to optimize routes, reduce delays, and manage inventory efficiently. Predictive analytics helps in making strategic logistics decisions, from the point of demand to delivery and returns. For instance, Maersk's fully digital solution allows customers to book air freight cargo requirements through a simple online tool, providing instant prices and enhancing decision-making in Connected Logistics Market.Government Initiatives and Regulations: Government initiatives and regulations, especially in the healthcare and defense sectors, are propelling the growth of connected logistics. For example, Protara Therapeutics' alignment with the FDA on the registrational path forward for IV Choline Chloride highlights regulatory support driving innovation in the healthcare sector. The increasing demand for last-mile delivery solutions, driven by the rise in online shopping, is fueling the growth of the connected logistics market. Companies are investing in technologies to improve the efficiency of last-mile delivery, enhancing customer satisfaction. Cox Automotive's investment in revolutionizing the vehicle transport industry through technology is a testament to this trend. Globalization and the increasing complexities of international trade are pushing companies to adopt connected logistics solutions to manage their global supply chains effectively. For example, Maersk's air freight cargo coverage extends to 70,000 airport pairings across more than 90 countries, catering to the needs of the global Connected Logistics Market. There is a growing focus on operational efficiency and cost reduction in logistics. Companies are increasingly turning to connected logistics solutions to optimize their operations, reduce costs, and enhance profitability. For instance, J.B. Hunt Transport Services Inc.'s acquisition of the brokerage operations of BNSF Logistics aims to create the most efficient transportation network in North America.

Connected Logistics Market Segment Analysis:

Based on Transportation, The Roadway segment dominates the Connected Logistics Market due to its extensive infrastructure and widespread application across various industries, offering cost-effective and reliable transportation solutions. The Roadway segment is expected to continue its dominance owing to the increasing demand for last-mile delivery solutions, particularly in the e-commerce sector. The Railway segment follows, offering efficient and eco-friendly transportation solutions. With the rising focus on sustainability, the Railway segment is anticipated to experience significant growth. The Airway segment, although currently lagging due to high costs, is expected to witness substantial growth, primarily due to the rising demand for faster delivery. Meanwhile, the Seaway segment, while relatively niche, is expected to see moderate growth, particularly in international trade. The Roadway segment is currently dominating the connected logistics market, with the Railway segment expected to witness significant growth in the coming years, followed by the Airway and Seaway segments.Connected Logistics Market Regional Insights:

North America leads the Connected Logistics Market, driven by the extensive use of technology and a well-established infrastructure in logistics management. The region's dominance is attributed to the presence of key players, significant investments in research and development, and the adoption of advanced technologies. For example, Penske Logistics, a leading logistics provider, successfully implemented the Blue Yonder Yard Management solution in North America, enhancing yard visibility through camera technology and machine learning-enabled solutions. Europe follows North America closely, with substantial investments in digitalization and a focus on sustainable practices. Asia Pacific (APAC) is expected to exhibit significant growth in the coming years, driven by rising demand for e-commerce, expansion of the retail sector, and government initiatives supporting the adoption of digital technologies in logistics. For example, Maersk, as part of its integrated logistics solutions, has launched a fully digital solution for customers willing to purchase air freight solutions, with coverage extending to 70,000 airport pairings across more than 90 countries globally. North America dominates the connected logistics market, followed by Europe. However, Asia Pacific is expected to witness the highest growth rate in the forecast period due to rapid digitalization and increased government initiatives, particularly in logistics technology.Competitive Landscape

The market's competitive landscape includes integrated offerings and profiles of several vendors. The integration of technology and machine learning, as seen in Penske Logistics' implementation of Blue Yonder’s Yard Management solution, exemplifies this trend. These technological advancements are expected to drive significant Connected Logistics Market growth, ensuring efficient, cost-effective, and sustainable logistics solutions. January 16, 2024, Kiran Rathod joins Connected Logistics as Chief Technology Officer (CTO) in Huntsville, AL. He will assist in the strategic growth of Connected Logistics and its Joint Venture, Canopy Health, a Department of Veterans Affairs (VA) Transformation Twenty-One Total Technology Next Generation 2 (T4NG2) Indefinite Delivery, Indefinite Quantity (IDIQ) Service-Disabled Veteran Owned Small Business (SDVOSB) prime. Rathod will drive strategic growth and operational excellence, ensuring technical solutions meet client needs, and identifying opportunities for improvement and growth. His role includes developing and executing technology strategies aligned with VA and DoD objectives, fostering partnerships, and delivering scalable, efficient solutions to clients. February 27, 2024: Penske Logistics becomes the first to implement Blue Yonder’s Yard Management solution. The solution, developed in partnership with Panasonic Connect, integrates camera technology and machine learning. This implementation aims to enhance yard visibility and control. Penske Logistics, renowned for innovative supply chain and logistics solutions, is now better equipped to optimize shipments, reduce transportation costs, and improve asset utilization. The solution was successfully implemented at one warehouse site, with plans for further growth in 2024. September 6, 2023: The National Retail Federation (NRF) announced its acquisition of the Reverse Logistics Association (RLA) during the RLA Leadership Summit in Atlanta. This acquisition aligns with NRF's commitment to support sustainable practices in the retail industry. Matthew Shay, NRF President and CEO, emphasized RLA's expertise in reverse logistics, which will help members accelerate the emergence of the circular economy. RLA Executive Director Tony Sciarrotta expressed excitement, highlighting the partnership's benefits. September 14, 2023, J.B. Hunt Transport Services Inc. announced the acquisition of the brokerage operations of BNSF Logistics, LLC. BNSF Logistics, an affiliate of BNSF Railway Company (BNSF), offers third-party logistics services for various transportation needs. John Roberts, CEO of J.B. Hunt, emphasized leveraging J.B. Hunt's technology platform, J.B. Hunt 360°, to serve the transportation market with 3PL services. The move aims to create the most efficient transportation network in North America.Connected Logistics Market Scope: Inquiry Before Buying

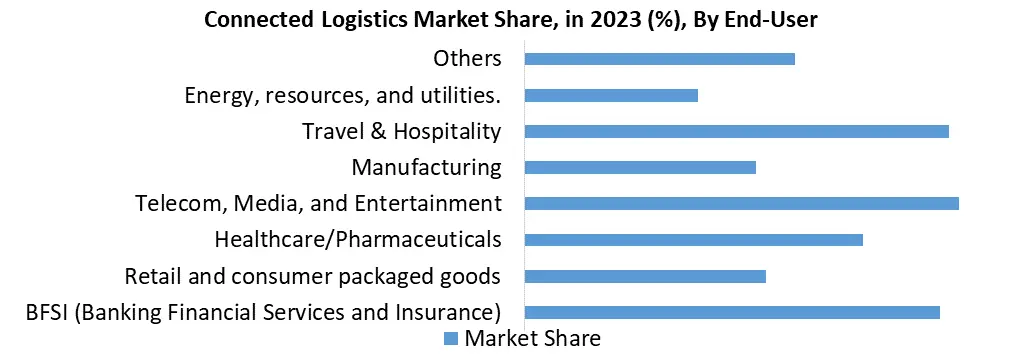

Connected Logistics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 32.41 Bn. Forecast Period 2024 to 2030 CAGR: 15.2% Market Size in 2030: US $ 87.27 Bn. Segments Covered: by Transportation Airway Railway Seaway Roadway by Platform Connectivity management Device management Application management by Services Asset Management Remote Asset Tracking Security Network Management Data Management by Technology Bluetooth Cellular Wi-Fi ZigBee NFC Satellite by End-User BFSI (Banking Financial Services and Insurance) Retail and consumer packaged goods Healthcare/Pharmaceuticals telecom, media, and entertainment Manufacturing Travel & Hospitality Energy, resources, and utilities. Others Connected Logistics Market Key Players:

North America 1. AT&T Inc. (Texas, USA) 2. Cisco Systems Inc. (California, USA) 3. Intel Corporation (California, USA) 4. Cloud Logistics (Florida, USA) 5. Freightgate Inc. (California, USA) 6. Losant IoT Inc. (Ohio, USA) 7. Veridify Security Inc. (New Jersey, USA) 8. Oracle (California, USA) 9. Amazon Web Services, Inc. (Washington, USA) 10. ThingWorx (Massachusetts, USA) 11. ORBCOMM (New Jersey, USA) 12. IBM Corporation (New York, USA) 13. Zebra (Illinois, USA) 14. GT Nexus (California, USA) 15. PTC (Massachusetts, USA) 16. ZIH Corp. (Illinois, USA) Europe 17. Eurotech S.P.A (Amaro, Italy) 18. SAP SE (Walldorf, Germany) 19. BluJay Solutions Ltd. (Manchester, UK) Asia Pacific 20. Infosys Limited (Bangalore, India) 21. HCL Technologies Limited (Noida, India) Middle East and Africa 22. Agility (Kuwait City, Kuwait)FAQs:

1. What are the growth drivers for the Connected Logistics Market? Ans. Technological Advancements in Supply Chain Management is expected to be the major driver for the Connected Logistics Market. 2. What are the major Opportunity for the Connected Logistics Market growth? Ans. Government Initiatives and Regulations are the major opportunities for the Connected Logistics market. 3. Which country is expected to lead the global Connected Logistics Market during the forecast period? Ans. North America is expected to lead the Connected Logistics Market during the forecast period. 4. What is the projected market size and growth rate of the Connected Logistics Market? Ans. The Connected Logistics Market size was valued at USD 32.41 Billion in 2023 and the total Connected Logistics Market revenue is expected to grow at a CAGR of 15.2 % from 2023 to 2030, reaching nearly USD 87.27 Billion. 5. What segments are covered in the Connected Logistics Market report? Ans. The segments covered in the Connected Logistics Market report are by Transportation, Platform, Services, Technology, End-User, and Region.

1. Connected Logistics Market: Research Methodology 2. Connected Logistics Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Connected Logistics Market: Dynamics 3.1 Connected Logistics Market Trends 3.2 Connected Logistics Market Dynamics by Region 3.2.1 Connected Logistics Market Drivers 3.2.2 Connected Logistics Market Restraints 3.2.3 Connected Logistics Market Opportunities 3.2.4 Connected Logistics Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 4. Global Connected Logistics Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 4.1 Global Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 4.1.1 Airway 4.1.2 Railway 4.1.3 Seaway 4.1.4 Roadway 4.2 Global Connected Logistics Market Size and Forecast, by Platform (2023-2030) 4.2.1 Connectivity management 4.2.2 Device management 4.2.3 Application management 4.3 Global Connected Logistics Market Size and Forecast, by Services (2023-2030) 4.3.1 Asset Management 4.3.2 Remote Asset Tracking 4.3.3 Security 4.3.4 Network Management 4.3.5 Data Management 4.4 Global Connected Logistics Market Size and Forecast, by Technology (2023-2030) 4.4.1 Bluetooth 4.4.2 Cellular 4.4.3 Wi-Fi 4.4.4 ZigBee 4.4.5 NFC 4.4.6 Satellite 4.5 Global Connected Logistics Market Size and Forecast, by End-User (2023-2030) 4.5.1 BFSI (Banking Financial Services and Insurance) 4.5.2 Retail and consumer packaged goods 4.5.3 Healthcare/Pharmaceuticals 4.5.4 telecom, media, and entertainment 4.5.5 Manufacturing 4.5.6 Travel & Hospitality 4.5.7 Energy, resources, and utilities. 4.5.8 Others 4.6 Global Connected Logistics Market Size and Forecast, by Region (2023-2030) 4.6.1 North America 4.6.2 Europe 4.6.3 Asia Pacific 4.6.4 Middle East and Africa 4.6.5 South America 5. North America Connected Logistics Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 5.1.1 Airway 5.1.2 Railway 5.1.3 Seaway 5.1.4 Roadway 5.2 North America Connected Logistics Market Size and Forecast, by Platform (2023-2030) 5.2.1 Connectivity management 5.2.2 Device management 5.2.3 Application management 5.3 North America Connected Logistics Market Size and Forecast, by Services (2023-2030) 5.3.1 Asset Management 5.3.2 Remote Asset Tracking 5.3.3 Security 5.3.4 Network Management 5.3.5 Data Management 5.4 North America Connected Logistics Market Size and Forecast, by Technology (2023-2030) 5.4.1 Bluetooth 5.4.2 Cellular 5.4.3 Wi-Fi 5.4.4 ZigBee 5.4.5 NFC 5.4.6 Satellite 5.5 North America Connected Logistics Market Size and Forecast, by End-User (2023-2030) 5.5.1 BFSI (Banking Financial Services and Insurance) 5.5.2 Retail and consumer packaged goods 5.5.3 Healthcare/Pharmaceuticals 5.5.4 telecom, media, and entertainment 5.5.5 Manufacturing 5.5.6 Travel & Hospitality 5.5.7 Energy, resources, and utilities. 5.5.8 Others 5.6 North America Connected Logistics Market Size and Forecast, by Country (2023-2030) 5.6.1 United States 5.6.1.1 United States Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 5.6.1.1.1 Airway 5.6.1.1.2 Railway 5.6.1.1.3 Seaway 5.6.1.1.4 Roadway 5.6.1.2 United States Connected Logistics Market Size and Forecast, by Platform (2023-2030) 5.6.1.2.1 Connectivity management 5.6.1.2.2 Device management 5.6.1.2.3 Application management 5.6.1.3 United States Connected Logistics Market Size and Forecast, by Services (2023-2030) 5.6.1.3.1 Asset Management 5.6.1.3.2 Remote Asset Tracking 5.6.1.3.3 Security 5.6.1.3.4 Network Management 5.6.1.3.5 Data Management 5.6.1.4 United States Connected Logistics Market Size and Forecast, by Technology (2023-2030) 5.6.1.4.1 Bluetooth 5.6.1.4.2 Cellular 5.6.1.4.3 Wi-Fi 5.6.1.4.4 ZigBee 5.6.1.4.5 NFC 5.6.1.4.6 Satellite 5.6.1.5 United States Connected Logistics Market Size and Forecast, by End-User (2023-2030) 5.6.1.5.1 BFSI (Banking Financial Services and Insurance) 5.6.1.5.2 Retail and consumer packaged goods 5.6.1.5.3 Healthcare/Pharmaceuticals 5.6.1.5.4 telecom, media, and entertainment 5.6.1.5.5 Manufacturing 5.6.1.5.6 Travel & Hospitality 5.6.1.5.7 Energy, resources, and utilities. 5.6.1.5.8 Others 5.6.2 Canada 5.6.2.1 Canada Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 5.6.2.1.1 Airway 5.6.2.1.2 Railway 5.6.2.1.3 Seaway 5.6.2.1.4 Roadway 5.6.2.2 Canada Connected Logistics Market Size and Forecast, by Platform (2023-2030) 5.6.2.2.1 Connectivity management 5.6.2.2.2 Device management 5.6.2.2.3 Application management 5.6.2.3 Canada Connected Logistics Market Size and Forecast, by Services (2023-2030) 5.6.2.3.1 Asset Management 5.6.2.3.2 Remote Asset Tracking 5.6.2.3.3 Security 5.6.2.3.4 Network Management 5.6.2.3.5 Data Management 5.6.2.4 Canada Connected Logistics Market Size and Forecast, by Technology (2023-2030) 5.6.2.4.1 Bluetooth 5.6.2.4.2 Cellular 5.6.2.4.3 Wi-Fi 5.6.2.4.4 ZigBee 5.6.2.4.5 NFC 5.6.2.4.6 Satellite 5.6.2.5 Canada Connected Logistics Market Size and Forecast, by End-User (2023-2030) 5.6.2.5.1 BFSI (Banking Financial Services and Insurance) 5.6.2.5.2 Retail and consumer packaged goods 5.6.2.5.3 Healthcare/Pharmaceuticals 5.6.2.5.4 telecom, media, and entertainment 5.6.2.5.5 Manufacturing 5.6.2.5.6 Travel & Hospitality 5.6.2.5.7 Energy, resources, and utilities. 5.6.2.5.8 Others 5.6.3 Mexico 5.6.3.1 Mexico Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 5.6.3.1.1 Airway 5.6.3.1.2 Railway 5.6.3.1.3 Seaway 5.6.3.1.4 Roadway 5.6.3.2 Mexico Connected Logistics Market Size and Forecast, by Platform (2023-2030) 5.6.3.2.1 Connectivity management 5.6.3.2.2 Device management 5.6.3.2.3 Application management 5.6.3.3 Mexico Connected Logistics Market Size and Forecast, by Services (2023-2030) 5.6.3.3.1 Asset Management 5.6.3.3.2 Remote Asset Tracking 5.6.3.3.3 Security 5.6.3.3.4 Network Management 5.6.3.3.5 Data Management 5.6.3.4 Mexico Connected Logistics Market Size and Forecast, by Technology (2023-2030) 5.6.3.4.1 Bluetooth 5.6.3.4.2 Cellular 5.6.3.4.3 Wi-Fi 5.6.3.4.4 ZigBee 5.6.3.4.5 NFC 5.6.3.4.6 Satellite 5.6.3.5 Mexico Connected Logistics Market Size and Forecast, by End-User (2023-2030) 5.6.3.5.1 BFSI (Banking Financial Services and Insurance) 5.6.3.5.2 Retail and consumer packaged goods 5.6.3.5.3 Healthcare/Pharmaceuticals 5.6.3.5.4 telecom, media, and entertainment 5.6.3.5.5 Manufacturing 5.6.3.5.6 Travel & Hospitality 5.6.3.5.7 Energy, resources, and utilities. 5.6.3.5.8 Others 6. Europe Connected Logistics Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.2 Europe Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.3 Europe Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.4 Europe Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.5 Europe Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6 Europe Connected Logistics Market Size and Forecast, by Country (2023-2030) 6.6.1 United Kingdom 6.6.1.1 United Kingdom Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.1.2 United Kingdom Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.1.3 United Kingdom Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.1.4 United Kingdom Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.1.5 United Kingdom Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.2 France 6.6.2.1 France Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.2.2 France Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.2.3 France Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.2.4 France Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.2.5 France Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.3 Germany 6.6.3.1 Germany Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.3.2 Germany Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.3.3 Germany Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.3.4 Germany Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.3.5 Germany Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.4 Italy 6.6.4.1 Italy Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.4.2 Italy Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.4.3 Italy Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.4.4 Italy Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.4.5 Italy Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.5 Spain 6.6.5.1 Spain Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.5.2 Spain Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.5.3 Spain Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.5.4 Spain Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.5.5 Spain Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.6 Sweden 6.6.6.1 Sweden Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.6.2 Sweden Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.6.3 Sweden Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.6.4 Sweden Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.6.5 Sweden Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.7 Russia 6.6.7.1 Russia Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.7.2 Russia Connected Logistics Market Size and Forecast, by Platform (2023-2030) 6.6.7.3 Russia Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.7.4 Russia Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.7.5 Russia Connected Logistics Market Size and Forecast, by End-User (2023-2030) 6.6.8 Rest of Europe 6.6.8.1 Rest of Europe Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 6.6.8.2 Rest of Europe Connected Logistics Market Size and Forecast, by Platform (2023-2030). 6.6.8.3 Rest of Europe Connected Logistics Market Size and Forecast, by Services (2023-2030) 6.6.8.4 Rest of Europe Connected Logistics Market Size and Forecast, by Technology (2023-2030) 6.6.8.5 Rest of Europe Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7. Asia Pacific Connected Logistics Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Asia Pacific Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.2 Asia Pacific Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.3 Asia Pacific Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.4 Asia Pacific Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.5 Asia Pacific Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6 Asia Pacific Connected Logistics Market Size and Forecast, by Country (2023-2030) 7.6.1 China 7.6.1.1 China Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.1.2 China Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.1.3 China Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.1.4 China Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.1.5 China Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6.2 South Korea 7.6.2.1 S Korea Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.2.2 S Korea Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.2.3 S Korea Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.2.4 S Korea Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.2.5 S Korea Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6.3 Japan 7.6.3.1 Japan Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.3.2 Japan Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.3.3 Japan Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.3.4 Japan Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.3.5 Japan Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6.4 India 7.6.4.1 India Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.4.2 India Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.4.3 India Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.4.4 India Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.4.5 India Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6.5 Australia 7.6.5.1 Australia Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.5.2 Australia Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.5.3 Australia Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.5.4 Australia Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.5.5 Australia Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6.6 ASEAN 7.6.6.1 ASEAN Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.6.2 ASEAN Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.6.3 ASEAN Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.6.4 ASEAN Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.6.5 ASEAN Connected Logistics Market Size and Forecast, by End-User (2023-2030) 7.6.7 Rest of Asia Pacific 7.6.7.1 Rest of Asia Pacific Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 7.6.7.2 Rest of Asia Pacific Connected Logistics Market Size and Forecast, by Platform (2023-2030) 7.6.7.3 Rest of Asia Pacific Connected Logistics Market Size and Forecast, by Services (2023-2030) 7.6.7.4 Rest of Asia Pacific Connected Logistics Market Size and Forecast, by Technology (2023-2030) 7.6.7.5 Rest of Asia Pacific Connected Logistics Market Size and Forecast, by End-User (2023-2030) 8. Middle East and Africa Connected Logistics Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Middle East and Africa Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 8.2 Middle East and Africa Connected Logistics Market Size and Forecast, by Platform (2023-2030) 8.3 Middle East and Africa Connected Logistics Market Size and Forecast, by Services (2023-2030) 8.4 Middle East and Africa Connected Logistics Market Size and Forecast, by Technology (2023-2030) 8.5 Middle East and Africa Connected Logistics Market Size and Forecast, by End-User (2023-2030) 8.6 Middle East and Africa Connected Logistics Market Size and Forecast, by Country (2023-2030) 8.6.1 South Africa 8.6.1.1 South Africa Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 8.6.1.2 South Africa Connected Logistics Market Size and Forecast, by Platform (2023-2030) 8.6.1.3 South Africa Connected Logistics Market Size and Forecast, by Services (2023-2030) 8.6.1.4 South Africa Connected Logistics Market Size and Forecast, by Technology (2023-2030) 8.6.1.5 South Africa Connected Logistics Market Size and Forecast, by End-User (2023-2030) 8.6.2 GCC 8.6.2.1 GCC Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 8.6.2.2 GCC Connected Logistics Market Size and Forecast, by Platform (2023-2030) 8.6.2.3 GCC Connected Logistics Market Size and Forecast, by Services (2023-2030) 8.6.2.4 GCC Connected Logistics Market Size and Forecast, by Technology (2023-2030) 8.6.2.5 GCC Connected Logistics Market Size and Forecast, by End-User (2023-2030) 8.6.3 Rest of ME&A 8.6.3.1 Rest of ME&A Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 8.6.3.2 Rest of ME&A Connected Logistics Market Size and Forecast, by Platform (2023-2030) 8.6.3.3 Rest of ME&A Connected Logistics Market Size and Forecast, by Services (2023-2030) 8.6.3.4 Rest of ME&A Connected Logistics Market Size and Forecast, by Technology (2023-2030) 8.6.3.5 Rest of ME&A Connected Logistics Market Size and Forecast, by End-User (2023-2030) 9. South America Connected Logistics Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 South America Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 9.2 South America Connected Logistics Market Size and Forecast, by Platform (2023-2030) 9.3 South America Connected Logistics Market Size and Forecast, by Services (2023-2030) 9.4 South America Connected Logistics Market Size and Forecast, by Technology (2023-2030) 9.5 South America Connected Logistics Market Size and Forecast, by End-User (2023-2030) 9.6 South America Connected Logistics Market Size and Forecast, by Country (2023-2030) 9.6.1 Brazil 9.6.1.1 Brazil Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 9.6.1.2 Brazil Connected Logistics Market Size and Forecast, by Platform (2023-2030) 9.6.1.3 Brazil Connected Logistics Market Size and Forecast, by Services (2023-2030) 9.6.1.4 Brazil Connected Logistics Market Size and Forecast, by Technology (2023-2030) 9.6.1.5 Brazil Connected Logistics Market Size and Forecast, by End-User (2023-2030) 9.6.2 Argentina 9.6.2.1 Argentina Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 9.6.2.2 Argentina Connected Logistics Market Size and Forecast, by Platform (2023-2030) 9.6.2.3 Argentina Connected Logistics Market Size and Forecast, by Services (2023-2030) 9.6.2.4 Argentina Connected Logistics Market Size and Forecast, by Technology (2023-2030) 9.6.2.5 Argentina Connected Logistics Market Size and Forecast, by End-User (2023-2030) 9.6.3 Rest Of South America 9.6.3.1 Rest Of South America Connected Logistics Market Size and Forecast, by Transportation (2023-2030) 9.6.3.2 Rest Of South America Connected Logistics Market Size and Forecast, by Platform (2023-2030) 9.6.3.3 Rest Of South America Connected Logistics Market Size and Forecast, by Services (2023-2030) 9.6.3.4 Rest Of South America Connected Logistics Market Size and Forecast, by Technology (2023-2030) 9.6.3.5 Rest Of South America Connected Logistics Market Size and Forecast, by End-User (2023-2030) 10. Global Connected Logistics Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Transportation Segment 10.3.3 End-User Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Connected Logistics Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 AT&T Inc. (Texas, USA) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Cisco Systems Inc. (California, USA) 11.3 Intel Corporation (California, USA) 11.4 Cloud Logistics (Florida, USA) 11.5 Freightgate Inc. (California, USA) 11.6 Losant IoT Inc. (Ohio, USA) 11.7 Veridify Security Inc. (New Jersey, USA) 11.8 Oracle (California, USA) 11.9 Amazon Web Services, Inc. (Washington, USA) 11.10 ThingWorx (Needham, Massachusetts, USA) 11.11 ORBCOMM (Rochelle Park, New Jersey, USA) 11.12 IBM Corporation (New York, USA) 11.13 Zebra (Illinois, USA) 11.14 GT Nexus (California, USA) 11.15 PTC (Massachusetts, USA) 11.16 ZIH Corp. (Illinois, USA) 11.17 Eurotech S.P.A (Amaro, Italy) 11.18 SAP SE (Walldorf, Germany) 11.19 BluJay Solutions Ltd. (Manchester, UK) 11.20 Infosys Limited (Bangalore, India) 11.21 HCL Technologies Limited (Noida, India) 11.22 Agility (Kuwait City, Kuwait) 12. Key Findings and Analyst Recommendations 13. Terms and Glossary