The Commercial Robotics Market size was valued at USD 23.46 Billion in 2025 and the total Commercial Robotics revenue is expected to grow at a CAGR of 15.8% from 2025 to 2032, reaching nearly USD 65.52 Billion by 2032. Commercial Robotics involves the design, development, and deployment of robotic systems for various industrial and business applications. These robots are utilized in the manufacturing, logistics, healthcare, and agriculture sectors to automate tasks, increase efficiency, and reduce costs. The Commercial Robotics Market experiences significant momentum, driven primarily by the surging demand for automation across diverse industries aiming to elevate productivity and operational precision. This escalating need for efficiency prompts businesses to explore avenues for streamlining processes, with robots emerging as pivotal instruments in achieving these objectives. The market is witnessing robust growth as industries increasingly recognize the transformative potential of innovative robotic solutions in optimizing workflows and yielding tangible benefits.To know about the Research Methodology :- Request Free Sample Report Automation has become a cornerstone in enhancing overall operational efficiency, cost-effectiveness, and reliability. As businesses navigate the evolving landscape, the Commercial Robotics Market stands as a beacon of transformative technology, offering solutions that align with the modern imperative for streamlined and high-performance operations. The market's trajectory is marked by the pursuit of cutting-edge solutions that promise to redefine industries and contribute to the ongoing evolution of business practices in the era of automation. A prominent player in the ever-evolving Commercial Robotics Market is ABB, a globally renowned industrial automation giant. ABB has recently made a significant impact with the introduction of its Swifti delivery robots, a ground-breaking innovation designed to autonomously navigate bustling environments and efficiently deliver goods within warehouses and other facilities. Boasting a substantial payload capacity of 132 pounds, the Swifti operates around the clock and seamlessly integrates with existing logistics systems. This development underscores ABB's commitment to advancing intralogistics robots, aligning with the thriving segment of the Commercial Robotics Market. As automation continues to permeate various industries, the Commercial Robotics Market is set to thrive, propelled by ground-breaking innovations like ABB's Swift and the relentless pursuit of operational excellence.

Commercial Robotics Market Dynamics

Commercial Robotics Market Driver Automation Uprising Steers Commercial Robotics Market toward Unprecedented Growth. Embarking on an exploration of the intricate dynamics within the Commercial Robotics Market unveils a captivating narrative of exponential growth at the core of this extraordinary ascent stand two influential titans reshaping the market landscape. The unfurling of the Automation Revolution. A seismic wave of automation fever is sweeping through diverse industries, propelling the Commercial Robotics Market to unparalleled heights. Businesses, fuelled by an insatiable quest for efficiency, are wholeheartedly adopting robots as tireless and unyielding workers, impervious to fatigue or monotony. Abound, from Amazon's bustling robotic warehouses, where Kiva bots seamlessly orchestrate operations, to Tesla's Gig factory, where robots adeptly handle intricate car assembly tasks. Automation emerges as the transformative force, rewriting established productivity norms. The impact on the Commercial Robotics Market is profound. Robots, undertaking repetitive tasks, liberate human workers for high-value activities, streamline workflows, minimize errors, and optimize resource allocation for substantial cost savings. Operating tirelessly 24/7, robots handle voluminous tasks with unwavering precision, accelerating output, shortening production cycles, and enhancing factory throughput, thereby conferring a competitive edge. Robots navigate hazardous terrains and manage perilous tasks, mitigating risks and ensuring the safety of human workers, fostering secure workspaces, and reducing liability concerns. Turning the page to recent developments in the Commercial Robotics Market, we spotlight Walmart's initiative with Self-Driving Delivery Bots. Walmart's expansion of self-driving delivery bots for grocery deliveries in the US signifies a dedicated effort to integrate robotics for efficient and streamlined logistics, exemplifying the market's commitment to ongoing innovation. As industries worldwide embrace the robotic revolution, the market's trajectory is poised to be defined by continual innovation, heightened efficiency, and an unwavering commitment to redefining the future of work. Commercial Robotics Market Restraint Commercial Robotics Market is the high initial investment required for the deployment and integration of robotic systems. The cost associated with acquiring advanced robotic technologies, implementing infrastructure changes, and providing specialized personnel training can be substantial. This financial barrier may deter smaller businesses from embracing robotic solutions, limiting market penetration and hindering the overall growth potential. Striking a balance between cost-effectiveness and cutting-edge technology remains a critical challenge for industry players a notable challenge is the concern over job displacement resulting from increased automation. While robots enhance efficiency and productivity, there is apprehension about the potential impact on human employment. The fear of job displacement can lead to resistance from the workforce and regulatory scrutiny, slowing down the adoption of commercial robotics solutions. Navigating this societal and ethical challenge is crucial for stakeholders to foster acceptance and cooperation in integrating robots into various industries. Commercial Robotics Market Challenges Technological Complexity and Integration, Regulatory Compliance and Standards The rapid evolution of robotics technologies introduces a challenge in terms of complexity and integration. Implementing advanced robotic solutions often requires compatibility with existing systems, and integrating new technologies can be intricate. Ensuring seamless interoperability and overcoming technical barriers is a continuous challenge for businesses adopting commercial robotics, impacting the efficiency of deployment and the speed of market expansion. Navigating regulatory frameworks and establishing industry standards pose substantial challenges for the Commercial Robotics Market. Given the diversity of applications and industries involved, there is a need for clear and adaptable regulations to ensure safety, ethical use, and standardization. Striking a balance between fostering innovation and safeguarding against potential risks becomes a complex task, as regulators seek to keep pace with the rapid advancements in robotic technologies. Cyber security Concerns, Public Perception and Ethical Considerations As robotics systems become more interconnected and reliant on data exchange, cyber security becomes a critical challenge. Ensuring the security of sensitive information, preventing unauthorized access, and safeguarding against cyber threats are paramount. The vulnerability of robotic systems to hacking poses risks not only to data integrity but also to physical safety, particularly in sectors where robots operate autonomously. Public perception of commercial robotics, influenced by concerns over job displacement, safety, and ethical considerations, presents a significant challenge. Building trust and addressing misconceptions about the role of robots in the workforce and society is crucial. Additionally, ethical considerations related to the use of AI in robots and potential societal impacts need careful attention to ensure responsible and socially acceptable deployment. Addressing these challenges requires collaborative efforts from industry players, regulators, and technology developers. Proactive engagement in standards development, transparent communication, and a commitment to ethical practices are essential for the sustained growth and acceptance of the Commercial Robotics Market.Commercial Robotics Market Trends

Integration of Artificial Intelligence (AI) A key trend in the Commercial Robotics Market is the increasing integration of AI, enhancing robots with cognitive abilities, machine learning, and decision-making capabilities. This trend not only makes robots smarter and more adaptable but also fosters improved collaboration between humans and machines, unlocking new possibilities for efficiency and productivity. There is a growing emphasis on creating robots that work alongside humans, facilitating collaboration rather than full automation. This trend is particularly evident in manufacturing and logistics, where robots assist human workers in tasks, leading to enhanced productivity, efficiency, and safety. Human-robot collaboration is fostering a more harmonious integration of automation into various industries. The Commercial Robotics Market is experiencing a surge in service robotics, especially in sectors like healthcare, hospitality, and retail. Robots are being deployed for tasks such as customer service, delivery, and assistance, transforming the way businesses operate and interact with customers. This trend is driven by the need for automation solutions that cater to a broader range of applications beyond traditional industrial settings. Autonomous vehicles and drones are witnessing sustained growth within the Commercial Robotics Market. In logistics and transportation, autonomous robots and drones are increasingly used for tasks like last-mile delivery and inventory management. The efficiency and cost-effectiveness of these autonomous systems contribute to their continued adoption across diverse industries. Advancements in sensor technologies are contributing to improve robotic sensing and perception capabilities. Robots equipped with advanced sensors, cameras, and LiDAR systems can navigate complex environments with greater precision, enabling applications in areas such as warehouse automation, agriculture, and healthcare. The trend towards modular and scalable robotics solutions allows businesses to adapt and expand their robotic systems according to evolving needs. This flexibility enhances cost-effectiveness and facilitates the integration of robotics into diverse industries, from small enterprises to large-scale manufacturing facilities.Commercial Robotics Market Segment Analysis

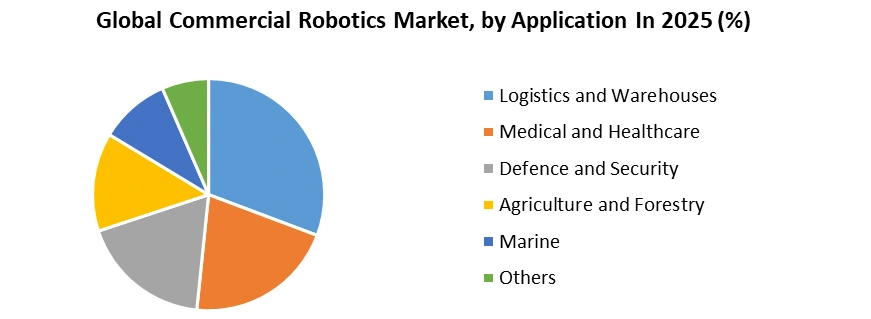

Based on Type, Among the diverse segments in the Commercial Robotics Market, the Field Robots segment held the largest Market share in 2025. Field robots encompass a wide range of applications, including agriculture, construction, and inspection tasks. These robots excel in navigating complex environments, performing various functions, and optimizing workflows in outdoor settings. Recent developments in the field robot segment underscore its dominance. Companies like Boston Dynamics have introduced advanced field robots like Spot, capable of versatile tasks such as inspection, data collection, and remote operation. The integration of artificial intelligence and advanced sensing technologies enhances the adaptability and autonomy of these field robots, making them indispensable in industries seeking automation solutions for outdoor operations. As industries increasingly prioritize efficiency and precision in field operations, the demand for field robots continues to surge. Their ability to perform diverse tasks across different sectors positions the field robot segment at the forefront of the Commercial Robotics Market's growth, making it a key player in shaping the market's trajectory. Based on Application, Within the diverse applications of the Commercial Robotics Market, the Medical and Healthcare segment stands out as the most dominating. The demand for robotics in medical applications has witnessed significant growth, driven by the need for precision, minimally invasive procedures, and enhanced patient care. Medical robots, including surgical systems like Intuitive Surgical's da Vinci, have revolutionized healthcare by providing surgeons with advanced tools for intricate procedures. Recent developments in the medical and healthcare segment further solidify its dominance. Advancements include the integration of artificial intelligence for surgical assistance, telepresence robots for remote medical consultations, and robotic exoskeletons for rehabilitation purposes. These innovations highlight the versatility and transformative impact of robotics in improving medical outcomes and patient experiences. As the healthcare industry continues to embrace automation for improved diagnostics and treatment, the dominance of the "Medical and Healthcare" segment in the Commercial Robotics Market is poised to persist, marking it as a key driver of market growth.

Commercial Robotics Market Regional Analysis

Asia Pacific held the Commercial Robotics Market share in 2025 at the forefront of Asia's dominance is its unparalleled manufacturing might, serving as a driving force for an escalating demand for automation. China, leading this charge, champions the Made in China 2025 initiative to domestically produce 80% of its robots by 2025, solidifying its market grip. Recent developments underscore Asia's ascendancy. Shenzhen, China's robotics hub, boasts over 1,500 robotics companies, attracting a staggering $10 billion in investments and hosting industry giants like Huawei's robotics arm, South Korea's Hyundai Motor Group commits a substantial USD 44.6 billion investment in robotics and AI, envisioning fully autonomous factories, creating a transformative ripple effect in the global automotive industry. Looking ahead, Japan's Softbank Robotics aims at widespread deployment of Pepper 2 humanoid robots in customer service roles, further cementing Asia's influence in the evolving Commercial Robotics Market. Asia-Pacific is home to vibrant technological innovation hubs and research centers, particularly in countries like China, South Korea, and Japan. These hubs serve as hotbeds for advancements in robotics and artificial intelligence, attracting talent and investment. For instance, Shenzhen in China has emerged as a prominent robotics hub, fostering the growth of numerous robotics companies and attracting significant investments. The Asia-Pacific region possesses a diverse and strong industrial base across sectors such as automotive, electronics, and healthcare. The diverse applications of commercial robotics in these industries contribute to the region's dominance. From automating manufacturing processes to logistics and healthcare applications, the demand for commercial robotics is driven by the varied needs of the region's industries. Major companies in the commercial robotics sector, especially those based in Asia-Pacific, have strategically invested in research, development, and deployment of robotic technologies. For example, the significant investment by Hyundai Motor Group in robotics and AI to transform factories into fully autonomous facilities by 2030 illustrates the commitment of key players to shaping the future of the industry. North America's Innovation Drive Propels Commercial Robotics Market into a New Era. In the dynamic landscape of the Commercial Robotics Market, North America emerges as a hub of innovation, driving the machine with groundbreaking advancements in various sectors. In the United States, the medical robotics sector takes center stage, witnessing a remarkable 24% surge in surgical robot sales. Intuitive Surgical's da Vinci system spearheads this surge, showcasing the region's prowess in medical robotics. Simultaneously, Amazon's Kiva robots revolutionize warehouse operations, processing millions of orders daily and exemplifying the impactful integration of robotics in logistics. Canada, within North America, embraces artificial intelligence (AI) with fervor. Clearpath Robotics' autonomous delivery vehicles navigate campuses, while Shopify's AI-powered fulfillment centers transform logistics operations. The Mila AI Institute in Montreal acts as a catalyst for cutting-edge research, contributing to the region's technological edge in the commercial robotics arena. Recent developments in North America showcase where imagination meets reality. Drones take center stage in revolutionizing logistics, with Zipline's medical drone deliveries in Rwanda saving lives, and Walmart partnering with Drone Up for rapid last-mile deliveries. In the realm of robotics exploration, Boston Dynamics' Spot robot navigates Iceland's geothermal plants, inspecting hazardous environments, while Ocean Infinity's drones map uncharted depths, pushing the boundaries of exploration. AI's potential is unleashed as robots equipped with advanced capabilities blur the line between human and machine, paving the way for unprecedented automation possibilities. Commercial Robotics Market Competitive Landscape The Commercial Robotics Market is a vibrant battleground, where established industry giants and nimble startups compete for dominance. In the realm of industrial robotics, ABB stands out as a global leader, focusing on connectivity and cloud-based solutions for smart factories. Fanuc, known for precision robots in automotive and electronics, maintains its edge through dedicated research and development. Logistics disruptors like Amazon revolutionize warehouse automation with Kiva robots, complemented by a foray into drone delivery. JD.com, China's e-commerce giant, boasts a fleet of over 50,000 robots for last-mile delivery, securing a prominent position in the Asian market. In healthcare robotics, Intuitive Surgical leads with the transformative da Vinci system for minimally invasive surgery. Medtronic integrates robotics into surgical and rehabilitation applications, creating a comprehensive ecosystem for patient care. Challengers, such as Boston Dynamics, push the boundaries of robot capabilities while emerging economies like China and India rapidly adopt robotics, challenging established players. Key trends shaping the future include AI integration for intelligent robots, cloud robotics enabling remote monitoring, and collaboration between humans and robots. The evolving landscape promises intense competition, where adaptability and innovation will determine the leaders in this multi-billion dollar market.Scope of Global Commercial Robotics Market: Inquire before buying

Global Commercial Robotics Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 23.46 Bn. Forecast Period 2026 to 2032 CAGR: 15.8% Market Size in 2032: USD 65.52 Bn. Segments Covered: by Type Field Robots Medical robots Autonomous Guided Robotics Drones Others by Application Logistics and Warehouses Medical and Healthcare Defence and Security Agriculture and Forestry Marine Others Commercial Robotics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Commercial Robotics Market, Key players

Asia-Pacific 1. ABB - Zurich, Switzerland (Europe) 2. Fanuc - Oshino-mura, Yamanashi, Japan (Asia-Pacific) 3. Yaskawa Electric - Kitakyushu, Fukuoka, Japan (Asia-Pacific) 4. Omron Adept Technologies - Pleasanton, California, USA (North America) 5. SoftBank Robotics - Tokyo, Japan (Asia-Pacific) 6. JD.com - Beijing, China (Asia-Pacific) 7. Ecovacs - Suzhou, Jiangsu, China (Asia-Pacific) North America 1. Amazon - Seattle, Washington, USA (North America) 2. Nuro - Mountain View, California, USA (North America) 3. Intuitive Surgical - Sunnyvale, California, USA (North America) 4. Medtronic - Dublin, Ireland Minneapolis, Minnesota, USA 5. Johnson & Johnson - New Brunswick, New Jersey, USA (North America) 6. Stryker - Kalamazoo, Michigan, USA (North America) 7. iRobot - Bedford, Massachusetts, USA (North America) 8. Brain Corp - San Diego, California, USA (North America) 9. Boston Dynamics - Waltham, Massachusetts, USA (North America) 10. Misty Robotics - Pittsburgh, Pennsylvania, USA (North America) Europe 1. Kuka - Augsburg, Bavaria, Germany (Europe) 2. DHL Robotics - Bonn, Germany (Europe) 3. Starship Technologies - Tallinn, Estonia (Europe) 4. Blue Ocean Robotics - Odense, Denmark (Europe) 5. UVD Robots - Odense, Denmark (Europe) 6. Ribotics - London, England, UK (Europe)Frequently Asked Questions:

1] What is the growth rate of the Global Commercial Robotics Market? Ans. The Global Commercial Robotics Market is growing at a significant rate of 15.8 % during the forecast period. 2] Which region is expected to dominate the Global Commercial Robotics Market? Ans. North America held a significant share in the global Commercial Robotics market, primarily due to advanced healthcare infrastructure, a higher prevalence of respiratory diseases, and a well-established market for medical devices. 3] What is the expected Global Commercial Robotics Market size by 2032? Ans. The Commercial Robotics Market size is expected to reach USD 65.52 Bn by 2032. 4] Which are the top players in the Global Commercial Robotics Market? Ans. The major top players in the Global Commercial Robotics Market are Gilead Sciences Inc, TCR2 Therapeutics Inc, Bluebird Bio Inc, Sorrento Therapeutics, Fate Therapeutics 5] What are the factors driving the Global Commercial Robotics Market growth? Ans. The Global Commercial Robotics Market growth is primarily propelled by increasing cases of respiratory disorders like COPD, technological advancements improving device efficiency and portability, rising elderly population susceptible to respiratory conditions, and the convenience of at-home oxygen therapy. Additionally, the COVID-19 pandemic accentuated the demand for these devices, driving market expansion due to the virus's impact on respiratory health worldwide. 6] Which country held the largest Global Commercial Robotics Market share in 2025? Ans. The United States held the largest Commercial Robotics Market share in 2025.

1. Commercial Robotics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Commercial Robotics Market: Dynamics 2.1. Commercial Robotics Market Trends by Region 2.1.1. North America Commercial Robotics Market Trends 2.1.2. Europe Commercial Robotics Market Trends 2.1.3. Asia Pacific Commercial Robotics Market Trends 2.1.4. Middle East and Africa Commercial Robotics Market Trends 2.1.5. South America Commercial Robotics Market Trends 2.2. Commercial Robotics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Commercial Robotics Market Drivers 2.2.1.2. North America Commercial Robotics Market Restraints 2.2.1.3. North America Commercial Robotics Market Opportunities 2.2.1.4. North America Commercial Robotics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Commercial Robotics Market Drivers 2.2.2.2. Europe Commercial Robotics Market Restraints 2.2.2.3. Europe Commercial Robotics Market Opportunities 2.2.2.4. Europe Commercial Robotics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Commercial Robotics Market Drivers 2.2.3.2. Asia Pacific Commercial Robotics Market Restraints 2.2.3.3. Asia Pacific Commercial Robotics Market Opportunities 2.2.3.4. Asia Pacific Commercial Robotics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Commercial Robotics Market Drivers 2.2.4.2. Middle East and Africa Commercial Robotics Market Restraints 2.2.4.3. Middle East and Africa Commercial Robotics Market Opportunities 2.2.4.4. Middle East and Africa Commercial Robotics Market Challenges 2.2.5. South America 2.2.5.1. South America Commercial Robotics Market Drivers 2.2.5.2. South America Commercial Robotics Market Restraints 2.2.5.3. South America Commercial Robotics Market Opportunities 2.2.5.4. South America Commercial Robotics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Commercial Robotics Industry 2.9. The Global Pandemic Impact on Commercial Robotics Market 2.10. Commercial Robotics Price Trend Analysis (2021-23) 3. Commercial Robotics Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2025-2032) 3.1. Commercial Robotics Market Size and Forecast, by Type (2025-2032) 3.1.1. Field Robots 3.1.2. Medical robots 3.1.3. Autonomous Guided Robotics 3.1.4. Drones 3.1.5. Others 3.2. Commercial Robotics Market Size and Forecast, by Application (2025-2032) 3.2.1. Logistics and Warehouses 3.2.2. Medical and Healthcare 3.2.3. Defence and Security 3.2.4. Agriculture and Forestry 3.2.5. Marine 3.2.6. Others 3.3. Commercial Robotics Market Size and Forecast, by Region (2025-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Commercial Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 4.1. North America Commercial Robotics Market Size and Forecast, by Type (2025-2032) 4.1.1. Field Robots 4.1.2. Medical robots 4.1.3. Autonomous Guided Robotics 4.1.4. Drones 4.1.5. Others 4.2. North America Commercial Robotics Market Size and Forecast, by Application (2025-2032) 4.2.1. Logistics and Warehouses 4.2.2. Medical and Healthcare 4.2.3. Defence and Security 4.2.4. Agriculture and Forestry 4.2.5. Marine 4.2.6. Others 4.3. North America Commercial Robotics Market Size and Forecast, by Country (2025-2032) 4.3.1. United States 4.3.1.1. United States Commercial Robotics Market Size and Forecast, by Type (2025-2032) 4.3.1.1.1. Field Robots 4.3.1.1.2. Medical robots 4.3.1.1.3. Autonomous Guided Robotics 4.3.1.1.4. Drones 4.3.1.1.5. Others 4.3.1.2. United States Commercial Robotics Market Size and Forecast, by Application (2025-2032) 4.3.1.2.1. Logistics and Warehouses 4.3.1.2.2. Medical and Healthcare 4.3.1.2.3. Defence and Security 4.3.1.2.4. Agriculture and Forestry 4.3.1.2.5. Marine 4.3.1.2.6. Others 4.3.2. Canada 4.3.2.1. Canada Commercial Robotics Market Size and Forecast, by Type (2025-2032) 4.3.2.1.1. Field Robots 4.3.2.1.2. Medical robots 4.3.2.1.3. Autonomous Guided Robotics 4.3.2.1.4. Drones 4.3.2.1.5. Others 4.3.2.2. Canada Commercial Robotics Market Size and Forecast, by Application (2025-2032) 4.3.2.2.1. Logistics and Warehouses 4.3.2.2.2. Medical and Healthcare 4.3.2.2.3. Defence and Security 4.3.2.2.4. Agriculture and Forestry 4.3.2.2.5. Marine 4.3.2.2.6. Others 4.3.3. Mexico 4.3.3.1.1. Mexico Commercial Robotics Market Size and Forecast, by Type (2025-2032) 4.3.3.1.1.1. Field Robots 4.3.3.1.1.2. Medical robots 4.3.3.1.1.3. Autonomous Guided Robotics 4.3.3.1.1.4. Drones 4.3.3.1.1.5. Others 4.3.3.1.2. Mexico Commercial Robotics Market Size and Forecast, by Application (2025-2032) 4.3.3.1.2.1. Logistics and Warehouses 4.3.3.1.2.2. Medical and Healthcare 4.3.3.1.2.3. Defence and Security 4.3.3.1.2.4. Agriculture and Forestry 4.3.3.1.2.5. Marine 4.3.3.1.2.6. Others 5. Europe Commercial Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 5.1. Europe Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.2. Europe Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3. Europe Commercial Robotics Market Size and Forecast, by Country (2025-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.1.2. United Kingdom Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.2. France 5.3.2.1. France Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.2.2. France Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.3. Germany 5.3.3.1. Germany Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.3.2. Germany Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.4. Italy 5.3.4.1. Italy Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.4.2. Italy Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.5. Spain 5.3.5.1. Spain Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.5.2. Spain Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.6. Sweden 5.3.6.1. Sweden Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.6.2. Sweden Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.7. Austria 5.3.7.1. Austria Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.7.2. Austria Commercial Robotics Market Size and Forecast, by Application (2025-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Commercial Robotics Market Size and Forecast, by Type (2025-2032) 5.3.8.2. Rest of Europe Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6. Asia Pacific Commercial Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 6.1. Asia Pacific Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.2. Asia Pacific Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3. Asia Pacific Commercial Robotics Market Size and Forecast, by Country (2025-2032) 6.3.1. China 6.3.1.1. China Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.1.2. China Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.2. S Korea 6.3.2.1. S Korea Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.2.2. S Korea Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.3. Japan 6.3.3.1. Japan Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.3.2. Japan Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.4. India 6.3.4.1. India Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.4.2. India Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.5. Australia 6.3.5.1. Australia Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.5.2. Australia Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.6.2. Indonesia Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.7.2. Malaysia Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.8.2. Vietnam Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.9.2. Taiwan Commercial Robotics Market Size and Forecast, by Application (2025-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Commercial Robotics Market Size and Forecast, by Type (2025-2032) 6.3.10.2. Rest of Asia Pacific Commercial Robotics Market Size and Forecast, by Application (2025-2032) 7. Middle East and Africa Commercial Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 7.1. Middle East and Africa Commercial Robotics Market Size and Forecast, by Type (2025-2032) 7.2. Middle East and Africa Commercial Robotics Market Size and Forecast, by Application (2025-2032) 7.3. Middle East and Africa Commercial Robotics Market Size and Forecast, by Country (2025-2032) 7.3.1. South Africa 7.3.1.1. South Africa Commercial Robotics Market Size and Forecast, by Type (2025-2032) 7.3.1.2. South Africa Commercial Robotics Market Size and Forecast, by Application (2025-2032) 7.3.2. GCC 7.3.2.1. GCC Commercial Robotics Market Size and Forecast, by Type (2025-2032) 7.3.2.2. GCC Commercial Robotics Market Size and Forecast, by Application (2025-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Commercial Robotics Market Size and Forecast, by Type (2025-2032) 7.3.3.2. Nigeria Commercial Robotics Market Size and Forecast, by Application (2025-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Commercial Robotics Market Size and Forecast, by Type (2025-2032) 7.3.4.2. Rest of ME&A Commercial Robotics Market Size and Forecast, by Application (2025-2032) 8. South America Commercial Robotics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 8.1. South America Commercial Robotics Market Size and Forecast, by Type (2025-2032) 8.2. South America Commercial Robotics Market Size and Forecast, by Application (2025-2032) 8.3. South America Commercial Robotics Market Size and Forecast, by Country (2025-2032) 8.3.1. Brazil 8.3.1.1. Brazil Commercial Robotics Market Size and Forecast, by Type (2025-2032) 8.3.1.2. Brazil Commercial Robotics Market Size and Forecast, by Application (2025-2032) 8.3.2. Argentina 8.3.2.1. Argentina Commercial Robotics Market Size and Forecast, by Type (2025-2032) 8.3.2.2. Argentina Commercial Robotics Market Size and Forecast, by Application (2025-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Commercial Robotics Market Size and Forecast, by Type (2025-2032) 8.3.3.2. Rest Of South America Commercial Robotics Market Size and Forecast, by Application (2025-2032) 9. Global Commercial Robotics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Commercial Robotics Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ABB - Zurich, Switzerland (Europe) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Awards Received by the Firm 10.1.6. Recent Developments 10.2. Fanuc - Oshino-mura, Yamanashi, Japan (Asia-Pacific) 10.3. Yaskawa Electric - Kitakyushu, Fukuoka, Japan (Asia-Pacific) 10.4. Omron Adept Technologies - Pleasanton, California, USA (North America) 10.5. SoftBank Robotics - Tokyo, Japan (Asia-Pacific) 10.6. JD.com - Beijing, China (Asia-Pacific) 10.7. Ecovacs - Suzhou, Jiangsu, China (Asia-Pacific) 10.8. Amazon - Seattle, Washington, USA (North America) 10.9. Nuro - Mountain View, California, USA (North America) 10.10. Intuitive Surgical - Sunnyvale, California, USA (North America) 10.11. Medtronic - Dublin, Ireland Minneapolis, Minnesota, USA 10.12. Johnson & Johnson - New Brunswick, New Jersey, USA (North America) 10.13. Stryker - Kalamazoo, Michigan, USA (North America) 10.14. iRobot - Bedford, Massachusetts, USA (North America) 10.15. Brain Corp - San Diego, California, USA (North America) 10.16. Boston Dynamics - Waltham, Massachusetts, USA (North America) 10.17. Misty Robotics - Pittsburgh, Pennsylvania, USA (North America) 10.18. Kuka - Augsburg, Bavaria, Germany (Europe) 10.19. DHL Robotics - Bonn, Germany (Europe) 10.20. Starship Technologies - Tallinn, Estonia (Europe) 10.21. Blue Ocean Robotics - Odense, Denmark (Europe) 10.22. UVD Robots - Odense, Denmark (Europe) 10.23. Ribotics - London, England, UK (Europe) 11. Key Findings 12. Industry Recommendations 13. Commercial Robotics Market: Research Methodology