The Cider Market size was valued at USD 17.42 Billion in 2025 and the total Cider revenue is expected to grow at a CAGR of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. Cider is a popular alcoholic beverage made primarily from fermented apple juice and, in some cases, other fruits. The global cider market includes a wide range of cider manufacturers, suppliers, and distributors engaged in the production, marketing, and sale of various cider types. This market encompasses traditional apple ciders, fruit-infused ciders, craft cider, hard cider, sparkling cider, organic cider, and premium cider, catering to diverse consumer preferences and tastes. The cider industry has experienced steady market growth due to rising consumer demand for low-calorie, gluten-free, and flavored cider, along with innovations in RTD cider, ready-to-drink cider, and flavored alcoholic beverages. While the United Kingdom and Ireland have historically dominated the European cider market, regions like Asia Pacific, North America, and Africa are emerging as lucrative growth markets. The cider market forecast remains positive, driven by the popularity of craft cider, premium cider launches, and sustainable cider production. However, the industry faces challenges from competitive alcoholic beverages, changing consumer preferences, and the need for diversified product portfolios to sustain long-term growth in the global cider industry.To know about the Research Methodology :- Request Free Sample Report Rising Demand for High-Performance Computing and Gaming Key drivers fueling the cider market include a shift towards healthier lifestyles, consumer preference for diverse and innovative flavors, rising disposable incomes, and urbanization. Craft and artisanal ciders, growth in retail and online availability, and an increased focus on sustainability also contribute to market growth. Additionally, the growing popularity of cider as an alternative to alcoholic beverages drives its market penetration and growth. Recent trends in the cider market include the growth of market players into untapped regions, the rise of artisanal and craft ciders with unique flavor profiles, and efforts by key players to address sustainability and consumer preferences. Opportunities lie in regional growth beyond traditional markets and investments in innovative flavors and sustainable practices. Recent developments by key players involve acquisitions, investments in market growth, and initiatives to connect consumers with the agricultural roots of cider production. Health-Conscious Choices Fueling the Cider Market's Evolution: The shift towards healthier lifestyles drives cider market growth. Consumers seeking low-calorie and gluten-free alternatives opt for cider. For instance, Strongbow's introduction of low-calorie, no-sugar ciders resonates with health-conscious consumers, propelling market growth. The introduction of innovative flavors and variants in ciders attracts diverse consumer preferences. For example, fruit-infused ciders like apple and berry combinations or exotic flavors like elderflower boost cider market demand. Brands like Angry Orchard are experimenting with various flavor profiles to cater to evolving consumer tastes, driving cider market growth. Cider's rising popularity as an alternative alcoholic drink amplifies market growth. Its refreshing taste and low alcohol content attract consumers seeking alternatives to beer or wine. This trend has been evident in various regions, contributing to the market's growth. The growing demand for craft and artisanal ciders among discerning consumers fuels market growth. Craft cider producers focusing on small-batch, premium-quality offerings, such as local orchard-produced ciders or limited-edition releases, gain traction among enthusiasts, driving cider market growth. Increased availability through various retail and online channels boosts market accessibility. The availability of ciders in supermarkets, bars, restaurants, and online platforms widens consumer reach, augmenting market demand. Brands like Woodchuck Hard Cider expanding their distribution to more outlets contribute to market growth. Growth in new cider market and export opportunities bolster market growth. Cider brands capitalizing on the growing international demand, such as Aspall, penetrate new markets, driving market growth. Effective marketing campaigns and branding strategies significantly impact consumer perceptions, influencing market growth. Brands investing in promotional activities and creating strong brand identities, like Stella Artois' Cider leveraging its beer brand reputation, witness increased cider market traction. The increase in disposable income and urbanization accelerates cider consumption. Urban populations with higher disposable incomes exhibit greater purchasing power for premium alcoholic beverages like cider, propelling cider market growth. On-premise consumption culture, including bars and restaurants, contributes significantly to cider market growth. Consumer experiences and preferences influenced by on-premise tasting events and menus featuring varied cider offerings drive cider market growth. Cider brands embracing sustainability and ethical practices resonate with conscious consumers, driving market growth. For instance, eco-friendly production methods and sustainable sourcing initiatives by brands like Kopparberg align with consumers' ethical considerations, influencing cider market demand. Flavor Innovation Driving Cider Market Growth through Diverse Profiles: Introducing diverse flavors like berry blends or exotic infusions, such as elderflower, caters to evolving consumer preferences. For instance, brands like Angry Orchard experimenting with various flavor profiles have witnessed increased market demand, driving growth. Leveraging the trend towards healthier beverage options by offering low-calorie, no-sugar cider variants. Strongbow's introduction of such ciders has resonated well with health-conscious consumers, driving market growth. Embracing sustainability initiatives, like eco-friendly production methods, aligns with consumer values. Brands like Kopparberg, focusing on sustainable sourcing, have seen increased consumer interest, leading to market growth. Increasing accessibility through retail, online platforms, and more outlets widens consumer reach. Brands like Woodchuck Hard Cider expanding their distribution networks have contributed to market growth. Capitalizing on global demand and exploring new markets fuels market growth. For instance, brands like Aspall focusing on international expansion have driven market growth. Meeting the demand for premium-quality offerings appeals to discerning consumers. Craft cider producers emphasizing small-batch, premium-quality ciders have gained traction among enthusiasts, boosting market growth. Investing in effective marketing campaigns and creating strong brand identities significantly influences consumer perceptions, impacting market growth. Brands like Stella Artois leveraging their beer brand reputation have witnessed increased traction in the cider market. Targeting urban populations with higher disposable incomes fosters greater purchasing power for premium beverages like cider, propelling market growth. Engaging consumers through on-premise tasting events and varied offerings at bars and restaurants drives market growth. Innovating packaging styles and sizes for convenience and appeal could attract new consumer segments and boost market growth.

Navigating Innovation's Cider Market's Battle amidst RTD Competition: The global cider market faces a blend of manufacturing and business challenges, shaping its landscape amidst evolving consumer preferences and market dynamics. Primarily, one significant manufacturing challenge involves meeting the demand for innovation while aligning with Ready-to-Drink (RTD) market cues. Innovation remains pivotal as cider manufacturers adapt to consumer preferences for diverse flavor profiles, packaging formats, and emerging consumption trends. An instance of this challenge is seen in competing with the RTD market for drinking occasions and consumers. The rising popularity of RTDs poses a threat to cider, compelling manufacturers to innovate, revamp marketing strategies, and diversify product portfolios to stay competitive. On the business front, diluting reliance on key markets like the UK and Ireland stands out as a pressing challenge. These regions, accounting for a third of global cider sales, may have witnessed a saturation point, making sustained growth challenging. Addressing this challenge requires strategic growth in untapped markets and regions. However, penetrating new markets demands understanding local preferences and adapting products accordingly, which presents hurdles such as cultural differences, regulatory compliance, and market entry barriers. For instance, although cider volumes have witnessed substantial growth in Africa, penetrating this market necessitates substantial investments, like Heineken's initiatives in South Africa, leveraging existing cider-drinking traditions. Regional growth at a domestic level, as witnessed in the UK's cider market, highlights the significance of geographical diversification for market resilience. Overcoming such challenges often entails reshaping distribution networks, tailoring products to diverse regional tastes, and fostering a wider consumer base. In the past, the UK cider market's emergence from a trough period stemmed from embracing new consumption trends, such as the 'over ice' concept, transforming cider into a national drink from a regional preference. The historical decline in cider consumption due to the introduction of RTD products in the UK illustrates the susceptibility of the cider market to changing consumer behaviors and the influence of competing beverage categories. This phenomenon underscores the importance of proactive strategies to counter emerging competitive threats and retain consumer interest.

Cider Market Segment Analysis:

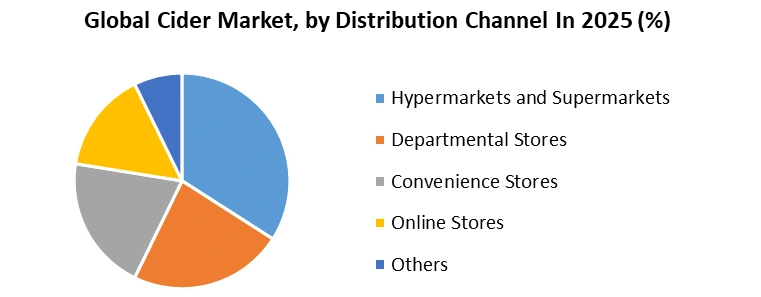

Based on product, based on product the global cider market is segmented into Perry Cider, Apple Cider, Fruit Flavoured Cider and Others. The fruit flavored category is the most lucrative in the global cider industry owing to the variety of flavors offered and the improvements made by different manufacturers to entice customers. Consumers are more health-conscious and want low-alcohol and gluten-free beverages, which is driving up demand for cider. The presence of well-known brands such as Kopparberg, Woodchuck, and Angry Orchard contributes to the growth of premium grade cider. The European cider market is more concentrated, while the North American industry is quickly expanding. If current growth continues at the same rate, fruit cider will be 48% of all cider by 2024. Based on distribution channel, Cider market is segmented into Hypermarkets and Supermarkets, Departmental Stores, Convenience Stores, Online Stores and Others. Online stores segment is expected to hold the largest share in the global cider market during the forecast period owing to the rising popularity of e-commerce websites among consumers across the globe. In addition, raising penetration of the internet and the growing usage of smart phones are also expected to drive the global cider market in a positive way. strategies and new café chains, blending premium coffee experiences with broad market accessibility and fueling overall coffee market growth.

Regional Insights:

Europe remains the dominant region in the global Cider Market and is expected to maintain its stronghold during the forecast period. The region’s leadership is primarily driven by the presence of key cider manufacturers, craft cider producers, and premium cider brands, alongside the widespread popularity of apple cider, hard cider, and flavored cider as preferred alcoholic beverages. The United Kingdom holds a pivotal position in the European cider market, hosting numerous major cider production companies. Other countries in central Europe, Spain, and Belgium have established themselves with distinctive cider varieties and fruit-infused cider, offering unique flavors such as sour and dry notes in regions like Rhineland-Palatinate and Hesse. The region’s longstanding tradition, coupled with the growing demand for gluten-free cider, organic cider, and craft cider, continues to reinforce its dominance in the European cider industry. North America is poised to register the highest CAGR in the global cider market during the forecast period. This growth is fueled by the expanding consumer base for hard cider, sparkling cider, and RTD cider. In the United States, brands such as Angry Orchard, Bold Rock, 2 Towns, and Ace have captured significant market share, driving substantial retail sales and increasing brand awareness. The Asia Pacific cider market is anticipated to witness robust growth, driven by rising per capita income, evolving consumer preferences, and increased disposable incomes. The expansion of bars, pubs, restaurants, and e-commerce cider sales platforms further supports the adoption of craft cider, premium cider, and flavored alcoholic beverages, bolstering the regional cider market growth.Europe dominates the global Cider Market, led by the United Kingdom, Germany, and France, with the highest production of traditional, craft, and premium ciders and strong consumer preference for apple-based and flavored alcoholic beverages. North America is the fastest-growing region, driven by rising demand for hard cider, RTD cider, and flavored cider, supported by increasing disposable incomes and expanding e-commerce and mobile ticketing platforms for beverage sales.

Cider Market Competitive Landscape

Recent developments in the cider market, such as Palo Alto Networks' acquisition of Cider Security, signal a heightened focus on fortifying application security amid escalating cyber threats. Schilling Cider's emphasis on sustainability and fostering partnerships with PNW farmers amplifies quality standards and promotes the introduction of diverse flavors to a wider audience. Fenceline Cider's innovative blends and accolades underscore the industry's pursuit of unique flavor profiles, catering to evolving consumer preferences. The ACA's CiderCon 2024 initiative, highlighting cider's agricultural heritage, fosters consumer connections, emphasizing storytelling in consumer goods, and potentially expanding consumer engagement and appreciation for cider's origins, which could drive market growth and consumer interest. Dec 20, 2023, Palo Alto Networks finalized the acquisition of Cider Security, specializing in application security and software supply chain security. This strategic move aligns with the escalating concern about application threats and vulnerabilities in modern software development. Cider's expertise integrates into Palo Alto Networks' Prisma® Cloud platform, fortifying early-stage security throughout the application lifecycle. The acquisition responds to the intensifying cybersecurity landscape as applications are increasingly vulnerable during continuous integration and delivery pipelines. This collaboration aims to preemptively safeguard against rising threats and security gaps, mirroring Gartner's projection of a significant surge in software supply chain attacks by 2025. Oct. 4, 2024, Amidst National Cider Month, Schilling Cider heralds the celebration, underscoring the essence of apple-centric hard beverages and fostering the cider industry's growth. As a Washington-based enterprise, Schilling Cider serves as a beacon of sustainability, emphasizing environmental consciousness, employee welfare, innovation, and quality enhancement within the hard cider sector. Notably, their profound ties with the cider community and partnerships with Pacific Northwest (PNW) farmers contribute to the production of high-quality ciders, leveraging 80% of the U.S.'s fresh apple supply. Schilling Cider's dedication extends to introducing the PNW's diverse flavors to a wider national audience through its world-class cider offerings. Apr 8, 2024, Fenceline Cider's recent accolades at the 2021 New York International Cider Competition highlight the industry's focus on artisanal craftsmanship and innovative flavor profiles. Their Windfall Cider, a French-style blend of Bittersweet apples sourced from Shawn Carney’s Atomic Orchard in Cedaredge, CO, signifies a growing trend towards unique fruit blends and slow fermentation in French oak casks. Similarly, their Understory Elderberry Cider, a blend of elderberry and heirloom apples, exemplifies the market's exploration of rich textures and diverse flavor combinations, packaged conveniently in a 12oz can or 4 packs. These award-winning offerings showcase the cider market's ongoing pursuit of distinctive, premium-quality beverages. On December 14, 2024, the American Cider Association (ACA) disclosed plans for CiderCon 2024, featuring apple growers and cider producers in its keynote lineup. Embracing the theme of Connecting to Consumers in an Age of Endless Choice, the event aims to spotlight cider's historical agricultural heritage in the US and globally. Michelle McGrath, ACA's CEO, emphasized the pivotal role of American apple growers within the cider supply chain, underscoring storytelling's growing significance in the consumer packaged goods industry. This initiative signifies a concerted effort to celebrate and highlight the agricultural roots integral to the narrative of the evolving market landscape.Global Cider Market Scope: Inquire before buying

Global Cider Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 17.42Bn. Forecast Period 2026 to 2032 CAGR: 6.4% Market Size in 2032: USD 26.90 Bn. Segments Covered: by Product Type Still Cider Sparkling Cider Draft Cider Apple Cider Fruit Flavored Cider Others by Packaging Type Draught Cans Glass Bottles Plastic Bottles Others by Distribution Channel Hypermarkets and Supermarkets Departmental Stores Convenience Stores Online Stores Others Cider Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Cider Market, Key Players

1. Anheuser-Busch Companies LLC (Missouri, U.S) 2. The Boston Beer Company (Boston, United States) 3. Angry Orchard (Walden, New York) 4. Smith & Forge (Massachusetts, United States) 5. Woodchuck (Middlebury, VT) 6. Seattle Cider Company (Seattle, Washington) 7. Asahi Premium Beverages(Victoria, Austria) 8. Aston Manor (Birmingham, United Kingdom) 9. C&C Group plc (United Kingdom) 10. Halewood (London, United Kingdom) 11. Celtic Marches Beverages Ltd (Worcestershire, United Kingdom) 12. Armagh Cider Company (Craigavon, United Kingdom) 13. Cider Ireland (Tipperary, Ireland) 14. Carlsberg Breweries A/S (Denmark, Europe) 15. Carlton & United Breweries (Victoria, Australia) 16. Distell Group Limited (Stellenbosch, South Africa) Asia Pacific 17. Heineken UK Limited (China) Rekorderlig Cider (Vimmerby, Sweden) 18. Kopparberg Brewery (Kopparberg, Sweden) 19. Thatchers Cider (Somerset, United Kingdom) 20. Westons Cider (Herefordshire, United Kingdom) 21. Aspall Cyder Ltd. (Suffolk, United Kingdom) 22. Bulmers / HP Bulmer (Hereford, United Kingdom) 23. SONOMA CIDER (California, United States) 24. Blake’s Hard Cider Co. (Michigan, United States) 25. Bold Rock Hard Cider (Virginia & North Carolina, U.S.) 26. 2 Towns Ciderhouse (Oregon, United States) 27. ACE Cider (California Cider Co.) (Sebastopol, California, U.S.) 28. Good George Brewing (Hamilton, New Zealand) 29. Saigon Cider (Ho Chi Minh City, Vietnam) 30. Kirin Holdings (Mercian Cider Division) (Tokyo, Japan) FAQs: 1. What are the growth drivers for the Market? Ans. Health-Conscious Choices Fueling the Market's Evolution and is expected to be the major driver for the Cider Market. 2. What is the major Opportunity for the Market growth? Ans. Flavor Innovation Driving Market Growth through Diverse Profiles is expected to be the major Opportunity in the Market. 3. Which country is expected to lead the global Market during the forecast period? Ans. Europe is expected to lead the Market during the forecast period. 4. What is the projected market size and growth rate of the Market? Ans. The Cider Market size was valued at USD 17.42 Billion in 2025 and the total Cider revenue is expected to grow at a CAGR of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. 5. What segments are covered in the Cider Market report? Ans. The segments covered in the Cider Market report are by Product Type, Packaging Type, Distribution Channel, and Region.

1. Cider Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cider Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. MMR Comptetive Positioning 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End-User Segment 2.3.5. Revenue Details in 2025 2.3.6. Market Share (%) 2.3.7. Profit Margin(%) 2.3.8. Growth Rate [Y-o-Y %)] 2.3.9. Technologies Advancements 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Cider Market: Dynamics 3.1. Cider Market Trends 3.2. Cider Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis For the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Industry Technology & Production Process Analysis 4.1. Advancements in fermentation technologies improving cider flavor consistency 4.2. Innovative filtration systems enabling stable clarity and extended shelf life 4.3. Automation in bottling, packaging, and labeling enhancing operational efficiency 4.4. Digital monitoring systems improving fermentation accuracy and product stability 4.5. Sustainable production technologies reducing carbon footprints and water usage 4.6. Cold-chain logistics innovations enhancing cider distribution quality preservation 5. Cost Structure, Pricing Model & Profitability Analysis 5.1. Breakdown of production cost components across small and large manufacturers 5.2. Variations in raw material sourcing and seasonal apple price fluctuations 5.3. Packaging, transportation, and storage cost implications on final cider prices 5.4. Profitability assessment across craft cideries, large breweries, and distributors 5.5. Pricing elasticity analysis based on region, product type, and brand segment 5.6. Retail margin structures across on-trade and off-trade distribution channels 6. Consumer Analysis & Behavioral Insights 6.1. Consumer demographic profiling across age, gender, income, and lifestyle groups 6.2. Growing preference for flavored ciders among younger urban drinkers globally 6.3. Influence of health-conscious behaviors driving low-sugar cider variant demand 6.4. Spending patterns across premium, craft, and commercial cider categories 6.5. Social-media-driven purchasing behavior influencing cider brand visibility 6.6. On-trade versus off-trade consumption preferences shaping distribution strategies 6.7. Analysis of festive, seasonal, and occasion-based cider consumption patterns 7. Regional & Country-Level Market Analysis 7.1. North America cider growth driven by craft innovations and premium branding 7.2. Europe maintaining leadership due to heritage consumption and strong producers 7.3. Asia-Pacific market expansion fueled by rising incomes and urban nightlife culture 7.4. Latin American growth driven by western beverage influence and premium imports 7.5. Middle East & Africa opportunities emerging from tourism and urban retail growth 7.6. Country-level forecasting for top 25 cider-consuming and producing nations 8. Supply Chain, Sourcing Strategy & Value Chain Mapping 8.1. Raw material sourcing patterns across key apple-producing regions globally 8.2. Supplier evaluation models based on cost, quality, and sustainability indicators 8.3. Mapping of value chain from orchards to distribution channels and retail partners 8.4. Logistics network optimization improving shelf life and distribution speed 9. Cider Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 9.1. Cider Market Size and Forecast, By Product Type (2025-2032) 9.1.1.1. Still Cider 9.1.1.2. Sparkling Cider 9.1.1.3. Draft Cider 9.1.1.4. Apple Cider 9.1.1.5. Fruit Flavored Cider 9.1.1.6. Others 9.2. Cider Market Size and Forecast, By Packaging Type (2025-2032) 9.2.1. Draught 9.2.2. Cans 9.2.3. Glass Bottles 9.2.4. Plastic Bottles 9.2.5. Others 9.3. Cider Market Size and Forecast, By Distribution Channel (2025-2032) 9.3.1. Hypermarkets and Supermarkets 9.3.2. Departmental Stores 9.3.3. Convenience Stores 9.3.4. Online Stores 9.3.5. Others 9.4. Cider Market Size and Forecast, By Region (2025-2032) 9.4.1. North America 9.4.2. Europe 9.4.3. Asia Pacific 9.4.4. Middle East and Africa 9.4.5. South America 10. North America Cider Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 10.1. North America Cider Market Size and Forecast, By Product Type (2025-2032) 10.1.1. Still Cider 10.1.2. Sparkling Cider 10.1.3. Draft Cider 10.1.4. Apple Cider 10.1.5. Fruit Flavored Cider 10.1.6. Others 10.2. North America Cider Market Size and Forecast, By Packaging Type (2025-2032) 10.2.1. Draught 10.2.2. Cans 10.2.3. Glass Bottles 10.2.4. Plastic Bottles 10.2.5. Others 10.3. North America Cider Market Size and Forecast, By Distribution Channel (2025-2032) 10.3.1. Hypermarkets and Supermarkets 10.3.2. Departmental Stores 10.3.3. Convenience Stores 10.3.4. Online Stores 10.3.5. Others 10.4. North America Cider Market Size and Forecast, by Country (2025-2032) 10.4.1. United States 10.4.1.1. United States Cider Market Size and Forecast, By Product Type (2025-2032) 10.4.1.1.1. Still Cider 10.4.1.1.2. Sparkling Cider 10.4.1.1.3. Draft Cider 10.4.1.1.4. Apple Cider 10.4.1.1.5. Fruit Flavored Cider 10.4.1.1.6. Others 10.4.1.2. United States Cider Market Size and Forecast, By Packaging Type (2025-2032) 10.4.1.2.1. Draught 10.4.1.2.2. Cans 10.4.1.2.3. Glass Bottles 10.4.1.2.4. Plastic Bottles 10.4.1.2.5. Others 10.4.1.3. United States Cider Market Size and Forecast, By Distribution Channel (2025-2032) 10.4.1.3.1. Hypermarkets and Supermarkets 10.4.1.3.2. Departmental Stores 10.4.1.3.3. Convenience Stores 10.4.1.3.4. Online Stores 10.4.1.3.5. Others 10.4.2. Canada 10.4.2.1. Canada Cider Market Size and Forecast, By Product Type (2025-2032) 10.4.2.1.1. Still Cider 10.4.2.1.2. Sparkling Cider 10.4.2.1.3. Draft Cider 10.4.2.1.4. Apple Cider 10.4.2.1.5. Fruit Flavored Cider 10.4.2.1.6. Others 10.4.2.2. Canada Cider Market Size and Forecast, By Packaging Type (2025-2032) 10.4.2.2.1. Draught 10.4.2.2.2. Cans 10.4.2.2.3. Glass Bottles 10.4.2.2.4. Plastic Bottles 10.4.2.2.5. Others 10.4.2.3. Canada Cider Market Size and Forecast, By Distribution Channel (2025-2032) 10.4.2.3.1. Hypermarkets and Supermarkets 10.4.2.3.2. Departmental Stores 10.4.2.3.3. Convenience Stores 10.4.2.3.4. Online Stores 10.4.2.3.5. Others 10.4.3. Mexico 10.4.3.1. Mexico Cider Market Size and Forecast, By Product Type (2025-2032) 10.4.3.1.1. Still Cider 10.4.3.1.2. Sparkling Cider 10.4.3.1.3. Draft Cider 10.4.3.1.4. Apple Cider 10.4.3.1.5. Fruit Flavored Cider 10.4.3.1.6. Others 10.4.3.2. Mexico Cider Market Size and Forecast, By Packaging Type (2025-2032) 10.4.3.2.1. Draught 10.4.3.2.2. Cans 10.4.3.2.3. Glass Bottles 10.4.3.2.4. Plastic Bottles 10.4.3.2.5. Others 10.4.3.3. Mexico Cider Market Size and Forecast, By Distribution Channel (2025-2032) 10.4.3.3.1. Hypermarkets and Supermarkets 10.4.3.3.2. Departmental Stores 10.4.3.3.3. Convenience Stores 10.4.3.3.4. Online Stores 10.4.3.3.5. Others 11. Europe Cider Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 11.1. Europe Cider Market Size and Forecast, By Product Type (2025-2032) 11.2. Europe Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.3. Europe Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4. Europe Cider Market Size and Forecast, by Country (2025-2032) 11.4.1. United Kingdom 11.4.1.1. United Kingdom Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.1.2. United Kingdom Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.1.3. United Kingdom Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.2. France 11.4.2.1. France Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.2.2. France Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.2.3. France Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.3. Germany 11.4.3.1. Germany Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.3.2. Germany Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.3.3. Germany Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.4. Italy 11.4.4.1. Italy Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.4.2. Italy Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.4.3. Italy Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.5. Spain 11.4.5.1. Spain Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.5.2. Spain Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.5.3. Spain Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.6. Sweden 11.4.6.1. Sweden Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.6.2. Sweden Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.6.3. Sweden Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.7. Russia 11.4.7.1. Russia Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.7.2. Russia Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.7.3. Russia Cider Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.8. Rest of Europe 11.4.8.1. Rest of Europe Cider Market Size and Forecast, By Product Type (2025-2032) 11.4.8.2. Rest of Europe Cider Market Size and Forecast, By Packaging Type (2025-2032) 11.4.8.3. Rest of Europe Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12. Asia Pacific Cider Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 12.1. Asia Pacific Cider Market Size and Forecast, By Product Type (2025-2032) 12.2. Asia Pacific Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.3. Asia Pacific Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4. Asia Pacific Cider Market Size and Forecast, by Country (2025-2032) 12.4.1. China 12.4.1.1. China Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.1.2. China Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.1.3. China Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.2. S Korea 12.4.2.1. S Korea Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.2.2. S Korea Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.2.3. S Korea Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.3. Japan 12.4.3.1. Japan Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.3.2. Japan Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.3.3. Japan Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.4. India 12.4.4.1. India Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.4.2. India Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.4.3. India Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.5. Australia 12.4.5.1. Australia Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.5.2. Australia Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.5.3. Australia Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.6. Indonesia 12.4.6.1. Indonesia Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.6.2. Indonesia Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.6.3. Indonesia Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.7. Malaysia 12.4.7.1. Malaysia Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.7.2. Malaysia Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.7.3. Malaysia Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.8. Philippines 12.4.8.1. Philippines Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.8.2. Philippines Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.8.3. Philippines Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.9. Thailand 12.4.9.1. Thailand Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.9.2. Thailand Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.9.3. Thailand Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.10. Vietnam 12.4.10.1. Vietnam Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.10.2. Vietnam Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.10.3. Vietnam Cider Market Size and Forecast, By Distribution Channel (2025-2032) 12.4.11. Rest of Asia Pacific 12.4.11.1. Rest of Asia Pacific Cider Market Size and Forecast, By Product Type (2025-2032) 12.4.11.2. Rest of Asia Pacific Cider Market Size and Forecast, By Packaging Type (2025-2032) 12.4.11.3. Rest of Asia Pacific Cider Market Size and Forecast, By Distribution Channel (2025-2032) 13. Middle East and Africa Cider Market Size and Forecast (by Value in USD Million) (2025-2032 13.1. Middle East and Africa Cider Market Size and Forecast, By Product Type (2025-2032) 13.2. Middle East and Africa Cider Market Size and Forecast, By Packaging Type (2025-2032) 13.3. Middle East and Africa Cider Market Size and Forecast, By Distribution Channel (2025-2032) 13.4. Middle East and Africa Cider Market Size and Forecast, by Country (2025-2032) 13.4.1. South Africa 13.4.1.1. South Africa Cider Market Size and Forecast, By Product Type (2025-2032) 13.4.1.2. South Africa Cider Market Size and Forecast, By Packaging Type (2025-2032) 13.4.1.3. South Africa Cider Market Size and Forecast, By Distribution Channel (2025-2032) 13.4.2. GCC 13.4.2.1. GCC Cider Market Size and Forecast, By Product Type (2025-2032) 13.4.2.2. GCC Cider Market Size and Forecast, By Packaging Type (2025-2032) 13.4.2.3. GCC Cider Market Size and Forecast, By Distribution Channel (2025-2032) 13.4.3. Egypt 13.4.3.1. Egypt Cider Market Size and Forecast, By Product Type (2025-2032) 13.4.3.2. Egypt Cider Market Size and Forecast, By Packaging Type (2025-2032) 13.4.3.3. Egypt Cider Market Size and Forecast, By Distribution Channel (2025-2032) 13.4.4. Nigeria 13.4.4.1. Nigeria Cider Market Size and Forecast, By Product Type (2025-2032) 13.4.4.2. Nigeria Cider Market Size and Forecast, By Packaging Type (2025-2032) 13.4.4.3. Nigeria Cider Market Size and Forecast, By Distribution Channel (2025-2032) 13.4.5. Rest of ME&A 13.4.5.1. Rest of ME&A Cider Market Size and Forecast, By Product Type (2025-2032) 13.4.5.2. Rest of ME&A Cider Market Size and Forecast, By Packaging Type (2025-2032) 13.4.5.3. Rest of ME&A Cider Market Size and Forecast, By Distribution Channel (2025-2032) 14. South America Cider Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032 14.1. South America Cider Market Size and Forecast, By Product Type (2025-2032) 14.2. South America Cider Market Size and Forecast, By Packaging Type (2025-2032) 14.3. South America Cider Market Size and Forecast, By Distribution Channel (2025-2032) 14.4. South America Cider Market Size and Forecast, by Country (2025-2032) 14.4.1. Brazil 14.4.1.1. Brazil Cider Market Size and Forecast, By Product Type (2025-2032) 14.4.1.2. Brazil Cider Market Size and Forecast, By Packaging Type (2025-2032) 14.4.1.3. Brazil Cider Market Size and Forecast, By Distribution Channel (2025-2032) 14.4.2. Argentina 14.4.2.1. Argentina Cider Market Size and Forecast, By Product Type (2025-2032) 14.4.2.2. Argentina Cider Market Size and Forecast, By Packaging Type (2025-2032) 14.4.2.3. Argentina Cider Market Size and Forecast, By Distribution Channel (2025-2032) 14.4.3. Colombia 14.4.3.1. Colombia Cider Market Size and Forecast, By Product Type (2025-2032) 14.4.3.2. Colombia Cider Market Size and Forecast, By Packaging Type (2025-2032) 14.4.3.3. Colombia Cider Market Size and Forecast, By Distribution Channel (2025-2032) 14.4.4. Chile 14.4.4.1. Chile Cider Market Size and Forecast, By Product Type (2025-2032) 14.4.4.2. Chile Cider Market Size and Forecast, By Packaging Type (2025-2032) 14.4.4.3. Chile Cider Market Size and Forecast, By Distribution Channel (2025-2032) 14.4.5. Rest Of South America 14.4.5.1. Rest Of South America Cider Market Size and Forecast, By Product Type (2025-2032) 14.4.5.2. Rest Of South America Cider Market Size and Forecast, By Packaging Type (2025-2032) 14.4.5.3. Rest Of South America Cider Market Size and Forecast, By Distribution Channel (2025-2032) 15. Company Profile: Key Players 15.1. Anheuser-Busch Companies LLC (Missouri, U.S) 15.1.1. Company Overview 15.1.2. Business Portfolio 15.1.3. Financial Overview 15.1.4. SWOT Analysis 15.1.5. Strategic Analysis 15.1.6. Recent Developments 15.2. The Boston Beer Company (Boston, United States) 15.3. Angry Orchard (Walden, New York) 15.4. Smith & Forge (Massachusetts, United States) 15.5. Woodchuck (Middlebury, VT) 15.6. Seattle Cider Company (Seattle, Washington) 15.7. Asahi Premium Beverages (Victoria, Austria) 15.8. Aston Manor (Birmingham, United Kingdom) 15.9. C&C Group plc (United Kingdom) 15.10. Halewood (London, United Kingdom) 15.11. Celtic Marches Beverages Ltd (Worcestershire, United Kingdom) 15.12. Armagh Cider Company (Craigavon, United Kingdom) 15.13. Cider Ireland (Tipperary, Ireland) 15.14. Carlsberg Breweries A/S (Denmark, Europe) 15.15. Carlton & United Breweries (Victoria, Australia) 15.16. Distell Group Limited (Stellenbosch, South Africa) Asia Pacific 15.17. Heineken UK Limited (China) Rekorderlig Cider (Vimmerby, Sweden) 15.18. Kopparberg Brewery (Kopparberg, Sweden) 15.19. Thatchers Cider (Somerset, United Kingdom) 15.20. Westons Cider (Herefordshire, United Kingdom) 15.21. Aspall Cyder Ltd. (Suffolk, United Kingdom) 15.22. Bulmers / HP Bulmer (Hereford, United Kingdom) 15.23. SONOMA CIDER (California, United States) 15.24. Blake’s Hard Cider Co. (Michigan, United States) 15.25. Bold Rock Hard Cider (Virginia & North Carolina, U.S.) 15.26. 2 Towns Ciderhouse (Oregon, United States) 15.27. ACE Cider (California Cider Co.) (Sebastopol, California, U.S.) 15.28. Good George Brewing (Hamilton, New Zealand) 15.29. Saigon Cider (Ho Chi Minh City, Vietnam) 15.30. Kirin Holdings (Mercian Cider Division) (Tokyo, Japan) 16. Key Findings 17. Industry Recommendations 18. Cider Market: Research Methodology