The Chewing Gum Market size was valued at USD 18.49 Billion in 2024 and the total Chewing Gum revenue is expected to grow at a CAGR of 2.01% from 2025 to 2032, reaching nearly USD 21.68 Billion in 2032. The Chewing Gum operates the broader confectionery and fast-moving consumer goods (FMCG) industry, shaped by behavioral consumption patterns, socio-cultural influences, and innovation-driven product development. The Chewing Gum market is fundamentally driven by the psychological and sensory appeal of chewing, which is associated with refreshment, stress relief, habit-forming behavior, and social acceptance. Chewing gum functions as both a recreational product and a utilitarian item, creating dual demand from pleasure-seeking consumers and seeking functional benefits such as oral hygiene, energy enhancement, smoking cessation, or nutritional supplementation. The Chewing Gum consumer behavior, where preference formation is influenced by taste, convenience, health perceptions, price sensitivity, and brand loyalty. The shift toward sugar-free and functional gums reflects the health belief model, where consumers choose products that align with preventive health behaviors. Additionally, the rise of natural, clean-label, and biodegradable gums aligns with theories of sustainable consumption and ethical purchasing, driven by environmental consciousness.To know about the Research Methodology:-Request Free Sample Report

Chewing Gum Market Dynamics:

The global chewing gum market is undergoing a significant transformation driven by shifting consumer preferences, lifestyle changes, and continuous innovation across formulation, flavor, and functionality. One of the foremost developments shaping market dynamics is the rapid rise of sugar-free and functional chewing gums. With increasing global awareness about oral hygiene, dental health, and low-calorie intake, sugar-free chewing gum now accounts for nearly 58–60% of the total market share, up from 48% ten years ago. Consumers are choosing xylitol- and sorbitol-based formulations due to their proven dental benefits, including reduced cavity risks and enhanced salivary flow. Parallel to this shift, the market is witnessing unprecedented growth in functional gum categories such as nicotine gum, vitamin-infused gum, probiotic gum, energy gum, and CBD gum. These specialized products are supported by demand from health-conscious consumers, urban professionals, and individuals seeking convenient wellness formats. Such trends highlight the evolution of chewing gum from a traditional confectionery item to a multifunctional, on-the-go wellness product. The major factor influencing the chewing gum market is the boom in flavor innovation and clean-label product development. Manufacturers are investing in new flavor combinations, long-lasting flavor technologies, and multi-layer gum formats to enhance consumer experience and strengthen brand differentiation. Fruit, mint, cooling-effect, and hybrid flavors dominate new global launches, driven by the preferences of younger demographics. Clean-label gum, which avoids artificial sweeteners such as aspartame and synthetic plasticizers, is gaining substantial traction in developed markets such as the United States, Germany, France, Japan, and the Nordic region, where natural ingredients are increasingly valued. These natural gums are contributing to the growth of eco-friendly chewing gum alternatives, with the biodegradable gum segment, presenting new opportunities for sustainability-driven manufacturers. Production trends the competitive landscape of the global chewing gum market. Annual global production ranges between 1.7 and 1.9 million tonnes, dominated by multinational giants such as Mars Wrigley, Mondelez International, Perfetti Van Melle, Lotte Confectionery, and Ferrero. These companies collectively hold 55–60% of global market share, supported by advanced manufacturing capabilities, extensive product portfolios, international distribution networks, and long-established brand recognition. The United States leads production with an estimated 580,000–600,000 tonnes annually, particularly in sugar-free and functional gum categories. China, producing around 320,000–350,000 tonnes, is a major global exporter and a key supplier for Asia-Pacific markets. Turkey, Mexico, and select European countries remain important production hubs due to their cost-efficient manufacturing bases and strategic export capabilities. Price dynamics play a critical role in shaping profitability and market competitiveness. In 2024, average global prices ranged between USD 3.2 and 5.5 per kg for standard chewing gum, USD 4.5–7.2 per kg for sugar-free gum, and USD 11–18 per kg for functional gum variants. Premium natural gum products, including plant-based gum bases, fetch USD 12–16 per kg due to higher production costs and niche demand. Raw material price fluctuations—particularly in natural sweeteners and mint oils—have affected production economics. Xylitol prices increased by 6–8% in late 2024, primarily due to limited birchwood supply in Finland and China. Similarly, mint oil prices showed volatility after lower-than-expected crop yields in India, which supplies nearly 80% of the world’s mint oils. These fluctuations have encouraged manufacturers to adopt cost-optimization strategies, alternative sweetener blends, and more efficient packaging solutions. Evolving consumer behavior is among the core drivers reshaping demand patterns. Young consumers, particularly teens and young adults, represent 45–48% of global gum consumption, preferring innovative flavors, sensory cooling effects, and interactive product formats. With growing concern over sugar content and oral hygiene, a substantial portion of consumers in urban markets now opt for sugar-free gum after meals, supported by dental associations worldwide. The rise of “on-the-go freshness” lifestyles has also boosted demand for pocket-sized packs and mini-format gums, which have grown 18–20% year-on-year. Meanwhile, smoking reduction trends have propelled the rapid growth of nicotine gum, expanding at 10–12% CAGR, supported by smoking cessation programs and increasing health awareness. The trend toward mindful snacking is pushing consumers away from high-calorie sweets toward healthier chewing alternatives, reinforcing long-term growth prospects for the chewing gum industry. Global trade patterns underscore the increasing demand for value-added gum products across international Chewing Gum market. Turkey emerged as the world’s largest exporter in 2023–2024, with export revenues of USD 475–520 million, followed by the United States with USD 420–460 million, China with USD 310–335 million, and the Netherlands, which recorded USD 190–210 million. Countries in Southeast Asia, Africa, and Latin America are becoming rapidly expanding import markets due to growing urban populations, Western-style retail formats, and rising demand for affordable yet high-quality confectionery products. Functional gums—particularly nicotine, vitamin, and energy variants are becoming the fastest-growing export segment, presenting strong opportunities for manufacturers investing in R&D and technological innovation.Chewing Gum Market Segment Analysis:

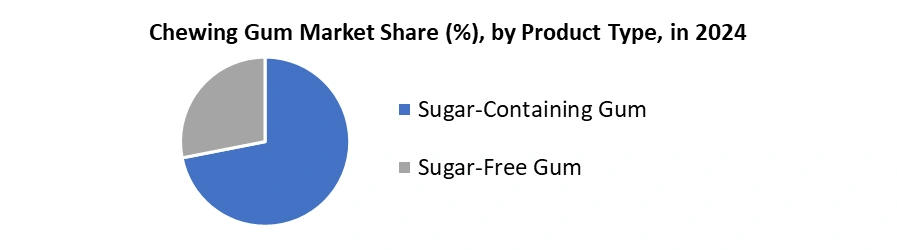

Sugar-free gum remained the dominant and fastest-growing segment in 2024, accounting for more than 55–60% of the global market. Its leadership was supported by strong consumer preference for oral-care benefits, lower calories, and dentist-endorsed ingredients such as xylitol. The segment benefited from lifestyle shifts toward preventive health, sugar reduction, and functional products. Innovations such as long-lasting flavours, whitening agents, vitamin-infused gums, and natural sweeteners further strengthened its appeal. Sugar-free gum also gained traction through supermarkets, pharmacies, and online platforms. With rising health consciousness, this segment consistently outperformed traditional sugar-containing variants. Sugar-containing gum dominated the traditional and legacy segment of the chewing gum market in 2024. Its demand driven due to strong penetration in developing countries, affordable pricing, and a wide variety of sweet flavours targeted at children and younger consumers. The segment continued to hold relevance due to impulse purchases at convenience stores and cultural preferences for sugary products. However, its growth had slowed significantly as global consumers became more aware of the negative health effects linked to sugar intake and dental decay. Increasing oral-health awareness campaigns, rising regulatory pressure on sugar consumption, and the growing popularity of healthier snacking habits further reduced demand. The sugar-containing gum-maintained importance in regions such as Asia, Latin America, and the Middle East, it increasingly lost share to healthier alternatives.

Regional Analysis:

North America is the dominant market with a 33–35% share in 2024, supported by high per capita consumption and strong demand for sugar-free and functional gum products. Europe, accounting for 27–29%, shows stable growth, driven by premium and natural gum offerings. The Asia-Pacific region, with a 26–28% market share, is forecast to be the fastest-growing region, supported by rising disposable incomes, rapid urbanization, and increasing consumer interest in flavored and sugar-free chewing gum. Markets such as India, China, Indonesia, and Vietnam display strong upward trends, while Japan and South Korea lead in consumption of wellness-oriented mouth-freshening gums. Latin America and the Middle East & Africa contribute modest shares, rapid expansion of modern retail and increasing exposure to Western confectionery trends are creating new sales opportunities.Competitive Landscape:

The chewing gum market characterized by strong consolidation, with a few global players dominating share through extensive distribution networks, brand loyalty, and continuous product innovation. Key companies such as Mars Wrigley, Mondelez International, Perfetti Van Melle, Lotte Confectionery, and Cloetta held leadership positions. These firms competed through flavour innovation, sugar-free formulations, long-lasting taste technologies, and functional gum offerings such as oral-care and nicotine-replacement gums. Regional players in Asia and Latin America expanded their presence through affordable price points and localized flavours. Sustainability, clean-label ingredients, and natural gum bases increasingly shaped competitive strategies.Recent Development:

• Mondelez International reshaped its portfolio by divesting its developed-market gum business including brands like Trident, Dentyne, and Bubblicious to Perfetti Van Melle in 2023, enabling strategic focus on chocolate and biscuits. The company continued strengthening emerging-market gum operations while investing in product innovation through natural sweeteners and long-lasting flavour systems. Mondelez advanced sustainability goals by improving supply-chain transparency and expanding recyclable packaging initiatives. • Perfetti Van Melle made one of the most significant moves in the gum industry by acquiring Mondelez International’s developed-market gum portfolio in 2023, effectively doubling its North American business and expanding its footprint in Europe. The acquisition strengthened Perfetti’s position with brands like Trident, Dentyne, and Bubbilicious. The company committed to sustainability by adopting science-based emission-reduction targets and expanding renewable-energy use at manufacturing sites.Scope of the Global Chewing Gum Market: Inquire before buying

Chewing Gum Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 18.49 Bn. Forecast Period 2025 to 2032 CAGR: 2.01% Market Size in 2032: USD 21.68 Bn. Segments Covered: by Product Sugar-free Gum Sugared Gum by Format Stick Gum Pellet/Tablet Gum Center-Filled Gum Liquid-Filled Gum Others by Distribution Channel Supermarkets / Hypermarkets Convenience Stores Specialty Stores Pharmacies / Drugstores (especially for functional and smoking-cessation gum) Online / E-commerce Global Chewing Gum Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Chewing Gum Market, Key players

1. Hershey 2. Mars Incorporated 3. Mondelez International 4. Tootsie Roll Industries 5. Kraft Heinz 6. Marich Confectionery 7. Simply Gum 8. Glee Gums 9. Lotte Ventures 10. Intergum 11. Takasago International 12. suifafood 13. gudgum 14. Perfetti Van Melle 15. Cloetta 16. Haribo 17. Mind The Gum 18. Alpengummi 19. Milliways Food 20. BenBits 21. Eace Gum 22. The PUR Company 23. VitaeGum 24. Sharawigroup 25. Arcor GroupFAQs

1. Which region has the largest share in Global Chewing Gum Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global Chewing Gum Market? Ans: The Global Chewing Gum Market is growing at a CAGR of 2.01% during forecasting period 2025-2032. 3. What is scope of the Global Chewing Gum market report? Ans: Global Chewing Gum Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What was the Global Chewing Gum Market size in 2024? Ans: The Global Chewing Gum Market size was USD 18.49 Billion in 2024.

1. Chewing Gum Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion)-By Segments, Regions, and Country 2. Chewing Gum Market : Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Chewing Gum Market : Dynamics 3.1. Chewing Gum Market Trends 3.2. Chewing Gum Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Biscuits Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Pricing Analysis 4.1. Historical Price Analysis of the Chewing Gum Market (2019–2024) 4.2. Average Selling Price (ASP) Trends in the Industry (2019–2024) 4.3. Price Variations By Product in the Chewing Gum Market 4.4. Cost Structure Analysis Production and Pricing 4.5. Raw Material Costs 4.6. Manufacturing Costs 4.7. Distribution & Logistics 5. Import & Export Analysis 5.1. Global Import–Export Trends of the Chewing Gum Market 5.2. Major Exporting Countries and Trade Flows 5.3. Major Importing Countries and Demand Patterns 5.4. Trade Balance Assessment by Region 5.5. Tariffs, Duties, and Cross-Border Trade Barrier 6. Consumer Preference Analysis 6.1. Industrial Consumer Requirements 6.2. Growing Demand for Eco-Friendly Solutions 6.3. End-User Buying Criteria 7. Chewing Gum Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Chewing Gum Market Size and Forecast, By Product (2024-2032) 7.1.1.1. Sugar-Containing Gum 7.1.1.2. Sugar-Free Gum 7.2. Chewing Gum Market Size and Forecast, By Format (2024-2032) 7.2.1.1. Stick Gum 7.2.1.2. Pellet/Tablet Gum 7.2.1.3. Center-Filled Gum 7.2.1.4. Liquid-Filled Gum 7.2.1.5. Others 7.3. Chewing Gum Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.1.1. Supermarkets / Hypermarkets 7.3.1.2. Convenience Stores 7.3.1.3. Specialty Stores 7.3.1.4. Pharmacies / Drugstores 7.3.1.5. Online / E-commerce 7.4. Chewing Gum Market Size and Forecast, By Region (2024-2032) 7.4.1.1. North America 7.4.1.2. Europe 7.4.1.3. Asia Pacific 7.4.1.4. Middle East and Africa 7.4.1.5. South America 8. North America Chewing Gum Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. North America Chewing Gum Market Size and Forecast, By Product (2024-2032) 8.1.1.1. Sugar-Containing Gum 8.1.1.2. Sugar-Free Gum 8.2. North America Chewing Gum Market Size and Forecast, By Format (2024-2032) 8.2.1.1. Stick Gum 8.2.1.2. Pellet/Tablet Gum 8.2.1.3. Center-Filled Gum 8.2.1.4. Liquid-Filled Gum 8.2.1.5. Others 8.3. North America Chewing Gum Market Size and Forecast, By Distribution Channel (2024-2032) 8.3.1.1. Supermarkets / Hypermarkets 8.3.1.2. Convenience Stores 8.3.1.3. Specialty Stores 8.3.1.4. Pharmacies / Drugstores 8.3.1.5. Online / E-commerce 8.4. North America Chewing Gum Market Size and Forecast, by Country (2024-2032) 8.4.1.1. United States 8.4.1.2. Canada 8.4.1.3. Mexico 9. Europe Chewing Gum Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. Europe Chewing Gum Market Size and Forecast, By Product (2024-2032) 9.2. Europe Chewing Gum Market Size and Forecast, By Format (2024-2032) 9.3. Europe Chewing Gum Market Size and Forecast, By Distribution Channel (2024-2032) 9.4. Europe Chewing Gum Market Size and Forecast, By Country (2024-2032) 9.4.1. United Kingdom 9.4.2. France 9.4.3. Germany 9.4.4. Italy 9.4.5. Spain 9.4.6. Sweden 9.4.7. Russia 9.4.8. Rest of Europe 10. Asia Pacific Chewing Gum Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1. Asia Pacific Chewing Gum Market Size and Forecast, By Product (2024-2032) 10.2. Asia Pacific Chewing Gum Market Size and Forecast, By Format (2024-2032) 10.3. Asia Pacific Chewing Gum Market Size and Forecast, By Distribution Channel (2024-2032) 10.4. Asia Pacific Chewing Gum Market Size and Forecast, by Country (2024-2032) 10.4.1. China 10.4.2. S Korea 10.4.3. Japan 10.4.4. India 10.4.5. Australia 10.4.6. Indonesia 10.4.7. Malaysia 10.4.8. Philippines 10.4.9. Thailand 10.4.10. Vietnam 10.4.11. Rest of Asia Pacific 11. Middle East and Africa Chewing Gum Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 11.1. Middle East and Africa Chewing Gum Market Size and Forecast, By Product (2024-2032) 11.2. Middle East and Africa Chewing Gum Market Size and Forecast, By Format (2024-2032) 11.3. Middle East and Africa Chewing Gum Market Size and Forecast, By Distribution Channel (2024-2032) 11.4. Middle East and Africa Chewing Gum Market Size and Forecast, By Country (2024-2032) 11.4.1. South Africa 11.4.2. GCC 11.4.3. Nigeria 11.4.4. Rest of ME&A 12. South America Chewing Gum Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 12.1. South America Chewing Gum Market Size and Forecast, By Product (2024-2032) 12.2. South America Chewing Gum Market Size and Forecast, By Format (2024-2032) 12.3. South America Chewing Gum Market Size and Forecast, By Distribution Channel (2024-2032) 12.4. South America Chewing Gum Market Size and Forecast, By Country (2024-2032) 12.4.1. Brazil 12.4.2. Argentina 12.4.3. Colombia 12.4.4. Chile 12.4.5. Rest of South America 13. Company Profile: Key Players 13.1. Hershey 13.1.1. Company Overview 13.1.2. Business Portfolio 13.1.3. Financial Overview 13.1.4. SWOT Analysis 13.1.5. Strategic Analysis 13.2. Mars Incorporated 13.3. Mondelez International 13.4. Tootsie Roll Industries 13.5. Kraft Heinz 13.6. Marich Confectionery 13.7. Simply Gum 13.8. Glee Gums 13.9. Lotte Ventures 13.10. Intergum 13.11. Takasago International 13.12. suifafood 13.13. gudgum 13.14. Perfetti Van Melle 13.15. Cloetta 13.16. Haribo 13.17. Mind The Gum 13.18. Alpengummi 13.19. Milliways Food 13.20. BenBits 13.21. Eace Gum 13.22. The PUR Company 13.23. VitaeGum 13.24. Sharawigroup 13.25. Arcor Group 13.26. Others 14. Key Findings 15. Analyst Recommendations 16. Chewing Gum Market – Research Methodology