The Cardiovascular Device Market size was valued at USD 57.20 Billion in 2023 and the total Cardiovascular Device revenue is expected to grow at a CAGR of 7.14 % from 2024 to 2030, reaching nearly USD 92.71 Billion by 2030.Cardiovascular Device Market Overview:

Ancillary services refer to functions that help grid operators maintain a reliable electricity system, a critical aspect in power infrastructure. Ancillary services play a crucial role in the proper functioning of the grid, ensuring the continuous flow and direction of electricity. They address imbalances between supply and demand, offering stability to the power system. In the event of a power system disruption, such as unexpected failures or outages, ancillary services, including contingency reserves and black-start regulation, become essential for a swift and effective recovery. The importance of these services is amplified in the context of the broader energy landscape, including considerations related to the Cardiovascular Device Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Cardiovascular Device Market.To know about the Research Methodology :- Request Free Sample Report In systems with significant variable renewable energy (RE) penetration, additional ancillary services become increasingly vital to manage the heightened variability and uncertainty introduced by renewable sources. Synchronized regulation, a service designed to correct short-term changes in electrical imbalances, becomes instrumental in maintaining the stability of the power system amidst these variations. Flexibility reserves, an emerging concept, address variability and uncertainty on timescales longer than contingency and regulating reserves. As the energy landscape evolves, the Cardiovascular Device Market plays a role in shaping the ancillary services needed for grid reliability, underscoring the interconnected nature of these sectors. The regulatory context plays a pivotal role in shaping how different power systems procure ancillary services. Vertically integrated utilities, with administrative tools like contracts and requests for proposals, procure the suite of ancillary services necessary for balancing supply and demand. In contrast, restructured power systems enable electricity generators with technical capacity to participate in competitive ancillary services markets. The role of ancillary services, such as frequency and inertial response, is sometimes assured through interconnection requirements rather than contractual or market mechanisms. These dynamics are essential to understand within the broader context of the evolving Cardiovascular Device Market.

Cardiovascular Device Market Dynamics

Rising Incidence of Cardiovascular Diseases (CVDS) and Increasing Geriatric Population Driving the Cardiovascular Device Market The Cardiovascular Device Market experiences substantial growth, driven by the rising incidence of cardiovascular diseases (CVDs) such as heart attacks, strokes, and heart failure. Lifestyle changes, sedentary habits, and an aging population globally contribute to the growing burden of CVDs, fueling the demand for advanced cardiovascular devices and interventions. This surge in demand showcases the market's growth potential, penetration, and the opportunity for innovation in addressing the diagnosis, treatment, and management of cardiovascular conditions. Ongoing technological advancements and innovations in medical technology, including minimally invasive procedures, wearable devices, and telemedicine, play a pivotal role in enhancing diagnostic and treatment capabilities within the cardiovascular domain. This technological innovation not only fosters market share growth but also encourages market penetration and opens avenues for further innovation in the industry. The adoption of state-of-the-art cardiovascular devices, driven by technological advancements, contributes significantly to improved patient outcomes, showcasing the market's potential and opportunities for industry players. The Cardiovascular Device Market is further influenced by the increasing geriatric population, which is more susceptible to cardiovascular disorders. This demographic shift drives the demand for cardiovascular devices and interventions tailored to address age-related cardiovascular conditions. The expanding geriatric population contributes to market fluctuation, ensuring a sustained demand for specialized devices. This phenomenon creates opportunities for market share expansion, reflecting the potential for growth in addressing the unique healthcare needs associated with aging and cardiovascular health. Rising awareness about cardiovascular health, coupled with preventive measures and government initiatives, is another driver shaping the Cardiovascular Device Market. The emphasis on awareness and prevention initiatives not only boosts market penetration but also offers opportunities for industry players to capitalize on emerging trends in preventive healthcare practices. The increasing awareness encourages early diagnosis and treatment, promoting the utilization of cardiovascular devices for early intervention and preventive healthcare purposes. The prevalence of lifestyle-related risk factors, such as smoking, obesity, and sedentary behavior, significantly contributes to an elevated risk of cardiovascular diseases. This necessity for monitoring, assessment, and treatment drives the adoption of cardiovascular devices, amplifying market share and opportunities. The adoption of devices for risk assessment, monitoring, and management is a direct result of the prevalence of risk factors, showcasing the market's potential in addressing the complex landscape of cardiovascular health.Rapid Technological Advancements and Increasing Focus on Remote Patient Monitoring penetrating the Cardiovascular Device Market The continuous evolution of technology presents a significant opportunity for the development of advanced cardiovascular devices. Innovations in minimally invasive procedures, telemedicine, and wearable devices open new avenues for improving diagnostic accuracy and treatment outcomes. The rising trend of remote patient monitoring creates opportunities for cardiovascular device manufacturers to develop connected devices. These devices enable real-time monitoring of patients' cardiovascular health, facilitating early intervention and personalized care. The shift toward personalized medicine creates opportunities for tailored cardiovascular devices. Advancements in genomics and biomarker research allow for the development of devices that cater to individual patient profiles, optimizing treatment effectiveness. There is untapped potential in emerging markets, where the prevalence of cardiovascular diseases is on the rise. Penetrating these markets offers opportunities for market expansion, especially with the development of cost-effective and scalable solutions. The integration of AI and ML in cardiovascular devices enhances diagnostic accuracy, treatment planning, and patient monitoring. This creates opportunities for developing intelligent devices that can analyse complex data patterns and provide actionable insights.

Cardiovascular Device Market Segment Analysis

Devices: ECG devices segment, play a fundamental role in cardiovascular diagnostics and continuous monitoring. Holding a substantial market share, they are indispensable for assessing and interpreting the heart's electrical activity, contributing significantly to the market's overall dynamics. Stents make a significant contribution to the market, holding a dominant segment share. Widespread use in addressing coronary and vascular conditions highlights their essential role in providing structural support to blood vessels, influencing interventional procedures. Defibrillators are crucial life-saving devices that hold a critical market share. In emergency cardiac care, they deliver electric shocks to restore normal heart rhythm during sudden cardiac arrest, emphasizing their pivotal role in critical medical interventions. Cardiac catheters, integral to interventional cardiology, contribute substantially to market growth, holding a major share. These thin tubes play a crucial role in diagnostic and therapeutic procedures, such as angiography, influencing overall market dynamics. Guide wires hold a prominent segment within interventional procedures. Offering guidance and support for precise navigation of catheters through blood vessels, they contribute significantly to the market dynamics, emphasizing their importance. Event monitors positively impact market share, meeting the rising demand for ambulatory cardiac monitoring. These portable devices play a crucial role in continuous heart activity monitoring, providing valuable data for detecting irregularities. Heart valves, both mechanical and biological, significantly contribute to the market, holding a major share. Addressing conditions like valvular heart disease, they play a crucial role in restoring normal blood flow, influencing market dynamics. Pacemakers, reflecting widespread use, hold a substantial market share. These implantable devices are crucial for regulating heart rhythm by delivering electrical impulses, playing a significant role in managing various cardiac rhythm abnormalities. Application: Devices addressing conditions contributing to strokes, such as atrial fibrillation, drive market share dominance. Playing a crucial role in preventing, diagnosing, and treating conditions leading to strokes, these devices are pivotal in stroke-related applications. Devices targeting conditions like atherosclerosis impacting cerebral blood vessels contribute significantly to segment major share. Addressing conditions affecting blood vessels supplying the brain, these devices play a crucial role in cerebrovascular health. Coronary stents, angioplasty devices, and diagnostic tools hold a substantial market share, addressing coronary heart disease. Focusing on conditions affecting coronary arteries, these devices play a central role in cardiovascular interventions. Defibrillators and advanced life support devices command a prominent segment, playing a key role in managing sudden cardiac arrest scenarios. Rapid intervention is crucial in addressing this emergency situation, influencing market dynamics. Niche applications and emerging trends contribute to the diversity within the "Others" category. Impacting market share, this segment includes unique applications and evolving trends in cardiovascular health, providing opportunities for innovation.Cardiovascular Device Market Regional Analysis

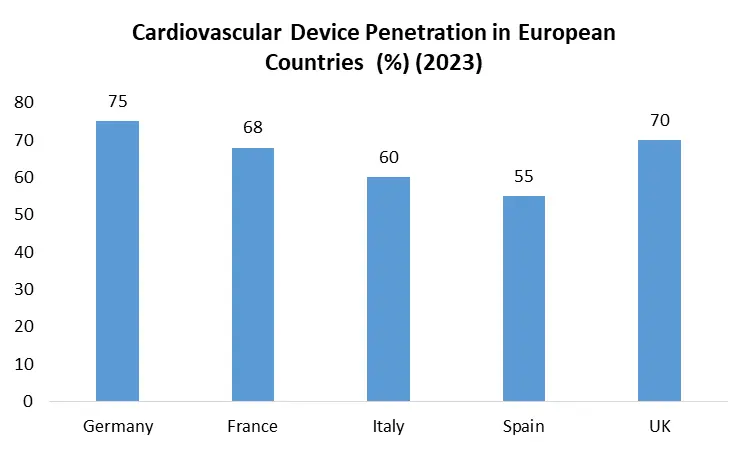

The Cardiovascular Device Market in North America, especially the US, exhibits robust regional growth, driven by advanced healthcare infrastructure and substantial investments in research and development. The US holds a significant Cardiovascular Device Market share, reflecting a high prevalence of cardiovascular diseases and a strong demand for innovative devices. The region benefits from technological advancements and well-established regulatory frameworks that contribute to its dominance. Key players in the US actively engage in continuous innovation, pushing the boundaries of cardiovascular technology and further solidifying the region's position as a crucial player in the global market. In the Asia Pacific region, including countries like China, India, and Japan, the Cardiovascular Device Market is experiencing rapid growth. The region's potential is fueled by the increasing incidence of cardiovascular diseases and a growing aging population. With rising healthcare expenditure and improving healthcare infrastructure, the Asia Pacific contributes significantly to the global market. Government initiatives promoting healthcare accessibility and a large patient pool further drive market growth. The Cardiovascular Device Market in Asia Pacific emerges as a dynamic landscape, showcasing regional key players and a combination of factors propelling its expansion. Europe stands out as a prominent player in the Cardiovascular Device Market, characterized by a well-established healthcare system and a growing aging population. The region prioritizes cardiovascular health, leading to the adoption of cutting-edge technologies and devices. European countries emphasize preventive healthcare measures, contributing to the demand for cardiovascular devices for early diagnosis and intervention. Regulatory frameworks ensure the safety and efficacy of these devices, fostering a conducive environment for market growth. Regional key players and research institutions further strengthen Europe's position, making it a significant contributor to the global Cardiovascular Device Market. The Middle East and Africa region are witnessing gradual growth in cardiovascular healthcare awareness and infrastructure development. Despite facing unique challenges such as varying economic conditions and healthcare accessibility, the region is making strides in addressing cardiovascular diseases. Investments in healthcare and a growing emphasis on medical tourism contribute to the expansion of the Cardiovascular Device Market. Local governments recognize the importance of cardiovascular health, implementing initiatives that drive market growth. The region reflects a blend of challenges and opportunities, making it an area of emerging significance in the global Cardiovascular Device Market.Cardiovascular Device Market Competitive Landscape The competitive landscape of the cardiovascular device market is dynamic, with several key players vying for market share and striving for innovation to address the evolving needs of healthcare. The industry is characterized by a mix of established companies, emerging players, and a focus on research and development to introduce advanced technologies. Here is an overview of the competitive landscape. On May 3, 2018, the J. Crayton Pruitt Family Department of Biomedical Engineering proudly announced a partnership with Edwards Lifesciences, a major market share holder and a leading global player in heart valves and hemodynamic monitoring. Renowned for its passion to help patients, Edwards Lifesciences collaborates with clinicians to develop innovative technologies in structural heart disease and critical care monitoring. Over the past three years, this partnership has been vital for the growth of the department, impacting students and providing opportunities such as student design projects, conference travel, and support for student-related activities. Edwards Lifesciences, as a global market player, significantly contributes to research and development in medical devices, aligning with the shared mission of improving patient outcomes and enhancing lives. On May 13, 2021, Medtronic plc, a prominent manufacturer and a global market player in medical technology, along with the Medtronic Foundation, announced an additional USD 3M for COVID-19 relief efforts. This initiative, part of Medtronic's ongoing response to the pandemic, demonstrates its commitment as a major market share holder. The relief efforts, spanning across India, Brazil, the United States, and other global regions, include financial resources, personal protective equipment (PPE) donations, and employee engagement. Medtronic Foundation collaborates with established nonprofit organizations on the ground, focusing on combatting COVID-19 surges. As a key company, Medtronic plays a crucial role in supplying medical resources, establishing treatment sites, training frontline health workers, and addressing vaccine hesitancy, showcasing its commitment as a global cardiovascular Device market player. In a groundbreaking collaboration reported on April 26, 2021, Medtronic plc, a leading key player in medical technology, partnered with Surgical Theater to integrate SyncAR augmented reality (AR) technology with the StealthStation S8 surgical navigation system. This partnership signifies Medtronic's role as a major market share holder and a global market player. The SyncAR platform enables real-time AR visualization during complex cranial procedures for neurosurgeons. Medtronic's involvement in this partnership highlights its position as a prominent manufacturer engaging with cutting-edge technologies. The collaboration aims to significantly enhance the planning, practicing, and execution of complex neurosurgeries, demonstrating Medtronic's commitment to advancing precision and efficiency in medical procedures as a leading key player in the industry.

Cardiovascular Device Market Scope: Inquire before buying

Global Cardiovascular Device Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 57.20 Bn. Forecast Period 2024 to 2030 CAGR: 7.14% Market Size in 2030: US $ 92.71 Bn. Segments Covered: by Type Product Cardiovascular Device Process Cardiovascular Device System Cardiovascular Device by Technology IoT-based Cardiovascular Devices Augmented Reality (AR) & Virtual Reality (VR) Cardiovascular Devices Machine Learning-based Cardiovascular Devices by End-User industry Manufacturing Healthcare Aerospace and Defence Automotive Energy and Utilities Cardiovascular Device Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cardiovascular Device Market Key Players:

Established Global Key Players: 1. Johnson & Johnson (United States) 2. Terumo Corporation (Japan) 3. Cardinal Health, Inc. (United States) 4. LivaNova PLC (United Kingdom) 5. Zimmer Biomet Holdings, Inc. (United States) Prominent Key Players in North America: 1. BD (Becton, Dickinson and Company) (United States) 2. Edwards Lifesciences Corporation (United States) 3. Medtronic (Ireland) 4. Biosense Webster, Inc (Johnson and Johnson) (United States) 5. General Electric Company (United States) 6. Boston Scientific Corporation (United States) 7. Abbott (United States) 8. Jarvik Heart (United States) 9. Merit Medical Systems (United States) 10. On-X Life Technologies (United States) 11. St. Jude Medical (United States) 12. Spectranetics (United States) 13. Sunshine Heart (United States) 14. Syncardia Systems (United States) 15. Thoratec (United States) 16. Volcano (United States) 17. Jarvik Heart (United States) Emerging Key Players in Europe: 1. Siemens AG (Germany) 2. B. Braun Melsungen AG (Germany) 3. Koninklijke Philips N.V (Netherlands) 4. Maquet Cardiovascular (Germany) 5. Orbusneich (Hong Kong) 6. Sorin Group (Italy) Leading Key Players in Asia Pacific: 1. Orbusneich (Hong Kong) FAQ’s: 1. Which segments dominate the cardiovascular device market? Ans: Coronary stents, pacemakers, and cardiac catheters are among the dominant segments in the cardiovascular device market. 2. What factors drive the growth of the cardiovascular device market? Ans: Factors such as the rising prevalence of cardiovascular diseases, technological advancements, and an aging population contribute to market growth. 3. How is the market divided regionally? Ans: North America, Europe, Asia Pacific, and Latin America are key regions in the global cardiovascular device market, with North America often leading in terms of market share. 4. What are some leading companies in the cardiovascular device market? Ans: Medtronic, Abbott Laboratories, Boston Scientific Corporation, and Johnson & Johnson are among the leading companies in the cardiovascular device market. 5. What technological trends impact the cardiovascular device industry? Ans: Advancements in minimally invasive procedures, telemedicine applications, and the integration of digital health technologies are influencing the cardiovascular device market.

1. Cardiovascular Device Market: Research Methodology 2. Cardiovascular Device Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Cardiovascular Device Market: Dynamics 3.1. Cardiovascular Device Market Trends by Region 3.1.1. North America Cardiovascular Device Market Trends 3.1.2. Europe Cardiovascular Device Market Trends 3.1.3. Asia Pacific Cardiovascular Device Market Trends 3.1.4. Middle East and Africa Cardiovascular Device Market Trends 3.1.5. South America Cardiovascular Device Market Trends 3.2. Cardiovascular Device Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cardiovascular Device Market Drivers 3.2.1.2. North America Cardiovascular Device Market Restraints 3.2.1.3. North America Cardiovascular Device Market Opportunities 3.2.1.4. North America Cardiovascular Device Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cardiovascular Device Market Drivers 3.2.2.2. Europe Cardiovascular Device Market Restraints 3.2.2.3. Europe Cardiovascular Device Market Opportunities 3.2.2.4. Europe Cardiovascular Device Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cardiovascular Device Market Drivers 3.2.3.2. Asia Pacific Cardiovascular Device Market Restraints 3.2.3.3. Asia Pacific Cardiovascular Device Market Opportunities 3.2.3.4. Asia Pacific Cardiovascular Device Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cardiovascular Device Market Drivers 3.2.4.2. Middle East and Africa Cardiovascular Device Market Restraints 3.2.4.3. Middle East and Africa Cardiovascular Device Market Opportunities 3.2.4.4. Middle East and Africa Cardiovascular Device Market Challenges 3.2.5. South America 3.2.5.1. South America Cardiovascular Device Market Drivers 3.2.5.2. South America Cardiovascular Device Market Restraints 3.2.5.3. South America Cardiovascular Device Market Opportunities 3.2.5.4. South America Cardiovascular Device Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cardiovascular Device Market 3.8. Analysis of Government Schemes and Initiatives For Cardiovascular Device Market 3.9. The Global Pandemic Impact on Cardiovascular Device Market 4. Cardiovascular Device Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 4.1.1. Electrocardiography (ECG) 4.1.2. Stent 4.1.3. Defibrillator 4.1.4. Cardiac Catheter 4.1.5. Guide wire 4.1.6. Event Monitor 4.1.7. Heart Valve 4.1.8. Pacemaker 4.1.9. Others 4.2. Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 4.2.1. IoT-based Cardiovascular Devices 4.2.2. Augmented Reality (AR) & Virtual Reality (VR) Cardiovascular Devices 4.2.3. Machine Learning-based Cardiovascular Devices 4.3. Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 4.3.1. Manufacturing 4.3.2. Healthcare 4.3.3. Aerospace and Defense 4.3.4. Automotive 4.3.5. Energy and Utilities 4.4. Cardiovascular Device Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Cardiovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 5.1.1. Electrocardiography (ECG) 5.1.2. Stent 5.1.3. Defibrillator 5.1.4. Cardiac Catheter 5.1.5. Guide wire 5.1.6. Event Monitor 5.1.7. Heart Valve 5.1.8. Pacemaker 5.1.9. Others 5.2. North America Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 5.2.1. Stroke 5.2.2. Cerebrovascular Heart Disease 5.2.3. Coronary Heart Disease 5.2.4. Sudden Cardiac Arrest 5.2.5. Others 5.3. North America Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 5.3.1. Cardiac Centers 5.3.2. Hospitals 5.3.3. Ambulatory Surgical Centers 5.4. North America Cardiovascular Device Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 5.4.1.1.1. Electrocardiography (ECG) 5.4.1.1.2. Stent 5.4.1.1.3. Defibrillator 5.4.1.1.4. Cardiac Catheter 5.4.1.1.5. Guide wire 5.4.1.1.6. Event Monitor 5.4.1.1.7. Heart Valve 5.4.1.1.8. Pacemaker 5.4.1.1.9. Others 5.4.1.2. United States Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 5.4.1.2.1. Stroke 5.4.1.2.2. Cerebrovascular Heart Disease 5.4.1.2.3. Coronary Heart Disease 5.4.1.2.4. Sudden Cardiac Arrest 5.4.1.2.5. Others 5.4.1.3. United States Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 5.4.1.3.1. Cardiac Centers 5.4.1.3.2. Hospitals 5.4.1.3.3. Ambulatory Surgical Centers 5.4.2. Canada 5.4.2.1. Canada Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 5.4.2.1.1. Electrocardiography (ECG) 5.4.2.1.2. Stent 5.4.2.1.3. Defibrillator 5.4.2.1.4. Cardiac Catheter 5.4.2.1.5. Guide wire 5.4.2.1.6. Event Monitor 5.4.2.1.7. Heart Valve 5.4.2.1.8. Pacemaker 5.4.2.1.9. Others 5.4.2.2. Canada Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 5.4.2.2.1. Stroke 5.4.2.2.2. Cerebrovascular Heart Disease 5.4.2.2.3. Coronary Heart Disease 5.4.2.2.4. Sudden Cardiac Arrest 5.4.2.2.5. Others 5.4.2.3. Canada Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 5.4.2.3.1. Cardiac Centers 5.4.2.3.2. Hospitals 5.4.2.3.3. Ambulatory Surgical Centers 5.4.3. Mexico 5.4.3.1. Mexico Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 5.4.3.1.1. Electrocardiography (ECG) 5.4.3.1.2. Stent 5.4.3.1.3. Defibrillator 5.4.3.1.4. Cardiac Catheter 5.4.3.1.5. Guide wire 5.4.3.1.6. Event Monitor 5.4.3.1.7. Heart Valve 5.4.3.1.8. Pacemaker 5.4.3.1.9. Others 5.4.3.2. Mexico Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 5.4.3.2.1. Stroke 5.4.3.2.2. Cerebrovascular Heart Disease 5.4.3.2.3. Coronary Heart Disease 5.4.3.2.4. Sudden Cardiac Arrest 5.4.3.2.5. Others 5.4.3.3. Mexico Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 5.4.3.3.1. Cardiac Centers 5.4.3.3.2. Hospitals 5.4.3.3.3. Ambulatory Surgical Centers 6. Europe Cardiovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.2. Europe Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.3. Europe Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4. Europe Cardiovascular Device Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.1.2. United Kingdom Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.1.3. United Kingdom Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.2. France 6.4.2.1. France Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.2.2. France Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.2.3. France Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.3.2. Germany Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.3.3. Germany Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.4.2. Italy Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.4.3. Italy Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.5.2. Spain Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.5.3. Spain Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.6.2. Sweden Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.6.3. Sweden Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.7.2. Austria Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.7.3. Austria Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 6.4.8.2. Rest of Europe Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 6.4.8.3. Rest of Europe Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7. Asia Pacific Cardiovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.2. Asia Pacific Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4. Asia Pacific Cardiovascular Device Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.1.2. China Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.1.3. China Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.2.2. S Korea Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.2.3. S Korea Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.3.2. Japan Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.3.3. Japan Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.4. India 7.4.4.1. India Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.4.2. India Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.4.3. India Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.5.2. Australia Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.5.3. Australia Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.6.2. Indonesia Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.6.3. Indonesia Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.7.2. Malaysia Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.7.3. Malaysia Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.8.2. Vietnam Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.8.3. Vietnam Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.9.2. Taiwan Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.9.3. Taiwan Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 7.4.10.2. Rest of Asia Pacific Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 7.4.10.3. Rest of Asia Pacific Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 8. Middle East and Africa Cardiovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 8.2. Middle East and Africa Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 8.4. Middle East and Africa Cardiovascular Device Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 8.4.1.2. South Africa Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 8.4.1.3. South Africa Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 8.4.2.2. GCC Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 8.4.2.3. GCC Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 8.4.3.2. Nigeria Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 8.4.3.3. Nigeria Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 8.4.4.2. Rest of ME&A Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 8.4.4.3. Rest of ME&A Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 9. South America Cardiovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 9.2. South America Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 9.3. South America Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 9.4. South America Cardiovascular Device Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 9.4.1.2. Brazil Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 9.4.1.3. Brazil Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 9.4.2.2. Argentina Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 9.4.2.3. Argentina Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Cardiovascular Device Market Size and Forecast, By Device (2023-2030) 9.4.3.2. Rest Of South America Cardiovascular Device Market Size and Forecast, By Application (2023-2030) 9.4.3.3. Rest Of South America Cardiovascular Device Market Size and Forecast, by End-user Industry (2023-2030) 10. Global Cardiovascular Device Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Cardiovascular Device Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Johnson & Johnson (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Terumo Corporation (Japan) 11.3. Cardinal Health, Inc. (United States) 11.4. LivaNova PLC (United Kingdom) 11.5. Zimmer Biomet Holdings, Inc. (United States) 11.6. BD (Becton, Dickinson and Company) (United States) 11.7. Edwards Lifesciences Corporation (United States) 11.8. Medtronic (Ireland) 11.9. Biosense Webster, Inc (Johnson and Johnson) (United States) 11.10. General Electric Company (United States) 11.11. Boston Scientific Corporation (United States) 11.12. Abbott (United States) 11.13. Jarvik Heart (United States) 11.14. Merit Medical Systems (United States) 11.15. On-X Life Technologies (United States) 11.16. St. Jude Medical (United States) 11.17. Spectranetics (United States) 11.18. Sunshine Heart (United States) 11.19. Syncardia Systems (United States) 11.20. Thoratec (United States) 11.21. Volcano (United States) 11.22. Jarvik Heart (United States) 11.23. Siemens AG (Germany) 11.24. B. Braun Melsungen AG (Germany) 11.25. Koninklijke Philips N.V (Netherlands) 11.26. Maquet Cardiovascular (Germany) 11.27. Orbusneich (Hong Kong) 11.28. Sorin Group (Italy) 11.29. Orbusneich (Hong Kong) 12. Key Findings 13. Industry Recommendations