The Cap Liner Market was valued at USD 3.25 Bn in 2024, and total global Cap Liner Market revenue is expected to grow at a CAGR of 4.1% and reach nearly USD 4.48 Bn from 2025-2032 due to rising focus on product safety, tamper-proof sealing, and sustainable materials.Cap Liner Market Definition:

Between the cap and the container is a piece of material called a liner. Its primary function is to provide appropriate item fixing, and it also determines the conclusion's fit and capacity feasibility on occasion. Because the liner in front of the item is in direct contact with it, compound similarity is essential. An ill-advised liner would not only shorten the time span of usability, but it will also allow spilling of the item during transportation, resulting in quality difficulties.To know about the Research Methodology :- Request Free Sample Report

Cap Liner Market Overview

Packaging's purpose has changed because of recent technology breakthroughs; currently, packaging is used for more than just moving things from one location to another; it is also utilized to improve the product's aesthetic value and shelf life. Cap liners were invented on account of firms' increasing attention on maintaining the integrity and hygiene of their products in order to achieve higher consumer satisfaction. The cap liner is used to seal the product, making it spill-proof and providing a moisture and gas barrier. Cap liners are often used in the packaging of pharmaceutical and medical products, as well as beverages, cosmetics, and chemicals. It also aids producers in achieving the desired level of packaging hygiene, hence attracting more customers. Cap liners are made from a variety of materials to get the appropriate properties for packaging a variety of items. Cap liners can be printed with the company's name or logo to improve communication between customers and the company. Rising Consumer Awareness regarding Food Borne Diseases Growing urbanization and disposable income are expected to boost demand for packaged food, as well as increased awareness of the importance of eating hygienic food, propelling the cap liners market forward. Cap liners are expected to play a key role in the cap liners market as they are used in the developing pharmaceutical and personal care industries throughout the world to improve graphic presentation of bottles and prevent content leakage. Moreover, the rapid depletion of packaged food has resulted in increased awareness about the importance of using a safe and secure cap liner for content shipment to consumer markets, which is expected to drive the cap liner market throughout the forecast period.Limitations:

The local manufacturers' unwillingness to invest more in food hygiene care is expected to slow the cap liner market's growth over the forecast period. Also, utilizing cap liners in the packaging of hazardous chemicals is inefficient, which may stymie cap liners market growth in the chemical and pharmacy sectors. COVID-19 Impact on Cap Liners Market The unusual COVID-19 outbreak has put a halt to output in a variety of sectors. Lockdown orders, both complete and partial, have disrupted supply chains around the world. Even once economies seek to return to normalcy after extended periods of shutdown, most industries will take time to recoup their growth speed. On the other hand, demand for packaged foods & beverages has soared during COVID-19, particularly since consumers demonstrate a preference for eating at home. Packaging is becoming increasingly important as consumers desire longer-lasting foods & beverages. Cap liners are in high demand because of this.Cap Liner Market Segmentation:

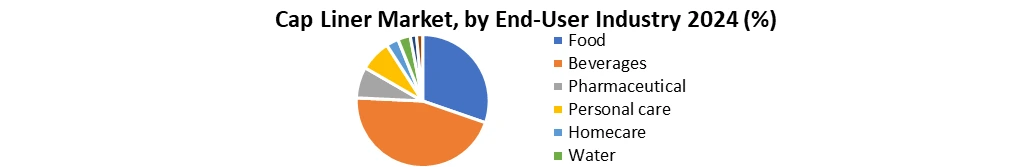

Based on Material Type: The cap liner market is further segmented into Foam, Paper, Plastic, Foil, and Glass. The plastic segment is further segmented into Polyvinyl chloride (PVC), Polypropylene (PP), Polyethylene (PE), High-density polyethylene (HDPE), Low-density polyethylene (LDPE), and Others. During the forecast period, the PVC plastic sector is expected to have the largest market share, with a CAGR of 7.02%. This is mostly because of the fact that poly liner is frequently found in metal caps and is commonly used for jellies, jams, solid and liquid products such as food. Because of PVC's great chemical resistance, it has a wide range of applications. Based on End-use Industry: The cap liner market is further segmented into Food, Beverages, Pharmaceutical, Personal care, Homecare, Water, Cosmetic, and Chemical. The beverages segment is further divided into alcoholic and non-alcoholic beverages. In the year 2024, the food & beverage combine segment had the greatest market share of over 45 percent, and it is expected to grow at a CAGR of around 7% over the forecast period.

Cap Liner Market Regional Insights:

Because of its large population and steady economic growth, Asia Pacific is expected to be the most attractive area in the cup liner market in terms of both value and volume. The Asia Pacific market, which accounted for over 25% of the market in 2023, is expected to increase at a CAGR of around 8% over the forecast period (2024-2030). Because the industry in the area is oriented to emphasis on health and hygiene in packaging, North America and Western Europe are expected to account for a major proportion of the cap liner market. The cap liner market is expected to develop moderately in MEA, Latin America, and Eastern Europe, with Japan accounting for a substantial portion of the market. Competitive Landscape The market is fragmented due to the existence of various regional and unorganized competitors. Because Asia Pacific has a higher concentration of small businesses, competition is likely to be stronger. Thus, the market's major competitors are concentrating on M&A to increase their global reach and portfolio. Aside from strategic partnerships, the market has a lot of room for R&D. To achieve a competitive advantage, some of the world's most successful corporations are devoting resources to product creation. The objective of the report is to present a comprehensive analysis of the global Cap Liner market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Cap Liner dynamics, structure by analyzing the market segments and projecting the Cap Liner size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Cap Liner market make the report investor’s guide.Cap Liner Market Scope: Inquire before buying

Cap Liner Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.25 Bn. Forecast Period 2025 to 2032 CAGR: 4.1% Market Size in 2032: USD 4.48 Bn. Segments Covered: by Material Type Foam Paper Plastic Polyvinyl chloride (PVC) Polypropylene (PP) Polyethylene (PE) High-density polyethylene (HDPE) Low-density polyethylene (LDPE) Others Foil Glass by Closure Type Screw Snap-on Flip-Top Pumps Spray Caps by End-User Food Beverages Alcoholic Non-alcoholic Pharmaceutical Personal care Homecare Water Cosmetic Chemical Cap Liner Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cap Liner Market, Key Players

1. Qorpak, Inc. 2. Sigma-Aldrich Co. LLC. 3. Enercon Industries Corporation 4. Sancap Liner Technology, Inc. 5. Selig Sealing Products Inc, 6. Danbury Plastics, Inc. 7. M-Industries, LLC 8. BERICAP 9. Bluemay Weston Limited 10.TEKNI-PLEX, INC. 11.Proofex Packagings Pvt. Ltd. 12.Baoding City Zhenghui Printing & Packing Industrial Co., Ltd 13.Zhongshan Chengzhan Aluminum & Plastic Packaging Co., Ltd 14.Changzhou Creherit Technology Co., Ltd. 15.Yantai Yongsheng Packing Material Co., Ltd. 16.OthersFrequently Asked Questions:

1. Which region has the largest share in Cap Liner Market? Ans: The Asia Pacific held the largest share in 2024. 2. What is the growth rate of the Cap Liner Market? Ans: The Cap Liner Market is growing at a CAGR of 4.1% during the forecasting period 2025-2032. 3. What segments are covered in the Cap Liner market? Ans: Cap Liner Market is segmented into Material Type, Closure Type, End-use Industry and Region. 4. Who are the key players in the Cap Liner market? Ans: The important key players in the Cap Liner Market are – Qorpak, Inc. Sigma-Aldrich Co. LLC. Enercon Industries Corporation, Sancap Liner Technology, Inc., Selig Sealing Products Inc, Danbury Plastics, Inc., M-Industries, LLC, BERICAP, Bluemay Weston Limited, TEKNI-PLEX, INC., Proofex Packagings Pvt. Ltd., Baoding City Zhenghui Printing & Packing Industrial Co., Ltd, Zhongshan Chengzhan Aluminum & Plastic Packaging Co., Ltd, Changzhou Creherit Technology Co., Ltd., Yantai Yongsheng Packing Material Co., Ltd. 5. What is the study period of this market? Ans: The Cap Liner Market is studied from 2024 to 2032.

1. Cap Liner Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cap Liner Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Cap Liner Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Cap Liner Market: Dynamics 3.1. Cap Liner Market Trends by Region 3.1.1. North America Cap Liner Market Trends 3.1.2. Europe Cap Liner Market Trends 3.1.3. Asia Pacific Cap Liner Market Trends 3.1.4. Middle East and Africa Cap Liner Market Trends 3.1.5. South America Cap Liner Market Trends 3.2. Cap Liner Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cap Liner Market Drivers 3.2.1.2. North America Cap Liner Market Restraints 3.2.1.3. North America Cap Liner Market Opportunities 3.2.1.4. North America Cap Liner Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cap Liner Market Drivers 3.2.2.2. Europe Cap Liner Market Restraints 3.2.2.3. Europe Cap Liner Market Opportunities 3.2.2.4. Europe Cap Liner Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cap Liner Market Drivers 3.2.3.2. Asia Pacific Cap Liner Market Restraints 3.2.3.3. Asia Pacific Cap Liner Market Opportunities 3.2.3.4. Asia Pacific Cap Liner Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cap Liner Market Drivers 3.2.4.2. Middle East and Africa Cap Liner Market Restraints 3.2.4.3. Middle East and Africa Cap Liner Market Opportunities 3.2.4.4. Middle East and Africa Cap Liner Market Challenges 3.2.5. South America 3.2.5.1. South America Cap Liner Market Drivers 3.2.5.2. South America Cap Liner Market Restraints 3.2.5.3. South America Cap Liner Market Opportunities 3.2.5.4. South America Cap Liner Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cap Liner Industry 3.8. Analysis of Government Schemes and Initiatives For Cap Liner Industry 3.9. Cap Liner Market Trade Analysis 3.10. The Global Pandemic Impact on Cap Liner Market 4. Cap Liner Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Cap Liner Market Size and Forecast, by Material Type (2024-2032) 4.1.1. Foam 4.1.2. Paper 4.1.3. Plastic 4.1.4. Polyvinyl chloride (PVC) 4.1.5. Polypropylene (PP) 4.1.6. Polyethylene (PE) 4.1.7. High-density polyethylene (HDPE) 4.1.8. Low-density polyethylene (LDPE) 4.1.9. Others 4.1.10. Foil 4.1.11. Glass 4.2. Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 4.2.1. Screw 4.2.2. Snap-on 4.2.3. Flip-Top 4.2.4. Pumps 4.2.5. Spray Caps 4.3. Cap Liner Market Size and Forecast, by End-User (2024-2032) 4.3.1. Food 4.3.2. Beverages 4.3.3. Alcoholic 4.3.4. Non-alcoholic 4.3.5. Pharmaceutical 4.3.6. Personal care 4.3.7. Homecare 4.3.8. Water 4.4. Cap Liner Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Cap Liner Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Cap Liner Market Size and Forecast, by Material Type (2024-2032) 5.1.1. Foam 5.1.2. Paper 5.1.3. Plastic 5.1.4. Polyvinyl chloride (PVC) 5.1.5. Polypropylene (PP) 5.1.6. Polyethylene (PE) 5.1.7. High-density polyethylene (HDPE) 5.1.8. Low-density polyethylene (LDPE) 5.1.9. Others 5.1.10. Foil 5.1.11. Glass 5.2. North America Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 5.2.1. Screw 5.2.2. Snap-on 5.2.3. Flip-Top 5.2.4. Pumps 5.2.5. Spray Caps 5.3. North America Cap Liner Market Size and Forecast, by End-User (2024-2032) 5.3.1. Food 5.3.2. Beverages 5.3.3. Alcoholic 5.3.4. Non-alcoholic 5.3.5. Pharmaceutical 5.3.6. Personal care 5.3.7. Homecare 5.3.8. Water 5.4. North America Cap Liner Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Cap Liner Market Size and Forecast, by Material Type (2024-2032) 5.4.1.1.1. Foam 5.4.1.1.2. Paper 5.4.1.1.3. Plastic 5.4.1.1.4. Polyvinyl chloride (PVC) 5.4.1.1.5. Polypropylene (PP) 5.4.1.1.6. Polyethylene (PE) 5.4.1.1.7. High-density polyethylene (HDPE) 5.4.1.1.8. Low-density polyethylene (LDPE) 5.4.1.1.9. Others 5.4.1.1.10. Foil 5.4.1.1.11. Glass 5.4.1.2. United States Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 5.4.1.2.1. Screw 5.4.1.2.2. Snap-on 5.4.1.2.3. Flip-Top 5.4.1.2.4. Pumps 5.4.1.2.5. Spray Caps 5.4.1.3. United States Cap Liner Market Size and Forecast, by End-User (2024-2032) 5.4.1.3.1. Food 5.4.1.3.2. Beverages 5.4.1.3.3. Alcoholic 5.4.1.3.4. Non-alcoholic 5.4.1.3.5. Pharmaceutical 5.4.1.3.6. Personal care 5.4.1.3.7. Homecare 5.4.1.3.8. Water 5.4.2. Canada 5.4.2.1. Canada Cap Liner Market Size and Forecast, by Material Type (2024-2032) 5.4.2.1.1. Foam 5.4.2.1.2. Paper 5.4.2.1.3. Plastic 5.4.2.1.4. Polyvinyl chloride (PVC) 5.4.2.1.5. Polypropylene (PP) 5.4.2.1.6. Polyethylene (PE) 5.4.2.1.7. High-density polyethylene (HDPE) 5.4.2.1.8. Low-density polyethylene (LDPE) 5.4.2.1.9. Others 5.4.2.1.10. Foil 5.4.2.1.11. Glass 5.4.2.2. Canada Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 5.4.2.2.1. Screw 5.4.2.2.2. Snap-on 5.4.2.2.3. Flip-Top 5.4.2.2.4. Pumps 5.4.2.2.5. Spray Caps 5.4.2.3. Canada Cap Liner Market Size and Forecast, by End-User (2024-2032) 5.4.2.3.1. Food 5.4.2.3.2. Beverages 5.4.2.3.3. Alcoholic 5.4.2.3.4. Non-alcoholic 5.4.2.3.5. Pharmaceutical 5.4.2.3.6. Personal care 5.4.2.3.7. Homecare 5.4.2.3.8. Water 5.4.3. Mexico 5.4.3.1. Mexico Cap Liner Market Size and Forecast, by Material Type (2024-2032) 5.4.3.1.1. Foam 5.4.3.1.2. Paper 5.4.3.1.3. Plastic 5.4.3.1.4. Polyvinyl chloride (PVC) 5.4.3.1.5. Polypropylene (PP) 5.4.3.1.6. Polyethylene (PE) 5.4.3.1.7. High-density polyethylene (HDPE) 5.4.3.1.8. Low-density polyethylene (LDPE) 5.4.3.1.9. Others 5.4.3.1.10. Foil 5.4.3.1.11. Glass 5.4.3.2. Mexico Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 5.4.3.2.1. Screw 5.4.3.2.2. Snap-on 5.4.3.2.3. Flip-Top 5.4.3.2.4. Pumps 5.4.3.2.5. Spray Caps 5.4.3.3. Mexico Cap Liner Market Size and Forecast, by End-User (2024-2032) 5.4.3.3.1. Food 5.4.3.3.2. Beverages 5.4.3.3.3. Alcoholic 5.4.3.3.4. Non-alcoholic 5.4.3.3.5. Pharmaceutical 5.4.3.3.6. Personal care 5.4.3.3.7. Homecare 5.4.3.3.8. Water 6. Europe Cap Liner Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.2. Europe Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.3. Europe Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4. Europe Cap Liner Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.1.2. United Kingdom Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.1.3. United Kingdom Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.2. France 6.4.2.1. France Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.2.2. France Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.2.3. France Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.3.2. Germany Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.3.3. Germany Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.4.2. Italy Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.4.3. Italy Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.5.2. Spain Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.5.3. Spain Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.6.2. Sweden Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.6.3. Sweden Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.7.2. Austria Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.7.3. Austria Cap Liner Market Size and Forecast, by End-User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Cap Liner Market Size and Forecast, by Material Type (2024-2032) 6.4.8.2. Rest of Europe Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 6.4.8.3. Rest of Europe Cap Liner Market Size and Forecast, by End-User (2024-2032) 7. Asia Pacific Cap Liner Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.2. Asia Pacific Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.3. Asia Pacific Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4. Asia Pacific Cap Liner Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.1.2. China Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.1.3. China Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.2.2. S Korea Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.2.3. S Korea Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.3.2. Japan Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.3.3. Japan Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.4. India 7.4.4.1. India Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.4.2. India Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.4.3. India Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.5.2. Australia Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.5.3. Australia Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.6.2. Indonesia Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.6.3. Indonesia Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.7.2. Malaysia Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.7.3. Malaysia Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.8.2. Vietnam Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.8.3. Vietnam Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.9.2. Taiwan Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.9.3. Taiwan Cap Liner Market Size and Forecast, by End-User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Cap Liner Market Size and Forecast, by Material Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 7.4.10.3. Rest of Asia Pacific Cap Liner Market Size and Forecast, by End-User (2024-2032) 8. Middle East and Africa Cap Liner Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Cap Liner Market Size and Forecast, by Material Type (2024-2032) 8.2. Middle East and Africa Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 8.3. Middle East and Africa Cap Liner Market Size and Forecast, by End-User (2024-2032) 8.4. Middle East and Africa Cap Liner Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Cap Liner Market Size and Forecast, by Material Type (2024-2032) 8.4.1.2. South Africa Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 8.4.1.3. South Africa Cap Liner Market Size and Forecast, by End-User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Cap Liner Market Size and Forecast, by Material Type (2024-2032) 8.4.2.2. GCC Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 8.4.2.3. GCC Cap Liner Market Size and Forecast, by End-User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Cap Liner Market Size and Forecast, by Material Type (2024-2032) 8.4.3.2. Nigeria Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 8.4.3.3. Nigeria Cap Liner Market Size and Forecast, by End-User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Cap Liner Market Size and Forecast, by Material Type (2024-2032) 8.4.4.2. Rest of ME&A Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 8.4.4.3. Rest of ME&A Cap Liner Market Size and Forecast, by End-User (2024-2032) 9. South America Cap Liner Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Cap Liner Market Size and Forecast, by Material Type (2024-2032) 9.2. South America Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 9.3. South America Cap Liner Market Size and Forecast, by End-User(2024-2032) 9.4. South America Cap Liner Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Cap Liner Market Size and Forecast, by Material Type (2024-2032) 9.4.1.2. Brazil Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 9.4.1.3. Brazil Cap Liner Market Size and Forecast, by End-User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Cap Liner Market Size and Forecast, by Material Type (2024-2032) 9.4.2.2. Argentina Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 9.4.2.3. Argentina Cap Liner Market Size and Forecast, by End-User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Cap Liner Market Size and Forecast, by Material Type (2024-2032) 9.4.3.2. Rest Of South America Cap Liner Market Size and Forecast, by Closure Type (2024-2032) 9.4.3.3. Rest Of South America Cap Liner Market Size and Forecast, by End-User (2024-2032) 10. Company Profile: Key Players 10.1. Qorpak, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sigma-Aldrich Co. LLC. 10.3. Enercon Industries Corporation 10.4. Sancap Liner Technology, Inc. 10.5. Selig Sealing Products Inc, 10.6. Danbury Plastics, Inc. 10.7. M-Industries, LLC 10.8. BERICAP 10.9. Bluemay Weston Limited 10.10. TEKNI-PLEX, INC. 10.11. Proofex Packagings Pvt. Ltd. 10.12. Baoding City Zhenghui Printing & Packing Industrial Co., Ltd 10.13. Zhongshan Chengzhan Aluminum & Plastic Packaging Co., Ltd 10.14. Changzhou Creherit Technology Co., Ltd. 10.15. Yantai Yongsheng Packing Material Co., Ltd. 11. Key Findings 12. Industry Recommendations 13. Cap Liner Market: Research Methodology 14. Terms and Glossary