Breast Pump Market size was valued at USD 2.80 Billion in 2023 and the total Breast Pump Revenue is expected to grow at a CAGR of 9.1 % from 2024 to 2030, reaching nearly USD 5.15 Billion in 2030.Breast Pump Market Overview:

A Breast Pump is a mechanical tool used to extract milk from the breast. It enables the user to store breast milk in bags or storage bottles to use it later. The breast pump is mainly used to alleviate breast pain and to produce breast milk for infants who are not able to suck milk on their own. The rising number of working women across the developed and developing nations is augmenting the growth of the Brest Pump Industry. According to the International Labour Organization, the employment rate of women aged 25 to 54 years is 51.6 % globe. As more women participate in the workforce, there is a growing need for convenient and efficient breast-pumping solutions. Wearable breast pumps offer convenience, mobility, discretion, and privacy to continuous breastfeeding while balancing their professional responsibility.To know about the Research Methodology :- Request Free Sample Report Many companies are launching new breast pumps in the market. In January 2023, Medela introduced its inaugural in-bra wearable breast pump solution, known as the Freestyle Hands-free breast pump. The new pump showcases a collection of exceptionally lightweight, comfortable, and discreet cups. Cups connect seamlessly to a portable pump motor, providing users with an unparalleled hands-free pumping experience, factors are expected to propel the wearable breast pumps market through the forecast period. 1. The International Labour Organization (ILO) launched the 2030 United Nations Agenda, which states that youth and disabled people likely receive equal pay without discrimination to achieve gender equality and empower all women and girls to achieve productive employment and economic development.

Breast Pump Market Dynamics:

Driving forces behind the Breast Pump Industry growth The increasing consumer service, secured health plans, and varieties offered by various manufacturers, coupled with the favorable insurance for positive child and mother health management, are projected to propel the Breast Pump Industry growth. Engorgement is expected to be one of the major factors driving demand for breast pumps through the forecast period. Excess milk must be removed to avoid engorgement. The only two methods for eliciting surplus milk from the breasts in a healthy way are the hand expression method and breast pumps. When the baby is suckling, mothers experience acute nipple pain as a result of inadequate attachment. As a result, poor attachment is another factor driving up demand for breast pumps.

Revolutionizing Breast Pump Technology

Open breast pumps are comparatively less hygienic than closed breast pumps, and they register high usage rates as the systems are contamination-free. Breast milk potentially enters the tubing of open-system breast pumps and goes to the motor since there is no barrier between the pump components and the tubing. As the motor cannot be cleaned, the open system's pump cannot be sterilized for usage by a different user. Product launches in the field of closed-system breast pumps are promoting the market segment's growth. Ongoing advances in breast pump technology, such as the development of electric and battery-operated pumps, dual pumps for simultaneous expression, and smart pump features, have made breast pumping more convenient and efficient, driving the market growth. Integration of smart technology into breast pumps allows mothers to track pumping sessions, milk production, and feeding patterns through mobile apps. The apps also provide tips, reminders, and personalized insights. Lately, wearable breast pumps have gained popularity, offering mothers the flexibility to pump discreetly and without being tethered to a traditional pump. The devices are often compact and quiet and allow hands-free pumping, enhancing convenience for on-the-go mothers. As technology advances, improvements and innovations likely emerge in the market. Overcoming Obstacles to Breast Pump Market Growth Electrical battery breast pumps and hospital-grade pumps have high maintenance requirements, and open-system breast pumps have a higher risk of contamination. Breast pumps are also expensive, and there is a lack of understanding about them, especially in developing countries. Nipple and Breast Tissue Damage, an increase in medicine production, depletion in the nutrients of Breast Milk, and a reduction of milk supply manually are some factors that obstruct the market growth to a great extent. Spain, Italy, Greece, and Portugal are among the top ten European countries with the lowest fertility rates. Other obstacles impeding the market in developed countries include a hectic lifestyle, late marriages (leading to high-risk pregnancy and lactation problems), diminished fertility, and illnesses such as uterus cancer)Breast Pump Market Segmentation:

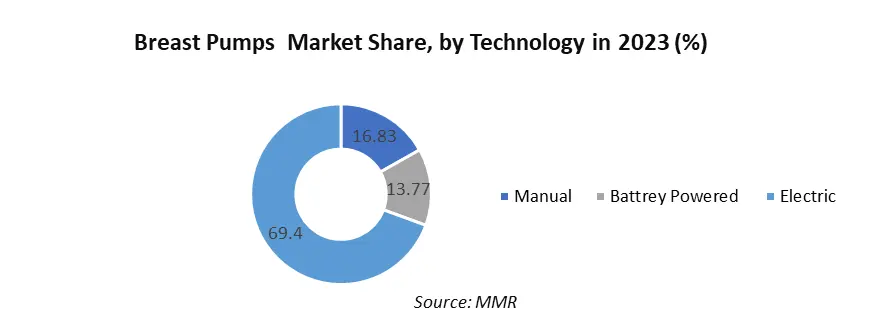

By Technology, the electric pumps segment held the largest market share of 69.4 % in 2023. Electric breast pumps are a suitable choice for working mothers who intend to feed their infants while they are away from home for work. Standard electric breast pumps are intended for one user only. Standard electric breast pumps are sold by lactation and DME providers as well as in some retail stores. electric breast pumps should not be shared because of the risk of infection transmission across multiple users. The increased availability of electric breast pumps through e-commerce is projected to contribute to Breast Pump Market development. End-users compare and select appropriate products based on their type, brand, price, and point of sale through the e-commerce channel. Amazon, Belly Bandit Walmart, Motherhood Maternity, and The Moms Co. are just a few of the top online retailers that offer products to customers. Factors such as rising consumer awareness and government backing are expected to drive global demand for electric breast pumps. The United Nations Children's Fund (UNICEF) and the World Health Organization (WHO) established the Baby Friendly Hospital Initiative (BFHI), which promotes evidence-based practices for breastfeeding success, to increase breastfeeding rates and enable families to attain their breastfeeding goals. As part of the Affordable Care Act, most insurance plans must now cover certain breastfeeding assistance and supplies, such as breast pumps. Some key brands in the segment include Purely Yours Ultra Breast Pump by Ameda AG and Isis iQ Duo Breast Pump by Philips AVENT, respectively. Technological advancements with the introduction of portable instruments, such as the Platinum electric breast pump by Ameda and Electric swing breast pumps by Medela, are expected to drive market growth through the forecast period.

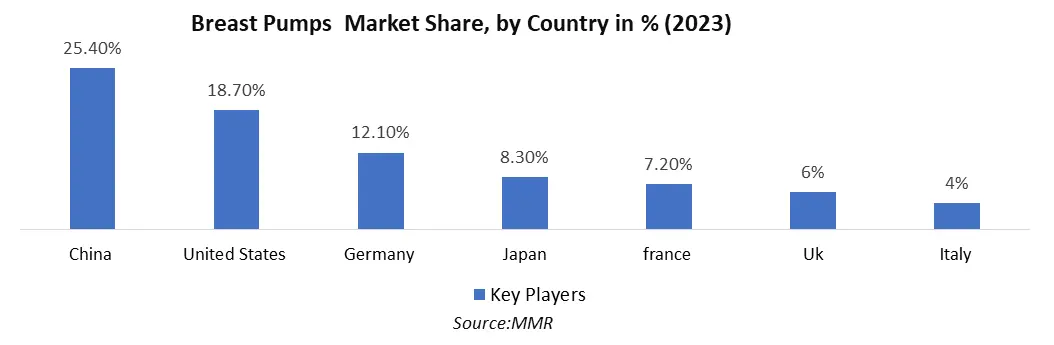

Breast Pump Market Regional Analysis:

North America accounted for the highest market share of 37 % in 2023. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. Attributable to high women employment rates, healthcare expenditure, sophisticated healthcare infrastructure, and patient awareness levels. The growing awareness and education about the numerous advantages of breastfeeding and the importance of breast milk for babies’ health across North America are majorly propelling the growth of the North American breast pump market. The growing understanding has led more women to choose to breastfeed. Where breast pumps become a promising option. Product launches and company collaborations in North America have a significant impact on the growth of breast pumps. Many working mothers prefer to express their milk with the breast pump and store it for the baby while they are at work. Electric and automated breast pumps have made the process of pumping simple and less time-consuming. Europe's breast pump market is growing at a significant 30 % CAGR through the forecast period, owing to a growing birth rate and rising women's employment in the region. European countries contribute with considerable market share for the breast pump industry, with Russia being the most lucrative market in Eastern European countries. The European breast pump market has witnessed considerable development in recent years due to features of breast penis pumps such as permitting women to keep dairy production and supply healthy feed to infants in their lack.Breast Pump Market Competitive Landscape: 1. In November 2023, Pigeon officially unveiled the much-projected release of its second-generation GoMini Electric Breast Pump, known as the GoMini Plus. Tailor-made for modern, on-the-go mums, this ground-breaking innovation promises a pumping experience like never before. Made with love and backed by decades of breastfeeding research, the new GoMini™️ Plus redefines convenience and comfort for breastfeeding mothers. 2. In August 2023, Lansinoh introduced the Lansinoh Wearable Pump as part of their commitment to "Stand with the Mothers," offering support to new moms through products and resources to simplify their journey. 3. In February 2023, Madela AG and Sarah Wells partnered to add the Allie sling bag to Madela’s Freestyle Hands-free Breast Pump portfolio for breastfeeding parents. 4. In January 2023, Willow Innovations, Inc. launched the first breast pump companion app, Willow 3.0, for Apple Watch. The Willow 3.0 pumps have a smartwatch companion app that allows breastfeeding parents to easily track, control, and view their pumping sessions.

Breast Pump Market Scope: Inquire before buying

Breast Pump Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.80 Bn. Forecast Period 2024 to 2030 CAGR: 9.1% Market Size in 2030: US $ 5.15 Bn. Segments Covered: by Product Closed system Open system by Technology Manual Battery powered Electric by Application Personal use Hospital grade Breast Pump Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Breast Pump Market Key Players:

1. Medela LLC (Switzerland) 2. Ardo Medical AG (Switzerland) 3. Philips Avent (Netherlands) 4. Ameda Inc. (United States) 5. Spectra Baby USA (United States) 6. Lansinoh Laboratories (United States) 7. NUK USA (United States) 8. Hygeia Health(United States) 9. Evenflo Feeding (United States) 10. BelleMa (United States) 11. Acelleron Medical Products (United States) 12. Bailey Medical Engineering (United States) 13. Freemie (United States) 14. Willow (United States) 15. Snow Bear (China) 16. RealBubee (China) 17. Mayborn Group Limited (United Kingdom) 18. Tommee Tippee (United Kingdom) 19. Chicco (Italy) 20. Pigeon Corporation (Japan) Frequently Asked Questions: 1] What segments are covered in the Breast Pump Market report? Ans. The segments covered in the Breast Pump Market report are based on, Product, Technology, Application. 2] Which region is expected to hold the highest share in the Breast Pump Market? Ans. The North American region is expected to hold the highest share of the Breast Pump Market. 3] What is the market size of the Breast Pump Market by 2030? Ans. The market size of the Breast Pump Market by 2030 will be $ 5.15 Billion. 4] What is the forecast period for the Breast Pump Market? Ans. The Forecast period for the Breast Pump Market is 2024- 2030.

1. Breast Pumps Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Breast Pumps Market: Dynamics 2.1. Breast Pumps Market Trends by Region 2.1.1. North America Breast Pumps Market Trends 2.1.2. Europe Breast Pumps Market Trends 2.1.3. Asia Pacific Breast Pumps Market Trends 2.1.4. Middle East and Africa Breast Pumps Market Trends 2.1.5. South America Breast Pumps Market Trends 2.2. Breast Pumps Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Breast Pumps Market Drivers 2.2.1.2. North America Breast Pumps Market Restraints 2.2.1.3. North America Breast Pumps Market Opportunities 2.2.1.4. North America Breast Pumps Market Challenges 2.2.2. Europe 2.2.2.1. Europe Breast Pumps Market Drivers 2.2.2.2. Europe Breast Pumps Market Restraints 2.2.2.3. Europe Breast Pumps Market Opportunities 2.2.2.4. Europe Breast Pumps Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Breast Pumps Market Drivers 2.2.3.2. Asia Pacific Breast Pumps Market Restraints 2.2.3.3. Asia Pacific Breast Pumps Market Opportunities 2.2.3.4. Asia Pacific Breast Pumps Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Breast Pumps Market Drivers 2.2.4.2. Middle East and Africa Breast Pumps Market Restraints 2.2.4.3. Middle East and Africa Breast Pumps Market Opportunities 2.2.4.4. Middle East and Africa Breast Pumps Market Challenges 2.2.5. South America 2.2.5.1. South America Breast Pumps Market Drivers 2.2.5.2. South America Breast Pumps Market Restraints 2.2.5.3. South America Breast Pumps Market Opportunities 2.2.5.4. South America Breast Pumps Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Breast Pumps Industry 2.8. Analysis of Government Schemes and Initiatives For Breast Pumps Industry 2.9. Breast Pumps Market Trade Analysis 2.10. The Global Pandemic Impact on Breast Pumps Market 3. Breast Pumps Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Breast Pumps Market Size and Forecast, by Product (2023-2030) 3.1.1. Closed system 3.1.2. Open system 3.2. Breast Pumps Market Size and Forecast, by Technology (2023-2030) 3.2.1. Manual 3.2.2. Battery powered 3.2.3. Electric 3.3. Breast Pumps Market Size and Forecast, by Application (2023-2030) 3.3.1. Personal use 3.3.2. Hospital grade 3.4. Breast Pumps Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Breast Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Breast Pumps Market Size and Forecast, by Product (2023-2030) 4.1.1. Closed system 4.1.2. Open system 4.2. North America Breast Pumps Market Size and Forecast, by Technology (2023-2030) 4.2.1. Manual 4.2.2. Battery powered 4.2.3. Electric 4.3. North America Breast Pumps Market Size and Forecast, by Application (2023-2030) 4.3.1. Personal use 4.3.2. Hospital grade 4.4. North America Breast Pumps Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Breast Pumps Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Closed system 4.4.1.1.2. Open system 4.4.1.2. United States Breast Pumps Market Size and Forecast, by Technology (2023-2030) 4.4.1.2.1. Manual 4.4.1.2.2. Battery powered 4.4.1.2.3. Electric 4.4.1.3. United States Breast Pumps Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Personal use 4.4.1.3.2. Hospital grade 4.4.2. Canada 4.4.2.1. Canada Breast Pumps Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Closed system 4.4.2.1.2. Open system 4.4.2.2. Canada Breast Pumps Market Size and Forecast, by Technology (2023-2030) 4.4.2.2.1. Manual 4.4.2.2.2. Battery powered 4.4.2.2.3. Electric 4.4.2.3. Canada Breast Pumps Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Personal use 4.4.2.3.2. Hospital grade 4.4.3. Mexico 4.4.3.1. Mexico Breast Pumps Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Closed system 4.4.3.1.2. Open system 4.4.3.2. Mexico Breast Pumps Market Size and Forecast, by Technology (2023-2030) 4.4.3.2.1. Manual 4.4.3.2.2. Battery powered 4.4.3.2.3. Electric 4.4.3.3. Mexico Breast Pumps Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Personal use 4.4.3.3.2. Hospital grade 5. Europe Breast Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.2. Europe Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4. Europe Breast Pumps Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.1.3. United Kingdom Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.2.3. France Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.3.3. Germany Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.4.3. Italy Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.5.3. Spain Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.6.3. Sweden Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.7.3. Austria Breast Pumps Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Breast Pumps Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Breast Pumps Market Size and Forecast, by Technology (2023-2030) 5.4.8.3. Rest of Europe Breast Pumps Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Breast Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Breast Pumps Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. China Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. S Korea Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Japan Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. India Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Australia Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Indonesia Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Malaysia Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Vietnam Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.9.3. Taiwan Breast Pumps Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Breast Pumps Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Breast Pumps Market Size and Forecast, by Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Breast Pumps Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Breast Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Breast Pumps Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Breast Pumps Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Breast Pumps Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Breast Pumps Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Breast Pumps Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Breast Pumps Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. South Africa Breast Pumps Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Breast Pumps Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Breast Pumps Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. GCC Breast Pumps Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Breast Pumps Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Breast Pumps Market Size and Forecast, by Technology (2023-2030) 7.4.3.3. Nigeria Breast Pumps Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Breast Pumps Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Breast Pumps Market Size and Forecast, by Technology (2023-2030) 7.4.4.3. Rest of ME&A Breast Pumps Market Size and Forecast, by Application (2023-2030) 8. South America Breast Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Breast Pumps Market Size and Forecast, by Product (2023-2030) 8.2. South America Breast Pumps Market Size and Forecast, by Technology (2023-2030) 8.3. South America Breast Pumps Market Size and Forecast, by Application(2023-2030) 8.4. South America Breast Pumps Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Breast Pumps Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Breast Pumps Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. Brazil Breast Pumps Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Breast Pumps Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Breast Pumps Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. Argentina Breast Pumps Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Breast Pumps Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Breast Pumps Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Rest Of South America Breast Pumps Market Size and Forecast, by Application (2023-2030) 9. Global Breast Pumps Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Breast Pumps Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Medela LLC (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ardo Medical AG (Switzerland) 10.3. Philips Avent (Netherlands) 10.4. Ameda Inc. (United States) 10.5. Spectra Baby USA (United States) 10.6. Lansinoh Laboratories (United States) 10.7. NUK USA (United States) 10.8. Hygeia Health (United States) 10.9. Evenflo Feeding (United States) 10.10. BelleMa (United States) 10.11. Acelleron Medical Products (United States) 10.12. Bailey Medical Engineering (United States) 10.13. Freemie (United States) 10.14. Willow (United States) 10.15. Snow Bear (China) 10.16. RealBubee (China) 10.17. Mayborn Group Limited (United Kingdom) 10.18. Tommee Tippee (United Kingdom) 10.19. Chicco (Italy) 10.20. Pigeon Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. Breast Pumps Market: Research Methodology 14. Terms and Glossary