The Bioremediation Technology and Services Market size was valued at USD 14.3 Billion in 2023 and the total Bioremediation Technology and Services Market revenue is expected to grow at a CAGR of 7.5% from 2023 to 2030, reaching nearly USD 23.72 Billion in 2030.Bioremediation Technology and Services Market Research Objectives:

Maximize Market Research conducted a brief analysis of the Bioremediation Technology and Services Market. The purpose of the research is to provide stakeholders in the industry with a thorough insight into the Bioremediation Technology and Services Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Bioremediation Technology and Services Market by product, price, financial situation, product portfolio, growth plans, and geographical presence. Bioremediation is a waste management technique that employs the use of living organisms, like microbes and bacteria in the removal of contaminants, pollutants, and toxins from soil, water, and other environments. The Bioremediation Technology and Services market is driven by factors like government regulations and funding for research & and development activities in bioremediation, a rise in environmental awareness, and the increasing demand for cost-effective and eco-friendly solutions for environmental remediation. • In the European Union alone, more than 2.9 million sites have been estimated to have potential contaminations, which lead to negative health consequences, such as congenital abnormalities, cancer, low birth weights, and high mortality rates. Therefore, high demand for bioremediation is expected from such areas shortly. The market is expected to grow because of rapid industrial development that has led to widespread environmental pollution such as oceans, freshwater systems, forests & agricultural lands. The mismanagement of plastic waste, crude oil spills, increasing production of Greenhouse Gases (GHG), and The release of chemical pollutants, including pesticides, dioxanes, bisphenol-A, pyrethroids, and polycyclic aromatic hydrocarbons, has resulted in unacceptable environmental outcomes and boosted the need for bioremediation services. The Market is dominated by major Key Players Such As Siemens AG, Thermo Fisher Scientific Inc., Ecolab Inc., SUEZ, Tetra Tech Inc., and AECOM. The Asia Pacific region is the fastest-growing region in the Bioremediation Technology and Services Market and has the highest growth rate because of the increasing number of hazardous waste sites and the lack of mature waste management infrastructure in many developing countries.To know about the Research Methodology :- Request Free Sample Report

Bioremediation Technology and Services Market Dynamics:

Rising awareness about natural resources scarcity of natural resources Growing awareness about natural resource scarcity is driven by increasing demands for degradation of the environment and sustainability. With rapid industrialization and urbanization, the amount of harmful waste is increasing, creating a need for effective waste management techniques like bioremediation. It is a process that uses organisms to neutralize or remove contamination from waste, such as soil, wastewater, and oilfields. The Analyser showed that the global consumer society causes misuse of resources and waste, increasing problems with the environment demanding changes in behavior, and a decrease in consumption of resources in the Bioremediation Technology and Services Market. Government funding and regulations for bioremediation research and development, growing public awareness of the depletion of natural resources like oil and water, and the safety, affordability, and effectiveness of bioremediation in comparison to conservative technologies are the main factors driving the Bioremediation Technology and Services Market. Bioremediation technology is used in both commercial as well as in residential areas. These devices are used to free various oil fields, fungal, soil as well as wastewater remediation. An increase in global warming and contamination of environmental factors raise the demand for bioremediation devices. Large quantities of Personal protective equipment (PPE) kits and facemasks used have led to new challenges in the disposal and treatment of medical waste, which present a new growth opportunity for Bioremediation Technology and Services Market. By relying only on natural processes, it minimizes damage to the ecosystem.Restraint faced by the Bioremediation technology of the services market The long period of bioremediation processes is a significant controlling variable for the bioremediation innovation and administration market. This is because of the huge time expected to finish the cycle, which prevent its broad reception and business feasibility. The adequacy of bioremediation is impacted by different variables, including the substance nature and convergence of contaminations, physicochemical qualities of the climate, and openness to existing microorganisms. The debasement of specific impurities in soil or water through bioremediation requires months or even a long time to accomplish desired results, making it a sluggish and tedious cycle. One proper illustration of this limitation is the remediation of soil damaged with hydrocarbons. The course of normally debasing hydrocarbons in the soil through bioremediation is delayed because of variables like the accessibility of oxygen, supplements, and the particular microbial populations expected for debasement. Now and again, this prompts an extended remediation course of events, influencing the general proficiency and cost viability of the bioremediation interaction in the Bioremediation Technology and Services Market. The treatment of enormous-scope oil slicks utilizing bioremediation. In marine environments, where factors like temperature, water movement, and the availability of nutrients significantly influence the rate of biodegradation, the time it takes for naturally occurring microorganisms to break down the spilled oil is considerable. Subsequently, the extensive term of the bioremediation cycle presents a test in really tending to and relieving the ecological effect of such occurrences. High cost of bioremediation technology and services During land redevelopment and remediation services, many bulk materials handling equipment is required to move hazardous or toxic waste hampering the bioremediation technology and services market. Even when hired, these pieces of equipment, such as excavators, loaders, dumpers, and trucks, are very expensive. A significant investment in supporting yet critical equipment is required to complete a remediation project.

Bioremediation Technology and Services Market Segment Analysis:

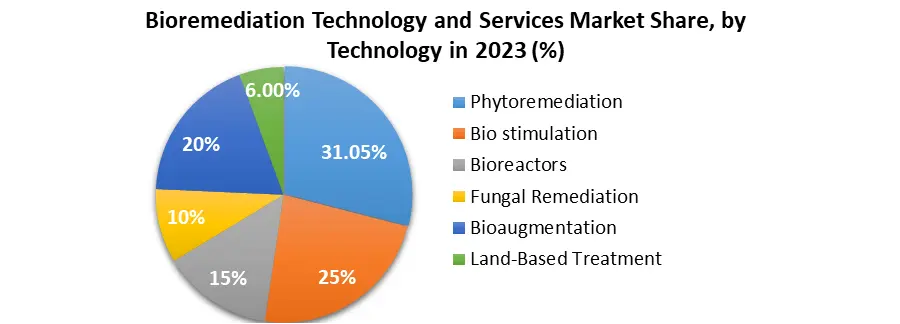

Based on Type, the In Situ type segment held the largest Bioremediation Technology and Services Market share of about 59.6% in the Bioremediation Technology and Services Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 7.7% during the forecast period and maintain its dominance till 2030. The Situ type segment is the highest because of its ability to treat contamination on-site without excavation and transportation of contaminated materials, which reduces costs and is less disruptive to the environment compared to the ex-situ methods. Utilizing in situ treatments that stimulate naturally occurring microbes in the environment, deeper contamination treated and a more permanent remedy is possible.Based on Technology, the Phytoremediation segment held the largest market share of about 31.5 % in the Bioremediation Technology and Services Market in 2023 and is expected to maintain its dominance till 2030. In the Bioremediation Technology and Services Market, phytoremediation is mostly less expensive than other technology. Phytoremedians use plants to clean up contaminants, which is a natural process. Investing in research and development to improve the efficacy and efficiency of phytoremediation technologies. This includes discovering new plant species, genetic engineering techniques, and supportive technologies. The demand for phytoremediation services is expected to drive innovation and new investments in Bioremediation technology and services Market.

Regional Analysis of Bioremediation Technology and Services Market:

North America region dominates the Bioremediation Technology and Services Market with the largest market share accounting for 43.62% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North America holds the largest market share because of strict environmental regulations as well as a powerful industrial sector, and awareness about environmental sustainability. The Bioremediation Technology and services market is driving cause of growing demand for natural remediation solutions and rising investments in research and development.Europe, the growing region in the Bioremediation Technology and Services Market held a market share of 22.5% and is significantly growing during its forecast period. The European region is growing because of increasing demand for cost-effective and sustainable remediation solutions as well as stringent environmental regulations. Developing Awareness about environmental protection. In Latin American bioremediation Technology and Services Market is emerging market because of increasing oil and gas exploration activities so, growing demand for remediation solutions for oil spills and industrial waste, and increasing investment in sources of renewable energy. Government programs promote sustainable development for market growth in Latin America.

Competitive Landscape for Bioremediation Technology and Services Market:

The competitive landscape of the Bioremediation Technology and Services Market is constantly evolving, with new players emerging and established players adapting their strategies. Leading companies in the Bioremediation Technology and Services Market including Sumas Remediation Service, Inc., Probiosphere, Inc. Drylet Inc., Xylem Inc., Regenesis Corp., Aquatech International Corp., Envirogen Technologies, Inc., and Microgen Biotech Ltd. Oil Spill Eater International, Inc. 1. On 12 December 2023, Xylem revealed its new Stratus IQ+™ electric meter with advanced grid-edge capabilities. 2. On 9 November 2023, the Board of Directors declared a dividend of $0.33 per share for the fourth quarter 3. In September 2023, Regenesis was featured in a Fast Company press release, highlighting that their PlumeStop Technology had been named as a finalist in prestigious awards 4. On 23 August 2023, Business Wire reported that Regenesis' PlumeStop Technology was recognized as a finalist in an award program 5. In June 2022, Microgen Biotech announced that it had closed a successful bridge round of funding and changed its name to Talam Biotech. Talam Biotech uses microbes found in the soil to develop solutions that help agriculture protect the integrity of our food and create a more sustainable planet 6. Aquatech Company Collaborate with Capstone Partners on recapitalization and joint venture partnership with UpWell to offer service for Water Technology. 7. Selection of Aquatech's evaporation process technology for a key service within 1PointFive's ground-breaking direct air capture (DAC) plant, Stratos, located in the U.S.Bioremediation Technology and Services Market Scope: Inquiry Before Buying

Bioremediation Technology and Services Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 14.3 Bn. Forecast Period 2024 to 2030 CAGR: 7.5% Market Size in 2030: US $ 23.72 Bn. Segments Covered: by Type In Situ Bioremediation Ex Situ Bioremediation by Technology Bio augmentation Phytoremediation Bio stimulation Fungal Remediation Bioreactors Land-based Treatments by Service Soil Remediation Wastewater Remediation Oilfield Remediation Bioremediation Technology and Services Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bioremediation Technology and Services Market Key Players:

North America 1. REGENESIS (California) 2. Aquatech International LLC (Pennsylvania) 3. Xylem Inc. ( Pennsylvania) 4. Drylet LLC (Texas) 5. Altogen Labs(Las Vegas) 6. InSitu Remediation Services Limited ( Canada) Europe 1. EnviTec Biogas AG ( Germany) 2. Remediation Ltd. (United Kingdom) 3. Bioreclamation AG ( Switzerland) 4. Envirozyme GmbH (Germany) 5. Bioclear BV Delft, (Netherlands) Asia-Pacific region 1. Jeen International Corporation (Japan) 2. Tokyo Engineering Corporation (Japan) 3. Microbial Ecology Research Institute (Japan) 4. Shandong Sanlian Environmental Protection Technology Co., Ltd (China) 5. Tata Consultancy Services (India) 6. Thermax Limited (India) 7. Ecosoft Co., Ltd. (South Korea) Latin America 1. Biolab Ambiental ( Brazil ) 2. Biotecno Engenharia (Brazil) 3. Grupo Quimmco (Mexico) Middle East & Africa 1. Aecom (South Africa) 2. Saudi green tech (Saudi Arabia) 3. Veolia Middle East ( Dubai)Frequently Asked Questions:

1. Which region has the largest share in the Bioremediation Technology and Services Market? Ans: The North American region held the highest share in 2023. 2. What is the growth rate of the Bioremediation Technology and Services Market? Ans: The Global Fuel Injection Systems Market is growing at a CAGR of 7.5% during the forecasting period 2023-2030. 3. What is the market size of the Bioremediation Technology and Services Market? Ans: The Bioremediation Technology and Services Market size was valued at USD 14.3 Billion in 2023 reaching nearly USD 23.72 Billion in 2030. 4. What segments are covered in the Bioremediation Technology and Services Market report? Ans: The segments covered in the Fuel Injection Systems market report are Type, Technology, Services, and Region. 5. Who are the key players in the Bioremediation Technology and Services Market? Ans: The important key players in the Bioremediation Technology and Services Market are Newterra Ltd., Sumas Remediation Service, Inc., Probiosphere, Inc. Drylet Inc., Xylem Inc., Regenesis Corp., Aquatech International Corp., Envirogen Technologies, Inc., and Microgen Biotech Ltd. Oil Spill Eater International, Inc.

1. Bioremediation Technology and Services Market: Research Methodology 2. Bioremediation Technology and Services Market 3. Introduction 3.1. Study Assumption and Market Definition 3.2. Scope of the Study 3.3. Executive Summary 4. Bioremediation Technology and Services Market: Dynamics 4.1. Global Bioremediation Technology and Services Market Trends by Region 4.1.1. North America Bioremediation Technology and Services Market Trends 4.1.2. Europe Bioremediation Technology and Services Market Trends 4.1.3. Asia Pacific Bioremediation Technology and Services Market Trends 4.1.4. Middle East and Africa Bioremediation Technology and Services Market Trends 4.1.5. South America Bioremediation Technology and Services Market Trends 4.2. Global Bioremediation Technology and Services Market Dynamics by Region 4.2.1. North America 4.2.1.1. North America Bioremediation Technology and Services Market Drivers 4.2.1.2. North America Bioremediation Technology and Services Market Restraints 4.2.1.3. North America Bioremediation Technology and Services Market Opportunities 4.2.1.4. North America Bioremediation Technology and Services Market Challenges 4.2.2. Europe 4.2.2.1. Europe Bioremediation Technology and Services Market Drivers 4.2.2.2. Europe Bioremediation Technology and Services Market Restraints 4.2.2.3. Europe Bioremediation Technology and Services Market Opportunities 4.2.2.4. Europe Bioremediation Technology and Services Market Challenges 4.2.3. Asia Pacific 4.2.3.1. Asia Pacific Bioremediation Technology and Services Market Drivers 4.2.3.2. Asia Pacific Bioremediation Technology and Services Market Restraints 4.2.3.3. Asia Pacific Bioremediation Technology and Services Market Opportunities 4.2.3.4. Asia Pacific Bioremediation Technology and Services Market Challenges 4.2.4. Middle East and Africa 4.2.4.1. Middle East and Africa Bioremediation Technology and Services Market Drivers 4.2.4.2. Middle East and Africa Bioremediation Technology and Services Market Restraints 4.2.4.3. Middle East and Africa Bioremediation Technology and Services Market Opportunities 4.2.4.4. Middle East and Africa Bioremediation Technology and Services Market Challenges 4.2.5. South America 4.2.5.1. South America Bioremediation Technology and Services Market Drivers 4.2.5.2. South America Bioremediation Technology and Services Market Restraints 4.2.5.3. South America Bioremediation Technology and Services Market Opportunities 4.2.5.4. South America Bioremediation Technology and Services Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Regulatory Landscape by Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 4.6. Analysis of Government Schemes and Initiatives For the Bioremediation Technology and Services Industry 5. Bioremediation Technology and Services Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 5.1. Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 5.1.1. In Situ Bioremediation 5.1.2. Ex Situ Bioremediation 5.2. Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 5.2.1. Bioaugmentation 5.2.2. Phytoremediation 5.2.3. Biostimulation 5.2.4. Fungal Remediation 5.2.5. Bioreactors 5.2.6. Land-based Treatments 5.3. Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 5.3.1. Soil Remediation 5.3.2. Wastewater Remediation 5.3.3. Oilfield Remediation 5.4. Bioremediation Technology and Services Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Bioremediation Technology and Services Market Size and Forecast (by Value in USD Billion) (2023-2030) 6.1. North America Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 6.1.1. In Situ Bioremediation 6.1.2. Ex Situ Bioremediation 6.2. North America Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 6.2.1. Bioaugmentation 6.2.2. Phytoremediation 6.2.3. Biostimulation 6.2.4. Fungal Remediation 6.2.5. Bioreactors 6.2.6. Land-based Treatments 6.3. North America Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 6.3.1. Soil Remediation 6.3.2. Wastewater Remediation 6.3.3. Oilfield Remediation 6.4. North America Bioremediation Technology and Services Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.1.1. United States Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 6.4.1.1.1. In Situ Bioremediation 6.4.1.1.2. Ex Situ Bioremediation 6.4.1.2. United States Bioremediation Technology and Services Market Size and Forecast by Technology (2023-2030) 6.4.1.2.1. Bioaugmentation 6.4.1.2.2. Phytoremediation 6.4.1.2.3. Biostimulation 6.4.1.2.4. Fungal Remediation 6.4.1.2.5. Bioreactors 6.4.1.2.6. Land-based Treatments 6.4.1.3. United States Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 6.4.1.3.1. Soil Remediation 6.4.1.3.2. Wastewater Remediation 6.4.1.3.3. Oilfield Remediation 6.4.2. Canada 6.4.2.1. Canada Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 6.4.2.1.1. In Situ Bioremediation 6.4.2.1.2. Ex Situ Bioremediation 6.4.2.2. Canada Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 6.4.2.2.1. Bioaugmentation 6.4.2.2.2. Phytoremediation 6.4.2.2.3. Biostimulation 6.4.2.2.4. Fungal Remediation 6.4.2.2.5. Bioreactors 6.4.2.2.6. Land-based Treatments 6.4.2.3. Canada Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 6.4.2.3.1. Soil Remediation 6.4.2.3.2. Wastewater Remediation 6.4.2.3.3. Oilfield Remediation 6.4.3. Mexico 6.4.3.1. Mexico Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 6.4.3.1.1. In Situ Bioremediation 6.4.3.1.2. Ex Situ Bioremediation 6.4.3.2. Mexico Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 6.4.3.2.1. Bioaugmentation 6.4.3.2.2. Phytoremediation 6.4.3.2.3. Biostimulation 6.4.3.2.4. Fungal Remediation 6.4.3.2.5. Bioreactors 6.4.3.2.6. Land-based Treatments 6.4.3.3. Mexico Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 6.4.3.3.1. Soil Remediation 6.4.3.3.2. Wastewater Remediation 6.4.3.3.3. Oilfield Remediation 7. Europe Bioremediation Technology and Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 7.1. Europe Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.2. Europe Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.3. Europe Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4. Europe Bioremediation Technology and Services Market Size and Forecast, by Country (2023-2030) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.1.2. United Kingdom Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. United Kingdom Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.2. France 7.4.2.1. France Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.2.2. France Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. France Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.3. Germany 7.4.3.1. Germany Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Germany Bioremediation Technology and Services Market Size and Forecast by Technology (2023-2030) 7.4.3.3. Germany Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.4. Italy 7.4.4.1. Italy Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Italy Bioremediation Technology and Services Market Size and Forecast by Technology (2023-2030) 7.4.4.3. Italy Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.5. Spain 7.4.5.1. Spain Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Spain Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.4.5.3. Spain Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.6. Sweden 7.4.6.1. Sweden Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Sweden Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.4.6.3. Sweden Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.7. Austria 7.4.7.1. Austria Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Austria Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.4.7.3. Austria Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Rest of Europe Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 7.4.8.3. Rest of Europe Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8. Asia Pacific Bioremediation Technology and Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 8.1. Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.2. Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.3. Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4. Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.1.1. China Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.1.2. China Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. China Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.2. S Korea 8.4.2.1. S Korea Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.2.2. S Korea Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. S Korea Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.3. Japan 8.4.3.1. Japan Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Japan Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Japan Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.4. India 8.4.4.1. India Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.4.2. India Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.4.3. India Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.5. Australia 8.4.5.1. Australia Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.5.2. Australia Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.5.3. Australia Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.6. Indonesia 8.4.6.1. Indonesia Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.6.2. Indonesia Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.6.3. Indonesia Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.7. Malaysia 8.4.7.1. Malaysia Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.7.2. Malaysia Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.7.3. Malaysia Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.8. Vietnam 8.4.8.1. Vietnam Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.8.2. Vietnam Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.8.3. Vietnam Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.9. Taiwan 8.4.9.1. Taiwan Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.9.2. Taiwan Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.9.3. Taiwan Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 8.4.10. Rest of Asia Pacific 8.4.10.1. Rest of Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 8.4.10.2. Rest of Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 8.4.10.3. Rest of Asia Pacific Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 9. Middle East and Africa Bioremediation Technology and Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 9.1. Middle East and Africa Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 9.2. Middle East and Africa Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 9.3. Middle East and Africa Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 9.4. Middle East and Africa Bioremediation Technology and Services Market Size and Forecast, by Country (2023-2030) 9.4.1. South Africa 9.4.1.1. South Africa Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 9.4.1.2. South Africa Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 9.4.1.3. South Africa Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 9.4.2. GCC 9.4.2.1. GCC Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 9.4.2.2. GCC Bioremediation Technology and Services Market Size and Forecast by Technology (2023-2030) 9.4.2.3. GCC Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 9.4.3. Nigeria 9.4.3.1. Nigeria Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Nigeria Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 9.4.3.3. Nigeria Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 9.4.4. Rest of ME&A 9.4.4.1. Rest of ME&A Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 9.4.4.2. Rest of ME&A Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 9.4.4.3. Rest of ME&A Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 10. South America Bioremediation Technology and Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 10.1. South America Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 10.2. South America Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 10.3. South America Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 10.4. South America Bioremediation Technology and Services Market Size and Forecast, by Country (2023-2030) 10.4.1. Brazil 10.4.1.1. Brazil Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 10.4.1.2. Brazil Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 10.4.1.3. Brazil Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 10.4.2. Argentina 10.4.2.1. Argentina Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 10.4.2.2. Argentina Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 10.4.2.3. Argentina Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 10.4.3. Rest Of South America 10.4.3.1. Rest Of South America Bioremediation Technology and Services Market Size and Forecast, by Type (2023-2030) 10.4.3.2. Rest Of South America Bioremediation Technology and Services Market Size and Forecast, by Technology (2023-2030) 10.4.3.3. Rest Of South America Bioremediation Technology and Services Market Size and Forecast, by Services (2023-2030) 11. Bioremediation Technology and Services Market: Competitive Landscape 11.1. MMR Competition Matrix 11.2. Competitive Landscape 11.3. Key Players Benchmarking 11.3.1. Company Name 11.3.2. Product Segment 11.3.3. End-user Segment 11.3.4. Revenue (2023) 11.3.5. Company Locations 11.4. Leading Bioremediation Technology and Services Market Companies, by Market Capitalization 11.5. Market Structure 11.5.1. Market Leaders 11.5.2. Market Followers 11.5.3. Emerging Players 11.6. Mergers and Acquisitions Details 12. Company Profile: Key Players 12.1. Xylem, Incorporation 12.1.1. Company Overview 12.1.2. Business Portfolio 12.1.3. Financial Overview 12.1.4. SWOT Analysis 12.1.5. Strategic Analysis 12.1.6. Scale of Operation (small, medium, and large) 12.1.7. Details on partnership 12.1.8. Regulatory Accreditations and certifications Received by Them 12.1.9. Awards Received by the firm 12.1.10. Recent Developments 12.2. Altogen Labs 12.3. Aquatech International Llc 12.4. Regenesis 12.5. Drylet Llc 12.6. Insitu Remediation Services Limited Piezo Kinetics, Inc. 12.7. Probiosphere 12.8. Ivey International, Inc. 12.9. Sumas Remediation Services, Inc. 12.10. Sarva Bio Remed, Llc. 12.11. Bayer Cropscience Ag 12.12. Basf Se 12.13. American Vanguard Corporation 12.14. Novozymes As 12.15. Soil Works Llc 12.16. Dowa Eco-System Co. Ltd 12.17. Isagro Spa 12.18. Adama Ltd 12.19. Southern Petrochemical Industries Corporation (Spic) Limited 12.20. Sa Lime & Gypsum. 13. Key Findings 14. Industry Recommendations 15. Bioremediation Technology and Services Market: Research Methodology