The Biopsy Market size was valued at USD 33.17 Billion in 2024 and the total biopsy revenue is expected to grow at a CAGR of 11.03% from 2025 to 2032, reaching nearly USD 68.96 Billion.Global Biopsy Market Overview

A biopsy is a medical procedure involving the removal of tissue or cells for examination, primarily used to detect, diagnose, and monitor diseases such as cancer, infections, and inflammatory conditions. The global biopsy market is expected to experience strong growth, driven by rising cancer prevalence, increasing demand for minimally invasive diagnostic procedures, and advancements in imaging-guided technologies. Key innovations such as liquid biopsies, AI-assisted diagnostics, and robotic-assisted procedures are enhancing precision and efficiency. North America leads the market due to advanced healthcare infrastructure and strong R&D investments, while Asia-Pacific is driven by growing healthcare access and awareness. With continuous regulatory approvals, technological innovation, and integration of personalized medicine approaches, the biopsy industry is set to grow, offering significant opportunities for healthcare providers and medical device manufacturers.To know about the Research Methodology :- Request Free Sample Report

Biopsy Market Dynamics

Rising Cancer Incidence to Drive Biopsy Demand The global surge in cancer prevalence is a major driver of the biopsy market. According to the WHO, cancer accounted for nearly a million deaths in 2022, with cases projected to rise sharply over the next decade. Biopsies remain the gold standard for definitive cancer diagnosis, staging, and treatment planning, driving strong demand across healthcare systems. Additionally, technological advancements in image-guided and minimally invasive biopsy methods have enhanced diagnostic accuracy while reducing patient discomfort, thereby improving adoption. As oncology continues to dominate clinical applications, the rising burden of cancer cases worldwide is expected to continue to accelerate the adoption of biopsy devices, instruments, and services. Innovations in Liquid Biopsy and Point-of-Care Devices to Create Lucrative Opportunities for Market Growth The growing adoption of liquid biopsy presents a transformative opportunity for the Biopsy Market growth. Unlike invasive tissue biopsies, liquid biopsies use blood or other fluids to analyze biomarkers, enabling early disease detection, treatment monitoring, and personalized medicine approaches. With increasing focus on precision oncology, companies are investing in developing advanced point-of-care liquid biopsy devices capable of detecting circulating tumor DNA (ctDNA) and other biomarkers in real time. These innovations not only improve accessibility but also reduce diagnostic turnaround times, particularly in decentralized and resource-limited settings. As healthcare shifts toward personalized care models, the convergence of liquid biopsy and point-of-care technologies is expected to unlock substantial growth potential in the biopsy industry. Key Challenge: Financial and Policy Barriers Limiting Accessibility Despite technological progress, reimbursement and cost challenges significantly hinder biopsy adoption. Liquid biopsies and molecular testing are often expensive, with complex and fragmented reimbursement structures creating uncertainty for patients and providers. Many insurers cover only single-gene analyses, leaving patients to bear high out-of-pocket expenses for comprehensive multi-gene tests. This lack of transparency in billing contributes to anxiety and limits the practical uptake of innovative biopsy methods. Moreover, evolving cancer care payment policies require constant compliance, posing additional administrative burdens. Without clear reimbursement frameworks and equitable coverage, access to advanced biopsy technologies will remain restricted, particularly in low- and middle-income countries, restraining the Biopsy Market growth potential.Global Biopsy Market Key Trends:

Key Trend Description Early Cancer Detection Liquid biopsies, being less invasive than tissue biopsies, are increasingly used for early cancer detection. Integration with AI & Imaging Biopsy instruments are adopting AI-assisted diagnostics and imaging support to enhance precision, reduce operator dependence, and improve decision-making. Minimally Invasive Procedures Image-guided and robotic-assisted biopsies are gaining popularity due to reduced risks, shorter recovery, and higher patient acceptance. Personalized Medicine Rising demand for liquid biopsies that provide real-time molecular insights to guide individualized treatment strategies. Global Biospy Market Segment Analysis

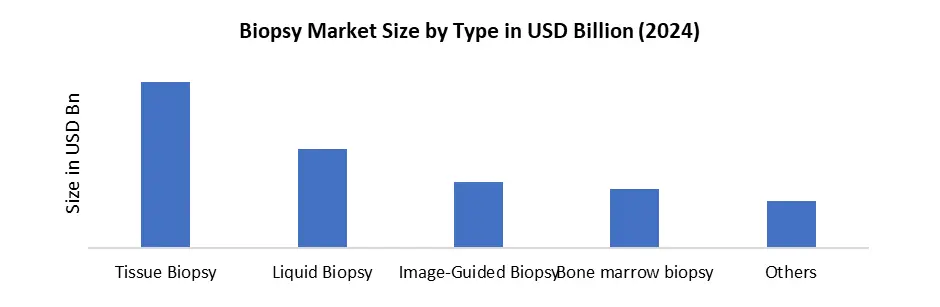

Based on the type segment, tissue biopsy held the largest share in the global biopsy market in 2024. This dominance is primarily attributed to its widespread use in cancer diagnosis and disease staging, where tissue sampling remains the gold standard for confirming malignancies and determining treatment pathways. Tissue biopsies provide high diagnostic accuracy through histopathological examination, making them a preferred choice among clinicians despite being invasive. The increasing global burden of cancer and advancements in image-guided tissue biopsy techniques are reinforcing its adoption. Tissue biopsy continues to account for the largest share compared to liquid and other biopsy types.

Global Biopsy Market Regional Analysis:

In 2024, North America dominated the global biopsy market, accounting for xx% of the total revenue share. The U.S. played a pivotal role in this dominance, contributing xx% of the global market share. The region’s growth is driven by the rising prevalence of cancer, with the National Cancer Institute estimating 2,001,140 new cancer cases in 2024. This escalating burden has accelerated the demand for accurate, minimally invasive diagnostic tools. Technological innovation continues to strengthen the region’s leadership. For instance, in September 2023-24, the U.S. FDA granted 510(k) clearance to Limaca Medical’s Precision GI endoscopic ultrasound biopsy device, underscoring the robust regulatory and innovation ecosystem in the country. The combination of advanced healthcare infrastructure, favorable reimbursement policies, and rapid adoption of novel biopsy techniques supports consistent market growth. The strong collaboration between medical device companies, research institutions, and healthcare providers is driving the introduction of AI-driven diagnostic platforms, robotic biopsy devices, and improved imaging-guided systems. With high healthcare spending, a large patient pool, and continuous product launches, North America is expected to remain the key driver of the biopsy market during the forecast period, mirroring its trajectory of innovation-driven growth seen in other advanced healthcare technology markets.Global Biopsy Market Competitive Analysis:

The global Biopsy Market is marked by intensifying competition, with leading players leveraging R&D, acquisitions, and integrated imaging solutions to strengthen market presence. Companies navigate a complex regulatory and reimbursement landscape, with premium adoption in North America and Europe and cost-sensitive dynamics in Asia-Pacific and emerging economies. Market leaders such as Hologic, BD, and Danaher (Mammotome/Leica) dominate breast biopsy through vacuum-assisted platforms, image-guided systems, and marker portfolios, while Boston Scientific, Olympus, and Cook compete strongly in GI, pulmonary, and urology biopsy tools. Argon, Merit, and B. Braun address niche opportunities with regionally tailored kits and accessories. Players emphasize workflow efficiency, specimen accuracy, and integration with imaging modalities to enhance clinician adoption. Competitive strategies are increasingly shaped by ambulatory migration, AI-driven targeting, and digital pathology connectivity, positioning innovation, localized offerings, and ecosystem lock-in as the key differentiators in this evolving market.Global Biopsy Market Key Development:

Biobot Surgical: In January 2025, Biobot Surgical obtained CE Certification for its Mona Lisa 2.0, a robotic system intended for accurate and efficient prostate ablation and biopsy. The device supports precise diagnosis and therapeutic actions by allowing real-time modifications to the prostrate model and needle placement. Its enhanced needle trajectory tracking lowers the possibility of damaging nearby tissues and improves biopsy reliability. Triopsy Medical, Inc.: In January 2025, the FDA awarded US-based Triopsy Medical 510(k) clearance for its Integrated Biopsy System. The system standardizes the collection and transport of prostrate biopsy samples. Its innovative trochar needle tip allows for precise lesion targeting, and its exclusive Biopsy Grip makes handling tissue samples in the lab simple and distortion-free. Additionally, the technology will make it easier to build a sizable data collection to assist upcoming advancements in surgical and pharmaceutical treatment.Biopsy Market Scope: Inquire before buying

Global Biopsy Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 33.17 Bn. Forecast Period 2025 to 2032 CAGR: 11.03% Market Size in 2032: USD 68.96 Bn. Segments Covered: by Type Tissue Biopsy Liquid Biopsy Image-Guided Biopsy Bone marrow biopsy Others by Product Type Instruments Kits & Consumables Services by Application Cancer Inflammatory disorders Immune disorders Peptic ulcer disease Endometriosis by End-User Hospitals Diagnostic laboratories Cancer research centers Academic & research institutions Ambulatory surgical centers Others Biopsy Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Biopsy Key Players

1. Hologic, Inc. (USA) 2. Leica Biosystems (Danaher Corporation) (USA) 3. Mammotome (Devicor Medical Products) (USA) 4. Becton Dickinson & Company (BD) (USA) 5. Medtronic plc (USA) 6. Johnson & Johnson (Ethicon) (USA) 7. C.R. Bard, Inc. (BD subsidiary) (USA) 8. Cook Medical (USA) 9. Guardant Health, Inc. (USA) 10. Triopsy Medical, Inc (USA) 11. Quibim (USA) 12. Exact Sciences Corporation (USA) 13. Celsee Diagnostics (USA) 14. Biocept, Inc. (USA) 15. Argon Medical Devices (USA) 16. Natera, Inc. (USA) 17. Freenome Holdings, Inc. (USA) 18. Leica Biosystems (Danaher Corporation) (Germany) 19. Roche Diagnostics (Switzerland) 20. QIAGEN N.V. (Netherlands) 21. Fujifilm Holdings Corporation (Japan) 22. Olympus Corporation (Japan) 23. Nipro Corporation (Japan) 24. Terumo Corporation (Japan) 25. Biobot Surgical (Singapore) 26. OthersFAQ

1. What is a biopsy and why is it important? Ans: A biopsy is the removal of tissue or cells for examination, mainly used to detect, diagnose, and monitor diseases such as cancer, infections, and inflammatory conditions. 2. What is the global biopsy market size in 2024? Ans: The global biopsy market was valued at USD 33.17 billion in 2024 and is projected to reach USD 68.96 billion by 2032, growing at a CAGR of 11.03%. 3. Which region dominates the biopsy market? Ans: North America dominates the biopsy market, driven by advanced healthcare infrastructure, high cancer prevalence, and strong R&D investment. 4. What are the key growth drivers of the biopsy market? Ans: Rising cancer incidence, demand for minimally invasive procedures, and technological advancements such as liquid biopsies, AI-assisted diagnostics, and robotic biopsy devices are major growth drivers. 5. Who are the leading players in the biopsy market? Ans: Key players include Hologic, BD, Danaher (Leica/Mammotome), Cook Medical, Olympus, Boston Scientific, Guardant Health, Roche Diagnostics, and Exact Sciences Corporation.

1. Biopsy Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Biopsy Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Biopsy Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Biopsy Market: Dynamics 3.1. Biopsy Market Trends by Region 3.1.1. North America Biopsy Market Trends 3.1.2. Europe Biopsy Market Trends 3.1.3. Asia Pacific Biopsy Market Trends 3.1.4. Middle East and Africa Biopsy Market Trends 3.1.5. South America Biopsy Market Trends 3.2. Biopsy Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Biopsy Market Drivers 3.2.1.2. North America Biopsy Market Restraints 3.2.1.3. North America Biopsy Market Opportunities 3.2.1.4. North America Biopsy Market Challenges 3.2.2. Europe 3.2.2.1. Europe Biopsy Market Drivers 3.2.2.2. Europe Biopsy Market Restraints 3.2.2.3. Europe Biopsy Market Opportunities 3.2.2.4. Europe Biopsy Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Biopsy Market Drivers 3.2.3.2. Asia Pacific Biopsy Market Restraints 3.2.3.3. Asia Pacific Biopsy Market Opportunities 3.2.3.4. Asia Pacific Biopsy Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Biopsy Market Drivers 3.2.4.2. Middle East and Africa Biopsy Market Restraints 3.2.4.3. Middle East and Africa Biopsy Market Opportunities 3.2.4.4. Middle East and Africa Biopsy Market Challenges 3.2.5. South America 3.2.5.1. South America Biopsy Market Drivers 3.2.5.2. South America Biopsy Market Restraints 3.2.5.3. South America Biopsy Market Opportunities 3.2.5.4. South America Biopsy Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Biopsy Industry 3.8. Analysis of Government Schemes and Initiatives For Biopsy Industry 3.9. Biopsy Market Trade Analysis 3.10. The Global Pandemic Impact on Biopsy Market 4. Biopsy Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Biopsy Market Size and Forecast, by Type (2024-2032) 4.1.1. Tissue Biopsy 4.1.2. Liquid Biopsy 4.1.3. Image-Guided Biopsy 4.1.4. Bone marrow biopsy 4.1.5. Others 4.2. Biopsy Market Size and Forecast, by Product Type (2024-2032) 4.2.1. Instruments 4.2.2. Kits & Consumables 4.2.3. Services 4.3. Biopsy Market Size and Forecast, by Application (2024-2032) 4.3.1. Cancer 4.3.2. Inflammatory disorders 4.3.3. Immune disorders 4.3.4. Peptic ulcer disease 4.3.5. Endometriosis 4.4. Biopsy Market Size and Forecast, by End User (2024-2032) 4.4.1. Hospitals 4.4.2. Diagnostic laboratories 4.4.3. Cancer research centers 4.4.4. Academic & research institutions 4.4.5. Ambulatory surgical centers 4.4.6. Others 4.5. Biopsy Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Biopsy Market Size and Forecast, by Type (2024-2032) 5.1.1. Tissue Biopsy 5.1.2. Liquid Biopsy 5.1.3. Image-Guided Biopsy 5.1.4. Bone marrow biopsy 5.1.5. Others 5.2. North America Biopsy Market Size and Forecast, by Product Type (2024-2032) 5.2.1. Instruments 5.2.2. Kits & Consumables 5.2.3. Services 5.3. North America Biopsy Market Size and Forecast, by Application (2024-2032) 5.3.1. Cancer 5.3.2. Inflammatory disorders 5.3.3. Immune disorders 5.3.4. Peptic ulcer disease 5.3.5. Endometriosis 5.4. North America Biopsy Market Size and Forecast, by End User (2024-2032) 5.4.1. Hospitals 5.4.2. Diagnostic laboratories 5.4.3. Cancer research centers 5.4.4. Academic & research institutions 5.4.5. Ambulatory surgical centers 5.4.6. Others 5.5. North America Biopsy Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Biopsy Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Tissue Biopsy 5.5.1.1.2. Liquid Biopsy 5.5.1.1.3. Image-Guided Biopsy 5.5.1.1.4. Bone marrow biopsy 5.5.1.1.5. Others 5.5.1.2. United States Biopsy Market Size and Forecast, by Product Type (2024-2032) 5.5.1.2.1. Instruments 5.5.1.2.2. Kits & Consumables 5.5.1.2.3. Services 5.5.1.3. United States Biopsy Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Cancer 5.5.1.3.2. Inflammatory disorders 5.5.1.3.3. Immune disorders 5.5.1.3.4. Peptic ulcer disease 5.5.1.3.5. Endometriosis 5.5.1.4. United States Biopsy Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Hospitals 5.5.1.4.2. Diagnostic laboratories 5.5.1.4.3. Cancer research centers 5.5.1.4.4. Academic & research institutions 5.5.1.4.5. Ambulatory surgical centers 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Biopsy Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Tissue Biopsy 5.5.2.1.2. Liquid Biopsy 5.5.2.1.3. Image-Guided Biopsy 5.5.2.1.4. Bone marrow biopsy 5.5.2.1.5. Others 5.5.2.2. Canada Biopsy Market Size and Forecast, by Product Type (2024-2032) 5.5.2.2.1. Instruments 5.5.2.2.2. Kits & Consumables 5.5.2.2.3. Services 5.5.2.3. Canada Biopsy Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Cancer 5.5.2.3.2. Inflammatory disorders 5.5.2.3.3. Immune disorders 5.5.2.3.4. Peptic ulcer disease 5.5.2.3.5. Endometriosis 5.5.2.4. Canada Biopsy Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Hospitals 5.5.2.4.2. Diagnostic laboratories 5.5.2.4.3. Cancer research centers 5.5.2.4.4. Academic & research institutions 5.5.2.4.5. Ambulatory surgical centers 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Biopsy Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Tissue Biopsy 5.5.3.1.2. Liquid Biopsy 5.5.3.1.3. Image-Guided Biopsy 5.5.3.1.4. Bone marrow biopsy 5.5.3.1.5. Others 5.5.3.2. Mexico Biopsy Market Size and Forecast, by Product Type (2024-2032) 5.5.3.2.1. Instruments 5.5.3.2.2. Kits & Consumables 5.5.3.2.3. Services 5.5.3.3. Mexico Biopsy Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Cancer 5.5.3.3.2. Inflammatory disorders 5.5.3.3.3. Immune disorders 5.5.3.3.4. Peptic ulcer disease 5.5.3.3.5. Endometriosis 5.5.3.4. Mexico Biopsy Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Hospitals 5.5.3.4.2. Diagnostic laboratories 5.5.3.4.3. Cancer research centers 5.5.3.4.4. Academic & research institutions 5.5.3.4.5. Ambulatory surgical centers 5.5.3.4.6. Others 6. Europe Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Biopsy Market Size and Forecast, by Type (2024-2032) 6.2. Europe Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.3. Europe Biopsy Market Size and Forecast, by Application (2024-2032) 6.4. Europe Biopsy Market Size and Forecast, by End User (2024-2032) 6.5. Europe Biopsy Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.1.3. United Kingdom Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.2.3. France Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.3.3. Germany Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.4.3. Italy Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.5.3. Spain Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.6.3. Sweden Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.7.3. Austria Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Biopsy Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Biopsy Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Biopsy Market Size and Forecast, by Product Type (2024-2032) 6.5.8.3. Rest of Europe Biopsy Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Biopsy Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Biopsy Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.3. Asia Pacific Biopsy Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Biopsy Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Biopsy Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.1.3. China Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.2.3. S Korea Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.3.3. Japan Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.4.3. India Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.5.3. Australia Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.6.3. Indonesia Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.7.3. Malaysia Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.8.3. Vietnam Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.9.3. Taiwan Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Biopsy Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Biopsy Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Biopsy Market Size and Forecast, by Product Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Biopsy Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Biopsy Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Biopsy Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Biopsy Market Size and Forecast, by Product Type (2024-2032) 8.3. Middle East and Africa Biopsy Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Biopsy Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Biopsy Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Biopsy Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Biopsy Market Size and Forecast, by Product Type (2024-2032) 8.5.1.3. South Africa Biopsy Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Biopsy Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Biopsy Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Biopsy Market Size and Forecast, by Product Type (2024-2032) 8.5.2.3. GCC Biopsy Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Biopsy Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Biopsy Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Biopsy Market Size and Forecast, by Product Type (2024-2032) 8.5.3.3. Nigeria Biopsy Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Biopsy Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Biopsy Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Biopsy Market Size and Forecast, by Product Type (2024-2032) 8.5.4.3. Rest of ME&A Biopsy Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Biopsy Market Size and Forecast, by End User (2024-2032) 9. South America Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Biopsy Market Size and Forecast, by Type (2024-2032) 9.2. South America Biopsy Market Size and Forecast, by Product Type (2024-2032) 9.3. South America Biopsy Market Size and Forecast, by Application(2024-2032) 9.4. South America Biopsy Market Size and Forecast, by End User (2024-2032) 9.5. South America Biopsy Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Biopsy Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Biopsy Market Size and Forecast, by Product Type (2024-2032) 9.5.1.3. Brazil Biopsy Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Biopsy Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Biopsy Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Biopsy Market Size and Forecast, by Product Type (2024-2032) 9.5.2.3. Argentina Biopsy Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Biopsy Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Biopsy Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Biopsy Market Size and Forecast, by Product Type (2024-2032) 9.5.3.3. Rest Of South America Biopsy Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Biopsy Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Hologic, Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Leica Biosystems (Danaher Corporation) (USA) 10.3. Mammotome (Devicor Medical Products) (USA) 10.4. Becton Dickinson & Company (BD) (USA) 10.5. Medtronic plc (USA) 10.6. Johnson & Johnson (Ethicon) (USA) 10.7. C.R. Bard, Inc. (BD subsidiary) (USA) 10.8. Cook Medical (USA) 10.9. Guardant Health, Inc. (USA) 10.10. Triopsy Medical, Inc (USA) 10.11. Quibim (USA) 10.12. Exact Sciences Corporation (USA) 10.13. Celsee Diagnostics (USA) 10.14. Biocept, Inc. (USA) 10.15. Argon Medical Devices (USA) 10.16. Natera, Inc. (USA) 10.17. Freenome Holdings, Inc. (USA) 10.18. Leica Biosystems (Danaher Corporation) (Germany) 10.19. Roche Diagnostics (Switzerland) 10.20. QIAGEN N.V. (Netherlands) 10.21. Fujifilm Holdings Corporation (Japan) 10.22. Olympus Corporation (Japan) 10.23. Nipro Corporation (Japan) 10.24. Terumo Corporation (Japan) 10.25. Biobot Surgical (Singapore) 10.26. Others 11. Key Findings 12. Industry Recommendations 13. Biopsy Market: Research Methodology 14. Terms and Glossary