Biometrics Technology Market size was valued at USD 38.23 Billion in 2023 and the Biometrics Technology Market revenue is expected to reach USD 119.42 Billion by 2030, at a CAGR of 17.67 % over the forecast period.Biometrics Technology Market Overview

Biometrics technology involves the use of biological characteristics or behavioral traits to authenticate and identify individuals. It relies on unique physical or behavioral attributes that are difficult to duplicate or forge. These attributes include fingerprints, iris patterns, facial features, voice patterns, hand geometry, and even DNA. Biometrics technology is used in various applications, including access control systems, time and attendance tracking, border control and immigration, law enforcement, financial transactions, and healthcare. It offers enhanced security, convenience, and efficiency compared to traditional methods of authentication, such as passwords or identity cards. There are also concerns about privacy, data security, and potential misuse of biometric data, which need to be addressed in the implementation of these systems.To know about the Research Methodology :- Request Free Sample Report Continued advancements in biometric technologies, such as the development of touchless or contactless biometric solutions, multimodal biometrics combining multiple biometric modalities for enhanced accuracy, and improvements in performance and usability, are driving the Biometrics Technology market growth. The biometrics industry is subject to various regulations and standards concerning data privacy and security, such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Compliance with these regulations is essential for biometric solution providers. The adoption of biometrics technology varies across regions, with North America and Europe being significant markets due to the presence of key players, stringent security regulations, and high adoption rates in sectors such as government and finance. The Asia-Pacific region is witnessing rapid growth due to increasing government initiatives, technological advancements, and rising adoption in sectors like banking, healthcare, and transportation.

Biometrics Technology Market Dynamics

Security Concerns and Identity Fraud to boost Biometrics Technology Market growth In an era marked by escalating cybersecurity threats and identity fraud, organizations are prioritizing robust security measures to safeguard sensitive information and assets. Biometric technologies offer a highly secure method of authentication, mitigating the risks associated with stolen passwords or identity theft. The escalating security concerns are driving the adoption of biometrics across various sectors, including government, finance, healthcare, and enterprise, which is expected to boost the Biometrics Technology Market growth. Continuous innovations and advancements in biometric technologies are significantly enhancing their accuracy, reliability, and usability. These advancements include the development of touchless or contactless biometric solutions, multimodal biometrics combining multiple biometric modalities for enhanced accuracy, and the integration of artificial intelligence (AI) and machine learning algorithms for improved performance. Such technological innovations are expanding the applicability of biometrics across diverse use cases and driving the Biometrics Technology Market growth. Biometric authentication offers unparalleled convenience and user experience compared to traditional authentication methods such as passwords or PINs. With biometrics, users authenticate themselves effortlessly using their unique biological characteristics or behavioral traits, eliminating the need to remember and manage complex passwords. This enhanced convenience and user experience are driving the adoption of biometrics in various consumer-facing applications, including mobile devices, banking, e-commerce, and travel, which significantly boosts the Biometrics Technology Market growth. Biometric technologies are finding applications across a wide range of industries, including government, banking and finance, healthcare, retail, transportation, and telecommunications. In the government sector, biometrics are used for border control, national ID programs, and law enforcement purposes. In banking and finance, biometric authentication is employed for secure access to accounts and financial transactions. Similarly, biometrics are being integrated into healthcare systems for patient identification and electronic health record (EHR) access. The increasing adoption of biometrics across diverse industries is fueling the Biometrics Technology Market growth.Table 1: A taxonomy for biometric AI systems in the workplace

Privacy Concerns and Security Vulnerabilities to limit Biometrics Technology Market growth The concern over privacy implications associated with the collection, storage, and use of biometric data is significantly restraining the Biometrics Technology Market growth. Biometric identifiers, such as fingerprints, iris scans, and facial features, are inherently personal and unique, raising concerns about potential misuse, unauthorized access, and identity theft. As biometric systems become more pervasive across various sectors, there is a growing need for stringent privacy safeguards, transparent data practices, and robust encryption methods to protect biometric data from unauthorized access and exploitation. Despite their inherent security features, biometric systems are not immune to vulnerabilities and attacks. Biometric data, once compromised, is not easily replaced such as passwords or tokens, making it crucial to safeguard against potential security breaches. Threats such as spoofing attacks (e.g., using fake fingerprints or facial images), replay attacks, and data breaches pose significant risks to biometric authentication systems, which is expected to boost the Biometrics Technology Market growth. To mitigate these risks, biometric system developers need to continually invest in research and development to enhance security measures, such as liveness detection techniques, encryption algorithms, and anti-spoofing technologies. The widespread adoption of biometric technologies raises ethical concerns and societal implications regarding individual privacy, autonomy, and civil liberties. Issues such as mass surveillance, discriminatory practices, and the potential for misuse of biometric data by governments and corporations have sparked debates around the ethical implications of biometric technologies, which is expected to boost the Biometrics Technology Market growth. Building public trust, fostering transparency, and engaging in open dialogue with stakeholders is essential for addressing these concerns and ensuring responsible deployment and use of biometric systems.

Purpose Technologies used Use case Real life example/brand Security Facial, fingerprint, gait,keystroke recognition Access control, continuous authentication BehavioSec, Innovatrics, FaceKey Recruitment Affective computing based on computer vision, voice and speech recognition and natural language processing (NLP) AI-powered job interviews and personality assessments to evaluate candidates Pymetrics, HireVue, Retorio Monitoring Affective computing basedon voice recognition andNLP; wearable movementtrackers; eye movementtrackers; smart mouse Worktime control,productivity and activity tracking, performance measurement Cogito, WorkSmart, Geodis,Humanyze Safety and well being Smart wearables; Computer vision

Accident prevention; physical and psychosocial health risk management StrongArm Technologies, Fitbit,(many technologies in development) Biometrics Technology Market Segment Analysis

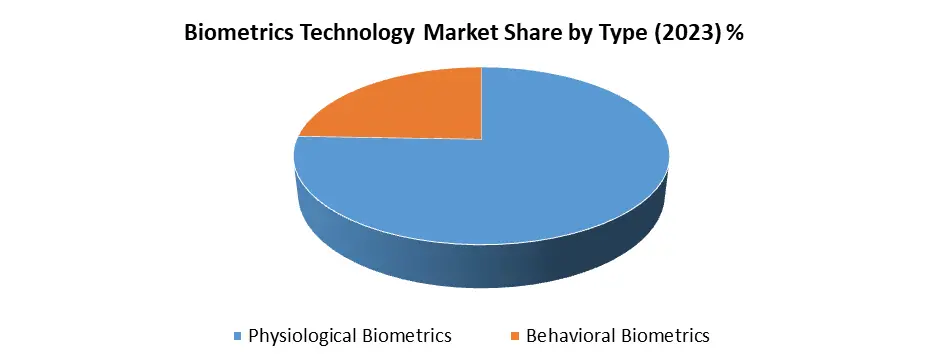

Based on Type, the market is segmented into Physiological Biometrics and Behavioral Biometrics. Physiological Biometrics segment dominated the market in 2023 and is expected to hold the largest Biometrics Technology Market share over the forecast period. Physiological biometrics is a branch of biometric technology that utilizes the physical characteristics of individuals for identification and authentication purposes. These physical characteristics are inherent to an individual's body and are difficult to alter or replicate, making them ideal for biometric authentication. Physiological biometrics offer several advantages over other biometric modalities. They are highly accurate, reliable, and difficult to spoof or replicate, making them suitable for a wide range of applications requiring robust authentication and identification. Physiological biometrics also pose challenges related to privacy, data security, and user acceptance, which need to be addressed in the deployment of biometric systems.

Biometrics Technology Market Regional Insight

Rising Adoption of Biometrics across Industries to boost North America Biometrics Technology Market growth North America dominated the market in 2023 and is expected to hold the largest Biometrics Technology market share over the forecast period. Biometric technologies find applications across a wide range of industries in North America, including government, banking and finance, healthcare, retail, transportation, and hospitality. The adoption of biometrics is driven by factors such as regulatory compliance requirements, the need for enhanced security, and the desire for convenient and frictionless user experiences. Industries such as banking and finance leverage biometric authentication to combat fraud and improve customer authentication processes, driving market growth. The proliferation of smartphones and mobile devices has led to the integration of biometric authentication capabilities, such as fingerprint recognition, facial recognition, and iris scanning, into mobile applications and devices. Mobile biometrics offer a convenient and secure method of authentication for users accessing mobile banking, e-commerce, and social media platforms, which significantly boosts the North America Biometrics Technology Market growth. The increasing adoption of mobile biometrics fuels market growth and increases the reach of biometric technologies in North America. The escalating cybersecurity threats, identity fraud, and data breaches drive the demand for robust authentication solutions in North America. Biometric technologies offer a highly secure method of identity verification, reducing the risk of unauthorized access and fraudulent activities. The growing awareness of security threats among businesses, government agencies, and consumers fuels the adoption of biometrics across various applications, including access control, financial transactions, and online authentication.Biometrics Technology Market Scope: Inquire before buying

Biometrics Technology Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 38.23 Bn. Forecast Period 2024 to 2030 CAGR: 17.67% Market Size in 2030: US $ 119.42 Bn. Segments Covered: by Type Physiological Biometrics Face Recognition Iris Recognition Fingerprint Recognition Hand Geometry Others Behavioral Biometrics Signature Recognition Voice Recognition Others by End User Public Sector BFSI Healthcare IT and Telecommunication Others Biometrics Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Leading Biometrics Technology key players include:

North America: 1. IDEMIA - Reston, Virginia, USA 2. Aware, Inc. - Bedford, Massachusetts, USA 3. HID Global - Austin, Texas, USA 4. Nuance Communications - Burlington, Massachusetts, USA 5. BIO-key International - Wall, New Jersey, USA 6. NEC Corporation of America - Irving, Texas, USA 7. L-1 Identity Solutions (now part of Idemia) - Stamford, Connecticut, USA 8. Veridium - Quincy, Massachusetts, USA 9. IDEX Biometrics - Wilmington, Delaware, USA 10. Daon - Reston, Virginia, USA Europe: 11. Thales Group - Paris, France 12. SAGEM (part of Idemia) - Paris, France 13. Fingerprint Cards AB - Gothenburg, Sweden 14. Precise Biometrics - Lund, Sweden 15. BioConnect - Toronto, Ontario, Canada 16. Vision-Box - Lisbon, Portugal Asia-Pacific: 17. NEC Corporation - Minato, Tokyo, Japan 18. Suprema Inc. - Seoul, South Korea 19. ZKTeco - Dongguan, Guangdong, China Frequently asked Questions: 1. What are the main drivers of growth in the biometrics technology market? Ans: Continued advancements in biometric technologies, increasing security concerns, rising adoption across industries, and regulatory compliance are key drivers of growth in the biometrics technology market. 2. What are some examples of technological advancements in biometrics technology? Ans: Technological advancements include the development of touchless or contactless biometric solutions, multimodal biometrics combining multiple biometric modalities, and integration of artificial intelligence (AI) and machine learning algorithms for improved performance. 3. Which region dominates the biometrics technology market, and why? Ans: North America dominates the biometrics technology market due to the presence of key players, stringent security regulations, high adoption rates in sectors like government and finance, and the proliferation of mobile biometrics. 4. What are the main challenges limiting the growth of the biometrics technology market? Ans: Privacy concerns, security vulnerabilities, ethical considerations, and societal acceptance issues pose challenges to the growth of the biometrics technology market, necessitating the development of stringent privacy safeguards and security measures. 5. How does biometrics technology address security concerns and identity fraud? Ans: Biometrics technology offers highly secure authentication methods that are difficult to replicate, mitigating the risks associated with stolen passwords or identity theft, and providing enhanced security measures for various sectors, including government, finance, healthcare, and enterprise.

1. Biometrics Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Biometrics Technology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Biometrics Technology Market: Dynamics 3.1. Market Trends - Global 3.2. Market Dynamics – By Region 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Biometrics Technology Industry 3.8. Analysis of Government Schemes and Initiatives for Biometrics Technology Industry 3.9. The Global Pandemic Impact on Biometrics Technology Market 4. Biometrics Technology Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Biometrics Technology Market Size and Forecast, By Type (2023-2030) 4.1.1. Physiological Biometrics 4.1.1.1. Face Recognition 4.1.1.2. Iris Recognition 4.1.1.3. Fingerprint Recognition 4.1.1.4. Hand Geometry 4.1.1.5. Others 4.1.2. Behavioral Biometrics 4.1.2.1. Signature Recognition 4.1.2.2. Voice Recognition 4.1.2.3. Others 4.2. Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 4.2.1. Public Sector 4.2.2. BFSI 4.2.3. Healthcare 4.2.4. IT and Telecommunication 4.2.5. Others 4.3. Biometrics Technology Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Biometrics Technology Market Size and Forecast (by Value in USD Million) (2023-2030) 5.1. North America Biometrics Technology Market Size and Forecast, By Type (2023-2030) 5.1.1. Physiological Biometrics 5.1.1.1. Face Recognition 5.1.1.2. Iris Recognition 5.1.1.3. Fingerprint Recognition 5.1.1.4. Hand Geometry 5.1.1.5. Others 5.1.2. Behavioral Biometrics 5.1.2.1. Signature Recognition 5.1.2.2. Voice Recognition 5.1.2.3. Others 5.2. North America Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 5.2.1. Public Sector 5.2.2. BFSI 5.2.3. Healthcare 5.2.4. IT and Telecommunication 5.2.5. Others 5.3. North America Biometrics Technology Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Biometrics Technology Market Size and Forecast, By Type (2023-2030) 5.3.1.1.1. Physiological Biometrics 5.3.1.1.1.1. Face Recognition 5.3.1.1.1.2. Iris Recognition 5.3.1.1.1.3. Fingerprint Recognition 5.3.1.1.1.4. Hand Geometry 5.3.1.1.1.5. Others 5.3.1.2. Behavioral Biometrics 5.3.1.2.1.1. Signature Recognition 5.3.1.2.1.2. Voice Recognition 5.3.1.2.1.3. Others 5.3.1.3. Others United States Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 5.3.1.3.1. Public Sector 5.3.1.3.2. BFSI 5.3.1.3.3. Healthcare 5.3.1.3.4. IT and Telecommunication 5.3.1.3.5. Others 5.3.2. Canada 5.3.2.1. Canada Biometrics Technology Market Size and Forecast, By Type (2023-2030) 5.3.2.1.1. Physiological Biometrics 5.3.2.1.1.1. Face Recognition 5.3.2.1.1.2. Iris Recognition 5.3.2.1.1.3. Fingerprint Recognition 5.3.2.1.1.4. Hand Geometry 5.3.2.1.1.5. Others 5.3.2.2. Behavioral Biometrics 5.3.2.2.1.1. Signature Recognition 5.3.2.2.1.2. Voice Recognition 5.3.2.2.1.3. Others 5.3.2.3. Canada Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 5.3.2.3.1. Public Sector 5.3.2.3.2. BFSI 5.3.2.3.3. Healthcare 5.3.2.3.4. IT and Telecommunication 5.3.2.3.5. Others 5.3.3. Mexico 5.3.3.1. Mexico Biometrics Technology Market Size and Forecast, By Type (2023-2030) 5.3.3.1.1. Physiological Biometrics 5.3.3.1.1.1. Face Recognition 5.3.3.1.1.2. Iris Recognition 5.3.3.1.1.3. Fingerprint Recognition 5.3.3.1.1.4. Hand Geometry 5.3.3.1.1.5. Others 5.3.3.2. Behavioral Biometrics 5.3.3.2.1.1. Signature Recognition 5.3.3.2.1.2. Voice Recognition 5.3.3.2.1.3. Others 5.3.3.3. Mexico Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 5.3.3.3.1. Public Sector 5.3.3.3.2. BFSI 5.3.3.3.3. Healthcare 5.3.3.3.4. IT and Telecommunication 5.3.3.3.5. Others 6. Europe Biometrics Technology Market Size and Forecast (by Value in USD Million) (2023-2030) 6.1. Europe Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.2. Europe Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3. Europe Biometrics Technology Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.1.2. United Kingdom Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.2. France 6.3.2.1. France Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.2.2. France Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.3.2. Germany Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.4.2. Italy Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.5.2. Spain Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.6.2. Sweden Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.7.2. Austria Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Biometrics Technology Market Size and Forecast, By Type (2023-2030) 6.3.8.2. Rest of Europe Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7. Asia Pacific Biometrics Technology Market Size and Forecast (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.2. Asia Pacific Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3. Asia Pacific Biometrics Technology Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.1.2. China Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.2.2. S Korea Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.3.2. Japan Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.4. India 7.3.4.1. India Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.4.2. India Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.5.2. Australia Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.6.2. Indonesia Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.7.2. Malaysia Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.8.2. Vietnam Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.9.2. Taiwan Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Biometrics Technology Market Size and Forecast, By Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 8. Middle East and Africa Biometrics Technology Market Size and Forecast (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Biometrics Technology Market Size and Forecast, By Type (2023-2030) 8.2. Middle East and Africa Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 8.3. Middle East and Africa Biometrics Technology Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Biometrics Technology Market Size and Forecast, By Type (2023-2030) 8.3.1.2. South Africa Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Biometrics Technology Market Size and Forecast, By Type (2023-2030) 8.3.2.2. GCC Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Biometrics Technology Market Size and Forecast, By Type (2023-2030) 8.3.3.2. Nigeria Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Biometrics Technology Market Size and Forecast, By Type (2023-2030) 8.3.4.2. Rest of ME&A Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 9. South America Biometrics Technology Market Size and Forecast (by Value in USD Million) (2023-2030) 9.1. South America Biometrics Technology Market Size and Forecast, By Type (2023-2030) 9.2. South America Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 9.3. South America Biometrics Technology Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Biometrics Technology Market Size and Forecast, By Type (2023-2030) 9.3.1.2. Brazil Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Biometrics Technology Market Size and Forecast, By Type (2023-2030) 9.3.2.2. Argentina Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Biometrics Technology Market Size and Forecast, By Type (2023-2030) 9.3.3.2. Rest Of South America Biometrics Technology Market Size and Forecast, By End-User (2023-2030) 10. Company Profile: Key Players 10.1. IDEMIA - Reston, Virginia, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Aware, Inc. - Bedford, Massachusetts, USA 10.3. HID Global - Austin, Texas, USA 10.4. Nuance Communications - Burlington, Massachusetts, USA 10.5. BIO-key International - Wall, New Jersey, USA 10.6. NEC Corporation of America - Irving, Texas, USA 10.7. L-1 Identity Solutions (now part of Idemia) - Stamford, Connecticut, USA 10.8. Veridium - Quincy, Massachusetts, USA 10.9. IDEX Biometrics - Wilmington, Delaware, USA 10.10. Daon - Reston, Virginia, USA 10.11. Thales Group - Paris, France 10.12. SAGEM (part of Idemia) - Paris, France 10.13. Fingerprint Cards AB - Gothenburg, Sweden 10.14. Precise Biometrics - Lund, Sweden 10.15. BioConnect - Toronto, Ontario, Canada 10.16. Vision-Box - Lisbon, Portugal 10.17. NEC Corporation - Minato, Tokyo, Japan 10.18. Suprema Inc. - Seoul, South Korea 10.19. ZKTeco - Dongguan, Guangdong, China 11. Key Findings 12. Industry Recommendations 13. Biometrics Technology Market: Research Methodology