Global Bicycle Derailleur Market size was valued at USD 1.93 Bn. in 2024, and the total Bicycle Derailleur Market revenue is expected to grow by 4.5% from 2025 to 2032, reaching nearly USD 2.74 Bn.Bicycle Derailleur Market Overview:

Bicycle Derailleur is an essential component in geared bicycles that permits riders to shift through gear ratios, which allow improved performance, speed, and ease of pedaling across a variety of terrains. They can be found across all types of bicycles, including mountain bikes, road bikes, hybrid bikes, and commuter bicycles, making them the most solicited component in the industry. The global demand for bicycle derailleurs is only going to keep climbing, fueled by a rise in health consciousness, an attitude shift towards cycling for recreation and commuting, and rapid urban growth driven by shared mobility and alternative sustainable transport. Urban bike sharing programs in cities including Amsterdam, New York, and Shanghai are also increasingly offering geared bicycles, in large part because durably constructed derailleur systems can be easily set up to ensure rider comfort and efficiency. The Asia-Pacific region holds the largest share of the derailleur market because bicycle production is greatest in China, Taiwan, and India. Because of rising government investment in supporting non-motorized transport infrastructure, along with bicycle production, the Asian market is expected to grow exponentially. In Europe and North America, there is increased consumer demand for high-end cycling technologies as the popularity of competitive and recreational biking grows. Leading derailleur firms, including Shimano, SRAM, Campagnolo, MicroSHIFT, and SunRace, continue to innovate with electronic, wireless, and lightweight derailleur systems to satisfy cyclists with high-performance expectations, along with low maintenance. Similarly, burgeoning smart mobility and e-bike usage mean many derailleur systems are evolving to accommodate increased integration with electronic and smart drivetrains designed for the marketplace of today and the foreseeable transportation developments of the future.To know about the Research Methodology :- Request Free Sample Report

Global Bicycle Derailleur Market Dynamics:

Expansion of Bike-Sharing Programs to Drive Bicycle Derailleur Market Growth in Urban Mobility Applications The surge of bicycle rental/bicycle sharing services is greatly increasing the demand for durable and reliable derailleur systems, especially in urban mobility fleets. Cities across the globe are promoting greener travel options and developing public bicycle sharing systems that allow for additional rentals and leasing, which is growing the market for geared bicycles with derailleur systems that accommodate diverse terrains and user needs. Bicycle share programs, such as Citi Bike in New York, Vélib' in Paris, and Yulu in India, have reduced barriers for cycling and made it inexpensive and available to so many individuals who require simple, smooth-shifting bicycles with long-lasting durability for heavy use. With the gear selection given by derailleur systems, users will have greater command over their bicycles; this then creates better control in the urban streets that are mixed traffic with bicycles navigating the slopes of our cities. Rentals using derailleur systems will only grow and expand. High Maintenance Requirements and Mechanical Complexity Pose Restraints on Bicycle Derailleur Market Growth Derailleur systems, although they offer versatility and performance benefits, are mechanically complex and more vulnerable to dirt, wetness, and impacts from the environment. They are more vulnerable since they will wear faster than an enclosed system like the internal gear hub. As a result, derailleur systems require more maintenance. Maintenance that includes frequent tuning of gears, adjusting chains, and replacing tires and other components. This is inconvenient and, depending on the newness of the bike, with the cost, one such as a casual rider, a bike-sharing rider, or a rider in a cost-sensitive market may not want to deal with frequent maintenance like that of the derailleur. In a community without a bicycle repair context, maintenance problems restrict derailleur use, thus inhibiting the growth of the bicycle derailleur market. Advancements in Electronic and Wireless Shifting Technologies to Create Opportunities for Innovation and Premium Growth in Bicycle Derailleur Market The advancements in derailleur systems from a technological perspective offer open doors for innovation and growth in the marketplace, especially in higher-end bicycles. Electronic and wireless shifting systems such as Shimano Di2 and SRAM AXS have completely revolutionized the experience of gear shifting, developing faster, more accurate, and less problematic performance, as they are built to endure less mechanical friction and the problem of cable stretch. They even allow for programmed shifting through Apps on phones, enhancing the overall experience for the rider.Global Bicycle Derailleur Market Segment Analysis

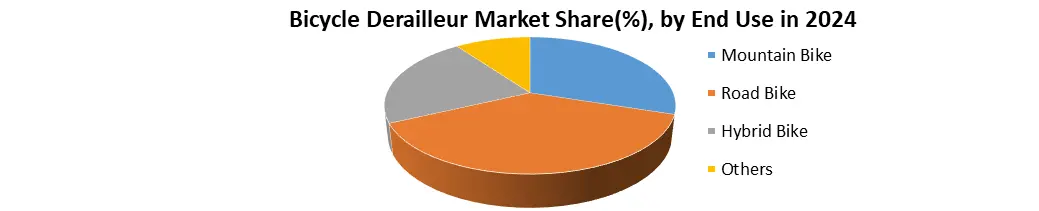

By product type, the Global Bicycle Derailleur Market is segmented into front derailleur and rear derailleur. The global bicycle derailleur is showing demand for rear derailers, owing to the demand for rear multi-gear systems is growing, as it costs less, and also its maintenance is easy. The front derailleur is usually used with the rear derailleur, costing more, restraining the growth of the front Market. By End Use, the Global Bicycle Derailleur Market is segmented into Hybrid Bike, Mountain Bike, Road Bike, and Other End uses. The Road Bike segment has dominance over the global bicycle derailleur market, owing to the growth in demand for bicycles in urban areas for health and short-distance travel. The hybrid bike and mountain bike market is growing significantly, driving the Global Bicycle Derailleur Market.

Bicycle Derailleur Market Regional Insights:

In 2024, Asia-Pacific dominated the global Bicycle Derailleur Market with the highest market share of around 45%. The region has a strong bicycle manufacturing base, rapid urbanization, and increasing adoption of bicycles for commuting purposes, and is classified as the top bicycle production and consumption region in the world. China, India, Japan, and Taiwan are leading producers and consumers of bicycles, as well as being some of the largest consumers and producers of derailleurs. China is the largest bicycle exporter in the world. Countries in the Asia-Pacific region have lower production costs, mass assembly lines, and differentiated government policies for promoting cycling as a more sustainable means of transportation. The increasing urban population and health awareness are also contributing to the demand for geared bicycles both in rural and metropolitan areas, encouraging the adoption of derailleurs in a range of different bicycle types. Bicycle Derailleur Market Competitive Landscape The Bicycle Derailleur Market is a highly competitive industry, influenced by global cycling component manufacturers that are focused on innovation and performance-driven technologies. Shimano Inc. (Japan) and SRAM LLC (USA) are the largest competitors in bicycle component sales across recreational, commuter, and performance bicycles. In the bicycle component, Shimano reported around USD 2.24 billion sales in 2024, only down from 2023 due to inventory adjustments, and generally up by 24% from pre-pandemic levels. Shimano's dominant position across the OEM supply chain and their breadth of derailleur products, including the Di2 electronic series, contribute to estimates of their market share around 70–80%. SRAM is expanding its footprint in the derailleur market with estimates of around USD 1 billion in component revenue, originating from an innovation-first approach with a strategic business model using the AXS wireless electronic shifting solutions, as well as developing new technologies with single chainring (1x) drivetrains for manufacture of mountain bikes and gravel bikes. Shimano and SRAM are making significant investments in electronic, lightweight, and wireless systems to satisfy consumer demand and expand their share of the premium bicycle market. Bicycle Derailleur Key Market Recent Development Shimano Inc. (Japan) revealed its next-generation wireless Di2 XTR mountain bike groupset for the 2025-2026 model year. Notably, the rear derailleur and the battery are now housed together in the body of the rear derailleur. The rear derailleur also comes with a protective skid plate to improve impact resistance. Campagnolo S.r.l. (Italy) Introduced its revolutionary Super Record 13 wireless groupset in early June 2025—the world's first 2 × 13 speed wireless derailleur system—with a 25% reduction in lateral bulk and up to 750 km of shifting from a single charge. In 2025, SRAM LLC (USA) added new Force and Rival AXS groupsets to its successful AXS electronic family of products, announced in June 2025, making the shifting ergonomics easier and adding some features directly from Red AXS to a more accessible price format. MicroSHIFT (Taiwan) changed its brand identity in June 2025 and is continuing product innovation with its new mechanical derailleur lines, including the new XLE rear derailleur for tripledrive 30 and the updated Advent X systems--targeting performance bicycles at accessible prices. Bianchi (Italy) released its 2025 Infinito Ultegra Di models. Di2 road bike,atamenteighting and performance of the Ultegra Di2 12-speed on the front and rear derailleurs--that adds and improves electronic shifting performance. Finally, black cable routing ties in the entire range of this Italian bike. Bicycle Derailleur Key Market Trends Shift Toward Electronic and Wireless Derailleurs Electronic shifting systems are becoming mainstream, especially in high-end road and mountain bikes. These derailleurs offer precise gear changes, reduced maintenance, and cleaner bike aesthetics. Example: In 2025, SRAM expanded its Force AXS and Rival AXS wireless derailleur lines, bringing pro-level features like app-based customization and improved ergonomics to mid-tier road bikes. Single Chainring (1x) Drivetrains Gaining Popularity Especially in mountain and gravel bikes, 1x systems are preferred due to their simplicity, lighter weight, and fewer mechanical issues, resulting in reduced dependence on front derailleurs. Example: Shimano’s Deore and SLX 1x12 MTB groupsets dominate trail and enduro biking segments, eliminating the need for front derailleurs. Increased Demand for Lightweight and Compact Derailleur Designs Consumers are seeking components made from carbon fiber or titanium that reduce overall bike weight while maintaining performance, especially for competitive cycling. Example: Campagnolo’s 2025 Super Record Wireless 2x13 rear derailleur features carbon fiber construction and a compact body with an integrated battery, catering to elite road racers.Bicycle Derailleur Market Scope: Inquire before buying

Bicycle Derailleur Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.93 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 2.74 Bn. Segments Covered: by Product Type Front Derailleur Rear Derailleur by End Use Hybrid Bike Mountain Bike Road Bike Other End User by Gear Mechanism Mechanical Electronic Wireless Bicycle Derailleur Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Bicycle Derailleur Market Key Players

North America Bicycle Derailleur Market Key Players 1. SRAM – USA 2. Blackspire – Canada 3. IRD – USA 4. Jagwire – USA 5. Sunlite – USA 6. Standard – USA 7. FSA – USA Europe Bicycle Derailleur Market Key Players 1. Campagnolo – Italy 2. Bianchi – Italy 3. BMC – Switzerland 4. Continental – Germany 5. Deda Elementi – Italy 6. DIA‑COMPE – Belgium 7. DMR – UK 8. Gipiemme – Italy 9. Mavic – France 10. Miche – Italy Asia Pacific Bicycle Derailleur Market Key Players 1. microSHIFT – Taiwan 2. Shimano – Japan 3. Suntour – Taiwan 4. Kenda – Taiwan 5. KCNC – Taiwan 6. Token – TaiwanFrequently Asked Questions:

1. Which region has the largest share in the Global Bicycle Derailleur Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Bicycle Derailleur Market? Ans: The Global Market is expected to grow at a CAGR of 4.5% during the forecast period 2025-2032. 3. What is the scope of the Global Bicycle Derailleur Market report? Ans: The Global Bicycle Derailleur Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Bicycle Derailleur Market? Ans: The important key players in the Global Bicycle Derailleur Market are – microSHIFT – Taiwan, Shimano – Japan, Suntour – Taiwan, Kenda – Taiwan, KCNC – Taiwan, etc. 5. What is the study period of this market? Ans: The Global Bicycle Derailleur Market is studied from 2024 to 2032.

1. Bicycle Derailleur Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Bicycle Derailleur Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Bicycle Derailleur Market: Dynamics 3.1. Region-wise Trends of Bicycle Derailleur Market 3.1.1. North America Bicycle Derailleur Market Trends 3.1.2. Europe Bicycle Derailleur Market Trends 3.1.3. Asia Pacific Bicycle Derailleur Market Trends 3.1.4. Middle East and Africa Bicycle Derailleur Market Trends 3.1.5. South America Bicycle Derailleur Market Trends 3.2. Bicycle Derailleur Market Dynamics 3.2.1. Global Bicycle Derailleur Market Drivers 3.2.1.1. Expansion of Bike-Sharing Programs 3.2.2. Global Bicycle Derailleur Market Restraints 3.2.3. Global Bicycle Derailleur Market Opportunities 3.2.3.1. Advancements in Electronic and Wireless Shifting Technologies 3.2.4. Global Bicycle Derailleur Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government Support for Cycling Infrastructure 3.4.2. Growth in Urban Mobility Markets 3.4.3. Growing Popularity of Recreational Cycling 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Bicycle Derailleur Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Front Derailleur 4.1.2. Rear Derailleur 4.2. Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 4.2.1. Hybrid Bike 4.2.2. Mountain Bike 4.2.3. Road Bike 4.2.4. Other End User 4.3. Bicycle Derailleur Market Size and Forecast, By Gear Mechanism (2024-2032) 4.3.1. Mechanical 4.3.2. Electronic 4.3.3. Wireless 4.4. Bicycle Derailleur Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Bicycle Derailleur Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Front Derailleur 5.1.2. Rear Derailleur 5.2. North America Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 5.2.1. Hybrid Bike 5.2.2. Mountain Bike 5.2.3. Road Bike 5.2.4. Other End User 5.3. North America Bicycle Derailleur Market Size and Forecast, By Gear Mechanism (2024-2032) 5.3.1. Mechanical 5.3.2. Electronic 5.3.3. Wireless 5.4. North America Bicycle Derailleur Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 5.4.1.1.1. Front Derailleur 5.4.1.1.2. Rear Derailleur 5.4.1.2. United States Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 5.4.1.2.1. Hybrid Bike 5.4.1.2.2. Mountain Bike 5.4.1.2.3. Road Bike 5.4.1.2.4. Other End User 5.4.1.3. Others United States Bicycle Derailleur Market Size and Forecast, By Gear Mechanism (2024-2032) 5.4.1.3.1. Mechanical 5.4.1.3.2. Electronic 5.4.1.3.3. Wireless 5.4.2. Canada 5.4.2.1. Canada Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 5.4.2.1.1. Front Derailleur 5.4.2.1.2. Rear Derailleur 5.4.2.2. Canada Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 5.4.2.2.1. Hybrid Bike 5.4.2.2.2. Mountain Bike 5.4.2.2.3. Road Bike 5.4.2.2.4. Other End User 5.4.2.3. Canada Bicycle Derailleur Market Size and Forecast, By Gear Mechanism (2024-2032) 5.4.2.3.1. Mechanical 5.4.2.3.2. Electronic 5.4.2.3.3. Wireless 5.4.2.4. Mexico Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 5.4.2.4.1. Front Derailleur 5.4.2.4.2. Rear Derailleur 5.4.2.5. Mexico Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 5.4.2.5.1. Hybrid Bike 5.4.2.5.2. Mountain Bike 5.4.2.5.3. Road Bike 5.4.2.5.4. Other End User 5.4.2.6. Mexico Bicycle Derailleur Market Size and Forecast, By Gear Mechanism (2024-2032) 5.4.2.6.1. Mechanical 5.4.2.6.2. Electronic 5.4.2.6.3. Wireless 6. Europe Bicycle Derailleur Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.3. Europe Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4. Europe Bicycle Derailleur Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.1.2. United Kingdom Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.1.3. United Kingdom Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.2. France 6.4.2.1. France Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.2.2. France Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.2.3. France Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.3.2. Germany Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.3.3. Germany Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.4.2. Italy Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.4.3. Italy Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.5.2. Spain Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.5.3. Spain Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.6.2. Sweden Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.6.3. Sweden Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.7.2. Austria Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.7.3. Austria Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 6.4.8.2. Rest of Europe Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 6.4.8.3. Rest of Europe Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7. Asia Pacific Bicycle Derailleur Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.3. Asia Pacific Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4. Asia Pacific Bicycle Derailleur Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.1.2. China Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.1.3. China Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.2.2. S Korea Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.2.3. S Korea Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.3.2. Japan Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.3.3. Japan Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.4. India 7.4.4.1. India Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.4.2. India Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.4.3. India Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.5.2. Australia Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.5.3. Australia Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.6.2. Indonesia Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.6.3. Indonesia Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.7.2. Philippines Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.7.3. Philippines Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.8.2. Malaysia Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.8.3. Malaysia Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.9.2. Vietnam Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.9.3. Vietnam Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.10.2. Thailand Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.10.3. Thailand Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 7.4.11.3. Rest of Asia Pacific Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 8. Middle East and Africa Bicycle Derailleur Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 8.3. Middle East and Africa Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 8.4. Middle East and Africa Bicycle Derailleur Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 8.4.1.2. South Africa Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 8.4.1.3. South Africa Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 8.4.2.2. GCC Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 8.4.2.3. GCC Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 8.4.3.2. Nigeria Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 8.4.3.3. Nigeria Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 8.4.4.2. Rest of ME&A Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 8.4.4.3. Rest of ME&A Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 9. South America Bicycle Derailleur Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 9.3. South America Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 9.4. South America Bicycle Derailleur Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 9.4.1.2. Brazil Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 9.4.1.3. Brazil Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 9.4.2.2. Argentina Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 9.4.2.3. Argentina Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Bicycle Derailleur Market Size and Forecast, By Product Type (2024-2032) 9.4.3.2. Rest of South America Bicycle Derailleur Market Size and Forecast, By End Use (2024-2032) 9.4.3.3. Rest of South America Bicycle Derailleur Market Size and Forecast, Gear Mechanism (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Gear Mechanism Players) 10.1. Shimano – Japan 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. SRAM – USA 10.3. Blackspire – Canada 10.4. IRD – USA 10.5. Jagwire – USA 10.6. Sunlite – USA 10.7. Standard – USA 10.8. FSA – USA 10.9. Campagnolo – Italy 10.10. Bianchi – Italy 10.11. BMC – Switzerland 10.12. Continental – Germany 10.13. Deda Elementi – Italy 10.14. DIA‑COMPE – Belgium 10.15. DMR – UK 10.16. Gipiemme – Italy 10.17. Mavic – France 10.18. Miche – Italy 10.19. microSHIFT – Taiwan 10.20. Suntour – Taiwan 10.21. Kenda – Taiwan 10.22. KCNC – Taiwan 10.23. Token – Taiwan 11. Key Findings 12. Analyst Recommendations 13. Bicycle Derailleur Market: Research Methodology