The Beta Carotene Market size was valued at US 725.23 Mn in 2023 and market revenue is growing at a CAGR of 4.2 % from 2023 to 2030, reaching nearly USD 967.27 Mn by 2030.Beta Carotene Market Overview

Beta Carotene, a member of the carotenoid family, encompasses a spectrum of vibrant pigments spanning red, orange, and yellow hues. These fat-soluble compounds are naturally abundant in various fruits, grains, oils, and vegetables, often concealed within leaves alongside chlorophyll. With a molecular formula of C40H56, Beta Carotene is synthesized through the saponification of vitamin A acetate. The resulting alcohol undergoes reactions to form either vitamin A Wittig reagent or vitamin A aldehyde, which are then combined to yield beta-carotene. Within the food industry, Beta Carotene is used as a natural coloring agent, infusing products such as beverages, confections, and dairy items with vibrant shades. As consumer preferences increasingly gravitate towards natural ingredients, the demand for Beta Carotene as a food colorant has seen a significant uptick this factor has boosted the Beta Carotene Market. Its antioxidant properties add to the visual appeal and augment the nutritional value of foods, catering to the preferences of health-conscious consumers.To know about the Research Methodology:-Request Free Sample Report In the pharmaceutical field, Beta Carotene holds esteem for its substantial contributions to eye health and bolstering the immune system. Widely consumed in supplement form, Beta Carotene aids in preventing age-related macular degeneration and certain types of cancers, offering vital support to overall health and well-being. According to the MMR Study Report, in 2020, over 2.1 million women and 1.8 million men aged between 18 and 64 encountered eye-related issues. Similarly, among individuals aged 65 and above, more than 1.3 million men and 1.8 million women experienced such challenges with their vision. Consequently, there has been a notable rise in the demand for supplements, particularly in the Beta Carotene Market.

Beta Carotene Market Trend:

The surge in demand for natural ingredients within the beta carotene market is driven by shifting consumer preferences toward cleaner, health-focused consumption habits. Consumers increasingly prioritize products containing naturally sourced beta carotene, abundant in fruits, vegetables, and plant-derived sources. This preference arises from the perception that natural ingredients offer health benefits and are safer and more environmentally sustainable than synthetic alternatives. Increasing awareness of the potential health advantages associated with natural beta carotene, including its antioxidant properties and support for eye health, reinforces this trend. Consequently, food and beverage manufacturers, as well as supplement producers, are adapting to meet this demand by incorporating natural beta carotene into their formulations. They market their products as featuring clean-label, naturally derived ingredients, aligning with consumer preferences for healthier choices.

Beta Carotene Market Dynamics

Driver Nutraceutical and Dietary Supplement Industry Growth Boosts the Beta Carotene Market The nutraceutical and dietary supplement industry has been experiencing significant growth, driven by various factors such as increasing health consciousness among consumers, rising awareness about the benefits of preventive healthcare, and the growing aging population seeking alternatives to traditional medicine. Within this industry, beta-carotene, a precursor to vitamin A and a potent antioxidant found in many fruits and vegetables, has gained attention for its potential health benefits. Beta-carotene is widely recognized for its role in supporting eye health, boosting immune function, and promoting healthy skin. As consumers become more proactive about their health and seek natural solutions, the demand for beta-carotene supplements has increased. beta-carotene is often used as a food colorant and a fortifying agent in various food and beverage products, further contributing to its Beta Carotene Market growth. Research studies highlighting the potential health benefits of beta-carotene have also powered its market extension. It's essential to note that while beta-carotene offers several health advantages, its effectiveness varies depending on factors such as dosage, individual health status, and dietary habits. As a result, consumers are mindful of sourcing high-quality products and consulting healthcare professionals before adding beta-carotene supplements to their regimen. The growth of the nutraceutical and dietary supplement industry has certainly contributed to the growth of the Beta Carotene Market, with consumers increasingly turning to these products to support their overall health and well-being. According to MMR Study Report In the United States, before the pandemic, dietary supplement sales rose by 5% ($345 million) in 2019 compared to the previous year. However, during the first wave of the pandemic, there was a remarkable 44% ($435 million) surge in sales in the six weeks leading up to April 5th, 2020, relative to the same period in 2019. Specifically, demand for multivitamins spiked in March 2020, with sales surging by 51.2%, totalling nearly 120 million units for that period alone. Similarly, in the UK, vitamin sales alone experienced a 63% increase, while in France, sales grew by approximately 40–60% in March 2020 compared to the same period the previous year. Furthermore, in Poland, online consumer search trends related to supplements saw a notable increase during both the first and second waves of the pandemic.Restrain Availability of substitutes Limit the Beta Carotene Market Growth The availability of substitutes significantly impedes the growth of the beta carotene market. Synthetic alternatives to natural beta-carotene, often derived through chemical processes, offer similar functionalities at potentially lower costs. This presents a challenge for natural beta-carotene producers, as consumers and manufacturers opt for the cheaper synthetic options. The perception of synthetic beta-carotene as being more stable or consistent in quality further sways purchasing decisions away from natural sources. Advancements in biotechnology have led to the development of alternative sources of beta-carotene, such as genetically modified organisms (GMOs) or bioengineered crops. These alternatives offer higher yields and novel properties, posing a competitive threat to traditional beta-carotene sources such as carrots or algae. To counteract this limitation, producers of natural beta-carotene must emphasize the unique benefits of their product, such as its organic or non-GMO status, superior bioavailability, or sustainable production methods. Marketing efforts focus on educating consumers about the advantages of natural beta-carotene over synthetic or genetically modified alternatives, thereby fostering a preference for authentic, nature-derived products. Investments in research and development lead to innovations that enhance the value proposition of natural beta-carotene, ensuring its continued relevance in the Beta Beta Carotene Market. Growing Health Consciousness Creates Lucrative Growth Opportunities for Beta Carotene Market Growth The increasing emphasis on health consciousness represents a significant opportunity for the beta carotene market's growth. As consumers become more aware of the importance of nutrition in maintaining overall well-being, they are actively seeking out products that offer health benefits. Beta-carotene, as a natural pigment found in many fruits and vegetables, holds a prominent position in the realm of health-promoting compounds. Beta-carotene is renowned for its role as a precursor to vitamin A, a crucial nutrient for vision health, immune function, and skin health. beta-carotene acts as a potent antioxidant, helping to neutralize harmful free radicals in the body and reduce the risk of chronic diseases such as cancer and cardiovascular disorders. The market stands to benefit from this growing health consciousness as consumers increasingly prioritize incorporating beta-carotene-rich foods and supplements into their diets. Manufacturers are responding to this trend by fortifying various food and beverage products with beta-carotene to enhance their nutritional profiles and appeal to health-conscious consumers. As individuals seek natural and organic alternatives to synthetic ingredients, the demand for beta-carotene sourced from natural sources such as fruits, vegetables, and algae is expected to rise. This presents an opportunity for companies to position themselves as providers of high-quality, natural beta-carotene ingredients, providing to the preferences of discerning consumers in the health and wellness market.

Beta Carotene Market Segment Analysis:

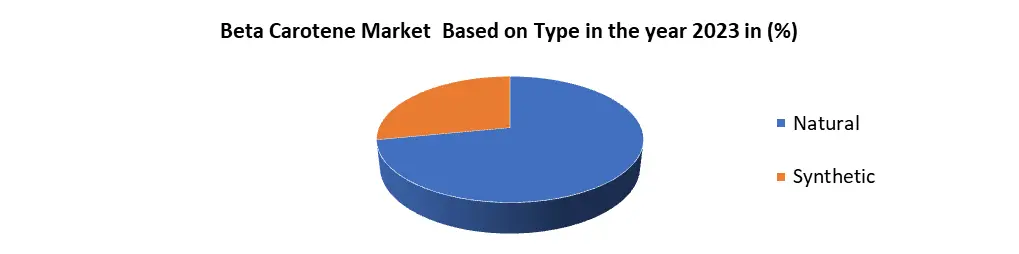

Based on Type, The Natural segment dominated the type segment of the global Beta Carotene Market in the year 2023. Natural Beta Carotene, extracted from fruits, vegetables, and other plant sources, appeals to consumers seeking clean-label products and prioritizing health-conscious choices. This preference aligns with the increasing awareness of the health benefits associated with natural ingredients, such as their antioxidant properties and potential to support overall well-being. Natural Beta Carotene is often perceived as safer and more sustainable compared to its synthetic counterparts, providing to the rising demand for environmentally friendly options. The Natural segment's dominance reflects not only consumer preferences but also the industry's response to meet these evolving demands by offering high-quality, plant-derived Beta Carotene products. As a result, this segment commands a significant share of the global market, driving growth and innovation in the Beta Carotene industry.

Beta Carotene Market Regional Analysis:

Europe dominated the Beta Carotene Market in the year 2023 Europe's dominance in the Beta Carotene market is attributed to several key factors. Europe has a strong agricultural sector, with a diverse range of fruits and vegetables rich in Beta Carotene, such as carrots, sweet potatoes, and spinach, which serve as primary sources for extraction. This abundance of raw materials facilitates efficient production processes, contributing to Europe's competitiveness in the Beta Carotene market. European consumers exhibit a strong preference for natural and healthy ingredients, aligning well with the natural Beta Carotene segment's offerings. This demand is further bolstered by stringent regulations promoting the use of natural additives and colorants in food and beverage products, creating a favorable environment for Beta Carotene suppliers. Europe's well-developed food and beverage industry, coupled with a high level of consumer awareness regarding the health benefits of Beta Carotene, drives market growth. Investments in research and development also enable European companies to innovate and diversify their product portfolios, providing to evolving consumer preferences. Europe emerges as a dominant force in the global Beta Carotene market.Beta Carotene Market Scope Report: Inquire before buying

Global Beta Carotene Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 725.23 Mn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US $ 967.27 Mn. Segments Covered: by Type Natural Algae Fruits & Vegetables Yeast Others Synthetic by End Use Food & Beverages Dietary Supplements Personal Care & Cosmetics Pharmaceutical Animal Feed Other Beta Carotene Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Beta Carotene Market Key players

North America 1. FMC Corporation (USA) 2. Sensient Technologies Corporation (USA) 3. Kemin Industries, Inc. (USA) 4. Cyanotech Corporation, (USA) 5. Nutralliance (USA) 6. DDW The Color House (USA) 7. ZMC LLC (USA) Europe 1. Döhler Group (Germany) 2. Chr. Hansen Holding A/S(Denmark) 3. BASF SE (Germany) 4. DSM Nutritional (Netherlands) 5. Naturex S.A. (Givaudan) (France) 6. Dynadis SARL (France) Asia Pacific 1. Lycored (Israel) 2. Allied Biotech Corporation (Taiwan) 3. Zhejiang NHU Co., Ltd. (China) 4. Algatechnologies Ltd. (Israel) 5. Tianjin Norland Biotech Co., Ltd. (China) 6. Divis Laboratories Ltd (India) 7. Vinayak Ingredients (India) Pvt. Ltd. (India) Frequently Asked Questions 1] What segments are covered in the Global Beta Carotene Market report? Ans. The segments covered in the Beta Carotene Market report are based on, Type, End Use and Regions. 2] Which region is expected to hold the highest share of the Global Beta Carotene Market? Ans. The Europe region is expected to hold the highest share of the Beta Carotene Market. 3] What is the market size of the Global Beta Carotene Market by 2030? Ans. The market size of the Beta Carotene Market by 2030 is expected to reach US$ 967.27 Mn. 4] What was the market size of the Global Beta Carotene Market in 2023? Ans. The market size of the Beta Carotene Market in 2023 was valued at US$ 725.23Mn. 5] Key players in the Beta Carotene Market. Ans. FMC Corporation (USA), Sensient Technologies Corporation (USA), Kemin Industries, Inc. (USA), Cyanotech Corporation, (USA), Nutralliance (USA), DDW The Color House (USA) and ZMC LLC (USA)

1. Beta Carotene Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Beta Carotene Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Service Segment 2.3.3. End-user Segment 2.3.4. Revenue (2022) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Beta Carotene Market: Dynamics 3.1. Beta Carotene Market Trends by Region 3.1.1. North America Beta Carotene Market Trends 3.1.2. Europe Beta Carotene Market Trends 3.1.3. Asia Pacific Beta Carotene Market Trends 3.1.4. Middle East and Africa Beta Carotene Market Trends 3.1.5. South America Beta Carotene Market Trends 3.2. Beta Carotene Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Beta Carotene Market Drivers 3.2.1.2. North America Beta Carotene Market Restraints 3.2.1.3. North America Beta Carotene Market Opportunities 3.2.1.4. North America Beta Carotene Market Challenges 3.2.2. Europe 3.2.2.1. Europe Beta Carotene Market Drivers 3.2.2.2. Europe Beta Carotene Market Restraints 3.2.2.3. Europe Beta Carotene Market Opportunities 3.2.2.4. Europe Beta Carotene Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Beta Carotene Market Drivers 3.2.3.2. Asia Pacific Beta Carotene Market Restraints 3.2.3.3. Asia Pacific Beta Carotene Market Opportunities 3.2.3.4. Asia Pacific Beta Carotene Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Beta Carotene Market Drivers 3.2.4.2. Middle East and Africa Beta Carotene Market Restraints 3.2.4.3. Middle East and Africa Beta Carotene Market Opportunities 3.2.4.4. Middle East and Africa Beta Carotene Market Challenges 3.2.5. South America 3.2.5.1. South America Beta Carotene Market Drivers 3.2.5.2. South America Beta Carotene Market Restraints 3.2.5.3. South America Beta Carotene Market Opportunities 3.2.5.4. South America Beta Carotene Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Beta Carotene Market 3.8. Analysis of Government Schemes and Initiatives for the Beta Carotene Market 3.9. The Global Pandemic Impact on the Beta Carotene Market 4. Beta Carotene Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 4.1. Beta Carotene Market Size and Forecast, By Type (2023-2030) 4.1.1. Natural 4.1.1.1. Algae 4.1.1.2. Fruits & Vegetables 4.1.1.3. Yeast 4.1.1.4. Others 4.1.2. Synthetic 4.2. Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 4.2.1. Food & Beverages 4.2.2. Dietary Supplements 4.2.3. Personal Care & Cosmetics 4.2.4. Pharmaceutical 4.2.5. Animal Feed 4.2.6. Other 4.3. Beta Carotene Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Beta Carotene Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. North America Beta Carotene Market Size and Forecast, By Type (2023-2030) 5.1.1. Natural 5.1.1.1. Algae 5.1.1.2. Fruits & Vegetables 5.1.1.3. Yeast 5.1.1.4. Others 5.1.2. Synthetic 5.2. North America Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 5.2.1. Food & Beverages 5.2.2. Dietary Supplements 5.2.3. Personal Care & Cosmetics 5.2.4. Pharmaceutical 5.2.5. Animal Feed 5.2.6. Other 5.3. North America Beta Carotene Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Beta Carotene Market Size and Forecast, By Type (2023-2030) 5.3.1.1.1. Natural 5.3.1.1.1.1. Algae 5.3.1.1.1.2. Fruits & Vegetables 5.3.1.1.1.3. Yeast 5.3.1.1.1.4. Others 5.3.1.1.2. Synthetic 5.3.1.2. United States Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 5.3.1.2.1. Food & Beverages 5.3.1.2.2. Dietary Supplements 5.3.1.2.3. Personal Care & Cosmetics 5.3.1.2.4. Pharmaceutical 5.3.1.2.5. Animal Feed 5.3.1.2.6. Other 5.3.2. Canada 5.3.2.1. Canada Beta Carotene Market Size and Forecast, By Type (2023-2030) 5.3.2.1.1. Natural 5.3.2.1.1.1. Algae 5.3.2.1.1.2. Fruits & Vegetables 5.3.2.1.1.3. Yeast 5.3.2.1.1.4. Others 5.3.2.1.2. Synthetic 5.3.2.2. Canada Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 5.3.2.2.1. Food & Beverages 5.3.2.2.2. Dietary Supplements 5.3.2.2.3. Personal Care & Cosmetics 5.3.2.2.4. Pharmaceutical 5.3.2.2.5. Animal Feed 5.3.2.2.6. Other 5.3.3. Mexico 5.3.3.1. Mexico Beta Carotene Market Size and Forecast, By Type (2023-2030) 5.3.3.1.1. Natural 5.3.3.1.1.1. Algae 5.3.3.1.1.2. Fruits & Vegetables 5.3.3.1.1.3. Yeast 5.3.3.1.1.4. Others 5.3.3.1.2. Synthetic 5.3.3.2. Mexico Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 5.3.3.2.1. Food & Beverages 5.3.3.2.2. Dietary Supplements 5.3.3.2.3. Personal Care & Cosmetics 5.3.3.2.4. Pharmaceutical 5.3.3.2.5. Animal Feed 5.3.3.2.6. Other 6. Europe Beta Carotene Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 6.1. Europe Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.2. Europe Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3. Europe Beta Carotene Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.1.2. United Kingdom Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.2. France 6.3.2.1. France Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.2.2. France Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.3.2. Germany Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.4.2. Italy Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.5.2. Spain Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.6.2. Sweden Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.7.2. Austria Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Beta Carotene Market Size and Forecast, By Type (2023-2030) 6.3.8.2. Rest of Europe Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7. Asia Pacific Beta Carotene Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 7.1. Asia Pacific Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.2. Asia Pacific Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3. Asia Pacific Beta Carotene Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.1.2. China Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.2.2. S Korea Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.3.2. Japan Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.4. India 7.3.4.1. India Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.4.2. India Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.5.2. Australia Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.6.2. Indonesia Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.7.2. Malaysia Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.8.2. Vietnam Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.9.2. Taiwan Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Beta Carotene Market Size and Forecast, By Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 8. Middle East and Africa Beta Carotene Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 8.1. Middle East and Africa Beta Carotene Market Size and Forecast, By Type (2023-2030) 8.2. Middle East and Africa Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 8.3. Middle East and Africa Beta Carotene Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Beta Carotene Market Size and Forecast, By Type (2023-2030) 8.3.1.2. South Africa Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Beta Carotene Market Size and Forecast, By Type (2023-2030) 8.3.2.2. GCC Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Beta Carotene Market Size and Forecast, By Type (2023-2030) 8.3.3.2. Nigeria Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Beta Carotene Market Size and Forecast, By Type (2023-2030) 8.3.4.2. Rest of ME&A Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 9. South America Beta Carotene Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 9.1. South America Beta Carotene Market Size and Forecast, By Type (2023-2030) 9.2. South America Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 9.3. South America Beta Carotene Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Beta Carotene Market Size and Forecast, By Type (2023-2030) 9.3.1.2. Brazil Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Beta Carotene Market Size and Forecast, By Type (2023-2030) 9.3.2.2. Argentina Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Beta Carotene Market Size and Forecast, By Type (2023-2030) 9.3.3.2. Rest Of South America Beta Carotene Market Size and Forecast, By End-Use (2023-2030) 10. Company Profile: Key Players 10.1. DSM Nutritional 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Details on Partnership 10.1.7. Recent Developments 10.2. DSM Nutritional 10.3. BASF SE 10.4. Lycored 10.5. Chr. Hansen Holding A/S 10.6. FMC Corporation 10.7. Döhler Group 10.8. Sensient Technologies Corporation 10.9. Kemin Industries, Inc. 10.10. Allied Biotech Corporation 10.11. Zhejiang NHU Co., Ltd. 10.12. Algatechnologies Ltd. 10.13. Tianjin Norland Biotech Co., Ltd. 10.14. Divis Laboratories Ltd. 10.15. Cyanotech Corporation 10.16. Naturex S.A. (Givaudan) 10.17. Dynadis SARL 10.18. Nutralliance 10.19. DDW The Color House 10.20. ZMC LLC 10.21. Vinayak Ingredients (India) Pvt. Ltd. 11. Key Findings 12. Analyst Recommendations 13. Beta Carotene Market: Research Methodology