Bentonite Market size was valued at USD 2.7 Billion in 2024, and the total Bentonite Market is expected to grow at a CAGR of 8.5 % from 2025 to 2032, reaching nearly USD 5.19 Billion Bentonite is a high-performance industrial mineral primarily composed of montmorillonite, a smectite group clay known for its exceptional swelling capacity, water absorption efficiency, viscosity enhancement, and thixotropic properties. These characteristics make Bentonite one of the most sought-after natural sealing and absorbent materials across global industries. With the ability to swell up to 15–20 times its original volume and absorb over 60% of its weight in water, Bentonite industry remains a top trending material in drilling, construction, wastewater treatment, environmental remediation, cat litter, and foundry applications. The oil & gas sector is a major consumer of sodium bentonite, known for delivering 30–40% improvements in drilling fluid viscosity and stronger cuttings suspension. As global drilling activities expand, demand for premium-grade bentonite drilling mud additives continues to surge. The material’s ability to stabilize boreholes, reduce fluid loss, and provide hydrostatic balancing makes it an essential component of advanced drilling fluid systems used in both onshore and offshore operations. Sodium bentonite market demand is increasing due to its superior rheology and gel strength compared to calcium-based variants. On the production side, the major countries a major global producer, such as China, United States, India and Turkey which collectively account for over 70% of total global output. Sodium bentonite constitutes approximately 60% of all production due to its superior performance in drilling, sealing, and clumping applications. In global trade, the U.S., China, Turkey, and India remain the leading bentonite exporters, supported by robust mining infrastructure and international Bentonite Market demand.To know about the Research Methodology :- Request Free Sample Report

Bentonite Market Dynamics:

Rising Bentonite Demand in Construction: Growth Driven by Urbanization and High-Yield Slurry Applications, BoostsBentonite Market Demand

Bentonite is at the lead of the construction and infrastructure development industry, where it plays a critical role in slurry walls, tunneling, diaphragm walls, waterproofing membranes, and deep foundation engineering. Bentonite slurry used in construction offers unmatched consistency and suspension properties, preventing soil collapse and improving structural integrity. Modern infrastructure projects rely heavily on high-yield bentonite for enhancing soil stability, reducing permeability, and achieving long-term durability. In Asia especially India and China bentonite-based construction solutions are witnessing 6–8% annual growth, supported by booming urbanization. Environmental engineering remains one of the fastest-growing segments, with Bentonite market widely adopted in landfill liners, geosynthetic clay liners (GCLs), tailing ponds, contaminated site remediation, and wastewater containment. Sodium bentonite in GCLs can achieve an ultra-low permeability of 1 × 10⁻⁹ m/s, ensuring 95%+ seepage reduction, making it one of the most eco-friendly natural sealing materials. As environmental regulations tighten and industries shift toward sustainable containment solutions, Bentonite is increasingly used as a green alternative to synthetic sealing compounds.The foundry and metal casting industry leads the global consumption landscape, accounting for 26–28% of total bentonite usage. Bentonite provides superior binding strength, thermal stability, and mold integrity, enabling the production of high-precision cast metal components. Its role in improving mold strength and dimensional accuracy positions it as a core raw material in automotive, heavy machinery, and equipment manufacturing in the Bentonite Market. In the consumer goods space, bentonite-based clumping cat litter has become a top trending product worldwide. Sodium bentonite’s rapid clumping action and exceptional absorbency drive 24–26% of the market’s total application share. Growing pet ownership and demand for premium cat litter products—especially in North America, Europe, and Southeast Asia have boosted the consumption of high-absorbency bentonite clay. Price trends for 2024 show fluctuations influenced by oil & gas activity and global shipping costs. FOB prices for sodium bentonite ranged from USD 185–290 per metric ton, while calcium bentonite remained 20–25% cheaper, making it popular in applications like civil engineering, pharmaceuticals, cosmetics, and agriculture. Rising consumer preference for natural, non-toxic, and eco-friendly minerals is also boosting the use of Bentonite in skincare, detox products, personal care formulations, and wellness applications segments experiencing 6–7% annual growth in Bentonite Market . Global Trade Patterns Highlight Structural Opportunities for High-Purity Bentonite Development and Export Optimisation Global Bentonite production consistently reaches tens of millions of tonnes annually, with historical peaks exceeding 20 million tonnes, indicating strong installed capacity and flexibility to meet rising demand. The United States, China, Turkey, and India dominate global output, supported by long-life deposits and integrated processing operations. The competitive landscape is moderately consolidated at the top, led by multinational companies such as Imerys, Clariant, Minerals Technologies, Ashapura, Wyo-Ben, and Black Hills Bentonite, while regional markets remain highly fragmented with numerous mid-sized miners and processors. Large integrated players differentiate themselves through broad product portfolios (sodium, calcium, organo- and activated Bentonite), extensive logistics networks, technical service capabilities, and long-term supply agreements with oil & gas, foundry, and GCL manufacturers. Meanwhile, emerging suppliers compete primarily on cost, proximity, and flexible delivery but increasingly recognise the need to invest in value-added processing, specialised grades, and certification-based quality assurance to maintain margins. Trade and production statistics further highlight the structural opportunities within the market. In 2023, the United States led global exports with USD 197 million, followed by Turkey (USD 194 million) and China (USD 122 million). Production data from 2022 show output of approximately 4.5 million tonnes in the U.S., 3.0 million tonnes in India, 2.1 million tonnes in China, 2.0 million tonnes in Turkey, and 1.3 million tonnes in Greece, around 15.6 million tonnes from these major producers. The concentration of production in a few countries, combined with strong export flows and dominance of high-specification sodium Bentonite, creates strategic opportunities for value-added processing, specialised product development, and optimised regional supply chains across industrial and environmental applications.

Bentonite Market Segment Analysis:

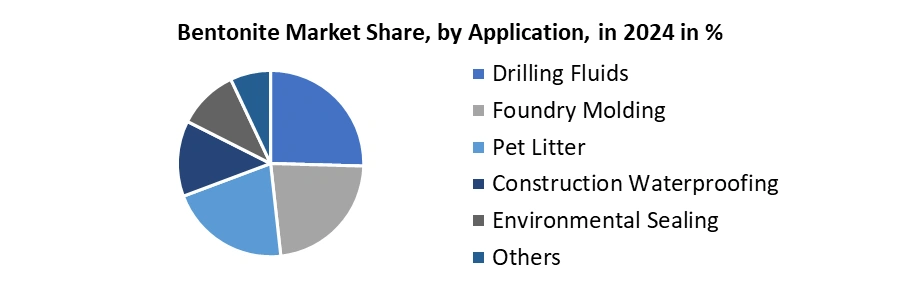

Based on Product Type, the Bentonite Market is segmented into Sodium Bentonite, Calcium Bentonite, and Potassium Bentonite. The Sodium Bentonite segment dominated the market in 2024 and is expected to maintain its lead throughout the forecast period. Globally, sodium bentonite accounts for over 65% of total bentonite consumption, supported by its exceptional swelling capacity, superior viscosity, and high gel strength, making it the preferred choice for drilling fluids, foundry moulding sands, geosynthetic clay liners, and premium clumping pet litter. It is estimated that more than 29% of all bentonite usage in industrial applications originates from demand for drilling mud formulations, where sodium bentonite remains the core material due to its ability to expand 15–20 times its volume. In addition to industrial dominance, sodium bentonite’s expanding use in environmental sealing systems, including landfill liners and mining tailings containment, further strengthens its leadership position.The fastest-growing segment is Environmental Sealing Applications, driven by global regulatory pressure for safer waste containment, groundwater protection, and mining compliance. Geosynthetic Clay Liners (GCLs) incorporating sodium bentonite now cover millions of square meters annually in landfill and industrial barrier installations, with adoption rising across North America, Europe, China, and the Middle East. Increasing investments in sustainable infrastructure, stricter EPA and EU landfill directives, and rapid growth in tailings dam rehabilitation projects continue to accelerate this segment in the Bentonite Market. The shift toward eco-friendly, natural, and high-performance sealing materials positions bentonite-based GCLs as the fastest-expanding revenue stream within the Bentonite Market. Based on Application, the Bentonite Market is segmented into Drilling Fluids, Construction Waterproofing, Foundry Molding, Environmental Sealing, Pet Litter, and Others. The Drilling Fluids segment dominated the market in 2024 and is projected to maintain its leadership throughout the forecast period. Globally, drilling activities account for nearly 29% of total bentonite application demand, with millions of tonnes of sodium bentonite consumed annually in water-based mud systems. Its unique ability to provide high viscosity, strong gel strength, and exceptional filtration control makes it indispensable for stabilizing boreholes in both onshore and offshore drilling operations. As exploration expands into deeper, more complex reservoirs, high-performance sodium bentonite continues to be the material of choice for wellbore conditioning across the U.S., Middle East, and Asia-Pacific. Environmental Sealing is emerging as the fastest-growing application, driven by escalating global regulations for waste containment, landfill lining, and mining tailings management. Geosynthetic Clay Liners (GCLs) incorporating sodium bentonite now cover millions of square meters annually, with adoption accelerating due to their ultra-low permeability levels of 1×10⁻⁹ m/s. Environmental sealing solutions are increasingly preferred for large-scale infrastructure, industrial waste storage, and groundwater protection, especially across North America, Europe, China, and the Middle East. As sustainability, groundwater safety, and climate-resilient engineering gain priority, bentonite-based sealing systems are expected to deliver the strongest growth momentum across the application landscape.

Bentonite Market Regional Analysis:

North America held the largest market share in 2024. The United States is the dominant region in the global Bentonite market, supported by unmatched production capacity, export leadership, and high-spec sodium bentonite reserves. The U.S. alone produced around 4.5 million tonnes of bentonite in 2022, making it the largest producer worldwide. Its geological advantage lies in the vast Wyoming beds, which supply some of the highest-swelling sodium bentonite globally, enabling superior performance in drilling fluids, GCL liners, foundry sands, and clumping pet litter. North America is also the top global exporter, with the U.S. shipping 785,000 tonnes valued at USD 186 million in 2023, outperforming Turkey, China, and India despite their larger populations and mining bases. The U.S. shale drilling sector consumes massive volumes of bentonite for wellbore stability and mud viscosity, while North America also accounts for 40% of global bentonite-based cat litter consumption, one of the fastest-growing high-margin applications. Advanced processing hubs, API-grade certification capabilities, and efficient rail-port logistics further enhance competitiveness. With its unique blend of resource quality, export scale, technological capability, and diversified demand, North America remains the most strategically powerful region in the global Bentonite value chain.Competitive Landscape:

The bentonite market features a mix of global leaders, regional champions, and niche specialists, each differentiated by product quality, application strength, and market reach. Imerys, Clariant AG, Halliburton, and Minerals Technologies (Bentonite Performance Minerals LLC) lead with advanced processing technologies, API-grade drilling bentonite, global supply chains, and strong penetration in oil & gas, foundry, and GCL markets. Ashapura Group, Wyo-Ben, and Black Hills Bentonite dominate high-swelling sodium bentonite from India and the U.S., supported by integrated mines and long-life reserves. European players such as Laviosa, Elementis, and Castiglioni Pes are recognized for their engineered environmental sealing products and specialized foundry formulations. Asian producers including Kunimine, Weifang Huawei, Fenghong, Chang’an Renheng, and Zhejiang Yuhong offer high-volume, cost-competitive supply for ceramics, construction, and chemical sectors. Indian mid-tier companies like Swell Well, Kutch Minerals, J&H Minerals, and The Sharad Group drive price-led competition and export growth. Meanwhile, Mountain Rose Herbs captures premium cosmetic-grade demand, PetroNaft, Canbensan, KarBen, and Sure Fluids strengthen regional drilling markets. Collectively, these players shape a landscape where technology leadership, sodium-grade quality, ESG compliance, and specialty application capabilities define competitive advantage.Recent Development:

Imerys S.A. – Strategic Expansion into Sustainable and High-Performance Bentonite Solutions Imerys strengthened its position in the global bentonite market through major sustainability- and performance-driven product launches in 2024. The company introduced a new eco-friendly bentonite portfolio aimed at industries seeking low-impact, high-efficiency mineral solutions. In September 2024, it expanded into premium industrial applications with Imerys Bentonite Pro, designed for advanced foundry sands and high-performance drilling systems. Additionally, Imerys launched ImerPure B, a bentonite-based technology for wastewater treatment and environmental sealing applications. These developments reflect Imerys’ strategy of diversifying its product mix, targeting high-value segments, and aligning its operations with growing demand for sustainable, high-performance mineral technologies. Wyo-Ben Inc. – Strengthening U.S. Supply Capabilities and Vertical Integration Wyo-Ben accelerated its expansion across the U.S. bentonite industry through acquisitions, capacity increases, and vertical integration. The 2023 acquisition of M-I Swaco’s bentonite operations in Greybull, Wyoming, significantly boosted its high-spec sodium bentonite supply, particularly for drilling and industrial applications. By mid-2024, Wyo-Ben increased operational shifts in the Big Horn Basin to meet rising domestic and international demand, including strong growth in the cat-litter segment. The company further expanded its value chain by establishing a dedicated cat-litter processing facility in Billings, Montana, enabling better granule quality, packaging control, and product differentiation in premium consumer applications. Minerals Technologies Inc. – Capacity Growth and Product Innovation in Bentonite Technologies Minerals Technologies reinforced its leadership in the global bentonite market by expanding processing capacity across North America and advancing product innovation. In 2024, the company filed several patents for bentonite applications in drilling fluids and fine chemical processes, reflecting its R&D-driven growth strategy. It also emphasized its market position as one of the world’s largest producers of bentonite-based materials, supplying a broad range of high-performance industrial, environmental, and construction applications. Toward the end of 2024, Minerals Technologies implemented price increases across its bentonite portfolio to offset rising logistics and raw-material costs, supporting margin stability amid global supply chain challenges.Bentonite Market Scope: Inquire before buying

Bentonite Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.7 Billion Forecast Period 2025 to 2032 CAGR: 8.5% Market Size in 2032: USD 5.19 Billion Segments Covered: by Product Calcium Bentonite Sodium Bentonite Potassium Bentonite by Application Drilling fluids Construction waterproofing Foundry molding Environmental sealing Pet litter Others by End User Oil & Gas Construction & Infrastructure Foundry & Metallurgy Environmental management Agriculture Others Bentonite Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bentonite Market, Key players

1. Ashapura Group 2. Clariant AG 3. Black Hills Bentonite LLC 4. Wyo-Ben Inc. 5. Imerys S.A. 6. The Sharad Group 7. J&H Minerals 8. PetroNaft Petroleum Products 9. Mountain Rose Herbs 10. Bentonite Performance Minerals LLC 11. Bentonite Company LLC 12. Laviosa Minerals SpA 13. Kunimine Industries Co. Ltd. 14. Weifang Huawei Bentonite Group 15. Fenghong New Material 16. Chang’an Renheng 17. Castiglioni Pes y Cia 18. Canbensan 19. KarBen 20. Elementis 21. Kutch Minerals 22. Sure Fluids 23. Zhejiang Yuhong New Materials Co., Ltd. 24. Swell Well Minechem Pvt. Ltd. 25. Halliburton Co. 26. Minerals Technologies Inc. 27.OthersFAQs

1. What are the growth drivers for the Bentonite Market? Ans. Growing popularity for eco-friendly chemicals is expected to be the major driver for the Bentonite Market. 2. What is the major restraint for the Bentonite Market growth? Ans. Stringent government regulations are expected to be the major restraining factor for the Bentonite Market growth. 3. Which Region is expected to lead the global Bentonite Market during the forecast period? Ans. North America is expected to lead the global Bentonite Market during the forecast period. 4. What is the growth rate of the Global Bentonite Market? Ans: The Global Bentonite Market is growing at a CAGR of 8.5% during the forecasting period 2025-2032. 5. What segments are covered in the Bentonite Market report? Ans. The segments covered in the Bentonite Market report are Product, Application, End Use and region.

1. Bentonite Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion)-By Segments, Regions, and Country 2. Bentonite Market : Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Bentonite Market : Dynamics 3.1. Bentonite Market Trends 3.2. Bentonite Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Biscuits Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Pricing Analysis 4.1. Historical Price Analysis of the Bentonite Market (2019–2024) 4.2. Average Selling Price (ASP) Trends in the Bentonite Industry (2019–2024) 4.3. Price Variations By Product in the Bentonite Market 4.4. Cost Structure Analysis of Bentonite Production and Pricing 4.5. Raw Material Costs 4.6. Manufacturing Costs 4.7. Distribution & Logistics 5. Import & Export Analysis 5.1. Global Import–Export Trends of the Bentonite Market 5.2. Major Exporting Countries and Trade Flows 5.3. Major Importing Countries and Demand Patterns 5.4. Trade Balance Assessment by Region 5.5. Tariffs, Duties, and Cross-Border Trade Barrier 6. Consumer Preference Analysis 6.1. Industrial Consumer Requirements (Oil & Gas, Foundry, Construction) 6.2. Preference Shifts Toward High-Spec Sodium Bentonite 6.3. Growing Demand for Eco-Friendly and Sustainable Bentonite Grades 6.4. Rising Adoption of Premium Clumping Pet Litter 6.5. End-User Buying Criteria (Performance, Purity, Certification, Price) 7. Regulatory & Compliance Landscape 7.1. Environmental Regulations Governing Bentonite Mining 7.2. Safety Standards for Drilling Fluids and GCL Applications 7.3. Regulatory Norms for Cosmetic, Pharma, and Food-Grade Bentonite 7.4. Export Regulations and Quality Certification Requirements 7.5. Regional Compliance Frameworks (EPA, EU Directives, APAC Standards) 8. Bentonite Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 8.1. Bentonite Market Size and Forecast, By Product (2024-2032) 8.1.1.1. Calcium Bentonite 8.1.1.2. Sodium Bentonite 8.1.1.3. Potassium Bentonite 8.2. Bentonite Market Size and Forecast, By Application (2024-2032) 8.2.1.1. Drilling fluids 8.2.1.2. Construction waterproofing 8.2.1.3. Foundry molding 8.2.1.4. Environmental sealing 8.2.1.5. Pet litter 8.2.1.6. Others 8.3. Bentonite Market Size and Forecast, By End Use (2024-2032) 8.3.1.1. Oil & Gas 8.3.1.2. Construction & Infrastructure 8.3.1.3. Foundry & Metallurgy 8.3.1.4. Environmental management 8.3.1.5. Agriculture 8.3.1.6. Others 8.4. Bentonite Market Size and Forecast, By Region (2024-2032) 8.4.1.1. North America 8.4.1.2. Europe 8.4.1.3. Asia Pacific 8.4.1.4. Middle East and Africa 8.4.1.5. South America 9. North America Bentonite Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 9.1. North America Bentonite Market Size and Forecast, By Product (2024-2032) 9.1.1.1. Calcium Bentonite 9.1.1.2. Sodium Bentonite 9.1.1.3. Potassium Bentonite 9.2. North America Bentonite Market Size and Forecast, By Application (2024-2032) 9.2.1.1. Drilling fluids 9.2.1.2. Construction waterproofing 9.2.1.3. Foundry molding 9.2.1.4. Environmental sealing 9.2.1.5. Pet litter 9.2.1.6. Others 9.3. North America Bentonite Market Size and Forecast, By End Use (2024-2032) 9.3.1.1. Oil & Gas 9.3.1.2. Construction & Infrastructure 9.3.1.3. Foundry & Metallurgy 9.3.1.4. Environmental management 9.3.1.5. Agriculture 9.3.1.6. Others 9.4. North America Bentonite Market Size and Forecast, by Country (2024-2032) 9.4.1.1. United States 9.4.1.2. Canada 9.4.1.3. Mexico 10. Europe Bentonite Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 10.1. Europe Bentonite Market Size and Forecast, By Product (2024-2032) 10.2. Europe Bentonite Market Size and Forecast, By Application (2024-2032) 10.3. Europe Bentonite Market Size and Forecast, By End Use (2024-2032) 10.4. Europe Bentonite Market Size and Forecast, By Country (2024-2032) 10.4.1. United Kingdom 10.4.2. France 10.4.3. Germany 10.4.4. Italy 10.4.5. Spain 10.4.6. Sweden 10.4.7. Russia 10.4.8. Rest of Europe 11. Asia Pacific Bentonite Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 11.1. Asia Pacific Bentonite Market Size and Forecast, By Product (2024-2032) 11.2. Asia Pacific Bentonite Market Size and Forecast, By Application (2024-2032) 11.3. Asia Pacific Bentonite Market Size and Forecast, By End Use (2024-2032) 11.4. Asia Pacific Bentonite Market Size and Forecast, by Country (2024-2032) 11.4.1. China 11.4.2. S Korea 11.4.3. Japan 11.4.4. India 11.4.5. Australia 11.4.6. Indonesia 11.4.7. Malaysia 11.4.8. Philippines 11.4.9. Thailand 11.4.10. Vietnam 11.4.11. Rest of Asia Pacific 12. Middle East and Africa Bentonite Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 12.1. Middle East and Africa Bentonite Market Size and Forecast, By Product (2024-2032) 12.2. Middle East and Africa Bentonite Market Size and Forecast, By Application (2024-2032) 12.3. Middle East and Africa Bentonite Market Size and Forecast, By End Use (2024-2032) 12.4. Middle East and Africa Bentonite Market Size and Forecast, By Country (2024-2032) 12.4.1. South Africa 12.4.2. GCC 12.4.3. Nigeria 12.4.4. Rest of ME&A 13. South America Bentonite Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonnes) (2024-2032) 13.1. South America Bentonite Market Size and Forecast, By Product (2024-2032) 13.2. South America Bentonite Market Size and Forecast, By Application (2024-2032) 13.3. South America Bentonite Market Size and Forecast, By End Use (2024-2032) 13.4. South America Bentonite Market Size and Forecast, By Country (2024-2032) 13.4.1. Brazil 13.4.2. Argentina 13.4.3. Colombia 13.4.4. Chile 13.4.5. Rest of South America 14. Company Profile: Key Players 14.1. Ashapura Group 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.2. Clariant AG 14.3. Black Hills Bentonite LLC 14.4. Wyo-Ben Inc. 14.5. Imerys S.A. 14.6. The Sharad Group 14.7. J&H Minerals 14.8. PetroNaft Petroleum Products 14.9. Mountain Rose Herbs 14.10. Bentonite Performance Minerals LLC 14.11. Bentonite Company LLC 14.12. Laviosa Minerals SpA 14.13. Kunimine Industries Co. Ltd. 14.14. Weifang Huawei Bentonite Group 14.15. Fenghong New Material 14.16. Chang’an Renheng 14.17. Castiglioni Pes y Cia 14.18. Canbensan 14.19. KarBen 14.20. Elementis 14.21. Kutch Minerals 14.22. Sure Fluids 14.23. Zhejiang Yuhong New Materials Co., Ltd. 14.24. Swell Well Minechem Pvt. Ltd. 14.25. Halliburton Co. 14.26. Minerals Technologies Inc. 14.27. Others 15. Key Findings 16. Analyst Recommendations 17. Bentonite Market – Research Methodology