Global Barrier Systems Market size was valued at USD 21.90 Billion in 2024, and the total Barrier Systems Market revenue is expected to grow by 5.44% from 2025 to 2032, reaching nearly USD 33.46 BillionBarrier Systems Market Overview

Barrier systems, which include fences, crash barriers, bollards, drop arms, and specialty devices, play a vital role in protecting motorists, pedestrians, and critical infrastructure from accidents or hostile threats. Governments and transportation authorities are mandating stringent safety regulations, driving large-scale adoption of crash cushions, guardrails, and end treatments across highways, bridges, airports, and urban transit networks. The Barrier Systems Market is witnessing a strong shift toward sustainable and modular materials, with manufacturers increasingly utilizing recycled composites, corrosion-resistant alloys, and eco-friendly coatings to align with green building standards.To know about the Research Methodology:-Request Free Sample Report Metal barriers, particularly steel, remain dominant due to their durability and cost-effectiveness, while non-metal alternatives such as plastics and concrete are gaining traction in temporary and flexible applications. The rise of intelligent, IoT-enabled barrier systems, which integrate sensors, automation, and AI for real-time monitoring, predictive alerts, and smart traffic management, enhances both safety and operational efficiency. Asia-Pacific leads the Barrier Systems Market, driven by rapid urbanization and infrastructure investments in China and India, followed by North America and Europe, where regulatory compliance and sustainability goals shape adoption patterns. With the dual push of innovation and regulation, the barrier systems market is evolving into a dynamic, technology-driven sector that balances safety, sustainability, and cost-efficiency.

Barrier Systems Market Dynamics

Infrastructure Modernization and Road Safety Regulations to drive the Barrier Systems Market Governments worldwide are channeling significant investments into highway expansions, smart cities, transit networks, and airport infrastructure, creating a surge in demand for advanced safety barriers. Such large-scale infrastructure investments are expected to accelerate the growth of the Barrier Systems Market, as modern projects increasingly prioritize both safety and traffic efficiency. Rising vehicle ownership, increasing road congestion, and accident-related fatalities have prompted regulators to enforce strict safety standards such as MASH (Manual for Assessing Safety Hardware) in the U.S. and EN 1317 in. In fast-growing economies such as China, India, and Southeast Asia, rapid urbanization and government-backed programs such as India’s Bharatmala Pariyojana and Smart Cities Mission are significantly expanding demand for roadside and urban barrier solutions. In North America and Europe, the focus extends to retrofitting outdated infrastructure with modern, sensor-enabled, and sustainable barrier systems. Technological advancements are further amplifying this trend, with IoT-enabled and AI-integrated barrier systems allowing for real-time monitoring, predictive safety alerts, and automated traffic control. High Installation and Maintenance Costs to hamper the Barrier Systems Market Crash barriers, crash cushions, and bollards made from high-grade steel, aluminum, or advanced composites require significant upfront investment, including material sourcing, engineering, and specialized installation. Although modular and prefabricated designs simplify installation, infrastructure projects still struggle with high upfront capital costs and recurring expenses for inspections, repairs, and replacements. These financial challenges, particularly for municipalities and developing regions, hamper the Barrier Systems Market, slowing adoption despite rising demand for safety solutions. Urban environments also present challenges, as installations may require modifications to existing underground utilities such as pipelines, power lines, and fiber optic cables, escalating costs and timelines.Barrier Systems Market Segment Analysis

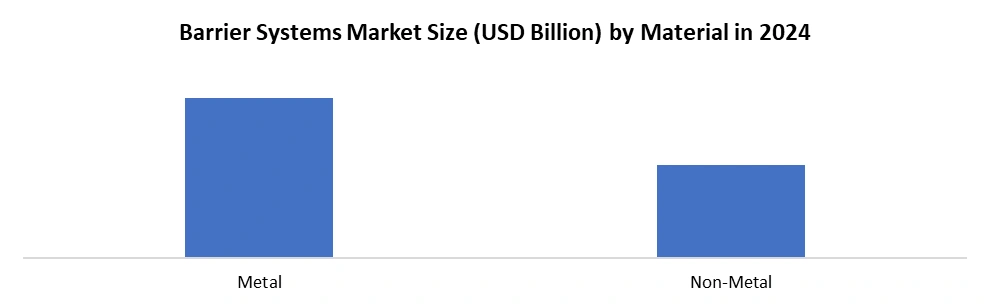

Based on Type, the market is segmented into the Crash Barrier Systems (Crash Cushions, End Treatments, Sand and Water Filled Barriers, Guardrail Energy Absorbent Terminal and Others), Crash Barrier Devices (Fences, Bollards, Drop arms, and Others). Crash Barrier Systems dominated the Barrier Systems Market in 2024. This ensures road safety and minimizes the impact of collisions across highways, urban streets, bridges, and critical infrastructure. This category, which includes crash cushions, end treatments, sand and water-filled barriers, guardrail energy-absorbent terminals, and related solutions, remains at the forefront because of the rising demand for vehicle safety measures and compliance with stringent government regulations worldwide. Roadway expansions, particularly in emerging economies of the Asia-Pacific and infrastructure upgrades in North America and Europe, have propelled the large-scale installation of these systems. Crash barriers serve as both passive and active safety measures, preventing vehicles from veering into dangerous zones while absorbing and redistributing impact energy to reduce fatalities. Recent innovations, such as sensor-enabled crash cushions and modular, easy-to-install end treatments, strengthen their Barrier Systems Market position by enhancing cost-effectiveness and operational efficiency.Based on Material, the market is categorized into the Metal (Steel, Aluminum, Tungsten and Others) and Non-Metal (Plastics, Wood, Concrete and Others). Metal is expected to continue its dominance in the Barrier Systems Market over the forecast period. Metal, particularly Steel, dominates the barrier systems market due to its unmatched durability, strength, and cost-effectiveness in withstanding high-impact collisions and harsh environmental conditions. Steel barriers, whether in the form of guardrails, bollards, or crash cushions, remain the preferred choice across highways, airports, construction zones, and critical facilities because they deliver long service life, high load-bearing capacity, and proven reliability under demanding scenarios. The material’s versatility, as seen in galvanized coatings or weather-resistant alloys, ensures corrosion resistance, making it suitable for diverse climates and geographies. The innovations in high-strength steel and hybrid alloy combinations have enhanced impact absorption capabilities while reducing overall weight, easing installation and transportation. Governments and private contractors continue to prioritize steel barriers in large-scale roadway safety programs, backed by proven compliance with standards such as MASH and ASTM F2656, strengthening growth opportunities in the Barrier Systems Market.

Barrier Systems Market Regional Analysis:

Asia Pacific dominated the Barrier Systems Market 2024 and is expected to continue its dominance over the forecast period. China’s dominance stems from continuous investment in smart transportation networks, expressways, and urban mobility projects, which require large-scale deployment of crash barriers, guardrails, crash cushions, and anti-ram systems. The country’s leadership in the Barrier Systems Market is supported by its robust domestic manufacturing base, offering both cost competitiveness and scalability, which enables wide adoption across highways, airports, railways, and urban projects. China’s push toward smart cities and sustainable construction practices aligns well with global trends, boosting demand for modular, corrosion-resistant, and eco-friendly barrier systems. India is emerging as a high-growth Barrier Systems Market due to significant infrastructure development under national programs such as Bharatmala Pariyojana and Smart Cities Mission, creating strong opportunities for international players like Lindsay, Valmont, and Hill & Smith to collaborate with local firms. Countries such as Japan, South Korea, and Australia also represent advanced markets where emphasis is placed on technologically advanced, IoT-enabled, and AI-integrated barrier systems to improve traffic management and enhance safety in dense urban centers. Southeast Asian nations, including Indonesia, Thailand, and Vietnam, are witnessing increasing demand driven by rapid highway expansions, urban population growth, and international investments in smart infrastructure. Barrier Systems Market Competitive Landscape: The competitive landscape of the Barrier Systems Market is characterized by the presence of a mix of global leaders, regional manufacturers, and specialized players competing across infrastructure safety, urban development, and high-security applications. Companies such as Lindsay Corporation, Valmont Industries, Hill & Smith Holdings, Trinity Industries, Delta Scientific, Bekaert SA, Betafence, A-SAFE, Avon Barrier Corporation, and Tata Steel Limited dominate the global market with strong portfolios spanning crash cushions, bollards, guardrails, anti-ram barriers, and modular fencing systems. North American players focus heavily on roadway safety and high-security solutions, driven by stringent regulatory standards and urban infrastructure upgrades. European firms emphasize sustainability, modularity, and compliance with green building directives, positioning themselves strongly in smart city projects. Asia-Pacific Barrier Systems Manufacturers increasingly leverage cost advantages, large-scale infrastructure spending, and rapid urbanization to capture significant Barrier Systems Market share, with companies such as Tata Steel and Chinese regional players gaining momentum. Strategic initiatives such as mergers, acquisitions, partnerships with governments, and continuous investment in IoT-enabled, AI-driven, and eco-friendly barrier technologies further intensify competition. Barrier Systems leading companies are introducing sensor-based barriers, crash cushions with rapid repair features, and modular composite systems to meet evolving customer needs. Barrier Systems Market EcosystemsBarrier Systems Market Key Developments: • On August 25, 2023, Delta Scientific announced that its DSC550 shallow foundation open frame vehicle barrier has been officially listed on the U.S. Department of Defense Anti-Ram Vehicle Barrier list, following successful testing at both 10’ and 16’ lengths. Meeting the ASTM F2656-20 M50/P1 standard with negative penetration, the DSC550 demonstrated exceptional strength and resilience, remaining operational after high-impact collisions. With a shallow 24-inch foundation, it minimizes interference with utilities, reduces installation complexity, and is ideal for corrosive soils or high-water-table environments. Featuring rapid deployment times 0.75 seconds hydraulic, 1.5 seconds electro-mechanical and touchscreen controls with data logging, this development reinforces Delta’s leadership in delivering innovative, high-security vehicle barrier solutions. • On June 25, 2024, Lindsay Corporation announced the successful installation of its first TAU-XR Xpress Repair Crash Cushion on a Las Vegas roadway, marking a significant advancement in barrier system technology. The TAU-XR is engineered for swift installation (30 minutes or less), cost-effective repairs, and long-term durability, addressing the dual needs of roadway safety and maintenance efficiency. Featuring a dual-rail configuration and innovative energy attenuation, the system provides maximum versatility with transition options up to 52 inches. Shipped fully assembled for expedited deployment, the MASH-tested TAU-XR works seamlessly on both asphalt and concrete. Barrier Systems Market Key Trends:

Trend Description Intelligent & Sensor-Enabled Barrier Systems Barrier systems are rapidly evolving through the integration of Internet of Things (IoT) technologies, advanced sensors, and artificial intelligence (AI). Intelligent barriers are increasingly being deployed in urban centers, airports, transportation hubs, and defense infrastructure where responsiveness and precision are crucial. For instance, smart barriers can detect approaching vehicles, adjust access controls automatically, and provide instant data feedback to command centers. Sustainable & Modular Materials Manufacturers are shifting toward the use of recycled composites, corrosion-resistant alloys, and eco-friendly coatings that enhance durability while reducing carbon footprint. Modular designs also allow for rapid installation, portability, and easier maintenance, making them especially suitable for temporary events, construction projects, and smart city developments that align with green building standards. Governments and urban planners are increasingly mandating eco-conscious infrastructure solutions, accelerating demand. Integration with Traffic & Mobility Management Barrier systems are no longer just static protective structures; they are becoming dynamic components of intelligent transport ecosystems. The integration of barriers with Intelligent Transport Systems (ITS), adaptive traffic signals, and automated tolling solutions is transforming road and urban safety. For example, barriers at toll plazas can be synchronized with vehicle recognition systems for seamless entry, while urban traffic barriers can coordinate with adaptive signals to redirect traffic in real time during emergencies. Barrier Systems Market Scope: Inquire before buying

Global Barrier Systems Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 21.90 Bn. Forecast Period 2025 to 2032 CAGR: 5.44% Market Size in 2032: USD 33.46 Bn. Segments Covered: by Type Crash Barrier Systems Crash Cushions End Treatments Sand and Water Filled Barriers Guardrail Energy Absorbent Terminal Others Crash Barrier Devices Fences Bollards Drop arms Others by Material Metal Steel Aluminum Tungsten Others Non-Metal Plastics Wood Concrete Others by Function Active Passive by Technology Rigid Semirigid Flexible by Access Control Device Token & Reader Technology Biometric Systems Perimeter Security & Alarms Turnstiles Push Button Controls Keypad/Password Access Systems Card-Based Access Systems Remote-Controlled Barriers Others by Application Roadways / Highways Railways Airports Factories & Warehouses Data Centers & IT Facilities Retail & Commercial Buildings Others Barrier Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Barrier Systems Key Players

North America 1. Lindsay Corporation 2. Valmont Industries Inc. 3. Hill & Smith PLC 4. Trinity Industries, Inc. 5. Delta Scientific Corporation 6. A-SAFE 7. Rite-Hite 8. Tractel Ltd 9. Barrier1 10. Betafence Europe 1. Bekaert SA 2. Hill & Smith Holdings PLC 3. Betafence 4. A-SAFE 5. Avon Barrier Corporation Ltd 6. FutureNet Group 7. Tractel Ltd 8. Arbus Ltd 9. Delta BLOC International GmbH 10. Nucor Corporation Asia Pacific 1. Tata Steel Limited 2. Bekaert SA 3. Valmont Industries Inc. 4. Lindsay Corporation 5. Avon Barrier Corporation Ltd 6. Guangxi Shiteng Transportation Engineering Co., Ltd. 7. Arbus Ltd 8. Barrier1 Systems, LLC 9. A-SAFE 10. FutureNet GroupFAQ’S

1. Which region has the largest share in Global Barrier Systems Market? Ans: Asia Pacific region held the largest share in the Global Barrier Systems Market in 2024. 2. What is the growth rate of the Global Barrier Systems Market? Ans: The Global Market is expected to grow at a CAGR of 5.44% during the forecast period 2024-2032. 3. What was the Global Barrier Systems Market Size in 2024? Ans: The Global Barrier Systems Market Size was USD 21.90 Billion in 2024. 4. Who are the key players in the Global Barrier Systems market? Ans: The key players in the Global Barrier Systems Market are Lindsay Corporation, Valmont Industries Inc., Hill & Smith PLC, Trinity Industries, Inc., Delta Scientific Corporation, A-SAFE and Others. 5. What is the study period of this Barrier Systems Market? Ans: The Global Barrier Systems Market is studied from 2024 to 2032.

1. Barrier Systems Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Barrier Systems Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Barrier Systems Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Barrier Systems Market: Dynamics 3.1. Barrier Systems Market Trends by Region 3.1.1. North America Barrier Systems Market Trends 3.1.2. Europe Barrier Systems Market Trends 3.1.3. Asia Pacific Barrier Systems Market Trends 3.1.4. Middle East and Africa Barrier Systems Market Trends 3.1.5. South America Barrier Systems Market Trends 3.2. Barrier Systems Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Barrier Systems Market Drivers 3.2.1.2. North America Barrier Systems Market Restraints 3.2.1.3. North America Barrier Systems Market Opportunities 3.2.1.4. North America Barrier Systems Market Challenges 3.2.2. Europe 3.2.2.1. Europe Barrier Systems Market Drivers 3.2.2.2. Europe Barrier Systems Market Restraints 3.2.2.3. Europe Barrier Systems Market Opportunities 3.2.2.4. Europe Barrier Systems Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Barrier Systems Market Drivers 3.2.3.2. Asia Pacific Barrier Systems Market Restraints 3.2.3.3. Asia Pacific Barrier Systems Market Opportunities 3.2.3.4. Asia Pacific Barrier Systems Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Barrier Systems Market Drivers 3.2.4.2. Middle East and Africa Barrier Systems Market Restraints 3.2.4.3. Middle East and Africa Barrier Systems Market Opportunities 3.2.4.4. Middle East and Africa Barrier Systems Market Challenges 3.2.5. South America 3.2.5.1. South America Barrier Systems Market Drivers 3.2.5.2. South America Barrier Systems Market Restraints 3.2.5.3. South America Barrier Systems Market Opportunities 3.2.5.4. South America Barrier Systems Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Barrier Systems Industry 3.8. Analysis of Government Schemes and Initiatives For Barrier Systems Industry 3.9. Barrier Systems Market Trade Analysis 3.10. The Global Pandemic Impact on Barrier Systems Market 4. Barrier Systems Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Barrier Systems Market Size and Forecast, by Type (2024-2032) 4.1.1. Crash Barrier Systems 4.1.2. Crash Barrier Devices 4.2. Barrier Systems Market Size and Forecast, by Material (2024-2032) 4.2.1. Metal 4.2.2. Non-Metal 4.3. Barrier Systems Market Size and Forecast, by Function (2024-2032) 4.3.1. Active 4.3.2. Passive 4.4. Barrier Systems Market Size and Forecast, by Technology (2024-2032) 4.4.1. Rigid 4.4.2. Semirigid 4.4.3. Flexible 4.5. Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 4.5.1. Token & Reader Technology 4.5.2. Biometric Systems 4.5.3. Perimeter Security & Alarms 4.5.4. Turnstiles 4.5.5. Push Button Controls 4.5.6. Keypad/Password Access Systems 4.5.7. Card-Based Access Systems 4.5.8. Remote-Controlled Barriers 4.5.9. Others 4.6. Barrier Systems Market Size and Forecast, by Application (2024-2032) 4.6.1. Roadways / Highways 4.6.2. Railways 4.6.3. Airports 4.6.4. Factories & Warehouses 4.6.5. Data Centers & IT Facilities 4.6.6. Retail & Commercial Buildings 4.6.7. Others 4.7. Barrier Systems Market Size and Forecast, by Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Barrier Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Barrier Systems Market Size and Forecast, by Type (2024-2032) 5.1.1. Crash Barrier Systems 5.1.2. Crash Barrier Devices 5.2. North America Barrier Systems Market Size and Forecast, by Material (2024-2032) 5.2.1. Metal 5.2.2. Non-Metal 5.3. North America Barrier Systems Market Size and Forecast, by Function (2024-2032) 5.3.1. Active 5.3.2. Passive 5.4. North America Barrier Systems Market Size and Forecast, by Technology (2024-2032) 5.4.1. Rigid 5.4.2. Semirigid 5.4.3. Flexible 5.5. North America Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 5.5.1. Token & Reader Technology 5.5.2. Biometric Systems 5.5.3. Perimeter Security & Alarms 5.5.4. Turnstiles 5.5.5. Push Button Controls 5.5.6. Keypad/Password Access Systems 5.5.7. Card-Based Access Systems 5.5.8. Remote-Controlled Barriers 5.5.9. Others 5.6. North America Barrier Systems Market Size and Forecast, by Application (2024-2032) 5.6.1. Roadways / Highways 5.6.2. Railways 5.6.3. Airports 5.6.4. Factories & Warehouses 5.6.5. Data Centers & IT Facilities 5.6.6. Retail & Commercial Buildings 5.6.7. Others 5.7. North America Barrier Systems Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. United States Barrier Systems Market Size and Forecast, by Type (2024-2032) 5.7.1.1.1. Crash Barrier Systems 5.7.1.1.2. Crash Barrier Devices 5.7.1.2. United States Barrier Systems Market Size and Forecast, by Material (2024-2032) 5.7.1.2.1. Metal 5.7.1.2.2. Non-Metal 5.7.1.3. United States Barrier Systems Market Size and Forecast, by Function (2024-2032) 5.7.1.3.1. Active 5.7.1.3.2. Passive 5.7.1.4. United States Barrier Systems Market Size and Forecast, by Technology (2024-2032) 5.7.1.4.1. Rigid 5.7.1.4.2. Semirigid 5.7.1.4.3. Flexible 5.7.1.5. United States Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 5.7.1.5.1. Token & Reader Technology 5.7.1.5.2. Biometric Systems 5.7.1.5.3. Perimeter Security & Alarms 5.7.1.5.4. Turnstiles 5.7.1.5.5. Push Button Controls 5.7.1.5.6. Keypad/Password Access Systems 5.7.1.5.7. Card-Based Access Systems 5.7.1.5.8. Remote-Controlled Barriers 5.7.1.5.9. Others 5.7.1.6. United States Barrier Systems Market Size and Forecast, by Application (2024-2032) 5.7.1.6.1. Roadways / Highways 5.7.1.6.2. Railways 5.7.1.6.3. Airports 5.7.1.6.4. Factories & Warehouses 5.7.1.6.5. Data Centers & IT Facilities 5.7.1.6.6. Retail & Commercial Buildings 5.7.1.6.7. Others 5.7.2. Canada 5.7.2.1. Canada Barrier Systems Market Size and Forecast, by Type (2024-2032) 5.7.2.1.1. Crash Barrier Systems 5.7.2.1.2. Crash Barrier Devices 5.7.2.2. Canada Barrier Systems Market Size and Forecast, by Material (2024-2032) 5.7.2.2.1. Metal 5.7.2.2.2. Non-Metal 5.7.2.3. Canada Barrier Systems Market Size and Forecast, by Function (2024-2032) 5.7.2.3.1. Active 5.7.2.3.2. Passive 5.7.2.4. Canada Barrier Systems Market Size and Forecast, by Technology (2024-2032) 5.7.2.4.1. Rigid 5.7.2.4.2. Semirigid 5.7.2.4.3. Flexible 5.7.2.5. Canada Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 5.7.2.5.1. Token & Reader Technology 5.7.2.5.2. Biometric Systems 5.7.2.5.3. Perimeter Security & Alarms 5.7.2.5.4. Turnstiles 5.7.2.5.5. Push Button Controls 5.7.2.5.6. Keypad/Password Access Systems 5.7.2.5.7. Card-Based Access Systems 5.7.2.5.8. Remote-Controlled Barriers 5.7.2.5.9. Others 5.7.2.6. Canada Barrier Systems Market Size and Forecast, by Application (2024-2032) 5.7.2.6.1. Roadways / Highways 5.7.2.6.2. Railways 5.7.2.6.3. Airports 5.7.2.6.4. Factories & Warehouses 5.7.2.6.5. Data Centers & IT Facilities 5.7.2.6.6. Retail & Commercial Buildings 5.7.2.6.7. Others 5.7.3. Mexico 5.7.3.1. Mexico Barrier Systems Market Size and Forecast, by Type (2024-2032) 5.7.3.1.1. Crash Barrier Systems 5.7.3.1.2. Crash Barrier Devices 5.7.3.2. Mexico Barrier Systems Market Size and Forecast, by Material (2024-2032) 5.7.3.2.1. Metal 5.7.3.2.2. Non-Metal 5.7.3.3. Mexico Barrier Systems Market Size and Forecast, by Function (2024-2032) 5.7.3.3.1. Active 5.7.3.3.2. Passive 5.7.3.4. Mexico Barrier Systems Market Size and Forecast, by Technology (2024-2032) 5.7.3.4.1. Rigid 5.7.3.4.2. Semirigid 5.7.3.4.3. Flexible 5.7.3.5. Mexico Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 5.7.3.5.1. Token & Reader Technology 5.7.3.5.2. Biometric Systems 5.7.3.5.3. Perimeter Security & Alarms 5.7.3.5.4. Turnstiles 5.7.3.5.5. Push Button Controls 5.7.3.5.6. Keypad/Password Access Systems 5.7.3.5.7. Card-Based Access Systems 5.7.3.5.8. Remote-Controlled Barriers 5.7.3.5.9. Others 5.7.3.6. Mexico Barrier Systems Market Size and Forecast, by Application (2024-2032) 5.7.3.6.1. Roadways / Highways 5.7.3.6.2. Railways 5.7.3.6.3. Airports 5.7.3.6.4. Factories & Warehouses 5.7.3.6.5. Data Centers & IT Facilities 5.7.3.6.6. Retail & Commercial Buildings 5.7.3.6.7. Others 6. Europe Barrier Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.2. Europe Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.3. Europe Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.4. Europe Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.5. Europe Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.6. Europe Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7. Europe Barrier Systems Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.1.2. United Kingdom Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.1.3. United Kingdom Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.1.4. United Kingdom Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.1.5. United Kingdom Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.1.6. United Kingdom Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.2. France 6.7.2.1. France Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.2.2. France Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.2.3. France Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.2.4. France Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.2.5. France Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.2.6. France Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.3.2. Germany Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.3.3. Germany Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.3.4. Germany Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.3.5. Germany Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.3.6. Germany Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.4.2. Italy Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.4.3. Italy Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.4.4. Italy Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.4.5. Italy Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.4.6. Italy Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.5.2. Spain Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.5.3. Spain Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.5.4. Spain Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.5.5. Spain Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.5.6. Spain Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.6.2. Sweden Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.6.3. Sweden Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.6.4. Sweden Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.6.5. Sweden Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.6.6. Sweden Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.7. Austria 6.7.7.1. Austria Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.7.2. Austria Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.7.3. Austria Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.7.4. Austria Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.7.5. Austria Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.7.6. Austria Barrier Systems Market Size and Forecast, by Application (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Barrier Systems Market Size and Forecast, by Type (2024-2032) 6.7.8.2. Rest of Europe Barrier Systems Market Size and Forecast, by Material (2024-2032) 6.7.8.3. Rest of Europe Barrier Systems Market Size and Forecast, by Function (2024-2032) 6.7.8.4. Rest of Europe Barrier Systems Market Size and Forecast, by Technology (2024-2032) 6.7.8.5. Rest of Europe Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 6.7.8.6. Rest of Europe Barrier Systems Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Barrier Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.3. Asia Pacific Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.4. Asia Pacific Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.5. Asia Pacific Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.6. Asia Pacific Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7. Asia Pacific Barrier Systems Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.1.2. China Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.1.3. China Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.1.4. China Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.1.5. China Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.1.6. China Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.2.2. S Korea Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.2.3. S Korea Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.2.4. S Korea Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.2.5. S Korea Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.2.6. S Korea Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.3.2. Japan Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.3.3. Japan Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.3.4. Japan Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.3.5. Japan Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.3.6. Japan Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.4. India 7.7.4.1. India Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.4.2. India Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.4.3. India Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.4.4. India Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.4.5. India Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.4.6. India Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.5.2. Australia Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.5.3. Australia Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.5.4. Australia Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.5.5. Australia Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.5.6. Australia Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.6.2. Indonesia Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.6.3. Indonesia Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.6.4. Indonesia Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.6.5. Indonesia Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.6.6. Indonesia Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.7.2. Malaysia Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.7.3. Malaysia Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.7.4. Malaysia Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.7.5. Malaysia Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.7.6. Malaysia Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.8. Vietnam 7.7.8.1. Vietnam Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.8.2. Vietnam Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.8.3. Vietnam Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.8.4. Vietnam Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.8.5. Vietnam Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.8.6. Vietnam Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.9. Taiwan 7.7.9.1. Taiwan Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.9.2. Taiwan Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.9.3. Taiwan Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.9.4. Taiwan Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.9.5. Taiwan Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.9.6. Taiwan Barrier Systems Market Size and Forecast, by Application (2024-2032) 7.7.10. Rest of Asia Pacific 7.7.10.1. Rest of Asia Pacific Barrier Systems Market Size and Forecast, by Type (2024-2032) 7.7.10.2. Rest of Asia Pacific Barrier Systems Market Size and Forecast, by Material (2024-2032) 7.7.10.3. Rest of Asia Pacific Barrier Systems Market Size and Forecast, by Function (2024-2032) 7.7.10.4. Rest of Asia Pacific Barrier Systems Market Size and Forecast, by Technology (2024-2032) 7.7.10.5. Rest of Asia Pacific Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 7.7.10.6. Rest of Asia Pacific Barrier Systems Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Barrier Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Barrier Systems Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Barrier Systems Market Size and Forecast, by Material (2024-2032) 8.3. Middle East and Africa Barrier Systems Market Size and Forecast, by Function (2024-2032) 8.4. Middle East and Africa Barrier Systems Market Size and Forecast, by Technology (2024-2032) 8.5. Middle East and Africa Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 8.6. Middle East and Africa Barrier Systems Market Size and Forecast, by Application (2024-2032) 8.7. Middle East and Africa Barrier Systems Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Barrier Systems Market Size and Forecast, by Type (2024-2032) 8.7.1.2. South Africa Barrier Systems Market Size and Forecast, by Material (2024-2032) 8.7.1.3. South Africa Barrier Systems Market Size and Forecast, by Function (2024-2032) 8.7.1.4. South Africa Barrier Systems Market Size and Forecast, by Technology (2024-2032) 8.7.1.5. South Africa Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 8.7.1.6. South Africa Barrier Systems Market Size and Forecast, by Application (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Barrier Systems Market Size and Forecast, by Type (2024-2032) 8.7.2.2. GCC Barrier Systems Market Size and Forecast, by Material (2024-2032) 8.7.2.3. GCC Barrier Systems Market Size and Forecast, by Function (2024-2032) 8.7.2.4. GCC Barrier Systems Market Size and Forecast, by Technology (2024-2032) 8.7.2.5. GCC Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 8.7.2.6. GCC Barrier Systems Market Size and Forecast, by Application (2024-2032) 8.7.3. Nigeria 8.7.3.1. Nigeria Barrier Systems Market Size and Forecast, by Type (2024-2032) 8.7.3.2. Nigeria Barrier Systems Market Size and Forecast, by Material (2024-2032) 8.7.3.3. Nigeria Barrier Systems Market Size and Forecast, by Function (2024-2032) 8.7.3.4. Nigeria Barrier Systems Market Size and Forecast, by Technology (2024-2032) 8.7.3.5. Nigeria Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 8.7.3.6. Nigeria Barrier Systems Market Size and Forecast, by Application (2024-2032) 8.7.4. Rest of ME&A 8.7.4.1. Rest of ME&A Barrier Systems Market Size and Forecast, by Type (2024-2032) 8.7.4.2. Rest of ME&A Barrier Systems Market Size and Forecast, by Material (2024-2032) 8.7.4.3. Rest of ME&A Barrier Systems Market Size and Forecast, by Function (2024-2032) 8.7.4.4. Rest of ME&A Barrier Systems Market Size and Forecast, by Technology (2024-2032) 8.7.4.5. Rest of ME&A Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 8.7.4.6. Rest of ME&A Barrier Systems Market Size and Forecast, by Application (2024-2032) 9. South America Barrier Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Barrier Systems Market Size and Forecast, by Type (2024-2032) 9.2. South America Barrier Systems Market Size and Forecast, by Material (2024-2032) 9.3. South America Barrier Systems Market Size and Forecast, by Function(2024-2032) 9.4. South America Barrier Systems Market Size and Forecast, by Technology (2024-2032) 9.5. South America Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 9.6. South America Barrier Systems Market Size and Forecast, by Application (2024-2032) 9.7. South America Barrier Systems Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Barrier Systems Market Size and Forecast, by Type (2024-2032) 9.7.1.2. Brazil Barrier Systems Market Size and Forecast, by Material (2024-2032) 9.7.1.3. Brazil Barrier Systems Market Size and Forecast, by Function (2024-2032) 9.7.1.4. Brazil Barrier Systems Market Size and Forecast, by Technology (2024-2032) 9.7.1.5. Brazil Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 9.7.1.6. Brazil Barrier Systems Market Size and Forecast, by Application (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Barrier Systems Market Size and Forecast, by Type (2024-2032) 9.7.2.2. Argentina Barrier Systems Market Size and Forecast, by Material (2024-2032) 9.7.2.3. Argentina Barrier Systems Market Size and Forecast, by Function (2024-2032) 9.7.2.4. Argentina Barrier Systems Market Size and Forecast, by Technology (2024-2032) 9.7.2.5. Argentina Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 9.7.2.6. Argentina Barrier Systems Market Size and Forecast, by Application (2024-2032) 9.7.3. Rest Of South America 9.7.3.1. Rest Of South America Barrier Systems Market Size and Forecast, by Type (2024-2032) 9.7.3.2. Rest Of South America Barrier Systems Market Size and Forecast, by Material (2024-2032) 9.7.3.3. Rest Of South America Barrier Systems Market Size and Forecast, by Function (2024-2032) 9.7.3.4. Rest Of South America Barrier Systems Market Size and Forecast, by Technology (2024-2032) 9.7.3.5. Rest Of South America Barrier Systems Market Size and Forecast, by Access Control Device (2024-2032) 9.7.3.6. Rest Of South America Barrier Systems Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Lindsay Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Valmont Industries Inc. 10.3. Hill & Smith PLC 10.4. Trinity Industries, Inc. 10.5. Delta Scientific Corporation 10.6. A-SAFE 10.7. Rite-Hite 10.8. Tractel Ltd 10.9. Barrier1 10.10. Betafence 10.11. Bekaert SA 10.12. Hill & Smith Holdings PLC 10.13. Betafence 10.14. A-SAFE 10.15. Avon Barrier Corporation Ltd 10.16. FutureNet Group 10.17. Tractel Ltd 10.18. Arbus Ltd 10.19. Delta BLOC International GmbH 10.20. Nucor Corporation 10.21. Tata Steel Limited 10.22. Bekaert SA 10.23. Valmont Industries Inc. 10.24. Lindsay Corporation 10.25. Avon Barrier Corporation Ltd 10.26. Guangxi Shiteng Transportation Engineering Co., Ltd. 10.27. Arbus Ltd 10.28. Barrier1 Systems, LLC 10.29. A-SAFE 10.30. FutureNet Group 11. Key Findings 12. Industry Recommendations 13. Barrier Systems Market: Research Methodology 14. Terms and Glossary