Automotive Starter Motor Market was valued at USD 73.36 Bn. in 2024 and the total Global Automotive Starter Motor Market revenue is Expected to grow at a CAGR of 5.6% from 2025 to 2032 reaching nearly USD 113.44 Bn. by 2032.Automotive Starter Motor Market Overview

Automotive starter is used to crank the vehicle; it converts the electrical energy into mechanical energy. To start the vehicle the starter has to rotate the crankshaft of the engine into number of cycles. When the required speed is achieved, the engine starts its combustion process. Starter then disengage from crankshaft and engine run on its power. Petrol Cars uses electric starters and diesel cars needs different types of starters according to their capacity, like pneumatic motor starter, Hydraulic starter, some big engine requires small petrol engine to use as starter.To know about the Research Methodology :- Request Free Sample Report

Automotive Starter Motor Market Drivers

Rising demand for automotive vehicle and acquisitions of numerous key players is increasing the demand for Starter Motor. New technology to auto start stop will increase fuel efficiency and emission will also reduce and is expected to drive integrated starter market. Commercial Automotive market is increasing due to new technology coming in fleet system and involvement of IT is making it easier.Automotive Starter Motor Market Segment Analysis:

Based on Vehicle Type Automotive Starter Motor Market is segmented into Passenger Cars and commercial Vehicle. Passenger Car segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to Passenger cars account for the majority of global vehicle production and sales, especially in Asia-Pacific, which is the largest automotive hub. Rising consumer demand, urbanization, and the adoption of start-stop and hybrid systems in passenger cars drive higher starter motor usage. Their large production volumes and continuous technological upgrades ensure passenger cars hold the largest market share compared to commercial vehicles. Based on Motor Type the market is segmented into Gear Reduction Starter Motors, Permanent Magnet Starter Motors and Direct Drive Starter Motors. Gear Reduction Starter Motors segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to high torque output, compact size, lighter weight and superior efficiency compared to direct drive systems. They are widely adopted in passenger cars and light commercial vehicles, which form the bulk of vehicle production. Their ability to meet modern fuel-efficiency standards and compatibility with start-stop technology ensures gear reduction starter motors maintain the largest market share.

Automotive Starter Motor Market Challenges

Increasing demand of electric vehicle may hamper the growth of Global Automotive Starter Motor Market. Rising Public transport solution reduces the growth of passenger car segment.Automotive Starter Motor Market Regional Overview

The Asia Pacific region has the major market share in global prospective approximately about 75%. In passenger vehicle segment, the Asia Pacific region is showing vast growth. APAC region has countries like India and China which are highly dense in terms of population and household income of people living here is also growing, Fueling the growth of automotive sector directly increases Global market. North America is a major market for the Automotive Starter Motor due to its high growth income. Countries like the United States and Canada shows consistent growth in sales of Vehicles. The report also helps in understanding market dynamics, structure by analyzing the market segments and projects the market size. Clear representation of competitive analysis of key players by Propulsion Type, price, financial position, Product portfolio, growth strategies, and regional presence in the market make the report investor’s guide.Automotive Starter Motor Market Scope: Inquire before buying

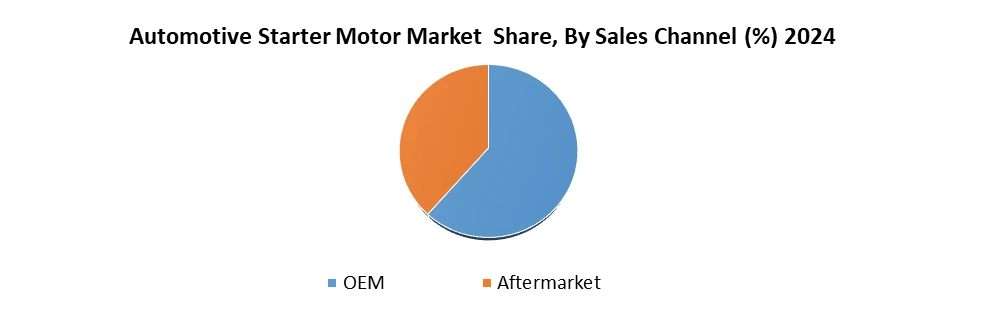

Global Automotive Starter Motor Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 73.36 Mn. Forecast Period 2025 to 2032 CAGR: 5.6% Market Size in 2032: USD 113.44 Mn. Segments Covered: by Vehicle Type Passenger Cars Commercial Vehicles by Engine Type Diesel Engine Petrol Engine by Motor Type Gear Reduction Starter Motors Permanent Magnet Starter Motors Direct Drive Starter Motors by Sales Channel OEM Aftermarket Automotive Starter Motor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Starter Motor Market, Key players

1. BorgWarner Inc. 2. DENSO EUROPE 3. Continental AG 4. Valeo 5. Delphi Technologies 6. Mitsuba Corp 7. Cummins Inc. 8. Bosch Auto Parts 9. Hitachi, Ltd 10. Mitsubishi Electric CorporationFrequently Asked Questions:

1. Which region has the largest share in Global market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global market? Ans: The Global market is growing at a CAGR of 5.6% during forecasting period 2025-2032. 3. What is scope of the Global market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global market are BorgWarner Inc., DENSO EUROPE, Continental AG, Valeo, Delphi Technologies, Mitsuba Corp, Cummins Inc., Bosch Auto Parts, Hitachi, Ltd, and Mitsubishi Electric Corporation. 5. What is the study period of this Market? Ans: The Global market is studied from 2024 to 2032.

1. Automotive Starter Motor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Automotive Starter Motor Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Automotive Starter Motor Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Automotive Starter Motor Market: Dynamics 3.1. Automotive Starter Motor Market Trends by Region 3.1.1. North America Automotive Starter Motor Market Trends 3.1.2. Europe Automotive Starter Motor Market Trends 3.1.3. Asia Pacific Automotive Starter Motor Market Trends 3.1.4. Middle East and Africa Automotive Starter Motor Market Trends 3.1.5. South America Automotive Starter Motor Market Trends 3.2. Automotive Starter Motor Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Automotive Starter Motor Market Drivers 3.2.1.2. North America Automotive Starter Motor Market Restraints 3.2.1.3. North America Automotive Starter Motor Market Opportunities 3.2.1.4. North America Automotive Starter Motor Market Challenges 3.2.2. Europe 3.2.2.1. Europe Automotive Starter Motor Market Drivers 3.2.2.2. Europe Automotive Starter Motor Market Restraints 3.2.2.3. Europe Automotive Starter Motor Market Opportunities 3.2.2.4. Europe Automotive Starter Motor Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Automotive Starter Motor Market Drivers 3.2.3.2. Asia Pacific Automotive Starter Motor Market Restraints 3.2.3.3. Asia Pacific Automotive Starter Motor Market Opportunities 3.2.3.4. Asia Pacific Automotive Starter Motor Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Automotive Starter Motor Market Drivers 3.2.4.2. Middle East and Africa Automotive Starter Motor Market Restraints 3.2.4.3. Middle East and Africa Automotive Starter Motor Market Opportunities 3.2.4.4. Middle East and Africa Automotive Starter Motor Market Challenges 3.2.5. South America 3.2.5.1. South America Automotive Starter Motor Market Drivers 3.2.5.2. South America Automotive Starter Motor Market Restraints 3.2.5.3. South America Automotive Starter Motor Market Opportunities 3.2.5.4. South America Automotive Starter Motor Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Automotive Starter Motor Industry 3.8. Analysis of Government Schemes and Initiatives For Automotive Starter Motor Industry 3.9. Automotive Starter Motor Market Trade Analysis 3.10. The Global Pandemic Impact on Automotive Starter Motor Market 4. Automotive Starter Motor Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 4.1.1. Passenger Cars 4.1.2. Commercial Vehicles 4.2. Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 4.2.1. Diesel Engine 4.2.2. Petrol Engine 4.3. Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 4.3.1. Gear Reduction Starter Motors 4.3.2. Permanent Magnet Starter Motors 4.3.3. Direct Drive Starter Motors 4.4. Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 4.4.1. OEM 4.4.2. Aftermarket 4.5. Automotive Starter Motor Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Automotive Starter Motor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 5.1.1. Passenger Cars 5.1.2. Commercial Vehicles 5.2. North America Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 5.2.1. Diesel Engine 5.2.2. Petrol Engine 5.3. North America Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 5.3.1. Gear Reduction Starter Motors 5.3.2. Permanent Magnet Starter Motors 5.3.3. Direct Drive Starter Motors 5.4. North America Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 5.4.1. OEM 5.4.2. Aftermarket 5.5. North America Automotive Starter Motor Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.1.1.1. Passenger Cars 5.5.1.1.2. Commercial Vehicles 5.5.1.2. United States Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 5.5.1.2.1. Diesel Engine 5.5.1.2.2. Petrol Engine 5.5.1.3. United States Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 5.5.1.3.1. Gear Reduction Starter Motors 5.5.1.3.2. Permanent Magnet Starter Motors 5.5.1.3.3. Direct Drive Starter Motors 5.5.1.4. United States Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 5.5.1.4.1. OEM 5.5.1.4.2. Aftermarket 5.5.2. Canada 5.5.2.1. Canada Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.2.1.1. Passenger Cars 5.5.2.1.2. Commercial Vehicles 5.5.2.2. Canada Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 5.5.2.2.1. Diesel Engine 5.5.2.2.2. Petrol Engine 5.5.2.3. Canada Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 5.5.2.3.1. Gear Reduction Starter Motors 5.5.2.3.2. Permanent Magnet Starter Motors 5.5.2.3.3. Direct Drive Starter Motors 5.5.2.4. Canada Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 5.5.2.4.1. OEM 5.5.2.4.2. Aftermarket 5.5.3. Mexico 5.5.3.1. Mexico Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.3.1.1. Passenger Cars 5.5.3.1.2. Commercial Vehicles 5.5.3.2. Mexico Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 5.5.3.2.1. Diesel Engine 5.5.3.2.2. Petrol Engine 5.5.3.3. Mexico Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 5.5.3.3.1. Gear Reduction Starter Motors 5.5.3.3.2. Permanent Magnet Starter Motors 5.5.3.3.3. Direct Drive Starter Motors 5.5.3.4. Mexico Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 5.5.3.4.1. OEM 5.5.3.4.2. Aftermarket 6. Europe Automotive Starter Motor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.2. Europe Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.3. Europe Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.4. Europe Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5. Europe Automotive Starter Motor Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.1.2. United Kingdom Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.1.3. United Kingdom Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.1.4. United Kingdom Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.2. France 6.5.2.1. France Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.2.2. France Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.2.3. France Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.2.4. France Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.3.2. Germany Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.3.3. Germany Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.3.4. Germany Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.4.2. Italy Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.4.3. Italy Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.4.4. Italy Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.5.2. Spain Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.5.3. Spain Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.5.4. Spain Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.6.2. Sweden Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.6.3. Sweden Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.6.4. Sweden Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.7.2. Austria Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.7.3. Austria Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.7.4. Austria Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.8.2. Rest of Europe Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 6.5.8.3. Rest of Europe Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 6.5.8.4. Rest of Europe Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7. Asia Pacific Automotive Starter Motor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.2. Asia Pacific Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.3. Asia Pacific Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.4. Asia Pacific Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5. Asia Pacific Automotive Starter Motor Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.1.2. China Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.1.3. China Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.1.4. China Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.2.2. S Korea Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.2.3. S Korea Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.2.4. S Korea Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.3.2. Japan Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.3.3. Japan Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.3.4. Japan Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.4. India 7.5.4.1. India Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.4.2. India Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.4.3. India Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.4.4. India Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.5.2. Australia Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.5.3. Australia Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.5.4. Australia Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.6.2. Indonesia Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.6.3. Indonesia Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.6.4. Indonesia Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.7.2. Malaysia Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.7.3. Malaysia Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.7.4. Malaysia Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.8.2. Vietnam Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.8.3. Vietnam Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.8.4. Vietnam Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.9.2. Taiwan Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.9.3. Taiwan Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.9.4. Taiwan Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 7.5.10.4. Rest of Asia Pacific Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 8. Middle East and Africa Automotive Starter Motor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 8.2. Middle East and Africa Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 8.3. Middle East and Africa Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 8.4. Middle East and Africa Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 8.5. Middle East and Africa Automotive Starter Motor Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.1.2. South Africa Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 8.5.1.3. South Africa Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 8.5.1.4. South Africa Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.2.2. GCC Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 8.5.2.3. GCC Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 8.5.2.4. GCC Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.3.2. Nigeria Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 8.5.3.3. Nigeria Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 8.5.3.4. Nigeria Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.4.2. Rest of ME&A Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 8.5.4.3. Rest of ME&A Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 8.5.4.4. Rest of ME&A Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 9. South America Automotive Starter Motor Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 9.2. South America Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 9.3. South America Automotive Starter Motor Market Size and Forecast, by Motor Type(2024-2032) 9.4. South America Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 9.5. South America Automotive Starter Motor Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 9.5.1.2. Brazil Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 9.5.1.3. Brazil Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 9.5.1.4. Brazil Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 9.5.2.2. Argentina Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 9.5.2.3. Argentina Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 9.5.2.4. Argentina Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Automotive Starter Motor Market Size and Forecast, by Vehicle Type (2024-2032) 9.5.3.2. Rest Of South America Automotive Starter Motor Market Size and Forecast, by Engine Type (2024-2032) 9.5.3.3. Rest Of South America Automotive Starter Motor Market Size and Forecast, by Motor Type (2024-2032) 9.5.3.4. Rest Of South America Automotive Starter Motor Market Size and Forecast, by Sales Channel (2024-2032) 10. Company Profile: Key Players 10.1. BorgWarner Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. DENSO EUROPE 10.3. Continental AG 10.4. Valeo 10.5. Delphi Technologies 10.6. Mitsuba Corp 10.7. Cummins Inc. 10.8. Bosch Auto Parts 10.9. Hitachi, Ltd 10.10. Mitsubishi Electric Corporation 11. Key Findings 12. Industry Recommendations 13. Automotive Starter Motor Market: Research Methodology 14. Terms and Glossary