The global instrument cluster market size was valued at USD 10.5 billion in 2024 and is projected to reach USD 22.2 billion at a CAGR of 9.7% from 2025 to 2032Global Automotive Instrument Cluster Market Overview

An automotive instrument cluster that displays critical information about the condition of a vehicle. An automotive instrument cluster includes the speedometer, fuel gauge, illumination & warning indicators, pointers, screen, sensors, and electronic control unit (ECU). In 2024, the automotive instrument cluster market continued its shift towards digital and hybrid clusters, driven by increasing demand for advanced driver assistance systems (ADAS) and enhanced in-vehicle infotainment. Traditional analog clusters are declining, making way for fully digital and 3D instrument clusters, particularly in passenger and luxury vehicles. Modern clusters now feature 2D and 3D graphics, offering real-time data on fuel levels, oil status, speed, mileage, and various vehicle warnings. Integration with Electronic Control Units (ECUs) and sensors allows for smarter data visualization and improved safety features. BMW’s new iX series includes a curved digital display instrument cluster that blends a 12.3-inch information display with a 14.9-inch control display, offering an immersive and customizable interface powered by 3D graphics and AI-based alerts. This reflects the broader industry trend toward intelligent and visually rich instrument panels. The market in 2024 will experience strong growth due to digitalization. Asia-Pacific and Europe are the leading regions in adoption, especially among electric and connected vehicle segments. Regions have emerged as the frontrunners in adopting electric and connected vehicles due to a combination of strong regulatory support, aggressive sustainability goals, and rapid technological advancements.To know about the Research Methodology :- Request Free Sample Report

Global Automotive Instrument Cluster Market Dynamics

Digital Innovation to Drive Automotive Instrument Cluster Market Growth

In 2024, the global automotive instrument cluster market experienced significant growth, driven by several key factors. The rapid adoption of electric and hybrid vehicles greatly increased the demand for digital instrument clusters capable of displaying real-time battery status, energy flow, and charging information. Technological advancements in display technologies, such as high-resolution TFT, OLED, and 3D graphics, enabled manufacturers to offer more dynamic and customizable driver interfaces. The growing integration of Advanced Driver Assistance Systems (ADAS) led to the inclusion of safety alerts, navigation data, and driver warnings directly within the cluster, enhancing both road safety and user convenience. The rising consumer expectations for premium in-vehicle experiences fueled the trend toward connected, visually appealing clusters that seamlessly integrate with infotainment systems and smartphones. In 2024, automakers prioritized digital transformation in vehicle dashboards to deliver a more engaging, safe, and tech-savvy driving environment, particularly in mid- and high-end vehicle segments.High Cost to Create Restraints for the Adoption of Automotive Instrument Cluster

The Global Automotive Instrument Cluster Market is suffering from the high cost of advanced digital clusters, which limits their adoption in budget or entry-level vehicles. While premium cars often feature fully digital, customizable displays, many automakers in the lower segment still rely on traditional analog or hybrid systems to keep production costs down. This price barrier slows the widespread adoption of next-gen instrument clusters across all vehicle categories.Growing Demand for Electric and Connected Vehicles to Create Automotive Instrument Cluster Market Opportunity

As the global shift toward electric and connected vehicles accelerates, there's a rising need for advanced instrument clusters that can display real-time data such as battery status, energy usage, and navigation. This trend presents a major opportunity for manufacturers to innovate and expand their offerings, especially with digital and customizable clusters that enhance the driving experience in smart vehicles.Automotive Instrument Cluster Market Segment Analysis

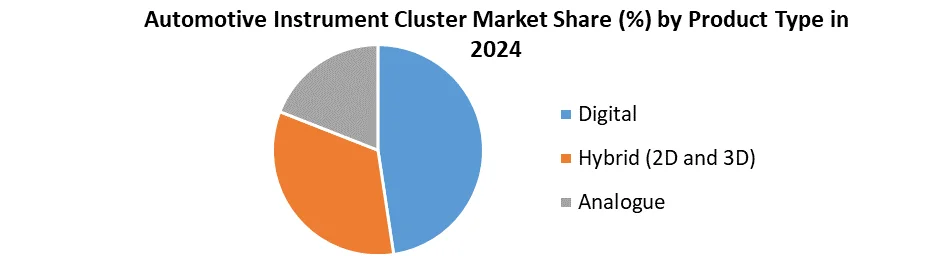

Based on Product Type, the market is segmented into Analogue, Digital, and Hybrid (2D & 3D). In 2024, digital instrument clusters accounted for approximately 30–35% of the global automotive instrument cluster market. This segment is rapidly growing due to the increasing adoption of electric and connected vehicles, which require real-time, customizable, and high-resolution displays. Digital clusters integrate seamlessly with infotainment systems and ADAS features, enhancing driver experience and safety. Leading automakers like BMW (iX), Mercedes-Benz (S-Class), Ford (Mustang), and Lincoln (Nautilus) have adopted advanced digital displays, some even using OLED technology or Unreal Engine graphics, reinforcing the shift toward fully digital and intelligent cockpit solutions.

Automotive Instrument Cluster Market Regional Insights

Asia-Pacific dominated the global automotive instrument cluster market with a 45% share in 2024, driven by high vehicle production in countries like China, Japan, and India. The region leads in electric and hybrid vehicle adoption, especially China, boosting demand for advanced digital and hybrid clusters. Cost-effective manufacturing, a well-developed automotive electronics supply chain, and rising urbanization contribute to growing demand for feature-rich vehicles. Global OEMs such as Toyota, Hyundai, and Maruti Suzuki are heavily invested in the region, offering vehicles equipped with hybrid clusters that balance affordability and modern functionality, making Asia-Pacific the top-performing region in this market. In 2024, Europe held a 25% share of the global automotive instrument cluster market, ranking as the second-largest region. The dominance is driven by the strong presence of premium and electric vehicle manufacturers such as BMW, Mercedes-Benz, Audi, and Volkswagen, which integrate fully digital and hybrid clusters in their vehicles. The region's early adoption of advanced driver-assistance systems (ADAS) and stringent regulations on vehicle safety and emissions have accelerated the demand for intelligent and customizable displays. Europe’s well-established automotive R&D ecosystem and consumer preference for high-tech, connected vehicles support the rapid growth of digital instrument clusters across the continent.Automotive Instrument Cluster Market Competitive Landscape

Asia-Pacific dominates the global automotive instrument cluster market, holding over 45% of the market share, largely due to the region’s massive automotive production base and growing demand for electric and connected vehicles. The availability of cost-effective manufacturing and government incentives in countries like India further boosts APAC’s stronghold in the market. Denso Corporation, headquartered in Japan, is a leading Tier-1 automotive supplier and a major player in the Asia-Pacific instrument cluster market. The company supplies analog, hybrid, and advanced digital clusters to top OEMs like Toyota, Honda, Mazda, and others. Denso focuses on innovation in TFT displays, head-up displays (HUDs), and AI-integrated clusters, especially for electric and hybrid vehicles. In 2024, Denso showcased a curved digital instrument cluster at CES, highlighting features like real-time driver assistance, personalization, and connectivity, reinforcing its leadership in next-gen vehicle display technologies. The automotive instrument cluster market is highly competitive, with major global players such as Continental AG, Robert Bosch GmbH, and Visteon Corporation leading the field with advanced digital and reconfigurable cluster technologies. In the Asia-Pacific region, key competitors include Denso Corporation, Nippon Seiki, Panasonic Automotive, Yazaki, and Mitsubishi Electric, all of which have strong ties with regional OEMs and significant R&D capabilities. Emerging players like Aptiv, Harman, and tech companies such as NVIDIA, NXP, and Luxoft are also gaining traction by contributing high-performance hardware and user interface software. These companies compete on innovation, integration of AI, AR, and connectivity features, and regional customization, especially in the context of rising demand for digital clusters in electric and connected vehicles across Asia-Pacific and beyond.Automotive Instrument Cluster Market Key Trends

Shift from Analog to Fully Digital Clusters Analog gauges are rapidly being replaced by high-resolution digital displays, FT, OLED, and even micro-LED, allowing fully customizable interfaces that adapt to driver preferences and driving modes. Focus on Sustainability & Slim Design Use of energy-efficient display tech (OLED) and recyclable components is increasing, supporting slimmer, lightweight clusters aligned with eco-conscious vehicle designAutomotive Instrument Cluster Market Recent Developments

• In 2024, augmented reality (AR) clusters were introduced by companies like Continental and Audi, contributing to the growing 15% share of reconfigurable digital displays in premium vehicles. • By mid-2025, AI-personalized clusters capable of learning driver habits were launched by Visteon and Marelli, helping digital clusters maintain a dominant over 50% market share globally. • Throughout 2024–2025, OLED and panoramic displays (up to 27") gained traction, led by Hyundai Mobis and BMW, boosting high-end digital cluster demand in the luxury EV segment (~20% share). • Starting in early 2024, over-the-air (OTA) update capabilities became standard in digital clusters, especially in connected vehicles, driving adoption in North America and Europe (combined ~35% regional share). • With EV growth in 2025, clusters designed for electric vehicles, displaying real-time battery and energy metrics, increased adoption, especially in Asia-Pacific, which held a regional market share of ~45%.Automotive Instrument Cluster Market Scope: Inquire before buying

Global Automotive Instrument Cluster Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.5 Bn. Forecast Period 2025 to 2032 CAGR: 9.7% Market Size in 2032: USD 22.2 Bn. Segments Covered: by Product Analogue Digital Hybrid (2D and 3D) by Application Speedometer Odometer Tachometer Others by vehicle type Passenger Cars Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Special Purpose Vehicles Automotive Instrument Cluster Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Automotive Instrument Cluster Market: Key Players

North America 1. Visteon Corporation – Michigan, USA 2. Gentex Corporation – Michigan, USA 3. Delphi Technologies – London, UK 4. Robert Bosch GmbH – Germany 5. Nippon Seiki Co., Ltd. – Japan 6. Yazaki Corporation – Japan 7. Panasonic Corporation – Japan Europe 1. Continental AG – Germany 2. Magneti Marelli S.p.A. – Italy 3. Valeo SA – France 4. Visteon Corporation – USA 5. Johnson Controls International – Ireland 6. ZF Friedrichshafen AG – Germany 7. Stoneridge Inc. – USA 8. Aptiv PLC – Ireland Asia-Pacific: 1. Denso Corporation – Kariya, Aichi, Japan 2. Nippon Seiki Co., Ltd. – Nagaoka, Niigata, Japan 3. Hyundai Mobis – Seoul, South Korea 4. Pricol Limited – Coimbatore, Tamil Nadu, India 5. FUNTORO (MSI Group) – New Taipei City, Taiwan 6. MiTAC Holdings Corporation – Taoyuan City, TaiwanFrequently Asked Questions:

1. Which region has the largest share in the Automotive Instrument Cluster Market? Ans: Asia-Pacific held the largest share in 2024. 2. What is the growth rate of the Automotive Instrument Cluster Market? Ans: The Market is growing at a CAGR of 9.7% during the forecasting period 2025-2032. 3. What segments are covered in the Automotive Instrument Cluster Market? Ans: The Market is segmented into product, application, and vehicle type. 4. Who are the key players in the Automotive Instrument Cluster Market? Ans: Continental AG, Robert Bosch GmbH, Denso corporation, Vieston corporation are the key players in market 5. What is the study period of the Automotive Instrument Cluster Market? Ans: The Market is studied from 2024 to 2032.

1. Automotive Instrument Cluster Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Instrument Cluster Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Automotive Instrument Cluster Market: Dynamics 3.1. Region-wise Trends of Automotive Instrument Cluster Market 3.1.1. North America Automotive Instrument Cluster Market Trends 3.1.2. Europe Automotive Instrument Cluster Market Trends 3.1.3. Asia Pacific Automotive Instrument Cluster Market Trends 3.1.4. Middle East and Africa Automotive Instrument Cluster Market Trends 3.1.5. South America Automotive Instrument Cluster Market Trends 3.2. Automotive Instrument Cluster Market Dynamics 3.2.1. Global Automotive Instrument Cluster Market Drivers 3.2.1.1. Rise in demand for Advanced Driver Systems 3.2.1.2. Growing Adoption of Electric Vehicles 3.2.1.3. Rising Production of Vehicles 3.2.2. Global Automotive Instrument Cluster Market Restraints 3.2.3. Global Automotive Instrument Cluster Market Opportunities 3.2.3.1. Integration of Augmented Reality 3.2.3.2. Developing Economy 3.2.4. Global Automotive Instrument Cluster Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Political 3.4.2. Economical 3.4.3. legal 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Automotive Instrument Cluster Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 4.1.1. Analogue 4.1.2. Digital 4.1.3. Hybrid (2D&3D) 4.2. Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 4.2.1. Speedometer 4.2.2. Odometer 4.2.3. Tachometers 4.2.4. Others 4.3. Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 4.3.1. Passenger Cars 4.3.2. Light Commercial Vehicle 4.3.3. Heavy Commercial Vehicle 4.3.4. Special Purpose Vehicle 4.4. Automotive Instrument Cluster Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Automotive Instrument Cluster Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 5.1.1. Analogue 5.1.2. Digital 5.1.3. Hybrid (2D&3D) 5.2. North America Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 5.2.1. Speedometer 5.2.2. Odometer 5.2.3. Tachometer 5.2.4. Others 5.3. North America Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 5.3.1. Passenger Cars 5.3.2. Light Commercial Vehicle 5.3.3. Heavy Commercial Vehicle 5.3.4. Special Purpose Vehicle 5.4. North America Automotive Instrument Cluster Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 5.4.1.1.1. Analogue 5.4.1.1.2. Digital 5.4.1.1.3. Hybrid (2D&3D) 5.4.1.2. United States Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Speedometer 5.4.1.2.2. Odometer 5.4.1.2.3. Tachometer 5.4.1.2.4. Others 5.4.1.3. Others United States Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.1.3.1. Passenger Cars 5.4.1.3.2. Light Commercial Vehicle 5.4.1.3.3. Heavy Commercial Vehicle 5.4.1.3.4. Special Purpose Vehicle 5.4.2. Canada 5.4.2.1. Canada Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 5.4.2.1.1. Analogue 5.4.2.1.2. Digital 5.4.2.1.3. Hybrid (2D&3D) 5.4.2.2. Canada Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Speedometer 5.4.2.2.2. Odometer 5.4.2.2.3. Tachometer 5.4.2.2.4. Others 5.4.2.3. Canada Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.2.3.1. Passenger Cars 5.4.2.3.2. Light Commercial Vehicle 5.4.2.3.3. Heavy Commercial Vehicle 5.4.2.3.4. Special Purpose Vehicle 5.4.2.4. Mexico Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 5.4.2.4.1. Analogue 5.4.2.4.2. Digital 5.4.2.4.3. Hybrid (2D&3D) 5.4.2.4.4. Others 5.4.2.5. Mexico Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 5.4.2.5.1. Speedometer 5.4.2.5.2. Odometer 5.4.2.5.3. Tachometer 5.4.2.5.4. Others 5.4.2.6. Mexico Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.2.6.1. Passenger Cars 5.4.2.6.2. Light Commercial Vehicle 5.4.2.6.3. Heavy Commercial Vehicle 5.4.2.6.4. Special Purpose vehicle 6. Europe Automotive Instrument Cluster Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.2. Europe Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.3. Europe Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4. Europe Automotive Instrument Cluster Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.1.2. United Kingdom Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.2. France 6.4.2.1. France Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.2.2. France Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.3.2. Germany Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.4.2. Italy Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.5.2. Spain Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.6.2. Sweden Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.7.2. Austria Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 6.4.8.2. Rest of Europe Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7. Asia Pacific Automotive Instrument Cluster Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4. Asia Pacific Automotive Instrument Cluster Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.1.2. China Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.2.2. S Korea Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.3.2. Japan Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.4. India 7.4.4.1. India Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.4.2. India Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.5.2. Australia Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.6.2. Indonesia Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.7.2. Philippines Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.8.2. Malaysia Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.9.2. Vietnam Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.10.2. Thailand Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 7.4.11.2. Rest of Asia Pacific Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 8. Middle East and Africa Automotive Instrument Cluster Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 8.4. Middle East and Africa Automotive Instrument Cluster Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 8.4.1.2. South Africa Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 8.4.2.2. GCC Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 8.4.3.2. Nigeria Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 8.4.4.2. Rest of ME&A Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 9. South America Automotive Instrument Cluster Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 9.2. South America Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 9.3. South America Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 9.4. South America Automotive Instrument Cluster Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 9.4.1.2. Brazil Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 9.4.2.2. Argentina Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Automotive Instrument Cluster Market Size and Forecast, By Product (2024-2032) 9.4.3.2. Rest of South America Automotive Instrument Cluster Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Automotive Instrument Cluster Market Size and Forecast, By Vehicle Type (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Nippon Seiki Co., Ltd 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Continental AG 10.3. Visteon Corporation 10.4. Denso Corporation 10.5. Robert Bosch GmbH 10.6. Panasonic Corporation 10.7. Magneti Marelli S.p. A. 10.8. Yazaki Corporation 10.9. Valeo SA 10.10. Delphi Technologies 10.11. Renesas Electronics Corporation 10.12. NVIDIA Corporation 10.13. Mitsubishi Electric Corporation 10.14. Bosch Automotive Technologies 10.15. Alps Alpine Co., Ltd. Key Findings 10.16. Analyst Recommendations 11. Automotive Instrument Cluster Market: Research Methodology